Parents Think They Have A Right To Daughter’s Money Because They Raised Her, Get A Reality Check

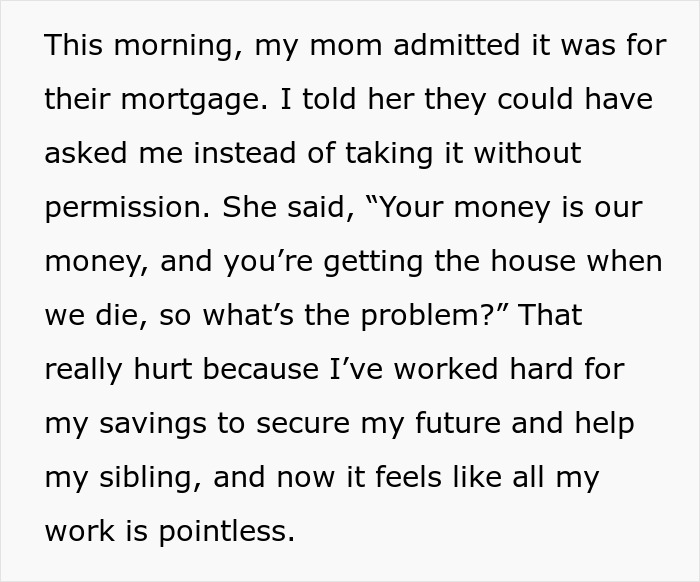

Interview With ExpertSome say money magnifies what people already are, and for one teen, it created a difficult family dilemma. An 18-year-old shared on Reddit that her parents withdrew close to a thousand dollars from her savings without her permission.

“Your money is our money,” they claimed and asked her to transfer more the next day.

The teen, who works for her father and has been putting away whatever she can, refused to hand over additional funds and it has led to a heated argument.

This teenager had big plans for how to spend her money

Image credits: Ave Calvar/Unsplash (not the actual photo)

But they were undermined by her parents’ actions

Image credits: Curated Lifestyle/Unsplash (not the actual photo)

Image credits: throwAwayWho818

Vicki Broadbent of Honest Mum believes that since an 18-year-old is deemed an adult, they are free to decide for themselves whether to work or not

Image credits: Joseph Sinclair

Our parenting expert, an award-winning TV broadcaster and author, Vicki Broadbent, thinks that it’s ideal for children and parents to have an open, trusting relationship so subjects like work and money can be discussed regularly, regardless of age.

But at the end of the day, “parents of those under 18 should approve the job their teen does. They have a duty of care towards their child,” Broadbent, who runs the popular family lifestyle blog Honest Mum, told Bored Panda.

The question of whether a working teenager who still lives with their parents should contribute to the family’s budget or bills can be hard to answer because the perspectives vary widely.

“Every situation will differ but whatever is decided upon should be discussed and feel fair for all parties,” Broadbent said. “Perhaps a percentage of the teen’s earnings (5 or 10%) could contribute to food and bills to help them learn life skills but ideally, the teen would work as an extra means to earn money to buy things they want, especially if they are studying and the job is part-time, and of course, contributing would depend on their age.”

“I think it’s a big ask for even a 16-year-old to contribute financially to the family. Their earnings are not going to match an 18-year-old usually and the pressure could feel stifling,” the author of Mumboss (UK) and The Working Mom (US and Canada) added.

Teenagers are increasingly returning to the workforce

After the 1970s, teen participation in the United States labor force steadily declined and dropped from 59.3% in 1978 to 32.5% in 2014. But since then, it’s been moving up again, reaching 36.2% last month.

Experts say financial need is driving more and more teenagers to work—prices are 22.1% more expensive today than they were before the pandemic recession began in February 2020.

Furthermore, according to a survey released in May, about 64% of parents living with children under the age of 18 said they felt financially secure in 2023, down from 69% in 2022.

So for many of those who are old enough to work, getting a part-time job to cover their needs and help the family with the bills has become a reality.

But in this case, the teen had already been working hard and saving for her future, showing responsibility beyond her years. She may have contributed to her parents’ budget if they had asked her directly, but taking the money behind her back not only broke her trust—it sent a message that her efforts didn’t matter (or belong to her) at all.

“The parents in the article absolutely crossed the line,” our parenting expert Vicki Broadbent said. “There was no discussion or explanation nor a request for their daughter’s hard-earned cash. They accessed her account without her consent.”

“Had they explained their financial situation and offered to pay back that money or create a plan where the daughter contributes a percentage of earnings to assist them in the future or to cover her rent, it would not have felt like a betrayal of trust.”

Vicki highlighted that in many places—such as the US or her home country, the UK—an 18-year-old is legally considered an adult, “so the parents would have no right to their daughter’s money irrespective of whether she lives with them or not.”

Image credits: Kateryna Hliznitsova/Unsplash (not the actual photo)

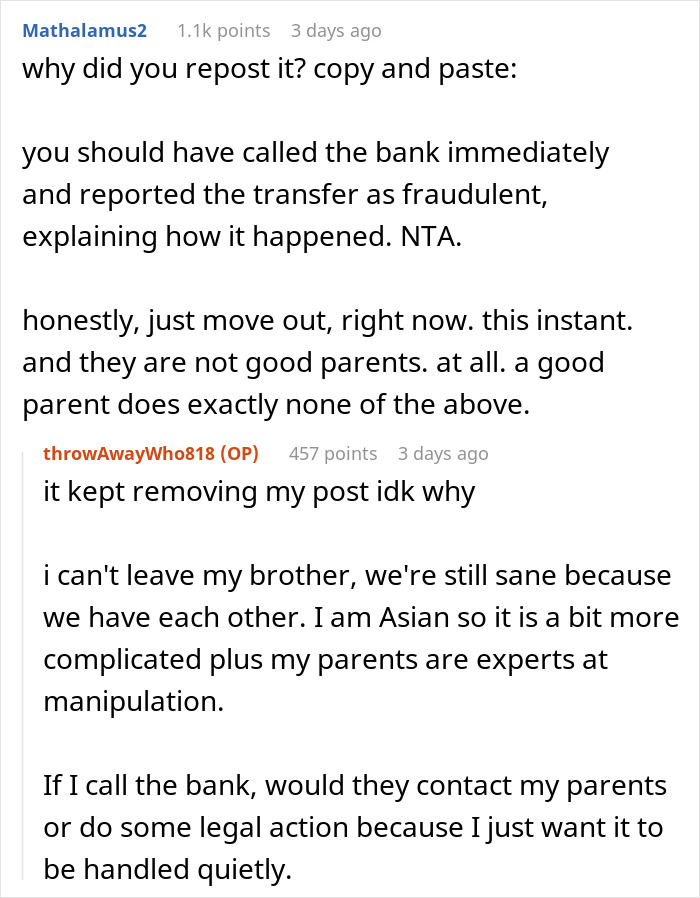

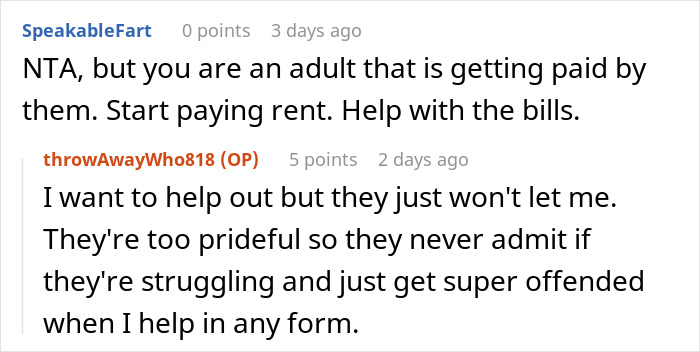

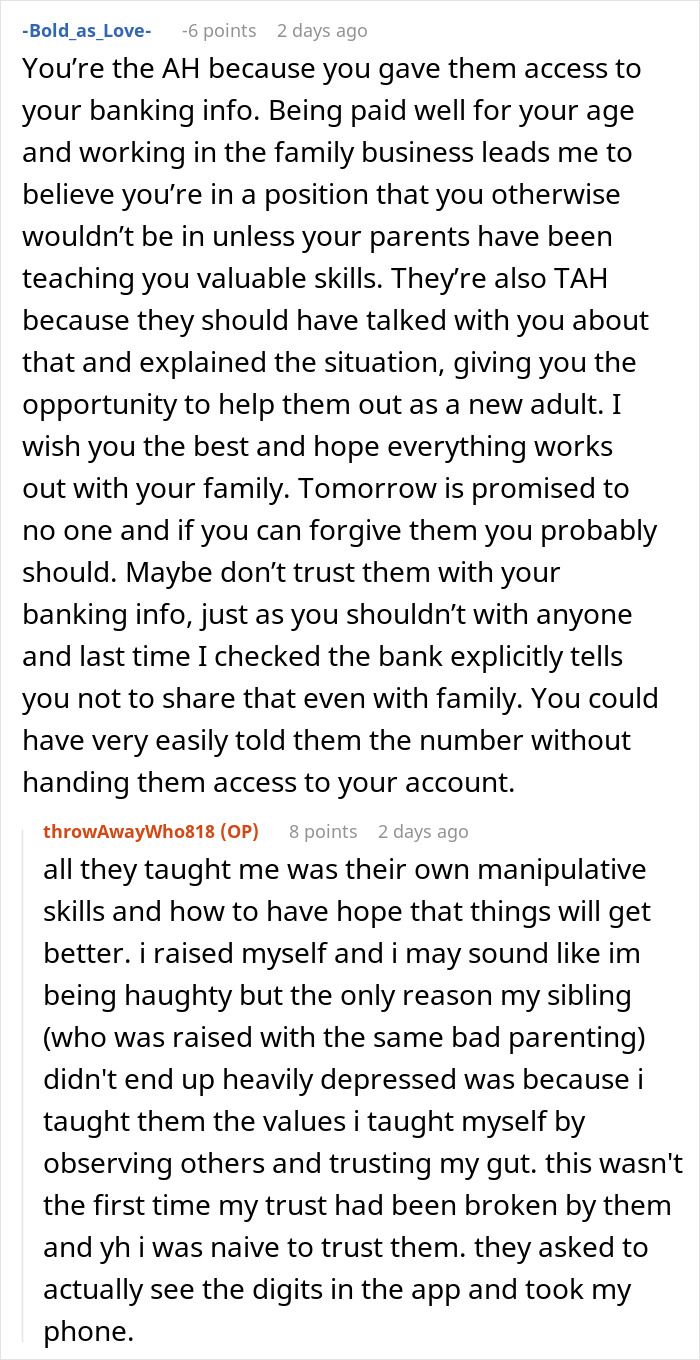

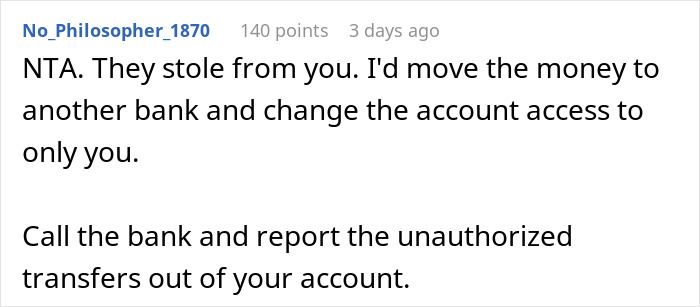

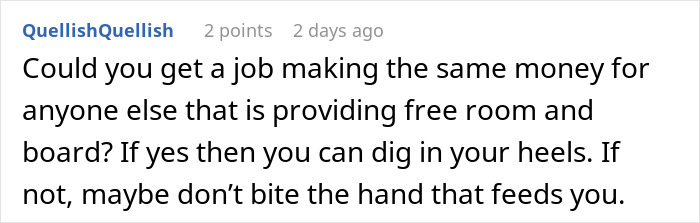

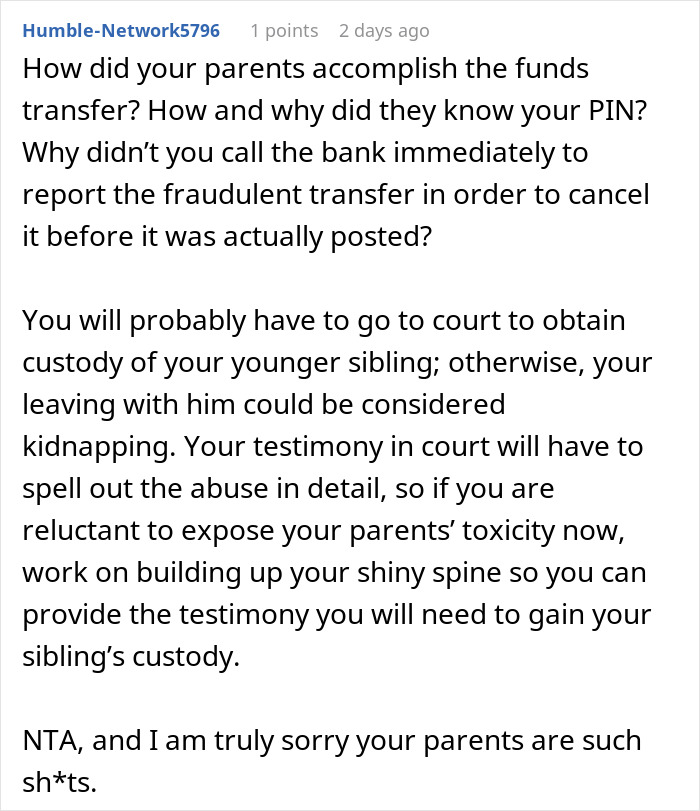

As her story went viral, the teen joined the discussion in the comments

Pretty much everyone said that her parents had crossed the line

Poll Question

Thanks! Check out the results:

Explore more of these tags

My dad did that to me a few times. I'd get a nice tax return and get my check in the mail. I'd hide it... "Hey, where's' that check you got?" "Um, I have it somewhere. Why?" All the sudden, my room is ransacked, my name forged on the check and he has my money, which I did have a purpose for!! "DAD, WHY DID YOU STEAL MY MONEY? I WAS GOING TO USE THAT FOR XX!!" "Well, too bad, your mother and I needed it. Sorry. We'll pay you back." 20+ years later and he's passed on. Never paid me back. Still quite salty.

Would have reported him the 2nd time, tbh. And moved.

Load More Replies...IF Dad employs 18 yo daughter and "pays her really well" to be a tax dodge to hide money, that should have been communicated (you'll work for $10/hr but I'm paying you $20/hr, I'll need half back later) otherwise it's STEALING. Taking her phone, laughing while transferring her money out over protests IS stealing. Asking 18 to daughter to contribute towards household costs is not unheard of but using her as a chump is. (They're manipulative and too prideful to ask so they just take). And the whole " we raised you, you owe us" is baloney. Parents have a legal obligation to provide food/shelter/etc for their offspring. You don't owe them 18 yrs of rent. How you ended up with morals to teach your little bro, living in that environment, is a mystery.

"Tax dodge" is the first thing that came to my mind too. I'd want to have a look at the business's books.

Load More Replies...Been there and done that! My dad TOOK my inheritance from granddad because "he'd been paying so much during my childhood". I am actually eternally grateful for my parents' s****y ways because I now have a perfect canvas for what NOT to do if I ever were to become a parent.

How do people get large sums of money like this taken with such frequency considering ALL the protections built into modern banking practices? Did you let him hold all the cash "just to smell it" and he ran away? I don't get it

Load More Replies...My mom did that to me. She was a prosperity gospel evangelical so all her money went to the church like a slot machine. She got $660/mo in child support, but couldn't pay $850 in rent inc utilities, plus about $150/mo in groceries. She worked full-time as a cleaning lady. When we got a little windfall she's guilt us into giving it to her. We bought our own groceries because there was never enough for 4 of us, paid the phone bill when it got cut off, and the power and gas when they got shut off. I remember having no power/heat/water in -20 C winter because she gave all her earnings to the church. If we had moved into our own house it would have been cheaper on us all, and we could have left that psychopath to rot

Providing for your child is required as a parent. You’re not entitled to pay anyone back for what they’re legally obligated to do. Parents like that disgust me.

Just to make it clear, in case someone might be wondering; If you have a child, you will be responsible for it's physical and emotional welfare until it is capable to support itself. This usually means the first 18 to 21 years, when the child usually will be ready with education, find a job and start to move out. This is not a loan, it is an obligation. If there is anything that might be expected to be repaid in some way, it would be; respect and love above and beyond the obligatory and some investment in time and help which is put in after that first 21 years.

Make sure you go to the hr for the company and tell them that if your wages are tampered with or transferred or docked to any other account but what you have set you will file a law suit for that. Federal wages are employees. Only a warrant can tamper with your pay. Or a messed up payroll person. Keep an eye on it.

Doubtful the company is large enough to have an HR dept...

Load More Replies...Unlike the poll I say just move out, there are good people and plenty of access for financial planners to help you get things sorted out period I would also consider lawyering up because using that information can help you also gain custody of her brother.

My dad did that to me a few times. I'd get a nice tax return and get my check in the mail. I'd hide it... "Hey, where's' that check you got?" "Um, I have it somewhere. Why?" All the sudden, my room is ransacked, my name forged on the check and he has my money, which I did have a purpose for!! "DAD, WHY DID YOU STEAL MY MONEY? I WAS GOING TO USE THAT FOR XX!!" "Well, too bad, your mother and I needed it. Sorry. We'll pay you back." 20+ years later and he's passed on. Never paid me back. Still quite salty.

Would have reported him the 2nd time, tbh. And moved.

Load More Replies...IF Dad employs 18 yo daughter and "pays her really well" to be a tax dodge to hide money, that should have been communicated (you'll work for $10/hr but I'm paying you $20/hr, I'll need half back later) otherwise it's STEALING. Taking her phone, laughing while transferring her money out over protests IS stealing. Asking 18 to daughter to contribute towards household costs is not unheard of but using her as a chump is. (They're manipulative and too prideful to ask so they just take). And the whole " we raised you, you owe us" is baloney. Parents have a legal obligation to provide food/shelter/etc for their offspring. You don't owe them 18 yrs of rent. How you ended up with morals to teach your little bro, living in that environment, is a mystery.

"Tax dodge" is the first thing that came to my mind too. I'd want to have a look at the business's books.

Load More Replies...Been there and done that! My dad TOOK my inheritance from granddad because "he'd been paying so much during my childhood". I am actually eternally grateful for my parents' s****y ways because I now have a perfect canvas for what NOT to do if I ever were to become a parent.

How do people get large sums of money like this taken with such frequency considering ALL the protections built into modern banking practices? Did you let him hold all the cash "just to smell it" and he ran away? I don't get it

Load More Replies...My mom did that to me. She was a prosperity gospel evangelical so all her money went to the church like a slot machine. She got $660/mo in child support, but couldn't pay $850 in rent inc utilities, plus about $150/mo in groceries. She worked full-time as a cleaning lady. When we got a little windfall she's guilt us into giving it to her. We bought our own groceries because there was never enough for 4 of us, paid the phone bill when it got cut off, and the power and gas when they got shut off. I remember having no power/heat/water in -20 C winter because she gave all her earnings to the church. If we had moved into our own house it would have been cheaper on us all, and we could have left that psychopath to rot

Providing for your child is required as a parent. You’re not entitled to pay anyone back for what they’re legally obligated to do. Parents like that disgust me.

Just to make it clear, in case someone might be wondering; If you have a child, you will be responsible for it's physical and emotional welfare until it is capable to support itself. This usually means the first 18 to 21 years, when the child usually will be ready with education, find a job and start to move out. This is not a loan, it is an obligation. If there is anything that might be expected to be repaid in some way, it would be; respect and love above and beyond the obligatory and some investment in time and help which is put in after that first 21 years.

Make sure you go to the hr for the company and tell them that if your wages are tampered with or transferred or docked to any other account but what you have set you will file a law suit for that. Federal wages are employees. Only a warrant can tamper with your pay. Or a messed up payroll person. Keep an eye on it.

Doubtful the company is large enough to have an HR dept...

Load More Replies...Unlike the poll I say just move out, there are good people and plenty of access for financial planners to help you get things sorted out period I would also consider lawyering up because using that information can help you also gain custody of her brother.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

46

29