35 Of The Best Jokes And Memes That Sum Up The Current Ongoing Ridiculousness Over GameStop

You might have been reading a lot about video game retailer GameStop in the news and on social media recently. And now, even the White House is monitoring the situation. What’s going on right now is the financial-world equivalent of the battle between David and Goliath… or rather between small investors and Wall Street. And it’s a story for the economics books, ladies and gentlemen, no matter who the winner turns out to be in the end.

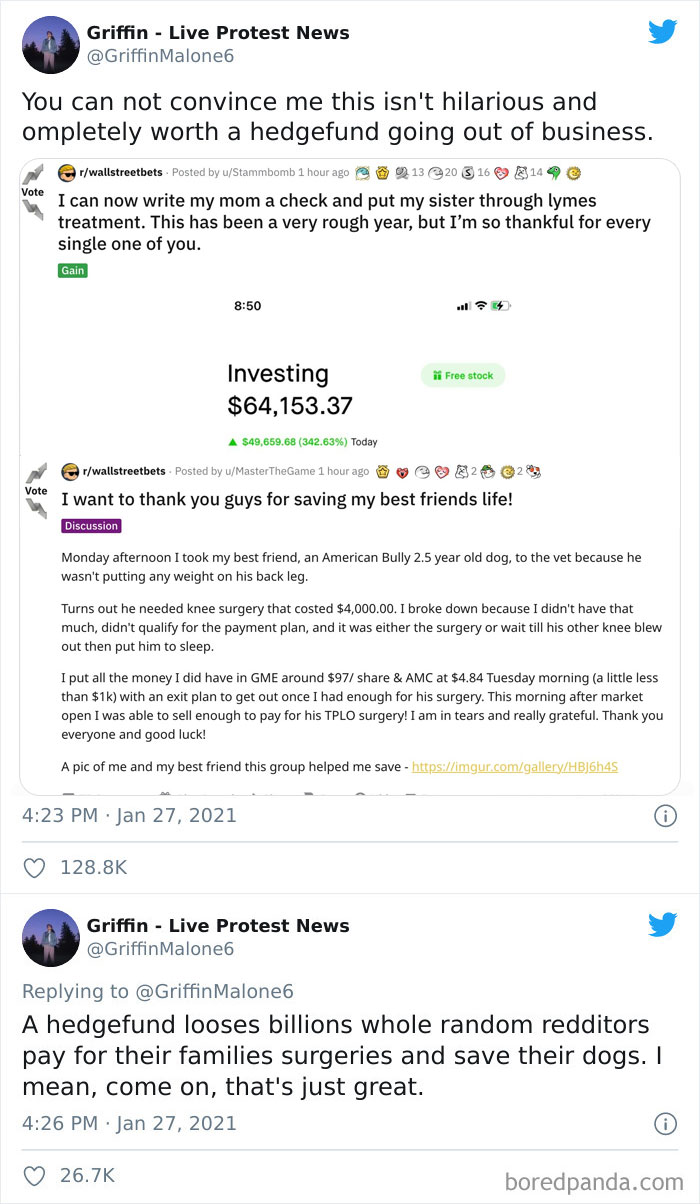

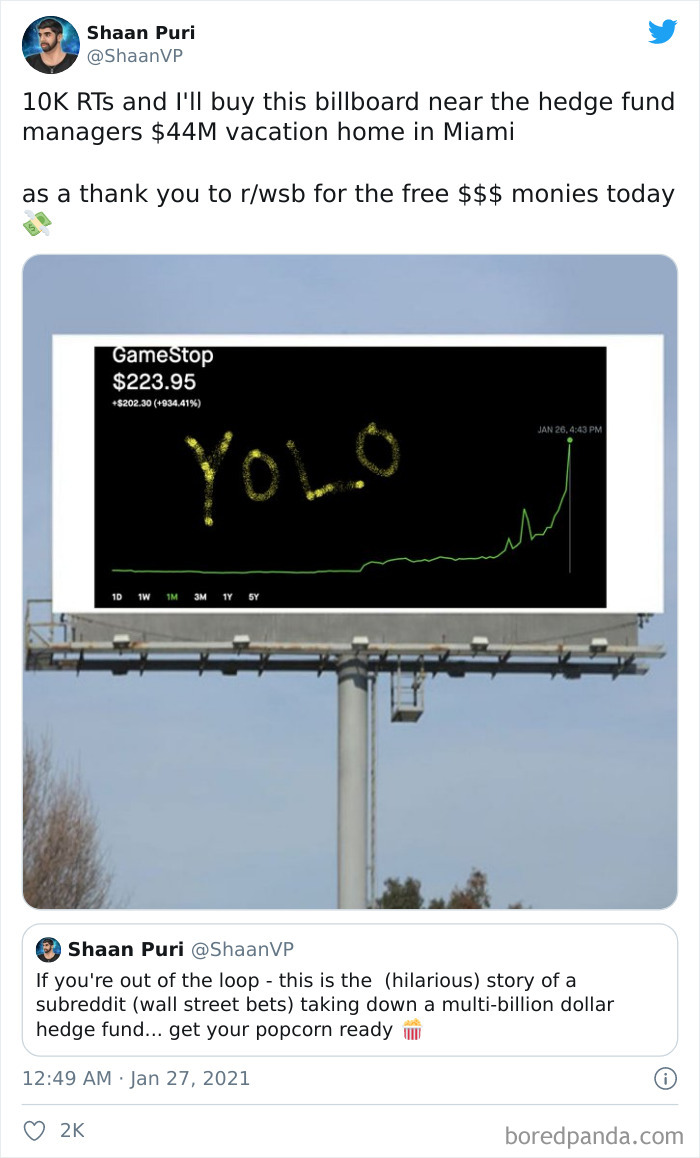

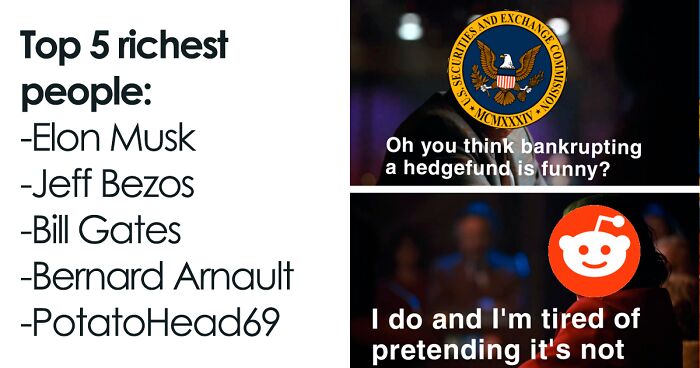

In short, small investors, who are mostly based in the r/wallstreetbets subreddit, are massively investing into GameStop because they believe in it as a company, causing its price to surge upwards. Meanwhile, Wall Street was betting on GameStop failing as a company and its stock prices to stay low. Now, Wall Street hedgefunds that were shorting stocks are hemorrhaging money. Some small investors have already ended up millionaires because of this. For instance, Bloomberg reports that “one trader turned $53,566 into more than $11 million.”

