Woman Puts Inflation Into Perspective By Buying The Same Grocery List In 2020, 2022, And 2023

Over the past few months, many of the factors that fueled a four-decade high in inflation have begun to fade, and shoppers found deeper discounts online and at malls during the holiday season, as retailers tried to clear through excess inventory.

Consumer prices fell 0.1% in December compared with the prior month. However, for many Americans, the price of their favorite products hasn’t budged.

To show just how high our everyday expenses have become, Kentucky-based content creator Amy Way to Save shared a video comparing the checks of her typical groceries in 2020, 2022, and the start of 2023.

More info: TikTok | Instagram | YouTube

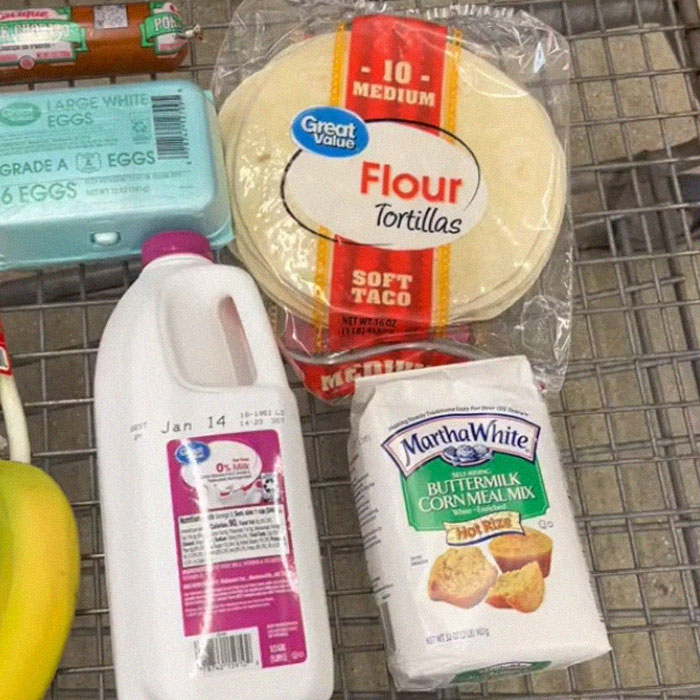

This woman compared food prices at the end of 2020 and the beginning of 2022

Image credits: amywaytosave

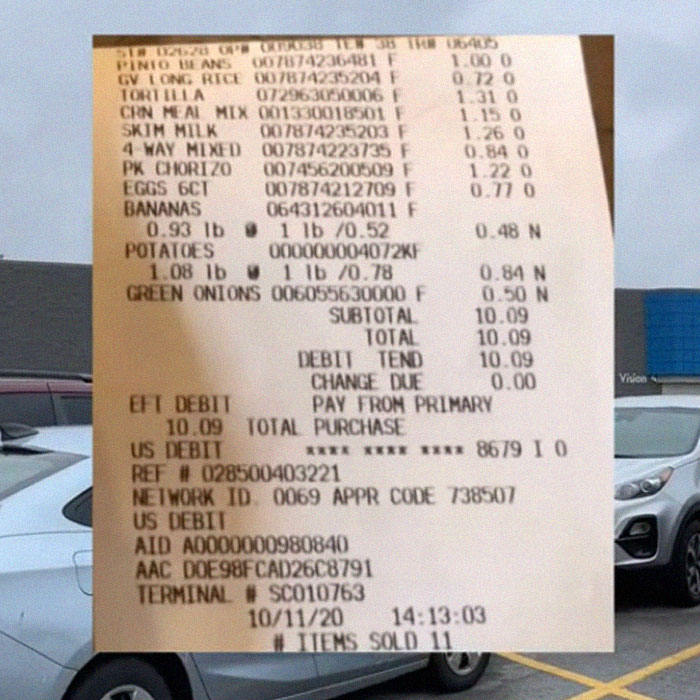

“Towards the end of 2020, I went to Walmart and I purchased all of these things for $10.09”

Image credits: amywaytosave

“I made a week’s worth of meals for one person”

Image credits: amywaytosave

“At the beginning of 2022, there was a lot of talk about inflation at the grocery store”

Image credits: amywaytosave

“So I went back and purchased all of the same things, and they cost me about 10% more”

Image credits: amywaytosave

Then she went back to get the same items at the start of 2023

Image credits: amywaytosave

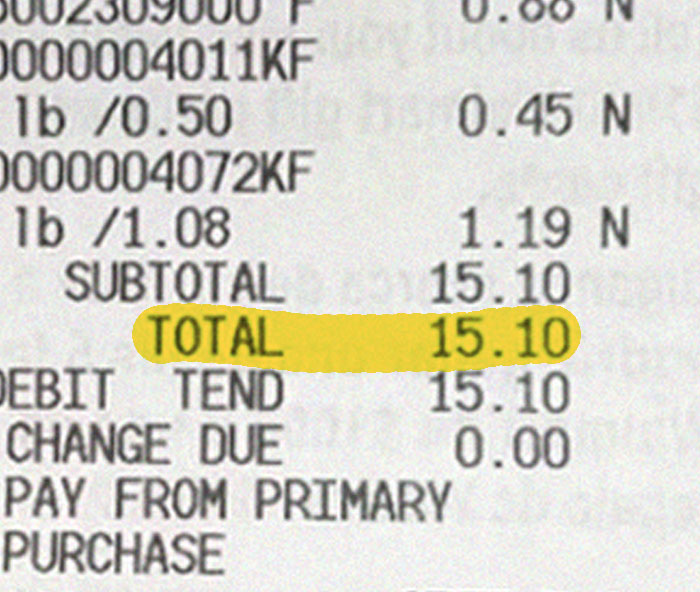

“This week, I went back again and purchased those same items”

Image credits: amywaytosave

“Now they cost $15.10, which is about 50% more than the prices at the end of 2020”

Image credits: amywaytosave

Americans feel this. A growing pessimism is one of the key findings of the fourth semiannual edition of McKinsey’s American Opportunity Survey (AOS), which explores in depth the country’s perceptions of the current and future state of the US economy.

People reported what seemed to be two approaches: some are spending more, and others are cutting back, with variation across categories of expenditure. Americans have increased spending on essentials such as groceries, utilities, transportation, housing, and healthcare but at the same time, many others are cutting back in many of the same categories.

What determines the approach? The answer is income. Those with less have slashed discretionary spending and, in some cases, essentials. Of those making less than $50,000 annually, 23 percent say they have reduced their grocery budget. By contrast, just 12 percent of those earning more than $100,000 annually have cut back.

It’s possible that the rising interest rate environment and increased reliance on debt financing may only grow financial difficulties for American households in 2023.

Image credits: amywaytosave

Amy’s video has been viewed 3 million times and now has over 350K likes

@amywaytosave Full vide0 & price comparison on my Y T! #inflation#groceryshopping#groceryprices#grocerypricetoohigh#inflationisreal#pricecomparison#10dollarmealchallenge♬ original sound – darcy stokes

The near future isn’t promising much, either. According to the United States Department of Agriculture (USDA), all food prices are predicted to increase by 7.1%, grocery store prices are forecast to climb by 8.0%, and restaurant prices are expected to lead the way, becoming 8.2% higher.

When it comes to individual products, prices are predicted to increase for eggs (27.3 percent), other meats (12.8 percent), dairy products (8.0 percent), fats and oils (16.5 percent), processed fruits and vegetables (9.6 percent), sugar and sweets (10.6 percent), cereals and bakery products (12.0 percent), nonalcoholic beverages (8.7 percent), and other foods (6.8 percent).

However, beef and veal prices are predicted to decrease by 1.8% in 2023, pork prices should go down by 3.0%, and fresh fruits are expected to become 1.7% cheaper.

People think it’s painfully accurate

540Kviews

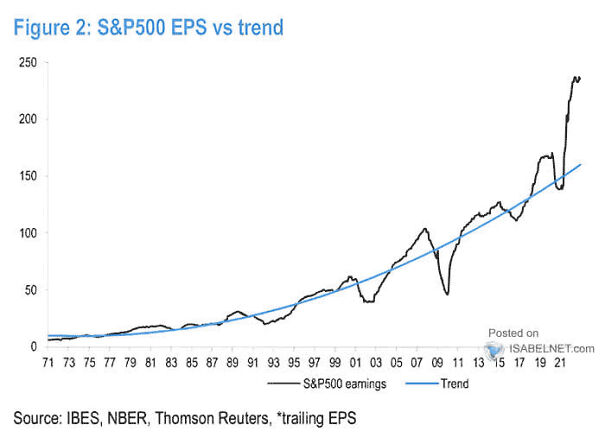

Share on FacebookInflationary gouging is one thing the US, European Union and possibly the whole world have in common right now. The slimmer the pickings get the more the oligarchs claim for themselves.

I was curious whether it was gouging. So I looked up profits of Smithfield Foods, Tyson, etc.( (since inflation seems to be worse for meat. They ARE making healthy -- even huge -- profit margins, but those margins are not up. Tyson's had a huge surge in profit in 2021, but it declined most of the way back down already. So price gouging is NOT a cause of inflation. The main issue is that governments have prevented food development while flooding the economies in cash. The cash flood sorta made sense in 2020, to prevent a credit freeze which could've turned the coronavirus pandemic into the Great Global Depression of the third millennium, but by 2021, this was simply covering up for mismanagement by artificially inflating growth. Which, again, would've been okay if we weren't simultaneously restricting growth.

Load More Replies...Yes, those prices are increasing, double, unfortunately our salaries are not.

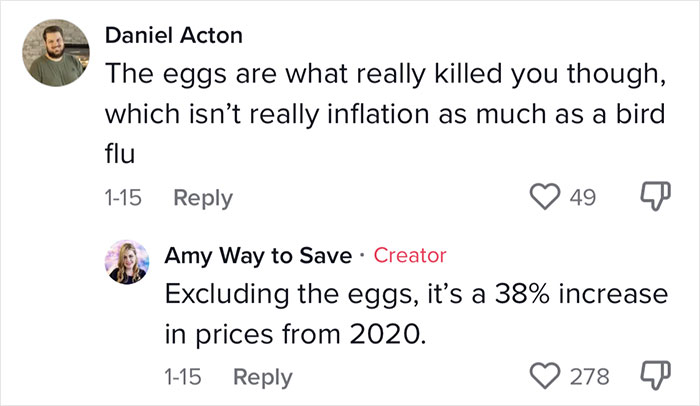

Someone said eggs are up 38%. No. A 12 pack used to be 99 cents. Now it is over $5.50. That is over 500%.

Outside of being on sale, I haven’t seen 12 eggs for a dollar in decades but I’m not in a state where there are a lot of poultry farms. The bird flu effect is nuts.

Load More Replies...Inflationary gouging is one thing the US, European Union and possibly the whole world have in common right now. The slimmer the pickings get the more the oligarchs claim for themselves.

I was curious whether it was gouging. So I looked up profits of Smithfield Foods, Tyson, etc.( (since inflation seems to be worse for meat. They ARE making healthy -- even huge -- profit margins, but those margins are not up. Tyson's had a huge surge in profit in 2021, but it declined most of the way back down already. So price gouging is NOT a cause of inflation. The main issue is that governments have prevented food development while flooding the economies in cash. The cash flood sorta made sense in 2020, to prevent a credit freeze which could've turned the coronavirus pandemic into the Great Global Depression of the third millennium, but by 2021, this was simply covering up for mismanagement by artificially inflating growth. Which, again, would've been okay if we weren't simultaneously restricting growth.

Load More Replies...Yes, those prices are increasing, double, unfortunately our salaries are not.

Someone said eggs are up 38%. No. A 12 pack used to be 99 cents. Now it is over $5.50. That is over 500%.

Outside of being on sale, I haven’t seen 12 eggs for a dollar in decades but I’m not in a state where there are a lot of poultry farms. The bird flu effect is nuts.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

133

146