30 Americans Share Their Student Loan Debts And You Can Feel How Hopeless These People Are

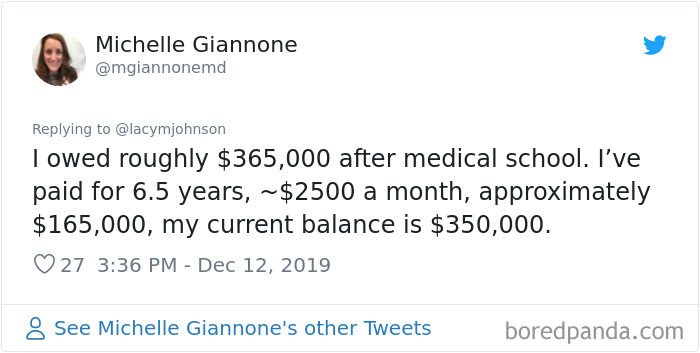

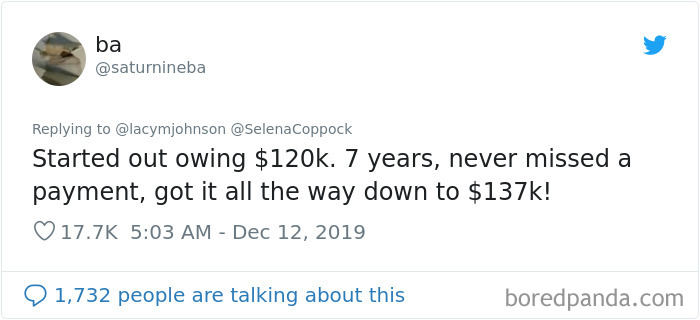

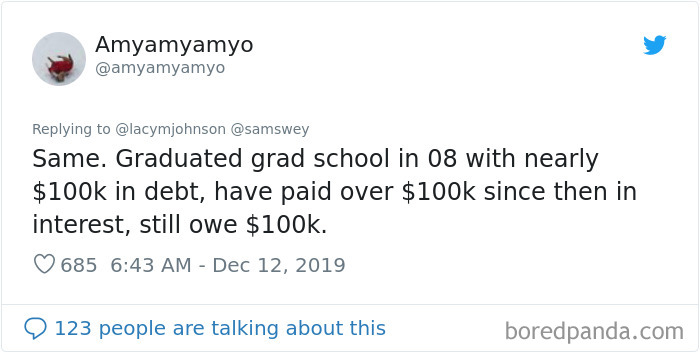

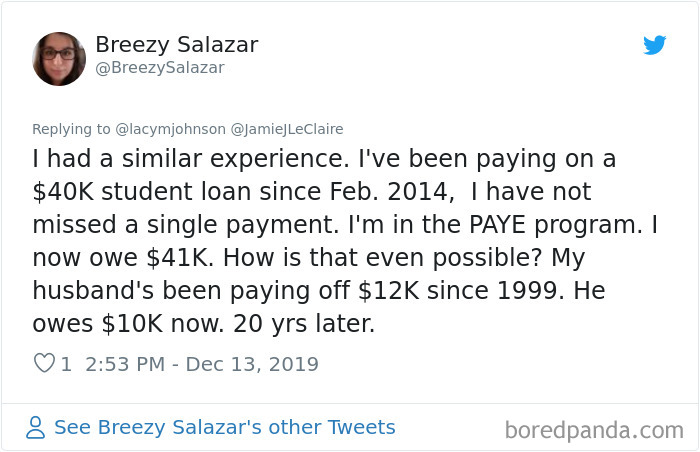

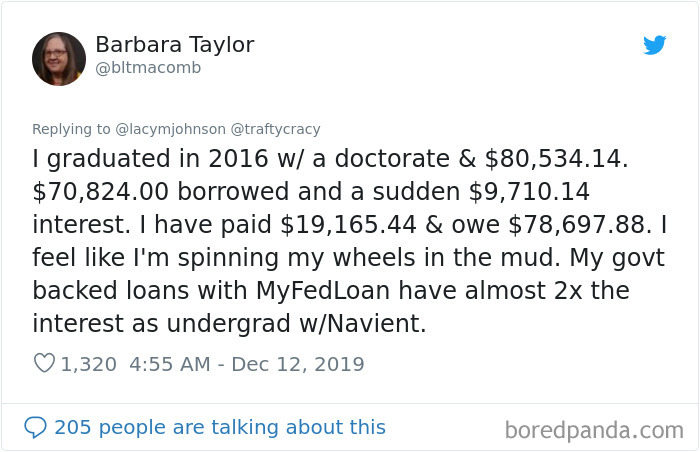

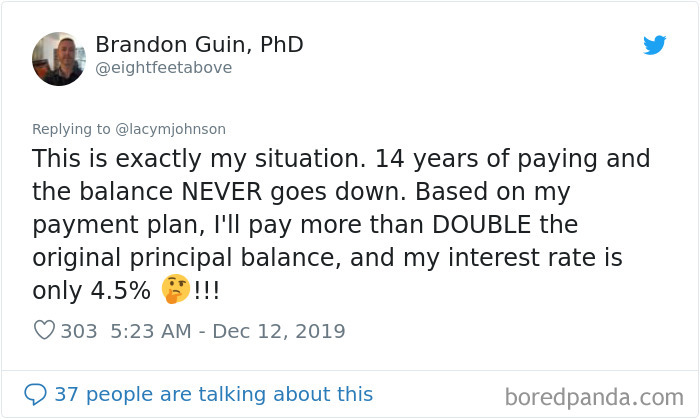

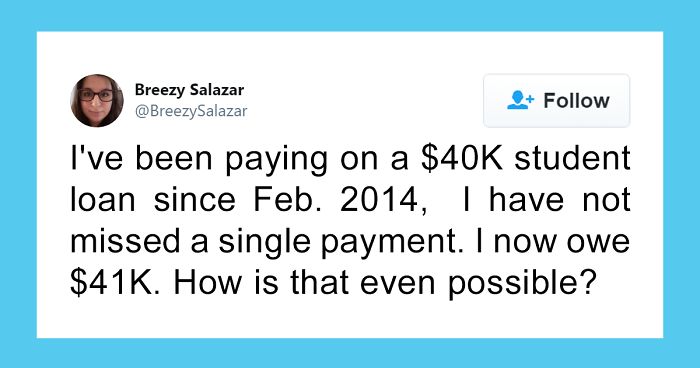

A writer and professor’s thread about student loan debt has inspired people to talk about the debt they’re facing, and the amount is truly staggering. Lacy M. Johnson, whose Ph.D. is in creative writing, revealed that despite making timely payments for over a decade to pay back the $70,000 loan she took out, almost equaling the amount of the loan in the first place… it hasn’t gotten any smaller.

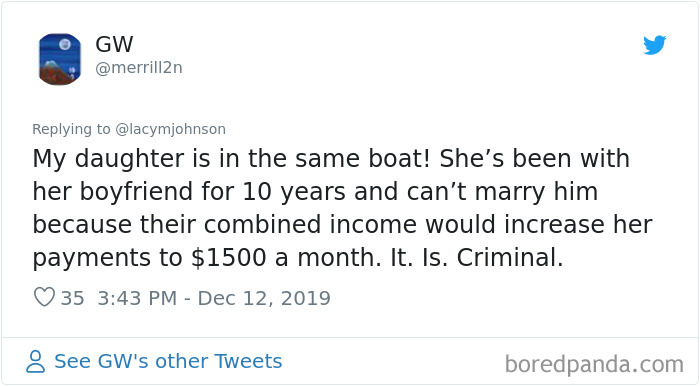

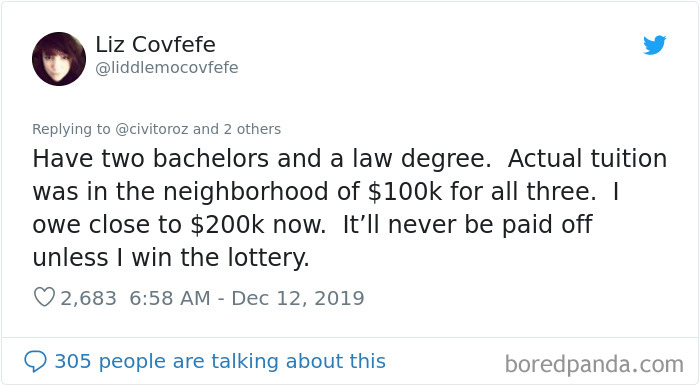

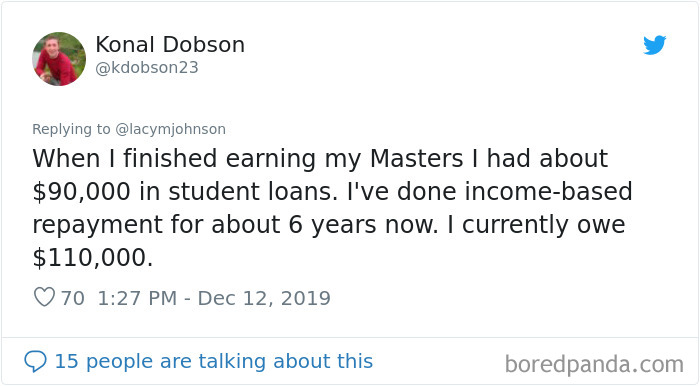

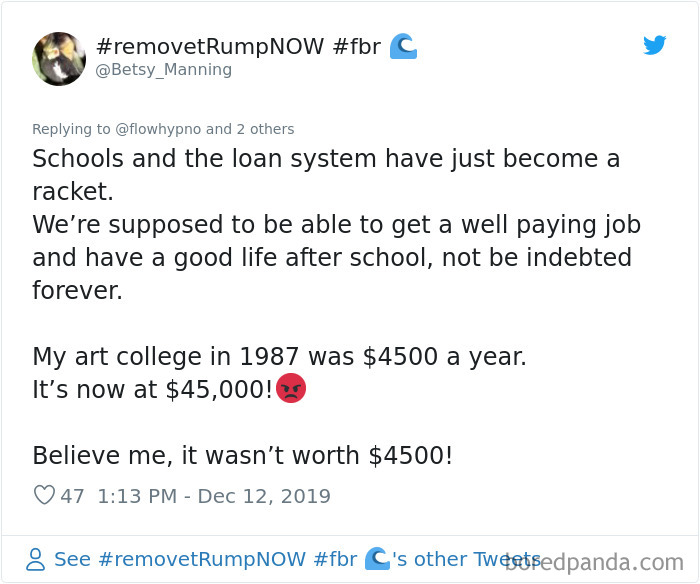

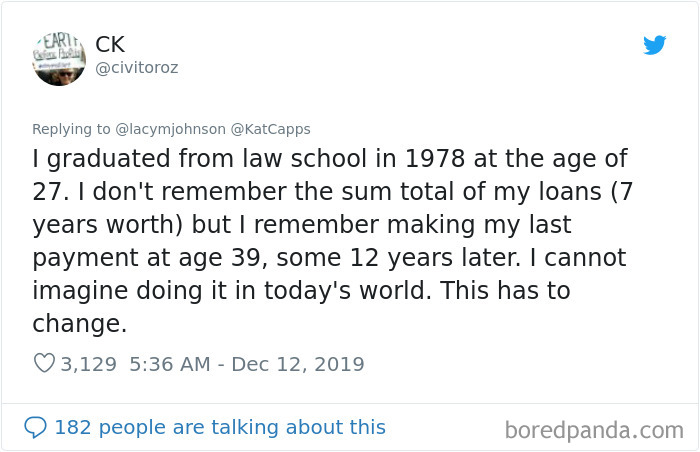

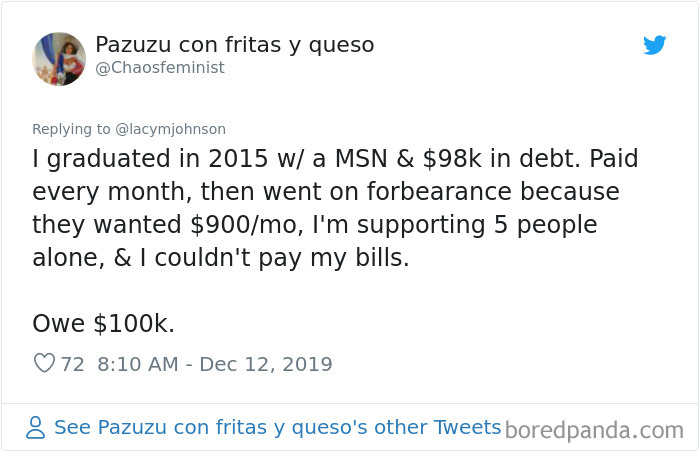

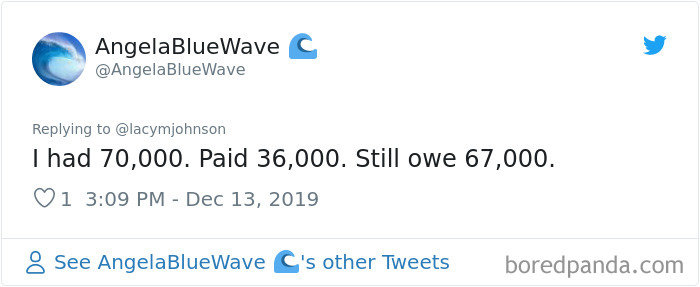

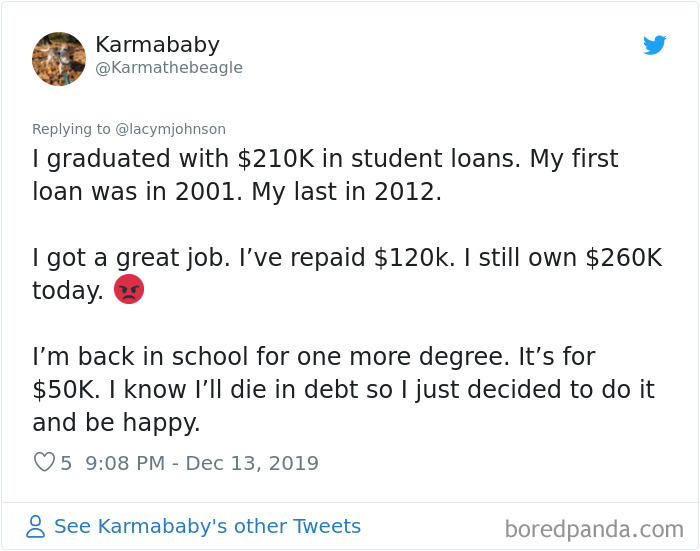

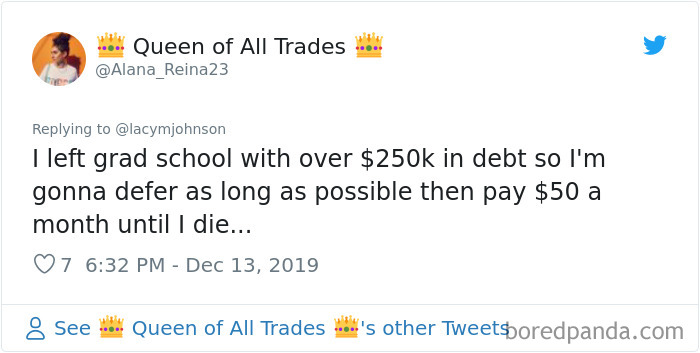

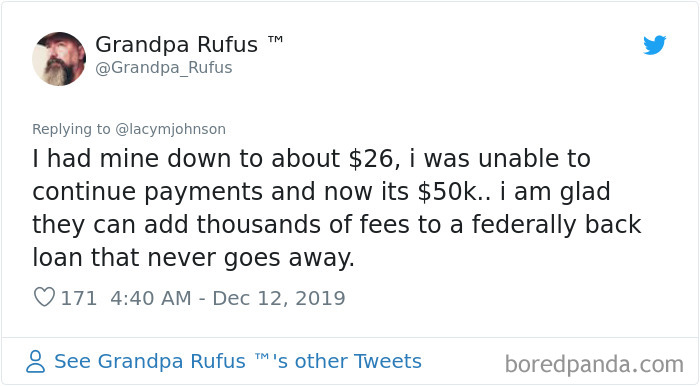

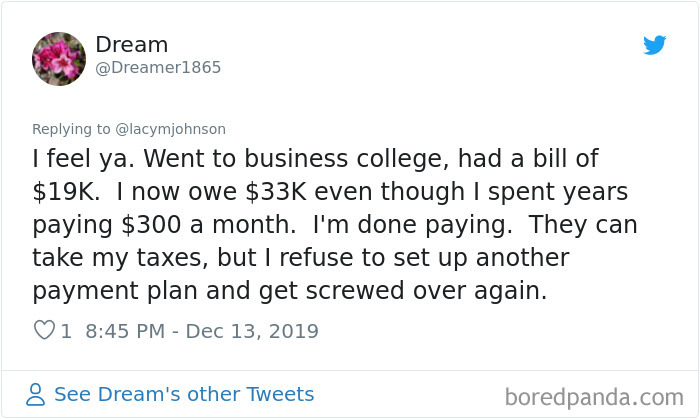

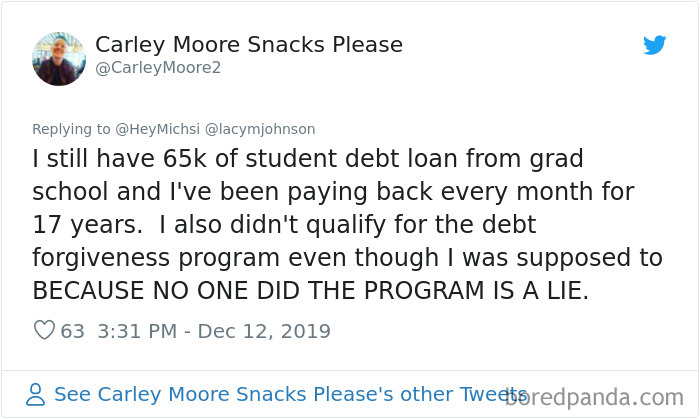

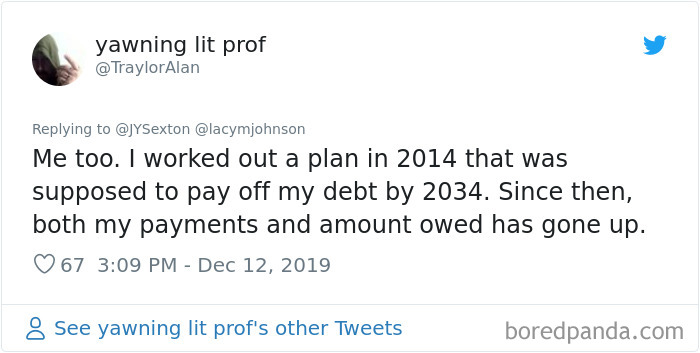

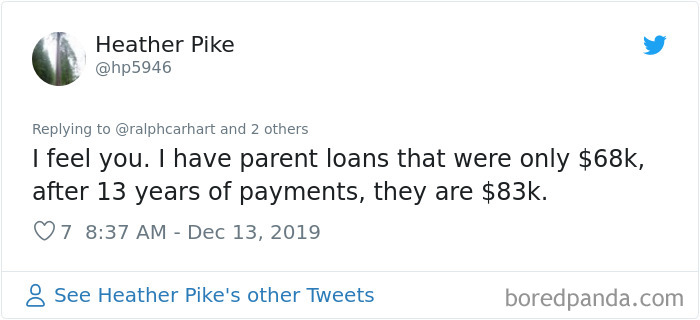

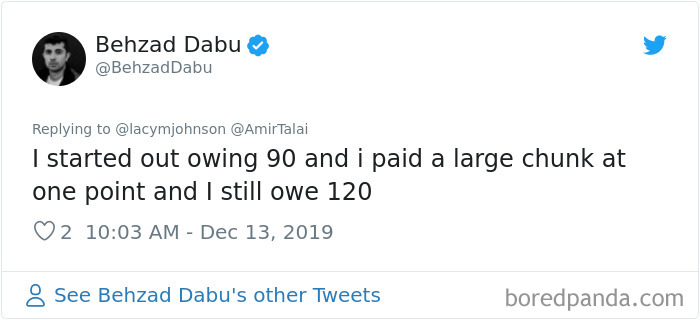

The responses to her thread tell the same story: after decades of trying to pay back their student debts and getting absolutely nowhere due to rapidly and unpredictably increasing interest, people feel almost like they are being punished for life just for getting an education.

This post may include affiliate links.

It's really unfair, illogical and disgusting that this happens to people. I pay student loans, too. I am thinking I'll never finish paying, either.

How is this legal? Reading about all these student loan horror stories makes me glad I didn't went to college in US, and makes me extremely worried thinking about when my now 8 yo will go to college.

How the hell are these monthly payments calculated in the US? In Europe, each monthly payment consists in one part interest and one part loan. The proportion between interest rate and base loan changes as the years pass, but you actually pay back a portion of the loan starting with the first payment. You can't actually owe the same amount that you loaned, after 11 years of on-time monthly payments. This is legalized theft, pure and simple. And a good way to keep you down and in your place!

Disturbingly, a person from a wealthy family with enough in the bank to pay for university tuition at face value pays less, while those who don’t are forced to spend years after graduation dumping their money into a black hole that can expand to twice the size of the loan itself.

And as you can see from the real stories that keep pouring in as responses to Johnson’s tweet, people in the US are accepting that they’re never going to buy homes, get married, have children, or retire because of it. They’re certainly not enjoying the benefits of the career paths they had to get a higher education in order to gain access to.

Lol, excuse me what???? I never love France as much as when I read about US healthcare and student loan...

Johnson, who started the Twitter thread, stated her support for presidential candidate Elizabeth Warren. The candidate has proposed a plan to cancel or majorly reduce student loan debt for most borrowers based on income, funding the cancellation by driving up taxes on ultra-millionaires.

She’s not the only US presidential candidate who wants people to live debt-free—Bernie Sanders’ goal is to completely erase student loan debt by taxing stock transactions.

Proponents of forgiving student loan debt believe that it would reduce social inequality, incentivize higher education, and enable more people to buy homes and start businesses.

With the US presidential election coming up, people who are being held back by paying off debt will likely turn to candidates who consider solving it a priority.

For those of you knocking an Art Degree: Look around you. This website, all websites, all marketing, all the cute packaging you get with the things you buy, all the clothes you wear, advertisements that make you want to see something, movie posters you treasure: All Art degrees. Some of you have your heads too far up your own arses to see this, thinking you can make a 'clever' joke or feel better about yourselves because you THINK you've put something down but instead you've made yourselves look like uncultured, unthinking idiots. Congrats Raul, AV7, Jeremiah Pierce, and Demi Zwaan for being such childish, idiotic caricatures to watch.

Same situation. Finally finished my bachelors in 2015. Over the years I borrowed the max $53,500. I was suckered by one online university. Come to find out I was completely bamboozled. The AA amounted to nothing. It's embarrassing to even put it on my resume. I now owe $115k in student loans and will never be able to pay it off in my lifetime. This was and IS a huge scam that guaranteed a revenue flow and keep us under the govt. thumb. It's criminal. Loan sharks don't charge this much.

Most school loans die with you, so your not leaving them for the family.

Wait, GOVERNMENT loans have that kind of interest on them??? Christ, the US are truly and deeply fu*cked up.

Full Name, I think you’re misreading it. She’s saying she has to defer, otherwise she can’t afford to pay and live at the same time. As a result, she pays instead the $50 which is probably a minimum per month.

Once the government started backing the loans isn't that when they started to skyrocket and every college and Uni course started to cost the moon and stars? Sounds like the schools and the finance companies are in un Holy alliance to squeeze the last drop of blood out of all the students.

I can totally relate to this! I have subcumed to the notion that I will die with this debt. I finally finished my BA, almost $80,000 later. Sine 2017 its almost to 110k, on deferment, and IBR. Now businesses want to hire real world experience not just that of an education. I'm in a 28k, temp job, no benefits, no PT, no Vaca, no sick pay and have 2 young children . Something's gotta give!! Talk about a double edge sword!!

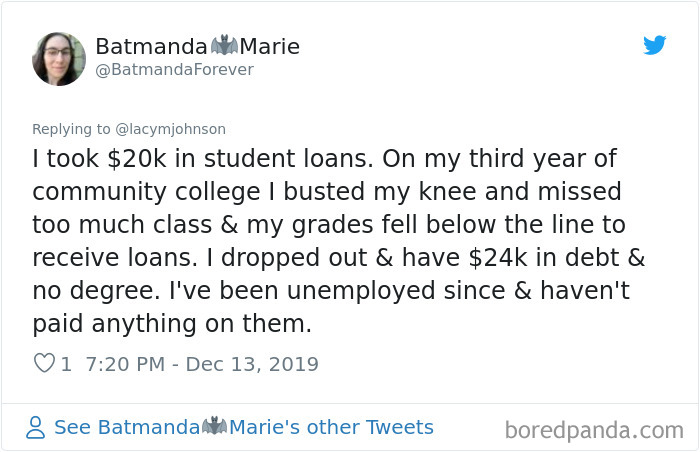

A ruined life because a busted knee. That's the American dream for you, in a nut shell.

The only way that we can have a solution that will be fair to all of us is to tear this one completely down and rebuild it more in line with the needs of modern people. While taking into account the respect of all living things on this planet. We can't continue to ravage this planet in our pursuit of progress. It's the mentality that we've been taught to accumulate a particular resource that we can hoard to ourselves that allows us to obtain more than another. As humans, we just need the basics to live, and the ability to express our creativity as we seek the end goal. Being a part of the world and leaving it in a better place than when we go there. Reality is the opposite. Achieve as much as you can in disregard to r the future at their expense. They are the ones who must clean up our mess

Well You don't qualify for forgiveness simply by having 20 years lapse. you needed to be on IDR for those 20 years.

That's because the interest is compounded daily. No other loans are. It's criminal and would be illegal for any other lender.

WHY is there not a huge protest storm happening right now? This is just disgusting and illegal of the Education system in America to just rob people like that!!! I hope they end up in jail for life and that they return the money they stole from you all, by waiving these horrible study debts!!!!!! They will go to hell (and no I am not religious but I believe in karma) in time for doing this to students. Also, the question is, why don't everyone all boycott the education by not enrolling in courses? Lets see it impact the greedy business that is stealing through student loans. Never mind the few rich who can just pay upfront, there is a few of them and many more of you who are not, so time to fight back!

You can't expect the government to help you out when they need to spend all of their money on the military and tax cuts for the wealthy.

Well, where do people in the US get their education if they (know they) can't afford student loans? In the army! So why would the gouvernment be so stupid as to cut off it's very effective poor people soldier breeding program?

Load More Replies...I guess according to some of you on here I was one of those idiots that got myself into one of these loans. Although, I don't think I was an idiot, I was desperate and un-informed about student loans. I came from a drug addicted mother and a very bad childhood. I wanted to better myself and did it completely on my own. No one helped and no one educated me on what my options were. I don't regret my decision but I feel like these loan companies prey on people in my situation and that is very wrong.

You are not an idiot, just a victim. you are completely right, it is predatory behavior to allow you to start a loan "underwater" or in a state where the interest exceeds your monthly due.

Load More Replies...I went to uni in my home country (Germany) and while I was enrolled, they started collecting tuition for a couple of semesters until another party took over the state government and abolished it again. I graduated owing 2,800 Euro and I was furious. Paid it back in 100 Euro installments, starting a year after graduation – that rule was put in place to make sure people had found employment in the meantime before they had to stat paying. It wasn't that big a dealbut I still don't think it's right. Can't imagine to be buried in debt like a lot of American students/graduates.

I already had my degree when Germany suddenly thought, it would be a great idea to introduce tuition. The politicians agreeing on that all went to uni for free, of course. Fortunately, most states have abolished them, again. It is inconceivable to me, why a country would cripple it's future generations like the US are doing. It destroyys any hope for a real future. Unless, of course, you want a banana republic with throngs of abject poor, plenty of soldiers to feed wars that a small percentage of very wealthy people get rich on. then it's a great concept.

Load More Replies...You can't expect the government to help you out when they need to spend all of their money on the military and tax cuts for the wealthy.

Well, where do people in the US get their education if they (know they) can't afford student loans? In the army! So why would the gouvernment be so stupid as to cut off it's very effective poor people soldier breeding program?

Load More Replies...I guess according to some of you on here I was one of those idiots that got myself into one of these loans. Although, I don't think I was an idiot, I was desperate and un-informed about student loans. I came from a drug addicted mother and a very bad childhood. I wanted to better myself and did it completely on my own. No one helped and no one educated me on what my options were. I don't regret my decision but I feel like these loan companies prey on people in my situation and that is very wrong.

You are not an idiot, just a victim. you are completely right, it is predatory behavior to allow you to start a loan "underwater" or in a state where the interest exceeds your monthly due.

Load More Replies...I went to uni in my home country (Germany) and while I was enrolled, they started collecting tuition for a couple of semesters until another party took over the state government and abolished it again. I graduated owing 2,800 Euro and I was furious. Paid it back in 100 Euro installments, starting a year after graduation – that rule was put in place to make sure people had found employment in the meantime before they had to stat paying. It wasn't that big a dealbut I still don't think it's right. Can't imagine to be buried in debt like a lot of American students/graduates.

I already had my degree when Germany suddenly thought, it would be a great idea to introduce tuition. The politicians agreeing on that all went to uni for free, of course. Fortunately, most states have abolished them, again. It is inconceivable to me, why a country would cripple it's future generations like the US are doing. It destroyys any hope for a real future. Unless, of course, you want a banana republic with throngs of abject poor, plenty of soldiers to feed wars that a small percentage of very wealthy people get rich on. then it's a great concept.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime