People Share Horror Stories Of Being Denied Insurance Claims After UnitedHealthcare CEO Attack

The assassination of UnitedHealthcare CEO Brian Thompson cast a harsh spotlight on the controversial practices of the health insurance giant, which has long been accused of prioritizing profits over patients. Thompson, who was gunned down in what was reported to be a calculated attack outside a New York City hotel on December 4, led a company notorious for its high claim-denial rate—double the industry average.

His killing spurred a flood of personal stories from patients and families who say they suffered due to UnitedHealthcare’s algorithms and policies, which critics claimed often deny necessary care to the most vulnerable.

As the investigation into Thompson’s death unfolds, patients and advocates alike in the US are calling attention to what they see as a broken system, with private insurers like UnitedHealthcare profiting at the expense of human lives.

Image credits: Stephen Maturen/Getty Images

Image credits: NYPDNews

This post may include affiliate links.

Peer-To-Peer Review Immunotherapy Denied

“My husband was diagnosed with peritoneal mesothelioma in 2010 at age 58. We had UHC through his employer.

“In 2016, he was being treated at the Cancer Treatment Centers of America in Philly and was prescribed a newly available immunotherapy.

“UHC denied it. We appealed. They denied it again. We had a peer-to-peer review and they still denied it.

“This entire process took 3-4 months, months where he wasn’t getting any treatment at all. Finally, the hospital itself decided to cover the cost of the Medication.

“So after months of haggling with UHC with no results, he got his meds. But he died 6 months later.

“But wait there’s more! He had an open lawsuit with a mesothelioma lawyer and once UHC found that out, that someone else was responsible for the exposure that caused his cancer, THEY sued US in order to get back the money they spent treating him!!!

“It’s a process called subrogation. They now get 10% of MY, the widow, portion of any settlement I receive.

“They are EVIL. I don’t give a flying f*ck their CEO was gunned down. Get every single one for all I care. None of it will bring Jake back.” – Seawitch88

Denied Chemotherapy For Stage 3 Cancer

“I had United Healthcare for years. When I went to my first chemo treatment I found out they had denied my ACTUAL CHEMOTHERAPY DRUGS - the nurse had to start me with an iron infusion while they called and fought with insurance for 2 hours.

“Stage 3 cancer and they denied my chemo. The anxiety that caused me - you don't know how hard it was to walk into that hospital and prepare mentally for chemo.

“Not to mention wasting so much time for the staff. It's absolutely criminal. Obvi I do not support what happened but how much do you think people can take?” – Megan

“$150,000 Of Medical Debt”

“My husband was diagnosed with a rare bone cancer at age 27. He had 9 months of rigorous chemo & radiation.

“He was on disability. I had just graduated and put my career on hold to take care of him. He was in [a] wheelchair because the tumor broke his right femur in half.

“That’s how we initially found out it was cancer; his doctor hesitated to order a simple X-ray.

“He’d just learned to walk again after chemo when we got the news that Aetna wouldn’t be covering all the treatment he’d just had.

“He was then declared in remission. But the relief was short-lived. $150,000 of medical debt was looming over us.

“The onslaught of calls every day from debt collectors. We could hardly breathe with all the anxiety & stress.

“Our lives were packed up in storage across the country because we’d moved back home to be close to family and good hospitals.

“We thought we’d be moving back soon so he could go back to work, but the debt held us back. The cancer returned 2 months later.

“He was a Ph.D. candidate [in] molecular genetics. He knew his odds were not good from the very beginning, but tried to soften the blow for me.

“He quietly worried he would be leaving me with his insurmountable medical debt. We learned about & applied for HCAP since we were below the poverty line.

“After nearly a year of waiting, we were approved on Xmas Eve while sitting in his oncologist’s office being told he had a month or 2 left.

“He died 2 months later at age 28. Healthcare is a human right.” – Catherine

“This Is Why No One Shoots NHS Executives”

“I needed a Hernia operation. USA standard cost $4200-$6200, USA cost with insurance $750-$1200.

“UK NHS cost which included treatment at a private hospital after a wait of 3 weeks (2 weeks between GP and specialist then 1 week between specialist and operation) and 2 weeks off paid work with full wages...£0

“This is why no one shoots NHS executives.” – Jimbo271

Deny, Defend, Depose

“When my daughter, Kyla, was diagnosed with an inoperable brain tumor at 21 months old, we did everything possible to save her.

“After chemo failed, we got her on an FDA clinical trial. [Insurance] refused to pay for it. We did fundraisers, moved across country, got senators involved...but the insurance company wouldn't budge and spoke to me like I was garbage.

“After Kyla died at 4 years old, we were over $300,000 in debt, had to claim bankruptcy, and lost our house. Deny, defend, [depose].” – Juliet Rose

“Fully Believe That Most Insurance Companies Are A Well-Oiled Scam”

“Shout out to United Health Care for attempting to fully deny my 4 week long stay in the hospital after I broke 2 hips, my foot, ankle and both wrists in a car accident 5 years ago, after their 'expert doctors' supposedly looked at my case and determined that after 24 hours, I simply didn’t ‘need to be there anymore.’

“I couldn’t even f*****g move a muscle from the waist down and was temporarily paralyzed for like the first 2 weeks.

“We went back and forth for months over a $40k bill (this was the balance left over from what my auto insurance paid), that they eventually just stopped pursuing.

“This was all happening while I was trying to heal from multiple injuries. I can’t imagine what other people have gone through with them in similar, or much worse situations.

“Fully believe that most insurance companies are a well-oiled scam and the people that run these companies deserve to spend a lifetime behind bars.” – u/_ladameblanche

Former Unitedhealthcare Employee Story

“I worked for UnitedHealthcare in a call center in my early twenties. I lasted about six months.

“The call that broke me was a woman calling in about a bill she received. She had lost her six-year-old to a brain tumor.

“They were planning the funeral and they got notice that they were being sued by a doctor because UH hadn't paid a nearly 1.4 million dollar claim.

“I couldn't really help her. Our call center was for checking if something was in network or covered.

“But I could see the claim. I spent an hour calling various departments trying to get someone to take care of it.

“Eventually, I got someone in claims that cared and started the process of pushing it through for review. Which would, at the very least, hold off on collections.

“I profusely apologized to the woman, she shouldn't have had to deal with this on top of planning a funeral for her six-year-old.

“When I got off the phone I got chewed out by my boss. Our calls should last no more than 300 seconds (it was always in seconds instead of minutes, I don't know why). And I walked out.

“I should add that I worked for a third-party call center that was contracted by United Healthcare. But the policies were set by UH.

“Side note: we did not have insurance options and we were typically kept between 32-35 hours so we couldn't be considered full-time.

“Again, set by UH (I worked for a different company in the same centre and that was not the policy for them).

“I have no condolences to give. I still think about that woman. She, and her family, deserved so much better.

“One last addition: I got severe pneumonia while I had Blue Cross Blue Shield (different job). My heart stopped twice and I was in the hospital for four days on various antibiotics and things like potassium drips etc.

“It was terrifying how close to death I got. BCBS decided to deny my claim because I went to the ER instead of my PCP (despite having gone two days prior and the doc saying it was just a minor cold).

"I owed the hospital over 90k. I appealed, nothing. Eventually, the hospital wrote off the majority and I paid 5k (I made about 20k teaching early education). So... F**k BCBS too.” – Li Michaels

“I Fought This Bill For Three Years”

"I had health insurance when I gave birth to my youngest child. I supposedly had 100% maternity coverage while in the hospital, so imagine my surprise when I got a $9,000 hospital bill.

“They decided they weren't going to cover the bill in total and denied my total coverage because the nurses working in the nursery weren't employees of the hospital.

“They were contracted staff or something. I fought this bill for three years before it was decided in my favor.

“And this was with me being a fairly intelligent person going line-by-line through my documents and also working in communications for a living, so I knew how to write letters and reach out to who I needed to talk to.

“I cannot imagine how that situation would have gone if none of those things were the case, and it made me very aware of how many people must be screwed over on a regular basis and just have to live with it." – u/mdmommy99

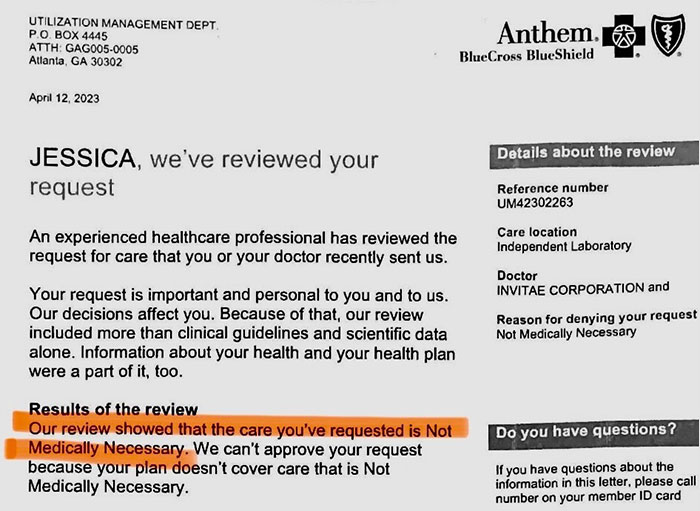

“The Care You’ve Requested Is Not Medically Necessary”

“Well, since we’re sharing our US Healthcare is a joke stories…March 2022, I collapsed getting ready for work, and got a concussion.

“This was preceded by 20 years of unexplained heart issues. After meeting with FOUR cardiologists in 6mon, they ordered genetic testing for my unexplained heart failure/cardiomyopathy at 35.

“It came back POSITIVE for a deadly mutation that causes sudden cardiac death. That test saved my life. I had an ICD implanted within weeks. Days later, I get this in the mail…” – JK

“Screwed By Health Insurance”

"I feel bad for his family. But as someone currently getting screwed by health insurance, I’m not surprised it happened.

“My mom has stage 4 breast cancer and has maxed out her insurance. They won’t cover anything again.

“My mom needs her chemo to live, and they are willing to let her die. Insurance is the devil." – u/Full-Clerk8497

$6,000 “Elective” Surgery

"I had to get my gallbladder out after being in excruciating pain for six months. Had to pay $6k because it was an 'elective' surgery." – Kayla

“I Barely Slept A Wink Due To The Stress Of This”

“After undergoing months of tests, my cardiologist and electrophysiologist (sp?) decided it was medically necessary for me to have a heart ablation.

“My heart would spontaneously race 140 bpm and I actually went back-to-back nights with no sleep due to this condition.

“You have some pretty dark thoughts when you don't get sleep for back-to-back nights. So the procedure was scheduled months in advance.

“THE DAY... no... THE AFTERNOON before the 7 AM procedure the insurance company calls to tell me it's not approved.

“They explain that they're trying to get it approved and that I should just go to sleep and hope it's done in the morning.

“I barely slept a wink due to the stress of this. I was told if it wasn't approved to still drive to the hospital and hope that it was approved before I arrived.

“If it wasn't, I'd be given the option to sign some paperwork and accept the financial burden myself if insurance didn't come through.

“The list price of my OUTPATIENT ablation (I was home by 2 PM) was $360,000. United Health Care shortened my life with all of the stress they inflicted during this.

“I hate them with a burning passion and genuinely laughed when I read the news this morning.” – u/ga-co

Honestly it's great that so many people are happy with the event last week. I think it's a big wakeup call for the people running these massive corporations that just screw people over. My hope is that this pressure on them keeps up until one or more of them start to push towards a reform out of fear. It's gotten to this point because of them, making examples out of these criminals is justice, our system that protect their actions are what are unjust!

Traumatized From UnitedHealthcare Denial

“My son was scheduled to have surgery to correct his pectum excavatum in 2022. His surgeon said he met all the medically required criteria.

“Two days before the surgery UHC denied the surgery. This was incredibly stressful. Apparently their reasoning was that my 22-year-old son had 82% lung capacity based upon the tests due this chronic condition and they only approve patients 80% or less.

“My son was don't worry mom we'll be ok. He is not angry he was just concerned about me.

“Later that year my husband lost his job and with it UHC medical insurance. My son( student) and I got coverage through the ACA.

“The next year with his new insurance, same doctor he was able to get the surgery. We are blessed.

“However I still feel traumatized every time I think about the denial from UHC. There are probably lots of other people in the same boat as me.

“Only a patient's doctor should be able to make these life-altering decisions, not insurance companies.” – u/LynxChoice7539

It is health care providers who created the need for "Utilization Reviews" by providing clinically unnecessary services to pad their pockets. The scales are broken, they shattered into dust long ago. There are better ways, health care should Never be for profit.

Denied At Four-Years-Old

"Even though I pay for a top-tier plan, my health insurance sent a letter to my daughter explaining that they denied a claim for a one-night stay in the hospital that literally saved her life.

“Also, my daughter was 4 years old at the time. The letter was addressed to her." – u/jimsmisc

Denied Prescription

"Literally just had my health insurance deny a prescription today. Went to the doctor, got a referral, and went to the specialist where I was given a trial run of some medication.

“Went back after the trial to tell them it worked great and go to get my prescription. 'Your insurance decided they didn’t want to pay for that.'" – u/chimichangaluva331

I have to buy animal grade insulin from Walmart because my insurance won't cover the type my doctor says I should be on and I can't afford the $174 dollars a month per vial alongside the $76 for blood glucose monitoring supplies. Which doesn't sound like a lot and other people clearly have it worse, but I would literally die if I couldn't get access to insulin. Thank god Walmart even has that option available for people like me.

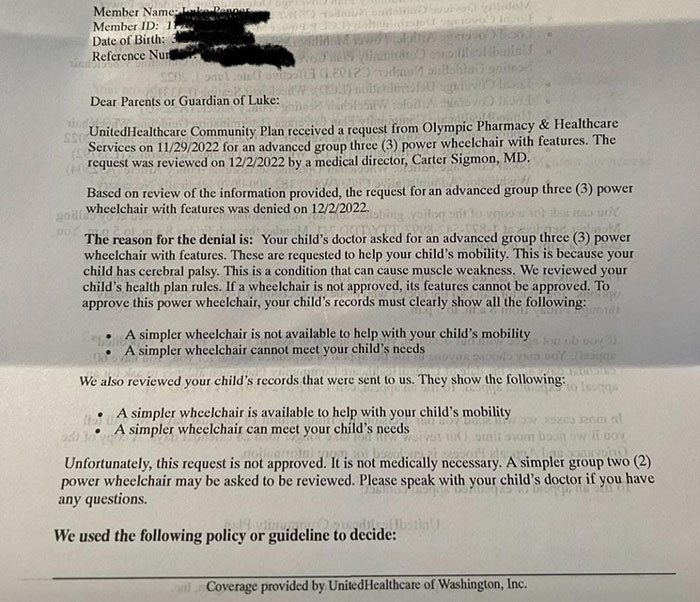

Denied A Child's Wheelchair

“Throwback to when the UnitedHealthCare (UHC) repeatedly denied a child's wheelchair.” – u/8O8I

Official Claims Addressed To Newborn Babies

“I had twin babies in our (in-network) hospital last April. It was a vaginal birth, complicated only due to it being a twin pregnancy and mild GD.

“Due to some weight gain issues, we were in the hospital for about 4 days following their birth.

“From what we were told, this was pretty par for the course for twin birth. The pediatrician on call was worried about the 10% weight loss threshold for our one twin and the other was very close to that weight loss as well.

“We listened to what the doctors were telling us and simply followed medical advice to stay put until both babies were healthy enough to go home.

“Fast forward to November, we got two letters in the mail. Each letter was addressed to a baby, written to that baby in (talking to the baby, not us as the parents), explaining why it wasn’t medically necessary to remain in the hospital, and essentially saying that they were denying our claim for most of the hospital stay for one baby, and two days of the stay for the other baby.

“We have 6 months to file an appeal. We had a fire in our a**es when we first got the letters. I asked our pediatrician what to do.

“She showed me on her computer the daily progress notes from the hospital and told me that’s what we needed for our appeal.

“I requested hospital records for both babies and myself. The files don’t contain these progress notes!

“We are not sure where to go from here."–u/Zealousideal-Ad-6512

$300,000 To Be Airlifted

“I’m really sad this incident happened, however, I have to be honest that I immediately thought of my disappointment with UnitedHealthcare. @UHC

“About a year and a half ago, UnitedHealthcare approved a claim for my husband who was involved in an accident at the gym, which resulted in him being a quadriplegic.

“Within two days, he was airlifted to an acute hospital in Chicago, because his doctors felt that there was a possibility for him to recover.

“After being airlifted, Within two days, UnitedHealthcare completely denied the claim, and my husband’s medical doctor fought very hard to have them approve the claim.

“After having his acute care denied, within a few weeks we had to find another facility and we were on a week-by-week basis, because each week they would deny the claim.

“Needless to say, I had to work really hard to find a facility that would accept him, and since he had already been admitted to an acute hospital, he was no longer eligible for acute care.

“I found a skilled nursing facility a few weeks after being at the acute hospital in Chicago, and had to put him on a commercial flight to Nebraska.

“I recently learned that @UHC has put a lien on an insurance policy from the gym, #AspiriaFitnessCenter @occmgmt stating that they denied the claim for him to be airlifted to Chicago and we needed to pay approximately $300,000.

“Please know, I’m very sorry for what happened to the gentleman, but just calling @UHC makes me physically ill.” – Billie Jean Queen

From what I’ve read, airlifts aren’t covered by most insurance. I think you may need prior permission from your physician or an insurance company, but if you are unconscious or in a life-threatening condition, how can you do that?

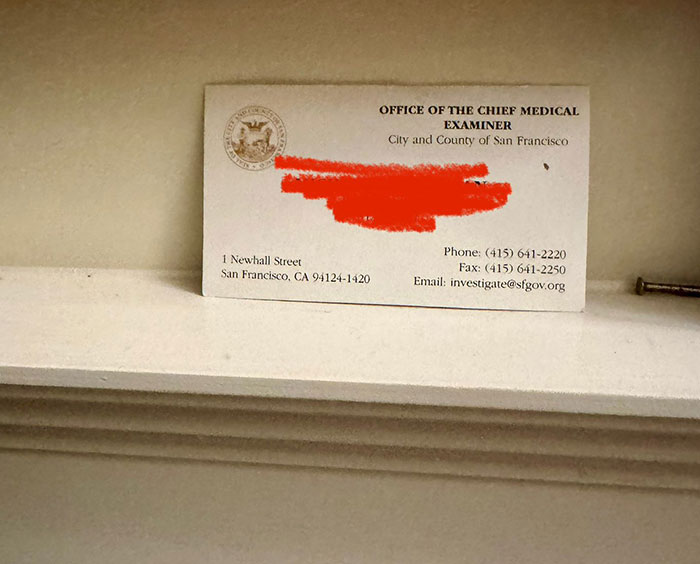

Ambulance Trip To The Morgue Claim Denied

“A propos of nothing, UnitedHealthcare declined to cover my husband’s ambulance trip to the morgue because his insurance policy lapsed at the second of his death.

“There is a technical exception because under California law a person is not deceased until they are declared dead and paramedics arrived before he had been declared dead.

“I appealed to the office of the CEO. My appeal was denied. San Francisco paramedics apparently know this and so they will put the deceased person’s name spelt incorrectly on the paperwork.

“I got a bill addressed to Zickity Jamjam. I was an idiot and submitted a claim to UnitedHealthcare.

“As a widow who found their husband dead in my own house, I have endless sympathy for every family that confronts loss.

“But let’s not be foolish and assume UnitedHealthcare extends that sympathy to its customers. I’m happy to go on the record about this experience.

“May you never find yourself on the phone with the CEO of UnitedHealthcare’s office arguing over how much time it should have reasonably taken you to find your husband’s dead body in your own house over a $2000 ambulance bill.

“And to prove I’m not making this up, here’s a card from the coroner’s office at the top of the stairs where I’ve left it untouched.

“(Hid the name of the investigator who declared my husband dead). My mom paid the bill because I couldn’t bring myself to and UnitedHealthcare, after my appeal to the CEO’s office was denied because they claimed my husband’s insurance lapsed the second he died and they wound not cover the ambulance to the morgue, threatened me with collections.” – Data&Politics

“In The Course Of 18 Months, I Spent $6,250 Out Of Pocket”

“My US Healthcare is a joke horror story. We moved in February ‘21. Husband’s new job had an insurance requirement that if the spouse can get insurance through their own employer, then husband’s employer won’t cover spouse.

“Insurance kicked in day 1. I got a job, but insurance wouldn’t kick in until 4/1, so I was on husband’s ins until then.

“Found the lump 3/9, did all testing and was diagnosed with breast cancer on 3/22. Out of pocket max was $750- it was met just from the diagnostic mammo.

“Like I said, my insurance kicked in 4/1. I had my port placed 4/6, first chemo was 4/8. My out-of-pocket max on my new insurance was $2750.

“I made that just from the port placement. One round of chemo was $50K. 1/3/22 was my first immunotherapy infusion of the year. $12k. Hit my OOP max in one shot again.

“In the course of 18 months, I spent $6250 out of pocket, because of feeling a lump.

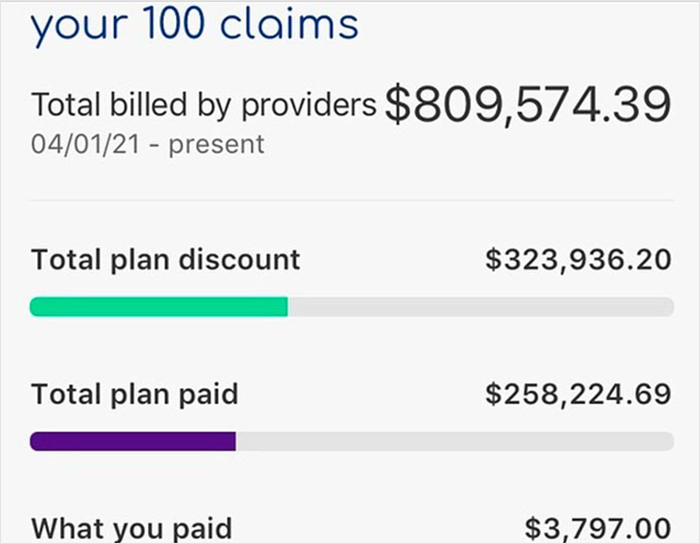

For funsies, here was my explanation of benefits total from 4/1/21-10/24/21.

“I still had about $45K of infusions, physical therapy, and surgical follow-ups to go in that year. f**k cancer.” – Robyn

The picture at the top is what started the scam. Originally it was marketing to show how much you would save with insurance. It's one reason why they jack up the prices so high on "insurable" items...so that they can show you the "savings". Every time I go to the doctor I get a non-bill showing that I save XX% with my insurance. And god forbid if you have no insurance....$10 for a bandaid, $20 for an aspirin....

And this is why the people who *could* help find the shooter AREN'T. Some say this shooting was "justice for all the claim denials." There was an article somewhere that said the claims were batched together in groups of like 10,000 + run thru a machine which automatically denied them, took like 1.2 seconds per claim. NOT ONE PERSON actually *looked* at the claim. So the moral of the story is "Don't be an AH" or "Don't be evil."

Reading this, the first question I had was: Is anyone with actual medical qualifications assessing these claims? I do not condone murder but looking at it from the UK and hearing about how it is in the USA, the most shocking thing is that this did not happen sooner.

Load More Replies...One point so many of these type articles fail to cover is how much money the insurance lobbyists hand out to our elected officials. Each year members of Congress - regardless of party - receive well over a million dollars in "gifts" from lobbyists. Consider how most politicians think - the more money they are "gifted" from a source, the more likely they are to protect and advance that source. The next time you are complaining about our "healthcare" (sick care) system, think of how your member of Congress is using the "gifts" the healthcare lobby hands them.

And how members of Congress get their top-notch, fully covered healthcare...paid by taxpayers.

Load More Replies...Oh, my. United Healthcare. There is nothing united about them apparently. The way they treat people is horrible. It's truly not shocking that someone shot and killed the CEO. They reached a point of no return and felt there was no other way. Looking at it from the shooter's perspective, United Healthcare had already ruined his life. Personally, insurance should NOT have a say in what doctors should or should not do for their patients. Doctors are human, they will make mistakes. But I'd trust a doctor over an insurance company any day regarding my wellbeing. This country is going to change one way or another eventually when it comes to a person's health.

And this is why the people who *could* help find the shooter AREN'T. Some say this shooting was "justice for all the claim denials." There was an article somewhere that said the claims were batched together in groups of like 10,000 + run thru a machine which automatically denied them, took like 1.2 seconds per claim. NOT ONE PERSON actually *looked* at the claim. So the moral of the story is "Don't be an AH" or "Don't be evil."

Reading this, the first question I had was: Is anyone with actual medical qualifications assessing these claims? I do not condone murder but looking at it from the UK and hearing about how it is in the USA, the most shocking thing is that this did not happen sooner.

Load More Replies...One point so many of these type articles fail to cover is how much money the insurance lobbyists hand out to our elected officials. Each year members of Congress - regardless of party - receive well over a million dollars in "gifts" from lobbyists. Consider how most politicians think - the more money they are "gifted" from a source, the more likely they are to protect and advance that source. The next time you are complaining about our "healthcare" (sick care) system, think of how your member of Congress is using the "gifts" the healthcare lobby hands them.

And how members of Congress get their top-notch, fully covered healthcare...paid by taxpayers.

Load More Replies...Oh, my. United Healthcare. There is nothing united about them apparently. The way they treat people is horrible. It's truly not shocking that someone shot and killed the CEO. They reached a point of no return and felt there was no other way. Looking at it from the shooter's perspective, United Healthcare had already ruined his life. Personally, insurance should NOT have a say in what doctors should or should not do for their patients. Doctors are human, they will make mistakes. But I'd trust a doctor over an insurance company any day regarding my wellbeing. This country is going to change one way or another eventually when it comes to a person's health.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime