“Your Friend Fund Is Stupid”: Man Asks Wife To Break A Promise To Friends, Wonders If He’s A Jerk

It’s no secret that buying a home—now, arguably more than ever—might call for a person’s entire life savings. But those who have their mind set on buying a dwelling have likely made their peace with that.

This redditor seemingly did; however, he didn’t find it fair that while he was planning to invest nearly all of his money into their home, his wife had $20k set aside that she refused to contribute, all because of a promise she had made to a group of friends.

Scroll down to find the full story below, where you will also find Bored Panda’s interview with the co-founder and CEO of ‘Spring Planning’, an expert in personal finance, and the co-author of “Women & Money”, Julia Chung, who was kind enough to share her insight on combining assets with other people.

Looking for a forever home together can be an exciting chapter in a couple’s life

Image credits: Lucas Pezeta / Pexels (not the actual photo)

This husband was looking forward to buying a home with his wife, but it quickly got complicated

Image credits: Yan Krukau / Pexels (not the actual photo)

Image credits: Mikhail Nilov / Pexels (not the actual photo)

Image credits: Artistic_Hippo4827

Image credits: Pavel Danilyuk / Pexels (not the actual photo)

The housing market is nowhere nearly the same as it was decades ago

If you have checked the state of the housing market lately, you probably noticed that it’s far from what your grandparents saw back when they were buying a home (for probably around $300 and five grapes). Nowadays, the price for a home is way different than several decades ago, and the situation does not seem to be any brighter in the near future.

Comparing how prices of homes have changed overtime, Statista found that in the 1970s, for instance, the average sales price of new homes in the US was somewhere around $21k. Some 50 years later, though, in 2022, it was roughly $540k.

Posing the question when will home prices be affordable again, Forbes pointed out that while the mortgage rates have been seemingly going down, dwelling prices are still at record heights, out of reach for many. “The upward pressure on home prices is making this the most unaffordable housing market in history,” the chief economist at Bright MLS, Lisa Sturtevant, told Forbes.

The OP shared that the kind of house that he and his wife were looking for required somewhere around $60-70k for a downpayment. And while he was willing to put nearly all of his savings into the downpayment, his significant other said she didn’t want to touch the money she had set aside in the friends’ combined savings account.

Combining assets without a written agreement might not be a good idea

According to the financial expert Julia Chung, when in a relationship, it’s important to have agreements that can make managing things—be it financial or other—easier. “If you are in any kind of a relationship with anyone, it’s so vital that you have explicit agreements about all kinds of things, from how you interact with each other in the relationship to how you manage shared assets,” she told Bored Panda in a recent interview.

“For spouses, regardless of whether the asset is legally shared, ongoing discussions on how we approach our assets and how this impacts our partner are vital. People say that money is one of the key reasons cited for marital breakdown; I agree in the sense that how we manage our financial assets during and after a marriage is frequently reflective of existing issues in a variety of other arenas.”

The expert continued to point out that agreements are crucial when combining assets with anyone, be it a spouse or a friend. “Ideally, it’s best not to combine your assets with anyone without the benefit of a written agreement of some kind. Whether that’s a cohabitation or marital agreement with your spouse, or a shareholders’ agreement with your business partner, the legal and tax implications of sharing assets are significant. Managing tax reporting is one thing, and dividing the asset when it’s time to do that, for any reason, isn’t entirely straightforward.”

J. Chung added that combining assets without an agreement can lead to numerous detrimental effects. “Should someone owe money to creditors, declare bankruptcy, go through a divorce, or die, there are external parties that will have an interest in what is going on with that account,” she pointed out. “Should there be a relationship breakdown, the decisions we make when we are angry are often quite a bit different than the decisions we make when we are happy with each other. Even if we’re not angry, time changes our memories. No one is immune to that. Sharing any kind of asset needs careful thought and, ideally, expert advice.”

Image credits: Kindel Media / Pexels (not the actual photo)

When handling household finances, it’s important to be a team

Situations like the one the OP found himself in only emphasize the importance of making sure that you and your partner are on the same page regarding financial matters. According to the American Psychological Association, not all couples sit down to discuss finances thoroughly. But luckily, it’s never too late to do it. Said source suggests that some good questions to start the conversation off include inquiring from your partner about what their parents taught them about money, what their financial goals were, and what their fears about money were.

According to APA, it’s also important to be a team; whatever that means to you. For some people, being a team entails splitting everything 50/50, for others, it’s taking turns covering certain expenses for a certain period of time. There seem to be plenty of ways to share the load—be it finances, chores, or walking the dog, for that matter—it’s important to find one that works for both partners, in order for it not to take a toll on the relationship.

In order to work well as a team, it’s necessary to openly talk things through, which includes discussing financial matters, too. “I always recommend that we recognize that there is more to a marriage than love. When we share our households, our families, and our finances, we need to talk about all of them,” J. Chung suggested.

“It’s like we’re adding a business partner as well as a romantic partner. We need to talk about what things are like right now, what we hope they will be like in the future, and what we think is ‘fair’ if things don’t work out. We need to talk about our own, different approaches and expectations around money. We need to talk about what we learned in our families, and what we learned outside of our families. We need to talk and talk and keep talking. We need to make agreements, we need to write them down, and we need to revisit and adjust these agreements to reflect the changes in where we are in life and who we are as people.”

Discussing how often couples should revisit their agreements, the expert said that covering the ‘big-picture’ matters at least once a year would be amazing. “I have clients who have an annual ‘retreat’ weekend where they discuss their current situation, changes since last time, and visions for the future. It’s such a good idea; check-ins around specific activities, whether it’s just paying monthly bills or achieving goals, are really important.”

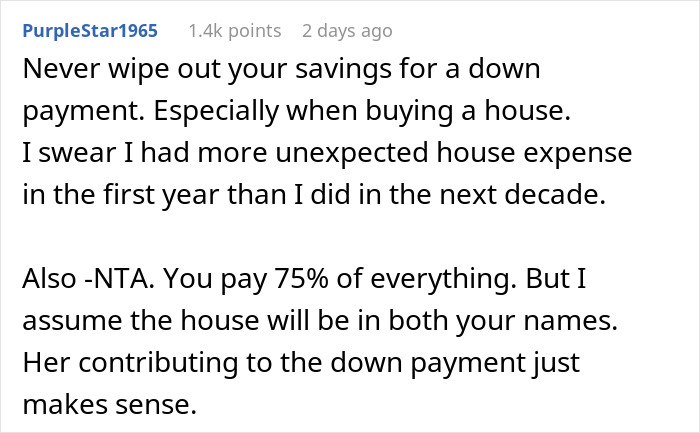

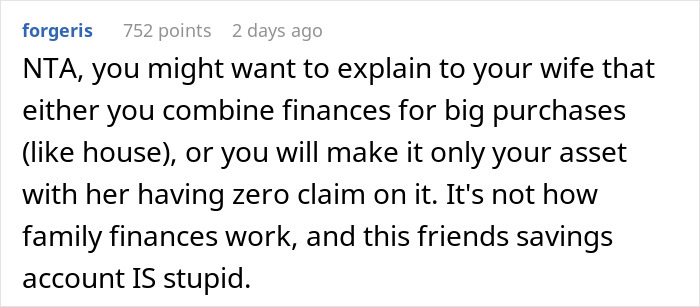

Most netizens didn’t think the husband was being a jerk in the situation

Others shared a different perspective on things

Poll Question

Thanks! Check out the results:

I'd put $20 on her not being able to withdraw that money since it's in someone else's account. She doesn't want to admit to the OP she's essentially given away 20K to a friend and has no savings.

That's what I'm afraid of. He has no right to demand she hand over her money, but can she actually get to it? It's a dumb way to save money, but it's HER money, and he has no right to demand it. They should save up money together, or get a zero down mortgage like my husband and I did

Load More Replies...People. Listen to me. Look up NACA (Neighborhood Assistance Corporation of America). You DO NOT NEED to pony up $60-70K down payment for a house! NACA's program rolls the down payment into the mortgage, AND they usually get an interest rate that is one percent below whatever the current market rate is. No, I don't work for them, but I am a homeowner since 2004 ONLY because of their program. I'm coming up on my 20-year anniversary of owning my house and it never would've been possible without their program. Look it up! It could save you thousands and get you into a house sooner.

Am I think only one who thinks it's odd that he waited until just after they were married to demand she give up the 20k? They had 8 years to discuss finances, to discuss buying a house, for him to raise his concerns about her (modest) savings. And WHY do they keep their finances separate like this? I'd be interested to know, because this arrangement has operated in his best interests for 8 years. Who paid for what during his medical school? He's in healthcare but we dont know what she does, but 4x is substantial. And neither of you should be investing every last dollar into property - you need a savings account and/or redraw facility. If this is how the marriage has started it does not bode well for the future.

He's 34....they've been together for eight years. Average age for med school graduates is 26. He made it clear to her that he thought it was a bad idea from the start, and has maintained that throughout the dumbfounding stupidity. He's spent the majority of the relationship footing the bill for pretty much everything, while she has been quite literally giving money away and pretending that it's magically going to turn into some kind of investment with no plan, and against the advice of actual financial advisors. But.....they're MARRIED now. The whole point of being married is that you are a team, working towards building a life TOGETHER. Not one person working to provide most everything, while the other one is more concerned with some baseless fantasy among friends. She doesn't want to contribute anything towards the home they will both live in, together, as husband and wife. Things change when you get married, if one of them thinks they shouldn't, they're kinda the problem.

Load More Replies...I'd put $20 on her not being able to withdraw that money since it's in someone else's account. She doesn't want to admit to the OP she's essentially given away 20K to a friend and has no savings.

That's what I'm afraid of. He has no right to demand she hand over her money, but can she actually get to it? It's a dumb way to save money, but it's HER money, and he has no right to demand it. They should save up money together, or get a zero down mortgage like my husband and I did

Load More Replies...People. Listen to me. Look up NACA (Neighborhood Assistance Corporation of America). You DO NOT NEED to pony up $60-70K down payment for a house! NACA's program rolls the down payment into the mortgage, AND they usually get an interest rate that is one percent below whatever the current market rate is. No, I don't work for them, but I am a homeowner since 2004 ONLY because of their program. I'm coming up on my 20-year anniversary of owning my house and it never would've been possible without their program. Look it up! It could save you thousands and get you into a house sooner.

Am I think only one who thinks it's odd that he waited until just after they were married to demand she give up the 20k? They had 8 years to discuss finances, to discuss buying a house, for him to raise his concerns about her (modest) savings. And WHY do they keep their finances separate like this? I'd be interested to know, because this arrangement has operated in his best interests for 8 years. Who paid for what during his medical school? He's in healthcare but we dont know what she does, but 4x is substantial. And neither of you should be investing every last dollar into property - you need a savings account and/or redraw facility. If this is how the marriage has started it does not bode well for the future.

He's 34....they've been together for eight years. Average age for med school graduates is 26. He made it clear to her that he thought it was a bad idea from the start, and has maintained that throughout the dumbfounding stupidity. He's spent the majority of the relationship footing the bill for pretty much everything, while she has been quite literally giving money away and pretending that it's magically going to turn into some kind of investment with no plan, and against the advice of actual financial advisors. But.....they're MARRIED now. The whole point of being married is that you are a team, working towards building a life TOGETHER. Not one person working to provide most everything, while the other one is more concerned with some baseless fantasy among friends. She doesn't want to contribute anything towards the home they will both live in, together, as husband and wife. Things change when you get married, if one of them thinks they shouldn't, they're kinda the problem.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

33

40