Man Shows No Interest In Marrying His Long-Time Girlfriend Until She Tries To Buy A House Alone

Interview With ExpertA healthy marriage is built on love, trust, communication, patience, and a willingness to compromise… But Reddit user Ok-Horror-2199 has just realized that her long-term partner wants to structure theirs primarily on real estate.

In a candid online confession, the woman said that she had been expressing her desire to get married for quite some time, but he would always avoid talking about taking their relationship to the next level — until he learned that she wanted to buy a house.

Suddenly, the prospect of a happily ever after became much clearer.

This woman thought her boyfriend wasn’t planning to marry her

Image credits: Mizuno K/Pexels (not the actual photo)

But everything changed when she informed him that she was serious about planning to buy a house

Image credits: Nataliya Vaitkevich/Pexels (not the actual photo)

Image credits: Mikhail Nilov/Pexels (not the actual photo)

Image credits: Pavel Danilyuk/Pexels (not the actual photo)

Image credits: Ok-Horror-2199

The timelines for buying a house and dating don’t always overlap

Image credits: Alena Darmel/Pexels (not the actual photo)

It may sound banal, but the key to deciding whether to invest in real estate with your partner isn’t some tricky secret known only to a handful of people — it’s the same relationship advice we’ve already heard: communication.

“Buying a house together can be a smart decision for an unmarried couple if both partners are financially stable, committed to their relationship, and share a clear vision for their future,” Lauren Kolazas, a real estate agent from Virginia, United States, told Bored Panda.

According to her, it makes sense when:

- You’re in a long-term, committed relationship. “If you both see a future together and have been building a stable partnership, buying a home can be a step toward creating shared roots,” Kolazas explained.

- Your finances are solid. “If both of you have good credit, reliable incomes, and enough savings for a down payment and emergencies, you’re in a stronger position to take on homeownership.”

- You have open communication. Kolazas said that successful co-ownership requires being honest with one another, not just about money but also expectations and responsibilities.

- You agree on the purpose of the property. “Whether you plan to live there long-term, rent it out, or eventually sell, it’s important to align with your goals,” she added.

- You’re willing to put legal protections in place. Lastly, unmarried couples don’t have the same legal rights as married couples, so Kolazas highlighted that having a co-ownership agreement can help protect both parties should things turn sour.

The real estate agent has spent two decades in the industry, and for those unmarried couples who want to set themselves up for success, she suggested they:

- Create a co-ownership agreement. “Work with an attorney to draft a legal agreement that outlines how you’ll divide ownership, handle expenses, and navigate situations like a breakup or selling the property,” Kolazas said.

- Discuss finances upfront. “Be transparent about your income, savings, debts, and credit scores. Decide how you’ll split the down payment, mortgage, and ongoing expenses.”

- Plan for the unexpected. There are so many things that can change over the years—talk about what happens if one partner wants to sell, move out, or faces a financial setback. “Having a clear exit strategy is key,” Kolazas highlighted.

- Decide on ownership structure. “Options include joint tenancy (equal ownership with rights of survivorship) or tenants in common (ownership can be unequal and passed to heirs),” she said. “A legal professional can advise on what’s best for your situation.”

- Budget for more than the mortgage. Similar to how a car needs more than gas, homeownership comes with maintenance costs, property taxes, and insurance. “Make sure both partners are comfortable with the full financial picture,” the real estate agent said.

Conversely, if we flip the script, we will begin to see circumstances under which it might not be a good idea to take your unmarried partner house hunting:

- Lack of financial stability. “If one or both of you have unstable incomes, high debt, or poor credit, it might be better to wait until your finances improve,” Kolazas advised.

- Unclear commitment levels. “If you’re unsure about the future of your relationship or haven’t been together long, the risks of co-owning a home may outweigh the benefits,” she said.

- Poor communication. If a couple are having frequent conflicts or one of them is hesitant to be transparent, it’s a red flag.

- No legal agreement. “Skipping a legal agreement leaves both partners vulnerable if disagreements arise,” Kolazas reiterated.

- Misaligned goals. If one partner views the home as a long-term investment and the other sees it as a short-term stepping stone, buying together may cause friction.

While the situation our Redditor has found herself in does sound like an emotionally taxing one, the woman can try to look at it this way: she may have found out that there’s no future for her with that man. And while breakups can be incredibly difficult, parting ways due to (financial) incompatibilities early on might be better than learning about them after you’ve taken on hundreds of thousands of dollars worth of commitments.

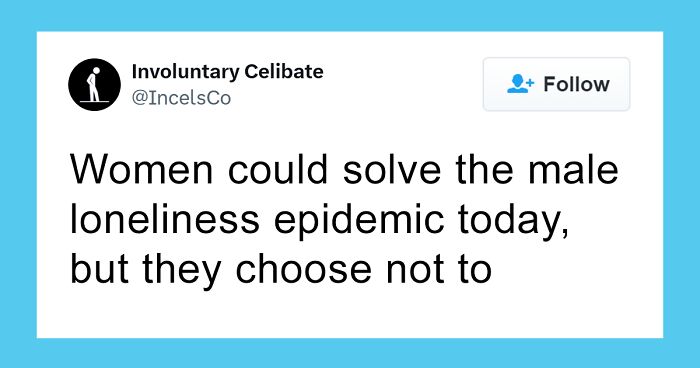

People who read the woman’s story understand her suspicion

Poll Question

How should Ok-Horror-2199 approach the home buying decision?

Buy independently

Include boyfriend in decisions

Postpone the purchase

Discuss with family

Thanks but no thanks. You'll be actually better off taking in a paying lodger, who will pay more monthly (I predict more than what he's offering), will provide their own food, and wouldn't dream of demanding equity!

Thanks but no thanks. You'll be actually better off taking in a paying lodger, who will pay more monthly (I predict more than what he's offering), will provide their own food, and wouldn't dream of demanding equity!

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

42

26