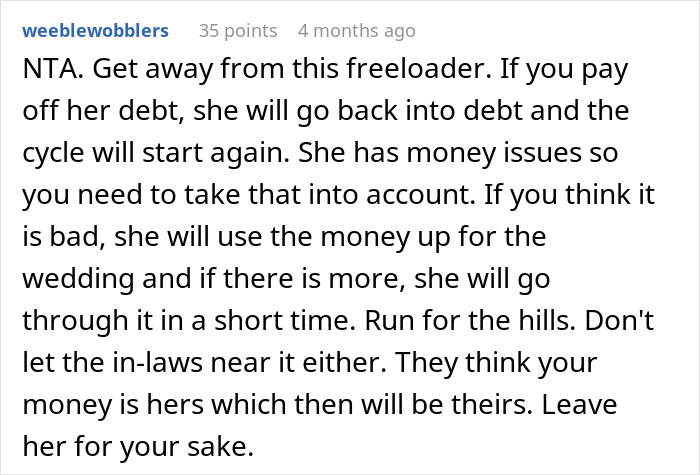

Man Deposits Money He Won At Casino, Fiancée Trashes Entire Room Trying To Find It So She Can Pay Off Her Debts

InterviewYou probably have thought about winning a large sum of money in the lottery. That sweet thought of all the things you’d do with that cash is something than can keep you awake at night.

For this 31-year-old guy, this became a reality after “winning a large jackpot.” The thing is since he’s now engaged, his 34-year-old fiancée who “is not good with money,” in the OP’s words, expects his money will be hers.

The problem is that the author’s soon-to-be-wife has been struggling with debt since she graduated from college. “My fiancée kept begging me to use all of the money on her debt,” the author explained, but he’s concerned that will only make matters worse.

A man won a large jackpot in the casino, so his fiancee expects him to put all that money into paying off her debts

Image credits: shotsstudio (not the actual photo)

He refused to do so for fear that it will only make her more financially irresponsible

Image credits: nebojsa_ki (not the actual photo)

The OP was going to use the money for bills, mortgage, and his car loan, which maddened his fiancee

Image credits: Fragrant-Leading-616

With limited financial resources, lower wages and shorter credit histories, young adults are struggling to manage high-interest debt more than any other age group, according to a new report by Urban Institute. Nearly one in five adults between the ages 18 and 24 with a credit record in the U.S. currently have debt in collections.

Recent data from the New York Fed Consumer Credit Panel and Equifax shows that Americans 18-29 years old owe a whopping $1.05 trillion in debt. While the debts are mostly student loans, they also include auto loans, credit card debt, mortgage debt and other forms of consumer credit.

Image credits: duallogic (not the actual photo)

According to Forbes, the last time this age group owed more than $1 trillion in debt was the fourth quarter of 2007, near the time of the 2008 financial crisis.

Zack Friedman, the Founder & CEO of Mentor Money, argues that proactive measures are very important for anyone considering paying off their debt. They include: refinancing student loans, consolidating credit card debt, improving your credit score and getting access to lower interest rates. Another important measure to think of is increasing your income, which will reduce your debt-income ratio.

Image credits: Netfalls (not the actual photo)

“The debts that matter most are the ones that have more than just monetary consequences,” a finance expert warns

Bored Panda reached out to James Andrews, a personal finance expert at Money.co.uk, who said that the big thing to remember is that not all debts are equal.

“The debts that matter most, though, are the ones that have more than just monetary consequences,” he said. “You can be jailed for non-payment of council tax, for example, while not keeping up with rent or a mortgage could see you evicted.”

Andrews said that any money you have spare needs to go to making sure you’re up to date with these first. “After that, put spare cash towards whatever’s charging you the most interest. This pays off in the long run – because each extra pound you pay off your expensive debts means less interest is charged overall and more cash for you.” That makes each debt you tackle after that easier and easier to clear.

“But ignoring ever-rising bills just makes things worse as interest builds, charges mount and the fallout becomes bigger and bigger,” the finance expert warns.

If you find yourself struggling to find the money to cover your debts, you need to get help straight away

If you find yourself struggling to find the money to cover your debts, Andrews’ advice is to get help. “Straight away.” If you live in the UK, there are free, independent debt charities that won’t judge you and can help you. “Stepchange and National Debtline are good places to start.”

Moreover, “if you live in England or Wales, debt advisers can even get you up to 60 days’ breathing space from interest, fees and court action related to debts to help reduce stress and give you time to sort out your payments,” Andrews said.

Many people expressed their support for the author

"my current fiance", "we are in no hurry to get married" - I think it's dawning on him that this might not be such a good idea after all :)

They can't afford to get married. She's lumbered with a heap of debt.

Load More Replies...Normally i hate the "break up immediately" advise you see in almost every post but this time, after reading she trashed the room looking for the money i definitely hope he breaks up with this woman. Maybe she has many otger good qualities but this is insane.

It’s never a great idea to marry someone who you can’t trust financially. Better to figure that out early, instead of learning through a divorce and bankruptcy like myself 🤦

Load More Replies..."my current fiance", "we are in no hurry to get married" - I think it's dawning on him that this might not be such a good idea after all :)

They can't afford to get married. She's lumbered with a heap of debt.

Load More Replies...Normally i hate the "break up immediately" advise you see in almost every post but this time, after reading she trashed the room looking for the money i definitely hope he breaks up with this woman. Maybe she has many otger good qualities but this is insane.

It’s never a great idea to marry someone who you can’t trust financially. Better to figure that out early, instead of learning through a divorce and bankruptcy like myself 🤦

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

95

109