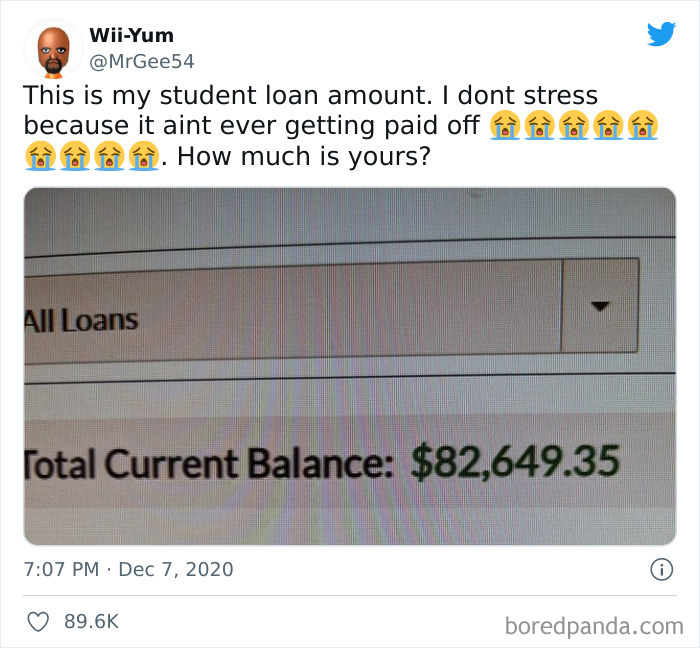

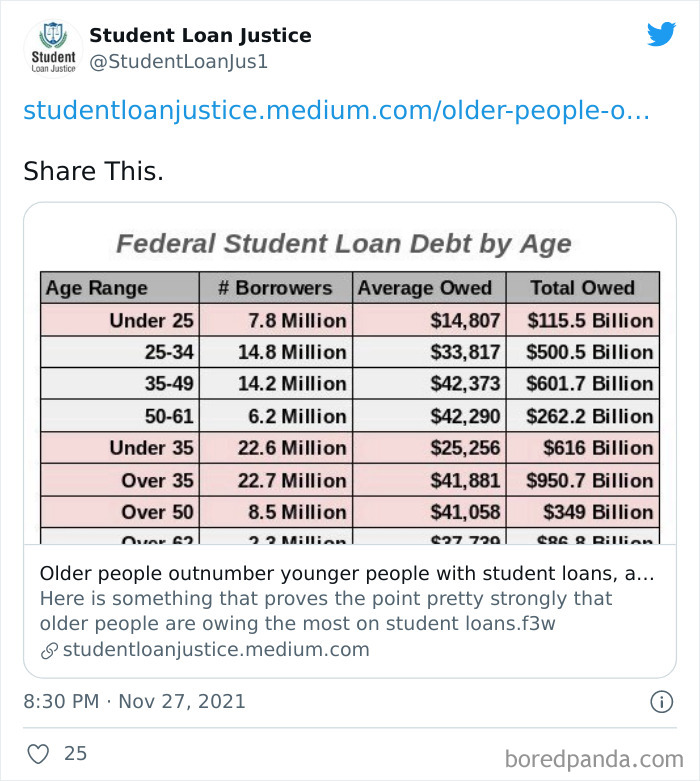

As of 2021, approximately 43 million Americans held student debt, with an average student loan balance of $37,105. In fact, Americans owe $1.71 trillion in total of student loan debt. The numbers are pretty shocking, to say the least.

Now, the sad part of owing federal student debt is the fact that a third of borrowers can’t keep up with it after just six years. With so much pressure building up, all this economic uncertainty, insane housing boom prices, it seems like many millennials and younger generations are stuck in a giant hamster wheel of hell. How did we end up here?

The screenshots below will shed light on the scope of the problem and how it’s basically impossible to pay off a student loan in the US. It may make your body temp soar, so if you’re already feeling on edge today, you may as well skip to the next article. And the brave ones, as well as the student debt survivors themselves, please scroll down below.

This post may include affiliate links.

Student Loans Put You Through College But Put You Through Debt For Much Longer!!

I'm in seminary right now, at age 52. I'll die in debt, but then I'll go to Heaven. Come get the money, jerks.

