Drama Erupts After Mom Takes $30K Loan In Child’s Name To Buy Boat, They Want To Report Her

No one will argue that parenthood is not only a great joy, but also an equally great burden associated with many issues and problems. And many parents actually perceive their kids as potential insurance for the days of their own retirement. They say, we spend time bringing them up now – let them do the same in several decades!

This approach, to put it mildly, is wrong. However, some parents even go further – like, for example, the mom and dad of the user u/credithelpscammed, the author of our story today, who did not hesitate to take a hefty loan behind their adult child’s back. So, let’s read on.

More info: Reddit

The author of the post has elderly parents who always wanted to buy a pontoon boat to enjoy their retirement

Image credits: lsame / pixabay (not the actual photo)

The boat wasn’t cheap so it wasn’t an easy task to buy it – but the couple finally managed to do it

Image credits: u/credithelpscammed

Image credits: Tima Miroshnichenko / pexels (not the actual photo)

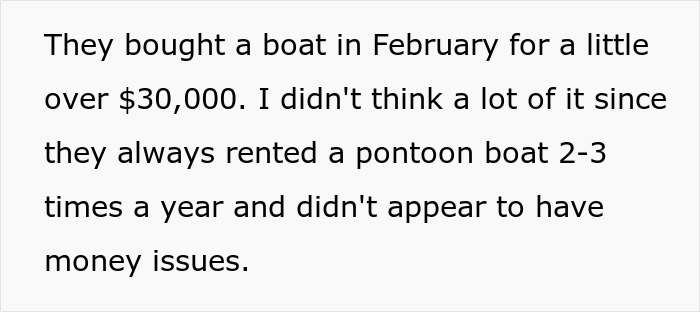

However, some months after turning to a bank for a mortgage loan, the author found out they have a $30K overdue loan now

Image credits: u/credithelpscammed

Image credits: Pixabay / pexels (not the actual photo)

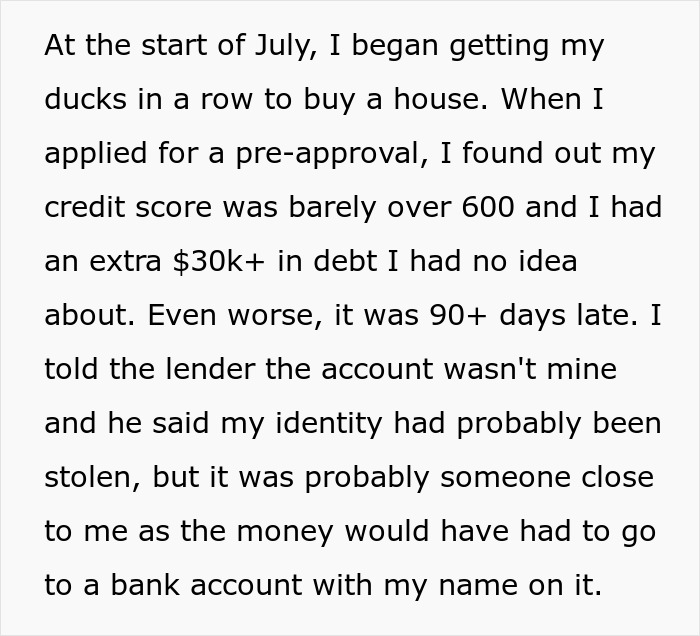

After doing an investigation, the author discovered that their mom had taken the loan in their name using their old shared account

Image credits: u/credithelpscammed

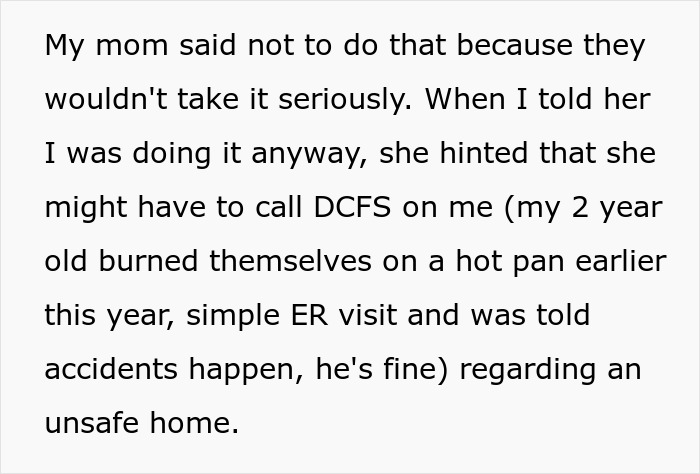

After the child told their mom they were going to report the police, the mom threatened to get Department of Children and Family Services involved on them in return

It all actually started with a boat: a pontoon boat that was so much-coveted for the Original Poster’s (OP) parents after their retirement. Well, you probably understand it perfectly well. People have worked hard for many decades, and now they want to enjoy life to the fullest. And a boat is a great idea for this, you must agree.

But there’s a catch. Money. A boat is not a cheap pleasure, and the author’s parents, although they worked hard all their lives, couldn’t save up enough money so that buying a boat would not make a hole in their family budget comparable to the one the iceberg made in the Titanic. And yet, they did it.

The original poster was glad for them, but a couple of months later, when they planned to buy a house and went to the bank to find out about the terms of the loan, they were unpleasantly surprised by a decrease in their credit score. Moreover, it turned out that they had $30K in overdue loan and were as much as 90+ days late on payments.

An investigation was launched – after all, the bank employee assumed that the author’s identity might have been stolen. The author shared their bank account only with their ex-fiance, but that was a long time ago, and that account was closed a couple of years ago – just after they broke up. So this thread led nowhere…

About a week later, the OP received a notice from a certain company – that if the payment on this loan was not made on time, then they were going to charge off the account. The author went to their office, the matter went to the fraud department – and the trail led to an account that the OP had shared with their mom as a minor.

Moreover, the bank confirmed that the money had been received on this account, and was then transferred to the OP’s mom’s account. The author contacted their mother and, after some hesitation, she admitted that yes, she and their dad took out a loan in their name to buy this boat. In addition, the mother said that they deliberately bypassed the child because they were afraid that they would say ‘no’ anyway.

And then there’s more. After the purchase, having made only one payment, the spouses realized that the obligation they had taken on for as many as 5 years would simply be beyond their means. And they did what seemed the most logical thing to them – they simply stopped paying. It also turned out that the boat can’t be repossessed, since it’s a personal loan.

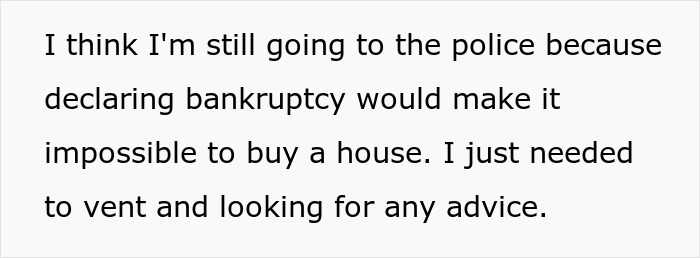

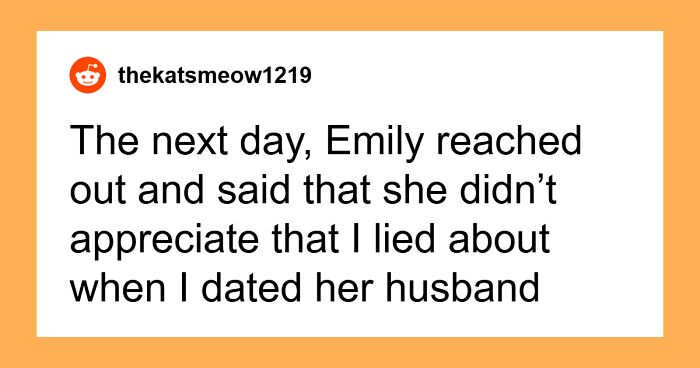

As a possible alternative, the decent lady suggested declaring bankruptcy – but this would automatically put an end to the possibility of buying a house for the author. When the OP threatened to contact the police, the mom first said that they wouldn’t take such a report seriously. And then, realizing that this promise was real, she threatened to contact the Department of Children and Family Services in response.

The thing is that the author’s toddler recently accidentally burned himself on a hot pan. Nothing terrible happened – the tot is already completely fine, but his grandma decided that this incident was an excellent opportunity to blackmail the parent. However, the author still plans to contact the police, and just decided to enlist the support of netizens.

Image credits: pressfoto / freepik (not the actual photo)

Well, using someone else’s account to get a bank loan is a crime under the laws of any country. And here, the parents of the original poster really face serious consequences. “Loan fraud can occur in many different forms. But in each case, it has the potential to ruin your credit rating and get in the way of buying a home, lending money, or starting a business,” Aura’s dedicated blog post claims.

And even more aggravating here is the fact that the role of the fraudster here is played by the parents of the potential plaintiff. However, history knows many cases in which dealing with parents has brought people nothing but problems, both financial and personal. Britney Spears, Macaulay Culkin and many other stars, I believe, can tell us a lot about this too.

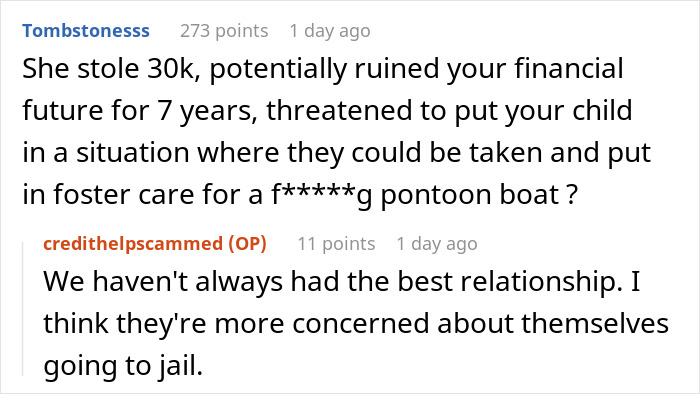

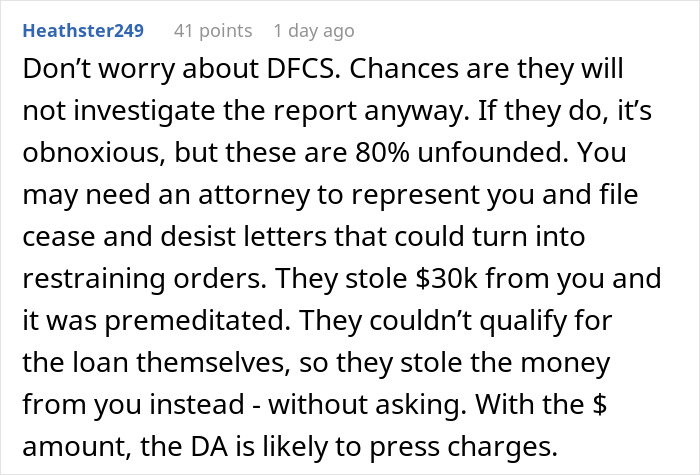

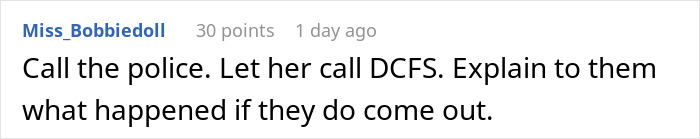

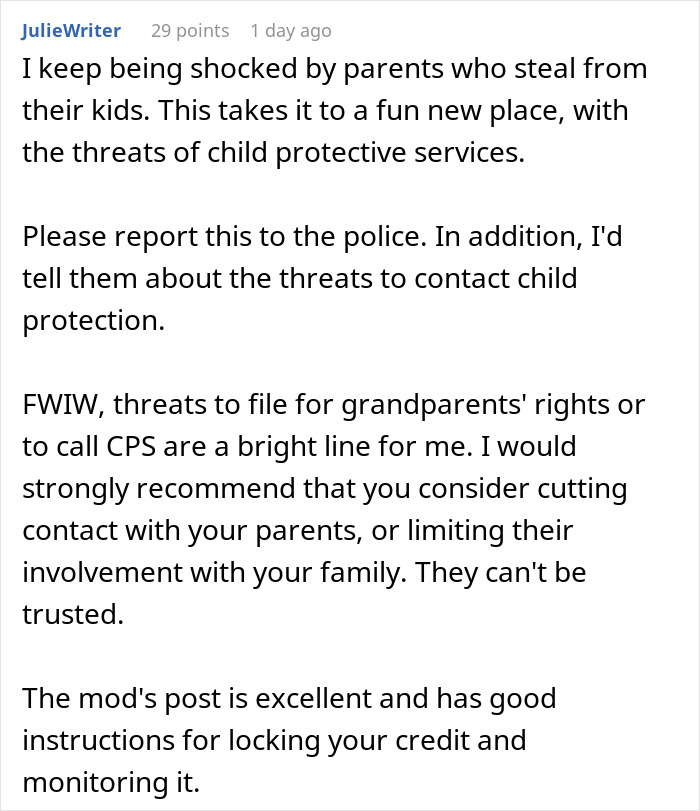

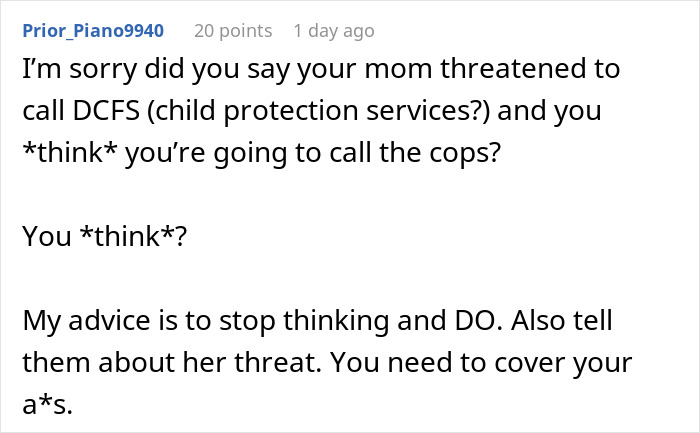

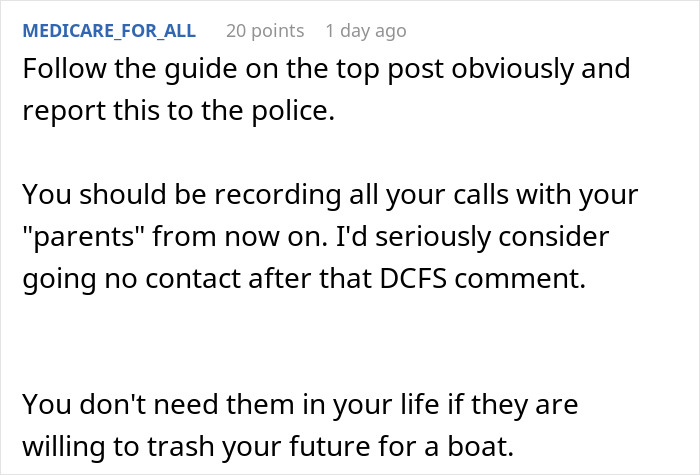

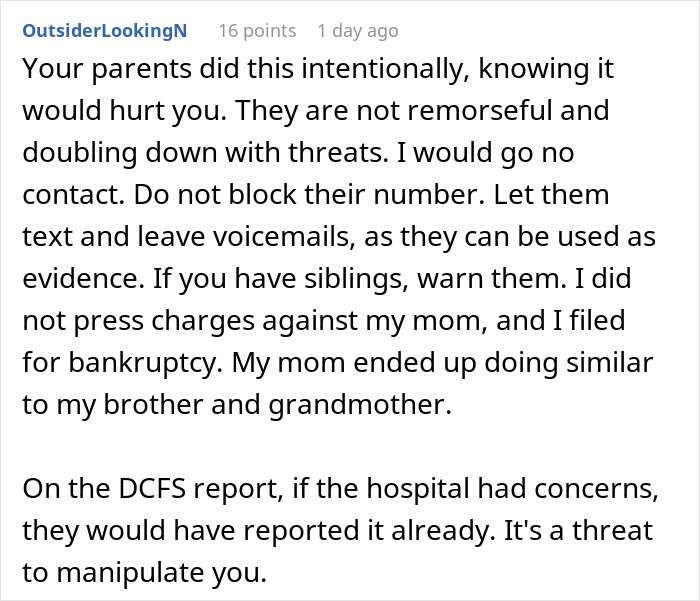

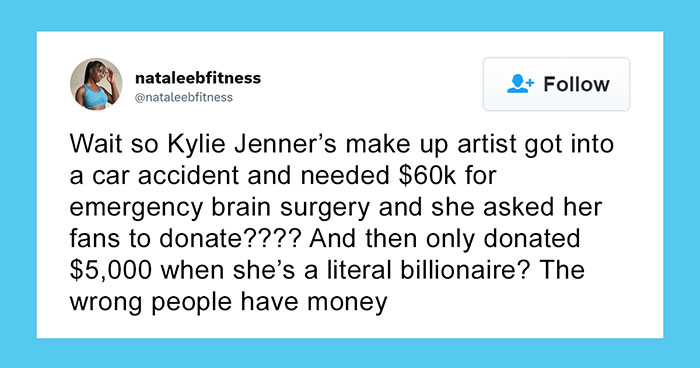

In the meantime, let’s turn to the comments under the original post. People there, as you might guess, are simply outraged – both by the actions of the author’s parents and their reaction to being brought into light. “I keep being shocked by parents who steal from their kids. This takes it to a fun new place, with the threats of child protective services,” one of the commenters exclaimed in anger.

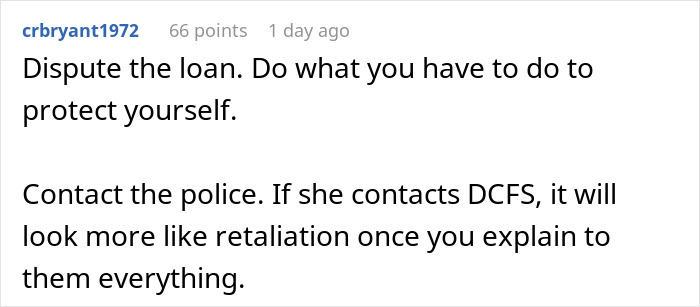

As for the original poster’s decision to involve the police in the case, the responders only welcome this idea. “Dispute the loan. Do what you have to do to protect yourself,” another person in the comments replied. “Contact the police. If she contacts DCFS, it will look more like retaliation once you explain everything to them.” And what would you, our dear readers, do in a similar situation?

People in the comments simply got indignant over the parents’ behavior and urged the author to take legal action here

I remember when my dad attacked me and then said if I call the cops he'd tell them I was beating my nephew. A nephew I had zero contact with and barely knew. Family is great.

I remember when my dad attacked me and then said if I call the cops he'd tell them I was beating my nephew. A nephew I had zero contact with and barely knew. Family is great.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

49

22