“I Don’t Understand How Stressed He Gets”: Wife Calls Husband Out On His Expensive Hobby

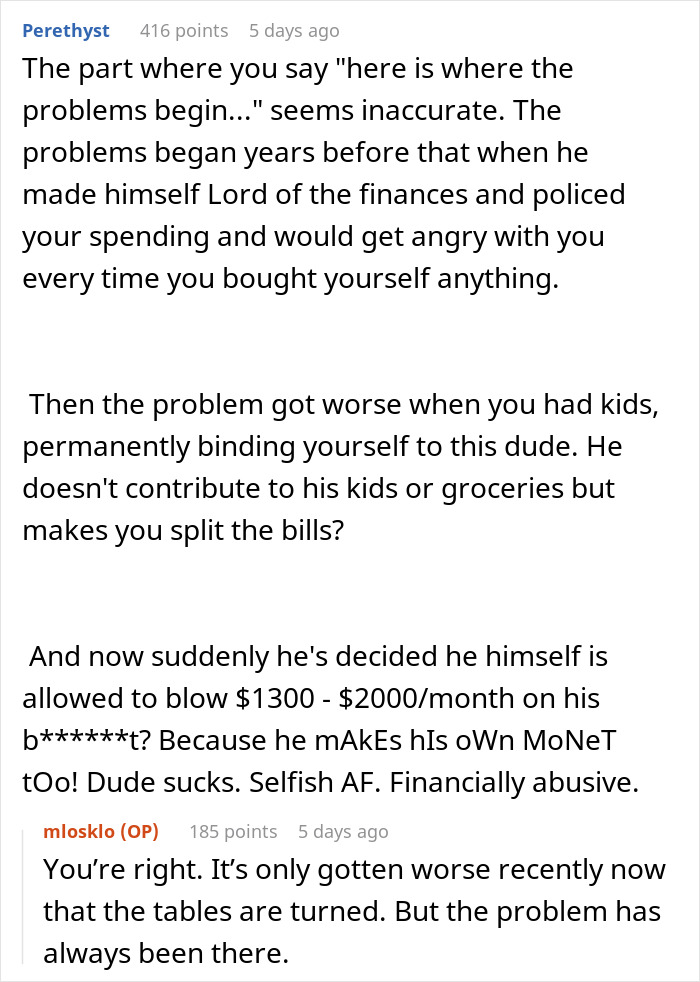

Last week, Reddit user Mlosklo made a post on r/TwoHotTakes to get something off her chest.

The woman said that she and her husband have been having increasingly bigger disagreements over money and that the tension has just reached new heights now that he’s begun collecting sports memorabilia.

According to her, the couple has tried both joining and separating their finances, but neither option seems to fully work for them, so she’s turning to the internet to vent her frustrations and is ready to welcome any advice people might have.

This couple can’t see eye to eye when it comes to their spending habits

Image credits: RDNE Stock project / pexels (not the actual photo)

And the wife can’t help but feel that her husband is invalidating her

Image credits: Karolina Kaboompics / pexels (not the actual photo)

Image source: mlosklo

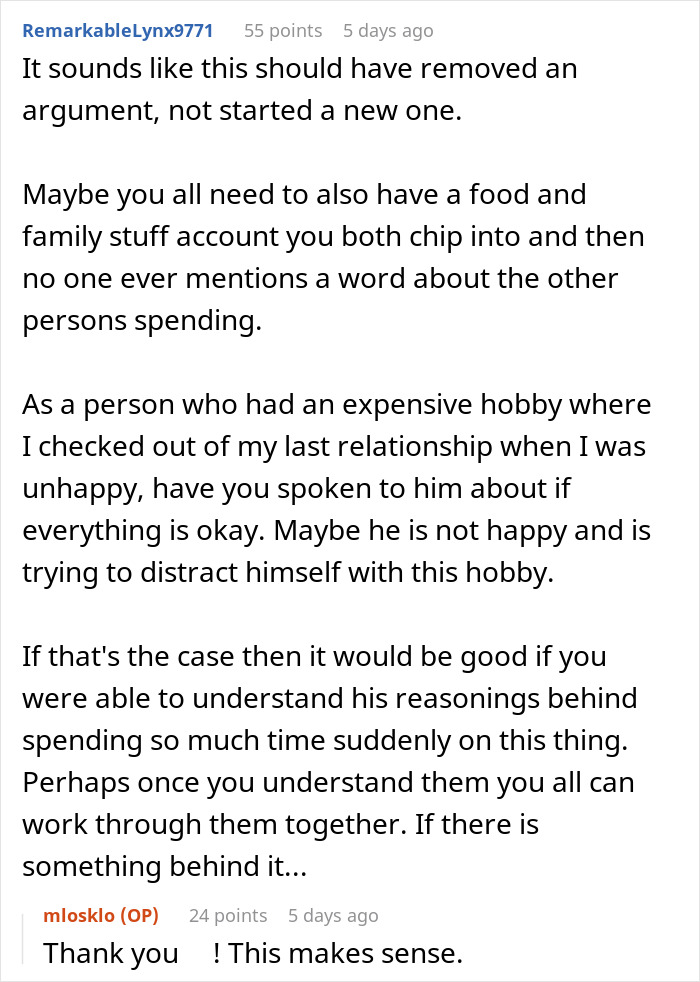

There are pros and cons to both combining finances and keeping them separate

Image credits: Mikhail Nilov / Pexels (not the actual photo)

According to a 2022 survey, about 43% of couples who are married, in a civil partnership, or living together have joint assets.

When you share all accounts with your partner, you rely on them to make the right money decisions; your own financial health depends on their habits.

But this arrangement also requires you to give away some of your autonomy.

If you and your partner have both established careers and financial assets, fully combining finances and sharing all accounts may be a challenge. As the story pointed out, if a couple is not earning and spending equally, conflicts may arise.

So who is better off? Those who keep their finances separate or those by share everything? To answer this question, researchers conducted six studies with more than 38,000 participants.

Those six studies included a variety of methods (e.g., cross-sectional, longitudinal, and experimental data sets) and were replicated in both individualistic and collectivistic cultures.

Their conclusion was that couples who put all of their money together were happier and less likely to break up, compared to other couples who kept some, or all, of their money separate from each other.

However, the author of the post and her husband aren’t the only ones who are having these problems. Another survey from 2023 discovered that a whopping 64% of couples admit to being “financially incompatible” with their partners, with different philosophies about spending, saving, and investing their money.

At least these two are trying to talk it out and settle their disagreements.

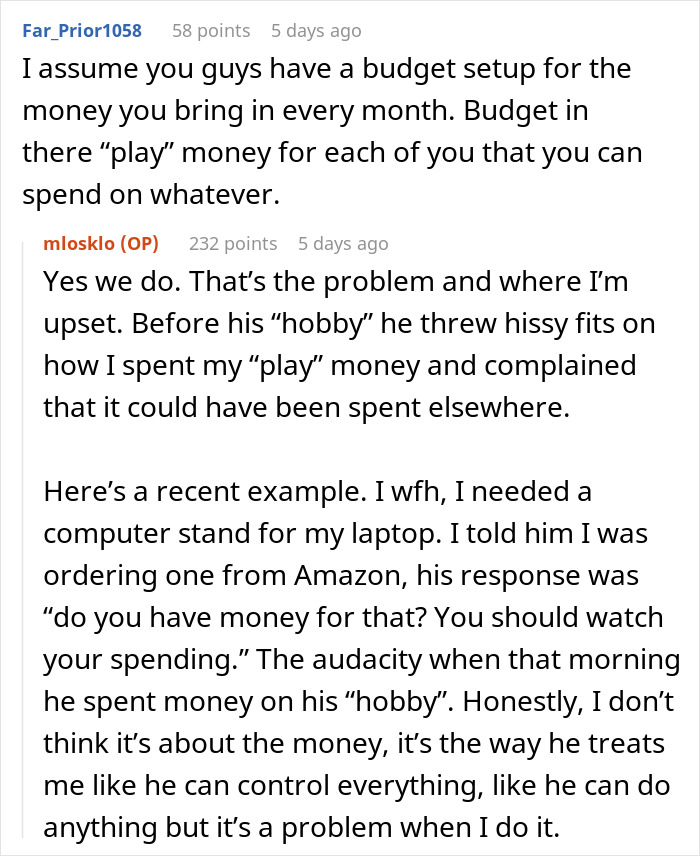

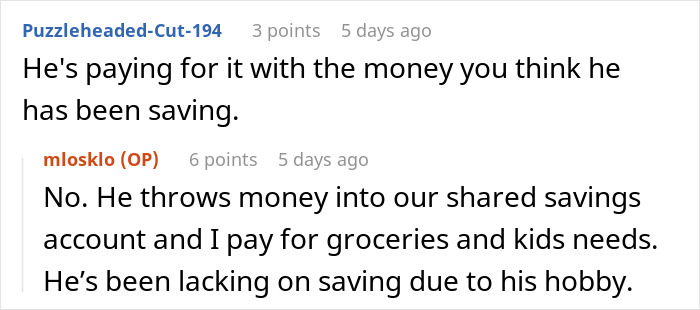

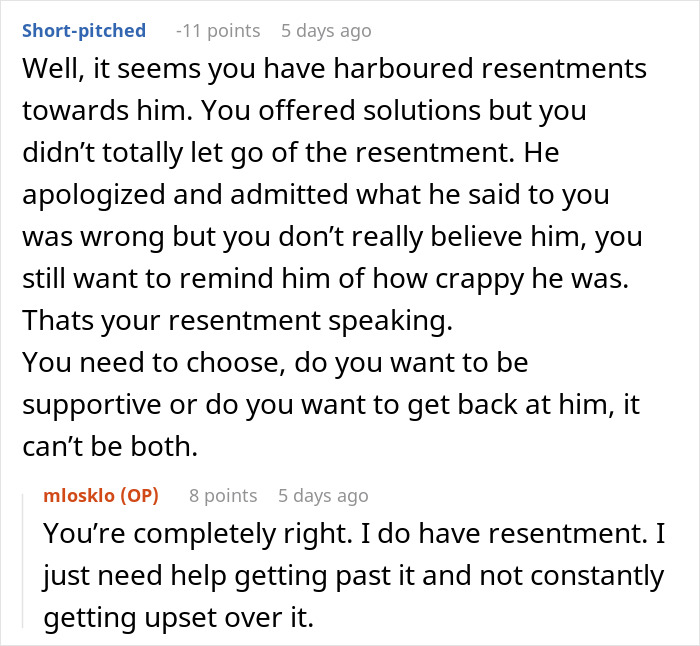

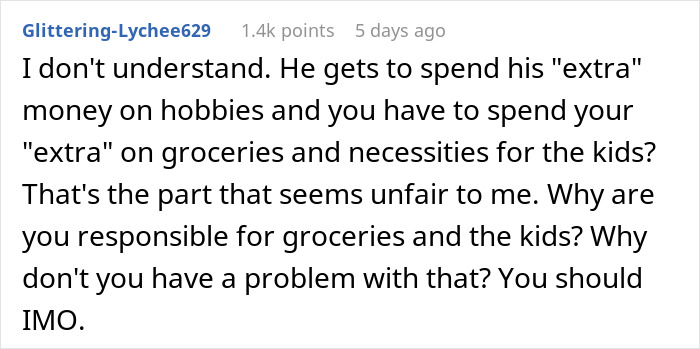

As people reacted to the story, its author joined the discussion in the comments

Her post has received a lot of reactions

Poll Question

Thanks! Check out the results:

Explore more of these tags

Don't leave because of the hobby, leave because he is a controlling bastard that makes his wife feel terrible on a regular basis.

Try this experiment. Go buy something only for yourself. A pretty new dress, some mid priced makeup, another computer gadget, anything. See how Mr. 'I was wrong' reacts to it.

Load More Replies...“It’s collecting. Sports related”. Is that the new code for gambling addiction? Anyone else thinking the same?

Don't leave because of the hobby, leave because he is a controlling bastard that makes his wife feel terrible on a regular basis.

Try this experiment. Go buy something only for yourself. A pretty new dress, some mid priced makeup, another computer gadget, anything. See how Mr. 'I was wrong' reacts to it.

Load More Replies...“It’s collecting. Sports related”. Is that the new code for gambling addiction? Anyone else thinking the same?

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

31

65