62% of employees have reduced their short- and long-term savings contributions amid high inflation and concerns about a possible recession. Moreover, 71% of employees said money-related stress has negatively affected their work and personal lives, a 7% increase from 2021.

And while we at Bored Panda don't have the instruments to change the monetary policy, there is something we can do to help the situation. Have a laugh about it. After all, humor makes everything better, doesn't it? So this time, we invite you to join us in exploring the subreddit 'Frugal Jerk.'

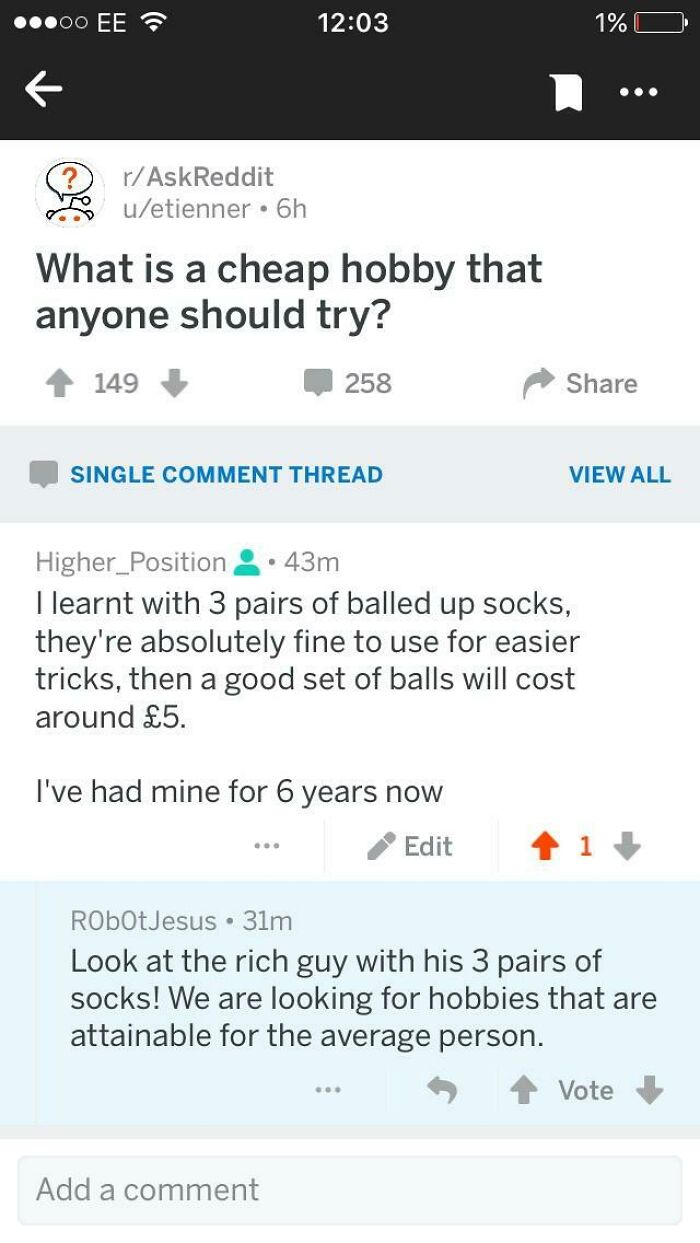

Its 147k members constantly share memes about being poor, often taking things to ridiculously extreme levels to accentuate the painful realities of bills, taxes, and everything else related to personal finances.

"We, the proud few who stand on the cutting edge of frugality. We hold our heads high as we steal toilet paper, shoplift lentils, reuse condoms, syringes, and drink our own piss to save multiple dollars each year," the people behind the online community write in its about section.

So continue scrolling to check everything out and don't miss the chat we had about spending and saving with Doug Nordman, who managed to retire at 41 and now runs the website Military Financial Independence and is the author of The Military Guide to Financial Independence and Retirement.

This post may include affiliate links.

When The Machines Try To Take Over

How To Furnish A Home

Check out the Johnny Cash song, "One Piece at a Time" - https://www.youtube.com/watch?v=uErKI0zWgjg

Nordman told Bored Panda the biggest mistake he sees people make in their early steps toward financial independence is trying too hard.

"Frugality is challenging and fulfilling, and it's sustainable," he said. "Deprivation has its uses (paying off credit-card debt) but it can lead to burnout. Strive for work/life balance, lead a quality of life that makes you enjoy the journey, and put your investing in autopilot."

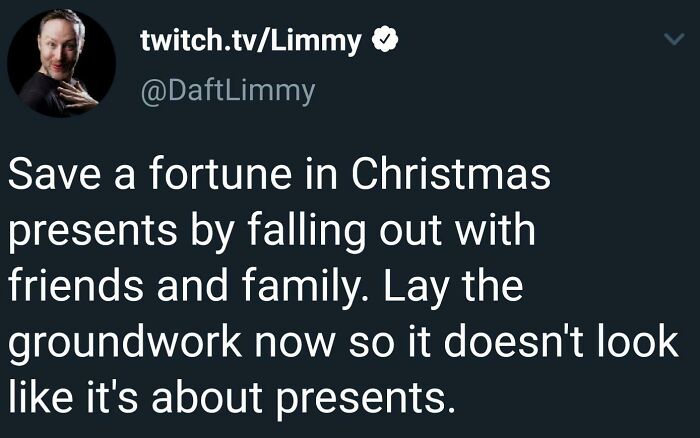

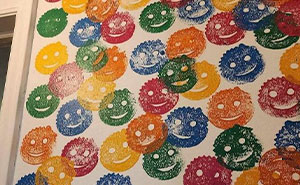

Saving Money This Christmas

Could Becoming A Murderous Clown Be The Secret To The Ultimate Frugal Lifestyle?

Pennywise, the ultimate millennial life hacker... would like to add wears one outfit, travels primarily at night to reduce idling and traffic, not only advocates for population reduction but takes an active role in reducing the cost of living in his community by restricting a landlords ability to increase rent what with all the dead kids, and eventually he finishes almost every meal he's started really reducing food waste.

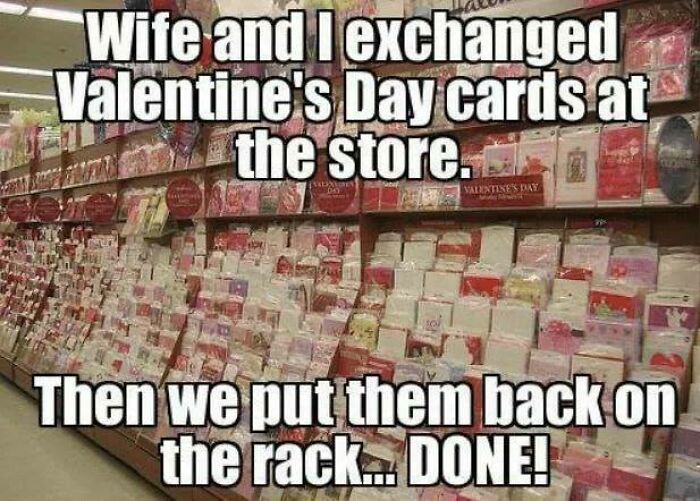

It's The Thought That Counts 😍😍😍

It's easy to form bad financial habits. For example, a 2021 study found that panic buying transformed into impulsive buying.

The survey of 2,000 online shoppers, commissioned by Slickdeals and conducted by OnePoll discovered that Americans impulsively spend an average of $276 every month. (That adds up to an extra $3,312 spent every year and about $198,720 in a lifetime.)

The most common spontaneous emotional purchases were food and groceries (48%), household items (42%), clothing (40%), and coffee (33%).

Live Frugal, Die Frugal

Tip: How To Do Laundry For Free!

Save A Fortune In Christmas Presents

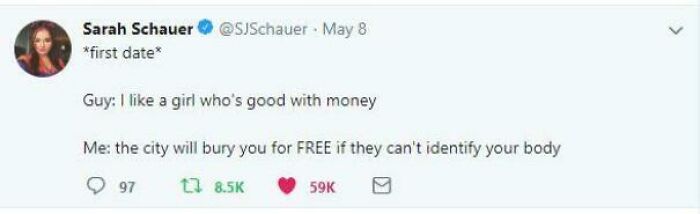

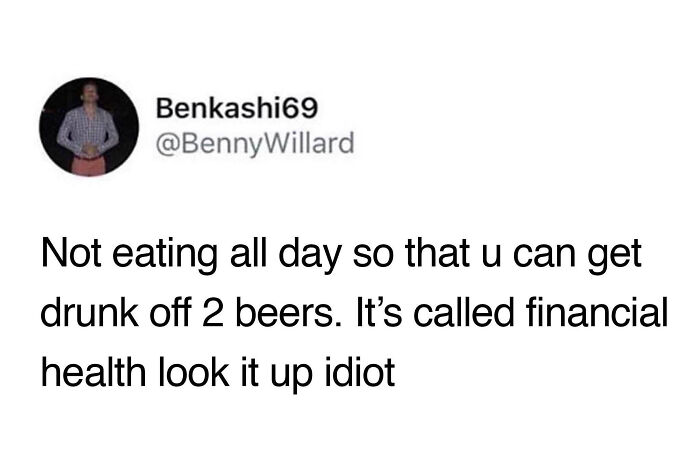

How To Get Absolutely Hammered (In A Frugal Manner)

To get rid of these pesky (and often expensive) habits, we need to be mindful about our budgets.

"Start by understanding your spending," Nordman suggests. "If it's valuable to you then you're willing to work for the extra years of life energy to pay for it."

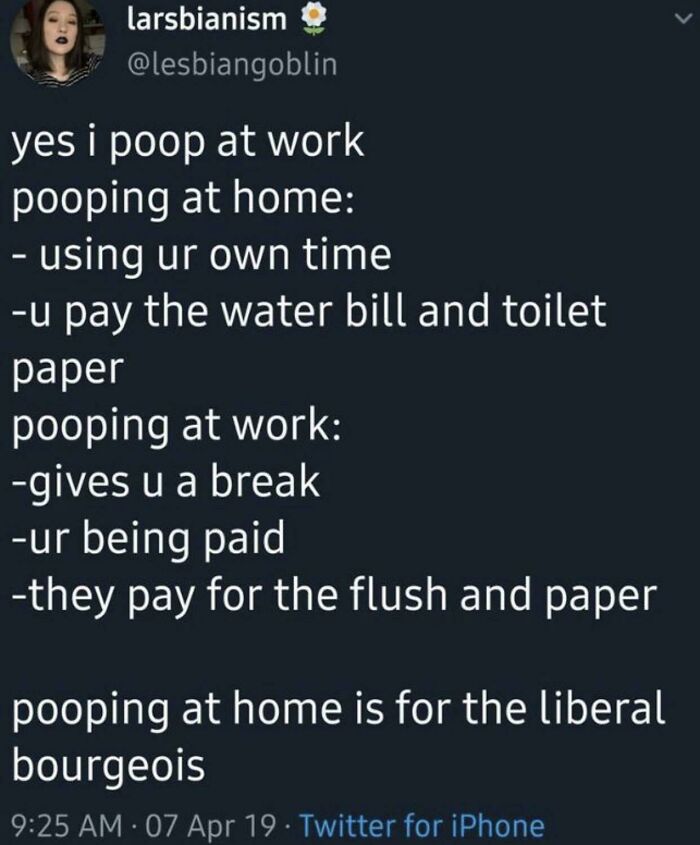

If You’re Not Part Of The Economic Elite That Can Afford To Flush

Everybody sing it with me: Boss makes a dollar while I make a dime, that's why I poop on company time.

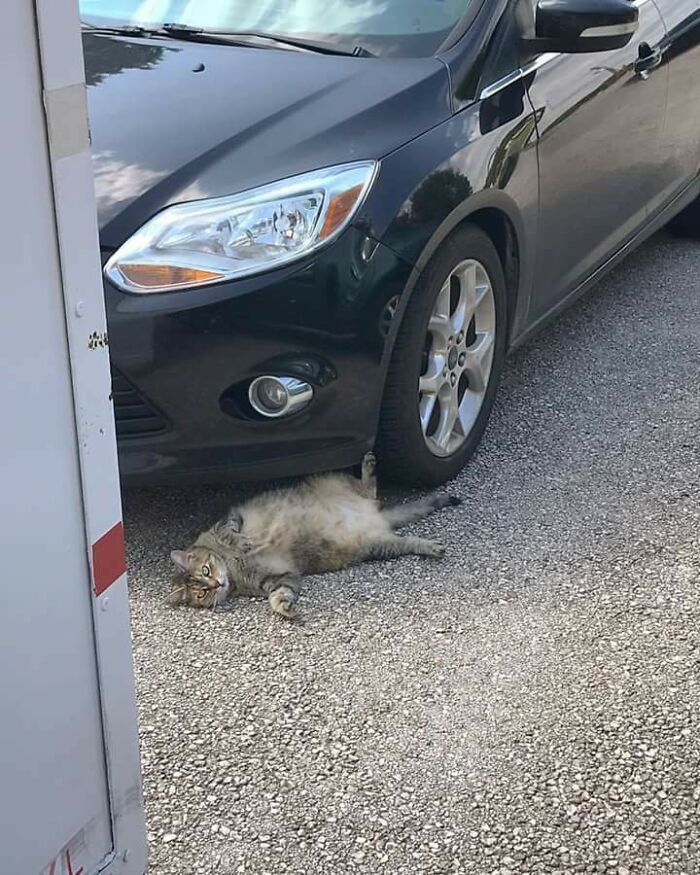

Cat Trying To Collect Insurance

Cat: Oh no i have been hit with this car. I will need to collect $5,000,000 from you

