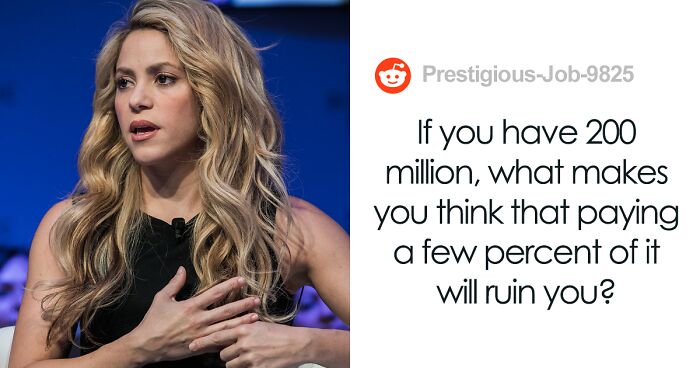

Shakira Charged With Tax Evasion, Faces Prison Time Of Up To 8 Years

From Chuck Berry to Prince and Lionel Richie, there have been several musicians who have faced tax evasion charges throughout their careers. In 2019, football star Cristiano Rolando had to pay $22 million to settle a tax fraud case. Some celebrities, like rapper Ja Rule, were put behind bars for this crime.

Now, it’s Colombian pop star Shakira who’s awaiting her fate.

The Colombian pop star was accused of owing $7.1 million to the Spanish state in income generated thanks to her 2018 “El Dorado World Tour”

Image credits: World Economic Forum

Prosecutors in Spain have accused the Latin star of failing to pay €6.7 million (the equivalent of $7.1 million) in 2018. The state alleges that Shakira didn’t declare millions in advance payments for her El Dorado World Tour and other sources of income generated during that year.

Though the investigation was opened in July 2023, it was only revealed this Tuesday in an Associated Press report. Barcelona prosecutors accuse her of using an offshore holding company based in a tax haven to avoid paying taxes on her 2018 income.

This is the second fiscal misconduct case that Shakira faces. In November, she’ll stand trial for evading taxes between 2012 and 2014

Image credits: joebelanger

Image credits: Shakira111

This is the second fiscal misconduct allegation that the “Hips Don’t Lie” singer faces.

Shakira, now a Miami resident, was then living in Barcelona with her former husband, retired football player Gerard Piqué, and their two children. Still, the pop star revealed in a Sep. 2022 interview with Elle magazine that she didn’t “qualify as a Spanish resident” because she was traveling for most of the year.

In an interview with Elle, the star argued that she didn’t qualify as a Spanish resident because she spent the 2012-2014 period traveling abroad

Image credits: shakira

According to the New York Times, Spanish law uses three factors to determine whether someone is a resident of the country: physical presence, location of a spouse and children, and whether the country is someone’s “center of economic interest.”

In addition to the revenue generated by her tour, the singer has signed commercial deals with brands such as Procter & Gamble, Fisher Price, Brazilian shoe brand Ipanema, and yogurt company Activia.

“I am confident that I have enough proof to support my case and that justice will prevail in my favor,” she said

Image credits: shakira

“I am confident that I have enough proof to support my case and that justice will prevail in my favor,” the Barranquilla-born singer said in an interview with Elle.

Additionally, representatives of Colombia’s highest-selling star said to Forbes in a July statement that she “has always acted in accordance with the law and under the advice of the best tax experts.”

While Shakira could face eight years in jail if convicted, she could also benefit from a law that allows first-time tax evaders to avoid prison time if their imposed sentence is lower than two years. Football legends Lionel Messi and Cristiano Ronaldo have both benefited from this provision in the past.

The Barranquilla-born singer could benefit from a law that allows first-time tax evaders to avoid prison time if the imposed sentence is lower than two years

Image credits: shakira

The charges come two months before the Grammy-winning star is set to stand trial for another case of income and wealth fraud that accuses her of failing to pay €14.5 million ($15.3 million) between 2012 and 2014.

Barcelona prosecutors allege that she spent more than half of that period in Spain and should, therefore, have paid taxes to the country.

“I’ve paid everything they claimed, even before they filed a lawsuit. So as of today, I owe zero to them”

Image credits: shakira

“I’ve paid everything they claimed I owed, even before they filed a lawsuit. So as of today, I owe zero to them,” the “Acróstico” singer said about the case. Furthermore, she argued she didn’t reside in Spain due to her “professional commitments around the world.”

“However, even without evidence to support these fictional claims, as they usually do, they’ve resorted to a salacious press campaign to try to sway people and apply pressure in the media along with the threat of reputational damage in order to coerce settlement agreements.”

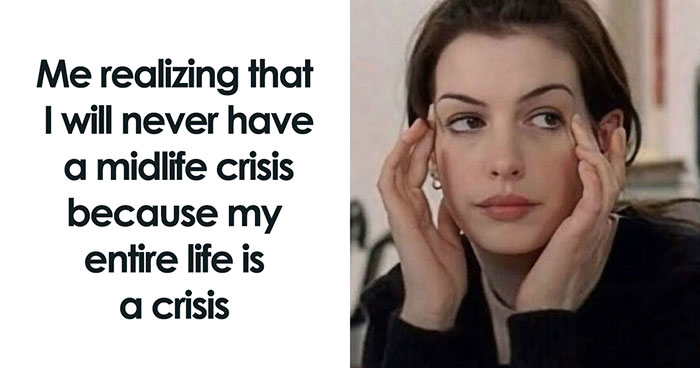

Now a Miami resident, Shakira then lived in Barcelona with football star Gerard Piqué and their two sons

Image credits: 3gerardpique

The trial for the 2012-2014 tax evasion case will begin Nov. 20. Let’s hope that the jury will decide that those hips weren’t lying.

Following her divorce from Piqué, whom she began dating in 2010, Shakira decided to move to Miami to focus on her career. As of today, the singer’s representatives haven’t issued a statement on her latest financial fraud case, and no date for a trial has been set.

Of course, people didn’t miss the opportunity to come up with creative puns

Others, however, condemned the pop star for her alleged tax avoidance schemes

14Kviews

Share on FacebookExplore more of these tags

I really don't like all the recent celebrity news pieces here. Especially since they're mostly negative. If I wanted to hate on celebrities I'd read yahoo news.

Anyone thought that it might actually be confusion or misunderstanding. She paid the bill as soon as she was told. In UK, its by tax year. If you left the country before April and earn money you wouldn't pay UK tax unless you returned in that financial year. So if you returned after April the next year you wouldnt pay tax on those earnings. Not sure if its different in America though. If she was living in Barcelona she shouldn't owe tax to America. If she was living in America she wouldn't owe tax to Barcelona is my understanding.

I really don't like all the recent celebrity news pieces here. Especially since they're mostly negative. If I wanted to hate on celebrities I'd read yahoo news.

Anyone thought that it might actually be confusion or misunderstanding. She paid the bill as soon as she was told. In UK, its by tax year. If you left the country before April and earn money you wouldn't pay UK tax unless you returned in that financial year. So if you returned after April the next year you wouldnt pay tax on those earnings. Not sure if its different in America though. If she was living in Barcelona she shouldn't owe tax to America. If she was living in America she wouldn't owe tax to Barcelona is my understanding.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

21

15