America Is A Scam

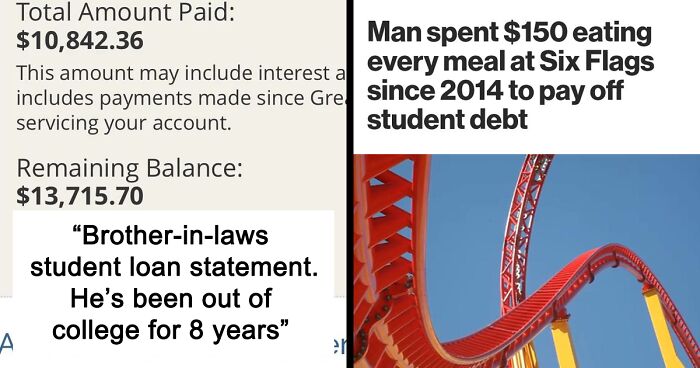

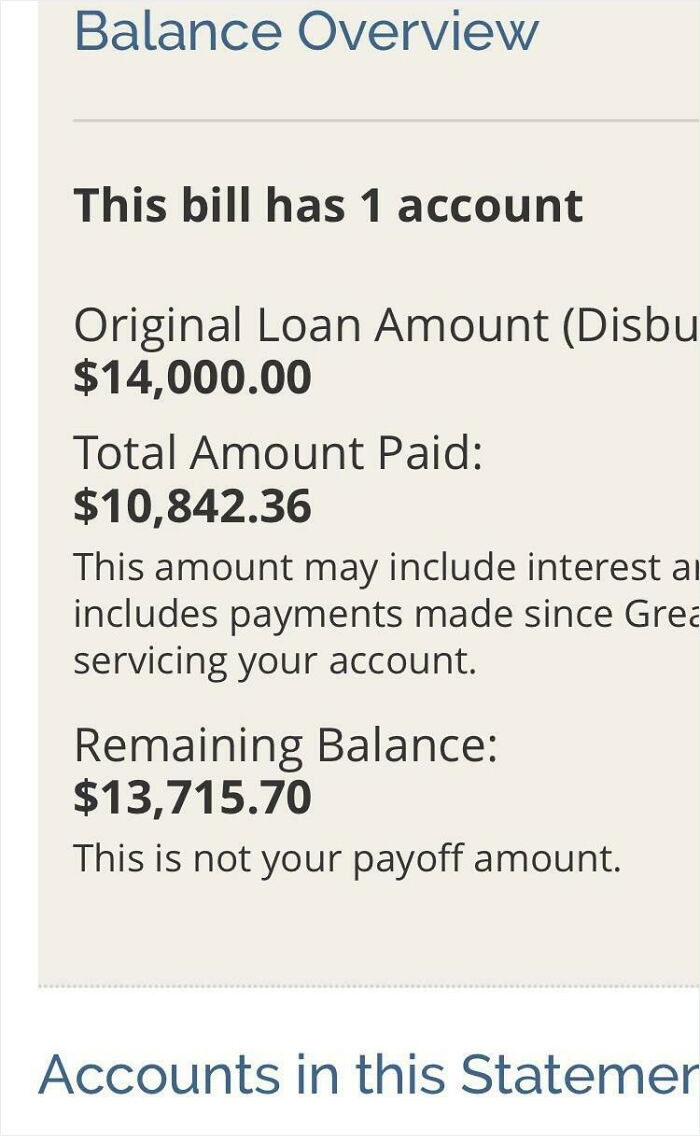

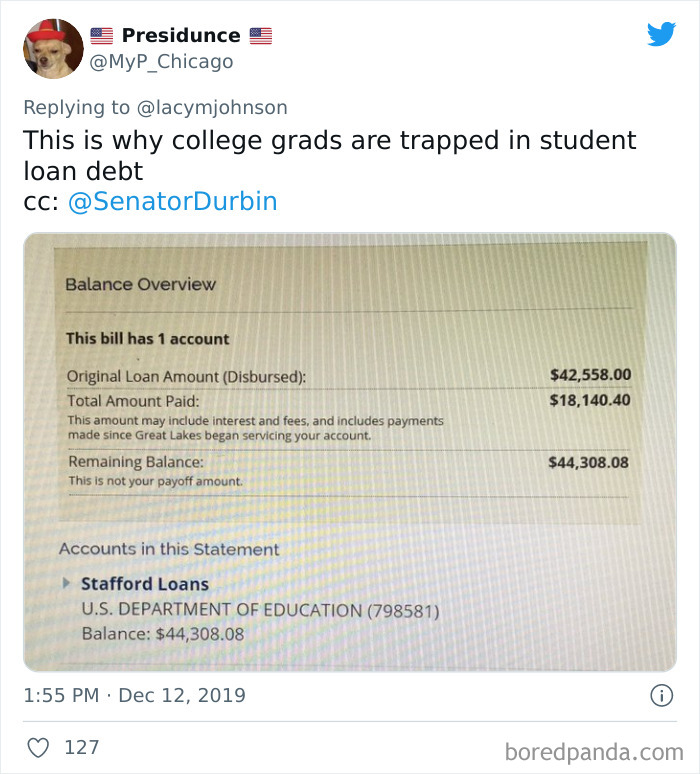

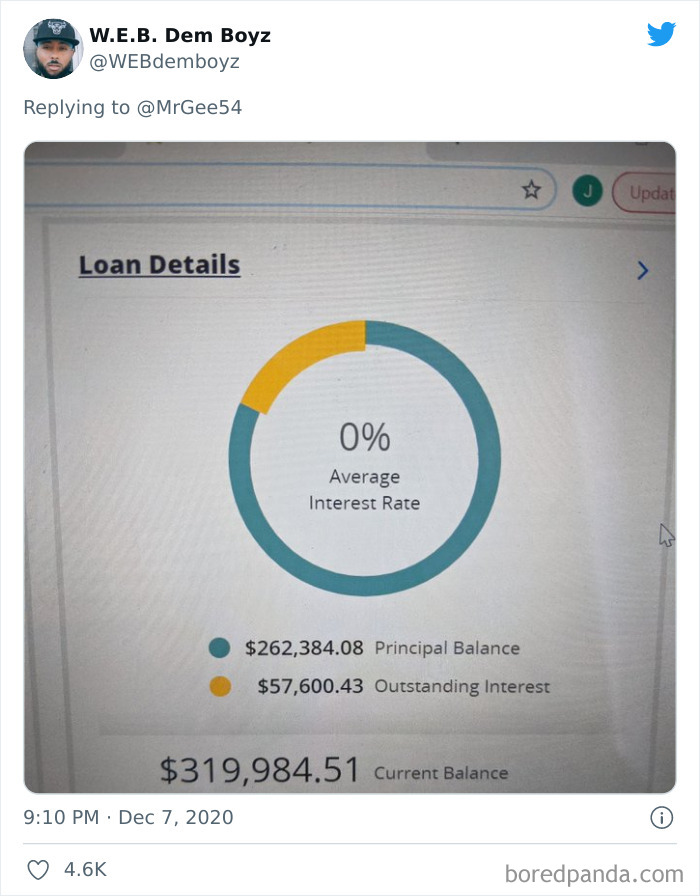

Brother-In-Laws Student Loan Statement. He’s Been Out Of College For 8 Years. How Do You Ever Get Out Of This?!?

In the Netherlands they would be prosecuted for loan sharking, scamming and blackmail.

The Federal Reserve estimates that in quarter two of 2021, Americans owed a startling $1.73 trillion in student loans. Despite a pause on federal student loan interest rates, the number marks a record-breaking amount and it increased 3% compared to quarter two of 2020.

WalletHub has recently compared the 50 states and the District of Columbia based on 11 measures of indebtedness (such as average student debt totals) and earning opportunities (such as unemployment among recent college graduates). They managed to determine which states struggle the most with student debt.

Yes, I Too, Love Paying Off Half My Student Loans. Or Be Able To Live Somewhere For Another 3 Months

One Year Of Student Loan Payments Down

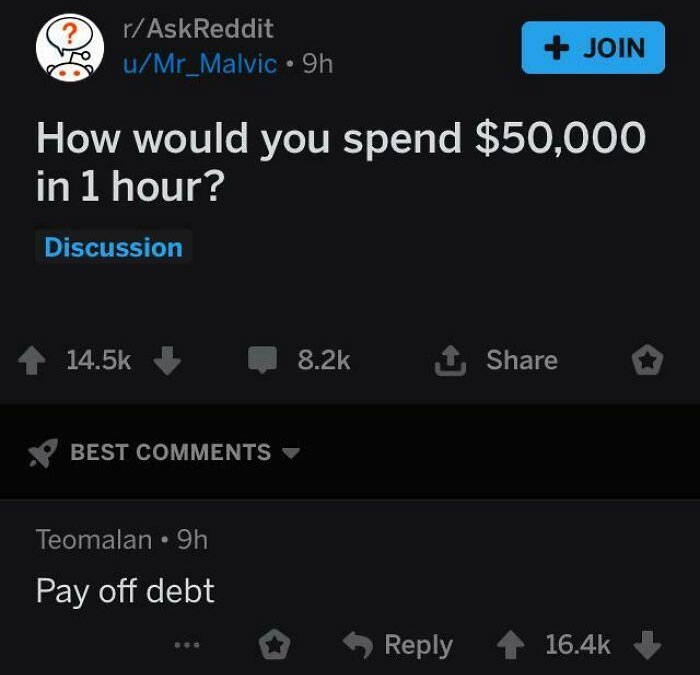

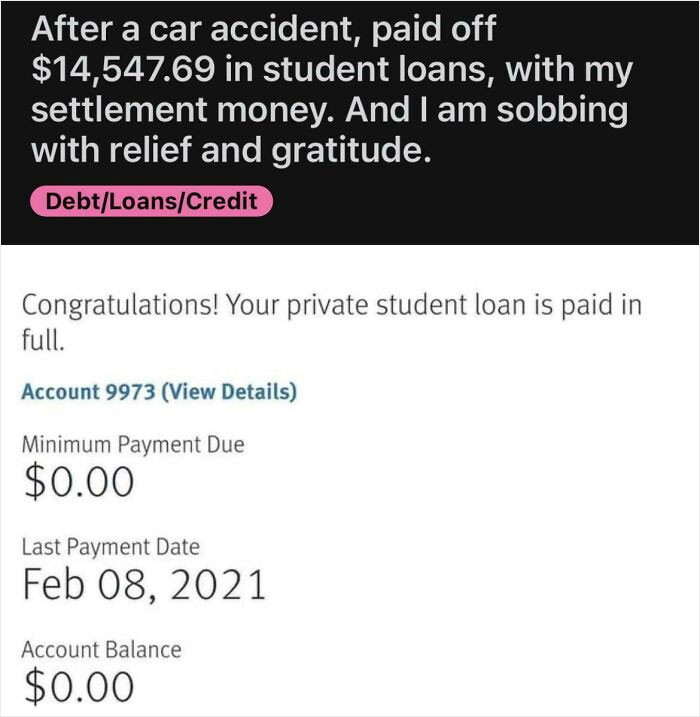

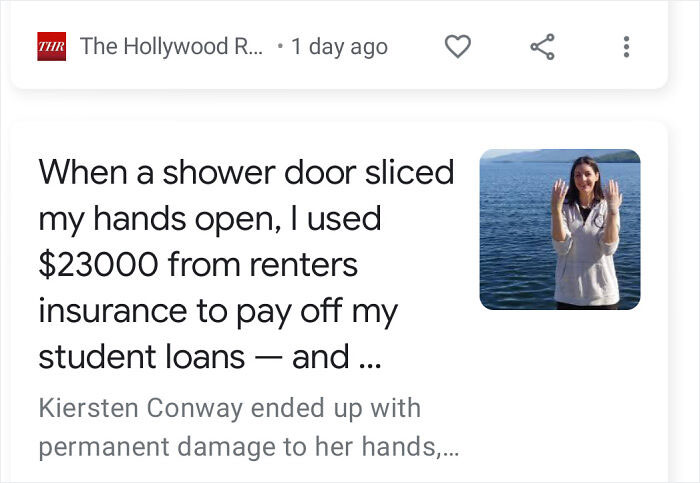

Paying Off Student Debt By Getting In A Car Accident

My dad had to die a horrible death from kidney cancer in order to cancel out the Parent Plus Loan he took for my education. I did manage to pay off my student loans a couple of years ago, buy defaulting and getting my wages garnished. It sucked but it was a payment plan that seemed to work.

It turned out that West Virginia is the state most impacted by student debt. The data showed that student loan borrowers from there face some of the worst ratios of student debt to income. Moreover, an astounding number of borrowers from the state are behind on their student loan payments. WalletHub data also found that New Hampshire is home to the second-worst student loan holders. The state has the highest average student debt totals and the highest proportion of students who currently have student debt.

A 2020 report by The Institute for College Access and Success estimated that an average student debt total for New Hampshire residents in the college Class of 2019 is roughly $39,410, more than any other state.

Imagine Having To Pay Off Your Mom’s Student Loan Debt In Literally Any Situation

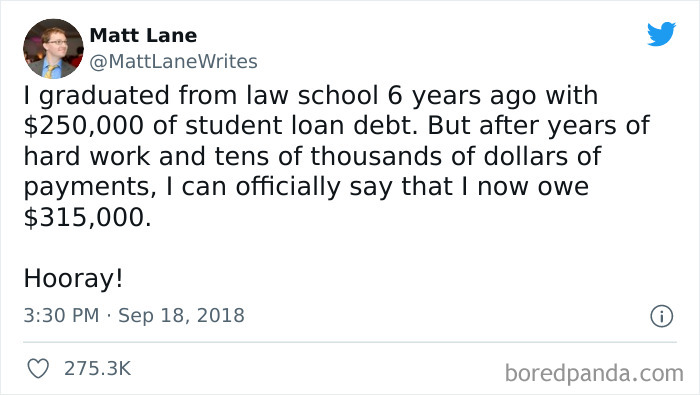

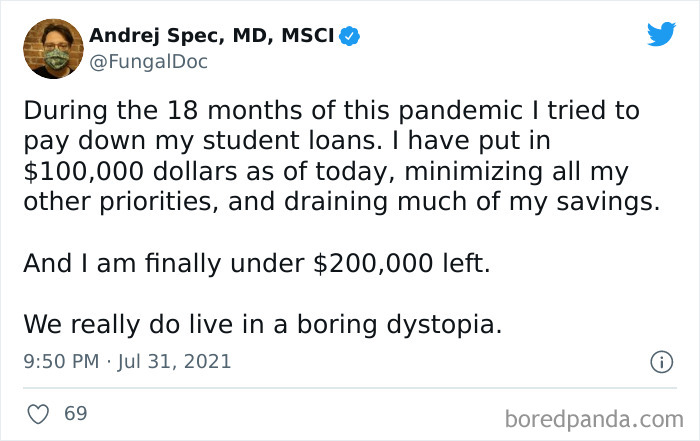

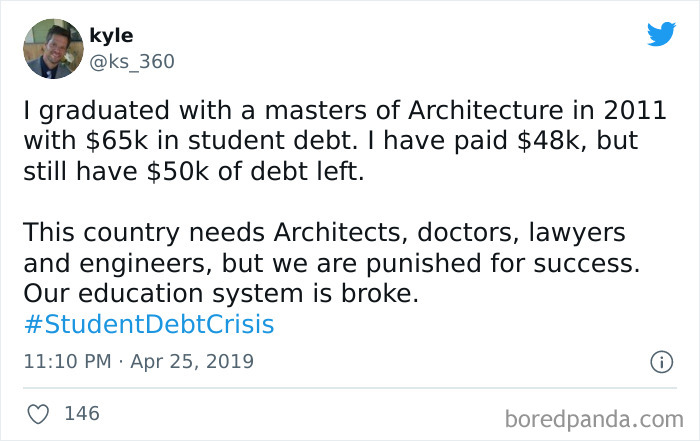

Found One In The Wild. Student Loans Make Even The Highly Paid Professions Painful

I was told there would be buff dudes with mohawks fighting over gasoline.

Student Loan Debt

The paradox of student loans is that higher education is supposed to improve our quality of life, granting access to high-quality jobs that provide greater stability, higher earnings, and critical benefits like health care and paid leave. This all turns out a distant dream after the student loan leaves many people wondering if it was even worth it.

It’s no secret that student debt has a profound impact on borrowers' lives and well-being. While many are not able to afford their monthly payments, those who make them usually have to make big sacrifices. For example, delaying home ownership, not starting a family and staying in unsatisfactory jobs.

A Man Risks Of Having Diabetic Complications Just To Save Money On Food And Pays Off Student Debt

Student Loan Debt

Chop Off Your Hands To Pay Off Your Student Debt!

So you have to physically get hurt to be able to pay off a debt, man that's all kinds of messed up

The burden of debt also takes a severe mental toll on borrowers. A 2021 mental health survey indicated 1 in 14 borrowers experienced suicidal ideation in response to the financial stress of student loans. Among borrowers who were unemployed or making less than $50,000 per year, this rate jumped to 1 in 8.

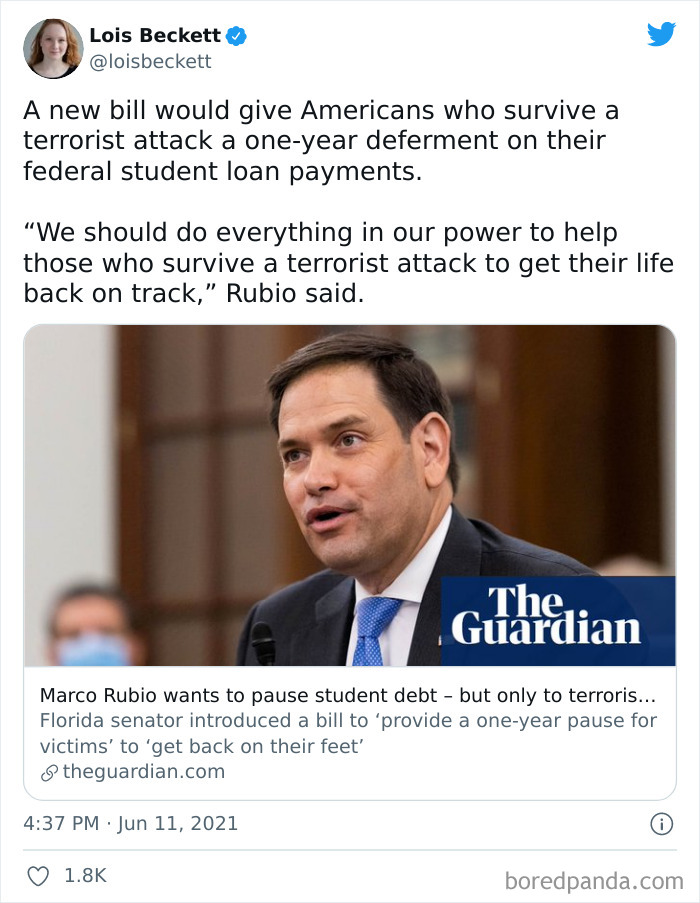

As of today, the Biden administration has canceled $9.5 billion in student loans for permanently disabled borrowers and those defrauded by for-profit institutions. Experts agree that this is a major step in the right direction; unfortunately, it’s very far from being enough.

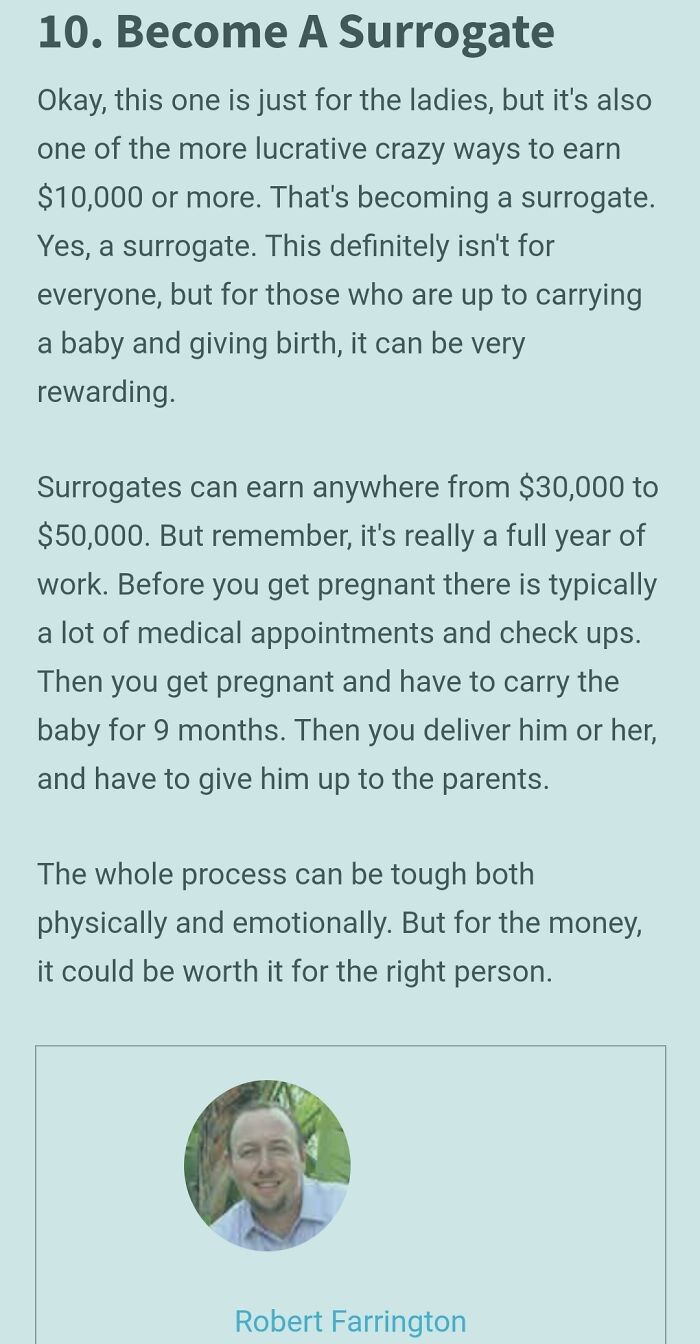

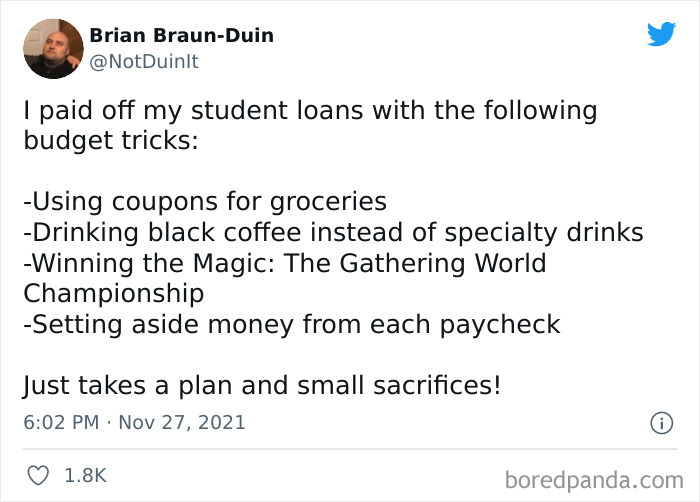

How To Pay Student Loans - By Money Experts

This is literally selling a baby as a way to pay off one's debt. God bless America.

Student Loan Debt

Sorry, You Can't Vote If You're 17 But You Can Still Take Out Tens Of Thousands Of Dollars In Predatory Student Loans

Student Loan Debt

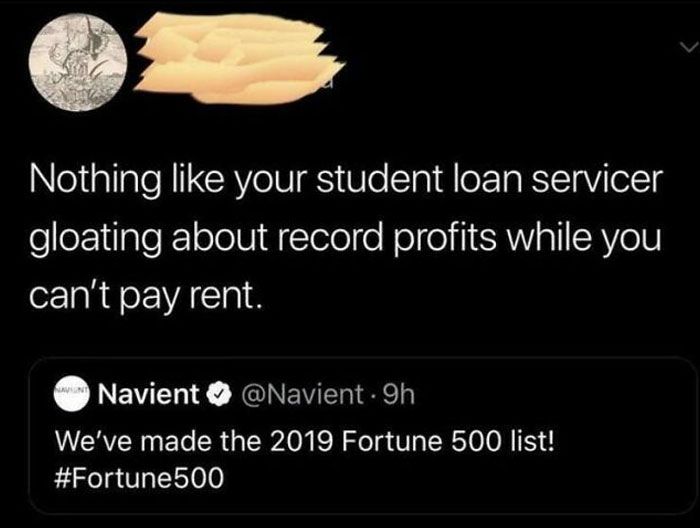

Corporate America Now Encouraging Folks To Binge-Drink Their Way Out Of Student Debt

It's funny that is says: "Post a video showing how you would celebrate paying off your student loans". Which means that they don't believe that anyone could actually do it. So they made a contest out of what people would do if they achieved something unreal like taming a dragon or finding the Fountain Of Youth. Which both are more likely to happen than people paying of their student debts.

Student Loan Debt

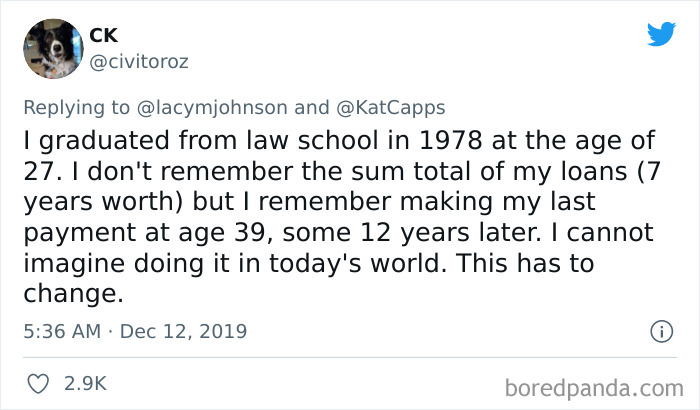

I graduated in 1980, and paid off my student loan in ten years (at $60 dollars a month.) The rate of inflation for college tuition is a sin. How did it get to this?

Student Loan Debt

Student Loan Debt

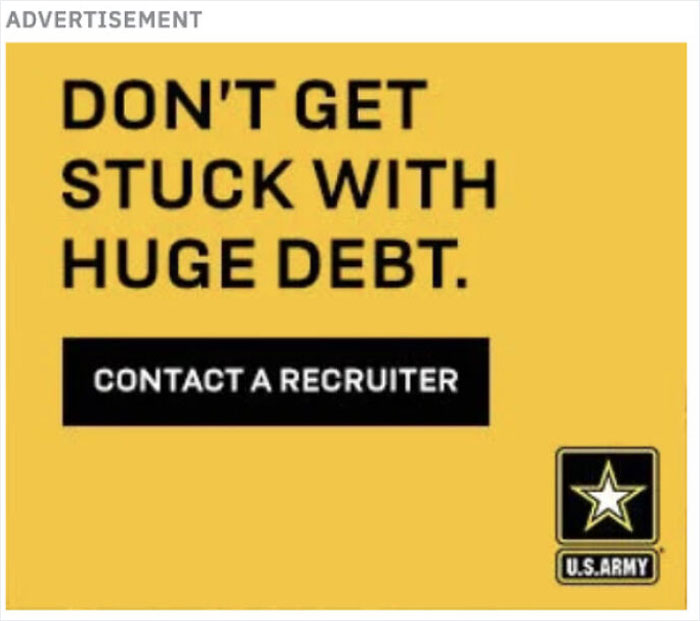

Want To Avoid Debt? Easy! Go To War!

The American Student Loan Debt Starter Pack

You mean one day I will be able to afford a 1990 Olds Cutlass? That'd be pretty sweet.

Student Loan Debt

Yes, Be An Egg Donor To Pay Off Your Student Debt!

Wow

Student Loan Debt

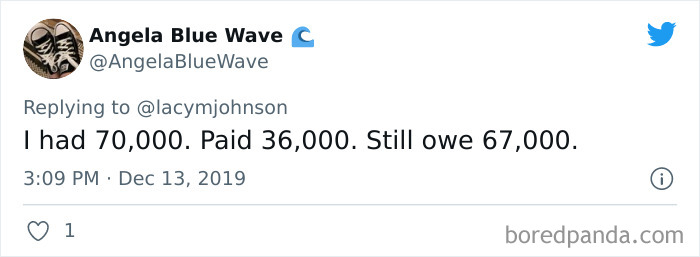

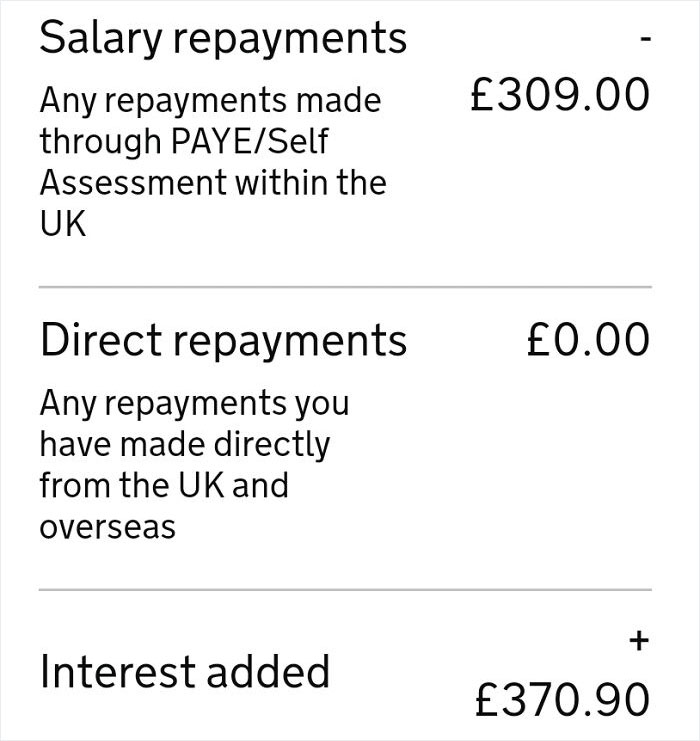

What on earth is the student loan interest rate in the US?!! I thought the UK's was bad enough

Student Loan Debt

Student Loan Debt

Student Loan Debt

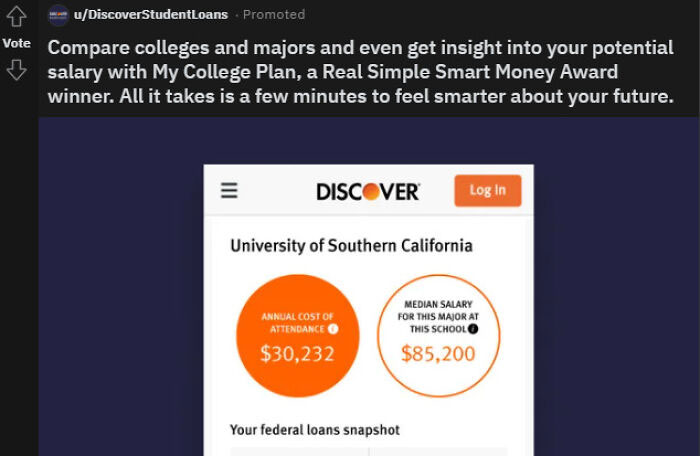

For Our Non-American Friends Who Probably Wouldn't See This Targeted Ad, I Present To You A Profit Calculator On Student Loans From A Major Credit Card Company

My grandmother died, and my sister and I split the inheritance my mom would have been given if she hadn’t died years ago. I gave my daughter the $7,000 from her estate. It will pay for possibly one year of in-state tuition for the local university. Thank you, Grandma, and thank you, Mom.

Student Loan Debt

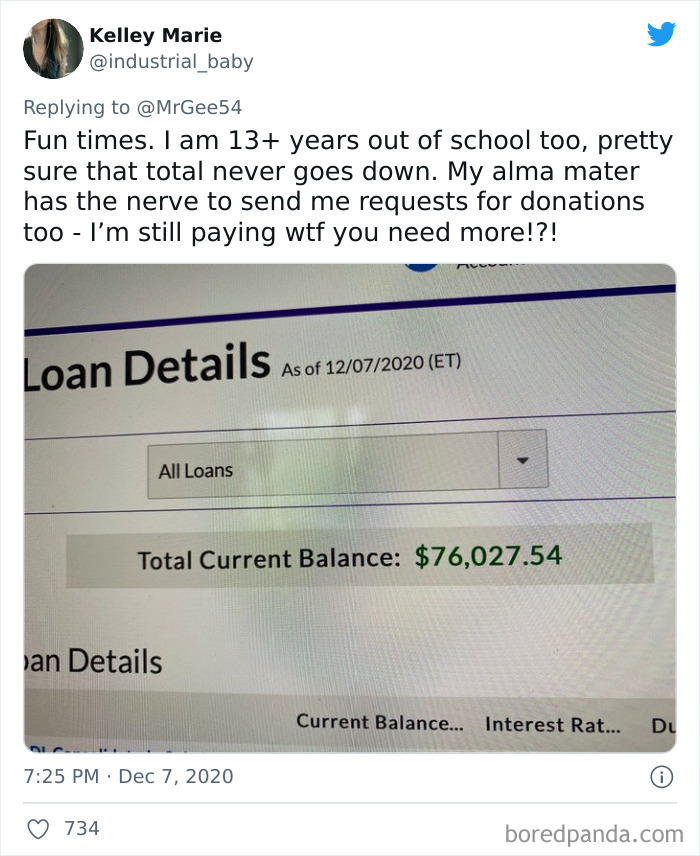

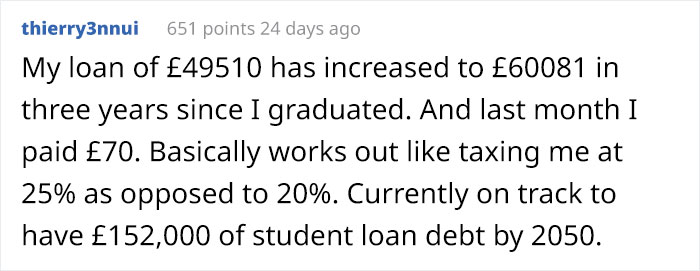

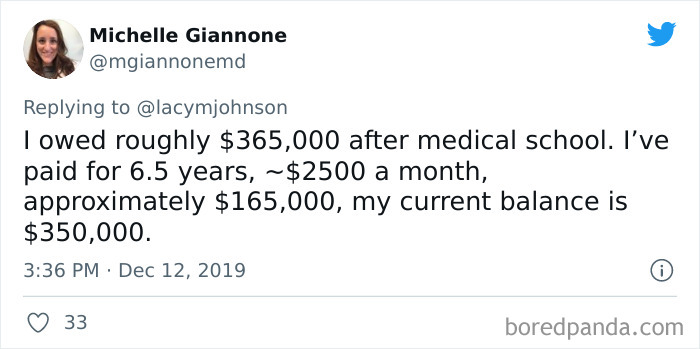

Love Having My Student Loan Increase Every Month Despite Repayments!

Tragic but it shows a number of things. 1. The cost of college courses in usa is excessive. Here you're looking at about half that cost. 2. Most people on the list seem to not understand that if you pay the minimum repayment rate you won't get out of debt. The banksters do this to keep you trapped. Try pay slightly more than required. If you just pay the interest off, the debt NEVER goes down. 3. You can sign up for degrees in other countries which are cheaper, e.g. EU, Africa, etc. A few of our universities here often come up in the top 100. 4. By all means, keep voting for capitalists. ORRRRR maybe make a socialist party and vote for them?

Unfortunately, they require you to tell them your salary when you get the loan or attempt to refinance, so they can fix the monthly payments in such a way that it is difficult to pay more than the minimum and still pay all your other bills. Not sure how I would have been able to get a degree from a different country without moving there, but I suppose it's easier now that there are more online options.

Load More Replies...My aunt emigrated to the U.S. 40 years ago and worked there as a secretary for a CEO. She told me how her american friends used to make fun of her because she only had one credit card... but in my family we were taught never to spend money you dont own. So no credits on nothing.. never. You work for it..you save it.. THEN you spend it. I know..easy to do.. when education and other things are free...

That is how to have terrible credit in the U.S. The “debt-free/spend only when you have it” approach is no longer as feasible as it was in previous generations, because the entire U.S. system is based on debt RATIO—meaning you need a fair amount of debt to salary to savings to prove you are able to hold and continue paying off debt in order to obtain loans for housing, vehicles, etc. The system is terrible, but without multiple (healthy) lines of credit, your credit score is actually worse than someone with a lot of debt. This means under this system if you are debt free, and have one or no credit cards, you will struggle to get a loan for a house, or car, or any legitimate life loan with reasonable interest. Having the correct debt ratio, as it works within the U.S. lending system, is the best way forward. (Sadly.)

Load More Replies...I'm from Canada so I know things are probably different, but it took me 14 years to pay off a little under $10,000 in student loans... my loan was also through a Provincial Financial Aid program and not through a bank so my interest rate was probably much lower, my payments were never more than $100 a month which at times, was more than I could afford. I know some of the comments on pictures are saying of course you're not going to pay the debt off if all you're paying is the accrued interest, but how can people afford to pay more than that when they're not making a livable wage? On one post the monthly payments were almost $500 on the interest alone, and the principal amount never changed.... it's all kinds of messed up.

Tragic but it shows a number of things. 1. The cost of college courses in usa is excessive. Here you're looking at about half that cost. 2. Most people on the list seem to not understand that if you pay the minimum repayment rate you won't get out of debt. The banksters do this to keep you trapped. Try pay slightly more than required. If you just pay the interest off, the debt NEVER goes down. 3. You can sign up for degrees in other countries which are cheaper, e.g. EU, Africa, etc. A few of our universities here often come up in the top 100. 4. By all means, keep voting for capitalists. ORRRRR maybe make a socialist party and vote for them?

Unfortunately, they require you to tell them your salary when you get the loan or attempt to refinance, so they can fix the monthly payments in such a way that it is difficult to pay more than the minimum and still pay all your other bills. Not sure how I would have been able to get a degree from a different country without moving there, but I suppose it's easier now that there are more online options.

Load More Replies...My aunt emigrated to the U.S. 40 years ago and worked there as a secretary for a CEO. She told me how her american friends used to make fun of her because she only had one credit card... but in my family we were taught never to spend money you dont own. So no credits on nothing.. never. You work for it..you save it.. THEN you spend it. I know..easy to do.. when education and other things are free...

That is how to have terrible credit in the U.S. The “debt-free/spend only when you have it” approach is no longer as feasible as it was in previous generations, because the entire U.S. system is based on debt RATIO—meaning you need a fair amount of debt to salary to savings to prove you are able to hold and continue paying off debt in order to obtain loans for housing, vehicles, etc. The system is terrible, but without multiple (healthy) lines of credit, your credit score is actually worse than someone with a lot of debt. This means under this system if you are debt free, and have one or no credit cards, you will struggle to get a loan for a house, or car, or any legitimate life loan with reasonable interest. Having the correct debt ratio, as it works within the U.S. lending system, is the best way forward. (Sadly.)

Load More Replies...I'm from Canada so I know things are probably different, but it took me 14 years to pay off a little under $10,000 in student loans... my loan was also through a Provincial Financial Aid program and not through a bank so my interest rate was probably much lower, my payments were never more than $100 a month which at times, was more than I could afford. I know some of the comments on pictures are saying of course you're not going to pay the debt off if all you're paying is the accrued interest, but how can people afford to pay more than that when they're not making a livable wage? On one post the monthly payments were almost $500 on the interest alone, and the principal amount never changed.... it's all kinds of messed up.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime