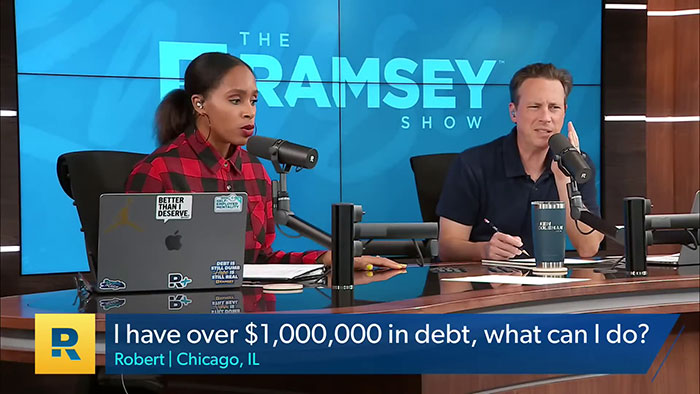

Couple Drowning in $1 Million Debt Seeks Financial Help From A TV Show, Leaves Viewers Shook

It’s dangerously easy to fall into financial troubles these days. Swiping your credit card left and right can quickly leave you in a pit of debt, and making a large purchase such as a home or a vehicle can saddle you with monthly payments for years. Don’t even get me started on student loans!

But what happens when our debt spirals completely out of control? Unfortunately, that’s the nightmare that one recent caller on The Ramsey Show is living. Below, you’ll find the full story of how this man and his wife found themselves over $1,000,000 in debt, as well as some of the replies viewers have shared.

A caller shocked the hosts and viewers of this financial show by revealing that he’s over $1,000,000 in debt

Image credits: The Ramsey Show

The caller: I’m in big financial trouble where we owe over a million dollars all in together, including mortgage.

Jade: Let’s break it down.

The caller: $462,000 mortgage, $96,000 student loan, $42,000 car.

Jade: Is that student loan federal?

The caller: No, it’s with Earnest. I’ve been paying it back for a couple of years at this point. The car is going, I already decided that. We’re going to get rid of it. Probably lose about $10,000 to $12,000 on it, but it is what it is.

Jade: Okay, good. That’s fine. Still going down.

The caller: The rest is installments and credit cards.

Jade: Wait, hold on a second. Run the rest because there’s still a good deal left. Is it all credit cards? What is it?

The caller: Installment loans and credit cards.

Image credits: The Ramsey Show

Jade: Like private loans? Give me the numbers.

The caller: Yes, I do have a $50,000 solar panel loan as well.

Jade: Solar panels? What else? What’s in the credit cards? What’s in the personal loans?

The caller: Personal loans, everything together is approximately $225,000.

Ken: Who do you owe that to? What persons?

The caller: SoFi, LightStream, and Upstart, and a couple of others.

Jade: And then there’s some credit cards in there too?

The caller: So here’s the thing. I’ve been trying to be smart and it didn’t quite work out. I was in a position where I could lend money to guys who need it and, you know, make a profit on it. So I would throw money on a card or get the installment loan and they pay me back. And I’ve been making some profit on it.

Jade: You’re taking out debt for other folks?

Image credits: The Ramsey Show

The caller: Right now, one guy stopped paying and it’s really been… it’s so much stress. I’m done with it.

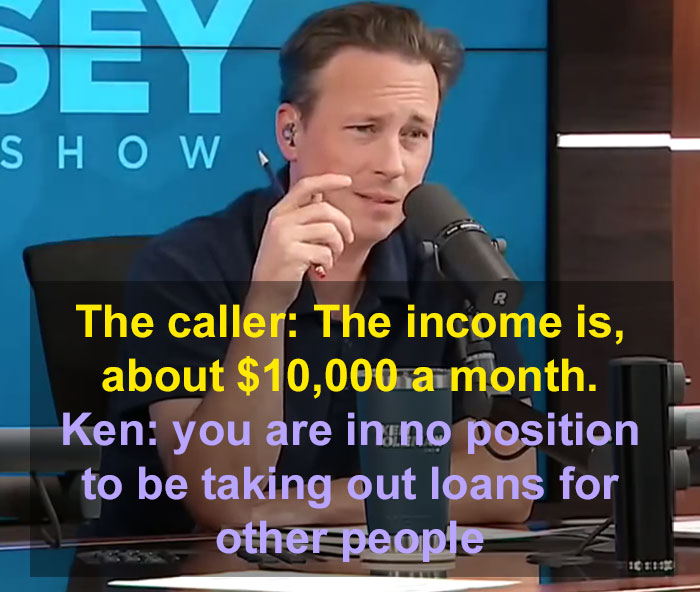

Ken: How much money do you make?

The caller: I only make $20,000 to $30,000 a year, net, after all the costs from the loaning money thing.

Jade: No, no, no. I wanna know your job income.

The caller: The income is about $10,000 a month.

Ken: Oh my gosh, you are in no position to be taking out loans for other people.

Jade: Yeah, I could spend a lot of time telling you the ridiculousness of all… I mean, it’s one thing to take out debt for yourself. It’s another thing to take out debt like some kind of a loan shark and loan it to other people. You know that, I think that you feel the weight of that. I think you know, I hope that you know.

The caller: I do.

Image credits: The Ramsey Show

Jade: Is it just you? Do you have a family? Tell me more.

The caller: No, it’s a full family. It’s my wife. She’s sitting right next to me here. We have three kids. We have a full house.

Jade: Are you both working?

The caller: Yes, she’s working. Her hours are a little bit irregular.

Jade: And does that $10k involve what she’s bringing in?

The caller: Yes.

Jade: Okay. I need her to work 40 hours a week. Not irregular. I need her to pick up something that is just as solid as what you’re doing. And then after she does that, and this applies to you too, you’re both getting side jobs. You guys are about to work your booty’s off. You have to. There’s no other way, okay. So you already said that you’re getting rid of the car. You’re gonna take a $10k loss. That’s fine. You’re still getting out of $32,000 of debt. That’s great. Solar panels. How is this… Is there any way to get out of it? Are you able to sell them? Have you looked into anything?

The caller: They essentially replace my utility bill. That’s what it is.

Jade: Right, but can you get out of them? Can you sell them?

The caller: Probably at a loss. I’m sure it would be $10,000 to $15,000 loss, if not more.

Image credits: The Ramsey Show

Jade: Yeah. But you’re also… you’re not thinking about the debt that’s gone. So getting that down to $15,000 that you owe is better than $50,000, right?

Ken: Just getting rid of the car and the solar panels, if you can do it, is going to give you some more room to be able to start really going after these other big debts.

The caller: So here is really the question I’m calling with. Honestly, we would need to increase our income by about $5,000 a month just to be able to afford these payments after getting rid of the car and everything. Credit cards will soon start charging because the balances are like on zero balance promotion and so on. Yeah, so I’m expecting to get a bigger payout next year in August, September.

Jade: No, we’re not waiting till August. It’s great that you have money coming, but we can’t wait or depend on that as the solution because as you’ve seen before, sometimes folks don’t pay. So we’ve got to start today. What are you paying every month for your home?

The caller: It’s about $3,200. That includes mortgage, taxes, insurance.

Jade: Are you guys on a budget? I need to know how far… how deeply you’ve gotten into this.

The caller: We started a budget where we’ve really cut our spending significantly, and we have a budget ready for September.

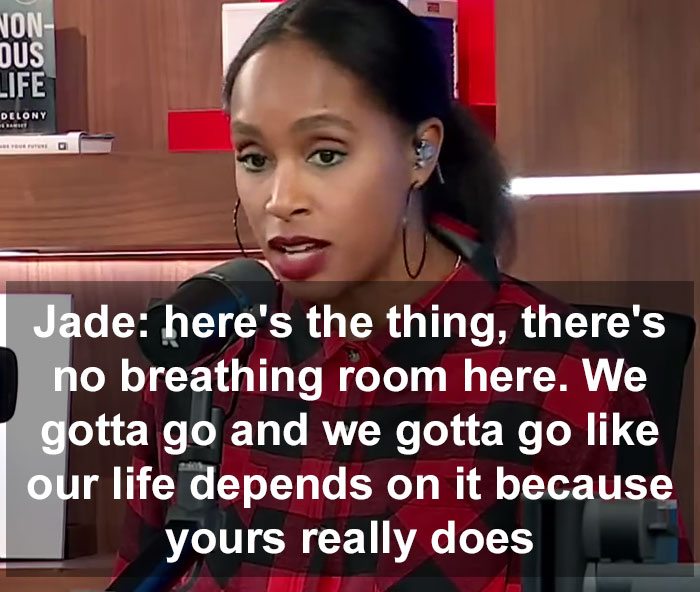

Jade: Here’s the thing, there’s no breathing room here. We gotta go and we gotta go like our life depends on it because yours really does. Wife is working, we’re starting that process to get her full time tomorrow, okay? You guys, pick up side hustles, I don’t care what it is, any money right now is gonna be so helpful for you. I’m looking at ways to get rid of the car instantly. Sell off these solar panels if you can. Instantly. I’m looking for ways to do anything I can. I’m looking at your mortgage, to be honest with you, and I want to know, when did you get this house? Did you get it recently? Or have you had it for a while?

The caller: Two years ago.

Image credits: The Ramsey Show

Jade: What’s it worth? And what’s the interest on it?

The caller: Probably under 3%. 600k, we could probably walk away with, you know, 650k and get.. We have $120,000, $130,000 equity in it. We put 20 percent down.

Ken: I would be scorched earth now. If it were me, I’d be selling the house and we would be getting a place that is… the kids are kids. They’ll be fine. I’d put them all in one room. I would be going bananas on this to take that $130k and put it towards this debt. Get you some breathing room. Your life is going to be so much better, so much faster. This house is just as big a problem in my mind as everything else. It’s too much of their income. I’d get out of it now. That’s what I would do. I’d rent.

Jade: Yeah. You need every dime that you can get. I’m not gonna make any bones about it. All of it’s gonna suck. It’s not gonna be fun.

Ken: Well, his life sucks already.

Jade: I’m just saying, you know, this is gonna be the one of those seasons where it’s like, wow, you’re gonna feel the gravity of the decisions that you made, but the good news is you can course correct, and you can right this ship, and you can make it happen, and you’re going to make it happen. But it’s not going to happen if you don’t do the things that Ken and I told you today. Starting today, don’t leave anything out. Don’t try to skirt the process. Do it!

You can watch the entire episode of The Ramsey Show featuring this conversation right here

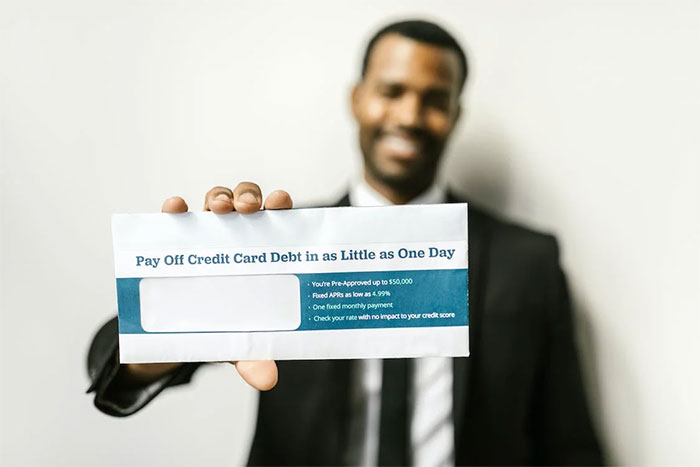

The average American has over $6,000 in credit card debt

We all know that debt is something that we’d like to avoid or keep as minimal as possible, but unfortunately, especially in the United States, that’s a lot easier said than done. According to Debt.org, Americans owe $986 billion on credit cards, $11.92 trillion on mortgages, $1.55 trillion on vehicle loans and $1.6 trillion on student loans.

The average American has over $6,000 in credit card debt and over $241k in mortgage debt, Fool reports. Meanwhile, they’re spending nearly 10% of their monthly income on paying off debts. Medical debt is also a prevalent issue in the US, as in some states, over 15% of the population has medical debt in collections. In Texas, 19% of people have medical debt, and in South Carolina, 22% of people do.

Unsurprisingly, the issue of personal debt in the US is only continuing to get worse. Money.com reports that in 2023, 35% of Americans were in the most debt they’ve ever been in their lives, and 39% don’t expect to pay off their debts within the next five years. Some admitted that it might even take them a lifetime to pay off.

It’s extremely easy to fall into debt in the US

Image credits: RDNE Stock project / Pexels (not the actual photo)

So why is it so easy for Americans to go into debt? According to Debt Hunch, getting a higher education is a huge factor, as the average student who takes on loans ends up owing approximately $35k (although many end up owing much more). Many residents also go into debt by trying to keep up appearances.

With the pressure from society and social media to have the newest, nicest phone, gaming console, car and more, some people believe that it’s worth it to take on debt to keep up with the Joneses. Budgeting isn’t a priority for everyone, and credit card debt has become so normalized that we’re not all afraid of it.

But of course, debts are often taken on out of necessity as well. While many lost their jobs during the pandemic or have found themselves with excessive medical bills due to not having insurance or needing emergency treatment, not everyone has the savings to pay for a rainy day. The average American under the age of 35 has only $20,540 in savings, but that can quickly be depleted with one surgery or devastating car accident.

But it is possible to pay off debts with some sacrifices and careful planning

Image credits: Mikhail Nilov / Pexels (not the actual photo)

We all need better education on staying out of debt, as well as getting out of debt. As the hosts in this video noted, getting out of $1 million dollars in debt will not be easy, but even a few thousand dollars can take Americans years if they don’t plan properly. Steve Azoury, ChFC® and owner of Azoury Financial, told CBS News that those on a low income should sign up for some sort of debt relief program.

Debt consolidation loans and programs offer lower interest rates and are designed to help residents get out of debt as fast as possible. Do not be afraid to seek help if you’re struggling with debt. Those in debt also need to get creative and find any way they can to cut costs. Stop eating out and grabbing coffee on the way to work, carpool with friends or colleagues to save money on gas, cancel subscription services you don’t need and shop for groceries based on the coupons you have.

Falling into debt is a dangerous game that can feel impossible to get out of. But with help from financial experts and commitment to making some sacrifices, it is possible to free yourself from the burden of debt. Let us know your thoughts on this couple’s situation down below, and then if you’re interested in checking out another Bored Panda article discussing massive debts, we recommend reading this one next.

Shocked viewers shared their thoughts on the caller’s situation and the advice he received from the hosts

Poll Question

Thanks! Check out the results:

This is all horrible advice: throw away equity to lower debt? That's insane! Lose money on the car, but have no transportation. Lose money on the solar panels, but have utility bills... sounds like cutting off your nose to spite your face.

Perhaps turning to a TV/radio program to solve their problems was not wise.

Load More Replies...Bad advice selling the solar panels. They are left with $15000 still owing plus now have utility bills they did not have before. Also, if they are selling the house they will get much better market value with panels. No talk about the dissembling and return to mains power costs either, I'm betting that's thousands. You wanna go scorched earth? File for bankruptcy or just sell everything, sell the house with panels. If these are financial advisers, they are panic inducing idiots with the advice they are offering. Can debts be frozen due to financial hardship? Can repayment plans be negotiated to a lower level per month? Can rooms be rented in the home? Would renting out the whole house and cramming into a cheap 2 bedroom or one bedroom trailer cover the house mortgage and then some? Where are the good options? They are making the caller feel desperate and helpless, they might even have family they can live with fgs.

I agree the panels and debt should be part of the house sale.

Load More Replies...The correct path is: 1) File Chapter 7 bankruptcy. They can keep the house, cars, etc but discharge the unsecured debt. Once that’s discharged, you move to step 2… 2) File Chapter 13 reprginization of debts. Every dollar of debt remaining after the chapter 7 is reworked as dictated by the courts. The courts will tell the mortgage company, the car loan company, etc., “this is what you’re getting and that’s it” When done with chapter 7, they’ll probably be left with about $300,000-$325,000 in debt that gets reorganized in the chapter 13 at roughly a $3000 per month payment - and forfeiting all tax refunds - for 5 years and at the end of that 5 years they are DEBT FREE and didn’t loose the home, cars, etc. PLUS, the laws of chapter 13 reorganization in the USA dictate that once a debtor begins the chapter 13 plan, they are NOT allowed to obtain ANY new debt of any kind without approval from the trustee and judge

Why don't you have more upvotes, as a non American, I can't say how your bankruptcy and debt laws work but it sounds like you have at least the best bones of a plan here.

Load More Replies...This is all horrible advice: throw away equity to lower debt? That's insane! Lose money on the car, but have no transportation. Lose money on the solar panels, but have utility bills... sounds like cutting off your nose to spite your face.

Perhaps turning to a TV/radio program to solve their problems was not wise.

Load More Replies...Bad advice selling the solar panels. They are left with $15000 still owing plus now have utility bills they did not have before. Also, if they are selling the house they will get much better market value with panels. No talk about the dissembling and return to mains power costs either, I'm betting that's thousands. You wanna go scorched earth? File for bankruptcy or just sell everything, sell the house with panels. If these are financial advisers, they are panic inducing idiots with the advice they are offering. Can debts be frozen due to financial hardship? Can repayment plans be negotiated to a lower level per month? Can rooms be rented in the home? Would renting out the whole house and cramming into a cheap 2 bedroom or one bedroom trailer cover the house mortgage and then some? Where are the good options? They are making the caller feel desperate and helpless, they might even have family they can live with fgs.

I agree the panels and debt should be part of the house sale.

Load More Replies...The correct path is: 1) File Chapter 7 bankruptcy. They can keep the house, cars, etc but discharge the unsecured debt. Once that’s discharged, you move to step 2… 2) File Chapter 13 reprginization of debts. Every dollar of debt remaining after the chapter 7 is reworked as dictated by the courts. The courts will tell the mortgage company, the car loan company, etc., “this is what you’re getting and that’s it” When done with chapter 7, they’ll probably be left with about $300,000-$325,000 in debt that gets reorganized in the chapter 13 at roughly a $3000 per month payment - and forfeiting all tax refunds - for 5 years and at the end of that 5 years they are DEBT FREE and didn’t loose the home, cars, etc. PLUS, the laws of chapter 13 reorganization in the USA dictate that once a debtor begins the chapter 13 plan, they are NOT allowed to obtain ANY new debt of any kind without approval from the trustee and judge

Why don't you have more upvotes, as a non American, I can't say how your bankruptcy and debt laws work but it sounds like you have at least the best bones of a plan here.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

14

58