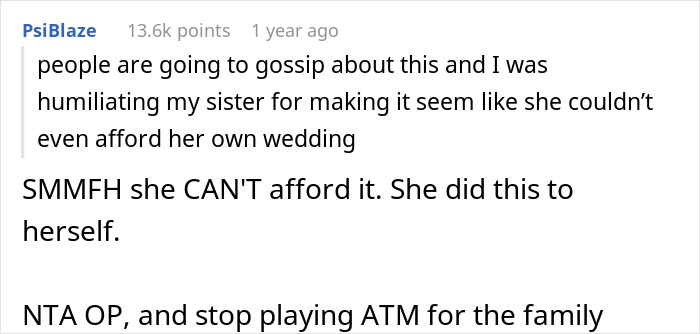

Woman Escapes Poverty Unlike Her Family, They’re Upset She Won’t Share Money With Them

Interview With ExpertWith the average American wedding costing around $35,000, it’s not too surprising that many couples go into debt to fund the big day. A survey conducted earlier this year found that 56% of newlyweds had tapped credit cards, accessed bank loans, or reached out to family to borrow money. Some had done all three…

One woman shared how her sister contributed to those stats by nearly maxing out all of her credit cards days before her wedding. Oblivious to her debt, the bride-to-be went shopping for groceries so she could cook for her guests. She filled her cart with almost $2,000 worth of goods, only to have all her credit cards declined at the cash register. The bride’s sister refused to help her out because she’s tired of her family asking her for money. And all hell broke loose. The sister’s now wondering if she was in the wrong. Bored Panda reached out to WalletHub‘s financial writer and analyst Chip Lupo, for his take on the matter.

The bride’s sister is the first college graduate in her family, and she’s managed to get a good job

Image credits: Juan Pablo Serrano/Pexels (not the actual photo)

But her family is forever asking her for money, and her sister’s wedding was no different

Image credits: AS Photography/Pexels (not the actual photo)

Image credits: anon

“Weddings should not jeopardize your financial stability”: an expert weighs in

Image credits: Leonel Caicedo/Pexels (not the actual photo)

According to WalletHub’s recent data, American households carry an average of $149,358 in debt overall, including $9,706 in credit card debt. The personal finance company also revealed that credit card debt in the U.S. totals a whopping $1.17 trillion. More than half the couples that took part in this survey said they’d gone into debt to fund their wedding. Many regretted it.

Bored Panda reached out to WalletHub’s finance writer and analyst Chip Lupo, to see what he had to say about using credit cards to cover wedding expenses. The expert believes it can be a helpful strategy if done responsibly. “The key is to avoid long-term debt and utilize credit card benefits effectively,” revealed Lupo.

“For example, a rewards credit card or one with a 0% introductory annual percentage rate (APR) can reduce costs or provide valuable perks such as travel points you can use toward the honeymoon.” However, he adds that you should only charge what you can afford to repay during the interest-free period.

There are other options, says Lupo. These include scaling back on wedding plans, hosting a simpler ceremony, or saving in advance. “Crowdfunding, family assistance, or DIY decorations can help reduce costs without incurring debt,” he added. “Weddings are memorable but should not jeopardize your financial stability. Prioritize your budget and focus on what matters most to create a joyful celebration within your means.”

We asked him what advice he had for the sisters. “The bride should reassess her budget and avoid maxing out credit cards, or relying on others to resolve financial mistakes,” replied Lupo. “Building an emergency fund and setting up a realistic spending plan can help prevent similar issues in the future.”

The expert added that he’d advise the bride’s sister to establish clear financial boundaries with her family. “It’s important to prioritize paying off student loans and other personal expenses before taking on additional financial responsibility,” Lupo told Bored Panda. “She should also avoid co-signing loans, or covering debts for others, unless she is fully prepared to handle the risk.”

If you’ve maxed out your credit cards, here’s what to do

Image credits: Anete Lusina/Pexels (not the actual photo)

Lupo says it’s important to take immediate action to regain control of your finances if you find yourself deep in debt and all your credit cards are maxed out. “Start by assessing your situation: calculate the total amount owed, the interest rates on each card, and your monthly minimum payments,” advised the analyst. “Then, prioritize paying down the highest-interest debt first, or focus on the smallest balance for quicker wins.”

He says you can also consider transferring balances to a card with a 0% introductory APR if possible. Alternatively, you can explore personal loans to consolidate your debt at lower interest rates. Lupo says you should definitely try to avoid accumulating new charges. “Make sure to stick to a strict budget to prevent further debt build-up,” he added. “Finally, contact your creditors to discuss payment plans or hardship programs if necessary.”

But at the end of the day, prevention is better than cure. “The best way to avoid debt when planning a wedding is to live within your means and plan ahead,” advises Lupo. He says the first step to avoiding wedding debt is to set a realistic budget and stick to it.

“Spend what you can afford, preferably from funds saved and not borrowed,” he cautioned. “If you need to finance certain expenses, as mentioned before, use a credit card with a 0% APR and pay it off before the interest kicks in. Avoid relying on loans, as they can quickly lead to long-term debt.”

Lupo says hidden costs often catch couples off-guard. “Prioritize the most important elements of the wedding, and cut back on less essential items. By staying disciplined and planning carefully, you can avoid debt and enjoy your wedding without financial stress.”

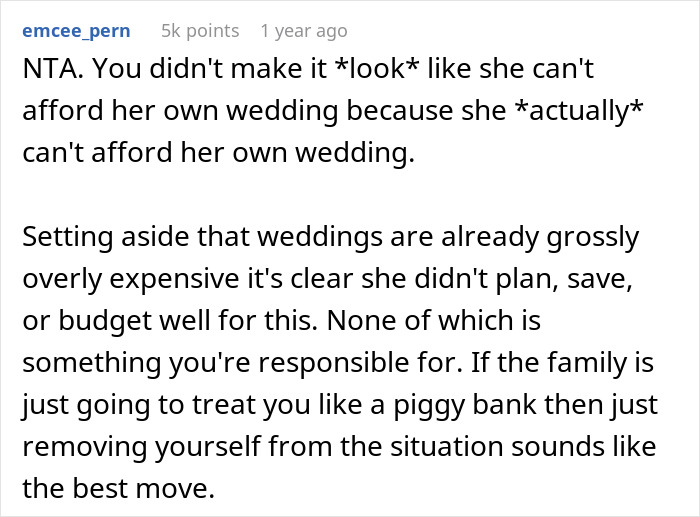

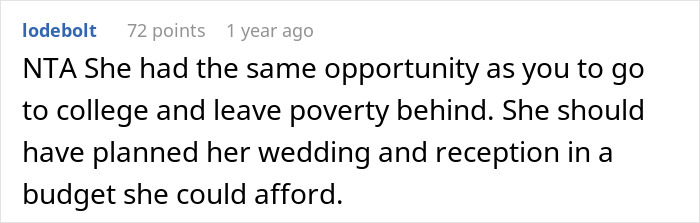

Netizens rallied behind the woman, with some saying the sister had always expected her to foot the grocery bill

Poll Question

Thanks! Check out the results:

She knew she didn't have the money to pay for the groceries. She brought you along thinking you'd cover it for her. I bet your mom was in on it too.

From capmanor 1755 "If she'd asked you for a $1700 wedding gift, that would at least been aan honest request. Instead she tried to embarrass you in the grocery store line, assumuming you'd cave in." And that is indeed the problem: she never asked, never thought of it as gift, she just wanted you to "cover" and I agree that the mom had expected you to cover. Just DON"T!

Load More Replies...GET AWAY! Now you know for sure what "value" you have with them. You're being used, and will always be used. NC - totally. What do you gain by being drained by leeches? I bet they planned on you being their meal ticket the moment you first went to college. They have no reality about college loans or responsibilities because they never experienced them. GET. AWAY!

She knew she didn't have the money to pay for the groceries. She brought you along thinking you'd cover it for her. I bet your mom was in on it too.

From capmanor 1755 "If she'd asked you for a $1700 wedding gift, that would at least been aan honest request. Instead she tried to embarrass you in the grocery store line, assumuming you'd cave in." And that is indeed the problem: she never asked, never thought of it as gift, she just wanted you to "cover" and I agree that the mom had expected you to cover. Just DON"T!

Load More Replies...GET AWAY! Now you know for sure what "value" you have with them. You're being used, and will always be used. NC - totally. What do you gain by being drained by leeches? I bet they planned on you being their meal ticket the moment you first went to college. They have no reality about college loans or responsibilities because they never experienced them. GET. AWAY!

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

56

59