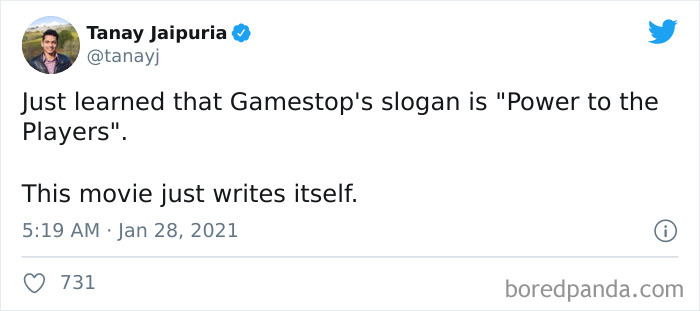

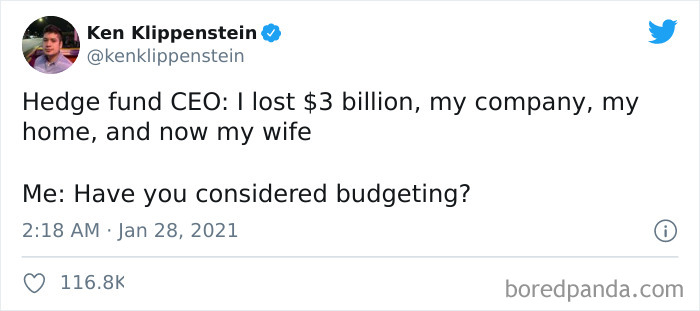

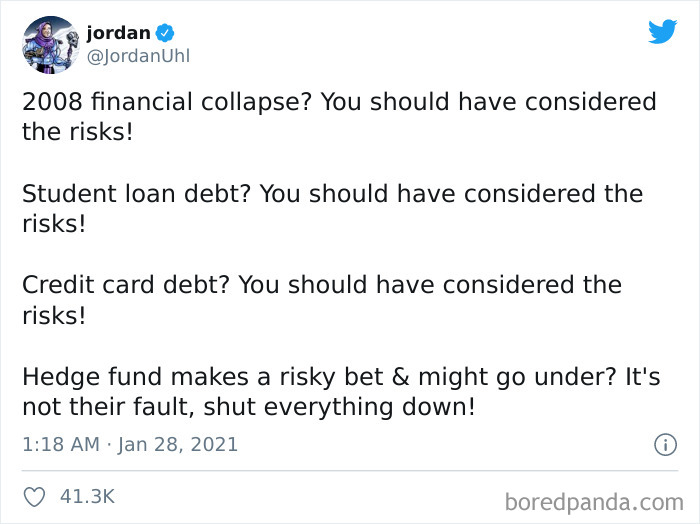

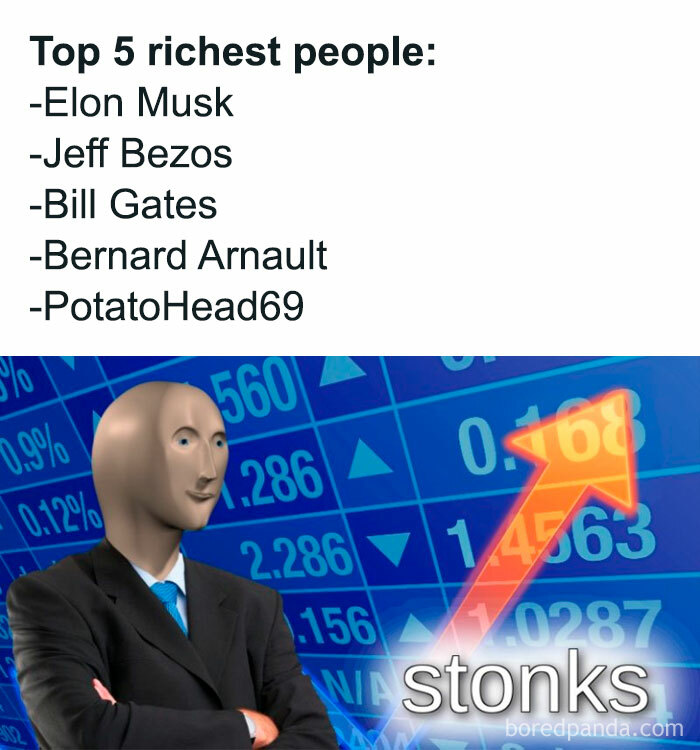

Bored Panda has collected some of the best memes about and reactions to GameStop stonks battle between Reddit and Wall Street, so scroll on down, give your fave pics a big ol’ upvote, and let us know what you think about the entire situation in the comment section below. And be sure to read our in-depth interview with a banking expert and independent investor about what's going on with GameStop.

But before we begin, a big, chunky note of warning for all of you: never, ever trust any random bits of advice about investment opportunities that you read online without turning on your critical thinking and evaluating your current financial situation. Sure, the stock price might be rising now, but you never know when it'll fall (and any expert who tells you that they know how the market will change for sure is selling you snake oil, whether they’re from Wall Street or from Reddit). If you do decide to invest, do so at your own risk, and don’t gamble away your future just because you’re hyped to become a millionaire—just like everyone else is. And not everyone can be a winner when it comes to stocks.

A one-word tweet from Elon Musk caused a further massive GameStop stock price surge

This post may include affiliate links.

So if you work from 8:00 to 6:00, that's ten hours, so that's $72.50. So it's 𝘯𝘰𝘵 enough.

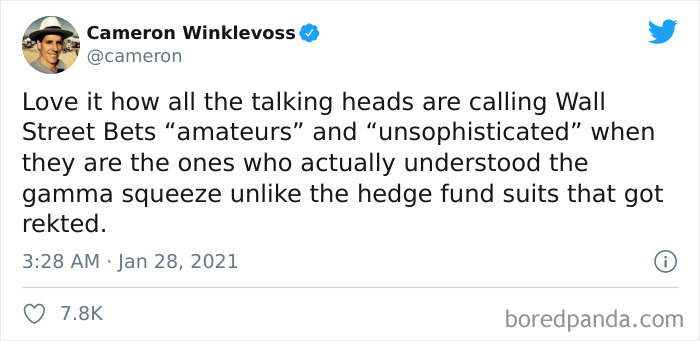

I find it hilarious that hedge-funders have always fought reugulatin, but are calling for regulation against small investors.

If a business can't afford to pay employees a livable wage they don't deserve to be in business. "It seems to me to be equally plain that no business which depends for existence on paying less than livable wages for its workers has any right to continue in this country" Franklin D. Roosevelt 1933

Load More Replies...I’m an even simpler human being, I see Harry Potter, I upvote

Load More Replies...You know what annoys me? Harry (and so many students at hogwarts) were bullied by Snape for years, he was a death eater and killed people, and everybody just likes him after 7 books of this because he loved Harry's mom? He gave a bottle of his tears/memories will the answer, and now he is forgiven? Downvote me if you want, but these are the resons I hate Snape.

1) Yes, he hated harry because he reminded him of Lily, who had given her life to save Harry. 2) He was living an extremely dangerous life as a double agent and likely saved the world. 3) Even after Dumbledore failed to protect Lily and James, and admitted that he had planned to sacrifice Harry all along, he still stayed loyal. He is not perfect, but nobody is.

Load More Replies...ha this reminds me of a graph of when it is ok to use HP references: Always get it always

Not when he is bullying all the students :D

Load More Replies...I care about dogs, about cats, about hedges, hedgehogs, other hogs, generally any animal that one can care about - so I think this is a win-win. Nothing that deserves any care has lost a single penny!

This is awesome. But one thing in here that really makes me mad (and always has) is the situation with the dog. And it's the same everywhere, and has been the same forever. Veterinarians and animal hospitals CLAIM to love animals, and to want to help them. But if you don't have the money, and RIGHT NOW, they won't treat your animal. Some of them won't even LOOK at the animal, unless you pay first. I get that everyone has bills, and has to make money. But to put that before the well-being of an innocent animal, that can't do a damn thing to help itself? To allow an animal to suffer or even die (had it happen, unfortunately), because the owner didn't have over $1000, right then and there? That's total, utter, and complete bullshit. That says those vets obviously care WAY more about the Almighty Dollar, than the animals they claim to love. It's f*****g sad.

OMG Griffin!!! He's a super awesome Portland based reporter. Happy to see his post here.

The White House is monitoring the GameStop situation and the “market volatility in the options and equities markets.” You know that what’s going on is serious when you see the top political players in the US reacting.

GameStop share prices had been at a low of just over $3 in April 2020. The price is $347 at the time of writing, but it’s always in flux, so go and get an update on that number whenever you’re reading this.

Redditors are already celebrating after a major Wall Street hedgefund, Melvin Capital Management, pulled out after losing 30% of the $12.5 billion that it manages this year. The fund was banking on GameStop prices staying low to make profit. However, as the prices kept rising, the fund lost money as it relied on its risky short-selling strategy.

It was all laid out in The Wolf of Wall St, you can bet some of the brokers are already finding ways to benefit from this situation, and the Redditors better know when to sell before the floor falls out from under them.

Underlying plot to Fight Club... Has anyone started talking about something they shouldn't be talking about?

Boo hoo, you're breaking my heart. (Worlds smallest violin plays in the background.) 🎻

I have minimal understanding of how the stock market works, but isn't this a little dangerous?

Large hedge fund short selled Game Stop meaning if the stock falls they win. They justified this by noticing most Game Stop stores are in large malls which many are closed due to COVID. Gamers and people on Reddit got maaaaad because they love games. So they are buying a lot of stock to drive the price waaaay up. When the price goes up, short sellers lose. One hedge fund lost $4 BILLION. What these poor kids don't realize is that eventually everyone will get bored and start selling and the stock will fall sharply.

Load More Replies...A banking expert and independent investor spoke to Bored Panda about the current situation in the stock market and all of the investment advice floating around on the net and on the news under the strict condition of keeping his identity anonymous. "First of all, nobody knows the future, and if any financial guru (whether anonymous or sitting in an expensive suit in front of you) tells you about some ‘guaranteed opportunity to double your money,' consider it a red flag," he pointed out that anyone making investments should be careful and think for themselves.

"Secondly, one of my personal golden rules for investment is the following: if everyone, including your grandmother, is talking about some particular stock or cryptocurrency—it’s already too late. Should people invest? Absolutely, but not necessarily in GameStop—there are dozens of opportunities like that every year, so don’t feel bad if you think you missed out on this one," the expert stressed that timing is everything but that other opportunities will always present themselves.

According to the independent investor, wild fluctuations in price are something that we sometimes see in the "traditional" stock market from time to time; it's not just an everyday feature of the cryptocurrency market. And even though we're all focused on GameStop right now, we shouldn't forget about companies like Tesla.

"Consider Tesla—had you invested any money in it a year ago, you would have increased your stack at least sixfold! Sharks in Wall Street hedge funds, smelling blood, tried shorting (betting against) GameStop’s stock, but underestimated the sheer volume of small individual investors who have easy access to markets thanks to apps like Robinhood, eToro, etc. and can share their intentions via social networks. This example might indicate that the age of individual investor (as opposed to institutional) is not over just yet."

yes finally someone who actually likes it

Load More Replies...except they didn't lose 'their' money - they 'lost' their clients' money. Or government subsidy money.

As for the future of GameStop? It all depends on how well they ride "this tsunami of electronic entertainment." The banking expert and investor said: "An influx of funds might allow GameStop to reinvent their business model and concentrate almost purely on digital sales and remote deliveries. They might decide to leave only a few brick-and-mortar places for that authentic old-school experience, for example. Did you know that global video game revenue is already larger than Hollywood’s?"

It’s not just GameStop that’s getting some love from investors, though. Movie theater chain AMC is also seeing its stocks skyrocket among other companies.

Meanwhile, the r/wallstreetbets subreddit went private for around an hour on Wednesday. What's more, Discord banned the subreddit's server for "hateful content" after repeated warnings. The subreddit accused Discord of "destroying their community" instead of trying to fix any issues at hand.

The subreddit modmail is down temporarily at the time of writing which, to us, suggests that the mods are getting absolutely bombarded with messages, spam, and requests for investment advice. Just imagine the flood.

Criticize Big Bird but he's been around since 1969. Long than most of those companies.

There is a timeline not too far from ours where Big Bird is a casualty of one of the worst astronautical disasters of all time.

Load More Replies...They all grew up watching Big Bird. Anyway, we all remember waiting in line on New Release day.

ROBINHOOD, the online trading service that imposed limits on GameStop purchases, needs to be taught a lesson next.

Let those hedge fund fat cats find out what life is really like for the millions who make their obscene fortunes possible. So your kids are screaming about having rice and beans for a third night in a row? Welcome to reality - now tuck in or Daddy will have to warm your hides because he can no longer afford a nanny!

Here's what Investopedia says about short-selling (i.e. what some hedgefunds were doing in the case of GameStop and continue to do in many other cases): "Short-selling occurs when an investor borrows a security and sells it on the open market, planning to buy it back later for less money. Short-sellers bet on, and profit from, a drop in a security's price. This can be contrasted with long investors who want the price to go up. Short selling has a high risk/reward ratio: It can offer big profits, but losses can mount quickly and infinitely due to margin calls."

Part of the reason why redditors are investing in GameStop and other companies is to 'punish' Wall Street hedgefunds for their practice of shorting stocks. Some small-time investors believe that what these funds are doing is immoral.

It's not just Melvin Capital Management that has had to run with its tail between its legs. For instance, a week ago, Citron Research bet that the 37-year-old GameStop company would fail; this motivated a lot of redditors to heavily invest in the company, forcing Citron to back off from short-selling stocks.

To them, the rules are always fair as long as they are the winners. Now they are the whiners.

If thousands of Redditors can cause this kind of pain to Wall St. High Rollers, I'm all for it.

I never knew game stop was big enough to pull something like this off

I can't say I fully do either, but to be honest I'm not sure I care. The super rich are being brought down a peg. That's a win in my book.

same i just clicked because it had gamestop with it and it looked interesting

I wonder if some elders will lose their retirement pension, their insurance and their home because of all that stuff.

Most likely not. Retirement funds don't take short positions on individual stocks. It's mostly invested in index funds and commodities. People already retired most likely have their money in bonds or other safe investments.

Load More Replies...Looks like nearly perfect English to me, is it the tech words you're having trouble with? Here's a translation attempt: "We let 500,000 people die because shutting down over the pandemic would have crashed the stock market. Said stock market is so stupid that it's being turned into a real-life game by users of a popular website called Reddit, destroying a hedge fund worth billions of dollars. Anyway there's clearly no problem here!"

Load More Replies...Great. Now I have the song "The furious little monkey" playing in my head.

Load More Replies...Reddit is NOT saving Game Stop in any form. All of these trades are on the open / secondary market. GME made their money during the IPO. GME has not benefited in any fashion. In order to do that, all these people should go buy all of their games and inventory to boost actual sales on the balance sheet. That would also drive up the stock price but not like this week.

Laughing while they miss the next payment on their yacht. How will they feed their families caviar now? Who will keep them in HErmes and Lanvin? Will somebody please think of the diamond encrusted man children?

Your comment deserves more upvote, cracked me up

Load More Replies...No I won't keep scrolling. Bore off with this crap.

Load More Replies...me too, outmaneuvered by a potato! *insert local potato happy today meme*

Load More Replies...Hedge fund also include investments of lower-class people who just tried to prepare their retirement and who might have lost everything.

People that got extremely rich by playing with other people's money, at the risk of those people. Not financially responsible for any loss. But taking a cut at winnings.

Load More Replies...He is right, you are supposed to let him win, that's how it was supposed to work.

I bet there will be more calls to regulate social media. But really, what else do people have to do in a pandemic except study these systems?

They hacked the game, but hey, that is how good players play a game! Also, seems like Wall Street may have learned from knowing the concept of Speedrun!

I feel less bad for the managers than for the clients. You know, those hundreds of small investors who just wanted to eventually be able to retire.

$18.95 for popcorn and a drink is a discount. Either that or I live in the wrong place!

7 dollars for a bottle water at my local theater. 7. dollars.

Load More Replies...Walmart may be too pricey for them by the time this over. They better get the Wish.com ones instead!!

Load More Replies..."Pull yourself up by your bootstraps" is my favourite accidentally-correct phrase, since it actually refers to something that is not possible but is used constantly by people who think it's legitimate advice for pulling a maneuver (escaping multigenerational poverty) that they think is easy, but actually almost never happens.

My second favourite is "f**k around and find out", a phrase meaning to learn that there are consequences to one's actions, which was the codename for the January 6th insurrection where - wait for it - everyone participating was shocked to learn that rules apply to them, too.

Load More Replies...Shorting is kind of a scam. Okay, I don't actually own any stock, but I'm going to sell it to you anyhow at todays price, then I'll just go buy it later. Cool?

It's not kind of a scam, it is a scam. They're setting others up to lose money for their benefit.

Load More Replies...That was one wonderfully weird movie. Oh, No country for old men is the name of it.

And make sure to pad your time with lots of B.S. examples, too. ;)

I found this explained it perfectly: https://www.thepoke.co.uk/2021/01/28/this-beginners-guide-to-the-amazing-gamestop-story-went-viral-because-its-so-good/

Load More Replies...The way that made sense to me is this: they "borrowed" the stock expecting it to end on a low price & now its high when they have to "return" it. Ex: say they bought it at $5, expecting it to drop & pay it back for $1 for it lowering, while making a $4 profit for "borrowing" it. The reality now is that they bought it for $5 & it went up to say $200 & they all have to take a $150 hit to do anything with it.

Load More Replies...I don't have money to invest with. I have no idea how sell short is. Please don't bother with how it works.

Unless you bought shares then started the subreddit for a traditional stock scam just like in the Wolf of Wall St. 2 economics students got busted about 5 years ago for the same thing

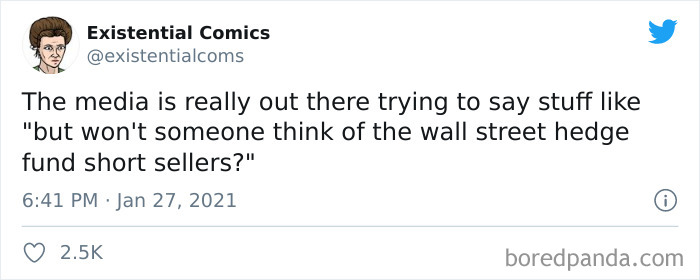

Load More Replies...Sadly yes. They wanna paint reddits actions in a negative light so people will be less likely to try it again in order to keep a stranglehold on their territory in a manner of speaking. Greedy shortsighted bastards.

Pt 1.Basically wallstreet experts including hedgefund managers predicted that the video game retailer gamestop would go bankrupt in 2021 for reasons such as covid. They were so sure that the company' stock price would fall that they engaged in short selling. Short selling is a little long and complicated to explain but it's basically a way for investors to profit off of a declining stock. If stock prices rise you basically lose. Unfortunately for hedgefund managers thats exactly what happened. You see, gamestop got a billionaire investor who made their stock value rise a little and suddenly they had a chance to avoid bankruptcy. Suddenly hedgefund managers were pissed that things weren't going as planned but doubled down on their short selling to prove their original point. This situation caught the eye of small investors part of a subreddit called walstreetbets, they decided to actually buy gamestop stocks to raise prices and beat hedgefund managers at their own game.

Pt 2. So basically the reddit investors were now thanos and their gamestock stocks were their infinity stones. With gamestop stock prices on the rise, being a shortseller was the dumbest thing you could do. The hedgefund managers are now selling their stocks to stop themselves from going broke.lol.and anyone who had actually invested in gamestocks poor lowly stocks are now rich. Take whatever I said with a grain of salt cuz I just understood this all today and could be wrong in some spots.

A short is basically. Hi everyone I'm selling Gamestop shares at todays price of $25. They don't actually own any shares to sell. They are going to wait a set period (say 6 months) then they actually buy the stock at that set date at whatever price it is to give to the people they sold it to. So if the price on that day is $1 they just made $24 for every share. If they have to buy it at $175 a share to give to the people they got $25 from... they are "fudged".

try this, worked for me :https://www.thepoke.co.uk/2021/01/28/this-beginners-guide-to-the-amazing-gamestop-story-went-viral-because-its-so-good/

Buy a lightbulb with that allowance....don't buy pants

Load More Replies...redit is going to slap wallstreat with the power of a 26 megaton nuke

As someone who worked with hedge funds in the past, here's the explanation of why shorting is so risky. Let's say that Company X is selling for $20 a share. You believe the stock will go down, so you borrow 100 shares of Company X from a lender and sell all 100 shares for $2000. The stock goes down in the next week to $10 a share like you hoped, so you buy 100 shares for $1000 and return those shares to the lender. Woohoo, you made a quick $1000! But not so fast... What if the stock went up instead? Company X had unexpected good news, and now the price has jumped to $200 a share! You have no choice but to spend $20,000 to buy those shares. And what if the price went up to $500? Or $1000? To compare this to normal investing, if you just bought a share of a company for $100 and the company goes bust, you've lost $100, which stinks, but's that's the limit. With shorting, there is no limit to how much you can lose.

The entirety of Wall Street can be summed up in the phrase from "Whose Line is it Anyway" - The rules are made up and the points don't matter. None of it is real! Everything from stocks to cryptocurrency is all based on "investor faith".

I agree, but the money in our pockets and bank accounts is just the same. And when the stock markets are affected, so are ordinary people.

Load More Replies...I just think it is hilarious that many of the user names will be obnoxious, downright rude, memes, and things like that. Well done, Reddit!

Here's why this matters: Hedge funds are complaining that rogue Redditors are artificially inflating the price, manipulating the market, blowing a dangerous bubble - that's absolutely correct. It's also exactly what hedge funds have been doing as an entire systemic industry for a long time. The more predictable the fluctuation (i.e. Gamestop going out of business because gaming is moving entirely online), the more money they make. So imagine someone out there buys all the pumpkins in October and jacks up the price just to resell them even higher, but then they don't actually pay for them until February, at Feb pumpkin value (lol $1). They make an absolute fortune. Meanwhile the average working non-investor wonders why they feel poorer every year with 2% "cost of living" increases and stagnant minimum wage, while pumpkins cost 10% more because profiteers own them all. Reddit came along and decided that Feb will be pumpkin appreciation month, flipping the tables on their entire plan.

Not gonna lie, I saw what was happening with Gamestop and started dropping money into it. Selling out and taking my winnings with me later this morning.

Admittedly, I understand very little about the stock market, and therefore not 100% sure what's going on here, but I'll be god damned if I'm not enjoying the show. 🍿😁🍿😁🍿

Damn. I wish I had known about this from the start. I would have loved to try to get some money together to buy a home. But, most of us only find out about this stuff till it's already done and too late.

The whole assumption that the Reddit investors are small investors is just a joke. You simply don't know who's behind those accounts, it could very well be that some wall streeters are behind the calls to invest in GameStop and they're using other people to achieve their goals. And 50k USD is in no way a small investor, as one of the examples assumes. What is called "large investor" is in many cases an aggregation of different smaller investors so it's not big millionaires who lose here. My point here is the whole "small versus big here" is ridiculous, you don't know the end result here and probably a lot of small inventors already lost money. And finally, GameStop has seen nothing of the money that has been invested here and they're probably doomed anyway because first party game companies (Microsoft, Sony, Nintendo) prefer to sell games digitally on their web shops because it saves them the retailer margin. PS: if you really want to save GameStop, go and spend your money there because, as I said, they get nothing from shares trading and if sales don't improve you can buy billions of dollars in shares and that won't change a thing.

Reddit/WallStreetBets (WSB) has a membership of over 2 million and it has been around for years. What was different now had to do with the COVID pandemic, when many professionals got laid off, or reduced hours and working from home. At that point, WSB became very, very knowledgeable about how these irrational markets really work under the hood and an angry mob formed to storm Wall Street and they were very effective because Wall Street was not prepared for that and relies on a lot of “dumb money” to keep pouring in at all times. This was a game changer and a good thing. Business books will soon be written about this and MBA finance courses taught, you’ll see. If there’s one thing the 1%ers will not tolerate, it’s being turned into poor people.

Load More Replies...They went short Gamestop as it was dying and now they need to repurchase at a 200%+ price. Going short: not having it in stock while you did put it in someones portolio. So now they have to buy it at a super inflated price because those portfolio owners know they have it in their portfolio and know that they should be making money with it now..

Load More Replies...As someone who worked with hedge funds in the past, here's the explanation of why shorting is so risky. Let's say that Company X is selling for $20 a share. You believe the stock will go down, so you borrow 100 shares of Company X from a lender and sell all 100 shares for $2000. The stock goes down in the next week to $10 a share like you hoped, so you buy 100 shares for $1000 and return those shares to the lender. Woohoo, you made a quick $1000! But not so fast... What if the stock went up instead? Company X had unexpected good news, and now the price has jumped to $200 a share! You have no choice but to spend $20,000 to buy those shares. And what if the price went up to $500? Or $1000? To compare this to normal investing, if you just bought a share of a company for $100 and the company goes bust, you've lost $100, which stinks, but's that's the limit. With shorting, there is no limit to how much you can lose.

The entirety of Wall Street can be summed up in the phrase from "Whose Line is it Anyway" - The rules are made up and the points don't matter. None of it is real! Everything from stocks to cryptocurrency is all based on "investor faith".

I agree, but the money in our pockets and bank accounts is just the same. And when the stock markets are affected, so are ordinary people.

Load More Replies...I just think it is hilarious that many of the user names will be obnoxious, downright rude, memes, and things like that. Well done, Reddit!

Here's why this matters: Hedge funds are complaining that rogue Redditors are artificially inflating the price, manipulating the market, blowing a dangerous bubble - that's absolutely correct. It's also exactly what hedge funds have been doing as an entire systemic industry for a long time. The more predictable the fluctuation (i.e. Gamestop going out of business because gaming is moving entirely online), the more money they make. So imagine someone out there buys all the pumpkins in October and jacks up the price just to resell them even higher, but then they don't actually pay for them until February, at Feb pumpkin value (lol $1). They make an absolute fortune. Meanwhile the average working non-investor wonders why they feel poorer every year with 2% "cost of living" increases and stagnant minimum wage, while pumpkins cost 10% more because profiteers own them all. Reddit came along and decided that Feb will be pumpkin appreciation month, flipping the tables on their entire plan.

Not gonna lie, I saw what was happening with Gamestop and started dropping money into it. Selling out and taking my winnings with me later this morning.

Admittedly, I understand very little about the stock market, and therefore not 100% sure what's going on here, but I'll be god damned if I'm not enjoying the show. 🍿😁🍿😁🍿

Damn. I wish I had known about this from the start. I would have loved to try to get some money together to buy a home. But, most of us only find out about this stuff till it's already done and too late.

The whole assumption that the Reddit investors are small investors is just a joke. You simply don't know who's behind those accounts, it could very well be that some wall streeters are behind the calls to invest in GameStop and they're using other people to achieve their goals. And 50k USD is in no way a small investor, as one of the examples assumes. What is called "large investor" is in many cases an aggregation of different smaller investors so it's not big millionaires who lose here. My point here is the whole "small versus big here" is ridiculous, you don't know the end result here and probably a lot of small inventors already lost money. And finally, GameStop has seen nothing of the money that has been invested here and they're probably doomed anyway because first party game companies (Microsoft, Sony, Nintendo) prefer to sell games digitally on their web shops because it saves them the retailer margin. PS: if you really want to save GameStop, go and spend your money there because, as I said, they get nothing from shares trading and if sales don't improve you can buy billions of dollars in shares and that won't change a thing.

Reddit/WallStreetBets (WSB) has a membership of over 2 million and it has been around for years. What was different now had to do with the COVID pandemic, when many professionals got laid off, or reduced hours and working from home. At that point, WSB became very, very knowledgeable about how these irrational markets really work under the hood and an angry mob formed to storm Wall Street and they were very effective because Wall Street was not prepared for that and relies on a lot of “dumb money” to keep pouring in at all times. This was a game changer and a good thing. Business books will soon be written about this and MBA finance courses taught, you’ll see. If there’s one thing the 1%ers will not tolerate, it’s being turned into poor people.

Load More Replies...They went short Gamestop as it was dying and now they need to repurchase at a 200%+ price. Going short: not having it in stock while you did put it in someones portolio. So now they have to buy it at a super inflated price because those portfolio owners know they have it in their portfolio and know that they should be making money with it now..

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime