Redditor Explains How Pathetic Wall Street Millionaires Sound Right Now Using A Brilliant Casino Analogy

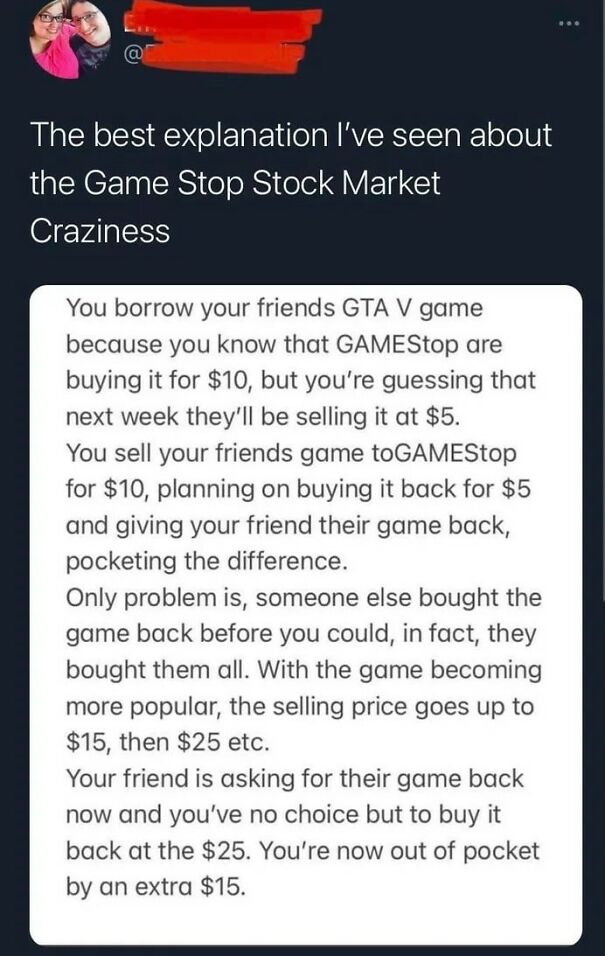

Major hedge funds had bet billions of dollars that GameStop’s shares would fall but they have faced major losses after Reddit users drove up the share price (it was $19 at the start of January but reached $330 last week). These people see it as both a troll of the hedge funds they call “parasites,” and a real attempt at making big bucks.

Sarah Nadav, a behavioral economist, senior strategist, and author of What the F*CK Should I Do Now?: How to Manage your Money when Money Stops Making Sense, told Bored Panda that the mere fact that an online community was able to organize itself to pull this off could mean a fundamental change in the market.

“In the past, efforts like Occupy Wall Street pointed out the flaws in the market but no one succeeded in exploiting them or bringing a meaningful change (they just kind of vocally complained about it). In a sense, this time is different because Redditors are beating [the big beasts of Wall Street] at their own game,” Nadav said.

“Now that the veil has been lifted, we can’t go back. People know that they have this power to control or manipulate the markets—and especially to break ‘financial products’ that serve no good purpose. I believe this will affect puts and derivatives next, as that market is in massive need of corrections.”

Image credits: Anna Shvets

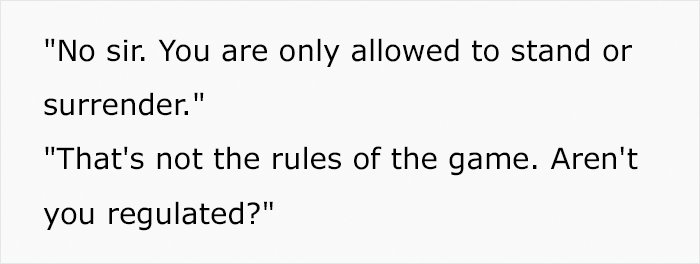

However, Robinhood and other popular online brokerages restricted trading in the high-flying stock, enraging individual investors who have sent it skyrocketing in recent days.

These restrictions virtually left traders with only two options: hold or sell.

They also fueled a firestorm of criticism among users and even some members of Congress who have called for hearings on the matter.

“I think Robinhood’s decision to restrict trading was a betrayal of their promise to the ‘little guy,'” Nadav said. “It shows where their allegiance lies which is to the traditional Wall Street system and not what they market to the public. It wasn’t and should never be up to a trading platform to restrict legal activity.”

Disappointed and furious, investors who were getting the best of seasoned professionals interpret the trading restrictions as the latest sign that financial markets are stacked against individuals.

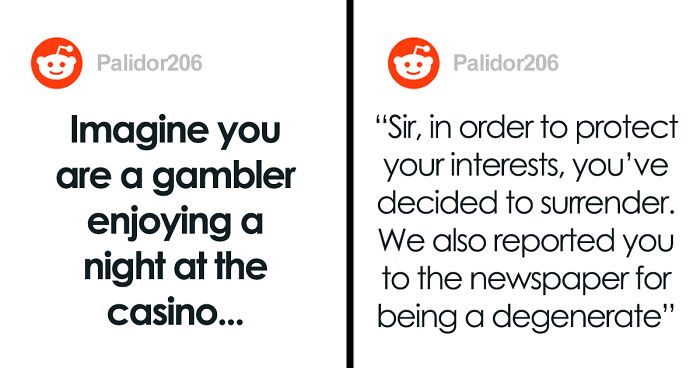

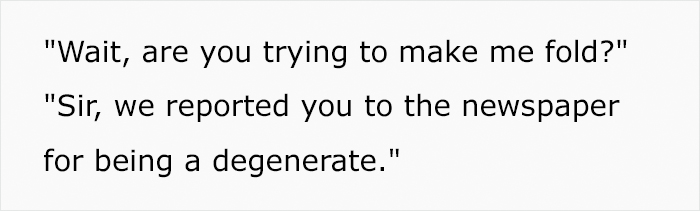

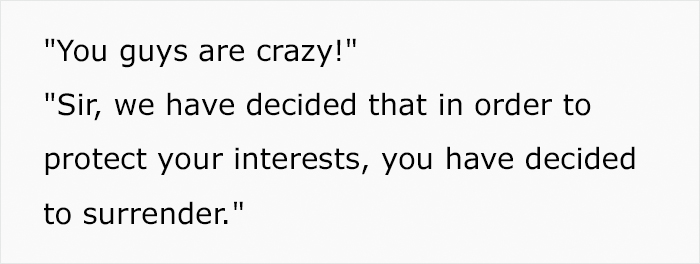

Trying to make sense of it all, Reddit user Palidor206 posted an analogy of the situation using a casino as an example and it’s clear there is no sense at all.

Palidor206 has bought 300 stocks of GME at around 40 themself. “I previously held the stock around the 15 as well. Those positions are gone now due to 2 separate equity calls,” the Reddit user told Bored Panda. “The first one happened at 150 which I paid into. The second one around 300. After that happened, I was hit with a Fed call. My profitable trade was then somehow hit with a Federal equity call. I was screwed no matter what I did.”

Palidor206 agrees with the statement The U.S. Securities and Exchange Commission and its statement regarding the situation, saying that ‘extreme stock price volatility has the potential to expose investors to rapid and severe losses.’

“That is almost the definition of volatility,” they said.

Interestingly, Reddit isn’t the only place where you can find this analogy. On Sunday, Sen. Elizabeth Warren said the GameStop saga is just the latest “ringing of the bell” that there are problems on Wall Street — ones the Securities and Exchange Commission needs to fix.

The Massachusetts Democrat compared today’s stock market to a casino, where according to her, big-money players are manipulating the markets through measures like pump-and-dump and stock buybacks to inflate stock prices.

“We need a market that is transparent, that is level and that is open to individual investors. It’s time for the SEC to get off their duffs and do their jobs,” Warren said on CNN’s State of the Union.

While we still don’t know how this situation will play out, there’s already one clear loser. Melvin Capital, a premier Wall Street hedge fund and a major short-seller of GameStop, lost 53% on its portfolio in January, a person familiar with the matter told CNN Business. Last week, prominent hedge funds Citadel and Point72 Asset Management extended a $2.75 billion financial lifeline to the fund.

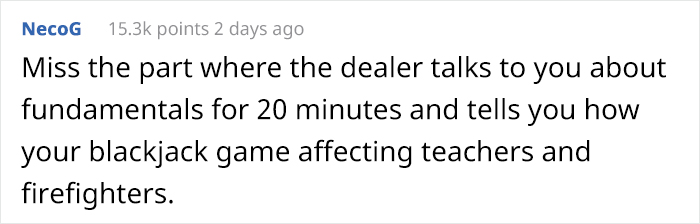

People think the analogy is spot on

63Kviews

Share on FacebookAll the "investors" always said that anyone can play their game and that they didn't mind, until everybody started to play their game. Now they want to change laws to make sure that none of them ever loses money to some internet trolls sabotaging their game.

Here is a really good analogy of what's happening with the hedge funds/reddit stock situation. 443fe8a1dd...29f730.jpg

I'm getting so tired of these incorrect analogies getting signal boosted. Fact: when volatility is high a clearinghouse has to have a certain amount of funds on deposit. Robinhood uses its own clearing house. They essentially got a margin call FROM REGULATORS stating they had to add $3 billion to deposit to cover. They HAD to prevent buys AS THEY COULD NOT SETTLE THEM. Robinhood was not the only one. Apex had to tell all the brokerages they clear for to stop allowing buys until they could meet the margin requirements. I am not a hedge fund billionaire, I just know how this stuff works. Please stop signal boosting this ignorance.

Though technically you are correct, you're missing the really important bit. If the reddit investors shorting stocks is a bad thing, then it's also a bad thing when hedge funds do it, irrespective of whether it's legal or not. What I hope will come out of this disruption is not so much that more people can do it but that the regulators curb the big guys doing it.

Load More Replies...All the "investors" always said that anyone can play their game and that they didn't mind, until everybody started to play their game. Now they want to change laws to make sure that none of them ever loses money to some internet trolls sabotaging their game.

Here is a really good analogy of what's happening with the hedge funds/reddit stock situation. 443fe8a1dd...29f730.jpg

I'm getting so tired of these incorrect analogies getting signal boosted. Fact: when volatility is high a clearinghouse has to have a certain amount of funds on deposit. Robinhood uses its own clearing house. They essentially got a margin call FROM REGULATORS stating they had to add $3 billion to deposit to cover. They HAD to prevent buys AS THEY COULD NOT SETTLE THEM. Robinhood was not the only one. Apex had to tell all the brokerages they clear for to stop allowing buys until they could meet the margin requirements. I am not a hedge fund billionaire, I just know how this stuff works. Please stop signal boosting this ignorance.

Though technically you are correct, you're missing the really important bit. If the reddit investors shorting stocks is a bad thing, then it's also a bad thing when hedge funds do it, irrespective of whether it's legal or not. What I hope will come out of this disruption is not so much that more people can do it but that the regulators curb the big guys doing it.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

139

18