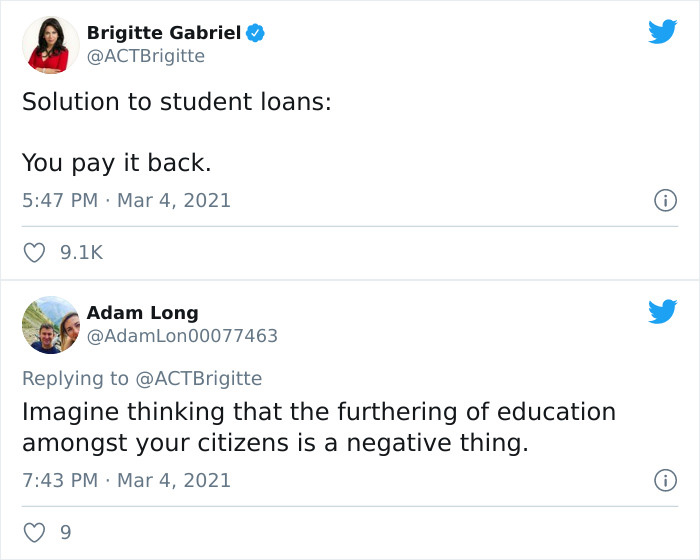

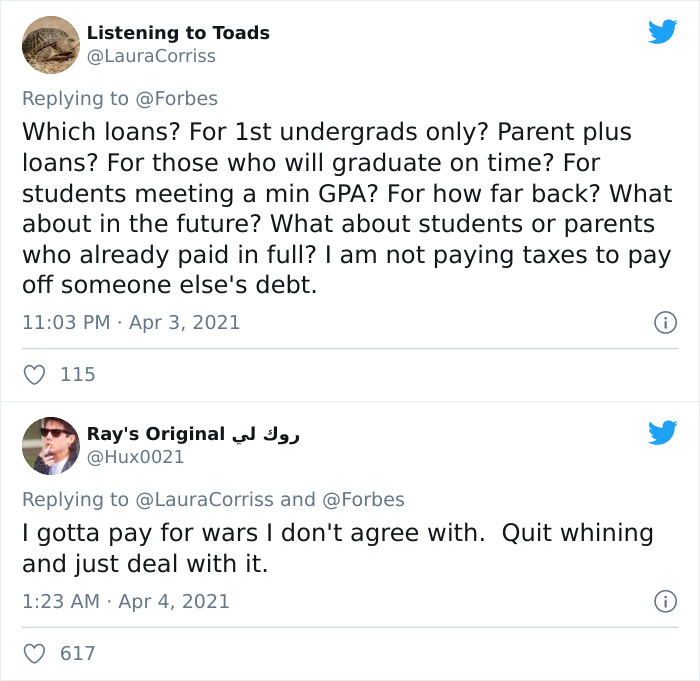

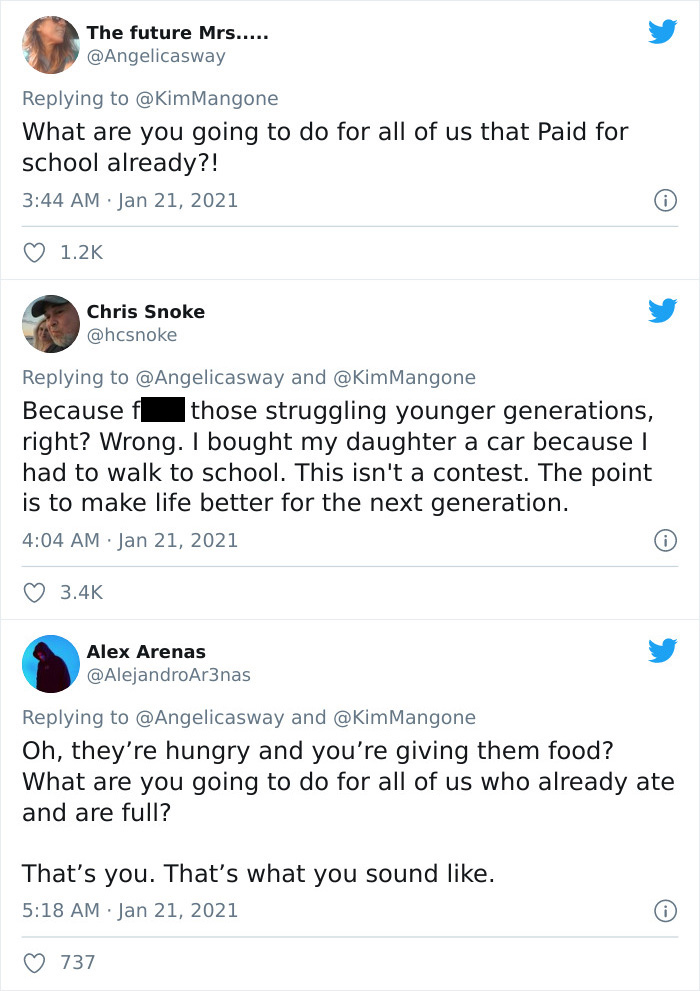

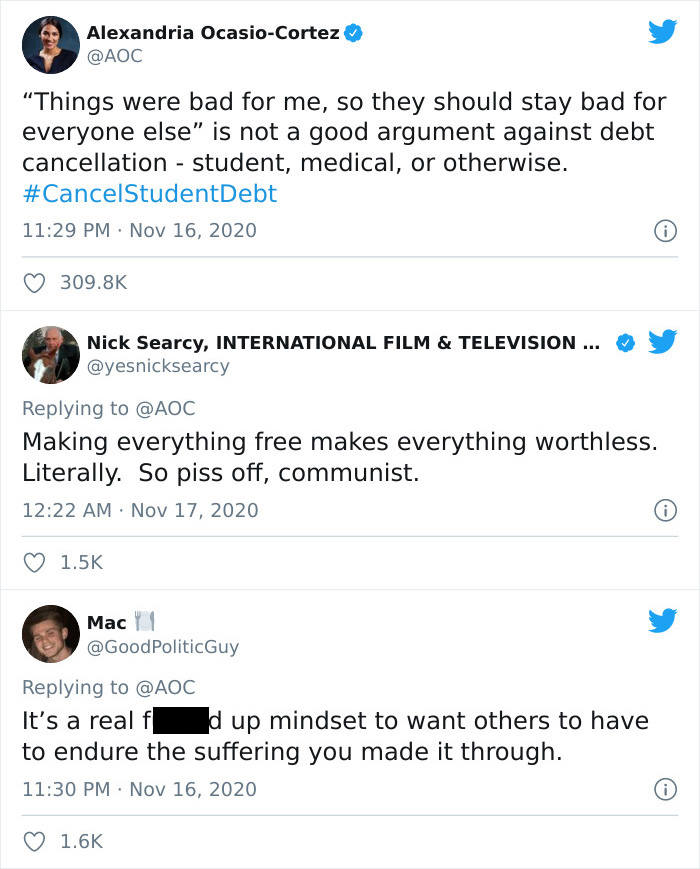

30 Of The Dumbest Points People Saw Americans Make Against Canceling Student Debt

There are 45 million Americans who collectively owe $1.71 trillion in student loans. And it’s no secret that the financial burden of it negatively affects the lives of many former students with education finished and unfinished, in profound ways. From mental health to home-buying, student loans are somewhat of an ever-present shadow looming over for many years to come.

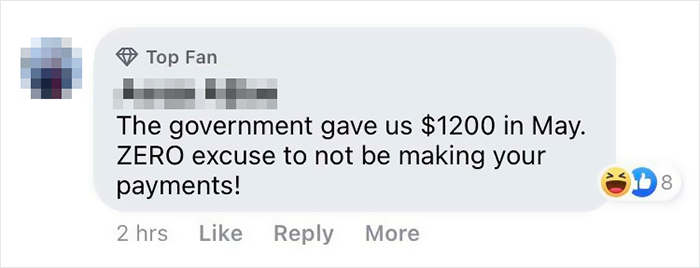

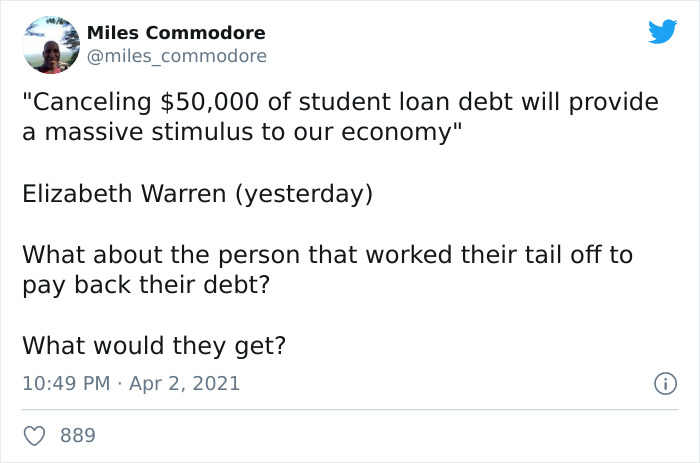

But President Biden has recently given hope to many by ordering Education Secretary Miguel Cardona to prepare a report on the president’s legal authority to cancel up to $50,000 in student debt per borrower. The possibility of Biden forgiving student loans has surely ignited a heated debate on this sensitive, and often sour subject matter.

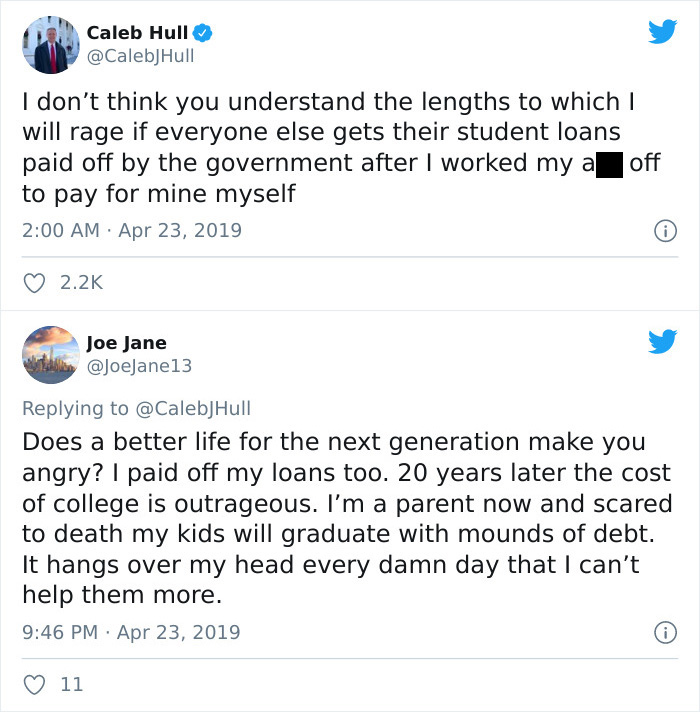

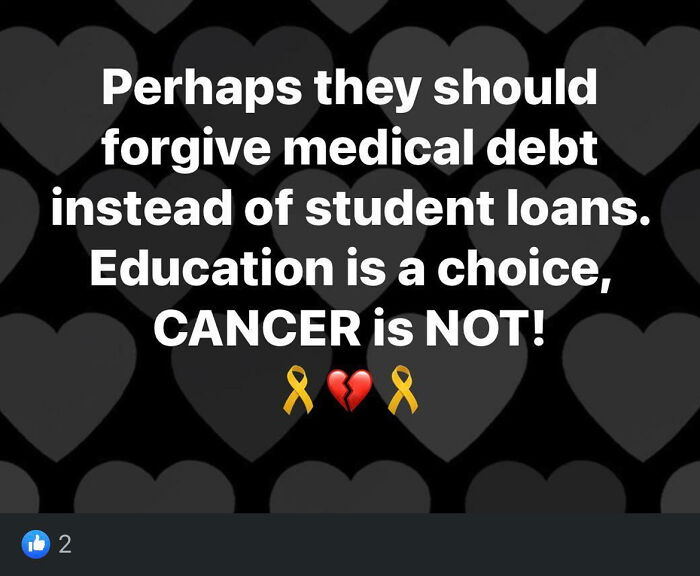

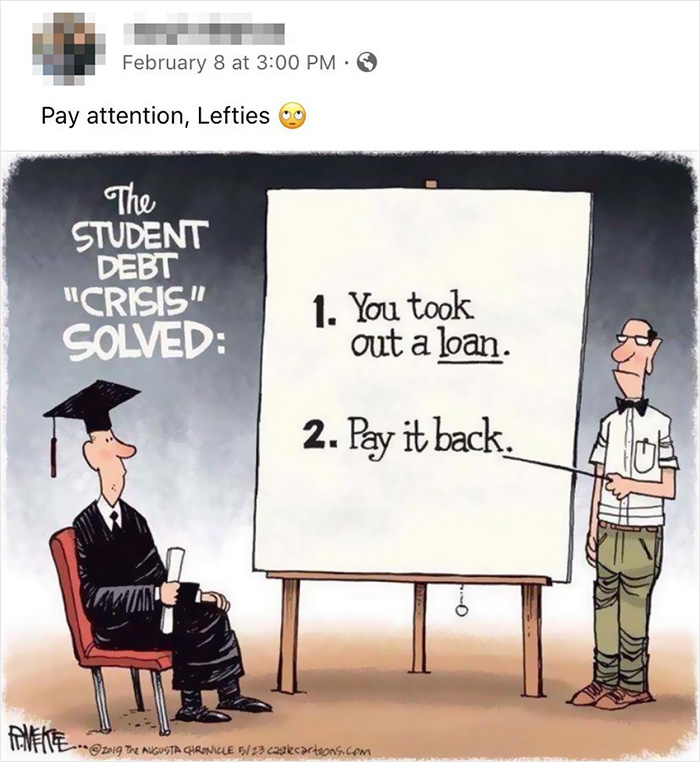

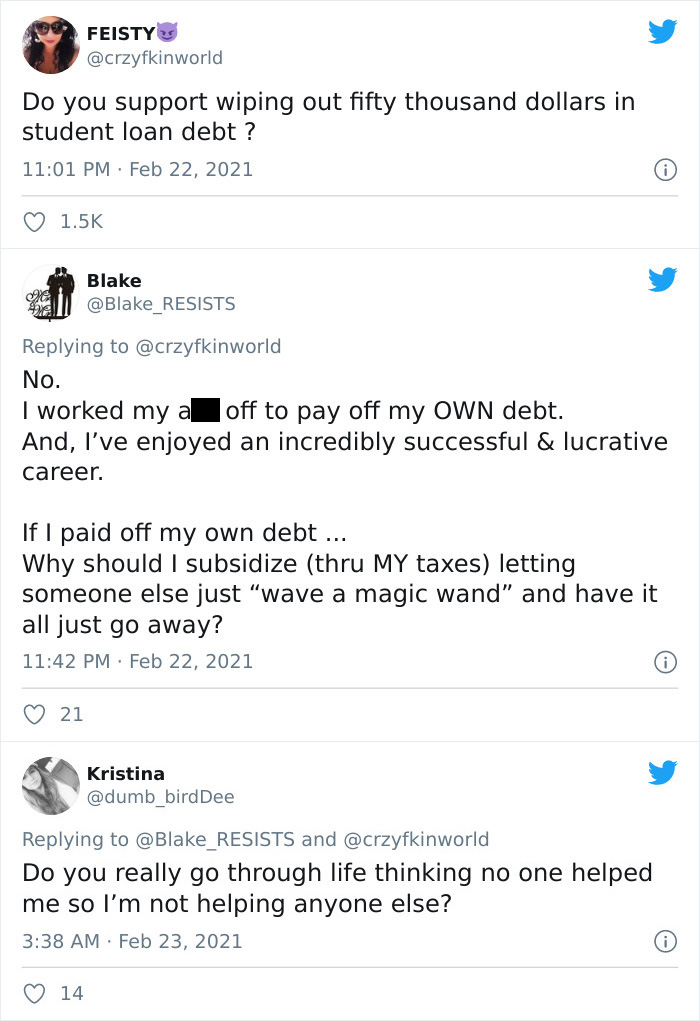

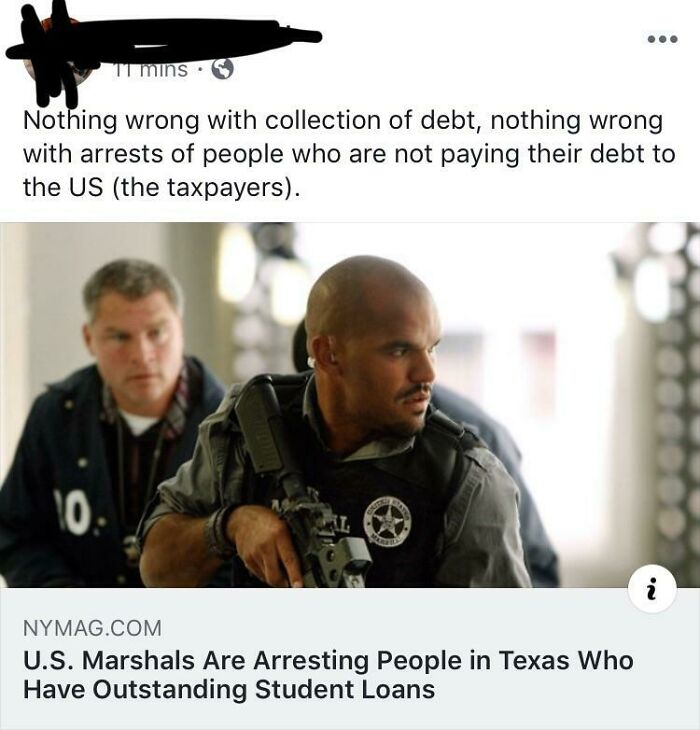

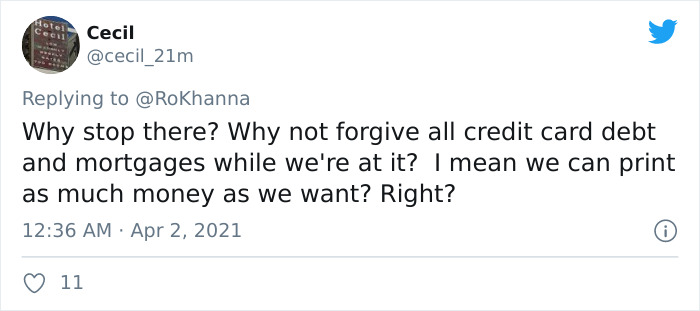

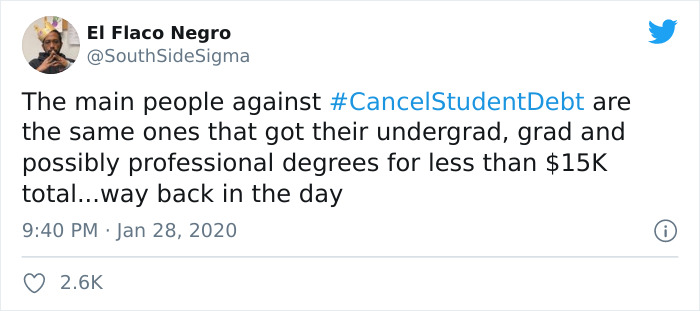

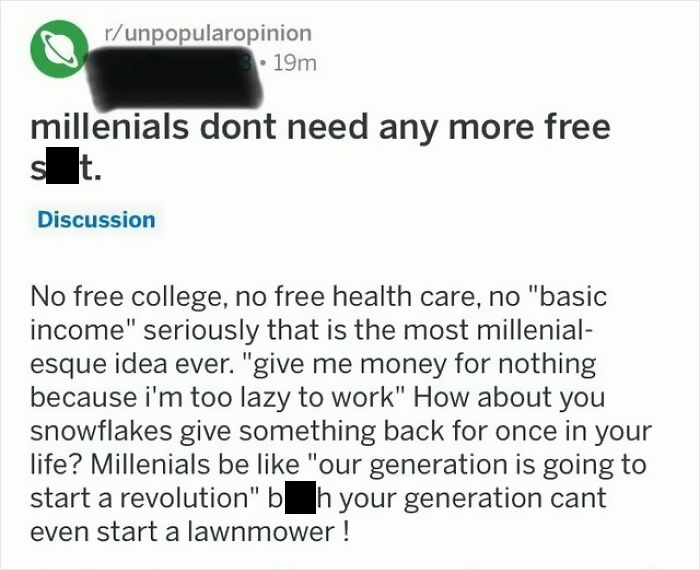

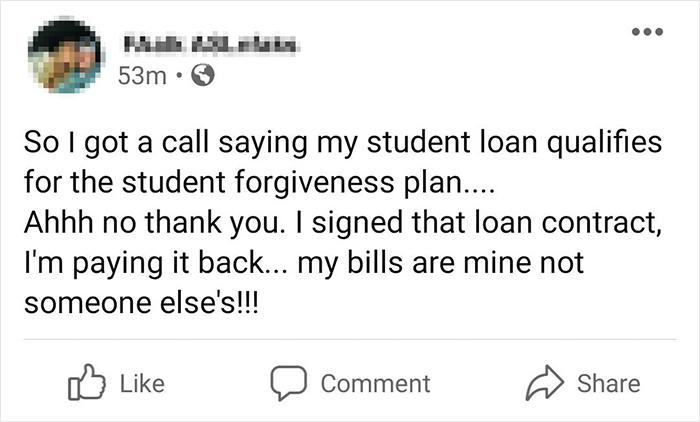

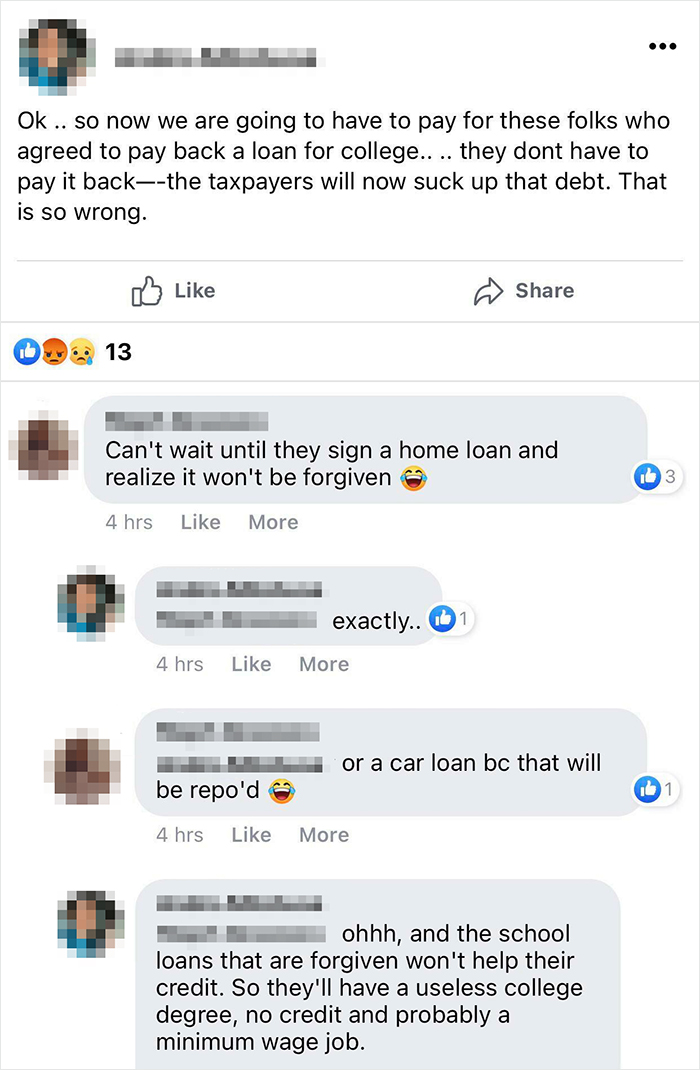

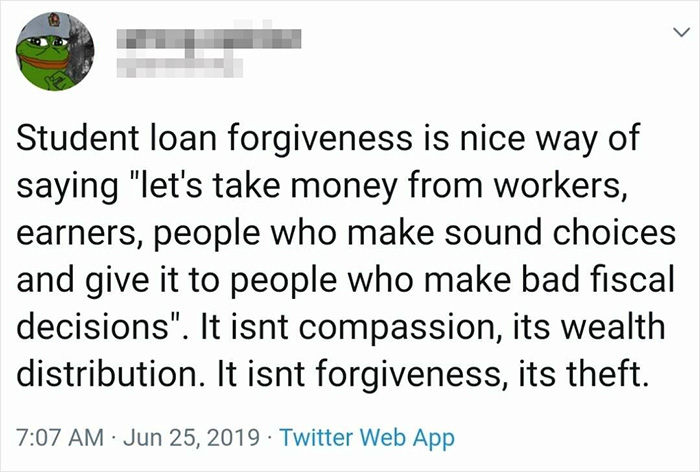

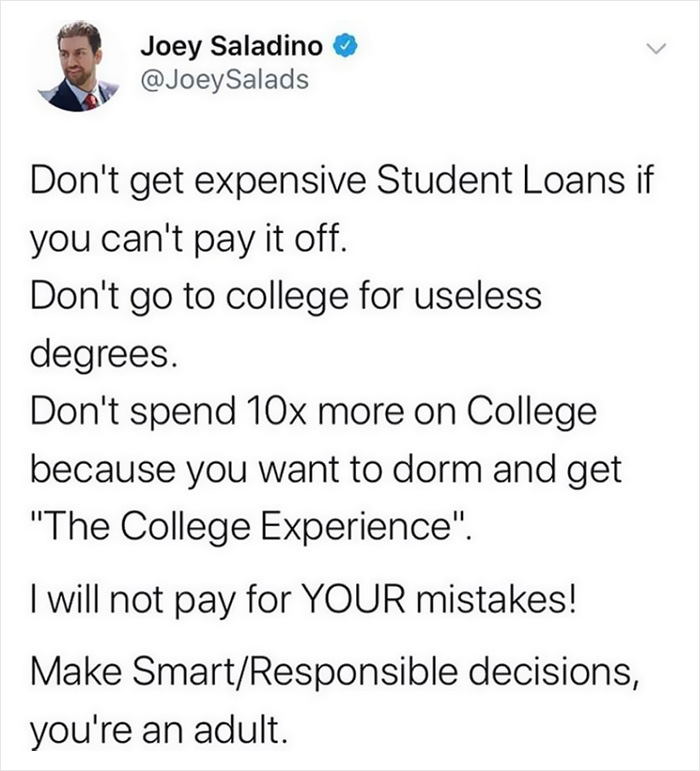

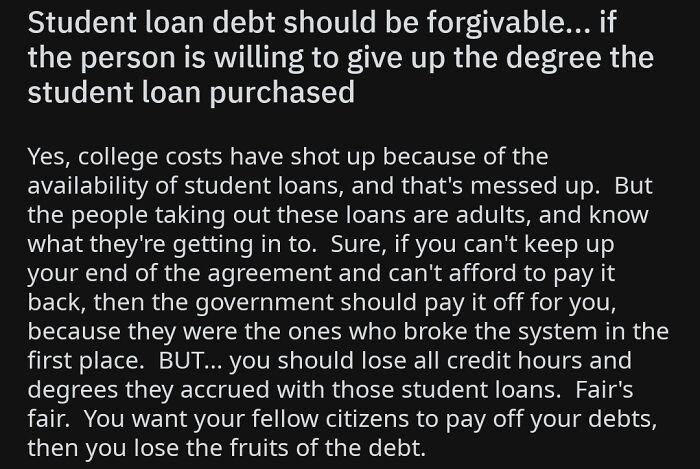

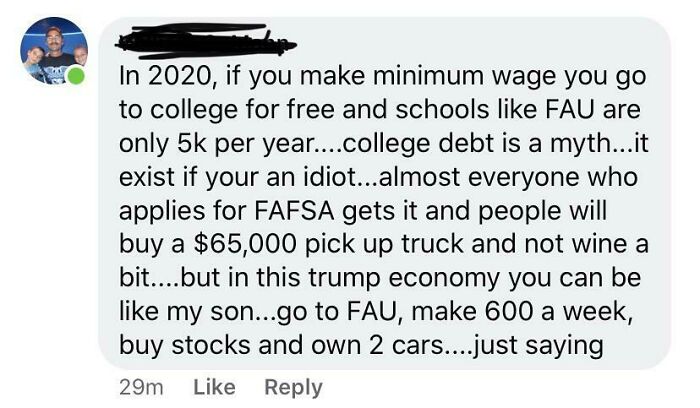

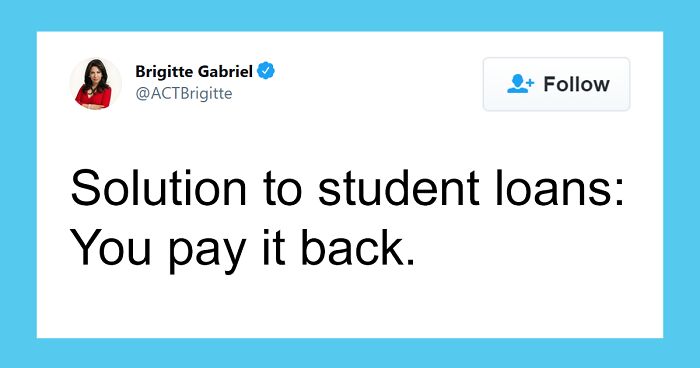

And while for many American borrowers, the prospect is more than just politics, giving a sense of long-awaited salvation, others have expressed arguments against it. They claim that simply wiping clean the debt is not a solution for the economy and equity. Which side are you on? Hit us in the comment section below!

This post may include affiliate links.

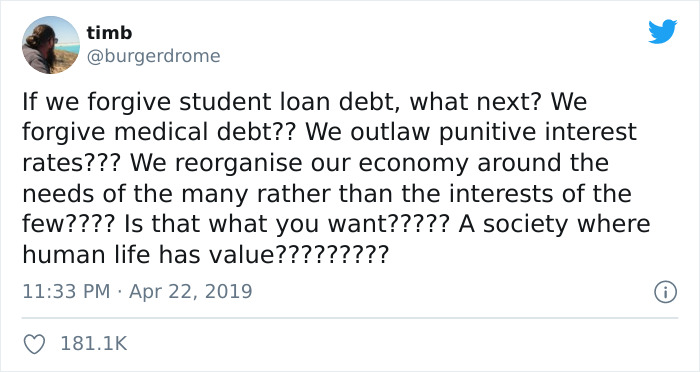

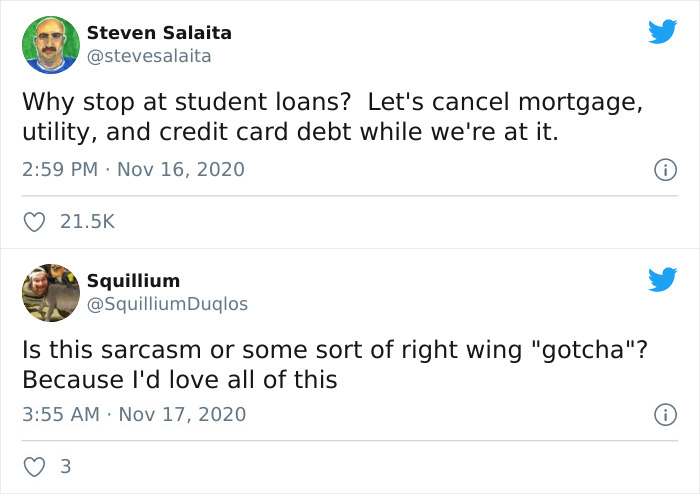

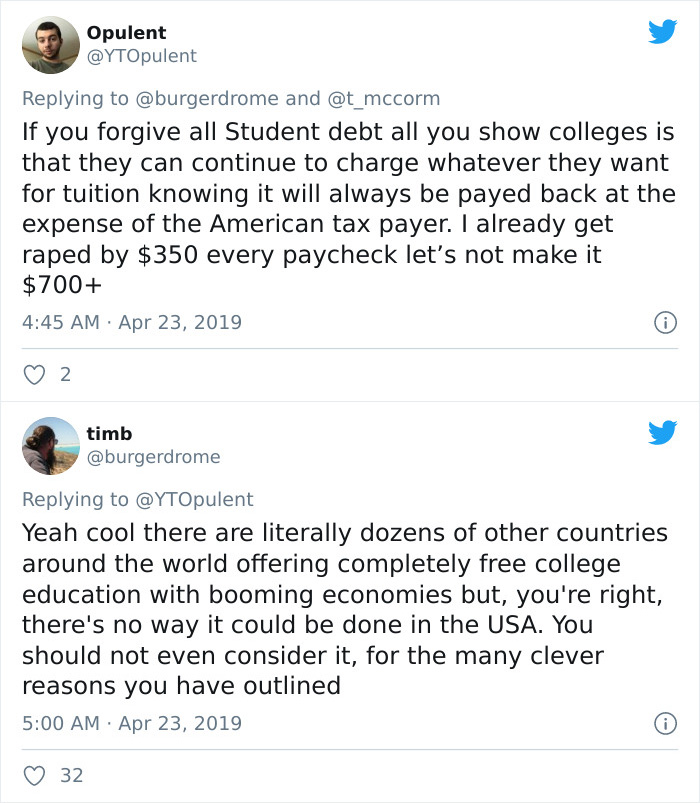

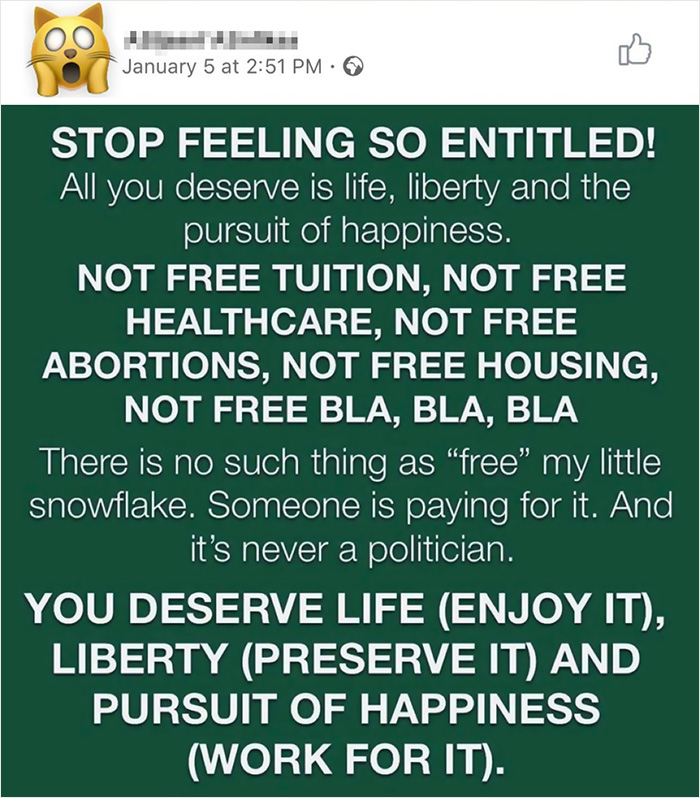

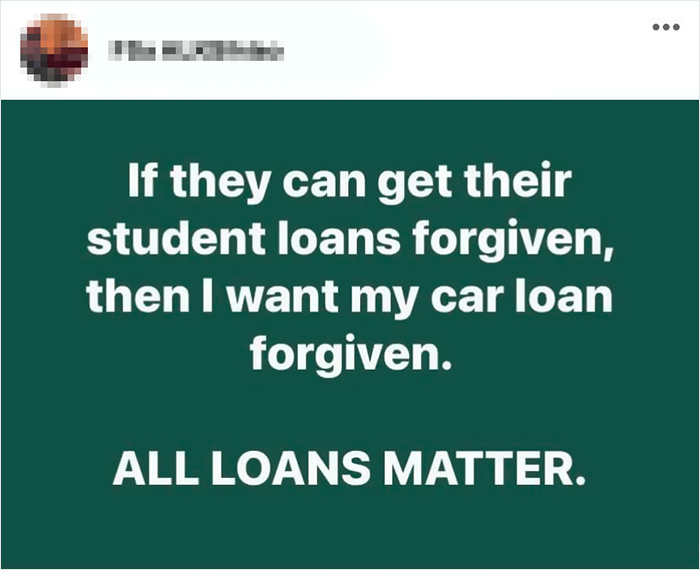

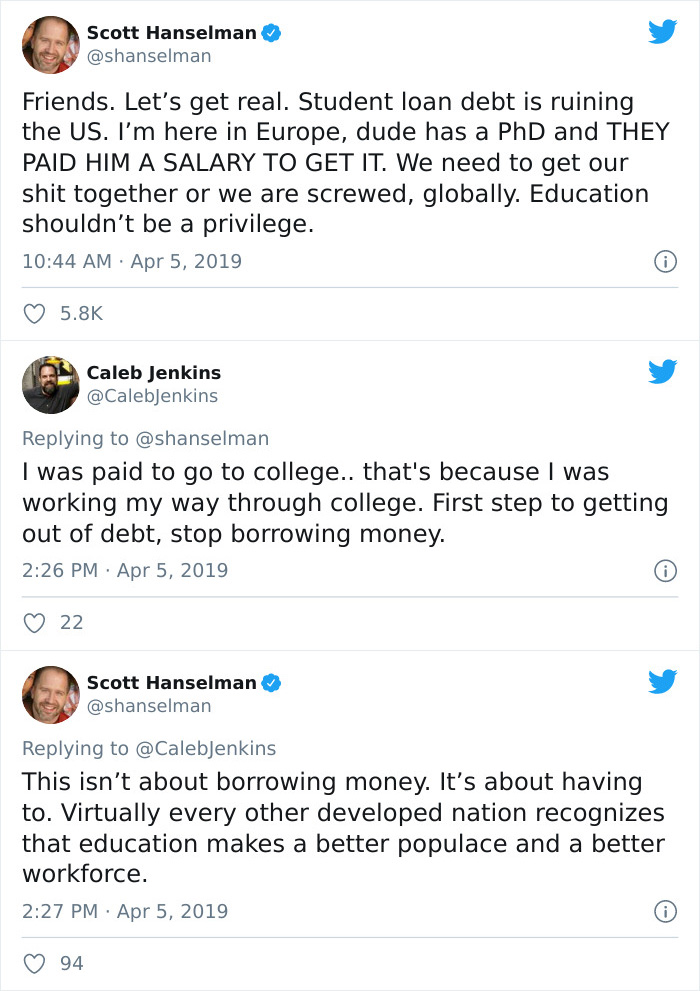

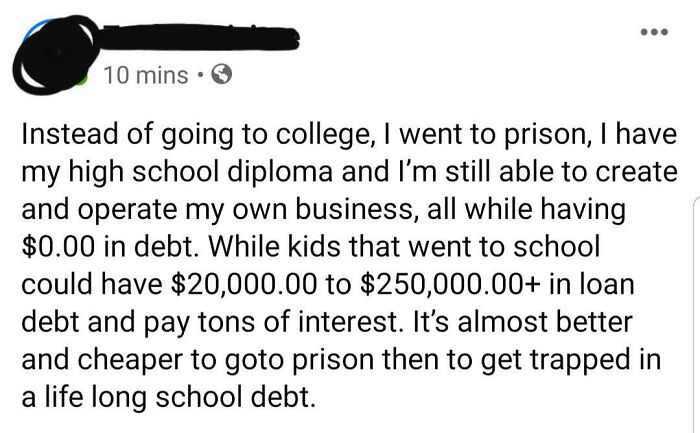

I could be wrong, but this really seems like some sardonic irony, and the poster clearly knows that's how any society is meant to function, but that of the U.S doesn't.

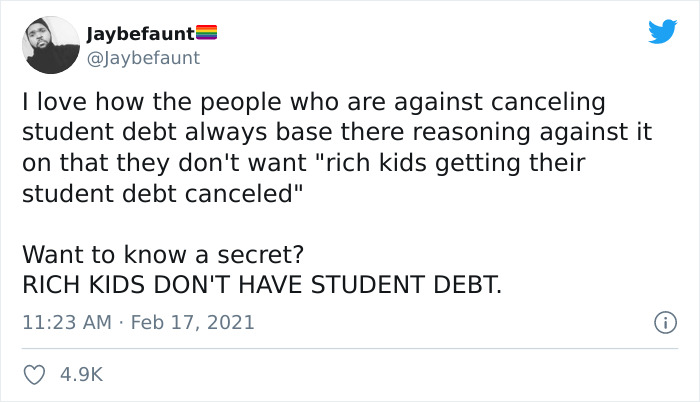

Rich kids also are never unemployed or flipping burgers with a degree in science.

Nearly 45 million Americans now owe a total of $1.7 trillion in federal and private student loans, for educations both finished and unfinished. The scale of the problem is undeniable in terms of the effects it takes on people's mental health, quality of life, and overall wellbeing.

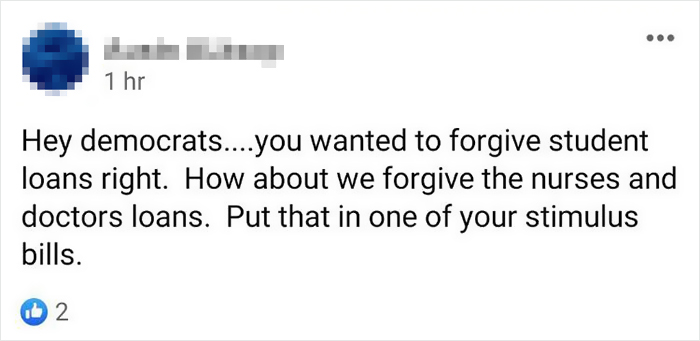

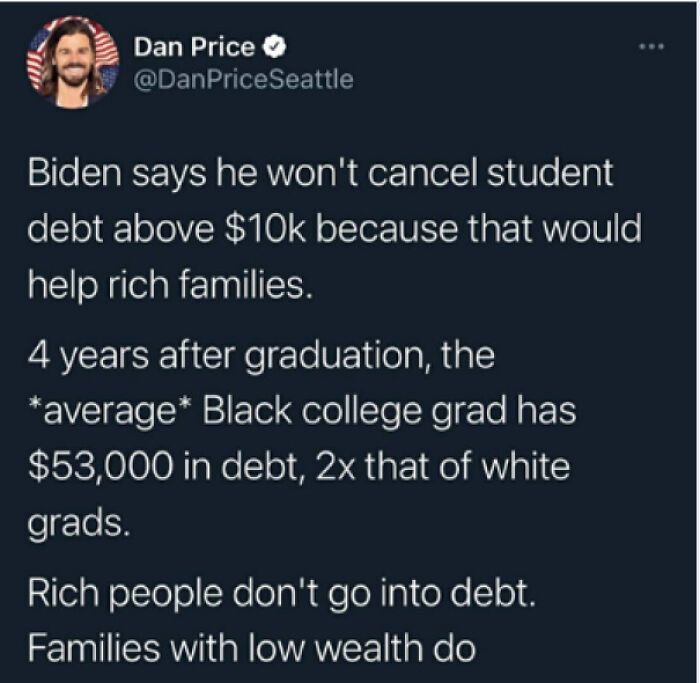

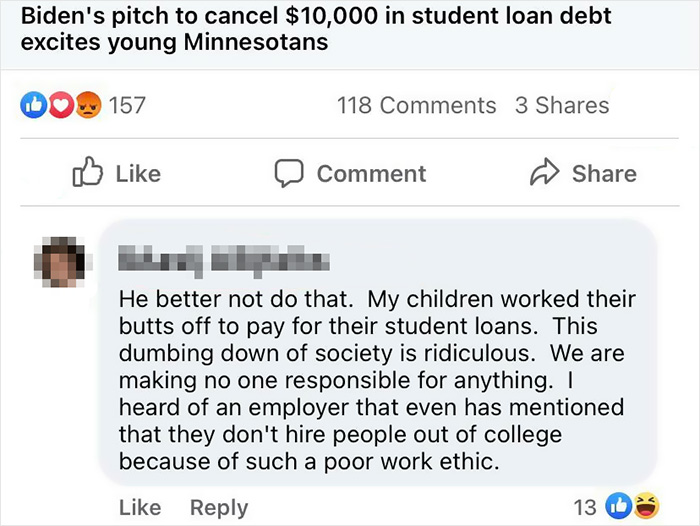

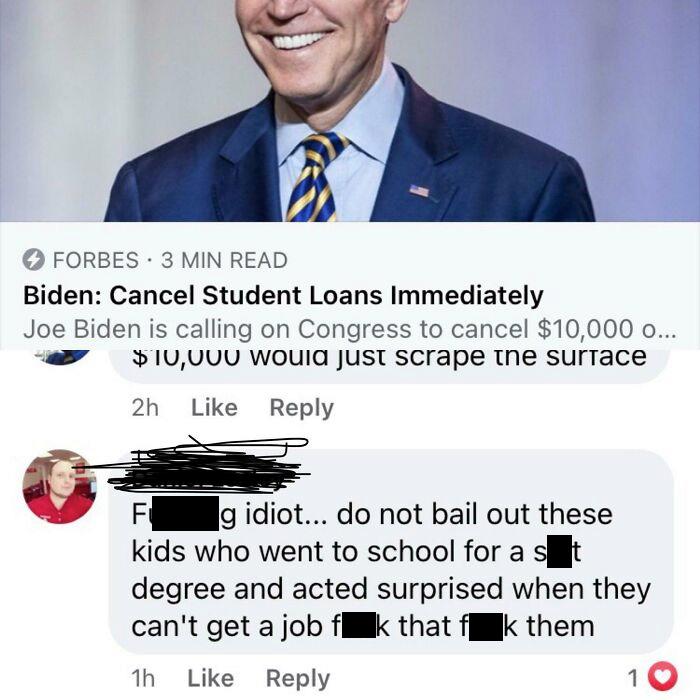

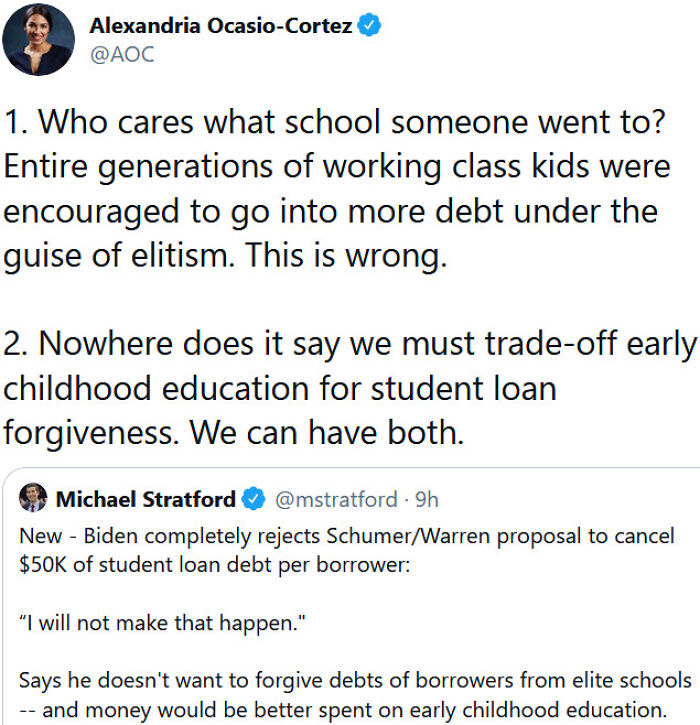

Now that President Biden has officially stated that he supports forgiving $10k of student loan through legislative action, many Democrats think it’s not nearly enough. Some claim the federal debt forgiveness could easily reach $50k per borrower, and some go as far as saying to erase all the amount altogether.

In an interview with Vox, Laura Beamer, lead researcher on higher education finance at the Jain Family Institute, said that it’s abundantly clear that “people with student debt are less likely to own a house, they’re less likely to start a business, they’re delaying normal financial life cycles than previous generations past.”

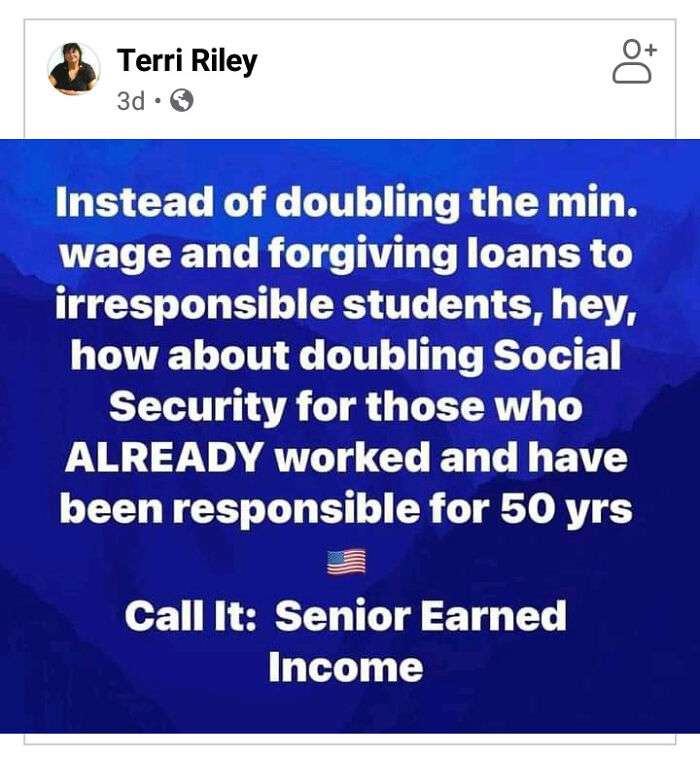

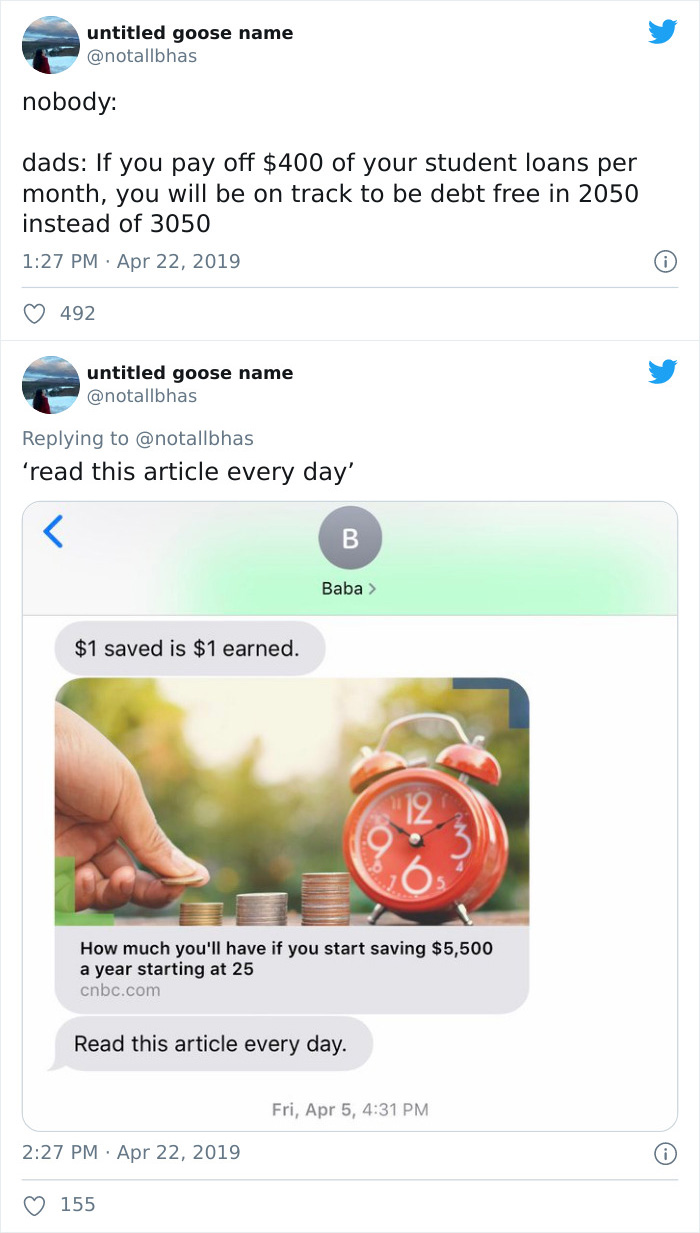

For many previous generations, starting a family and saving for retirement were natural life decisions, but student loan borrowers don’t feel like they have the luxury of doing so. “We also know that people 50 and above are the fastest-growth student debt loan-accruing debt group, because they’re taking loans out for their kids or their grandkids,” Laura Beamer added.

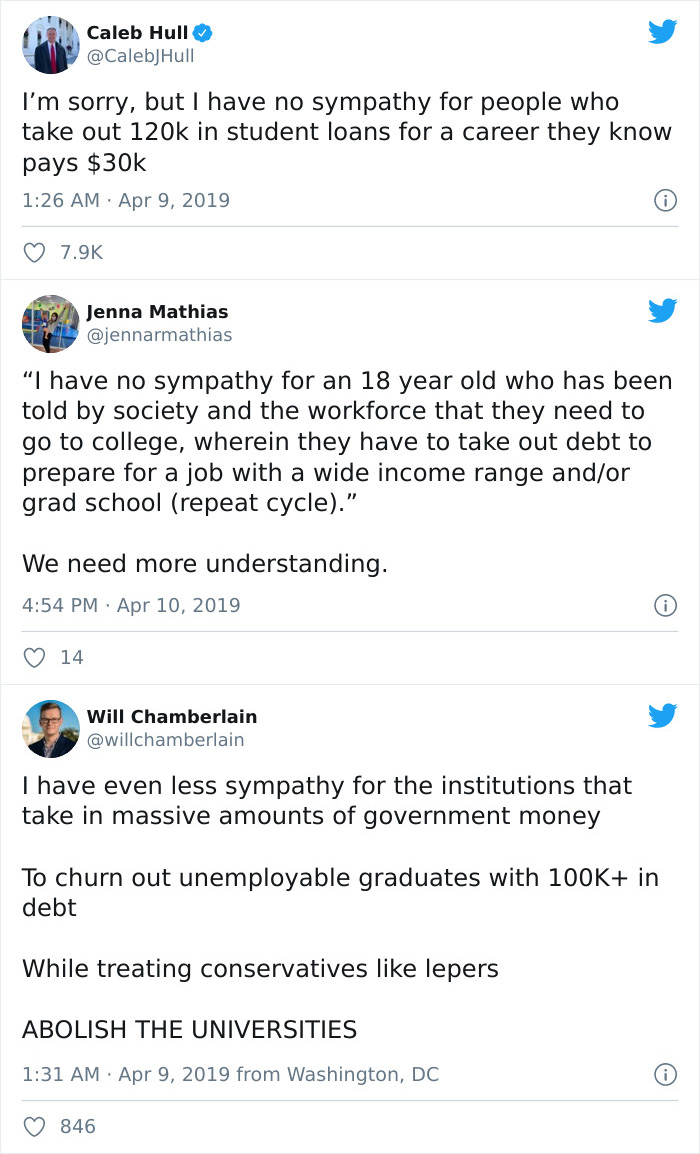

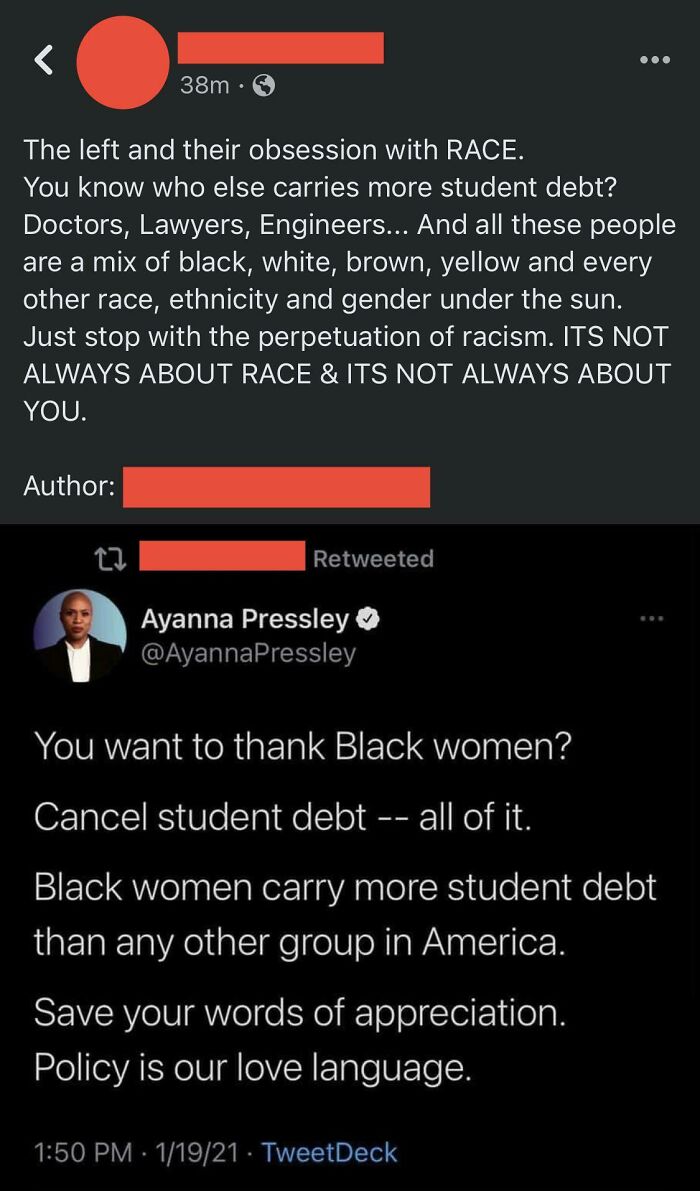

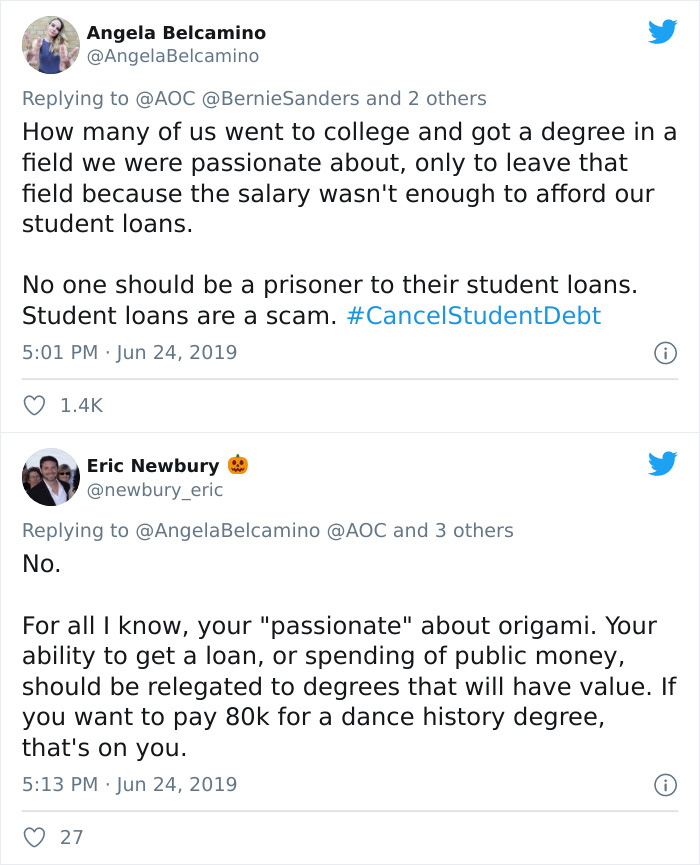

Another crucial point about student loan borrowers is that not all loans are equal. The economist Steven Deller from the University of Wisconsin Madison argues that “There is a huge difference between someone who assumes a lot of debt and gets an MBA from Harvard or a medical degree from Columbia University, and ... a first-generation student who’s coming from a poor family background and goes into debt and doesn’t complete their degree.”

These two individuals are words apart, and while for one, the student debt doesn’t feel like a big deal with a successful career prospect and stable financial background which comes from the family, the other is likely to carry the same burden throughout life, hoping for a cash windfall one day.

Or drastically raising the price of something while the quality and quantity diminish.

Please stop censoring words like "crappy". It's not a curse word in any language.

The geniuses who went to college figured it out: cancel student loan debt.

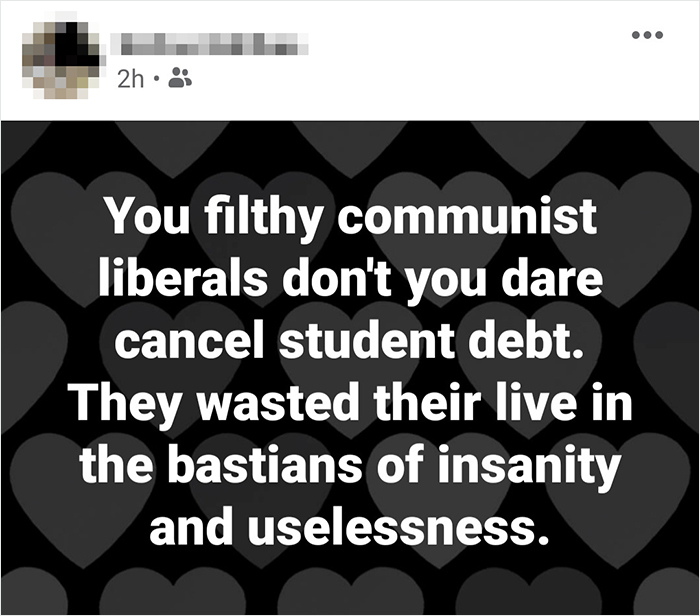

How has political strife gotten to the point where we feel it's ok to refer to people as less than human just because they believe in different things than is? Lefties, liberals it just makes no sense how humans have lost all compassion for others.

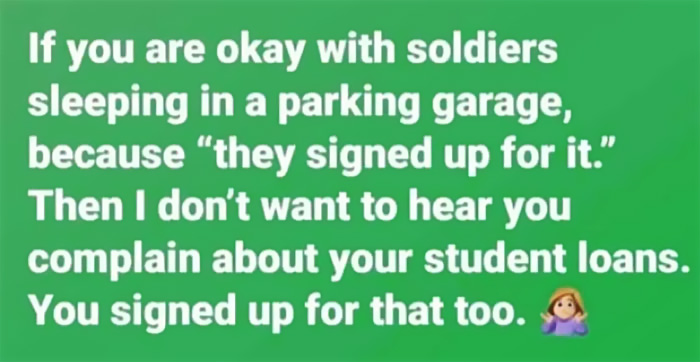

We spend untold money on the military. If there are soldiers sleeping in parking lots it is because their superiors want it that way.

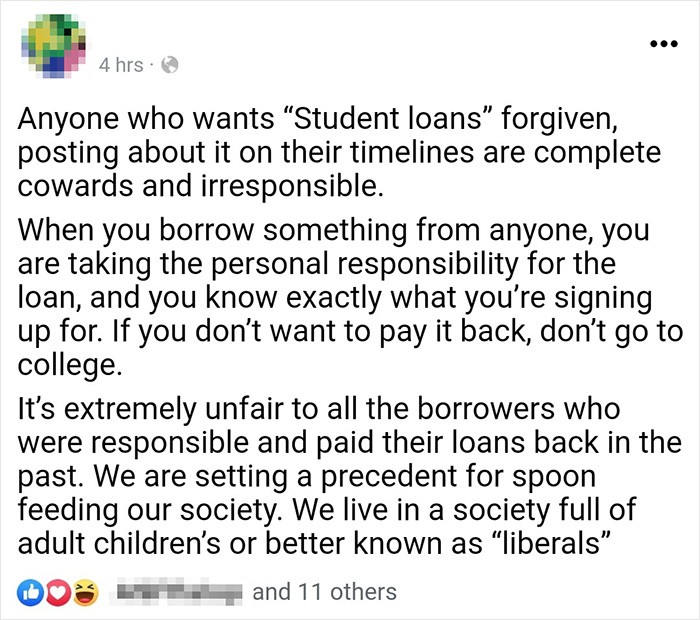

"adult children's". I'd bet that person didn't go to a private school, so maybe he should reimburse the taxpayers.

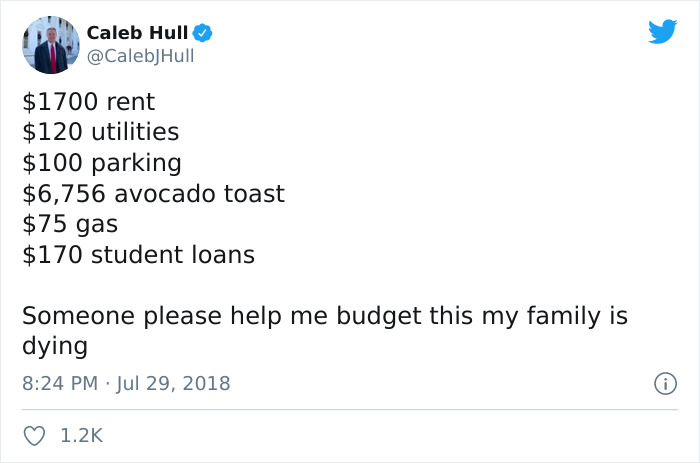

That’s about 666 avocado toasts a month if you make them at home, or 9 pieces every hour. Seems a tad exaggerated....

I'd be willing to bet Blake has an MBA. The majority of those people are pricks.

Every dollar spent on education generates at least 15 dollars. Free education is the best investment to the future of a nation.

*You're This person needed to go to college if they didn't. Then maybe they would be on the sensible side too.

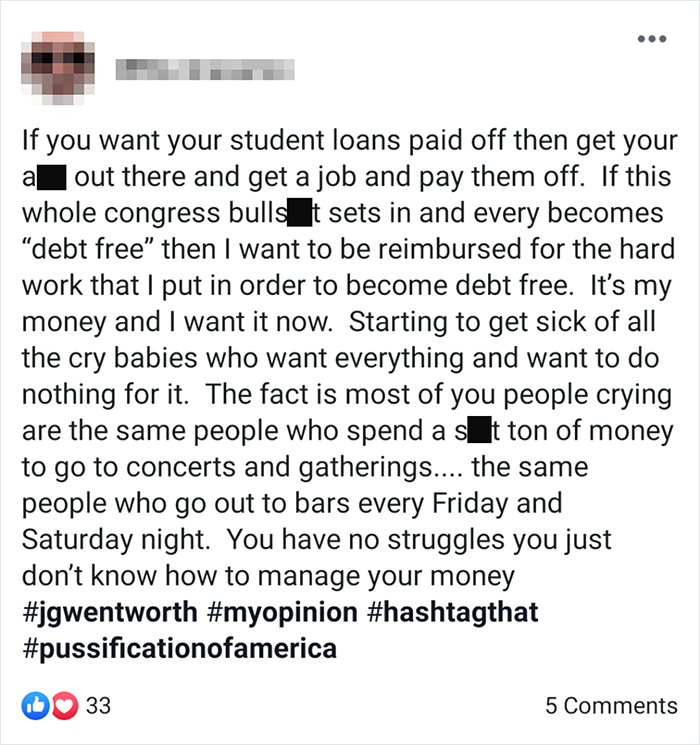

I'm 33. I've been to a grand total of 4 concerts in my life. I've visited a bar less than 5 times ever. I haven't watched a movie in a theater in the last 3 years. My primary car is 19 years old. I spent $0 on clothing last year. I manage my money very carefully, and so do many other people my age. I think it's ironic that you tagged a structured settlement law firm. Those firms exist to bilk desperate people. They're part of the problem.

He signed his name at the beginning of his message rather than at the end...

Yes, keep the poor uneducated, so the circle of the rich gets richer.

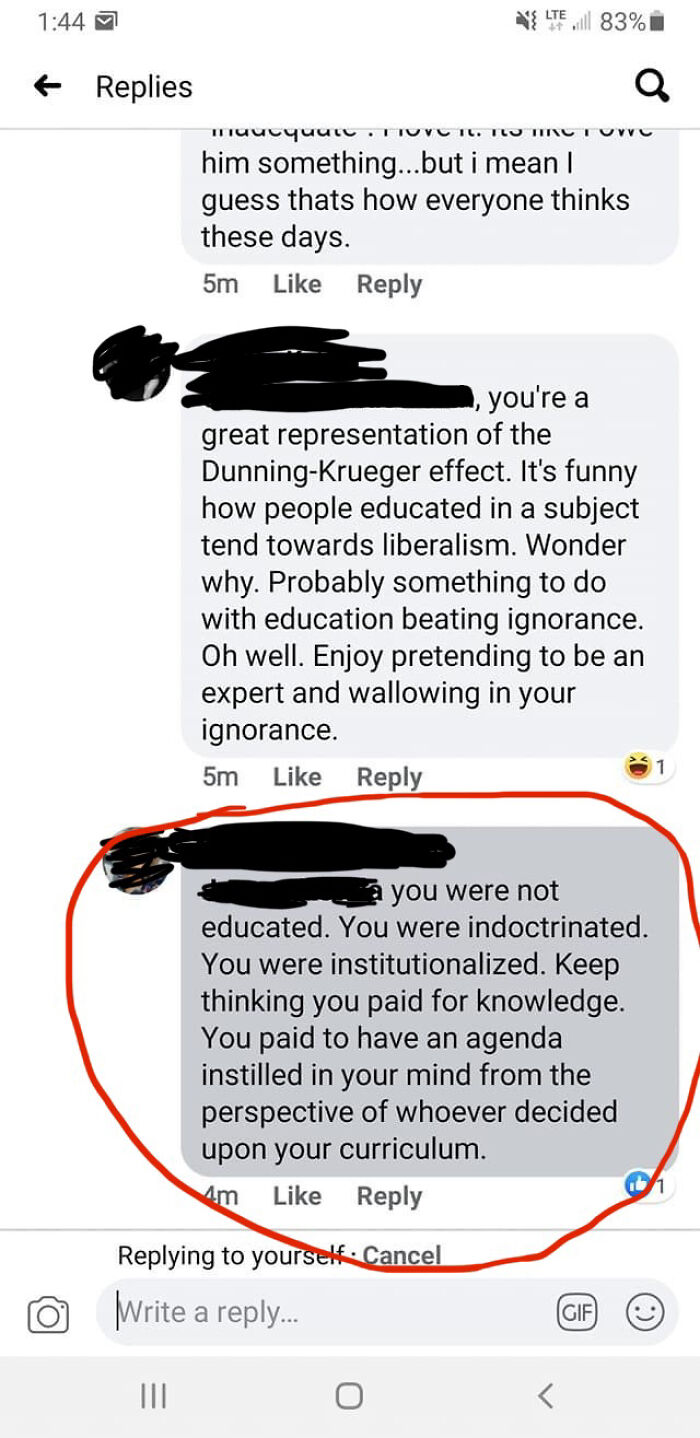

I've always wanted to ask someone like this what they believe the "endgame" of that agenda is.

The education of the people in this country benefits the whole country. My skills from my education and my taxes benefit everyone.

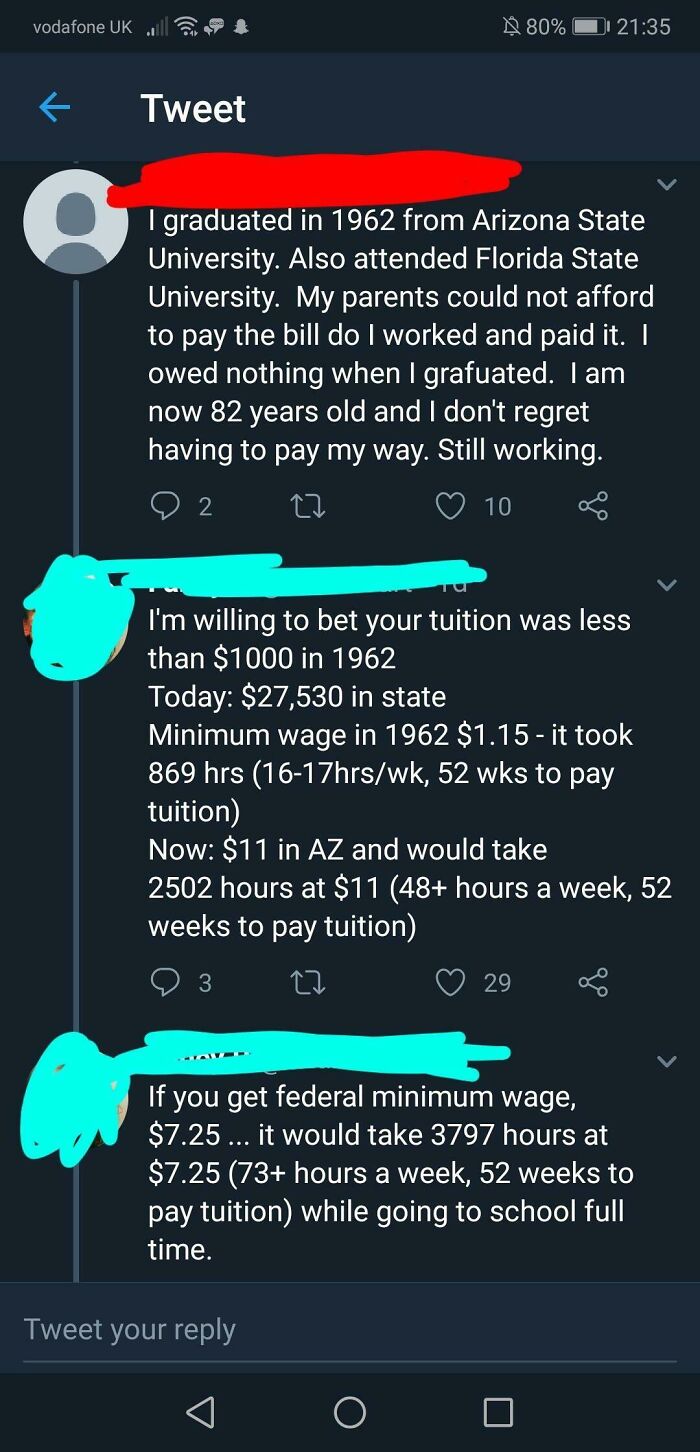

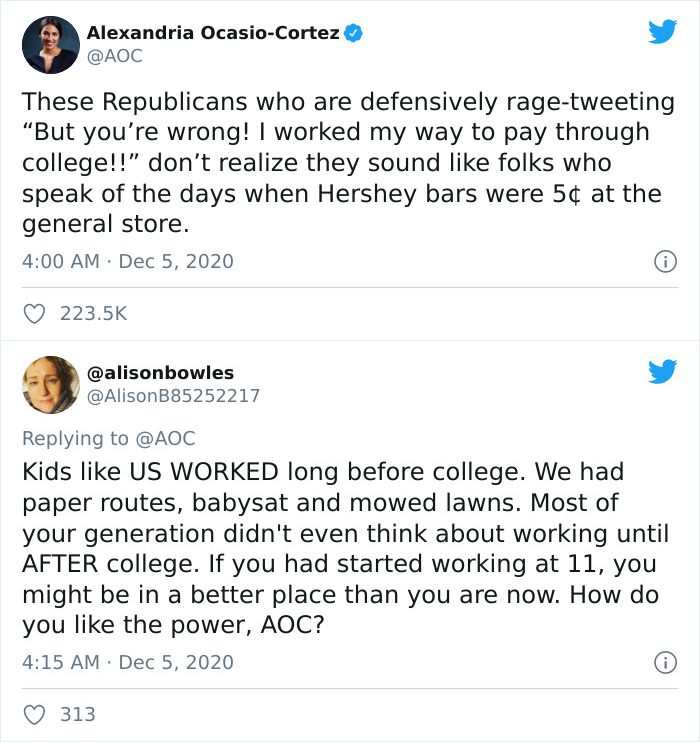

I assume it was when everything was cheap, when anyone could buy a house which is now worth four time more. Millenials are not poor because they are lazy, they are poor because everything is frigging expensive and they are not payed enough.

Maybe instead of cancelling the debt, they should cancel the interests and offer loans with 0% interest. Apparently, the rate of the interests is a bigger problem than the loan itself.

This. We don't mind paying back my loans, but the interest is high and compounds daily, so our principal now is greater than our originating principal. When we first graduated, we had to use income based repayment to afford the bill, but that just meant that it grew and grew and then when we did have the income to be capable of paying the originating principal, it had ballooned beyond our means. This is a vicious, predatory cycle keeping honest, hard working people who want to do the right thing paying until they die.

Load More Replies...Student debt doesn't necessarily need to be cancelled. Instead it should be made more affordable. I like our system. You don't start paying your debt until you get employment and earn over a certain threshold. Once you reach that limit the tax department takes a small percentage of your earnings to pay back your education cost. If you never earn over the threshold then you never have to pay. Also there is no interest added.

Loans related to education should be exceptionally low-interest. You shouldn't be able to get a car loan for 2.5% when the very best you can do on a student loan is 3%. If banks and auto manufacturers can get by on a 2.5% interest rate, then so can student lenders.

Load More Replies...Dear US, maybe... look at the EU and adopt that system for a couple things? Like healthcare, education?

Nooooooooo, never, never ever neveeeeeer. Because, this is communism!!! Whole western Europe, with functioning school systems, universal healtcare, minimum wages, maternity leaves, insurances, free schools...ale this is just a bad bad communism :D :D

Load More Replies...Maybe instead of cancelling the debt, they should cancel the interests and offer loans with 0% interest. Apparently, the rate of the interests is a bigger problem than the loan itself.

This. We don't mind paying back my loans, but the interest is high and compounds daily, so our principal now is greater than our originating principal. When we first graduated, we had to use income based repayment to afford the bill, but that just meant that it grew and grew and then when we did have the income to be capable of paying the originating principal, it had ballooned beyond our means. This is a vicious, predatory cycle keeping honest, hard working people who want to do the right thing paying until they die.

Load More Replies...Student debt doesn't necessarily need to be cancelled. Instead it should be made more affordable. I like our system. You don't start paying your debt until you get employment and earn over a certain threshold. Once you reach that limit the tax department takes a small percentage of your earnings to pay back your education cost. If you never earn over the threshold then you never have to pay. Also there is no interest added.

Loans related to education should be exceptionally low-interest. You shouldn't be able to get a car loan for 2.5% when the very best you can do on a student loan is 3%. If banks and auto manufacturers can get by on a 2.5% interest rate, then so can student lenders.

Load More Replies...Dear US, maybe... look at the EU and adopt that system for a couple things? Like healthcare, education?

Nooooooooo, never, never ever neveeeeeer. Because, this is communism!!! Whole western Europe, with functioning school systems, universal healtcare, minimum wages, maternity leaves, insurances, free schools...ale this is just a bad bad communism :D :D

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime