“I Am So Angry”: Woman Realizes She Can’t Even Afford A Divorce After Husband’s Secret Purchase

In a perfect world, a marriage is both a loving relationship and a strong alliance. After all, people tend to make vows to stick with their partner through thick and thin. Finances, property, assets, and offspring all become a joint responsibility. So imagine if you found out that your spouse was, instead, making financially unwise decisions without your knowledge or consent.

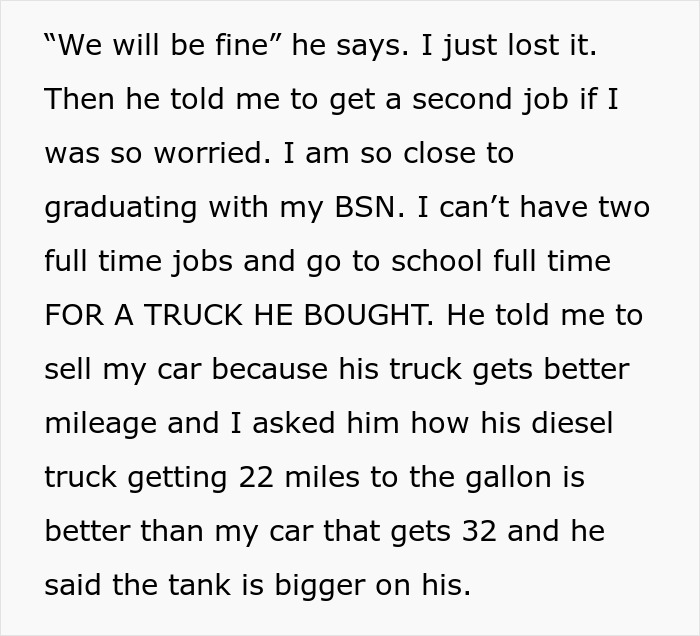

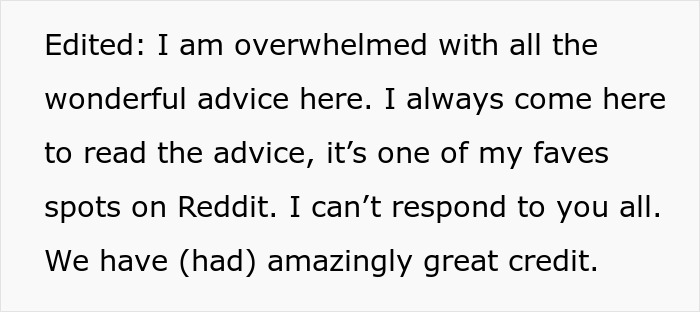

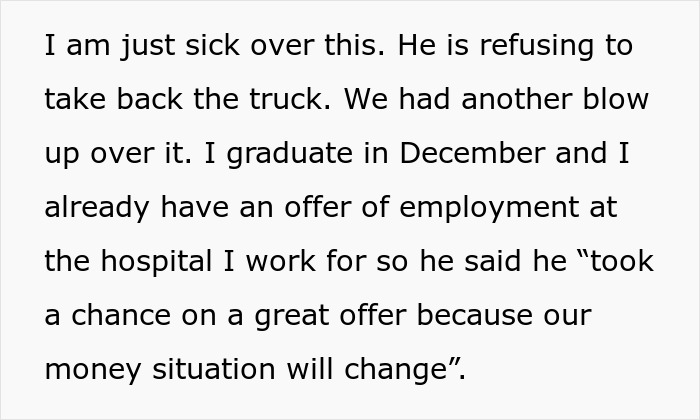

A woman turned to the internet for advice when her husband bought a new truck behind her back. After doing the math, she realized that they simply could not afford it, but the situation also left her too broke to divorce him. Netizens shared their sympathies and gave some useful advice.

Every couple handles finances differently, but hiding things from your spouse is a bad idea

Image credits: Sadi Gökpınar (not the actual photo)

A woman realized that she couldn’t even afford to divorce her husband when he secretly bought a new truck

Image credits: Liza Summer (not the actual photo)

Image source: memawszuchinnibread

Disagreements about finances are sadly quite common

Love it or hate it, money finds a way to dig its claws into nearly anything we touch. From hobbies, and what we eat to even our relationships, the constant stress of thinking about and planning finances can and will take a toll on most people. This is particularly true in a marriage, where, unlike casual dating, in most cases, both parties have equal, legal rights to what the household brings in.

The result is that arguments about money tend to be more recurring and deep-cutting than disagreements about most topics. For example, OP’s husband does not seem like he is the nicest person in the world. He goes behind his wife’s back, suggests that she gets two jobs to cover the bills incurred by his truck, and seems to think the aforementioned truck somehow gets reasonable gas mileage.

It’s not hard to imagine all the other questionable things he has said and done over the years. However, it’s telling that this particular debate about money and bills seems to be what spurred OP to start seriously considering a divorce. His secrecy doesn’t help either, after all, buying this (unnecessary) truck behind OP’s back communicates that he knows she won’t approve, but he was willing to do it anyway.

Dealing with money can be very hard, even with a loved one

Because, married or single, money tends to be a constant stressor, psychologists believe that arguments about it are, according to one study, “more pervasive, problematic, and recurrent, and remained unresolved, despite including more attempts at problem-solving.” There are a variety of issues at play, generally, when it comes to money problems, but a common one is that, regardless of intentions, sometimes the solution is to simply have more money, which isn’t always possible.

At the same time, greed, personal desires, and entitlement all come into play, making it hard to communicate and resolve money problems. Logically, financially stable couples should be, overall, more happy. There does seem to be some evidence for this. Another similar study found that “Credit management and insurance behaviors are the most important for the quality of the relationship between partners.”

So it’s not hard to see how just the act of going behind OP’s back was enough to have her wondering how to pay for a divorce lawyer. Her household, which is ostensibly raising a child, now has no way to develop any savings, all because of a gas (or diesel) guzzling machine that has already depreciated from just the drive home from the dealership.

It’s clear that OP has a better grasp of managing money than her husband

This story is also a clear example of why the age-old stereotype that men are better with finances seems to have little bearing on reality. First and foremost, OP’s husband did not need to buy this truck. This almost goes without saying. Second of all, it’s quite clear that OP is the one who actually has a better handle on money in her own home.

This deeply incorrect stereotype still seems to be quite pervasive in some groups, so it’s good that OP knows exactly what she needs and is willing to fight for it. Other netizens did help as much as they could, giving a plethora of suggestions in the comments section below. We can only wish OP the best with her divorce.

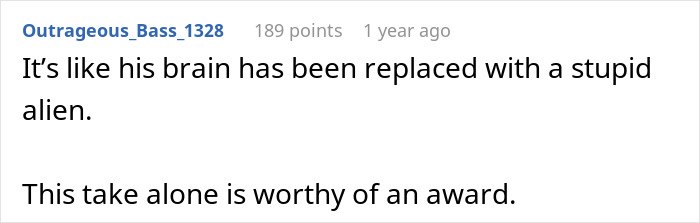

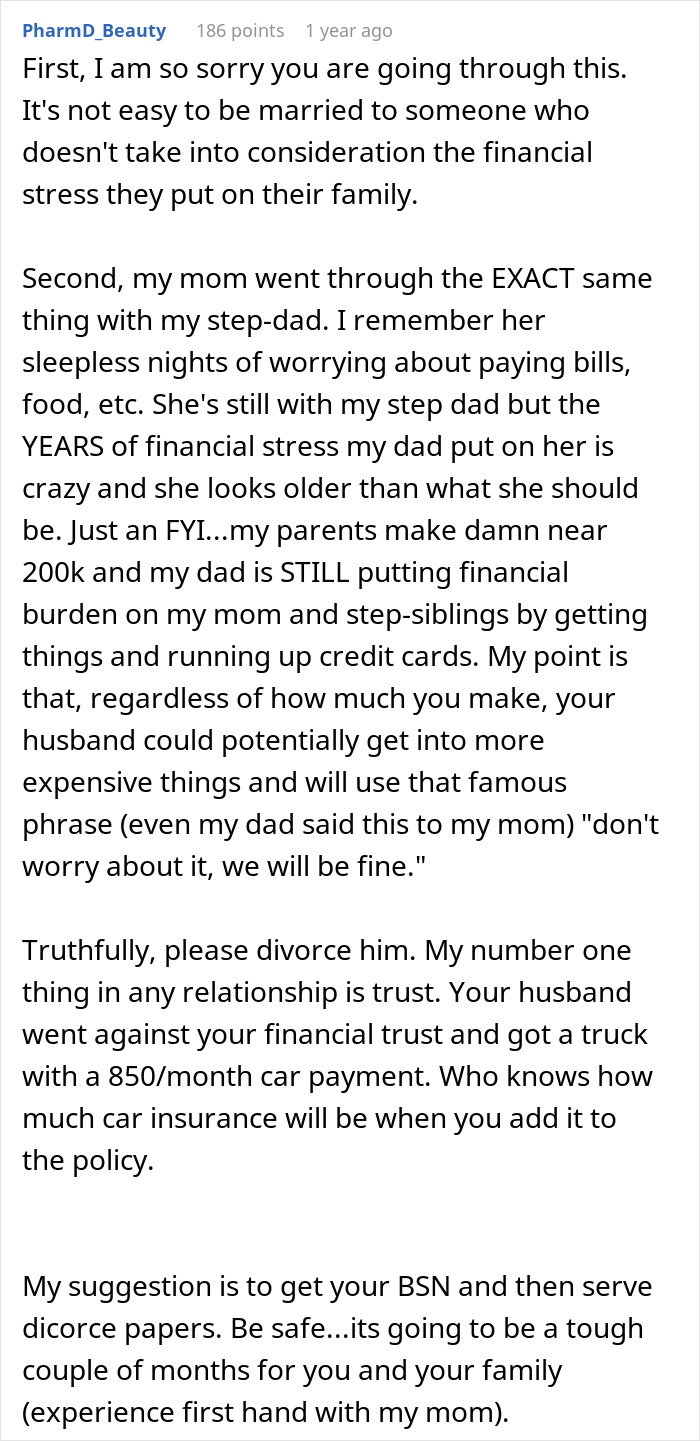

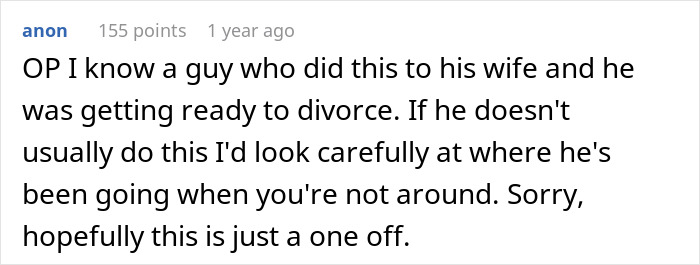

People shared their sympathies with OP and gave some suggestions

Poll Question

Thanks! Check out the results:

Explore more of these tags

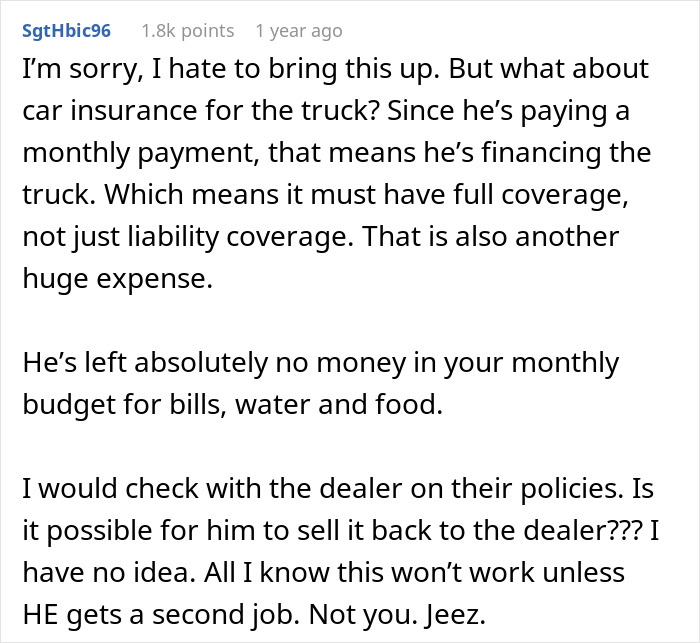

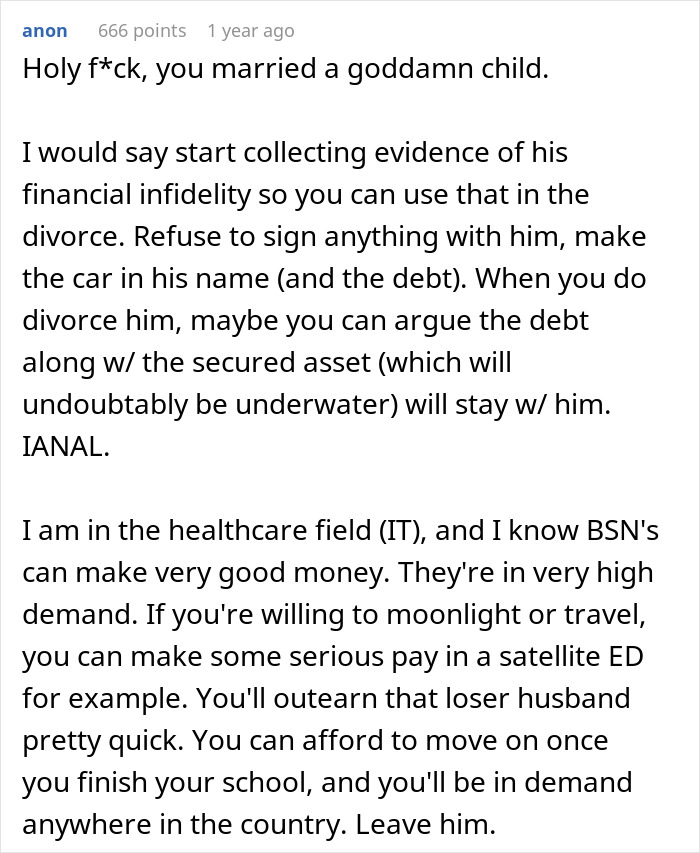

Where I live, if one spouse takes out a loan without the other spouse's signature, they alone are responsible for the debt. In the event of a divorce, the debt goes with the person who took out the loan. OP should start moving her money into an account he cannot access and should also consult an attorney to see what spousal and child support she and their child could be entitled to.

In my country, it depends on the matrimonial regime they choose when they marry. If it's joint, both are responsible, but both have to sign to take out the loan, too. If it's not joint, each spouse is responsible for their own debts.

Load More Replies...The woman posted an update (11 months ago, as the story is two yeas old): "Hi! Our money is separated because we are separated! Got my BSN, waiting to take my registration exam but I landed a great job as a Graduate Nurse. Life is great now, logging into Reddit for the first time because I’ve been a little busy and wow! If anyone is wondering if they should drop dead weight in a relationship… DO IT. It’s the most freeing thing ever."

Thanks much for getting that, dragonfly! I only wish she’d regaled us with how miserable the fuckwad is!

Load More Replies...Well, guess who's eating instant ramen in their truck for every meal. I like the plan of essentially saving as much money separate from that AH and suck it up until graduation then leaving his a*s.

I doubt he’ll be able live on a small budget. If she says “this is how much we have to spend,” and buys cheap groceries, then he seems like the kind of person to go spend money on a meal out or drinks with his friends or whatever, and would rather go into debt than live frugally.

Load More Replies...Where I live, if one spouse takes out a loan without the other spouse's signature, they alone are responsible for the debt. In the event of a divorce, the debt goes with the person who took out the loan. OP should start moving her money into an account he cannot access and should also consult an attorney to see what spousal and child support she and their child could be entitled to.

In my country, it depends on the matrimonial regime they choose when they marry. If it's joint, both are responsible, but both have to sign to take out the loan, too. If it's not joint, each spouse is responsible for their own debts.

Load More Replies...The woman posted an update (11 months ago, as the story is two yeas old): "Hi! Our money is separated because we are separated! Got my BSN, waiting to take my registration exam but I landed a great job as a Graduate Nurse. Life is great now, logging into Reddit for the first time because I’ve been a little busy and wow! If anyone is wondering if they should drop dead weight in a relationship… DO IT. It’s the most freeing thing ever."

Thanks much for getting that, dragonfly! I only wish she’d regaled us with how miserable the fuckwad is!

Load More Replies...Well, guess who's eating instant ramen in their truck for every meal. I like the plan of essentially saving as much money separate from that AH and suck it up until graduation then leaving his a*s.

I doubt he’ll be able live on a small budget. If she says “this is how much we have to spend,” and buys cheap groceries, then he seems like the kind of person to go spend money on a meal out or drinks with his friends or whatever, and would rather go into debt than live frugally.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

55

31