Husband Is Tired Of Wife’s Pity Story That They’re Broke, Reveals They’re Actually Millionaires, Making Her Look Like A Liar

InterviewTalking about money can be a hard river to navigate. If you have a lot, you can come off as materialistic or proud and maybe even open yourself up to loan requests from friends and family, which is a whole ‘nother can of worms. If you don’t have a lot, you may perhaps feel ashamed or self-conscious.

So it’s not surprising that one internet user wanted a second opinion about his choice to speak openly about his finances. Despite being millionaires, OP’s wife insisted on telling everyone that they were broke, which often made him feel embarrassed, as their hard work never gets acknowledged and it makes him look like he is bad with money.

Money is a touchy subject, so most people prefer to just not bring it up around friends and family

Image credits: Karolina Grabowska (not the actual photo)

This man explained to the internet that he and his family are doing quite well financially, but his partner likes to tell people another story

Finally, he decided that he had enough of it and took matters into his own hands

Image credits: DC_Studio (not the actual photo)

There is a lot of societal pressure around income, so if you feel awkward talking about it, you aren’t alone

Image credits: seventyfourimages (not the actual photo)

We contacted the OP to ask about their perspective on involving one’s family in financial discussions: “I all for talking about finances without going into specific dollar amounts. I openly tell people about how I budget and invest. I won’t go into a dollar amount or how much I have. I think it’s very important. The problem is when you tell people how much you actually have. IMO there is just no upside to knowing friends’ and families’ finances. It only brings problems into the equation. Most of the time you can estimate people’s income based on their lifestyle and I think that’s enough. The problems start when you know there is a big imbalance. If you have a lot of money people expect you to do more. Pay for meals, host more parties, feed everyone, buy drinks at the bar, and pay for concert tickets. The worst is when they ask to borrow money. My dad warned me this would happen and I have experienced this in life.”

Discussing money may seem awkward, and it’s even considered taboo in some cultures. What makes it even harder is that most people acknowledge that there often is a need to talk about finances, even if it makes them feel bad. Researchers have found that this conflict actually makes it even harder to speak openly about one’s income. The person feels so under pressure from different directions that most simply never talk about money.

Sociologist Jeffrey A. Winters believes that this taboo does have one societal function. Countries with very high-income inequality tend to be less stable since the poor are more often reminded about their social position. So if multiple segments of the population just never speak about money, it blurs the lines between economic classes and creates the appearance of more equality where it may not actually exist.

Even in cultures that are more permissive about communicating one’s wealth, there still are some psychological traps. If having resources is seen as a status symbol, people without resources will generally feel unhappy in addition to the “normal” problems with lacking money. In other cases, your income is tied to your worth as a person. Like in the case of OP, he worked hard and made smart investments. Appearing broke created a feeling of shame since it would appear to outsiders that he made poor decisions and wasn’t a conscientious worker.

Taboos around money end up causing more harm than good

Image credits: Alexander Mils (not the actual photo)

If this story got you wondering about your own family and acquaintances, you aren’t alone. In over one-third of couples where both people live together, at least one partner had only a rough approximation of the other’s income. Americans in general seem to hate talking about money, with some studies indicating that most prefer to discuss politics, mental health and even addiction over income. This taboo should not be seen as one, blanket explanation, but as a patchwork of different forces, all affecting different segments of the population. Some rich people actually feel guilty about their money, regardless of its origin. The middle class often avoids talking about wealth as it could diminish their status. After all, if you have to rely on friends and family for regular loans, you aren’t actually middle class, or so they think.

Ultimately, people should still have privacy when it comes to their finances. But a constant feeling of shame does still have negative consequences. In families where money is a taboo subject, children often end up less financially literate. Studies show that these kids know less about managing money and also are less likely to ask for advice since the entire topic appears off-limits. Fortunately, the cause of the issue is also the solution. Parents should be somewhat more open about income, saving and budgeting. This will better help their children prepare for the future.

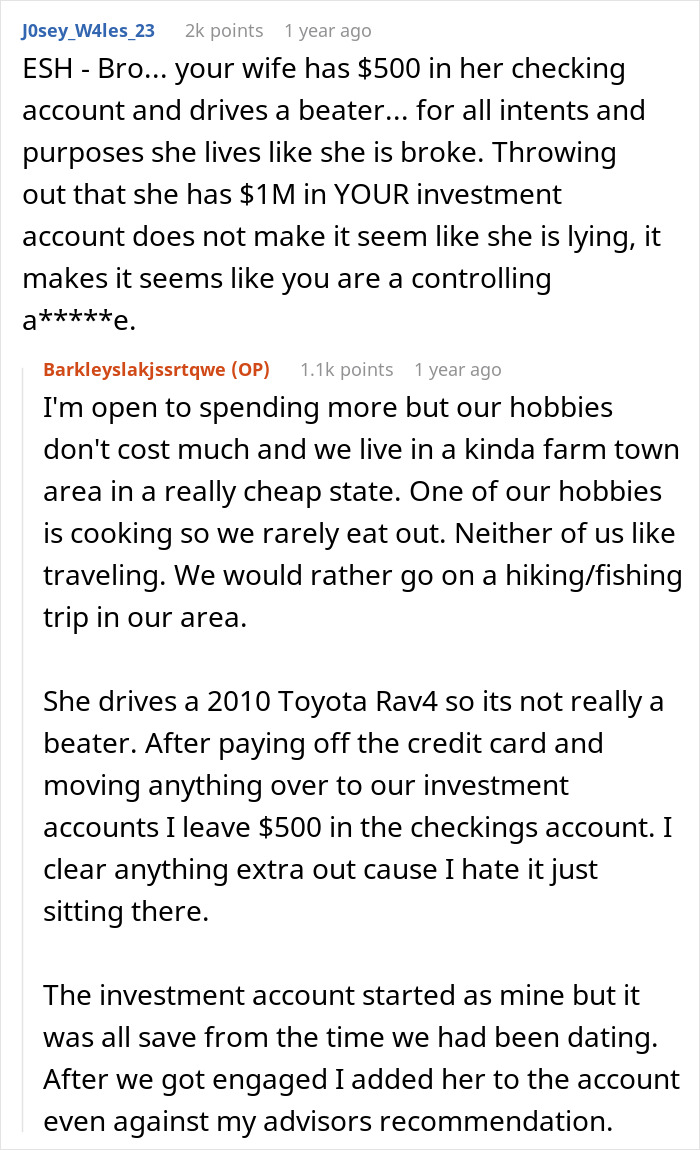

Later, OP gave some clarifying details about his situation in an update

Credits: Barkleyslakjssrtqwe

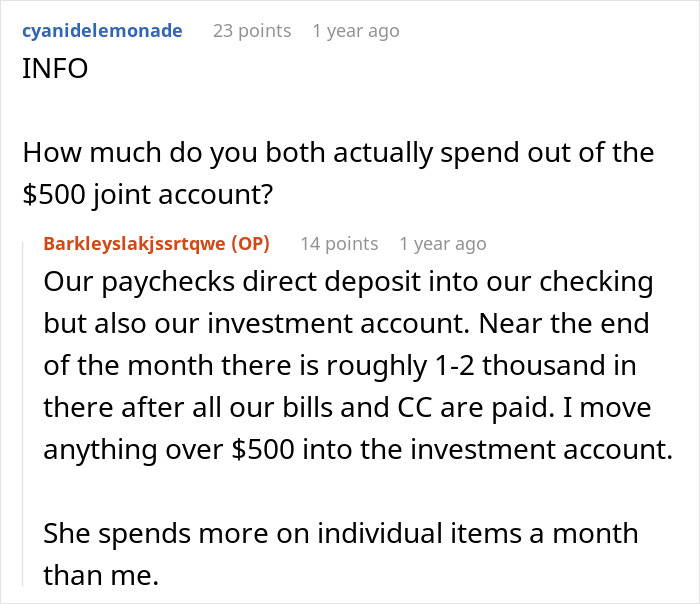

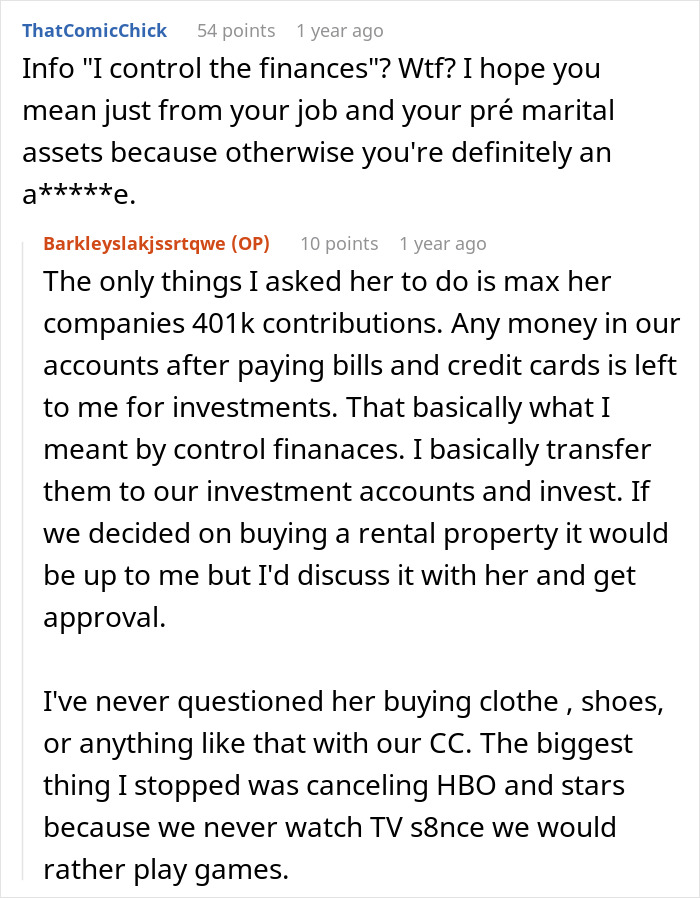

Commentors asked some follow-up questions about OP’s finances

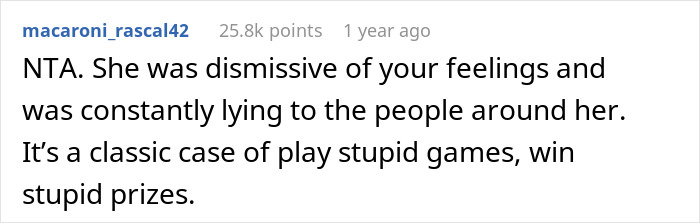

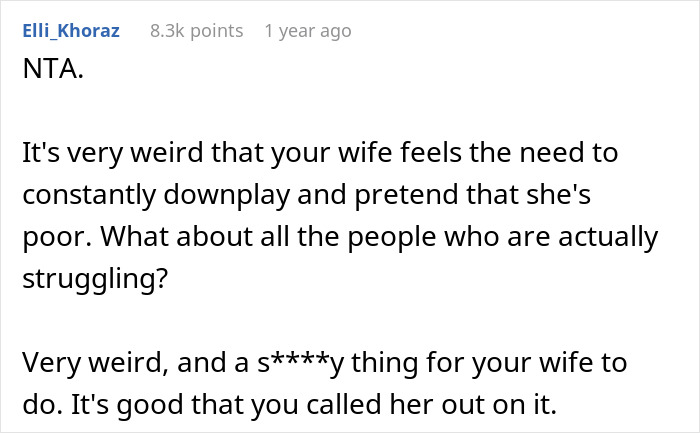

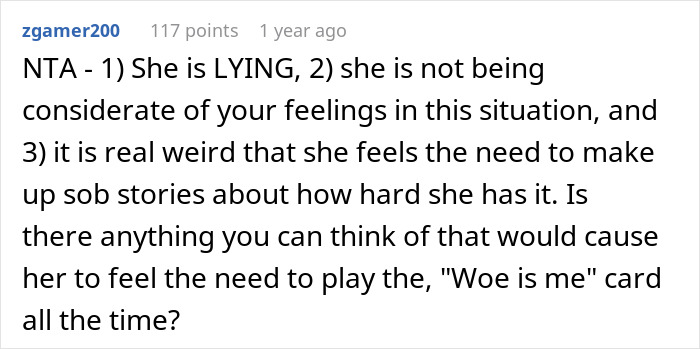

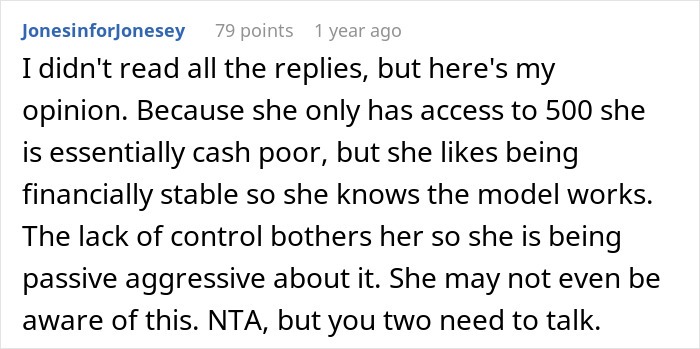

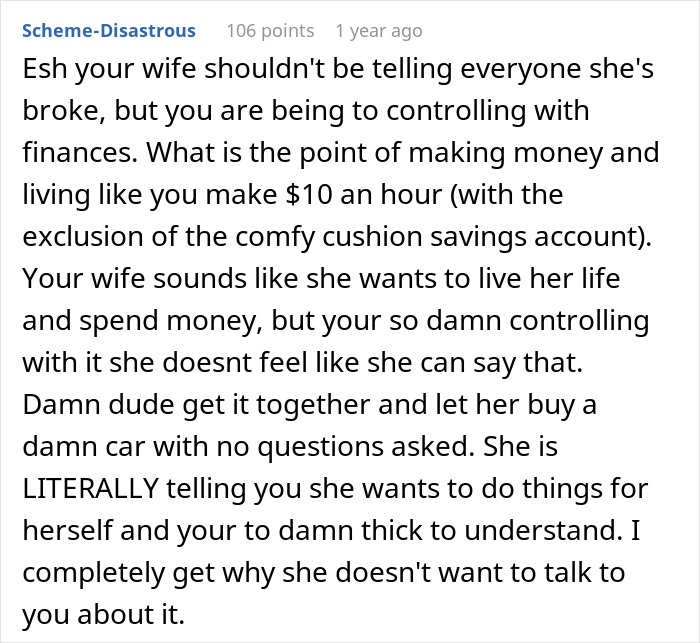

Ultimately, most commenters agreed that he was not at fault for being honest about his wealth

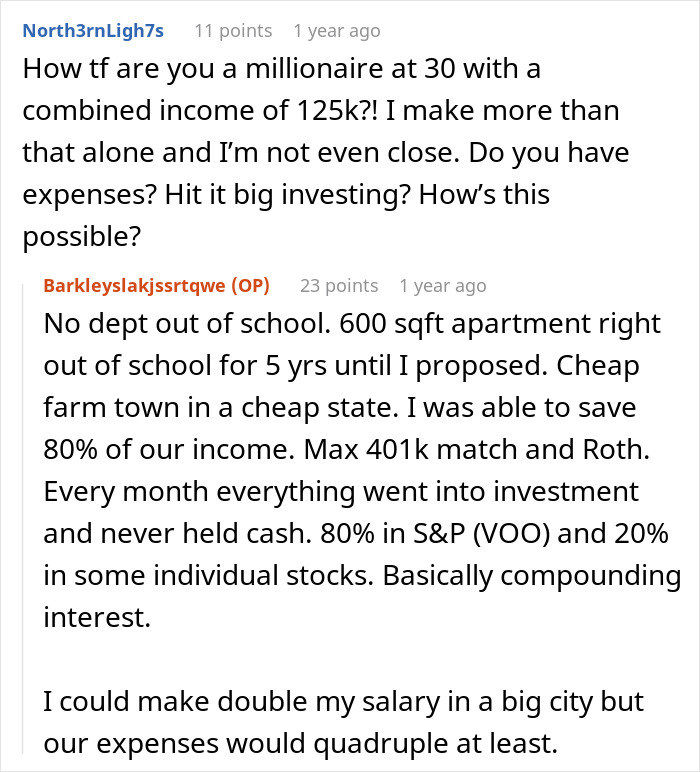

Some also added that no one was really at fault here and that they could understand where the wife was coming from

105Kviews

Share on FacebookExplore more of these tags

I can't come over the comment where someone says 125 000$ are not much....I know there are differences in places and so. Countrywide and global. But my minimum wage a*s is crying 😭

That was combined income as well, not individual. In Toronto, for example, a combined $125k wouldn't get you far.

Load More Replies...If the majority of their finances are in some type of investment/retirement account, then yes you've set up your retirement very well and kudos. However, your immediate disposable income is intentionally low (to max the investments) so it really does feel/seem like you don't have a lot of money to burn.

Yes, I think his insistence on snatching away any extra every single month makes her feel very limited in her finances. If it was allowed to build up a bit she might feel comfortable suggesting "how about we upgrade the kitchen" or "how about we buy electric bikes/take a nice holiday to a beach somewhere". But with it having to be out of the emergency $10k or breaking into investments, it becomes a bigger deal to make suggestions. It's living an essentials only life for the sake of what? A cosy retirement you might not live to see.

Load More Replies...I can't come over the comment where someone says 125 000$ are not much....I know there are differences in places and so. Countrywide and global. But my minimum wage a*s is crying 😭

That was combined income as well, not individual. In Toronto, for example, a combined $125k wouldn't get you far.

Load More Replies...If the majority of their finances are in some type of investment/retirement account, then yes you've set up your retirement very well and kudos. However, your immediate disposable income is intentionally low (to max the investments) so it really does feel/seem like you don't have a lot of money to burn.

Yes, I think his insistence on snatching away any extra every single month makes her feel very limited in her finances. If it was allowed to build up a bit she might feel comfortable suggesting "how about we upgrade the kitchen" or "how about we buy electric bikes/take a nice holiday to a beach somewhere". But with it having to be out of the emergency $10k or breaking into investments, it becomes a bigger deal to make suggestions. It's living an essentials only life for the sake of what? A cosy retirement you might not live to see.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

82

45