Someone Created A Meme About How The Government Tax System Works And It’s Painfully Hilarious

Taxes have been a touchy subject throughout American history. After all, it is what led Americans to revolt against the British in 1773. Following the Revolutionary War, the American government had to be cautious when it came to direct taxation. In modern times, arguments over what should be taxed, how much each financial bracket is taxed, and how they are allocated remains a hot button topic.

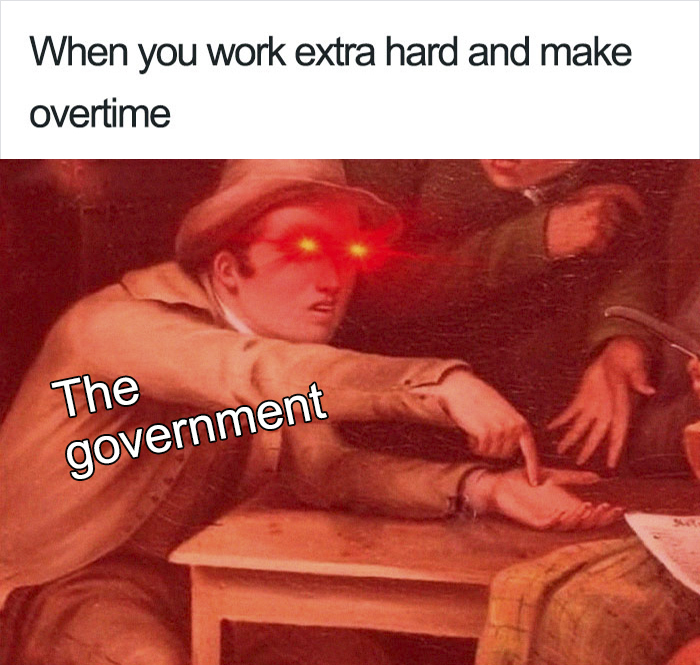

Someone online created a series of hilarious memes to illustrate the argument of how the government can tax people to death, using an old fashioned painting and photoshop and some people are finding them hilariously relatable.

Governments impose taxes to meet the expenses needed to run various services provided to citizens. Rich countries like Saudi Arabia and Oman do not tax their citizens because the government has sufficient money to meet its expenses to run the country.

1.

The American Civil War was not only devastating, it was expensive and the nation wracked up massive debt. In order to help pay for the war, Congress passed the Revenue Act of 1861. The tax was levied on incomes exceeding $800 and was not rescinded until 1872. This act built most of the foundation for the modern U.S tax system and the U.S. Internal Revenue Service (IRS) was founded.

2.

3.

The Constitution forbade any direct taxes that were not levied in proportion to each state’s population. So in 1913, the 16th Amendment was introduced which paved the way to establish the first permanent U.S income tax by removing the proportional to population clause. It was then followed by an income tax on people with an annual income of over $3,000. This tax touched less than 1% of Americans. Four states rejected the amendment: Connecticut, Florida, Rhode Island, and Utah.

4.

5.

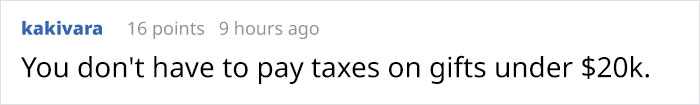

Each state has its own tax laws and therefore depending on what state you visit, you might find there are certain items that are taxed differently. Alabama has a 10 cent tax on a deck of playing cards, blueberries from Maine are subject to a tax of 1.5 cents per pound sold, New York levies an 8 cent tax on each sliced or toasted bagels, and Texas charges a $5 per customer fee on each strip club pole.

6.

7.

Marijuana laws are changing in many states, with Illinois being the latest state poised to sign a bill into law for recreational use. In many states, while the plant is still illegal, the tax collectors know that sales are still being made and therefore must be taxed. In illegal sale states, you have to buy tax stamps and affix it to the packaging – here are the instructions from the Kansas Department of Revenue’s drug tax stamp page. This is how they got Al Capone!

8.

9.

There are over 7 million words in the tax law and regulations. That’s more words than the Gettysburg address, the Declaration of Independence, and the Holy Bible all put together (269+1,337+773k). There were 402 tax forms in 1990, there are now currently over 800 various forms and schedules.

10.

11.

According to the UK’s Tax Avoidance Schemes Regulations 2006, “It is illegal not to tell the taxman anything you don’t want him to know, though you don’t have to tell him anything you don’t mind him knowing.” Try figuring out that riddle.

12.

13.

Sure, Americans went to war over taxes but the French said, “Off with their heads, ” in protest. In 1789, at the start of the French Revolution, revolutionaries sent tax collectors to the guillotine! This is a prime example of ‘don’t shoot the messenger!’ The poor collectors were just trying to do their jobs.

14.

15.

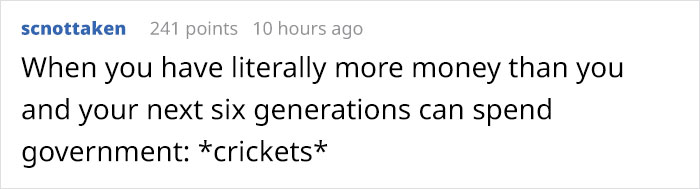

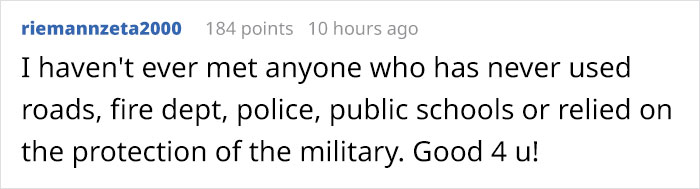

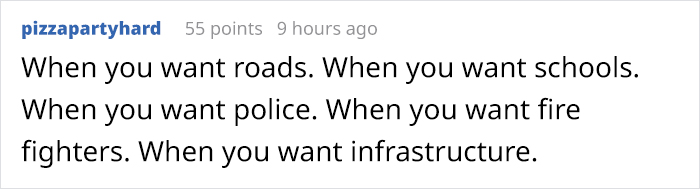

Not everyone agreed and pointed out why taxes are so necessary

It would be nice to have safe bridges instead of military equipment that even the military doesn't want. Subsidies for school might be nice instead of subsidies for Exxon-Mobile. Medicare for all might reduce that pesky "worst maternal death rate in the developed world" thing. But I'm just a libbrill so and so...sorry, let's buy more bombs.

Yew jus cain't callum bombs, boy - those are Freedom Bombs(TM)! Gurr'an-TEED to blast them kommrnists, libtards, demournkats, turr-ists and all enemies of 'murica to the skah! (sky) Up yonder, Gawd kin sort 'im out!

Load More Replies...The problems aren't taxes. Independent of welfare or weak state, you need taxes, just trhe height can be discussed. The problem really is unfaireness. Typically, the hard-working middle class needs to pay a lot, while the upper class can (the irony!) afford to use evasive measures. And multinational companies paying almost zero taxes are a topic of its own. Interestingly, this is no leftiest moaning but the reality today. Panama papers? Google and Amazon tactics? Everything seems to be ignored as long as there are some states who earn well by keeping loopholes.

I think the essential point here is that although we know taxes are necessary, the manner in which they are handled is not. There is no need for so many tax brackets, no need to constantly vary and increase the brackets and amounts. That is just due to mismanagement and corruption of the people and bodies handling our taxes. Taxes should be simple, fixed and those handling them should be responsible and accountable. Misuse or waste should be punished severely.

YES. Flat tax for all! Taxes absolutely do not need to be so complicated.

Load More Replies...It would be nice to have safe bridges instead of military equipment that even the military doesn't want. Subsidies for school might be nice instead of subsidies for Exxon-Mobile. Medicare for all might reduce that pesky "worst maternal death rate in the developed world" thing. But I'm just a libbrill so and so...sorry, let's buy more bombs.

Yew jus cain't callum bombs, boy - those are Freedom Bombs(TM)! Gurr'an-TEED to blast them kommrnists, libtards, demournkats, turr-ists and all enemies of 'murica to the skah! (sky) Up yonder, Gawd kin sort 'im out!

Load More Replies...The problems aren't taxes. Independent of welfare or weak state, you need taxes, just trhe height can be discussed. The problem really is unfaireness. Typically, the hard-working middle class needs to pay a lot, while the upper class can (the irony!) afford to use evasive measures. And multinational companies paying almost zero taxes are a topic of its own. Interestingly, this is no leftiest moaning but the reality today. Panama papers? Google and Amazon tactics? Everything seems to be ignored as long as there are some states who earn well by keeping loopholes.

I think the essential point here is that although we know taxes are necessary, the manner in which they are handled is not. There is no need for so many tax brackets, no need to constantly vary and increase the brackets and amounts. That is just due to mismanagement and corruption of the people and bodies handling our taxes. Taxes should be simple, fixed and those handling them should be responsible and accountable. Misuse or waste should be punished severely.

YES. Flat tax for all! Taxes absolutely do not need to be so complicated.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

134

68