Expert Teaches Woman How To Manage Finances After Marriage: “Not What She Wanted To Hear”

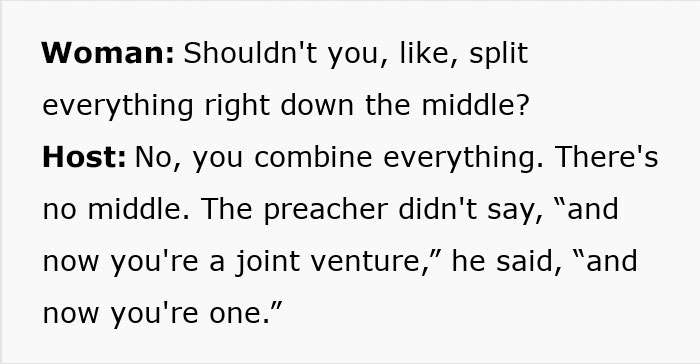

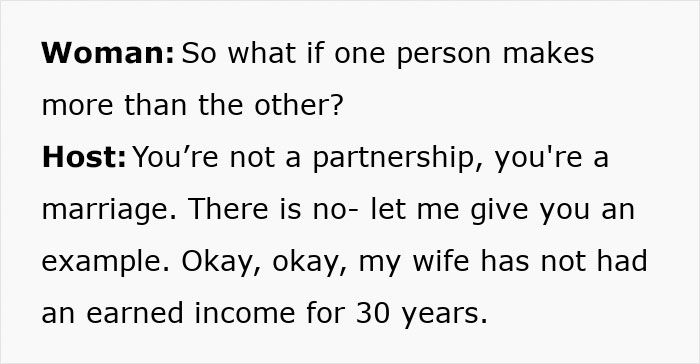

Interview With ExpertShould married couples merge their incomes and have one joint account? Financial expert Dave Ramsey seems to think so. But it’s a controversial topic, and not everyone agrees. In a TikTok video that’s since garnered thousands of views, Ramsey says money shouldn’t be a ‘me’ thing, it should be a ‘we’ thing. The expert says that sharing equally can only lead to a stronger, healthier marriage that is built on trust, teamwork, and accountability.

The guru was responding to a woman who wanted to know whether money should be shared equally even if one spouse earns more than the other. “You’re married. You’re not roommates!” Ramsey replied. And while some people welcomed his words, others were quick to point out that this kind of financial advice can backfire. Bored Panda spoke to WalletHub‘s financial writer and analyst Chip Lupo for his take on the matter.

Dave Ramsey is a well-known financial guru who has become a go-to when it comes to money advice

Image credits: daveramsey

But not everyone agrees with him when it comes to how married couples should manage their finances

Image credits: Getty Images (not the actual photo)

Image credits: Alexander Mils (not the actual photo)

Image credits: daveramsey

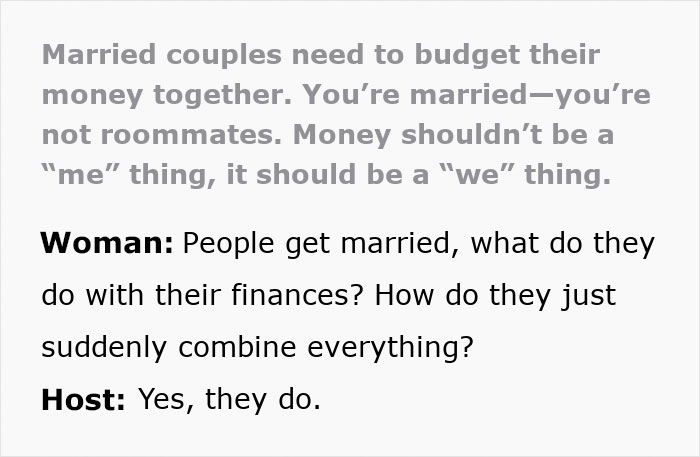

Survey reveals nearly 2 in 5 people have a bank account their partner doesn’t know about

Dave Ramsey is a self-made millionaire. He had a net worth of over one million by the age of 26 but soon got trapped by debt and lost everything. After clawing his way back to the top, he made it his business to teach others how to manage money responsibly and flourish.