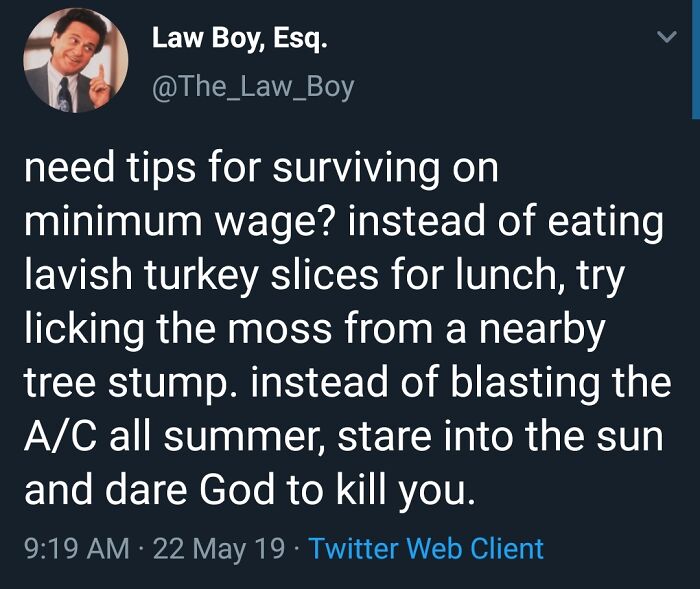

Deli Meat And A/C Are For Fat Cats

It's The Perfect Crime

"If it's wasted spending then cut it ruthlessly and invest it in your retirement accounts. Here's the important part: automate your investing so that it's a habit you won't have to decide with every paycheck," Nordman added.

"You used to be a person who lived only for today. Now you’re the person who’s stacking new habits for a better life."

Not A Bad Idea

Pro tip: Defer his second birthday for another year. In the meantime, teach him rudimentary reading/math skills and other stuff. By the time he enters kindergarten, your 'four-year-old' (who's actually five at this point) will be more academically advanced than his peers and the teachers will assume he's gifted. If you're worried he'll be taller than his classmates, limit his diet to non-nutritional food to keep his height down. That's what I did with my three boys. Although it would also work for girls.

5 Dollar Thrift Store Chair. On Mondays Everything Is Half Off So We Got It For $2.50. Upon Bringing It Inside We Found $3.88 In The Cushions. #blessed

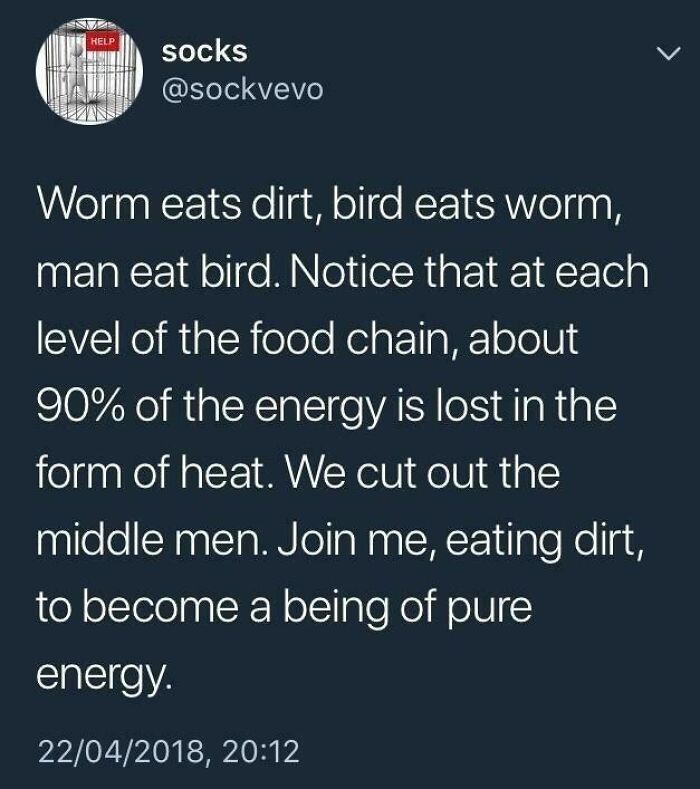

Join The Revolution, Brothers

aight (dirtifies) (edit: ty for all the likes and compliments, pandas!)

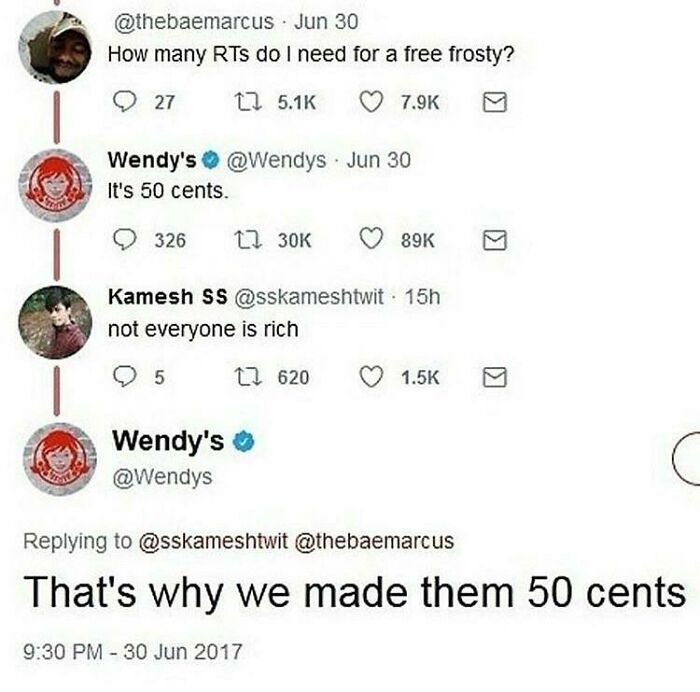

This Wendy Person Is Clearly An Elitist Fatcat!

It looks like people have been increasingly interested in saving (or earning) an extra dollar. At least on the internet.

For example, membership on the subreddit r/FinancialPlanning grew 87% between June 2020 and 2021 to more than 241,000.

And in the past year, it nearly doubled, reaching 423,000.

This Genius Has A Good Idea About Keeping Rent Low

I have told this story before. Moved into a new house in new neighbor hood. I was outside cleaning my throw rugs with an oldtimey wire thing. Cop pulls up, asks me if i heard anything, they have had reports of gunfire. No, i havent. He drove away. I thought " where have i moved to?" . Picked up the rug beater, hit the carpet. Oh.. um my bad. Beat the carpets a little less vigourously from then on.

How To Get Free Grapes

My Father, Smuggling Cheese Slices Into A Local Burger Joint, Rebelling Against Their $.60 Upcharge... Resist!!!

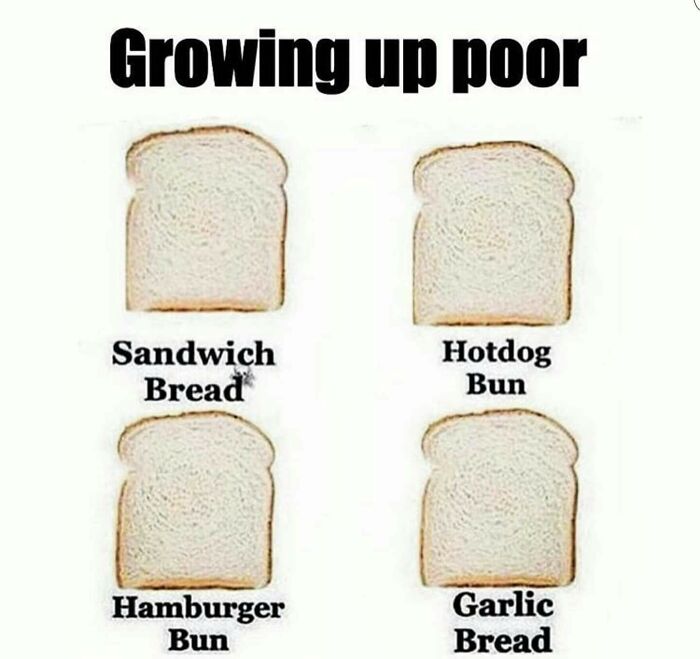

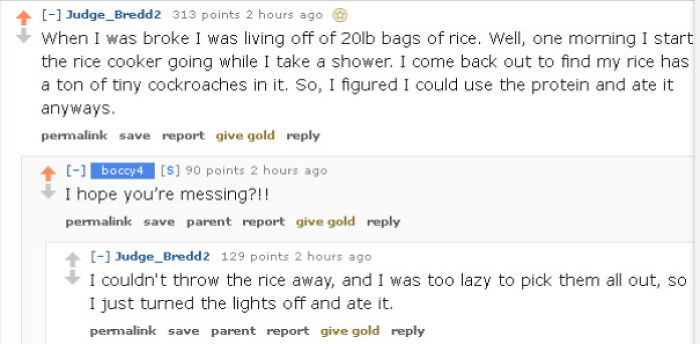

Imagine Thinking You're Poor When You Have Four Whole Slices Of Bread!

this is hella legit... specially when the lights are off because they were Too Much

For investing-specific conversations and news, over 2.1 million users turn to r/investing. (That subreddit's membership grew 83% between June 2020 and 2021.)

Then there's the subreddit r/personalfinance with a whopping 16.6 million-member army that hosts conversations about anything and everything related to spending, earning, saving, and investing.

So there's much more than memes to discover. Although these are savage, not gonna lie.

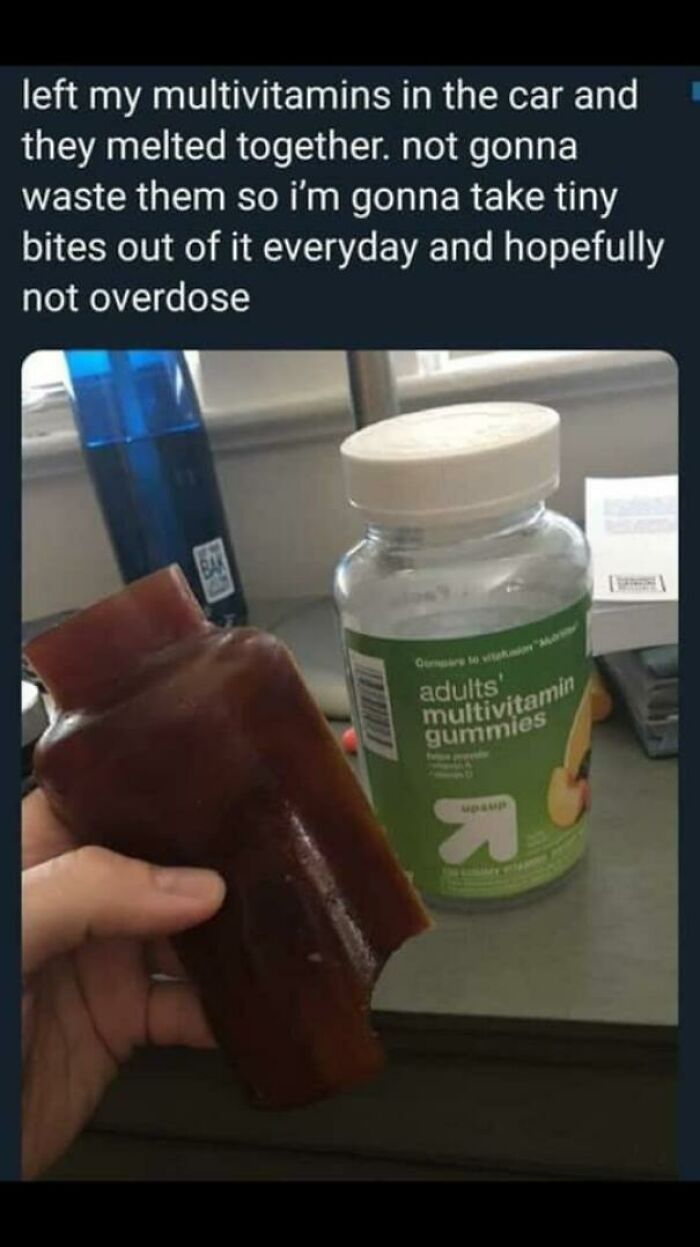

Practical Thinking

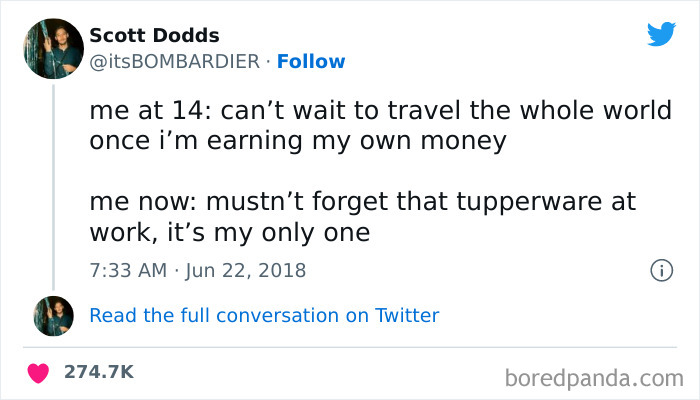

This Guy Understands Us

Look At Mr Fancy Pants Here With Tupperware. I Use Leaves To Carry My Food

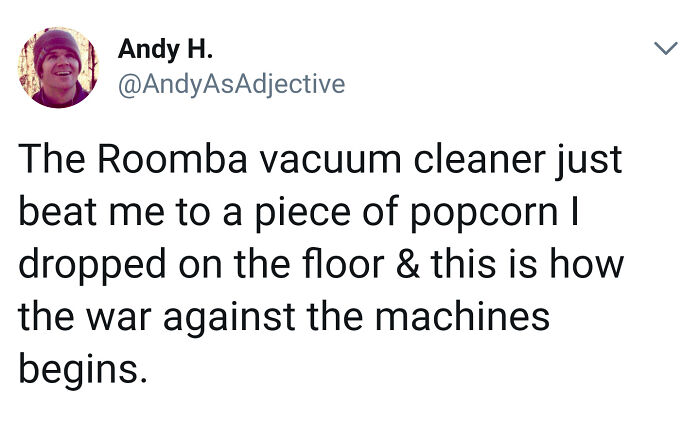

Lpt: Peel All Produce Before Weighing To Save $$$ At The Grocery Store

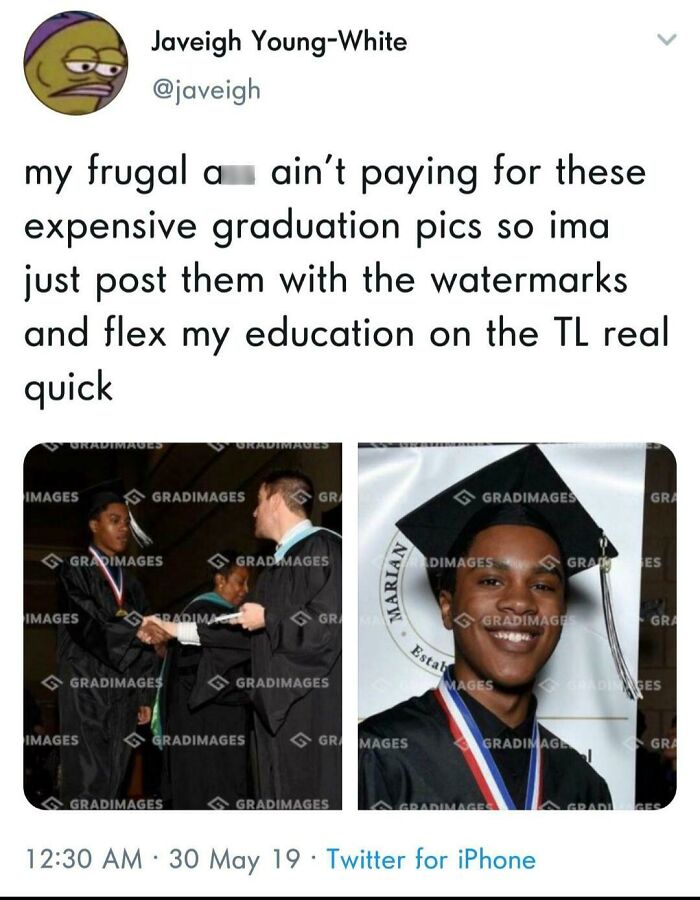

Saving On Graduation Pics

Easy Grill

Before anybody actually tries this. That's likely made from galvanized steel. You could get zinc poisoning or worse if other metals/compounds are present.

I Got Outed As A Fat Cat

Our New God?

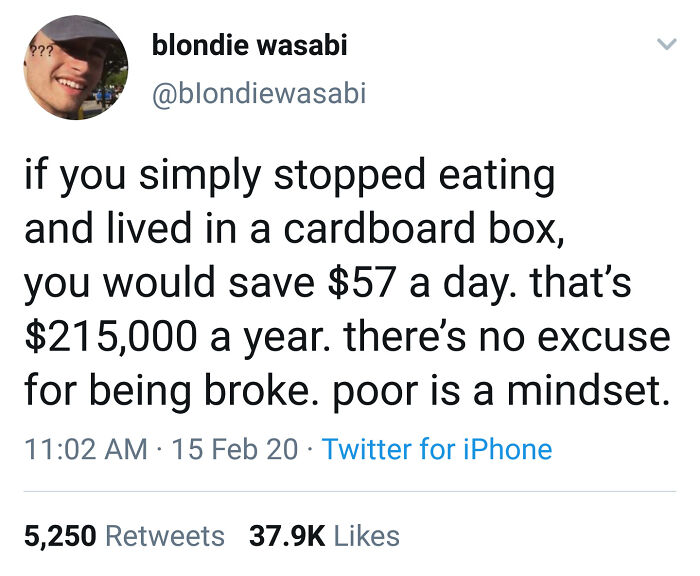

I Already Live In A Cardboard Box And Don't Eat, When Do I Get The Money???

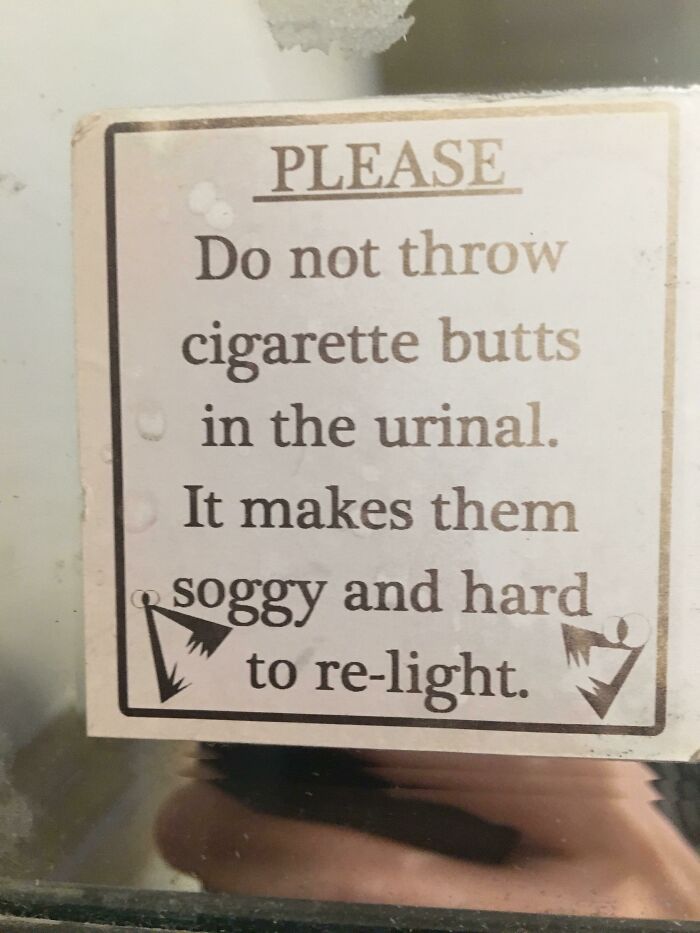

Found This And Thought It Was Fitting

Wasteful Fat Cats

Finally Had My New Pool Installed. Nice Knowing You Jerks!

Stickin' It To Those Goodyear Big-Wigs

Next Time You Are Visiting Someone's Home, Try To Get Yourself Alone With Their Toaster. A Great Bounty Awaits You

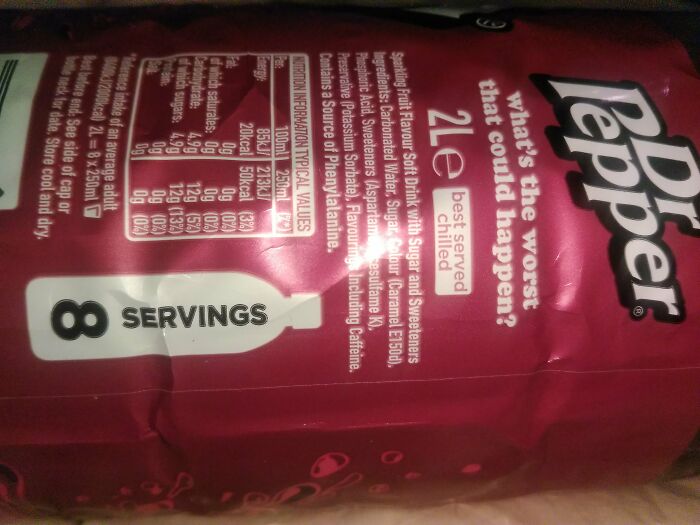

Fellers I'm Set For Life! I Found A Beverage With Infinite Servings Therefore Infinite Calories

You Know The Vibes

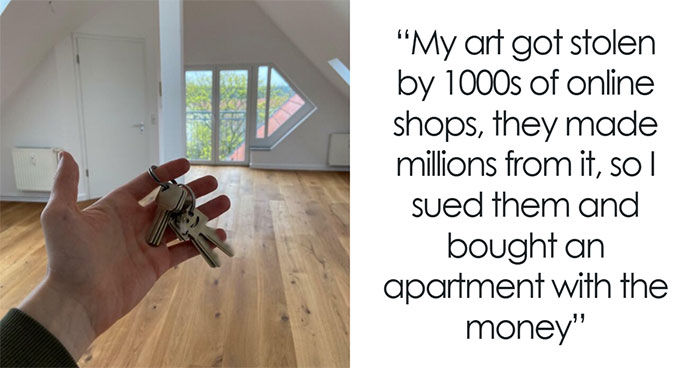

Today I'm Mortgage Free At 27!

oh hey, my house is like that too! i was able to save a little and upgrade to an Amazon box though… 😎😎

Instant Breakfast! Eat That You Fat-Cat Bastards!

The Gods Smile On Me Today

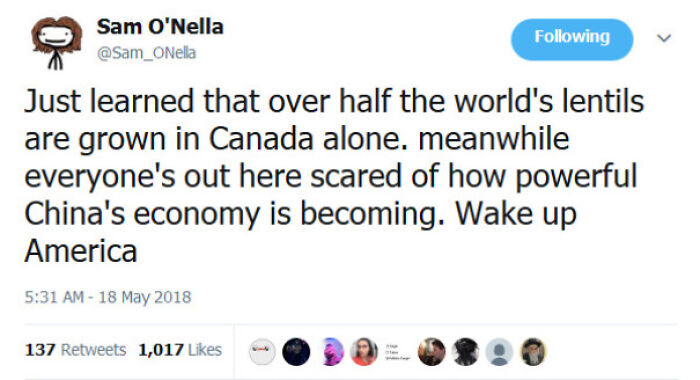

Now Who's Really Controlling The World??

Arrivederci, Suckers! I Just Scored Some Sweet Waterfront Property. Off To Join The 1%!

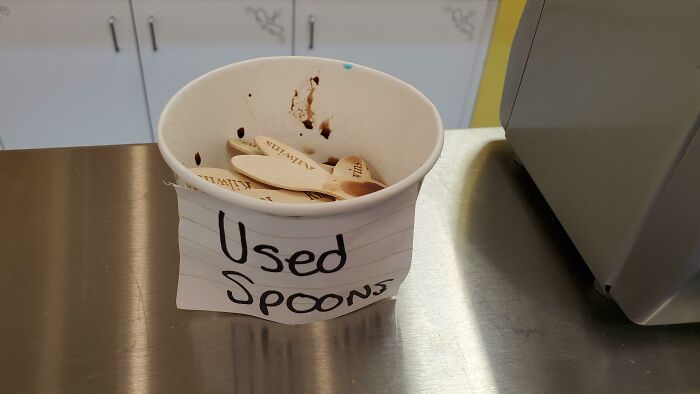

Holy S**t Guys, This Ice Cream Store Has A Cup Of Sample Spoons Covered In Free Ice Cream Just Sitting There

These Crumpets I Found Behind The Tesco Came With Free Antibiotics To Cure My Infection!

free therapy to most of the people here 😅 not trying to be offensive

free therapy to most of the people here 😅 not trying to be offensive

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime