If You’ve Recently Hit The Jackpot Or Got Any Sudden Wealth, This Guy’s Advice Is Exactly What You Need

My father-in-law had a habit for decades – every Saturday he bought a few lottery tickets and then excitedly told everyone what he would buy after he hit the jackpot. These conversations usually ended immediately after the next drawing. He passed away over a year ago, and his biggest win was still 20 bucks.

Mathematics and probability theory give us a cold shower about the chances of winning the lottery – it’s about 1 in 13,983,816 in the case of only 6 balls (without any powerballs), but excitement and fantasy make many of us take risks anyway. In the end, it’s not so much the wealth that matters, but the anticipation of it. And advice on how to spend the huge amount of money that unexpectedly fell on us.

More info: TikTok

In case you hit a huge lottery jackpot, don’t rush to brag and spend big – just think wiser!

Image credits: maxxxheron

This dad from Canada once went viral with his reasonable video of financial planning advice

Rod Oracheski, a Canadian dad, gamer, and devoted hockey fan, as he introduces himself on his TikTok account (God bless America, we still have a chance to watch his and other folks’ videos!), once went viral with his purely weighed roadmap for anyone who’d just hit the jackpot or got any other sheer wealth.

Rod’s video has over 6.4M views and nearly 7K various comments, so it’s definitely worth watching. So what does this guy advise us? First of all, as the characters in the Fight Club movie used to say, “Do not talk about Fight Club!” In other words, if you win the lottery, don’t brag to everyone about it. First, make sure to play it safe.

Image credits: rod_oracheski

Rod advises you to immediately contact a trusted lawyer – and best of all, some good and expensive law firm (damn, you now have money to pay for their services!) so that they can represent your interests. If you want to share some of the money with relatives or friends, allocate about 15%-20%, and fix it on paper with a lawyer.

Image credits: rod_oracheski

So the main idea is to ensure your financial stability first with smart investing

Then the author of the video recommends spending part of the money on ensuring your financial security for the coming years and decades. In other words, investing in US treasuries or buying government bonds (if you live in America or another G7 country), shares and stocks of reliable companies.

Image credits: Erik Mclean / Pexels (not the actual photo)

Next – setting up a series of trusts that help with higher education, purchasing a first home and whatnot. And only then, when you have provided yourself with a certain “financial safety net,” can you start spending the remaining money at your own discretion – houses, cars, wedding gifts to your friends and other things like that.

Image credits: Alexander Grey / Unsplash (not the actual photo)

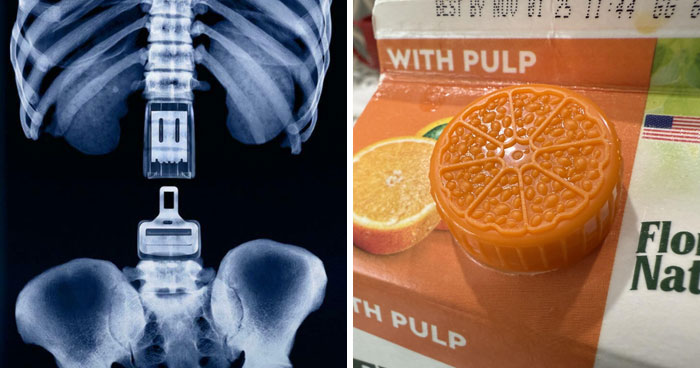

Investing in real estate could also be quite risky, and so is crypto

Well, in any case, the advice from Mr. Oracheski is very rational and thoughtful. After all, even an investment in real estate can be unsuccessful. As, for example, happened to Edwin Castro, the owner of the largest jackpot in the history of lotteries, who recently lost his $3.8M Malibu home in the Palisades Fire. A smartly built investment portfolio is almost a guarantee of preserving or even increasing your winnings.

As for choosing assets for investment, the author of the video strongly advises against hiring a dedicated investment manager and being guided by your own expectations. For example, The Times agrees with this idea, advising in such cases to focus on shortlists published by investment platforms to help narrow down the choice.

“There is no guarantee the funds on these shortlists will perform better than those that are not. But at the very least, having a look can help give you investment ideas,” this article from The Times says. As for investing in cryptocurrencies, their volatility has already become legendary, so if your goal is to provide yourself and your descendants with a comfortable future, it is better to choose something more classic.

You can watch the original video here

@rod_oracheski#stitch with @maxxxheron #lottery#lotterywinner#advice♬ Chillest in the Room – L.Dre

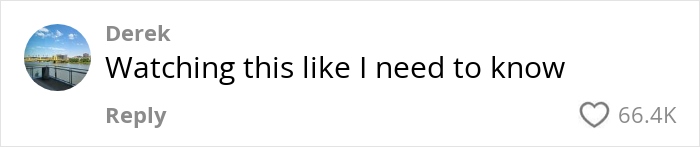

As for the commenters on Mr. Oracheski’s video, many folks thanked him for his sensible advice, although they noted that 15%-20% for family and friends can be a hell of a lot. Depending on their mood, some responders are willing to give away even just 1% of their probable winnings. And the wisest people thought the first piece of advice was to simply keep everything a secret.

However, some commenters also noted that no matter how reasonable and balanced this strategy may seem, the main problem here is, well, winning the lottery. “Why did I save this as if I am ever gonna get $50m,” someone wondered quite wittily. But, well, money can come to you not as a result of winning, but as a completely unexpected inheritance – as it happened, for example, with the hero of this story of ours.

Be that as it may, the advice in this video seems quite correct and wise for almost any financial situation. “Bookmarked just in case,” another person added in the comments. And what would you, our dear readers, do if you won some insanely big money in any lottery? Please feel free to share your thoughts in the comments below.

People in the comments praised the author for the wise advice, but noted that it remains just a little difficult to hit the jackpot!

Poll Question

Thanks! Check out the results:

Explore more of these tags

First thing you do is call your friends and family. Tell them you have hit on some hard times and can't make your rent or mortgage payment. Anyone that is willing to lend you a few hundred dollars is still on your friend and family list. Everyone else is on your "who are you, again?" list.

What if they literally haven’t got the money to lend?? It’s not fair to exclude those in poverty from a share of what would help them the most.

Load More Replies...To the one saying she is buying her mum a house. Go for it, buy it in the name of the trust you set up and give her right of residency for life. That way, if she is single, nobody is going to benefit that you did not intend if she remarries, also nobody is going to be able scam her, cheat her financially and make claims on her assets because she doesnt have them, the trust owns the assets and the recipients are by discretion of the executor who can say who gets the assets when she passes when setting up the terms of said trust..

First thing you do is call your friends and family. Tell them you have hit on some hard times and can't make your rent or mortgage payment. Anyone that is willing to lend you a few hundred dollars is still on your friend and family list. Everyone else is on your "who are you, again?" list.

What if they literally haven’t got the money to lend?? It’s not fair to exclude those in poverty from a share of what would help them the most.

Load More Replies...To the one saying she is buying her mum a house. Go for it, buy it in the name of the trust you set up and give her right of residency for life. That way, if she is single, nobody is going to benefit that you did not intend if she remarries, also nobody is going to be able scam her, cheat her financially and make claims on her assets because she doesnt have them, the trust owns the assets and the recipients are by discretion of the executor who can say who gets the assets when she passes when setting up the terms of said trust..

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

31

10