His podcast, The Dave Ramsey Show, attracts millions of listeners every week. Many people trust him and go to him for advice. Just like the woman who wanted to know how married couples should navigate their finances after they tie the knot.

“Keeping separate accounts creates financial secrets and division,” wrote Ramsey in a separate Facebook post. “When you combine your income, goals, and expenses, you’re building trust, teamwork, and accountability—essential for a successful marriage.”

A survey conducted by personal finance company WalletHub found that nearly 2 in 5 people keep financial secrets, and have a bank account their partner doesn’t know about. The same survey found that around 1 in 3 people believe that sharing a financial account leads to more money problems rather than preventing them.

In an interview with Bored Panda, WalletHub writer and analyst Chip Lupo said the best way for married couples to manage their money depends on their unique financial dynamics, but stressed that open communication and shared goals are key. “Whether you decide to combine all your accounts, keep them separate, or go with a mix of both, the key is transparency and trust,” Lupo told Bored Panda.

“We can’t keep each area of our marriage neatly separated”: Dave Ramsey explains

Ramsey warns that money touches everything. And if there are arguments about finances, the tension can spill over into areas like trust, parenting, or intimacy.

Another expert, Lindsay Bryan-Podvin, agrees. The financial therapist and author of The Financial Anxiety Solution believes that merging money decreases the likelihood of financial infidelity. Research has shown that finances are a common cause of arguments for couples. And Bryan-Podvin says this often happens when each spouse has completely separate accounts.

“Maybe somebody is racking up a ton of credit card debt or taking out personal loans. Or maybe they don’t have a great credit score and aren’t working on improving it,” Bryan-Podvin told NPR. She says when couples have a joint bank account, these issues are out in the open from the beginning.

“If one person has taken on a lot of debt or exercises poor financial habits, it could affect both partners,” warns Lupo. “When everything is pooled together, their financial plight also becomes yours.” He adds that when or if these kinds of financial secrets emerge, they can really shake the trust in the relationship.

While Ramsey believes in the “what’s mine is yours, what’s yours is mine” strategy, Lupo says this doesn’t work for all couples.” Although the idea of combining everything can make things simpler and avoid any confusion about who owes what, it’s not for everyone,” he explained.

“If there’s a big income gap or different spending habits, merging everything could lead to feelings of resentment. Some couples feel more comfortable keeping things separate, while still sharing joint expenses. That way, they can maintain some independence while still working together.”

Bryan-Podvin also believes some financial independence is important. She suggests a “theirs, mine, and ours” approach.

This means there’s a joint account where the bulk of your money is shared. It’ll be used to make sure that bills, rent, mortgage, vehicles, etc. are paid on time. Additionally, the couple can save toward future goals together.

But each spouse also has their own separate account with a bit of money for small purchases. For example, a pair of jeans. “None of us want to feel like we are under the control of our partner, so having some financial autonomy is important,” explains Bryan-Podvin.

Lupo says it’s essential to set clear boundaries, “like deciding how much either partner can spend without checking in with the other.” And when it comes to tackling debt, he advises that having a plan in place can relieve a lot of pressure.

“Ultimately, making sure both of you are on the same page with shared financial goals, whether it’s saving for a home or paying off debt, will keep you moving in the right direction as a team,” Lupo told Bored Panda. “Regular check-ins or even ‘money dates’ can help ensure things stay on track and prevent misunderstandings down the road.”

Ramsey says he’s heard time and again that couples who combine accounts and work together experience fewer fights about money, achieve their goals faster and have stronger relationships. And this has been proven by at least one study.

A few years ago, the American Psychological Association (APA) explored whether the way in which couples keep their money affects happiness in their relationship. Upon releasing their research results in 2022, APA revealed that “couples who pool all of their money (compared to couples who keep all or some of their money separate) experience greater relationship satisfaction and are less likely to break up.”

“It cannot be emphasized enough that the most important thing is communication,” Lupo once again stressed. “Whatever approach you take, if you both feel comfortable and respected, combining finances can work. It’s all about finding what feels right for you as a team.”

“No man will take MY house, MY money, MY car”: not everyone welcomed Ramsey’s advice

Poll Question

Thanks! Check out the results:

9Kviews

Share on FacebookLike so many things in marriage, there's no one size fits all rule. Do what makes the most sense for you.

Agreed. However, if you have reservations about a combined income such as this, where it's all equal regardless of who makes more, that can be a concern. All the successful marriage s I know are like the dude said, money, expenses, resources, it's all ours, us. Nothing is me, mine. We pay for the groceries, we make $$ per, even if only one works, we are paying for spouses surgery, etc. Even this seemingly casual use of words is very powerful. I wish I'd learned these things before marriage

Load More Replies...You can call it 'our' all you want. But serious income imbalance has led to all kinds of abusive situations and was one of the main drivers of the women lib movement. 'They'd never do that to me' until the day you seriously displease the other and suddenly it is very clear exactly whose money it actually is.

I stated above and I'll state again. If this is you're relationship/marriage you're settling and you didn't marry someone where true trust exists. 15 years married and my wife has at times made more than me and the opposite. We have NEVER discussed what's hers and mine. Everything is ours. We have run the gambit from struggling to afford groceries to our current situation of being faily comfortable and not just the good but the bad have been shared. Early on we regularly sat down to dinners of craft mac and cheese and a 3$ bottle of wine but we both worked hard and supported each other to better our situation my wife is pretty amazing but I'm not what you call ambitious. The partnership drove me to do better. Being part of the "team". Not criticism per say but if your partner holds money over your head they aren't your partner.

Load More Replies...Marriage is a partnership. Two partners. Who discuss issues and decide on solutions that work for THEM. Some people combine all finances. Some feel better combining only a portion. It doesn’t matter what their solution is, only that it’s the solution that works for them! Married couples must have that conversation and, when the situation changes, have a follow-up conversation. That is how you keep a marriage alive and working. Good grief. This is not rocket science. It’s Basic Partnership 101.

Agreed. It's two partners, not two partners and some random guy.

Load More Replies...Like so many things in marriage, there's no one size fits all rule. Do what makes the most sense for you.

Agreed. However, if you have reservations about a combined income such as this, where it's all equal regardless of who makes more, that can be a concern. All the successful marriage s I know are like the dude said, money, expenses, resources, it's all ours, us. Nothing is me, mine. We pay for the groceries, we make $$ per, even if only one works, we are paying for spouses surgery, etc. Even this seemingly casual use of words is very powerful. I wish I'd learned these things before marriage

Load More Replies...You can call it 'our' all you want. But serious income imbalance has led to all kinds of abusive situations and was one of the main drivers of the women lib movement. 'They'd never do that to me' until the day you seriously displease the other and suddenly it is very clear exactly whose money it actually is.

I stated above and I'll state again. If this is you're relationship/marriage you're settling and you didn't marry someone where true trust exists. 15 years married and my wife has at times made more than me and the opposite. We have NEVER discussed what's hers and mine. Everything is ours. We have run the gambit from struggling to afford groceries to our current situation of being faily comfortable and not just the good but the bad have been shared. Early on we regularly sat down to dinners of craft mac and cheese and a 3$ bottle of wine but we both worked hard and supported each other to better our situation my wife is pretty amazing but I'm not what you call ambitious. The partnership drove me to do better. Being part of the "team". Not criticism per say but if your partner holds money over your head they aren't your partner.

Load More Replies...Marriage is a partnership. Two partners. Who discuss issues and decide on solutions that work for THEM. Some people combine all finances. Some feel better combining only a portion. It doesn’t matter what their solution is, only that it’s the solution that works for them! Married couples must have that conversation and, when the situation changes, have a follow-up conversation. That is how you keep a marriage alive and working. Good grief. This is not rocket science. It’s Basic Partnership 101.

Agreed. It's two partners, not two partners and some random guy.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

5

44