Being middle class might mean different things to different people. While some see it as living a super fancy lifestyle without technically being rich, others view it as a stable lifestyle and finally not having to worry about putting food on the table every night.

The American middle class might be shrinking, however, it still makes up the majority, standing at 52 percent of households. So it’s only natural that the internet pays a lot of attention to middle-class shenanigans. For example, the ‘Middle Class Fancy’ account over on Instagram has some utterly hilarious memes to share with all of us, poking fun at the more ridiculous parts of living in a middle-class household and at the differences between different generations.

Go grab yourself some meat and cheese on a piece of wood, scroll down, upvote your fave memes, and let us know which of these got you chuckling the most. Which of these memes did you relate to the most, Pandas? Share your thoughts in the comments.

More info: Instagram | Facebook | Twitter | MiddleClassFancy.com

This post may include affiliate links.

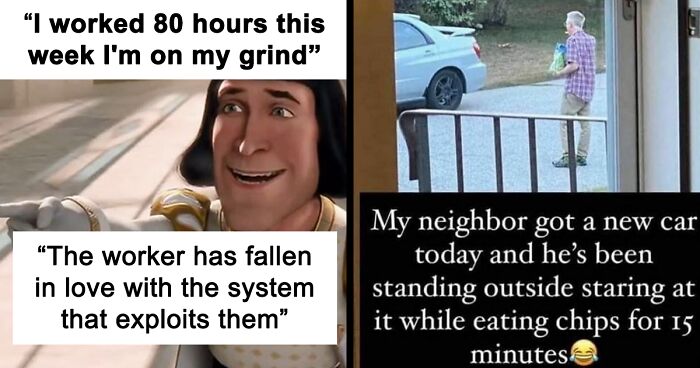

Guy Fieri 2024

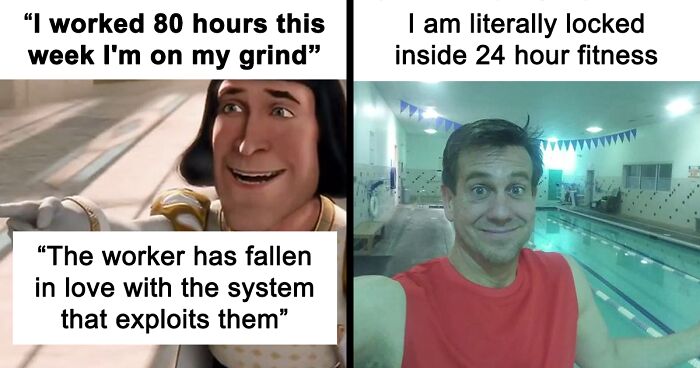

Heck Off Dennis

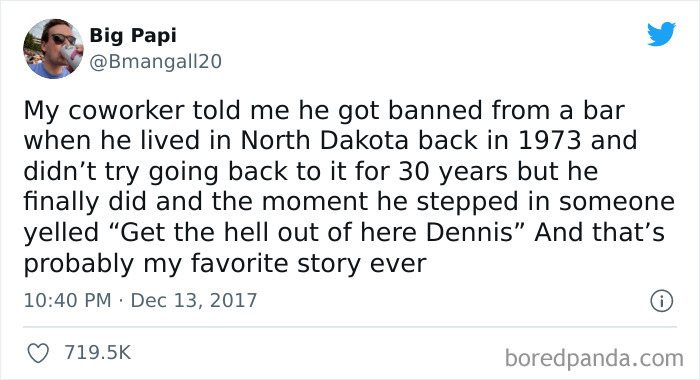

Pouring One Out For The Shinseki’s Bathroom

The ‘Middle Class Fancy’ project has a whopping 2.4 million fans on Instagram. A further 122.5k people follow the project’s page on Facebook while Twitter brings in another 16.4k followers. The tagline of MCF is that “LiFe Is GoOd.” A little too good for some middle-class homeowners, judging by the memes the page keeps posting.

Despite all the humor, there are some serious issues affecting the middle class. Investopedia notes that the middle class in the US is pulling in far less income than half a century ago. The share of income it was capturing stood at 60 percent back in 1970. Meanwhile, in 2014, the share dropped down to just 43 percent.

I’m Speechless

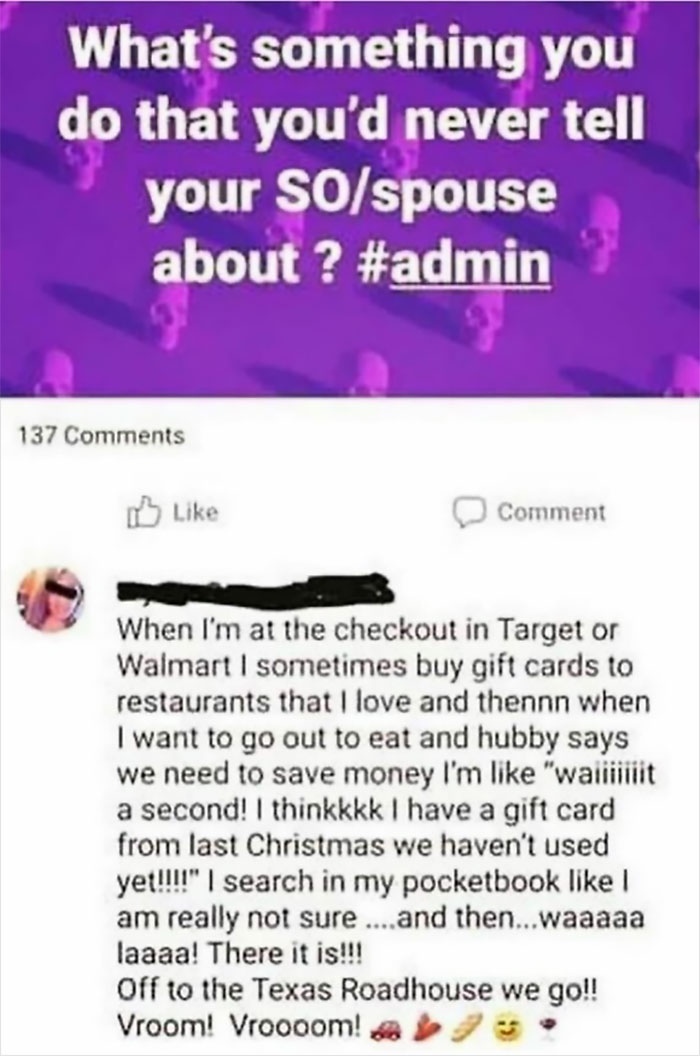

The "waaaaa laaaa!" is the most middle class fancy part of the whole thing.

Guess I'm the no-fun, Debbie-downer (wah wah) for this kind of thinking. For me this isn't funny. It's sad, and unhealthful to the point of toxicity in a relationship. Honesty in finances is huge. We're almost 30 years in, and learned this the hard way early on. We now have regular meetings to review finances, household projects, life goals, everything. I guess maybe that seems extreme, but once we committed to being a TEAM in every aspect of our lives, it changed our entire world.

The amount of people that like this is sad. Lying to your spouse is not a good foundation for any relationship.

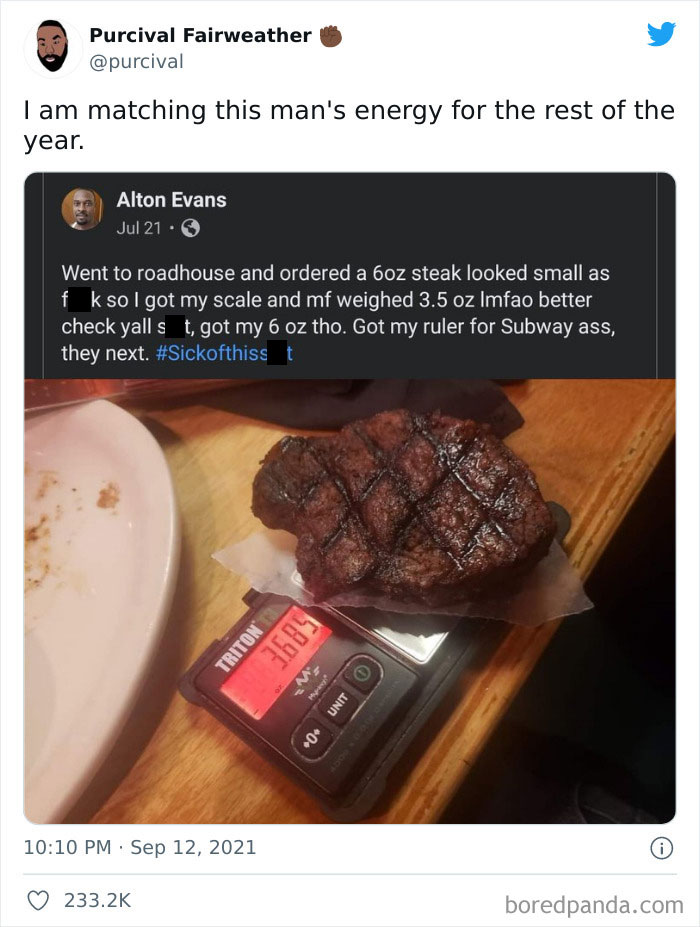

I don't know which is more embarrassing, that she says "waaaaa laaaa" or that Texas Roadhouse is her restaurant of choice

I do this too (also with store gift cards, like Wal-Mart and Target), but not because my hubby wants us to save money. He can't stick to a budget, so I have to "prepay" for the stuff I want to do later in the month.

If she didn't spend so much sneaking the gift cards, husband might not have to say they have to watch their money so much. Just a thought.

Exactly. I am horrified with how many people think is good.

Load More Replies...Financial manipulation and pathological lying is so sweet.

Load More Replies...This is absolutely brilliant. Better yet, if you have an Amazon Prime account and credit card, buy the gift cards on there and you'll earn 5% cash back on them!

On top of that, I sometimes get a coupon for 5-$10 off a gift card purchase of $50+, so I buy gift cards for places we'd be going anyway. (Not behind hubby's back tho)

Load More Replies...That is amazing!! I used to buy clothes and take them to the dry cleaners and then bring them home in the bag. Yes, I have had this outfit forever.

an honest "waalaaa" sends shivers down my spine every time I read it >:(

Why did you spend $85 at Wal-Mart if all you said you bought was a few snacks?

Got to love how so many people assume that it's HIS money being spent on the cards. Sexist much?

No one here has assumed that it's his money. Everyone has assumed that it is *their* money - as in a joint account that they both contribute to for food and bills. Why are people assuming this? Because she literally says so in the post, that this is about the husband worrying about saving *their* money. If she is using her own separate money for this, that is a different story, but that's not what she has implied. My ex constantly stole money from our joint account to pay for his meals out, and it's as financially abusive for him to that as it is for her to do it if she is, in fact, stealing money from *their* bill money or *their* savings, and it has nothing to do with gender.

Load More Replies...sooooo, lying to your life partner just to get your way? Hmmm. Sounds pretty shitty to me. Also, it's voilà. Ugh.

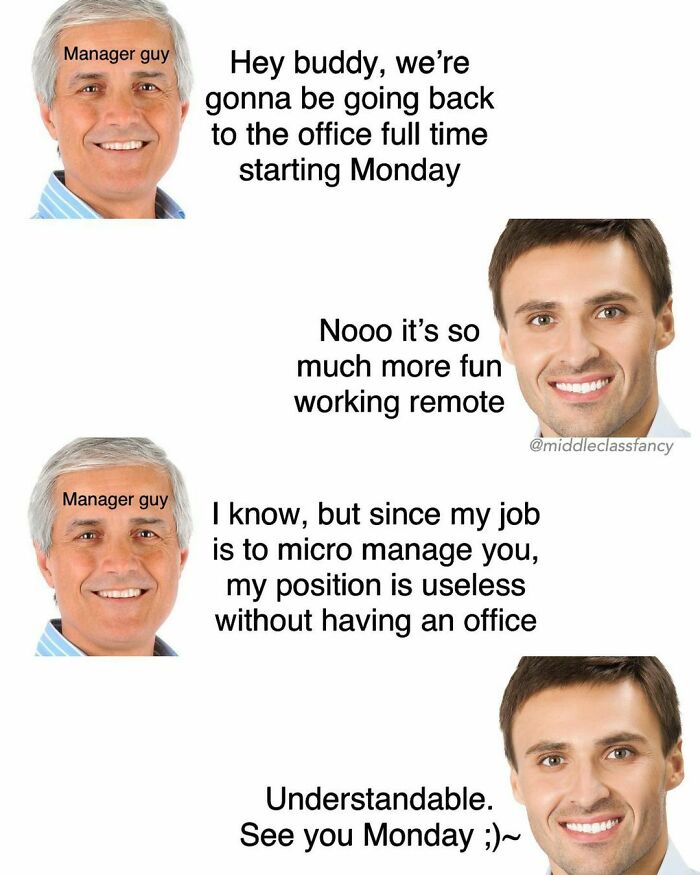

Understandable

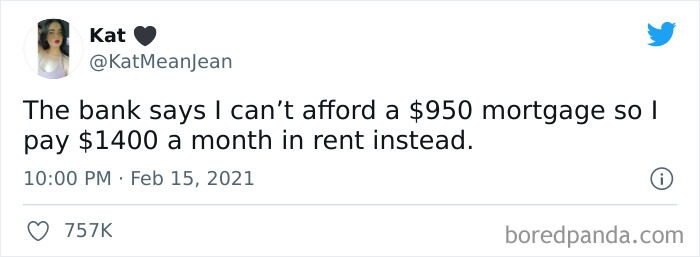

Yes my bank says I can only afford 1k in mortgage and my rent for the past 3 years has been $2700 and still have to pay electricity, water, cable, Internet, trash disposal, renters insurance, and association.

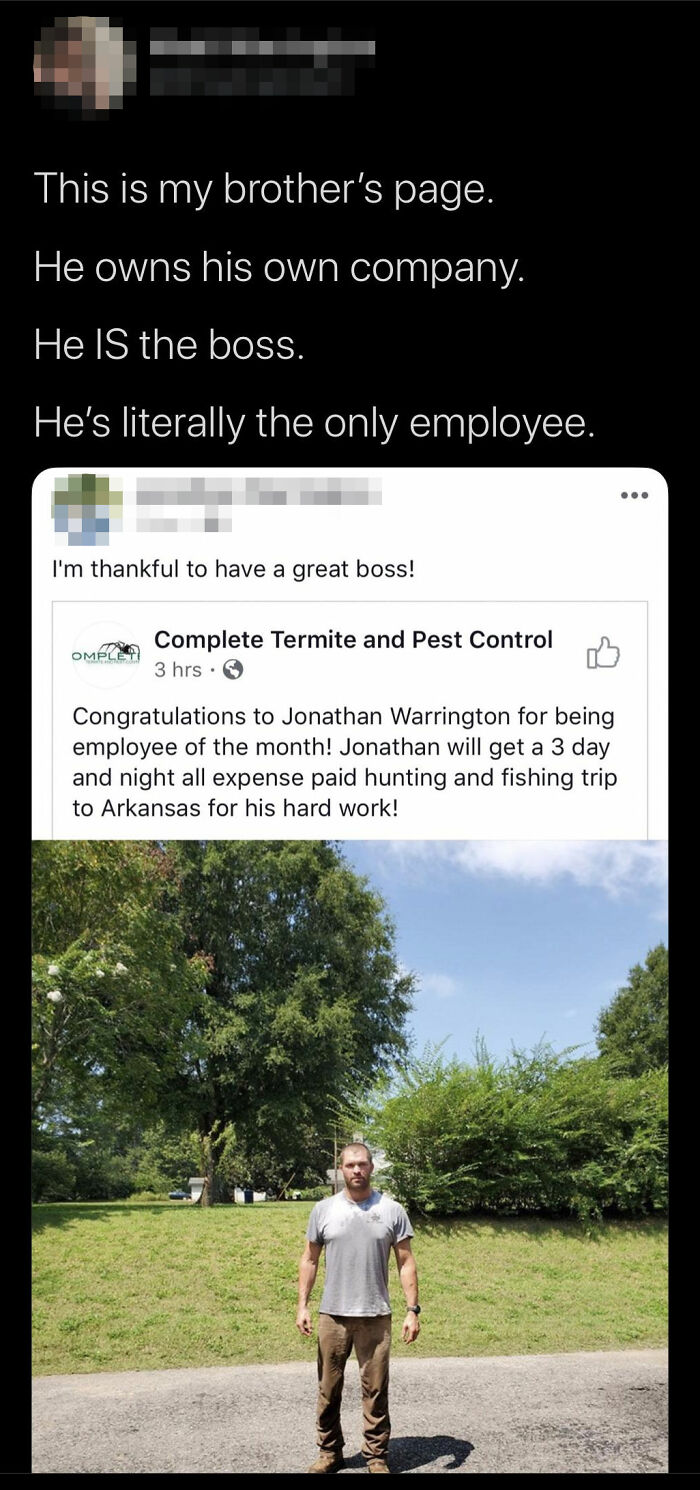

Congrats Jonathan

In short, it’s implied that the American middle class is shrinking and getting poorer, as the population in the extreme bottom and top of the economic spectrum continues to increase.

Pew Research explains that it’s not just the working class that felt the brunt of the Covid-19 pandemic. The Center’s survey from April and May 2020 found that 36 percent of lower-income and 28 percent of middle-income adults lost their jobs or had to take a paycut because of the pandemic and lockdowns. At the same time, 22 percent of upper-income Americans were in the same situation.

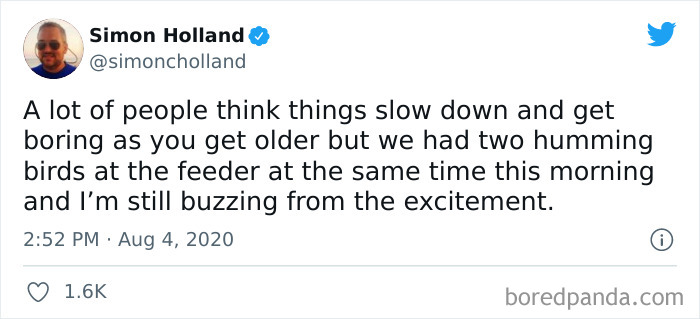

Exhilarating

I Hate That We’re Like This

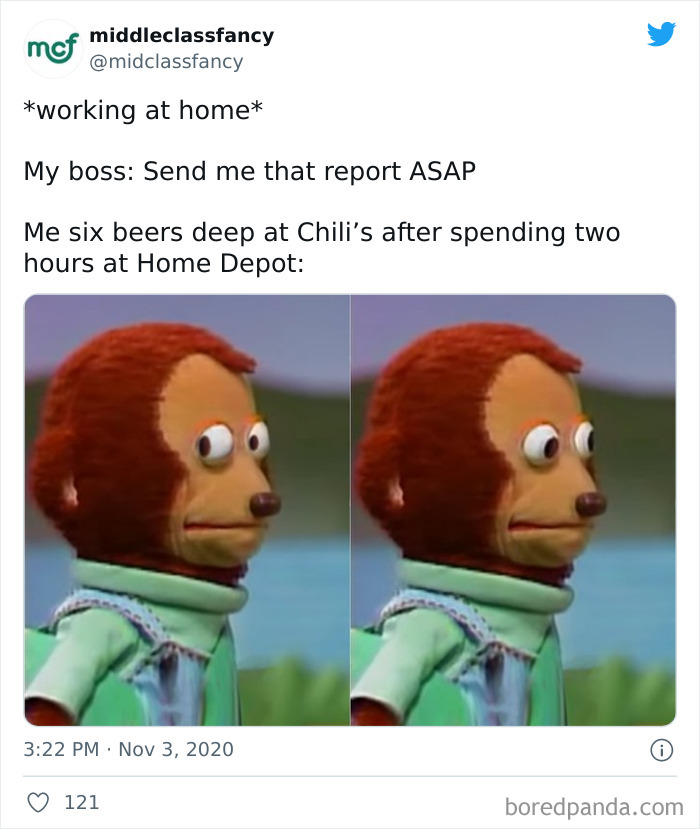

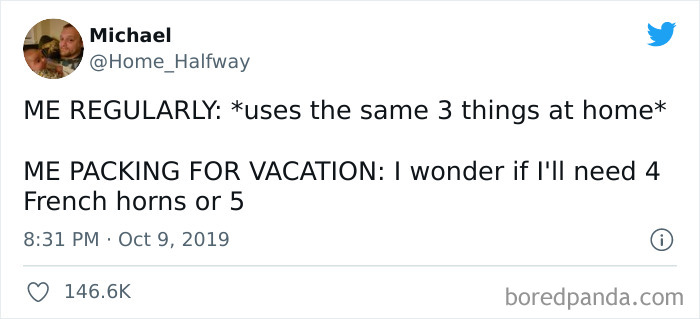

Better Make It 6

There’s absolutely nothing wrong with financial stability or providing for your family. However, what is a problem is the lack of financial education in schools. Sam Dogen, the founder of the Financial Samurai personal finance website, told Bored Panda during an earlier interview that the biggest barrier for people to become rich is the lack of education.

“We learn things like chemistry, geology, and English in high school and college, but there are no mandatory courses on personal finance. For example, if more people thoroughly understood their mortgage contracts before signing, the housing crisis between 2008– 2010 may not have been as deep,” Sam said that financial education can even help reduce the severity of economic crises if applied properly and on a wider scale.

Congrats On The New Ride Doug

If you don't look back at it after you park it, you bought the wrong one.

Good Lord Judi

People who craft with fabric are VERY protective of their fabric scissors.

“In another example, if more people knew they could negotiate a severance instead of quit with nothing, more people would have a more comfortable financial runway to take their time and find a new job or start a new business that is truly meaningful to them. The more people are empowered with financial knowledge, the better financial decisions they can make to ultimately live the lives they desire.”

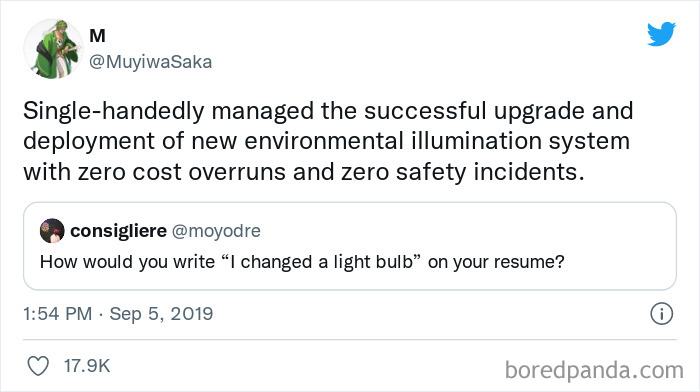

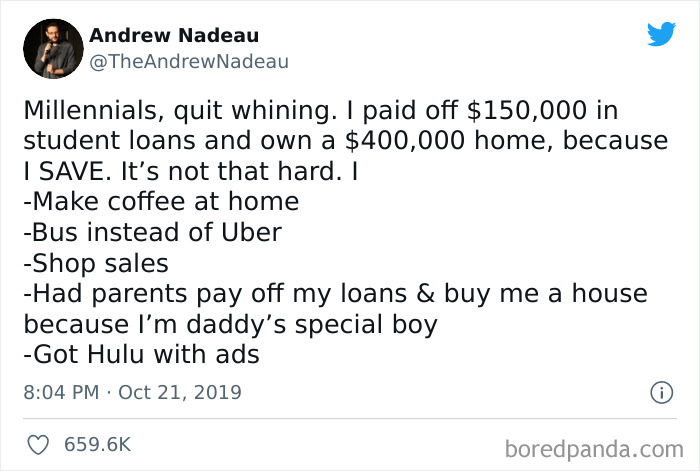

It’s Quite Simple

Hey, it must have been really hard work to convince his parents to pay off his loans and buy him a house. Those whose parents are not doing these things for them are not asking them hard enough.

Looks Pretty Sick

I Feel Like This Guy Is Living Inside A Mcf Meme @doyouevenlift

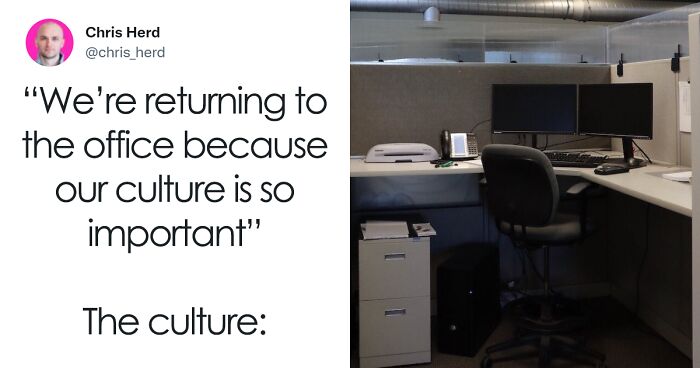

That happened to a guy in a bar in Spain, he fell asleep in the toilet and woke up when everyone had gone home. He came out the toilets and tripped the silent alarm. The alarm company phoned the owner and told then that the cameras cold see a guy poring himself a beer and siting at the bar. The punter was quoted saying " I'd had a few and fell asleep on the can. When I woke up the bar was empty so I called the police (guardia civil) and waited but the took a while to find the owner to bring the keys so I thought I'd have beer" The owner said that next time he'd check the toilets properly but wasn't doing to charge him for the beer.

According to financial expert Sam, saving has to ‘hurt,’ otherwise, you’re likely not saving enough. “One of the key mantras I tell my readers is this: If the amount of money you’re saving each month doesn’t hurt, you’re not saving enough! Too many people go through life, paying no attention to their finances. Then they wake up 10, 15, 20 years from now and wonder where all their money went. Always pay yourself first. By paying yourself first after each paycheck, and making it hurt a little to change your spendy ways, only then will you know whether you are saving enough.”

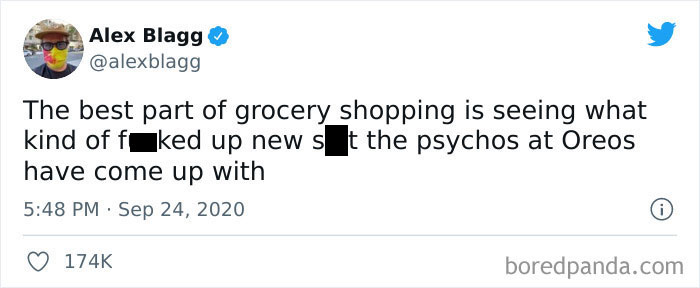

Waiting On Them To Drop Dill Pickle Flavor

The Millennial Dream

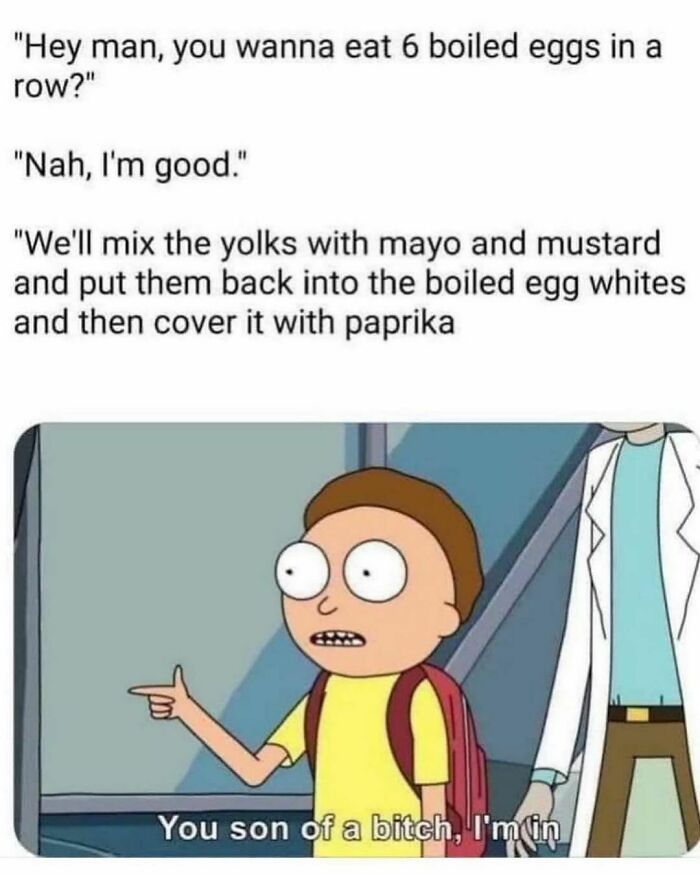

The Paprika Gives It A Little Kick

Sam also had some advice for lower-income families. He noted that even large families can save money despite how overwhelming life sometimes feels. “Despite more mouths to feed, large families also have synergies that can save them money. Use hand-me-down clothing and shoes for all children with occasional aesthetic adjustments between boys and girls if desired. Buy food in bulk.”

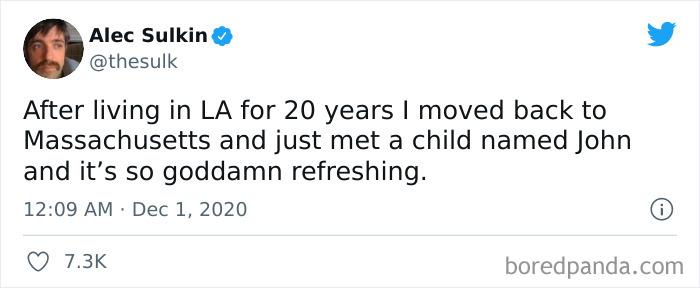

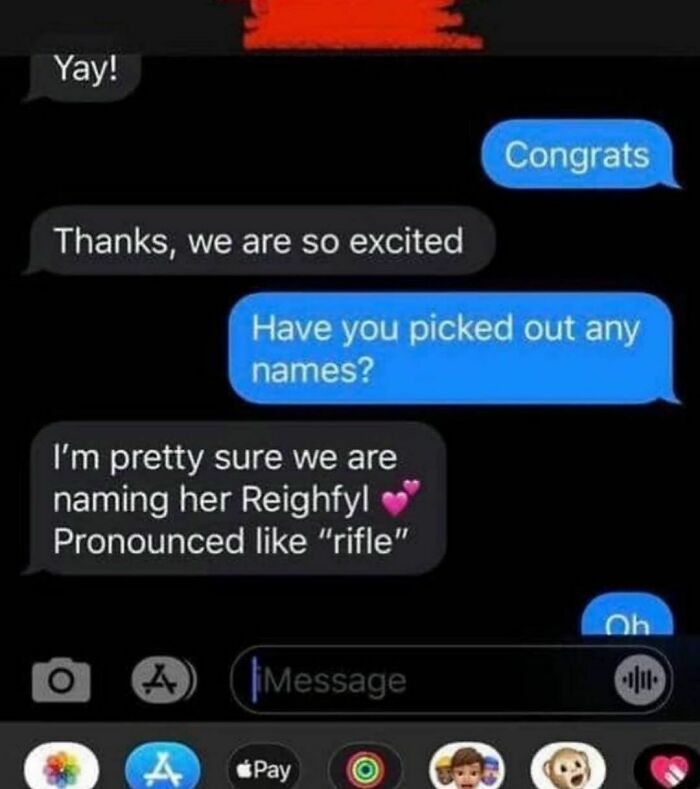

It’s Still Probably Pronounced Yohn

Makes Sense

He continued: “Send kids to a preschool co-op where they require parental involvement usually once a week. Send your kids to public school and forget about the ridiculous cost of private school tuition. Enjoy the free parks and libraries. Have kids share rooms to save on buying a larger house. But the two most important things are having one parent who works to help subsidize healthcare costs and avoiding private schools.”

You Can Never Be Too Sure

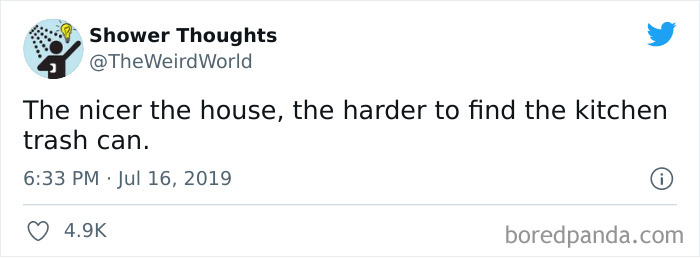

The Trashcan? Oh It’s On The Roof Lol

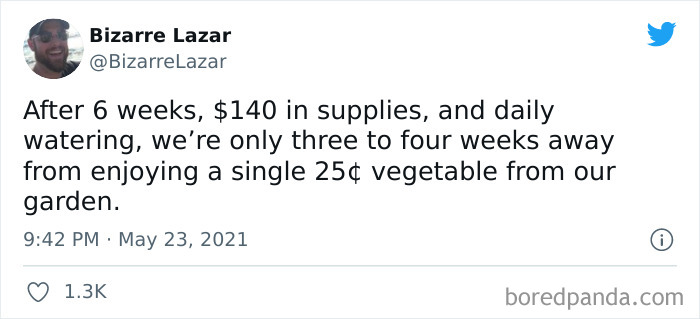

Life Hack: Buy Vegetables From The Grocery Store And Tell People They’re Fresh Picked From The Garden And Watch Them Talk About How Fresh They Taste

People who tasted fresh produce before will probably know the difference.

Meanwhile, entrepreneur Morgan told Bored Panda that money is a pivotal part of our lives, provides security, and gives access to all kinds of experiences that we want. However, wealth inequality can lead to jealousy and even anger.

"I think some people have nothing better to do with their time, and when people see someone living a different lifestyle than their own or doing better than them, they judge out of anger or jealousy. We should try empathy and understanding over criticizing and judging," the entrepreneur said.

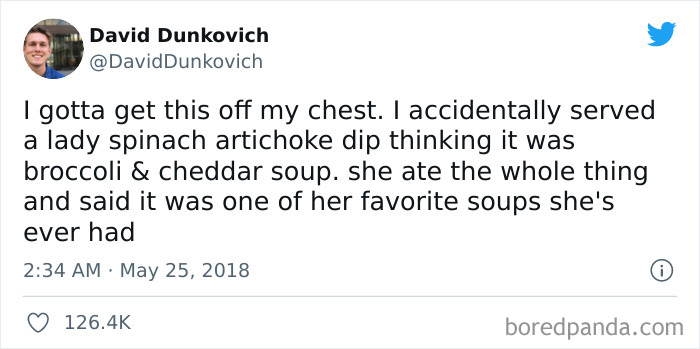

Sounds Delightful

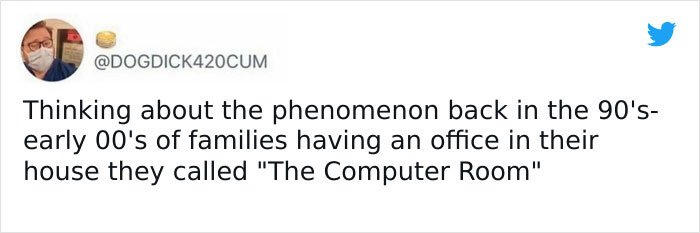

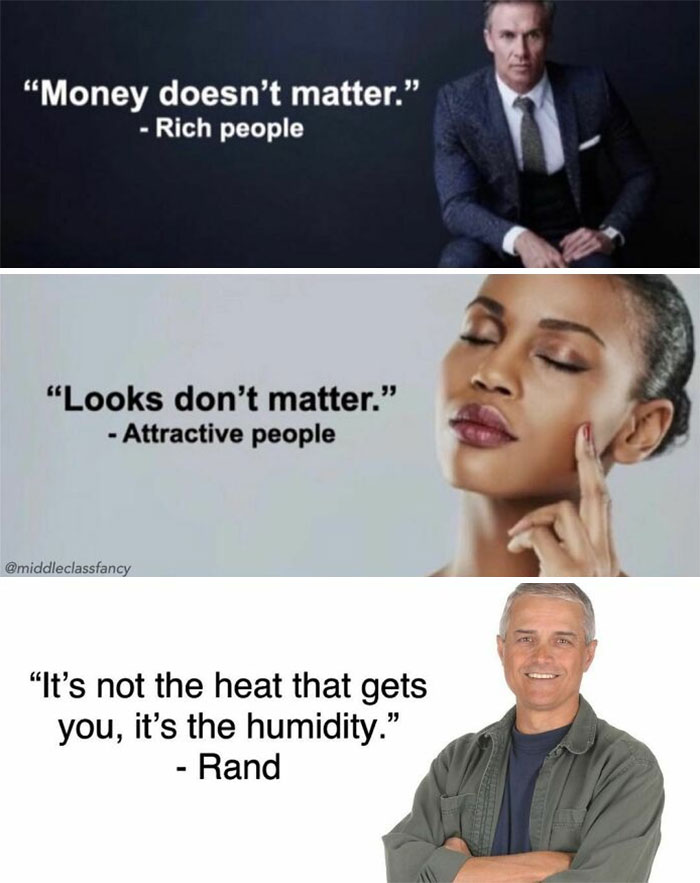

Fire Up The Gateway Rand

Yeah! And your young self wasn't allowed in there! Oh, memories...

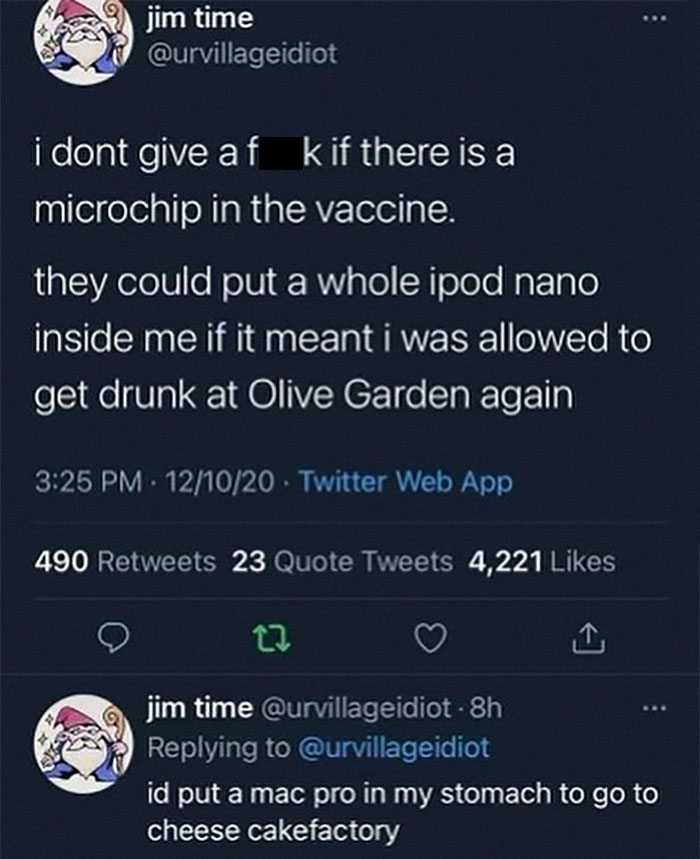

Y’all Taking The Vaccine For Endless Breadsticks Or Nah?

According to Morgan, everything is possible if you put in the effort and apply yourself correctly. She revealed that she “grew up broke in a trailer park,” but ended up starting her own company and becoming a millionaire by the time she was 30. “I am proof the American Dream is still alive and well," she shared that if it was possible for her, it’s possible for anyone.

I Had My Rehearsal Dinner At Olive Garden

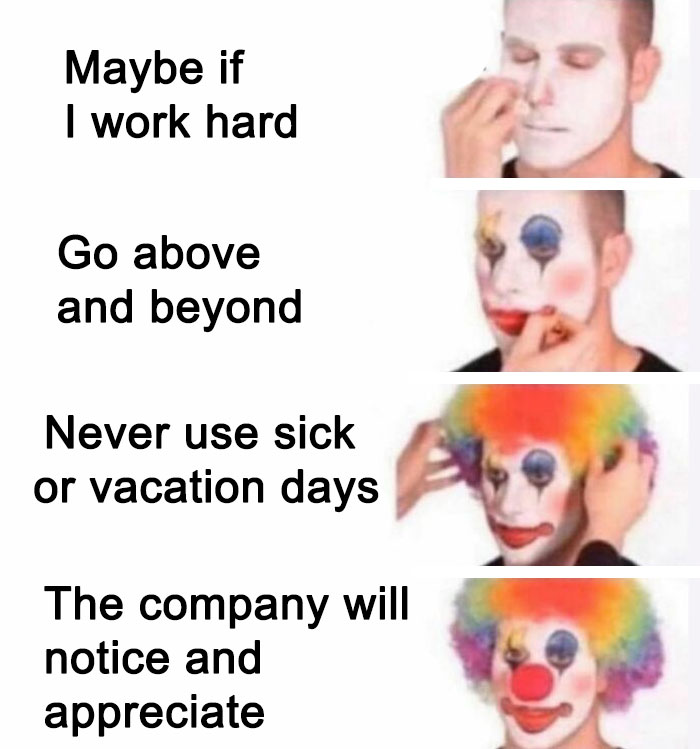

Just Gotta Keep Climbing That Corporate Latter

Congrats Zander, You Played Yourself

Let us all agree that Debbie B Hogan (comment below) is far from home here on BP, and that she should marry a Nigerian prince to complete her success story.

"The internet has an insane amount of opportunity, and I have been able to help thousands of people make money online for free. I started a million-dollar company with only $1 at Goodwill flipping books. It's possible if you are willing to put in the work," Morgan noted the importance of flexibility and creativity. And those are the skills you’ll find useful, alongside financial education, moving upwards from class to class.

Thanks Rand

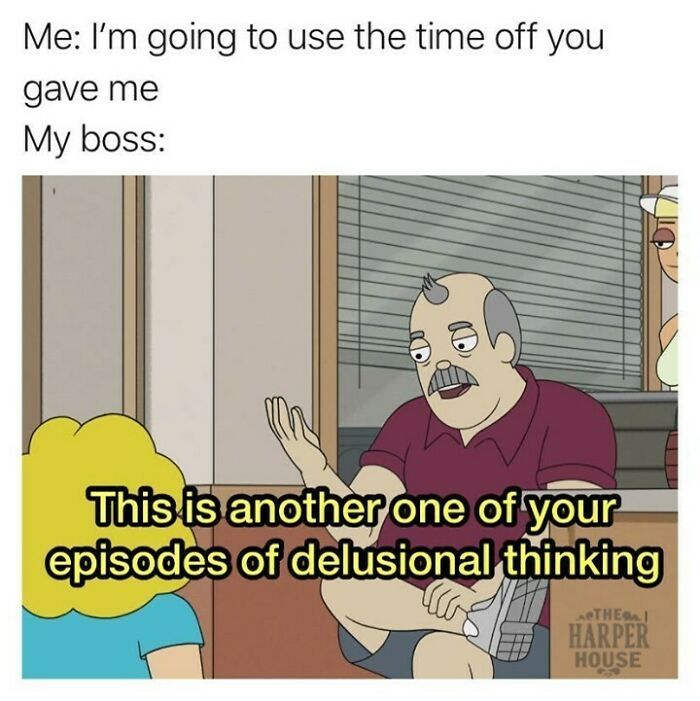

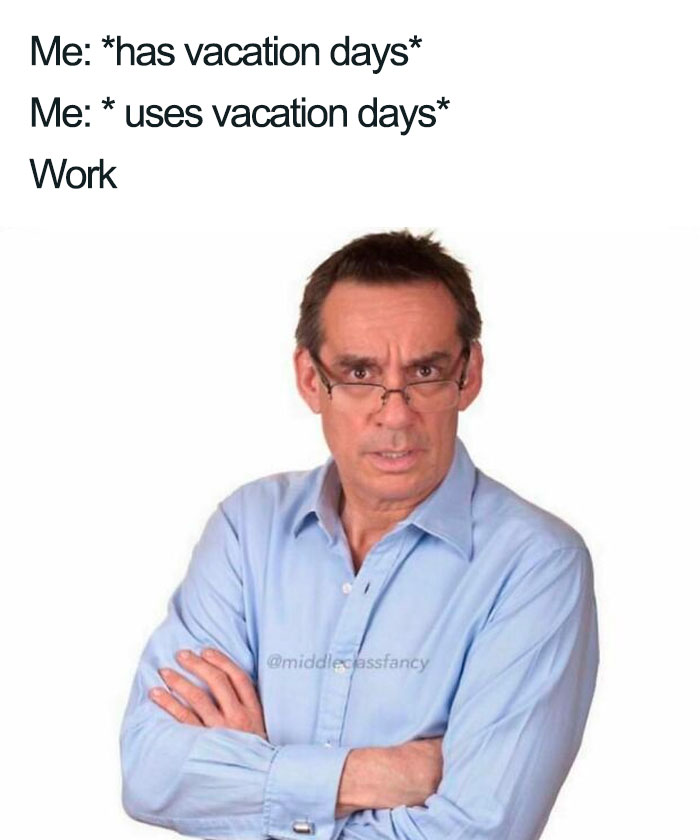

You Wanna Use Your Sick Days Too You Bag Of S**t?

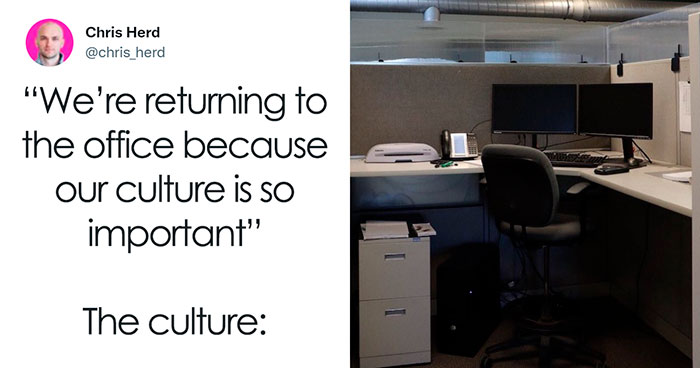

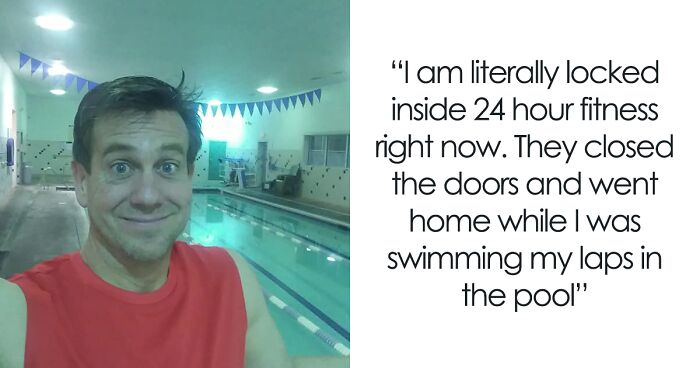

Let’s Have A Productive Day

That’s what I’ve been thinking - Middle Managers have realised how useless they actually are with WFH proving that employees work better without someone looking over their shoulder and organising pointless meetings to fill their days.

It’s Perfect

Love My Ninja Turtle And Gluten Allergy

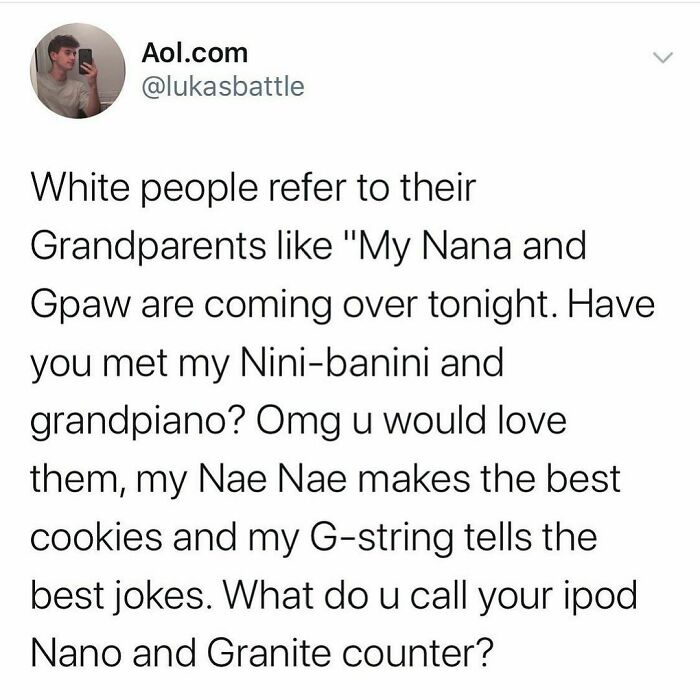

I once dated a woman who was wonderful: we really connected on both emotional and intellectual levels (the physical was pretty good too) - and then I heard her refer to her grandfather as "Peepoo". Not saying that was the end of the relationship, but it didn't last much longer.

Kohl’s Had A Sale

It’s Fall Y’all

It’s That Time Of Year Again

Had to look this up. It's a brand claiming that their main goal is to save the world. They do that by flying all over the world to photograph influenza's in exotic places.

Messy Bun And Getting Stuff Done

It’s The Kombucha Talking

Really BP, you you found anything this financial advisor Sam guy had to say as useful and worth repeating? Pay yourself first, always comes from someone who has never had a necessary service disrupted, run out of gas on the way to or from work, scrounged the parking lot for just a couple more coins to get a prescription, or gone to bed hungry. You pay whatever service is about to be disrupted, fill your gas tank, and get groceries. And that's all with what's left after all the damn overdraft fees have been paid to the bank. Then you pay whichever creditor is the scariest or most obnoxious, and because everything sucks, you go out for drinks and blow your last $30. And low income families have "synergies", they can just dress their kids in whatever hand me downs they get; "adjust" the clothes to match gender, if you're picky. Yeah, because socks, underwear, and sneakers are hand-me-downs this guy knows something about

I'll try empathy and understanding for the well-off when they show empathy and understanding for me. I'm homeless.

Oh my god I don’t care about your opinion, just show me the f*****g memes

There's stuff to read?! Lol. I just skip over it and look at the memes.

Load More Replies...A) The population of the top economic status isn't getting bigger; just its share of the wealth is. B) The 2008 housing crisis was caused entirely by the banking industry. Watch The Con documentary to find out how it happened, and then watch theAnalysis.news afterwards. They have a 9-part series called The Best Way to Rob a Bank Is to Own One, interviewing the former Federal banking regulator and the author of the book of the same name, Bill Black, who breaks it down detail by detail.

What the actual f...? I did not delete that comment!

Load More Replies...Really BP, you you found anything this financial advisor Sam guy had to say as useful and worth repeating? Pay yourself first, always comes from someone who has never had a necessary service disrupted, run out of gas on the way to or from work, scrounged the parking lot for just a couple more coins to get a prescription, or gone to bed hungry. You pay whatever service is about to be disrupted, fill your gas tank, and get groceries. And that's all with what's left after all the damn overdraft fees have been paid to the bank. Then you pay whichever creditor is the scariest or most obnoxious, and because everything sucks, you go out for drinks and blow your last $30. And low income families have "synergies", they can just dress their kids in whatever hand me downs they get; "adjust" the clothes to match gender, if you're picky. Yeah, because socks, underwear, and sneakers are hand-me-downs this guy knows something about

I'll try empathy and understanding for the well-off when they show empathy and understanding for me. I'm homeless.

Oh my god I don’t care about your opinion, just show me the f*****g memes

There's stuff to read?! Lol. I just skip over it and look at the memes.

Load More Replies...A) The population of the top economic status isn't getting bigger; just its share of the wealth is. B) The 2008 housing crisis was caused entirely by the banking industry. Watch The Con documentary to find out how it happened, and then watch theAnalysis.news afterwards. They have a 9-part series called The Best Way to Rob a Bank Is to Own One, interviewing the former Federal banking regulator and the author of the book of the same name, Bill Black, who breaks it down detail by detail.

What the actual f...? I did not delete that comment!

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

![I Feel Like I’ve Seen This Episode Before, But I Don’t Remember It Being So [bad] I Feel Like I’ve Seen This Episode Before, But I Don’t Remember It Being So [bad]](https://www.boredpanda.com/blog/wp-content/uploads/2021/09/CJEZLIWh40R-png__700.jpg)