17-Year-Old Thinks She Is Entitled To Spend College Fund Money The Way She Wants, Gets Turned Down

It is normal to learn by doing; however, in some areas, the cost of mistakes might be too high and they tend to be protected by limiting access to them. One such area is funds for long-term financial goals, as it often takes many years to save it, while it can be spent in no time.

No wonder this Redditor wasn’t going to let her daughter use the college money saved by her parents on various small purchases, just because she decided to take a gap year, and was considering not attending college.

More info: Reddit

Parents have been saving for their daughter’s college, yet were recently informed she had other plans for using the money

Image credits: Nicole Michalou (not the actual photo)

The daughter is unsure whether she will attend college and plans to take some time off after graduating high school

Image credit: u/Immediate-Sector-114

Image credits: javier trueba (not the actual photo)

Image credit: u/Immediate-Sector-114

The girl’s mother supports her daughter no matter what path she decides to take

Image credits: Tima Miroshnichenko (not the actual photo)

Yet the daughter asked for her college fund money so she can purchase a car, among other things, in the meantime

A woman turned to the Reddit AITAH community online asking if she was a jerk to turn down her 17-year-old daughter’s request when she asked for her college fund money so she could purchase a car, among other things.

The woman shared that she and her husband had been saving since their daughter was a baby, therefore they already have $200,000 in the account.

Their daughter, however, who is a senior in high school, has recently decided to take some time off of education after graduating high school, planning to get a job and figure out when, and if at all, she wants to continue her education.

The 17-year-old also wished to purchase a car, among other things, and asked to take her college fund money. The adolescent argued that she was entitled to the money because it was meant for her.

While the mother explained that she would support her daughter no matter what path she decided to take, the parents turned down their daughter’s request and kept the college fund money for now in case their daughter decided to attend college.

Despite the adolescent claiming the money is hers as it was meant for her, the parents refused to hand over the college fund money

Image credits: Pixabay (not the actual photo)

The mother explained that they will hold on to the fund for now in case their daughter decides to attend college

When it comes to financial behavior, financial goals and accordingly budgeting are often classified into long-term, middle-term, and short-term goals. While saving for a child’s education is often attributed to long-term financial goals, buying a car tends to be classified as middle-term financial goal.

A difference between long-term and short-term financial goals was discussed by J. Wagner and W. B Walstad, who compared long-term and short-term financial behaviors and observed the importance and effectiveness of financial education, rather than simply a learning-by-doing approach when it comes to long-term financial behavior.

The researchers explained that short-term financial behavior such as paying bills each month tends to be corrected quite easily due to receiving frequent and continual feedback and reminders to correct one’s actions. For this reason, learning by doing might be also effective.

However, when it comes to long-term financial behavior, financial education tends to be crucial for bringing positive results as first, the feedback is often irregular or infrequent when it comes to long-term financial behavior, and second, the mistakes of not saving enough for long-term financial goals might be irreversible or at least cannot be quickly and easily changed after a certain point.

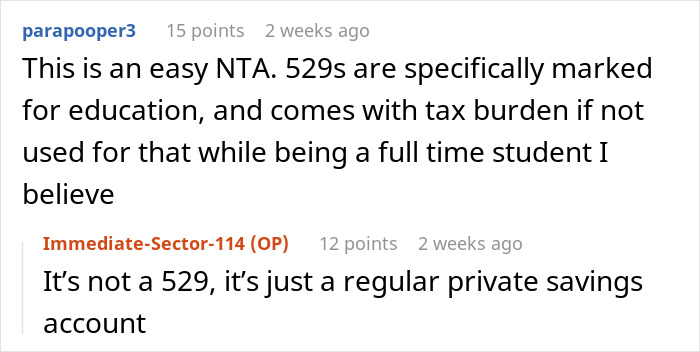

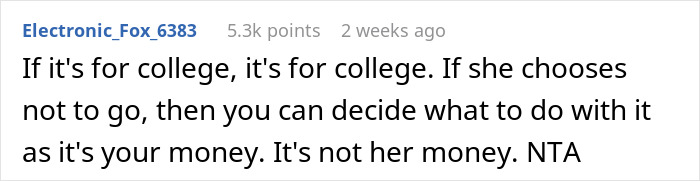

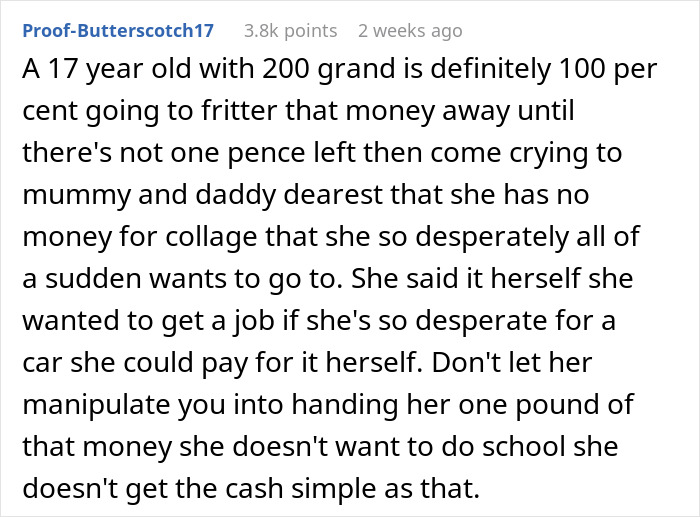

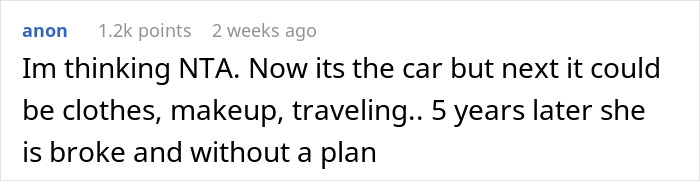

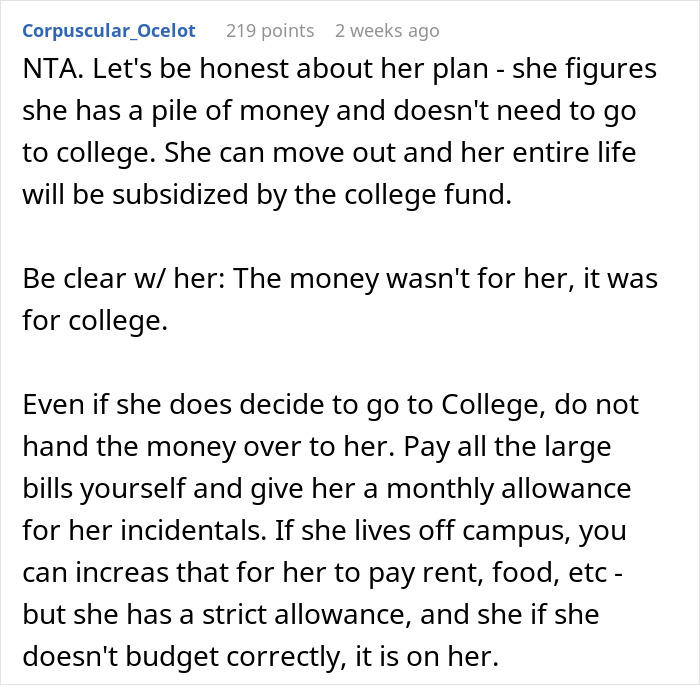

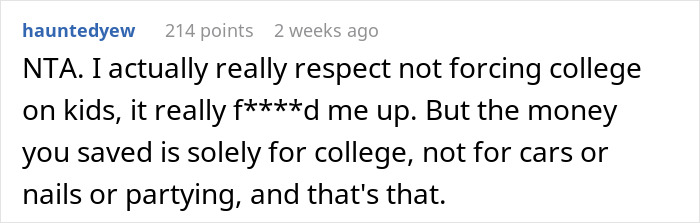

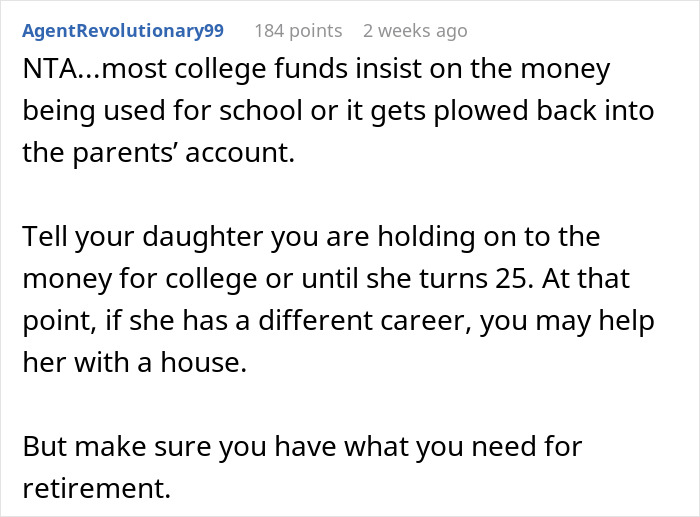

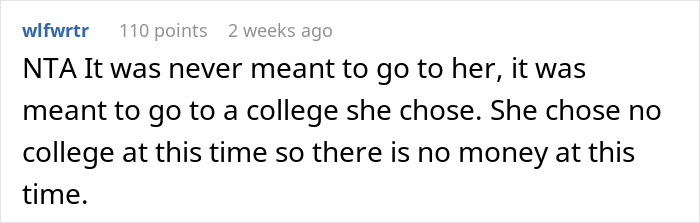

Coming back to the original story, the woman’s post gathered 12.5k upvotes on Reddit and people sided with the parents, as the fund was meant specifically for college in addition to it being the parents’ money and therefore it being their decision what to do with it.

What’s your take on the situation? Please share your thoughts in the comment section below!

Redditors shared their takes on the situation

Second mistake: Apparently, not learning how to tell her NO! Be the adult!

Load More Replies...No way should she get the money now for anything other than for school (and payments to the school should be made directly). On the other hand, if she does choose a different path, OP might be able to offer a fair alternative when she is 25/30, something like putting that money towards the down-payment of a house, or, if she has acquired the necessary skills, and has a sensible business plan, it could be used as startup money (and no, I wouldn't count a dream wedding as a legitimate alternative)

My thoughts exactly, although after this attempt I would buy a house in the name of a family trust and make her pay rent to pay it off, she has shown her colours. The trust can be disbanded after age 30 into her name if all goes well.

Load More Replies...A 17 year old should not have a new car. They're young and insurance will cost a fortune as well as the cost of new car. A secondhand car would be much better for younger, new drivers.

My thoughts exactly, a used car is more suitable for her.

Load More Replies...Second mistake: Apparently, not learning how to tell her NO! Be the adult!

Load More Replies...No way should she get the money now for anything other than for school (and payments to the school should be made directly). On the other hand, if she does choose a different path, OP might be able to offer a fair alternative when she is 25/30, something like putting that money towards the down-payment of a house, or, if she has acquired the necessary skills, and has a sensible business plan, it could be used as startup money (and no, I wouldn't count a dream wedding as a legitimate alternative)

My thoughts exactly, although after this attempt I would buy a house in the name of a family trust and make her pay rent to pay it off, she has shown her colours. The trust can be disbanded after age 30 into her name if all goes well.

Load More Replies...A 17 year old should not have a new car. They're young and insurance will cost a fortune as well as the cost of new car. A secondhand car would be much better for younger, new drivers.

My thoughts exactly, a used car is more suitable for her.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

62

55