The Internet Is Mocking The ‘Poor’ Millionaires That Are Losing Money In Their Hedge Funds By Telling Them To Just ‘Work Harder’ (52 Pics)

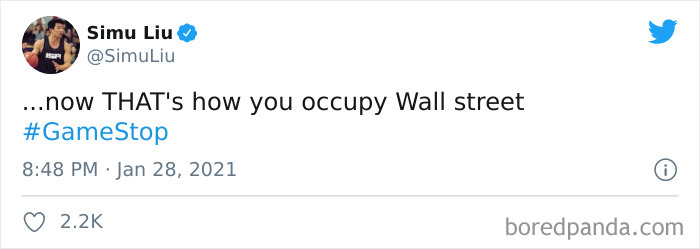

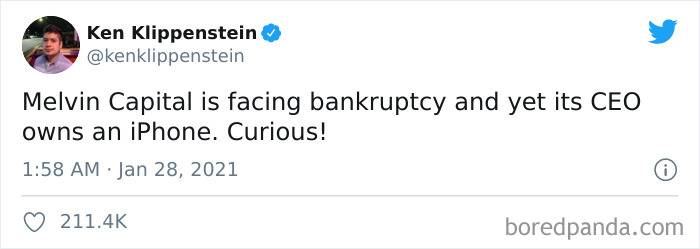

Call it a Reddit Rebellion or Occupy Wall Street: Reddit Edition, but what we’re now witnessing in the stock market is rather, let's put it this way, “unprecedented.” A small group of Reddit traders from r/WallStreetBets sent GameStop shares soaring, causing billions in losses to billionaire Wall Street investors.

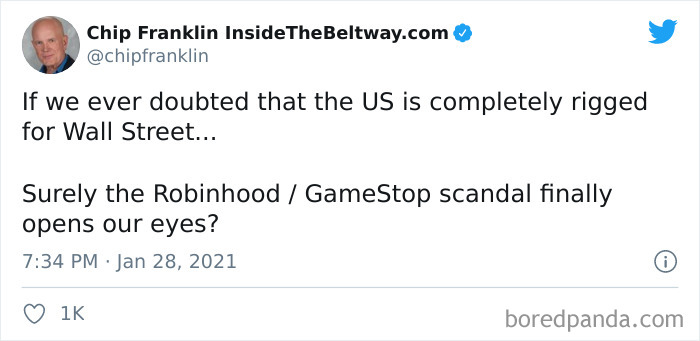

At this point, the GameStop turmoil has far exceeded the walls of the online forum and got the White House monitoring the situation. Meanwhile, amid outcry over limiting GameStop trades, the brokerage app Robinhood is about to reopen “limited buys” again this Friday.

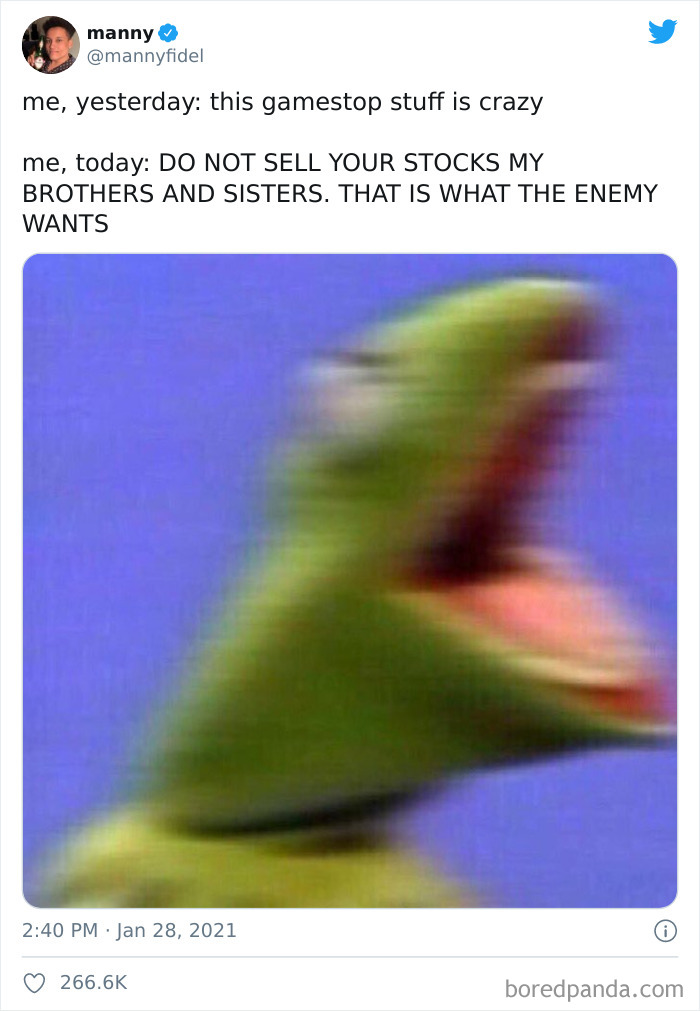

And just a day ago, a Reddit trader penned this viral open letter explaining the real motives behind the group’s resentment for the Wall Street giants. Turns out, they’re not backing down. Did someone say something about 2021 being "boring?"

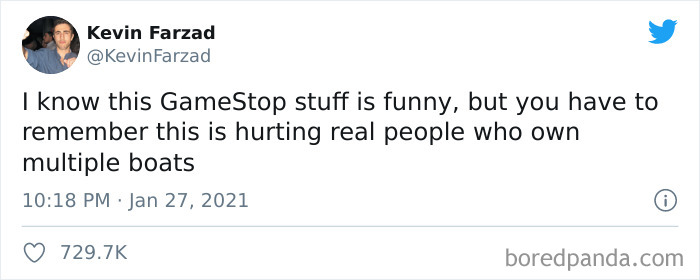

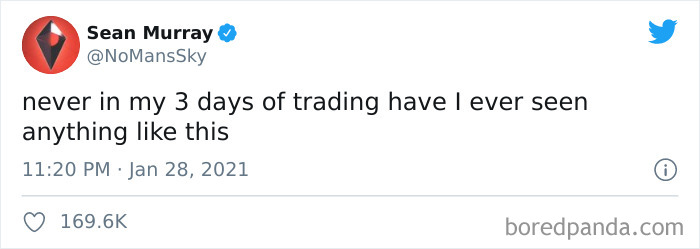

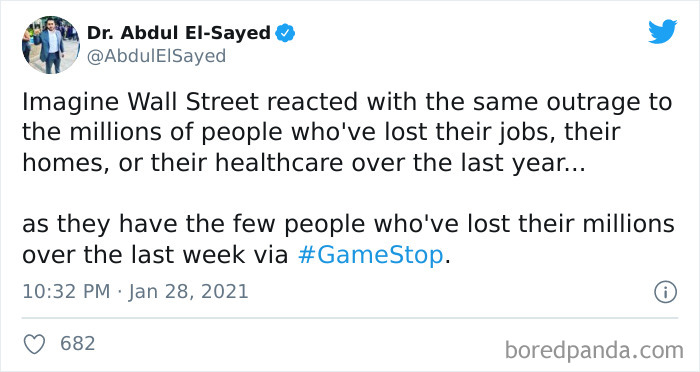

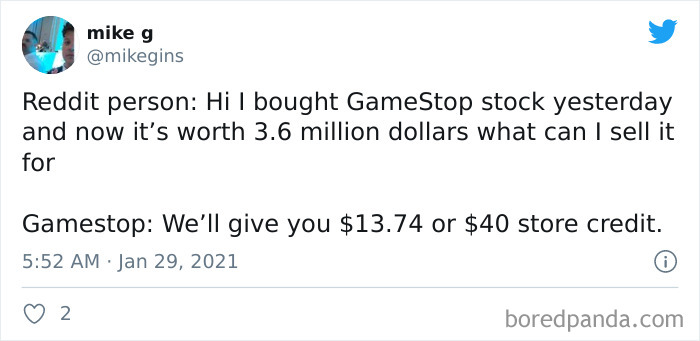

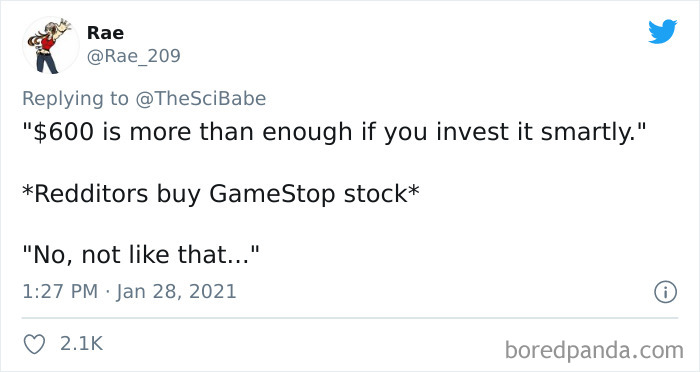

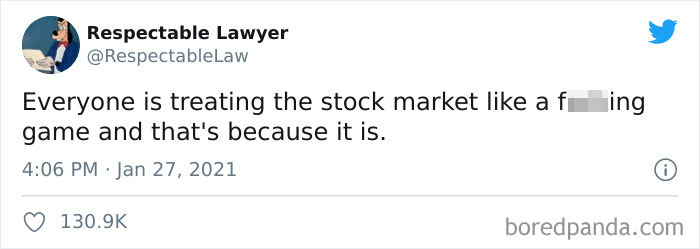

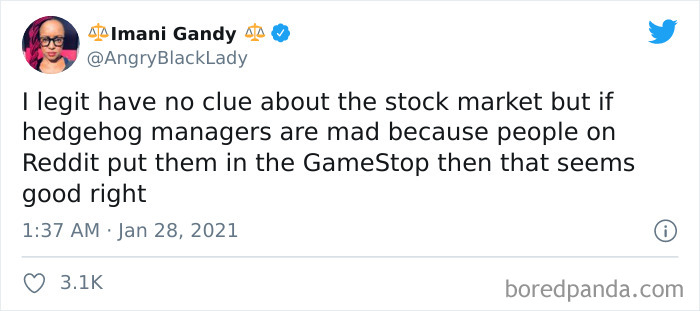

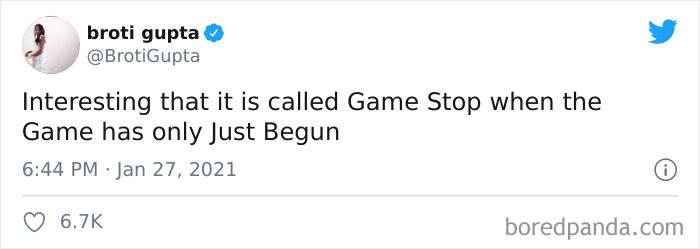

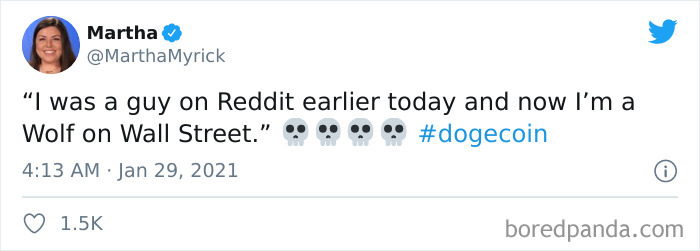

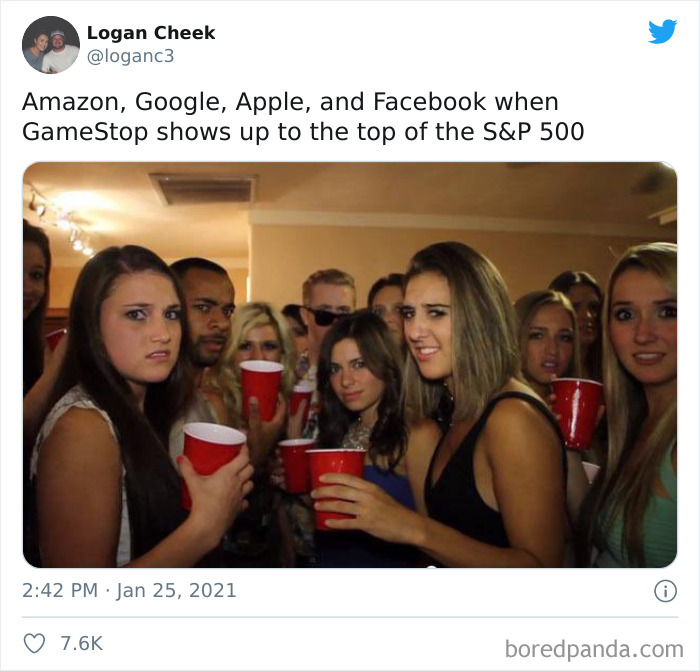

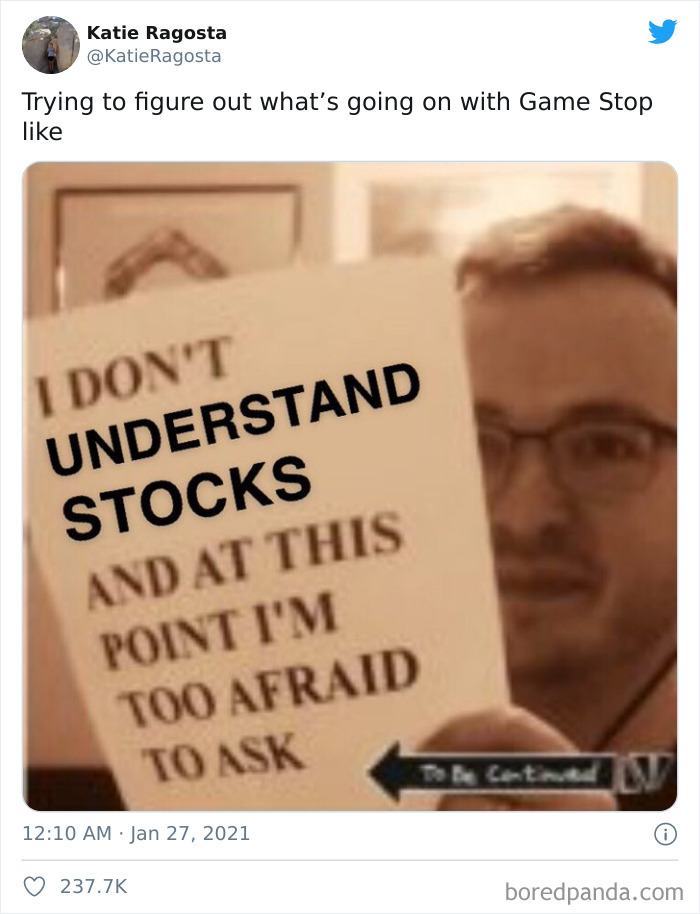

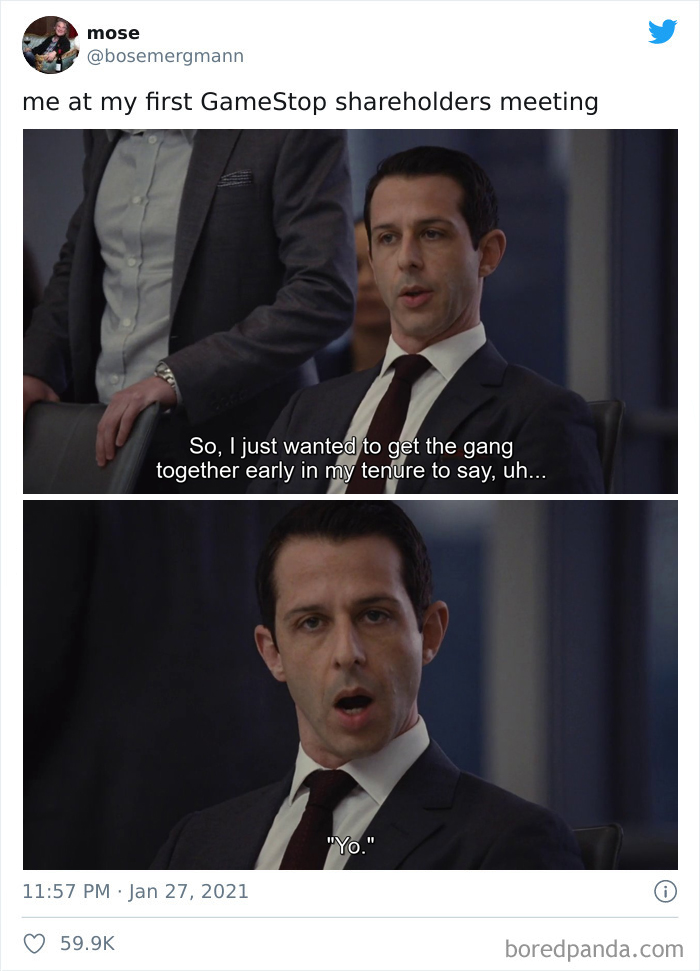

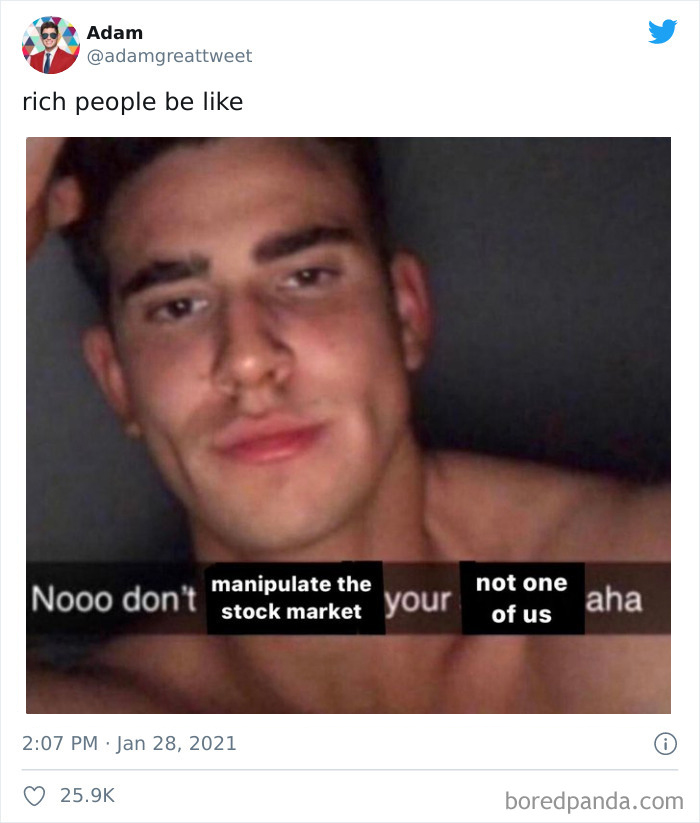

But the GameStop frenzy has not only shed light on the imbalance of power we see in this world, but has also sparked some of the funniest jokes, memes, and puns on the way. Because in the end, no matter who wins the mad stock fury, the small people of Reddit, or the rich and powerful guys, at least we got something to add to our beloved comedy department.

This post may include affiliate links.

The common man is just playing the same game they've played for years. Wall Street doesn't like that the common man is beating them at it.

Previously, Bored Panda reached out to a banking expert and independent investor who preferred to stay anonymous to find out more about the current frenzy in the stock market.

The investor said that sharks in Wall Street hedge funds smelled blood and tried shorting (betting against) GameStop’s stock. What happened is that they “underestimated the sheer volume of small individual investors who have easy access to markets thanks to apps like Robinhood, eToro, etc. and can share their intentions via social networks.”

Most importantly, this unprecedented case of the success of online forum-bred traders indicates that “the age of individual investor (as opposed to institutional) is not over just yet."

Never in my almost 40 years either. And I like it. I don't have a dog in this fight but I am cheering for the Reddit side. F**k the banks and brokers. They f****d us enough and now it's their turn.

Even though nobody can be sure about the future of GameStop at this point, the independent investor believes that it depends on how well they manage “this tsunami of electronic entertainment."

What may happen is that “an influx of funds might allow GameStop to reinvent their business model and concentrate almost purely on digital sales and remote deliveries.” They may also leave “a few brick-and-mortar places for that authentic old-school experience.”

But right now, get your popcorn, kiddos. The stock entertainment buzz is still airing and there’s no end on the horizon just yet.

LOL! I'm a boomer but that "make coffee at home" crap really pissed me off. I'm glad to see it getting thrown back at the assholes.

You can sell it, you just can’t buy more. Which is fine I guess because it’s not like you’d be averaging down. You either got in by now or you didn’t.

You can literally bet on it. It’s a literal actual game, and you can even make side bets like in a casino.

You're a rich dude that sells something you borrowed, because you thought you could buy it back later way cheaper and earn money off it. But many other people (with less money) buy a lot of the thing you sold, and now it's very expensive to get back. It wasn't yours so you're forced to buy it back for way more money. And now you, as a spoiled rich guy, lost a lot of money. You are not used to this, especially because the 'little' man is the cause of your loss... Now you're crying like a big baby because 'it's not fair'......

I guess they'll have to "pull themselves up by their own boot straps" ... (do Ferragamo loafers have straps?)

As if the hedge fund managers now suddenly are the poor suffering people, they themselves always told people that they should stop being poor. And if they are, than here's some advice: "Stop being poor."

What Jedi is that in the profile pic or is it just the dude making the post but with a lightsaber

No worries. We know it’s rigged and we know how to play the game now. Your move!

to modify a popular movie series tagline... "Buy or sell, make your choice."

"GameStop is soaring because of me! You didn't see these numbers when Obama was president because he was a loser! Game Stop is a winner like me! You wouldn't see these great numbers under a Democrat! Game Stop pulled their stores out of blue run states because of fraud and lies! They are only in red states now who voted for me in the best election ever and are rewarded for it! Covfefe."

Hou take your sister's iPhone from her room while she's asleep. You sell that iPhone to some dweeb down thw street for $500. Before your sister wakes up, the dweeb's parents find out and force him to sell it back. You offer to buy it $100, and he grudgingly accepts. You sneak the iPhone back into your sister's room and you walk away with $400.... That's called "shorting"... What happened with GameStop was that the "dweeb" you sold the phone to figured out it was your sister's phone and if you don't get it back to her room before she wakes up she's going to kill you. Grinning from ear to ear, he offers to sell it back for $1000. And, because you want to live, you paid it.

Confirmation bias leads to lots of people being overconfident in their ability to predict the future...

Quite frankly, if you have enough money to have it in a hedge fund, you can afford to lose some money waaaaay more than,s ay, the other 300 million Americans....

Here’s the thing about hedge funds: they are *known* to be dangerous. It is *known* that they employ riskier practices. In fact, it is so well known that not just anyone is allowed to be in a hedge fund. By law, you have to prove that you have enough money/assets so that even if you lose every penny you invest in the hedge fund, it won’t ruin you. So I can understand how this would ruin the hedge funds themselves, but any investor in those funds who’s claiming it ruined them is either lying now or was lying when they first invested.

Heres the thing, Melvin is a piece of s**t for shorting GME, they deserve the loss of billions. If they can short we can squeeze. F them.

Load More Replies...Honestly, what are they crying about? They're still rich, and they're probably going to make all of the money they lost back within a few years.

Hedgefund bro crying and banging fists on table like a toddler: "But I'm not as rich as I COULD HAVE BEEN!! IT'S NOT FAIR!!! IT'S NOT FAIR IT'S NOT FAIR IT'S NOT FAIR!!!. I ALWAYS HAVE THE BEST TOYS BECAUSE DADDY SAYS SO! YOU'RE NOT MY DADDY!!!!! IT'S. NOT. FAAAAAAIIIIIIIIIIRRRRRRRRRR&^%$&^%#%$#^$#^&%!!!!!!" *Mommy wipes his nose while he catches his breath* "I'm taking my ball and going home!"

Load More Replies...Quite frankly, if you have enough money to have it in a hedge fund, you can afford to lose some money waaaaay more than,s ay, the other 300 million Americans....

Here’s the thing about hedge funds: they are *known* to be dangerous. It is *known* that they employ riskier practices. In fact, it is so well known that not just anyone is allowed to be in a hedge fund. By law, you have to prove that you have enough money/assets so that even if you lose every penny you invest in the hedge fund, it won’t ruin you. So I can understand how this would ruin the hedge funds themselves, but any investor in those funds who’s claiming it ruined them is either lying now or was lying when they first invested.

Heres the thing, Melvin is a piece of s**t for shorting GME, they deserve the loss of billions. If they can short we can squeeze. F them.

Load More Replies...Honestly, what are they crying about? They're still rich, and they're probably going to make all of the money they lost back within a few years.

Hedgefund bro crying and banging fists on table like a toddler: "But I'm not as rich as I COULD HAVE BEEN!! IT'S NOT FAIR!!! IT'S NOT FAIR IT'S NOT FAIR IT'S NOT FAIR!!!. I ALWAYS HAVE THE BEST TOYS BECAUSE DADDY SAYS SO! YOU'RE NOT MY DADDY!!!!! IT'S. NOT. FAAAAAAIIIIIIIIIIRRRRRRRRRR&^%$&^%#%$#^$#^&%!!!!!!" *Mommy wipes his nose while he catches his breath* "I'm taking my ball and going home!"

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime