This Group Is Sharing Painful Truths And Jokes About Being Poor, Here Are 40 Of The Best

InterviewGoogle "how to save money" and you'll get 3,740,000,000 results, promising you will be able to save up for any purchase if you just give them a click and scroll through their ads. Oops, I mean, text. Move over Jerome Powell, nowadays even teenage TikTokers are experts on macro and micro economy. Or are they?

The members of the subreddit Poverty Finance: Personal Finance For The Financially Challenged don't think so. And when you look at their content, it becomes pretty difficult to disagree with them. These Redditors share actual financial advice, frugality tips, stories, opportunities, and general guidance for people who are struggling financially. Oh, and they also torch pseudo financial gurus, burning their out-of-touch content to a crisp. My favorite.

So this time, as an introduction to the online community, we'll focus on the jokes and memes they've collected since getting together in 2018.

This post may include affiliate links.

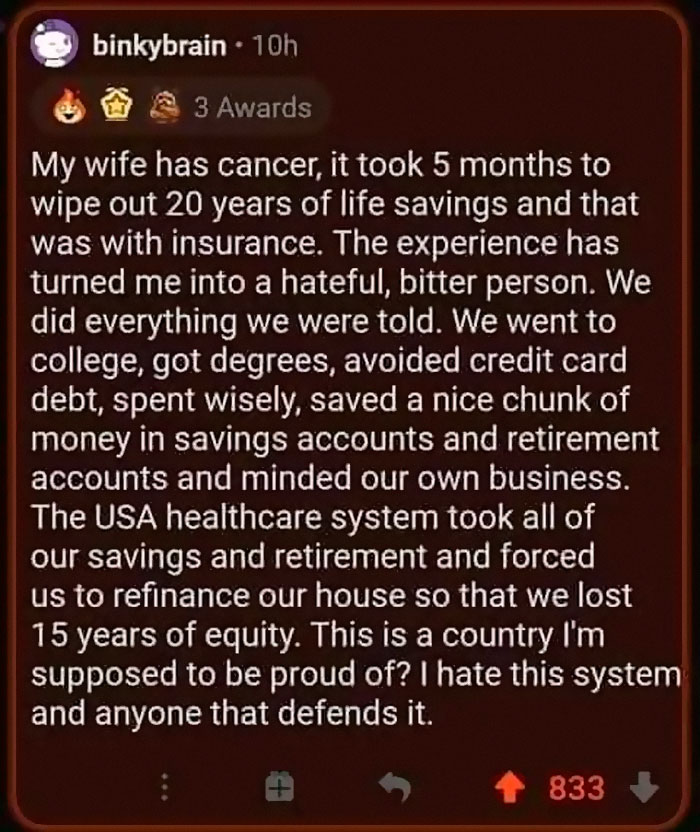

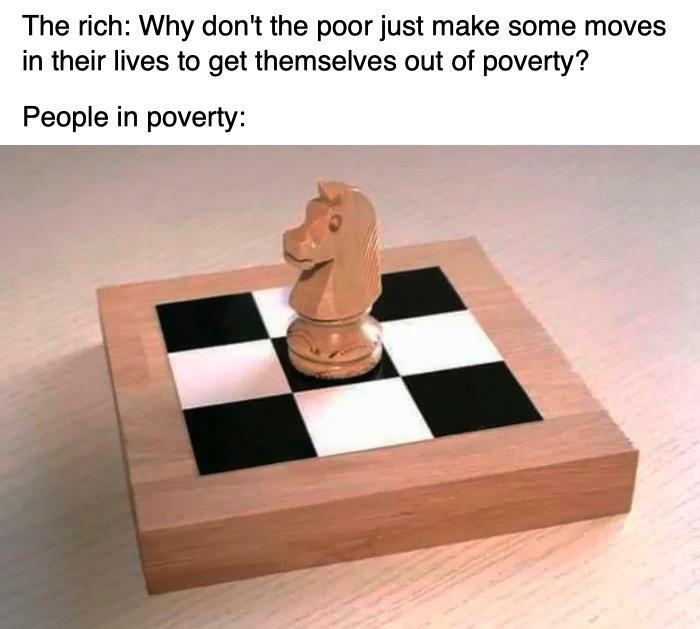

Being Poor Is A Choice? If You Play By The Rules You'll Be Safe? Really? Tell That To Him

A huge part of this community's charm is its inclusivity. "Much of the financial advice online and on Reddit is aimed at people who have varying degrees of disposable income, ability to invest, lots of free time, available transportation, no kids, a partner, access to credit, and beyond," the people running the subreddit write in its 'About' section.

"This is a place for people who do not have a lot, nor ideal circumstances, to help each other get by and hopefully move up in the world."

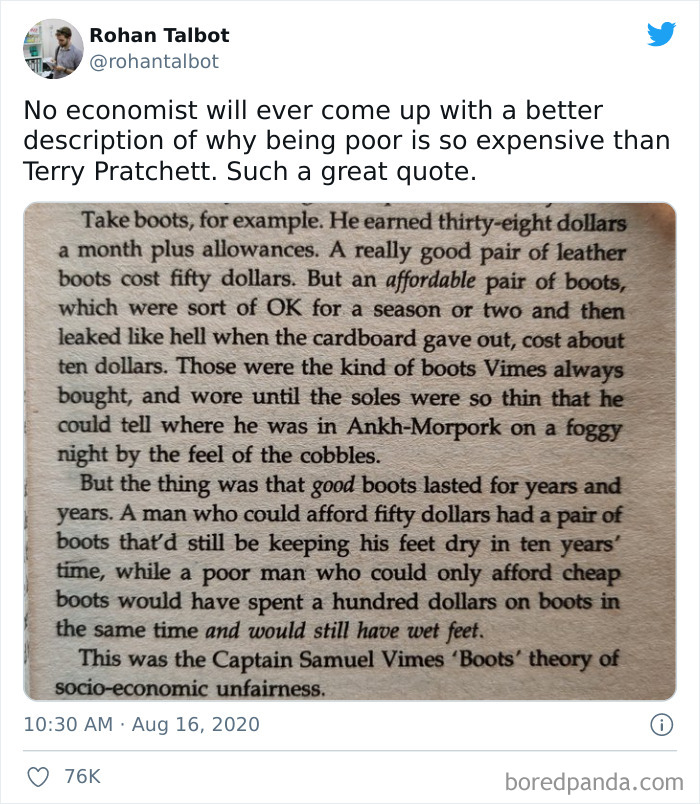

Being Poor Is Expensive

What A Lot Of "Frugal Bloggers" Don't Realize

As of this publication, it has 847K members and if you relate to Poverty Finance's content, we suggest you join them too. "You do not have to be absolutely destitute to be here. Whether you are a single parent only pulling 10K a year, or a single person trying to get past student loans at 28K, you are welcome here," the moderators say.

"The goal here is to help anyone who doesn't have a lot of breathing room get to a place where they have stability, comfort, contingency, and maybe even a little luxury."

So True It Hurts

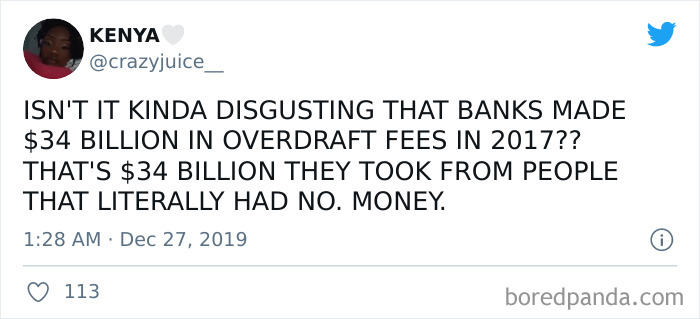

We picked a credit union because we made it clear that if we don't have the money, we wanted to be declined. No bank would agree to that but we found a credit union that promised they would not if we signed up for the overdraft protection. They got rid of it a year later without telling us, my husband was 50 cents short and our credit union allowed the cable company to try to run the payment 3 times in one day, meaning 3 overdraft fees of $32 for being 50 cents short. My husband gave a very impassioned speech in the lobby, about how they were their to protect our money and they had left us exposed, etc. Told them that our money was better protected in our mattress. The manager came out, agreed with my husbands logic and set us up a line of credit so if we don't have the funds in our account, it pulls from the line of credit automatically. No overdraft fees in 10 years. Highly recommend if you can find a bank who will set that up for you.

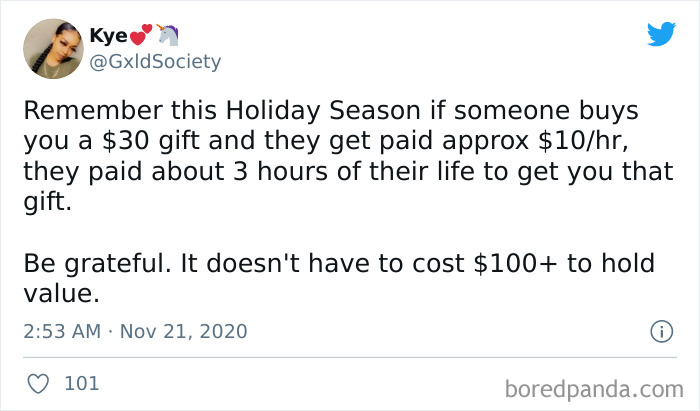

Just A Holiday Reminder

That's how I think about unnecessary purchases. "Well, this coat will cost me three days work", or renting a movie will cost five minutes work, or and a possible vacation will cost two weeks work or whatever. Thinking about whether an item is worth the amount of work put into buying it really puts things into perspective!

We contacted the moderator team and one of them was kind enough to spare their morning break for us. Regarding the content on the subreddit, they told Bored Panda: "There are fewer themes and more cyclical subject matters that come up depending upon the time of the year and the current economic and social ongoings. Right this moment, questions about housing, the moratoriums, how to get an apartment with low credit, or whether even buying a house is within the budget of those who fit within the national and international descriptions of low income/poverty line."

As an example, the moderator took us back a few months ago when there were many questions regarding the Emergency Broadband Benefit program issued by the government. But with fall fast approaching, they think the subreddit will soon see questions about how to get supplies for students and questions on how to qualify for free or reduced lunches at school."

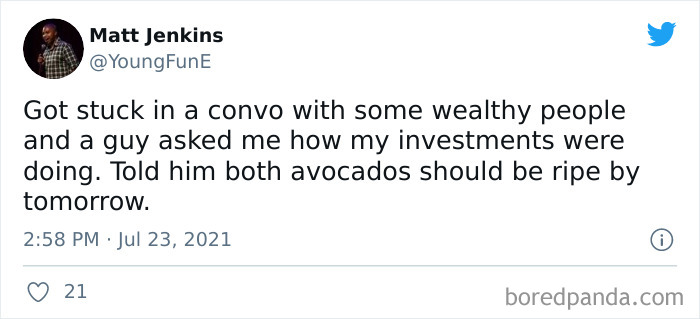

Had A Good Laugh At This

Love this! I think I'll go out today and invest in some avocados. I finished my last investment (bananas), and want a change now.

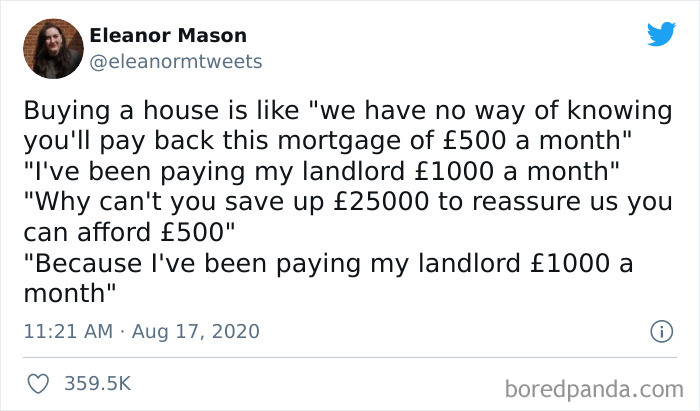

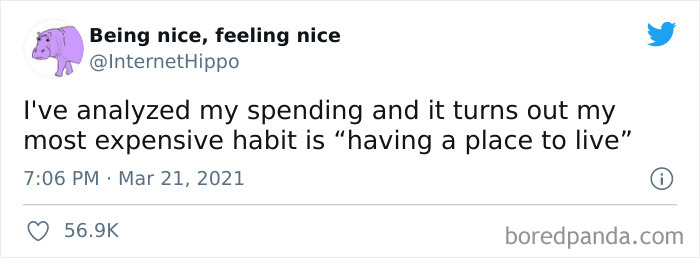

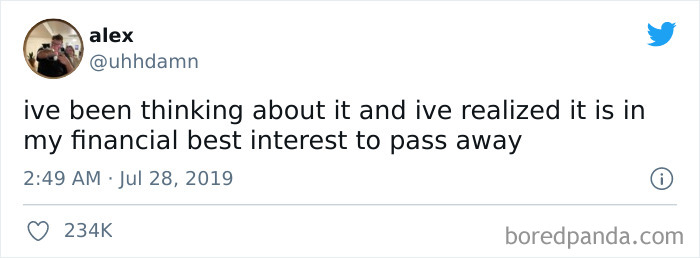

*Sad Noises*

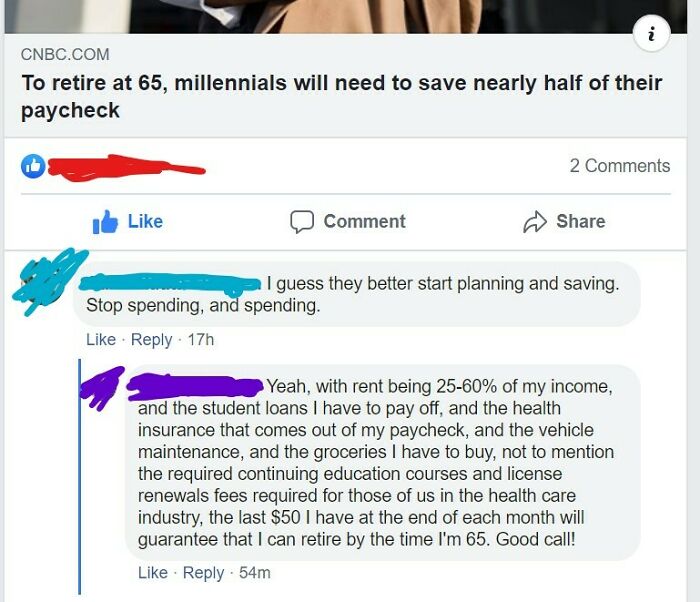

This is exactly my situation. Rent is almost 900e/month. If I somehow managed to save 4000-6000e, I could ask for a loan at the bank and buy a nice place at 120k. And pay that 500e or something a month for 25 years. But I can't save much because my pay is 1900e / month and over half goes to rent and bills.

"Once we approach November to December, we will be fielding questions with regards to worries about being able to afford gifts for their children, how to survive the holidays if you are economically disadvantaged," they continued. "Year-round common subject matters tend to be where to find the resources for food, someone to handhold or direct on how to apply for SNAP/EBT, Section 8 Housing, the hardships of just existing in society this day and age and just looking for some emotional support from their economic peers."

According to the moderator, their community is mostly composed of those who have or are currently experiencing poverty. "Whether it's [someone who faces] generational poverty, long-term poverty, short-term poverty, or self-identify as low income for their various regions. We have those who have made it out and into the middle class but are still dealing with the after-effects of having experienced poverty short or long term and the problems that that in and of itself brings."

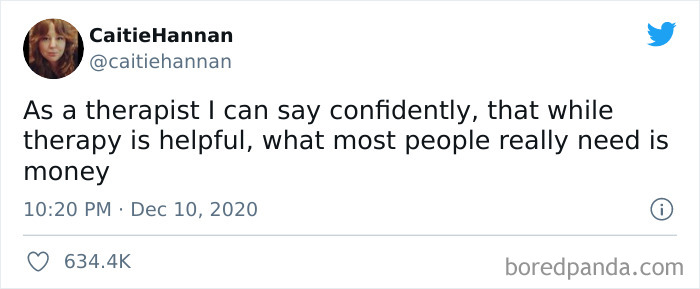

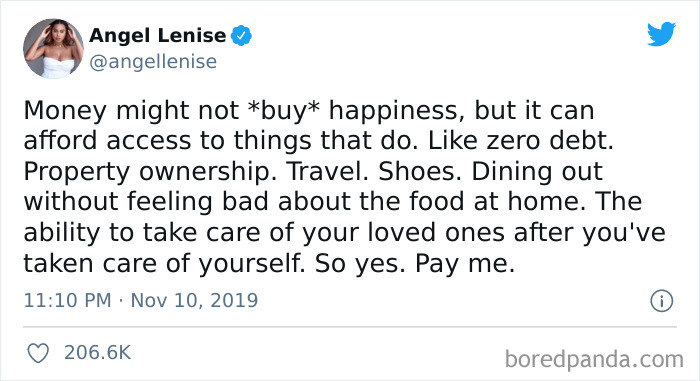

Financial Health Is The Best Form Of Therapy

Money doesn't buy happiness, but it does buy food, housing, heat, clothing....

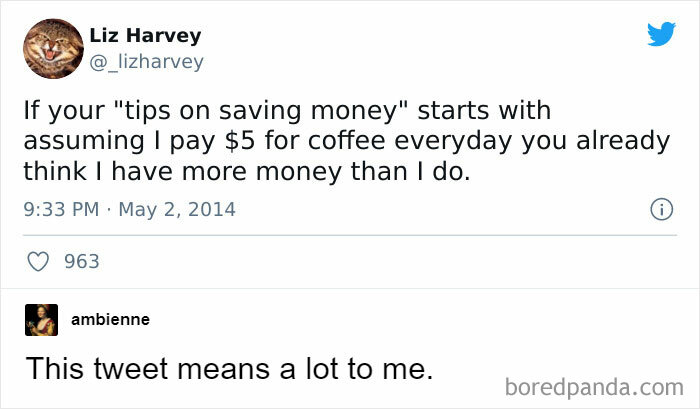

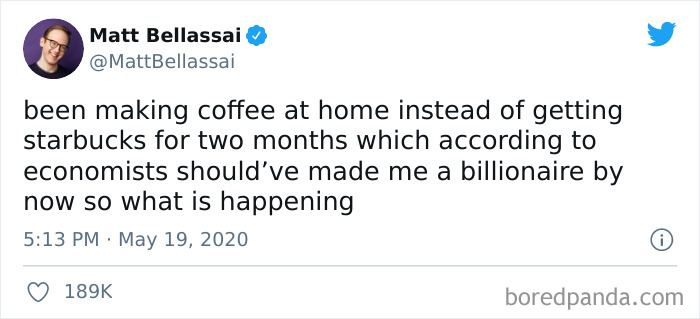

Can Anyone Explain Where My Starbucks Money Is Going?

Not drinking enough coffee. You could be a billionaire when you're high on caffeine. Infact, you could be anything.

Certified financial planner and frequent contributor to Forbes, Jeff Rose, agrees that there is no shortage of bad financial advice in this world. Rose finds it especially troubling when some of them become so widely spread, so championed, that people actually start blindly following them. The financial planner believes the most harmful tips are: 1. Never use credit cards; 2. Don't waste money on conveniences; 3. All debt is bad; 4. Getting a tax refund is bad; 5. Always get the 401k match; 6. Your home is your most valuable asset. Click here if you want to read Rose's thoughts on each point.

Talking about bad financial advice, the moderator of Poverty Finance thinks it has to do less with authors and influencers being out of touch and more with the fact that one size rarely fits all. "More and more people gain access to technology that's being developed to give the everyman more access over their finances and their financial future," they explained. "Things that were previously thought to be the purview of just the upper class or left to the financial professionals who knew better."

Pretty Much

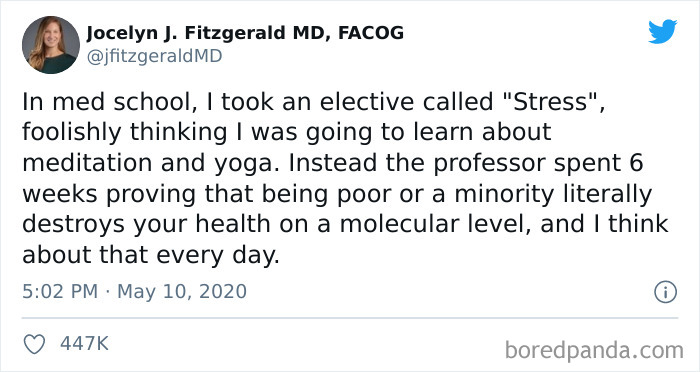

Stress

But they wonder if it can also be a sign of gatekeeping: "Oh, you're poor? Then you have no need for financial advice, it won't benefit you or the maintenance costs made what amount you wanted to add in, too costly and pointless. You can't come up with 10k to open an investment account? They don't want to deal with you. Salary jobs usually come with a 401k, hourly jobs at McDonald's and the like generally do not, and so you're left on your own to figure it out because no one will help you."

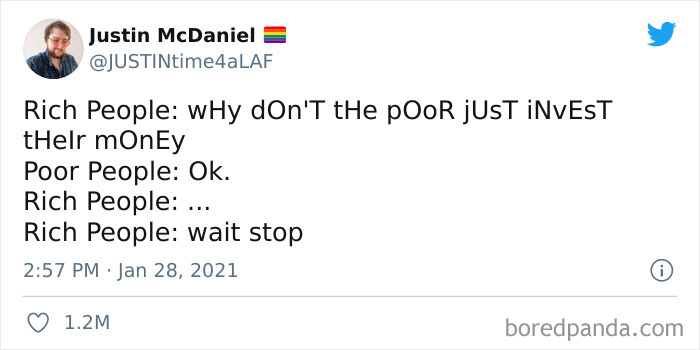

The good thing is that technology might be starting to bridge that. "People realize that there are far more low-income and middle-income individuals with a willingness and ability to put away ten, twenty, a hundred, five hundred a month into an account. Who care about not having to work once they hit sixty-five. A neglected and overlooked economic subset who have a significant buying power en mass. But the advice isn't there from the usual places because their advice only works for the upper income. For the gross amounts of money vs the smaller amounts," the moderator added.

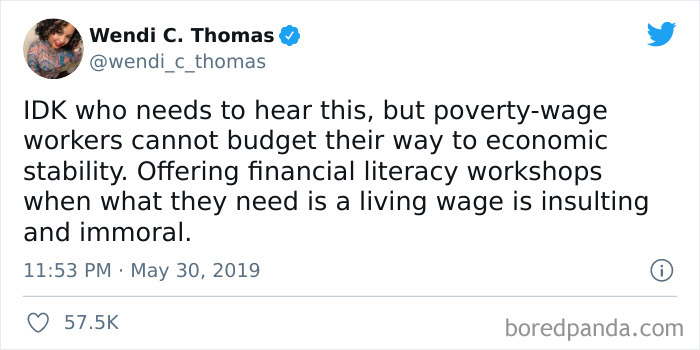

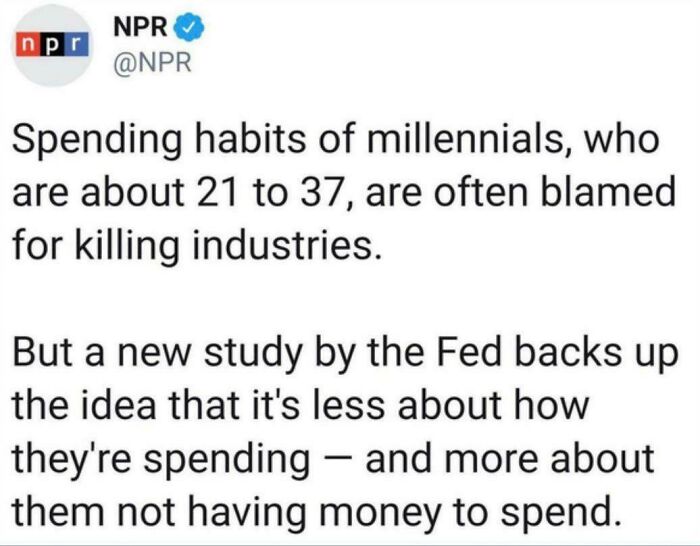

I Know Many Of Us Are Taking Responsibility For Our Part, But...

The lie that all poor people are poor because they're "bad with money" needs to die.

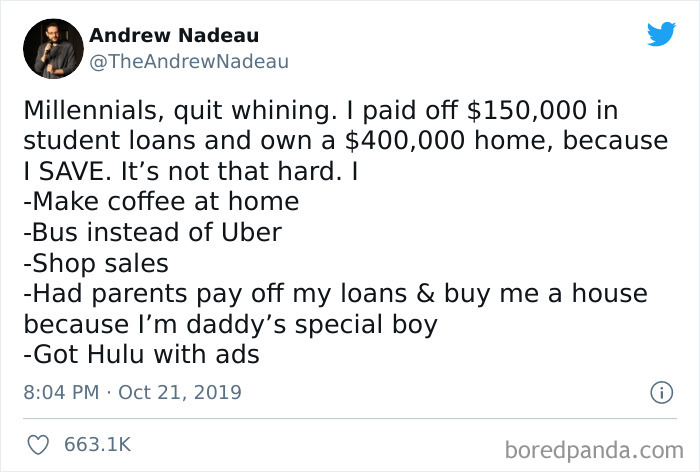

It’s Not That Hard

But the reality is a bit worrying. Financial literacy — defined as the knowledge and understanding of areas related to personal finance, money, and investing — has been in decline. In 2009, 42% of respondents were able to answer four or more questions correctly in a five-question survey on fundamental concepts of economics and personal finance. By 2018 this dropped 8 percentage points to 34%. What's even more alarming, less than one-third of adults understand three basic financial literacy topics by age 40, although many important financial decisions are made decades earlier.

Under such circumstances, (online) communities like this one might be doing society more good than we can imagine.

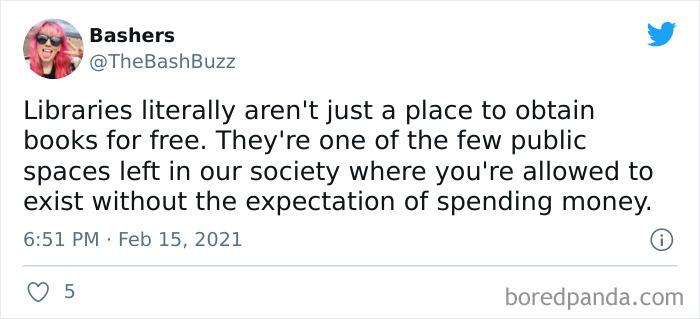

Money Saving Tip!

They are not everywhere.Distance costs money but the peace and books are worth more than anything. *sighs

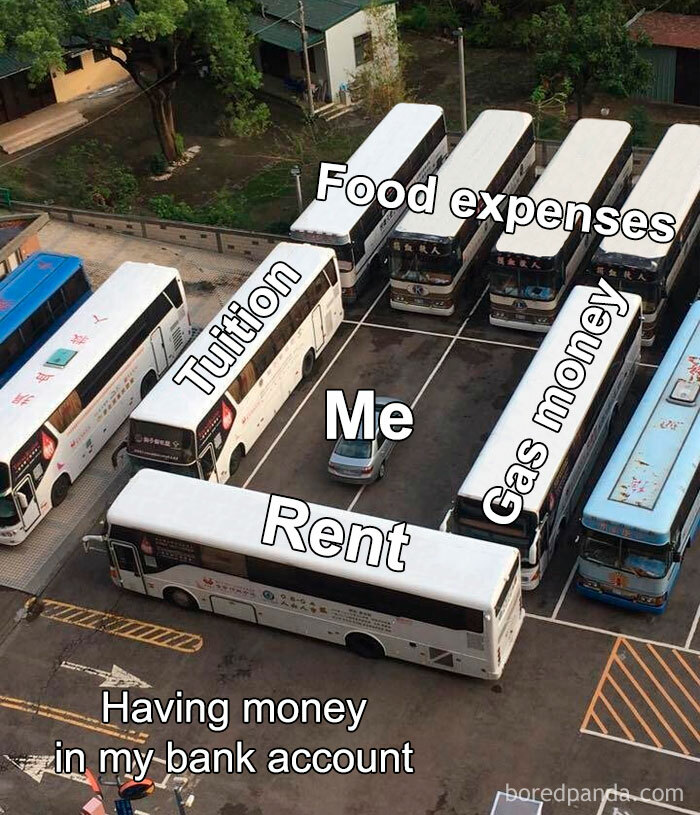

Me, Organizing My Finances

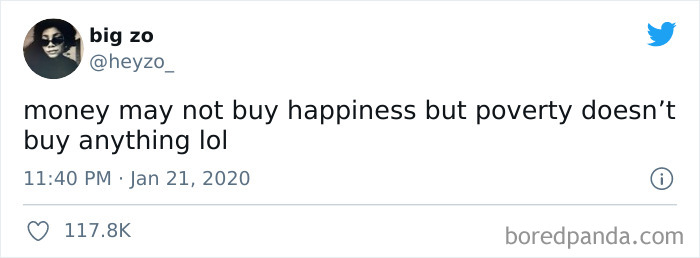

To Be Honest

Growing up poor, you learn that what the world sees as junk stacked in your yard, is actually the only bank account that you have. Thus, the ads on blocks in the yard, the scrap steel, the old lawnmowers. You know that as soon as you get rid of something, you will need it, and can't afford to buy it. You pass this knowledge and insecurity on to your children without even realizing it. America is NOT the home of the free, and the brave. It's the home of wage slavery, and politicians picking away at what little you have left. It's time to change things. For the better, for everyone except the 1%.

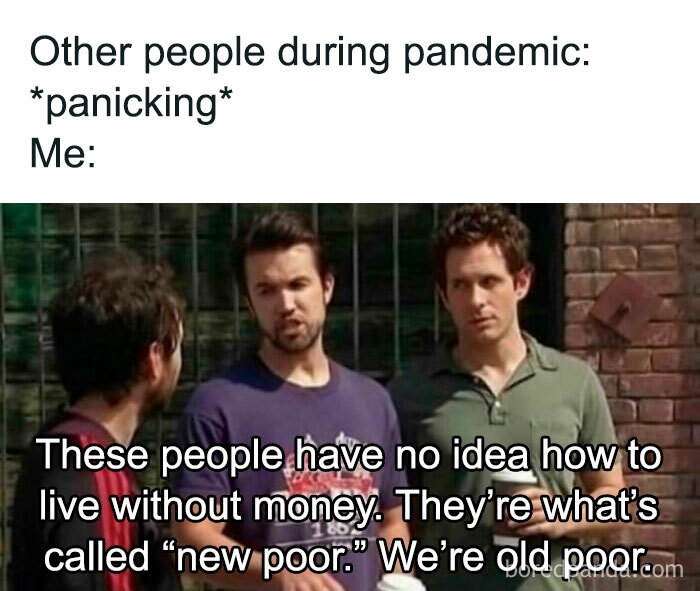

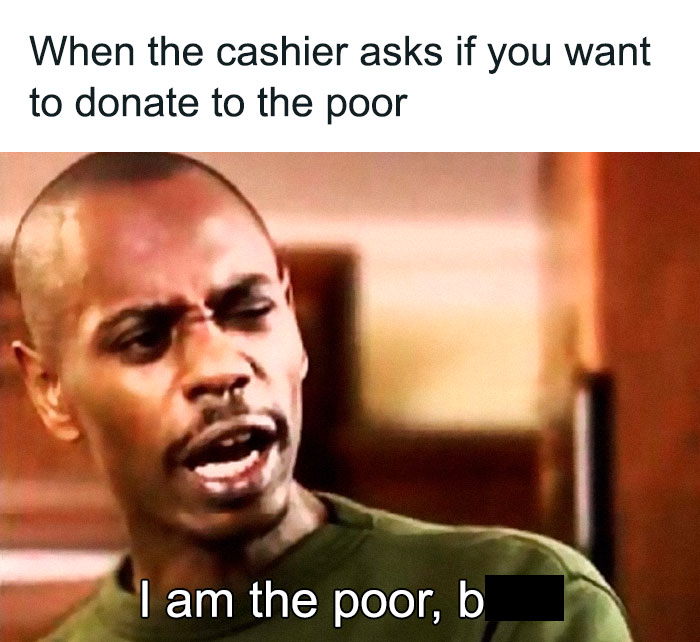

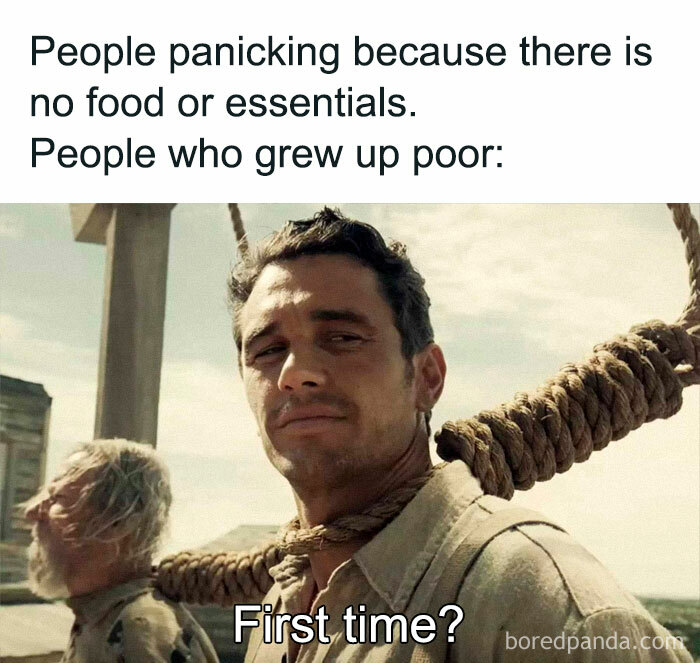

I Felt That While I Laughed

I’ve Never Felt More Prepared

Ain’t That The Truth

Poverty Marriage

One Star

Amirite

Overdraft Fees Cripple People Already Struggling Financially

It Never Ends

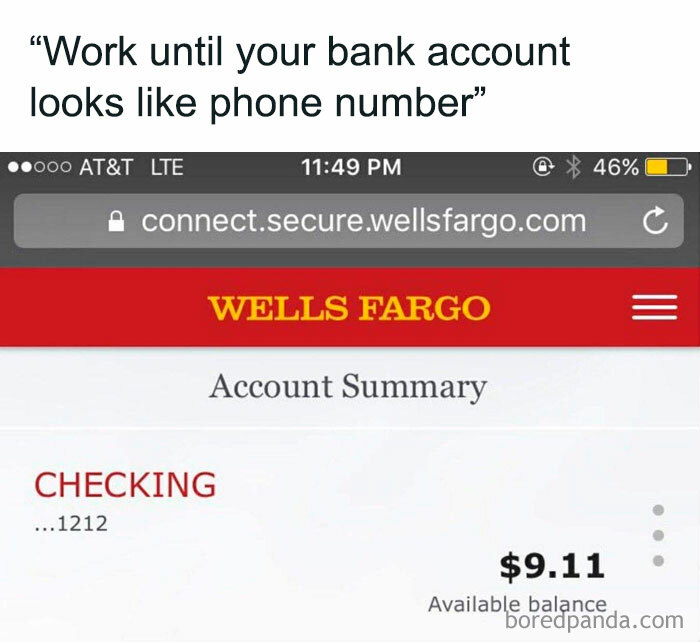

Well, It's Technically A Phone Number...

It’s Almost Offensive, Right?

Santa Won’t Bring Me Rent Money

Big Poverty

Of course there is. Nothing easier than taking advantage of someone who can't afford to fight back. It's the socioeconomic equivalent of beating up crippled people.

Finally Figured It Out

It’s Fine, I Didn’t Want To Have Fun Anyway

Breaking News! Millennials Are Still Poor

Oof

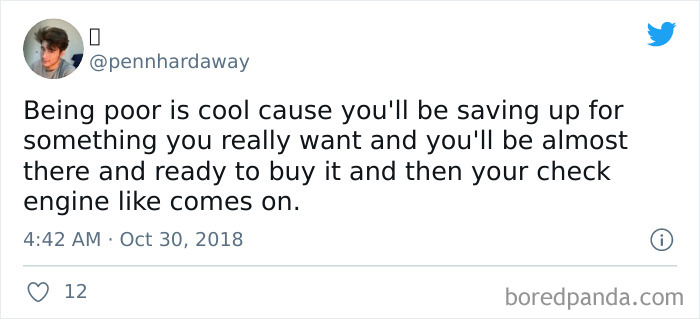

Well if you want to look on the bright side of things, we poor folks are always ready for that struggle battle, and come out of it alive until the next one comes along

Here’s How To Pay Off Your Debt

Save Half Your Paycheck, Regardless Of Whatever Else You Have To Pay For, Regardless Of What You Earn, I Guess

And It Also Doesn't Have Debt

Pigeon breast cooked in a herb and cracked pepper butter, with a red wine and plum sauce reduction on a bed of sorrel leaves. And $20 to spend on drugs and alcohol.

Two Ways

I have just been able to retrain for a job that will pay me more, with a government grant and £10 000 of debt. I mean, I worked hard, but essentially I paid for a qualification in order to earn slightly more money, which I will now spend several years of my life working off. I do wonder if it was worth it.

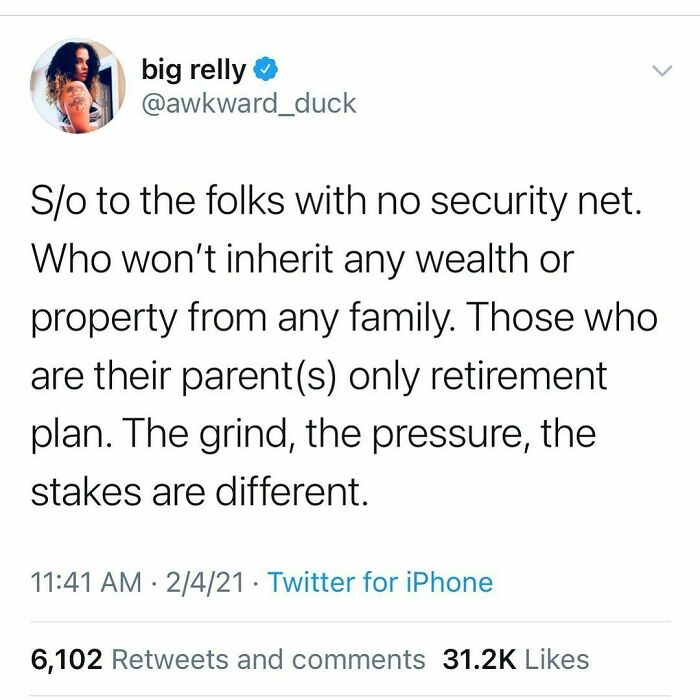

This Hit Me Hard

YES. Double if you have a sibling doing better than you, that your parents like better, but you’re still the retirement plan.

Game Stop Stock

"Poor People Are Just Bad At Saving Money"

So True

There are only houses in this price range in some states. Definitely not California!

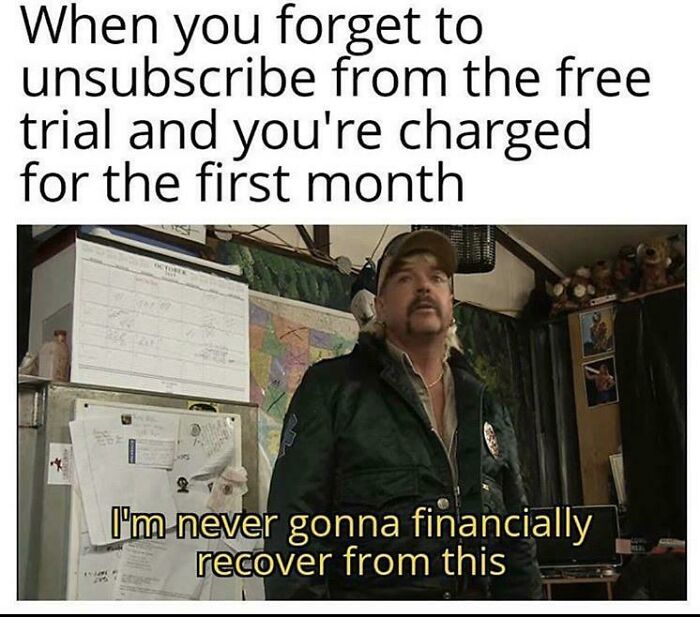

This Hit Close To Home

I never go forward if they ask for my bank account details for the free trial, if I go forward I put a warning /reminder in my calendar. And since I had to pay for things because I forgot to do the Kündigung = notice of termination. I sign the contract and at the same day I send the Kündigung for the future too.

Can’t Shame Poor People For Wanting Nice Things Too

"Nice things" in this case should also include paid time off work because we're not autonomous machines and need to recharge. "Nice things" includes the latest Matt Haig book (if that's what floats your boat - I just googled top popular authors 2020), because reading shouldn't be a luxury. "Nice things" includes a decent internet connection - needed for most things these days and if you want to spend 4 hours on YouTube, no one has the right to police that. "Nice things" does NOT automatically mean "latest iPhone" and I think that's where people's brain shortcut makes them push back against this opinion.

It's Time For A New Loan

Poor persons airconditioning in a car. It is called 4/36. That is 4 windows open at 36 mph.

How I Feel About Overdraft

Are these numbers realistic? We pay interest here when we overdraw, but that’s not much. I overdrew a few 100 and payed 3 cents. Do you really pay 30 bucks for 75 cent overdraw?

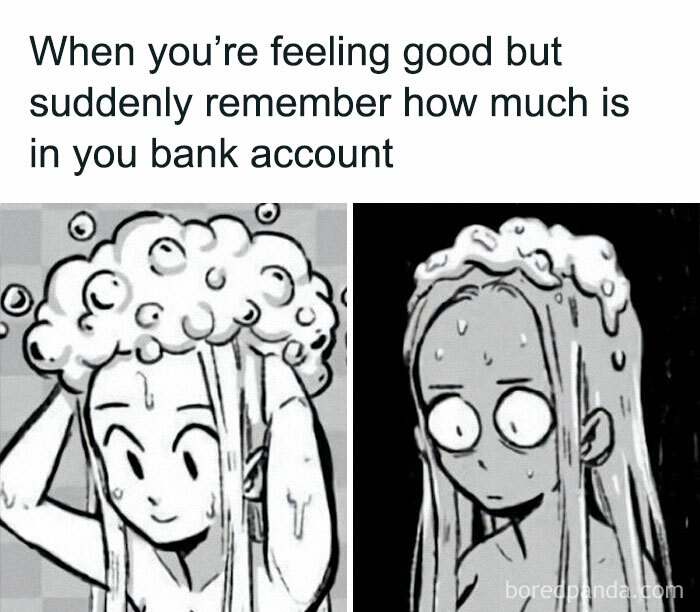

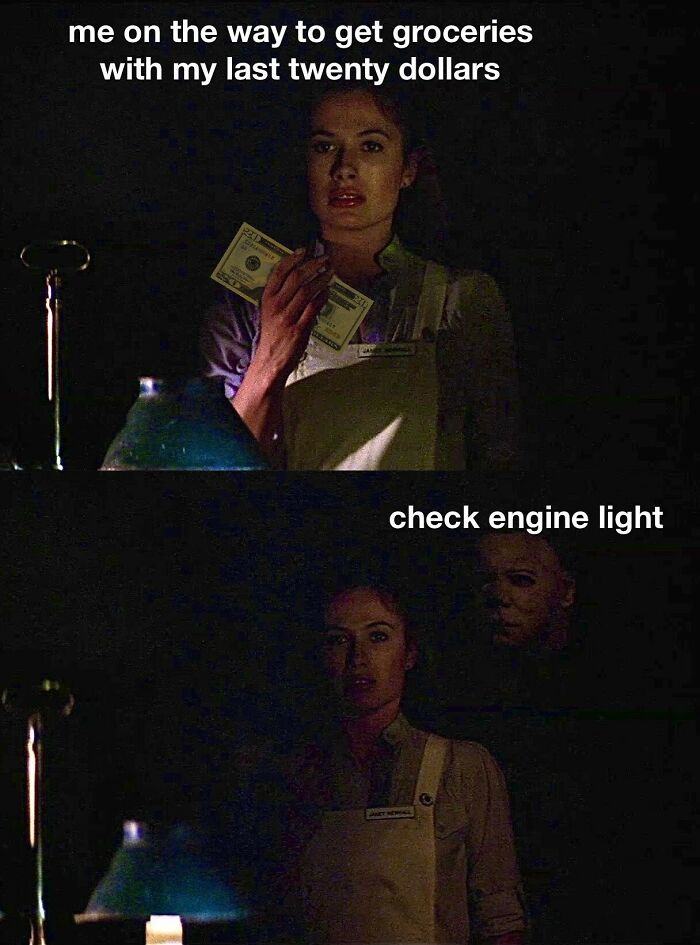

It'll Ruin The Day

In Trying Times Like These, It's Important To Remember This Advice

Or in a country where poverty means that you don't have a mansion or a multi million dollar sport car.

Feels Bad

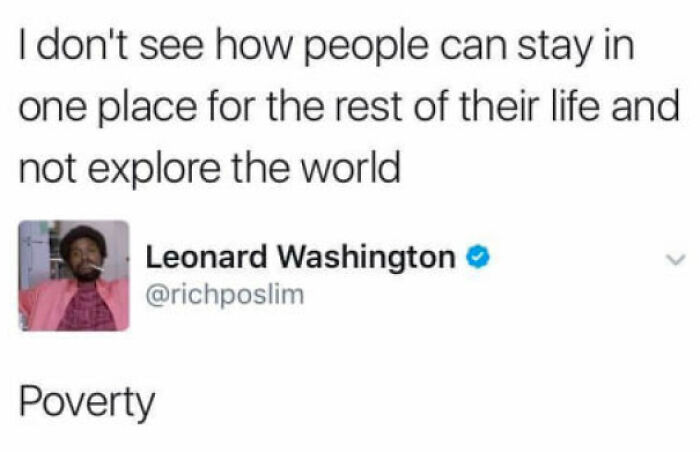

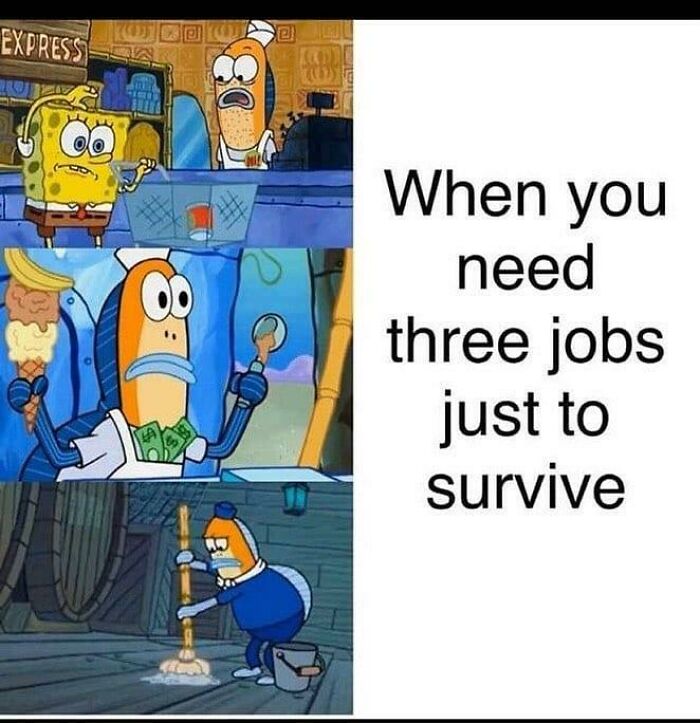

He Gets It

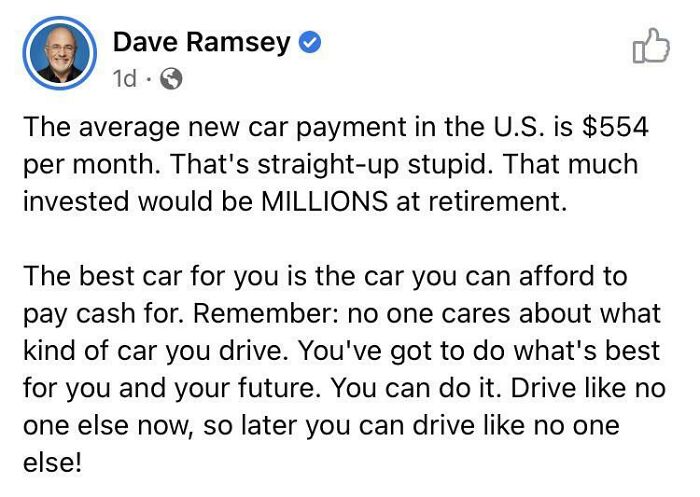

Not Big On Dave Ramsey But This Is Solid Advice On Car Buying

The car i can afford to pay cash for costs approx $1 and is likely a Hot Wheels. If, by a miracle, I were to save up a few hundred for an old beater car, I'd prob spend more money in repairs and duct tape holding it together, as my kids push it down the road to get to school. So, I go into debt to have a reliable car, where my kids can actually ride inside of it.

Paying Rent With Cash Really Puts The Cost Of Living Into Perspective For Me

It Never Ends

I went to open my first account in Japan. It was at Citibank. They explained that they would charge $50 per month if I had less than $500 in it. So I asked "so you take money from me if I don't have money?! Is that a joke?". He said it's standard at any bank. I laughingly said "no it's not" an opened somewhere else that doesn't have those fees, even though it was hard because I didn't speak Japanese. I will never even try another American bank.

Ha. I had this same experience. I opened with CitiBank (hilariously Shitibanku in Japanese) because I needed a place for my paychecks, rent, etc. Luckily I was able to maintain the minimum. After a few months, I was able to get my office manager on the phone to set up an account with Mizuho. That said, I've never had fees in the US on any bank.

Load More Replies...Was talking to a buddy of mine a while back. He told me that he and his wife had a deal. If either one of them got really sick, they'd immediately get a divorce so they wouldn't totally destroy the family's finances. Why the hell should that even have to be on the table? To have to do such drastic measures just to avoid ruining your finances is just criminally depressing.

That is sad. Kudos to them for their creativity in finding a solution, but awful that they had to resort to a plan like that.

Load More Replies...Eddie Vedder had a great take on wealth: There's only two things I appreciate about finally having some money. The first is I no longer have to worry about money, & that's such a constant burden that's lifted. And secondly, I can help those in need or help righteous people or organizations that deserve it. Money is like fertilizer: If you spread it around it can do a world of good. If you don't, your selfish ass will end up with a pile of s**t.

The quote is "Money, pardon the expression, is like manure. It's not worth a thing unless it's spread around, encouraging young things to grow." Dolly Levi.

Load More Replies...I went to open my first account in Japan. It was at Citibank. They explained that they would charge $50 per month if I had less than $500 in it. So I asked "so you take money from me if I don't have money?! Is that a joke?". He said it's standard at any bank. I laughingly said "no it's not" an opened somewhere else that doesn't have those fees, even though it was hard because I didn't speak Japanese. I will never even try another American bank.

Ha. I had this same experience. I opened with CitiBank (hilariously Shitibanku in Japanese) because I needed a place for my paychecks, rent, etc. Luckily I was able to maintain the minimum. After a few months, I was able to get my office manager on the phone to set up an account with Mizuho. That said, I've never had fees in the US on any bank.

Load More Replies...Was talking to a buddy of mine a while back. He told me that he and his wife had a deal. If either one of them got really sick, they'd immediately get a divorce so they wouldn't totally destroy the family's finances. Why the hell should that even have to be on the table? To have to do such drastic measures just to avoid ruining your finances is just criminally depressing.

That is sad. Kudos to them for their creativity in finding a solution, but awful that they had to resort to a plan like that.

Load More Replies...Eddie Vedder had a great take on wealth: There's only two things I appreciate about finally having some money. The first is I no longer have to worry about money, & that's such a constant burden that's lifted. And secondly, I can help those in need or help righteous people or organizations that deserve it. Money is like fertilizer: If you spread it around it can do a world of good. If you don't, your selfish ass will end up with a pile of s**t.

The quote is "Money, pardon the expression, is like manure. It's not worth a thing unless it's spread around, encouraging young things to grow." Dolly Levi.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime