Money has the tendency to run out even when you don’t feel like you’ve spent a lot. But it doesn’t have to be a big purchase to drain out the wallet. Minor expenses, such as the daily coffee run or going to a restaurant instead of bringing a lunch box to work, can add up to quite a sum. That’s why it’s important to be aware of your spending.

But some people come to realize how much they’ve spent on activities only when they stop doing them. They often change their habits for unrelated reasons and end up saving money without the intention to. If you’re confused about how one saves money ‘by accident’, check out these stories shared by reddit’s ‘Frugal’ community members.

The user ‘girlenteringtheworld’ asked them what actions ended up saving them money, when that was not the initial goal, and fellow redditors were happy to share. Scroll down to find their answers below, as well as some tips from a professor of economics at American University, Mary Eschelbach Hansen, which she shared with Bored Panda in a recent interview. You will also find some comments from the redditor herself.

This post may include affiliate links.

Limiting contact and then going no contact with my ultra conservative, bigoted, toxic family. No birthday gifts, Christmas gifts, wedding gifts, graduation gifts, anniversary gifts, mother's day and father's day gifts, baby shower gifts, travel expenses, and no therapy bills for the depression they created.

Limiting contact and then going no contact with my ultra conservative, bigoted, toxic family. No birthday gifts, Christmas gifts, wedding gifts, graduation gifts, anniversary gifts, mother's day and father's day gifts, baby shower gifts, travel expenses, and no therapy bills for the depression they created.

The redditor ‘girlenteringtheworld’ told Bored Panda that the reason she decided to ask such a question was pretty straightforward: “After noticing how much money I saved, I was curious what other people had experienced in their life. I was also somewhat interested in adopting some other things to save money.”

She also pointed out that she’s usually pretty prudent when it comes to handling money, yet it takes effort nevertheless. “In general, I do consider myself to be frugal but, like many others, I am in a battle with hyperconsumerist habits I grew up with and still experience in the current American society.

“I have been trying to implement things like mindfulness and low buys on things I don't need. That said, I do thoroughly enjoy saving money and try to find coupons on everyday essentials (like groceries) whenever I can,” she added.

Brewing my own coffee at home and quitting smoking.

Brewing my own coffee at home and quitting smoking.

This is a weird one, but help out your neighbors and be friendly. I babysat a little bit for free for one of mine who ended up working for Proctor & Gamble. They apparently give employees giant boxes of stuff sometimes. I have a 3-year supply of toothbrushes, Dawn dish soap, Venus razors, and Tide. She was just like, please get all this out of my house, I already took enough for my whole family. Results may vary.

Spending a bit more on quality shoes. More upfront cost but lasts longer so less replacing

Spending a bit more on quality shoes. More upfront cost but lasts longer so less replacing

The Sam Vimes Boots Theory (and can't believe I'm the first person to put this in the comments!)

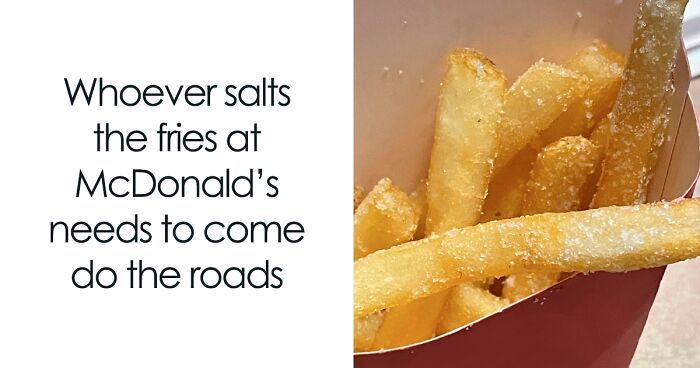

I started bringing a peanut butter and jelly sandwich to work for lunch when my car was in the shop and I couldn’t drive somewhere to grab food on my lunch hour. It wasn’t until a few months of this went by that I realized that $200-240ish per month of my income had been going to pay off my credit card that I bring to work with me every day, which I had not been using to buy lunches for awhile. I was like “huh, I have money leftover, did I pay all my bills or forget one or what??”

It was so common to spend about $10-12ish a day on Taco Bell, McDonald’s, Burger King, or whatever, and it never felt like much but it was really adding up. Pb&j is so cheap and easy, I should’ve been doing this all along.

I started bringing a peanut butter and jelly sandwich to work for lunch when my car was in the shop and I couldn’t drive somewhere to grab food on my lunch hour. It wasn’t until a few months of this went by that I realized that $200-240ish per month of my income had been going to pay off my credit card that I bring to work with me every day, which I had not been using to buy lunches for awhile. I was like “huh, I have money leftover, did I pay all my bills or forget one or what??”

It was so common to spend about $10-12ish a day on Taco Bell, McDonald’s, Burger King, or whatever, and it never felt like much but it was really adding up. Pb&j is so cheap and easy, I should’ve been doing this all along.

Not to mention, probably slightly better for you. Maybe level up from pb&j now.

Professor of economics Mary Eschelbach Hansen pointed out that your views play an important role when it comes to saving money. One of the three tips for taking better care of personal finances that she revealed to Bored Panda was keeping a positive attitude. “Think about money as a way to achieve your life goals,” she suggested.

According to Investopedia, setting short or long-term goals can help minimize unnecessary spending that often occurs when the money is not set toward something specific. In addition to that, setting goals can help trigger new behaviors, guide your focus and sustain momentum, all of which can boost your willingness to save money.

I quit drinking alcohol years ago for health reasons, and the financial aspect of it hit me later in life, I was already frugal and didn't spend much already but I know it saved me a ton of cash. Once in a while, like maybe twice a year I will buy a bottle of good red wine if I need to celebrate and that's it. Any addiction in fact isn't so good for the wallet (I was once addicted to buying books)

I quit drinking alcohol years ago for health reasons, and the financial aspect of it hit me later in life, I was already frugal and didn't spend much already but I know it saved me a ton of cash. Once in a while, like maybe twice a year I will buy a bottle of good red wine if I need to celebrate and that's it. Any addiction in fact isn't so good for the wallet (I was once addicted to buying books)

I started using a menstrual cup.

Originally I was researching organic tampons bc I was worried about TSS and the environment so that ultimately led me to reusable period products.

I haven’t bought tampons/pads since 2018 which has saved me hundreds of dollars and I’ve dramatically cut down the amount of waste I produce from my menstrual cycle!

I started using a menstrual cup.

Originally I was researching organic tampons bc I was worried about TSS and the environment so that ultimately led me to reusable period products.

I haven’t bought tampons/pads since 2018 which has saved me hundreds of dollars and I’ve dramatically cut down the amount of waste I produce from my menstrual cycle!

They are so worth it in my opinion. You have to persevere with how to insert and remove them in the first use but once you get used to it, it is pretty easy.

We got a dedicated freezer so we could have more food on hand. Turns out when I know that I've got $1000 worth of food in the freezer I don't eat out as much "Holy c**p, that's a lot of money stored in that freezer!"

Also we're able to take advantage of sales at the grocery store. Around Easter we'll buy a BUNCH of ham at pennies a pound. At Thanksgiving I'll buy 2 extra turkeys and break them down for eating later. It's hard to do a whole turkey, it's easy to do a turkey breast or legs or thighs. Again super cheap at the right time of year.

We got a dedicated freezer so we could have more food on hand. Turns out when I know that I've got $1000 worth of food in the freezer I don't eat out as much "Holy c**p, that's a lot of money stored in that freezer!"

Also we're able to take advantage of sales at the grocery store. Around Easter we'll buy a BUNCH of ham at pennies a pound. At Thanksgiving I'll buy 2 extra turkeys and break them down for eating later. It's hard to do a whole turkey, it's easy to do a turkey breast or legs or thighs. Again super cheap at the right time of year.

My library loans out ps5, Xbox series, and switch games. I've probably saved over $1000 never buying a single player game anymore. I also get to test out mutliplayer games before I commit to buying.

My library loans out ps5, Xbox series, and switch games. I've probably saved over $1000 never buying a single player game anymore. I also get to test out mutliplayer games before I commit to buying.

In my city, we even have play spaces on librairies, with Switch, Xbox etc

I stopped eating out because I’m lazy and don’t feel like leaving the house in the evening once I’ve changed into sweats.

And uh turns out I save a lot of money that way!

I stopped eating out because I’m lazy and don’t feel like leaving the house in the evening once I’ve changed into sweats.

And uh turns out I save a lot of money that way!

Broke up with ex - he was really into ordering food delivery often and I am more likely to be happy cooking at home. We would alternate paying and not to say I didn’t enjoy the meals, I’m just more inclined to find something at home given the option. And when I do order out I usually pick it up myself which ends up a lot cheaper than some of the delivery services. He was very into delivery

Broke up with ex - he was really into ordering food delivery often and I am more likely to be happy cooking at home. We would alternate paying and not to say I didn’t enjoy the meals, I’m just more inclined to find something at home given the option. And when I do order out I usually pick it up myself which ends up a lot cheaper than some of the delivery services. He was very into delivery

Defining your targets leads to the second piece of advice shared by M. E. Hansen, “Keep your life goals in sight. (Try setting your background to a picture that reminds you of your goals.)”

Studies show that steps as simple as writing your goals down can increase the likelihood of succeeding to accomplish them. It is related to external storage and encoding. The first one is a reminder in a physical form that can be easily accessed and reviewed any time, while the second relates to our brain activity and ensures that the information gets stored in our long-term memory.

Quit smoking for health reasons, a pack a day is $7. Ended up saving around $220 dollars a month. Started ordering grocery pickup, because I'm lazy and hate going in the store. Turns out I not only save money but I lost weight. Because I actually eat better and I'm not impulse buying anything I don't need.

Quit smoking for health reasons, a pack a day is $7. Ended up saving around $220 dollars a month. Started ordering grocery pickup, because I'm lazy and hate going in the store. Turns out I not only save money but I lost weight. Because I actually eat better and I'm not impulse buying anything I don't need.

Twenty five years ago I bought a fancy tote bag for $50 in a chi-chi gift shop while travelling. The design on it was a printed reproduction of glasswork by Tiffany. I’m still using it after all this time. It comes with me every time I need to carry something that won’t fit in my purse, and people still come up to me and say how they like it. It paid for itself over and over again.

Twenty five years ago I bought a fancy tote bag for $50 in a chi-chi gift shop while travelling. The design on it was a printed reproduction of glasswork by Tiffany. I’m still using it after all this time. It comes with me every time I need to carry something that won’t fit in my purse, and people still come up to me and say how they like it. It paid for itself over and over again.

Started using Lysol concentrate at the beginning of the pandemic because I couldn’t find the spray bottles.

A bottle of concentrate will last a year+ and is only $5

Started using Lysol concentrate at the beginning of the pandemic because I couldn’t find the spray bottles.

A bottle of concentrate will last a year+ and is only $5

Put a container under the kitchen and bathroom sinks. Everything clean in the blink of an eye.

“Know where your money goes! Use the budget planner in your banking, credit card, or payment apps to see what you are spending on,” the professor suggested as tip number three. In addition to that, she pointed out that automating your savings is also a good idea.

“If you have the option to 'round up' to savings, use it! Or open a separate account for savings and set up an automatic transfer to it when you get paid,” she said.

I started buying clothes on EBay, Poshmark and Mercari to get cute clothes while avoiding supporting brands that are unethical or owned by s****y people. Quickly realized that everything I could want including jewelry gets sold secondhand for way less, lots of times even new with tag & that’s basically how I get 90% of my clothing now.

I started buying clothes on EBay, Poshmark and Mercari to get cute clothes while avoiding supporting brands that are unethical or owned by s****y people. Quickly realized that everything I could want including jewelry gets sold secondhand for way less, lots of times even new with tag & that’s basically how I get 90% of my clothing now.

I love Poshmark. I only buy the expensive, well-made brands I wouldn't otherwise be able to afford. It's amazing.

We started a cover band to play outdoors during COVID. We simply needed more social interactions when we started the project.

Today, we are booked regularly at our favorite places to hang out. We get to enjoy our favorite places and instead of spending money to be there, we get paid and come home with more money!

We started a cover band to play outdoors during COVID. We simply needed more social interactions when we started the project.

Today, we are booked regularly at our favorite places to hang out. We get to enjoy our favorite places and instead of spending money to be there, we get paid and come home with more money!

I started trying to live lower waste. The following switches have saved me money in the long run:

* paper napkins → cloth napkins

* paper towels → rags, washable sponges, dish towels

* tampons/pads → menstrual disc/period underwear

* toilet paper → bidet + less TP

* tin foil/parchment paper/plastic wrap→ glass storage containers, silicone baking mats, beeswrap/vegan wax wrap

* ziploc bags → stasher bags/jars/Pyrex containers

* liquid detergent → powdered detergent

* liquid shampoo/conditioner/body wash → bars

* liquid hand soap → bar soap

* canned soda/bubbly water → sodastream

* clay cat litter → compostable pine pellet cat litter

* trash bags → bagless/washable bin liners/using packaging like dog food bags for bin liners

Other things:

* joining a buy nothing group

* eating less/stop eating animal products

* buying used/refurbished/secondhand

* learning how to store vegetables properly

* growing my own herbs

I started trying to live lower waste. The following switches have saved me money in the long run:

* paper napkins → cloth napkins

* paper towels → rags, washable sponges, dish towels

* tampons/pads → menstrual disc/period underwear

* toilet paper → bidet + less TP

* tin foil/parchment paper/plastic wrap→ glass storage containers, silicone baking mats, beeswrap/vegan wax wrap

* ziploc bags → stasher bags/jars/Pyrex containers

* liquid detergent → powdered detergent

* liquid shampoo/conditioner/body wash → bars

* liquid hand soap → bar soap

* canned soda/bubbly water → sodastream

* clay cat litter → compostable pine pellet cat litter

* trash bags → bagless/washable bin liners/using packaging like dog food bags for bin liners

Other things:

* joining a buy nothing group

* eating less/stop eating animal products

* buying used/refurbished/secondhand

* learning how to store vegetables properly

* growing my own herbs

The OP also shared her insight on ways to save money: “I noticed I'm more likely to overspend whenever I am bored or don't have enough vitamin D. I noticed this after I started going for walks outside, or spending a day taking pictures of flowers at nearby parks. After I noticed it, I started implementing an "outside time" requirement before I buy anything to make sure it's something I actually want, rather than a dopamine-deprived impulse.”

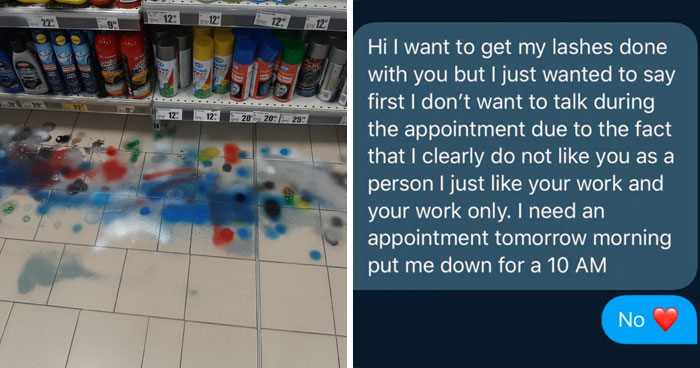

I cut my own hair. I kept going to the salon only to have them not do what I wanted so out of frustration I started doing it myself.

I also do my own pedicures. I’m so afraid so picking up a foot fungus or them cutting me.

I cut my own hair. I kept going to the salon only to have them not do what I wanted so out of frustration I started doing it myself.

I also do my own pedicures. I’m so afraid so picking up a foot fungus or them cutting me.

Raising fruits and vegetables.

Naysayers insist it doesn't save money but we've gotten better with practice.

And the effort that goes into gardening, that's exercise. Saves the cost of a gym membership.

Raising fruits and vegetables.

Naysayers insist it doesn't save money but we've gotten better with practice.

And the effort that goes into gardening, that's exercise. Saves the cost of a gym membership.

I remember reading you need around 50 square meters of plantations for it to become profitable. If you have less, you’re not getting enough to cover the time spent and the costs, that’s a hobby. But on the other hand, 50m2 is not that much, you can easily save money while enjoying gardening.

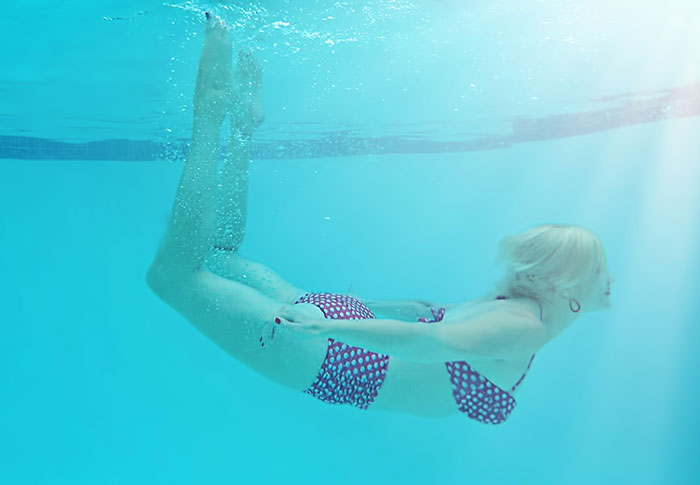

Go swimming.

I started it because it's fun and good for my health.

The thing is I only pay 1.80€ for entry, because it's really cheap here.

At home I have a warm water heater, which is running on power.

I am paying 50 Cent/kWh and the warm water heater takes 21 KW.

So showering 15 Minutes are 2.50€.

So I am saving 70 cent on showering and get the swimming free and get shower as long I want without any stress :)

Go swimming.

I started it because it's fun and good for my health.

The thing is I only pay 1.80€ for entry, because it's really cheap here.

At home I have a warm water heater, which is running on power.

I am paying 50 Cent/kWh and the warm water heater takes 21 KW.

So showering 15 Minutes are 2.50€.

So I am saving 70 cent on showering and get the swimming free and get shower as long I want without any stress :)

I saw a statistic that said peeing just once a day in the shower saves 525 gallons of water a year.

“I would like to add that finding things you enjoy doing could save you more money than you think it will, and you should definitely take a leap if you're debating it,” the redditor said. “If you like baking, start making your own bread. If you like experimenting with your style, shop your own closet and see what hidden gems you already have.”

I learned how to fix things.

Yeah, grew up wanting to tinker and mess around with stuff, but it's only been recently that I'm realizing just how much money I've saved by doing my own repairs. Fixing phones, small appliances, computers, broken s**t around the house, etc.

I even recently saved a family member over $100 for replacing a broken screen on their phone :)

Caveat: I did have to invest in tools/supplies initially and over time. But they've easily paid for themselves by now.

I learned how to fix things.

Yeah, grew up wanting to tinker and mess around with stuff, but it's only been recently that I'm realizing just how much money I've saved by doing my own repairs. Fixing phones, small appliances, computers, broken s**t around the house, etc.

I even recently saved a family member over $100 for replacing a broken screen on their phone :)

Caveat: I did have to invest in tools/supplies initially and over time. But they've easily paid for themselves by now.

I daily drive my 1961 moped. All steel made, very simple maintenance, everything can be fixed. Doing 250 km with 5 litres of mix, takes me the same time to commute to work as with a car, sometimes faster in case of traffic jam. Not mentionning riding with style, the kindness towards my granma from other road users, thumbs up and small talks everywhere I stop

Buying a new (used) car. Was really just tired of my car being in the shop all of the time. Bought a new car which resulted in a slightly higher monthly payment at the time, but was pleasantly surprised when my insurance cost was basically cut in half. Of course there were maintenance savings as well, but that wasn't really my main goal.

Buying a new (used) car. Was really just tired of my car being in the shop all of the time. Bought a new car which resulted in a slightly higher monthly payment at the time, but was pleasantly surprised when my insurance cost was basically cut in half. Of course there were maintenance savings as well, but that wasn't really my main goal.

I quit drinking alcohol. Alcohol is expensive, going out to eat and having a few drinks is expensive, trying new breweries or wineries is expensive, spending a Sunday afternoon at a bar is expensive. Thankfully I never had to pay the cost of a DUI because that's REALLY expensive. Cutting the one thing saved thousands a year in associated costs.

I quit drinking alcohol. Alcohol is expensive, going out to eat and having a few drinks is expensive, trying new breweries or wineries is expensive, spending a Sunday afternoon at a bar is expensive. Thankfully I never had to pay the cost of a DUI because that's REALLY expensive. Cutting the one thing saved thousands a year in associated costs.

I can testify to this one. My husband and I are both raging alcoholics in recovery for a little over a year. We are saving so much money and we are really benefiting in other ways.

Homemade bread products. Tried making bread in my 20’s. It always failed. Gave up for a couple decades. On a lark I found a bagel recipe online. Figured, why not. They are fantastic. Started thinking about other stuff I could try to make. Haven’t bought any bread products in three months now. Loaf breads, hamburger and hot dog buns, pizza dough, English muffins, dinner rolls, donuts, and of course, bagels.

Didn’t start this as a cost savings thing. Just like good quality stuff that I can customize flavors with. Was buying the 5lb bags of bread flour at the grocery store at about $1/lb. Found a 50 lb bag of bread flour at US Foods ChefStore for 50 cents a pound. Also a brick of instant yeast at a quarter of the price I’d been getting it at the grocery store for. Worked up the cost of all this stuff I’m making and it averages about a quarter the cost of buying any of it premade.

Even bought a bread box on marketplace to keep it all in!!

Homemade bread products. Tried making bread in my 20’s. It always failed. Gave up for a couple decades. On a lark I found a bagel recipe online. Figured, why not. They are fantastic. Started thinking about other stuff I could try to make. Haven’t bought any bread products in three months now. Loaf breads, hamburger and hot dog buns, pizza dough, English muffins, dinner rolls, donuts, and of course, bagels.

Didn’t start this as a cost savings thing. Just like good quality stuff that I can customize flavors with. Was buying the 5lb bags of bread flour at the grocery store at about $1/lb. Found a 50 lb bag of bread flour at US Foods ChefStore for 50 cents a pound. Also a brick of instant yeast at a quarter of the price I’d been getting it at the grocery store for. Worked up the cost of all this stuff I’m making and it averages about a quarter the cost of buying any of it premade.

Even bought a bread box on marketplace to keep it all in!!

You have to eat and bake a lot of bread for this to be a saving, but I do enjoy bread I've made myself.

I bought clippers for my cat when our mobile groomer shut down in 2020 and I haven't paid for pet grooming since. Almost everything I've ever done to be healthier or more environmentally responsible has saved money as a side effect.

I bought clippers for my cat when our mobile groomer shut down in 2020 and I haven't paid for pet grooming since. Almost everything I've ever done to be healthier or more environmentally responsible has saved money as a side effect.

Installing a bidet

Installing a bidet

I'm not convinced about this one - I wonder how many years of saving on toilet paper it takes to even pay for itself. It may not be expensive but you need to add in water/sewage costs as well.

I started cutting my own hair and doing my own nails because I don't like random people in my personal space and hate small talk. It was a one time purchase of proper scissors and one of those uv sets from Amazon. Less than one trip to the nail salon. Now I can do these things whenever I want without waiting for an appointment or having to drive anywhere. It's also a bonus because now I can easily convince my tween daughter to sit and talk to me about her life for an hour while I do her nails. I also got to make sure it wasn't a strong UV light and we always use sunscreen on our hands as a pre treatment.

I started cutting my own hair and doing my own nails because I don't like random people in my personal space and hate small talk. It was a one time purchase of proper scissors and one of those uv sets from Amazon. Less than one trip to the nail salon. Now I can do these things whenever I want without waiting for an appointment or having to drive anywhere. It's also a bonus because now I can easily convince my tween daughter to sit and talk to me about her life for an hour while I do her nails. I also got to make sure it wasn't a strong UV light and we always use sunscreen on our hands as a pre treatment.

I started making vanilla syrup for my coffee because I couldn't find it in stock at any local stores in 2020, I typically had been going through a $5 bottle every week. It doesn't seem like much, but pennies for sugar and cheap artificial vanilla compared to $260 a year is a change I'm really glad I made.

I started making vanilla syrup for my coffee because I couldn't find it in stock at any local stores in 2020, I typically had been going through a $5 bottle every week. It doesn't seem like much, but pennies for sugar and cheap artificial vanilla compared to $260 a year is a change I'm really glad I made.

I cut cable when I moved overseas - never missed it. Barely watched any streaming outside of youtube. So when I came back I just got internet only. I used to have some streaming channels, but I've cut almost all of those too... I find it's not that I really want to watch a show or movie that often, I just want background noise while I surf.

Also I dropped my Audible subscription - I used to listen to a lot of nonfiction books which were more expensive as a book than the monthly sub - but these days I just listen to podcasts mostly.

I cut cable when I moved overseas - never missed it. Barely watched any streaming outside of youtube. So when I came back I just got internet only. I used to have some streaming channels, but I've cut almost all of those too... I find it's not that I really want to watch a show or movie that often, I just want background noise while I surf.

Also I dropped my Audible subscription - I used to listen to a lot of nonfiction books which were more expensive as a book than the monthly sub - but these days I just listen to podcasts mostly.

Started doing my own oil changes because I'm rural and I'd have to wait with the car for the shop to do it. It's both quicker and costs only 1/5 of what the shop charges. Main tool that makes this easy is a oil transfer pump, slurps old stuff right from the dipstick tube, just keep the empty container from previous change to fill it and take it to the parts store next time.

Honestly, you should really be changing your oil filter every time you change your oil. Since you're already under the car changing the filter, just loosen the oil plug. I hate changing my oil and will gladly absorb the cost and have someone else do it.

Got a Soda Stream because they stopped selling Canada Dry seltzer.

Got a Soda Stream because they stopped selling Canada Dry seltzer.

Bought a food processor so I could make homemade pizza. It literally saved me a small fortune.

As someone who can't afford to eat out and doesn't drink alcohol or drive (yay medication), no money-saving tips were found.

this! + I don't smoke and I live in a small apartment (=bills are not high)

Load More Replies...I don't know why it is but Brita water tastes sooo good! I have never found bottled water that tastes as good.

Load More Replies...As someone who can't afford to eat out and doesn't drink alcohol or drive (yay medication), no money-saving tips were found.

this! + I don't smoke and I live in a small apartment (=bills are not high)

Load More Replies...I don't know why it is but Brita water tastes sooo good! I have never found bottled water that tastes as good.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime