“Call Me A Snitch, But It Felt Good”: Person Tattles On House Flipper Who Tried To Avoid Taxes

Society has (more or less) decided that snitching on folks is a bad thing and it should be shunned. At the very least. Probably tarring and feathering at the very most. Good thing we don’t live in those times any more. Anywho.

We need to consider snitching—as well as many other things—in context. Most importantly, folks need to ask themselves why did someone snitch? Was it because they were cheating more than just the government? After all, everyone more or less agrees to play by a democratically determined set of rules, right?

More Info: Reddit

Snitching is frowned upon in most cases, but you gotta consider it in context to understand that the world ain’t so black and white sometimes

Image credits: Tomáš Malík (not the actual photo)

Consider the case when you’re snitching on a company that was flat out lying about a property they were selling to earn an extra buck at the expense of… well, everyone

Image credits: Successful-Heart9134

In the end, the Redditor simply reported the company that was claiming it as their primary place of residence, but we all know what’s up

Image credits: Porapak Apichodilok (not the actual photo)

A Redditor by the nickname of u/Successful-Heart9134 had to get it off their chest. By it, they meant the fact that they snitched on someone who has to face possibly dire consequences for it. Financially, of course. Those can be dire too.

The story goes that OP was scrolling through Zillow and noticed a property that was acquired by someone in May 2023, and was back up for sale in July of that same year—just two months later. All signs pointed at a house flipper (someone who buys up property, fixes, and sells it for a profit). All fine and dandy, it’s someone trying to make a living. However, something was off…

The property was listed as Principal Residence Exemption, which, if you’re not aware, means that the owner lives there full-time. If the property is up for sale, and it’s the owner’s primary place of residence, this in turn means certain tax exemptions upon the sale of the property. However, if you’re a house flipper, let alone a company, no house is your primary place of residence. Hence, no tax exemptions should apply. Right?

So, OP in turn decided to bring forth some justice upon the unsuspecting LLC and contacted the appropriate authorities and let them know (with screenshots and stuff) that this ought to be investigated. OP noted that it felt good snitching on the house flipper, especially since they were not only lying, but essentially bamboozling the community that lived there.

Image credits: ajay_suresh (not the actual photo)

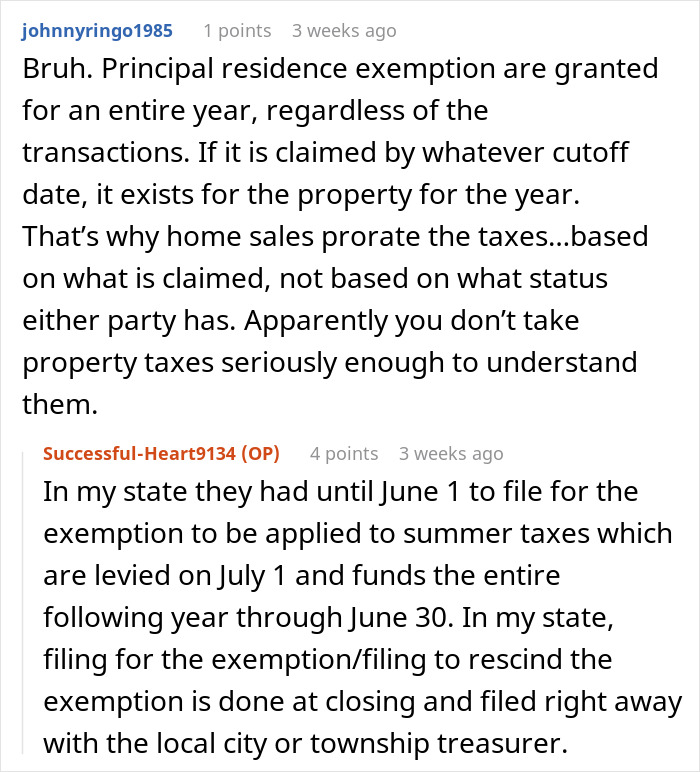

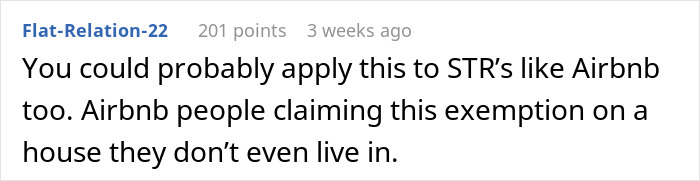

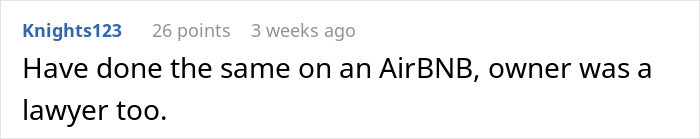

Well, folks on Reddit had a lot to say about what had just happened. On one end, we have everyone who was in support of this move. For more or less the same reasons, but also it’s just plain unfair in general. Not only because the amount of times cities and counties don’t check the sales data is too darn high, but also because many flippers have a notorious reputation with their shady corner-cutting tactics.

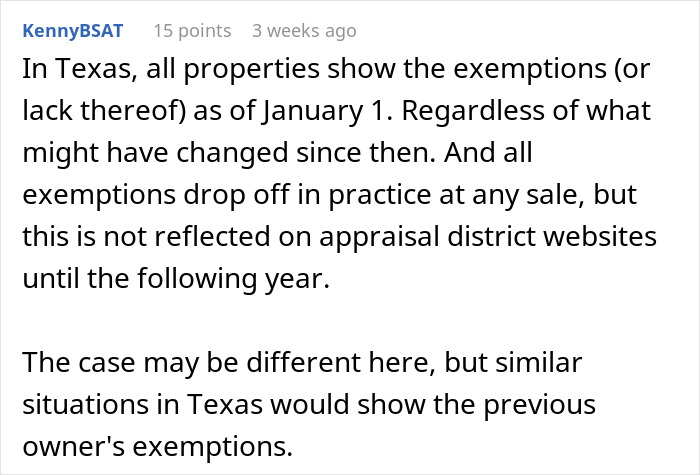

Others, however, pointed out that OP’s efforts are in vain for a number of reasons. In some cases, principal exemptions are granted for an entire year. Plus, Zillow might also be slow to update, and hence OP’s snitching might have been a waste of time.

There were even those who went the same route as OP—reporting companies for their shady dealing. One person reports companies that seemingly had arrangements with apartment complexes for corporate housing, but because of remote work, they were double-dipping as AirBnBs. Even more of a reason for them to get reported to every single institution, including local news and IRS.

Image credits: Iqbal farooz (not the actual photo)

For context, and in order to better understand things, let’s try and nail this at the basic level. Principal residence, in terms of taxes, is a location where a person lives most of the time. It’s like a primary or main residence. In such a case, if the owner decides to sell the place, they are eligible for some tax exemptions.

In particular, the exemption comes in the form of an exclusion of a $250,000 gain (or $500,000 if the owners are married and are filing it jointly). The seller has to meet some requirements as per the Internal Revenue Office, though: [1] the home was owned and used as a primary residence for at least 2 of 5 years before the sale; [2] the house was not acquired through a like-kind exchange in the last 5 years; and [3] the seller did not exclude the gain from the sale of another home two years prior to the sale of this home.

Interestingly enough, primary residency applies to more than just houses and apartments. You can get that status with trailers, mobile homes and even boats, as long as it has a bedroom, a bathroom, and a kitchen (well, areas for these facilities).

Bottom line is primary residence might need to be proven, especially if folks have a second home. That can be done with anything from providing a voter registration card or tax registration letters addressed to your home to simply showing your driver’s license. However, the loopholes and potential for tax evasion arise when there is nobody who keeps track of these or bothers to check the sales data. And companies might just take a risk of saving money because the fine might not be that much compared to the amount that they end up earning.

So, what are your thoughts on any of this? Share your opinions and stories in the comment section below!

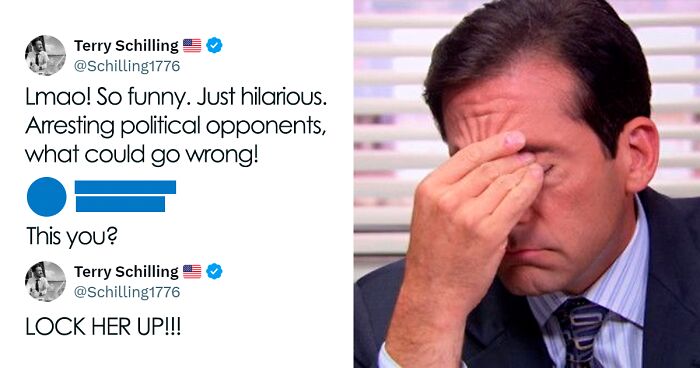

Folks online also knew what was up, garnering the post 4K upvotes on Reddit and it even went viral on X where it got 4.1M views

Didn't think I was going to be on board with this one, but I was wrong. Flippers suck. They are destroying the market and ruining any chance for regular people to buy homes and reasonable prices.

The over-wealthy use every trick to avoid paying any tax. Mostly in collusion with the various tax agencies. Good on you. Editorial comment-due to diverse states, cities and counties, US has at least 150 property tax regimes, which makes it easy for the rich to avoid property tax. I.e. limited oversight and coordination

Once the state has made its official finding, you might pass that information along to the IRS.. They'll be interested to see how he handles the capital gain on his federal return.

I was going to comment on capital gains but wasn't sure about US tax laws. Here in Canada, principal residences are exempt from capital gains taxes if the homeowner has lived in the house for one year.

Load More Replies...Didn't think I was going to be on board with this one, but I was wrong. Flippers suck. They are destroying the market and ruining any chance for regular people to buy homes and reasonable prices.

The over-wealthy use every trick to avoid paying any tax. Mostly in collusion with the various tax agencies. Good on you. Editorial comment-due to diverse states, cities and counties, US has at least 150 property tax regimes, which makes it easy for the rich to avoid property tax. I.e. limited oversight and coordination

Once the state has made its official finding, you might pass that information along to the IRS.. They'll be interested to see how he handles the capital gain on his federal return.

I was going to comment on capital gains but wasn't sure about US tax laws. Here in Canada, principal residences are exempt from capital gains taxes if the homeowner has lived in the house for one year.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

31

9