388Kviews

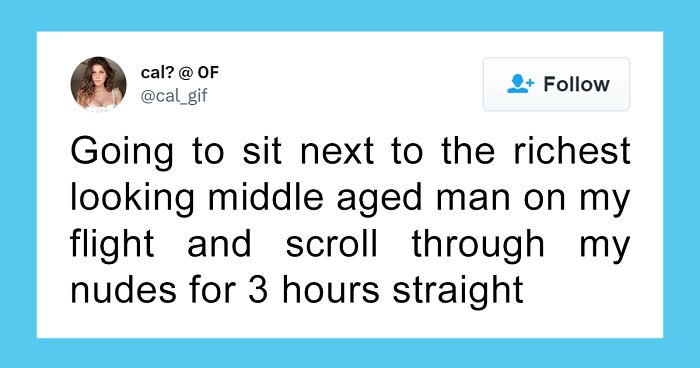

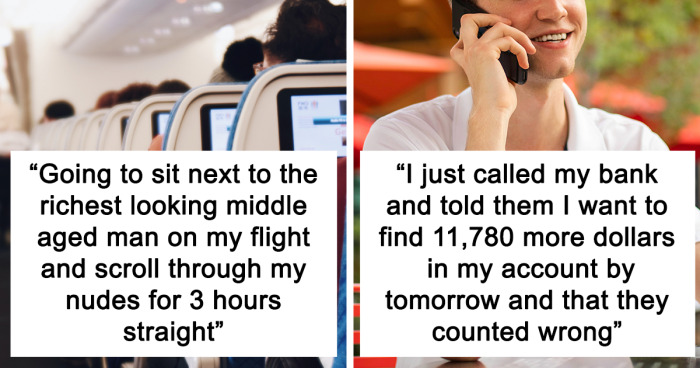

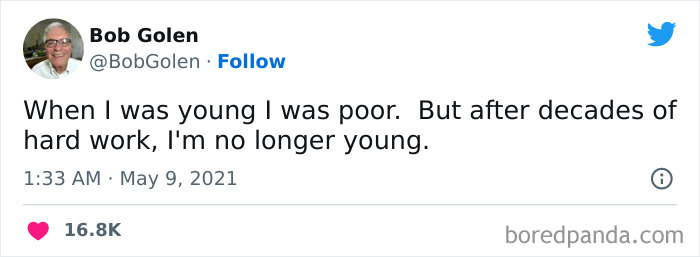

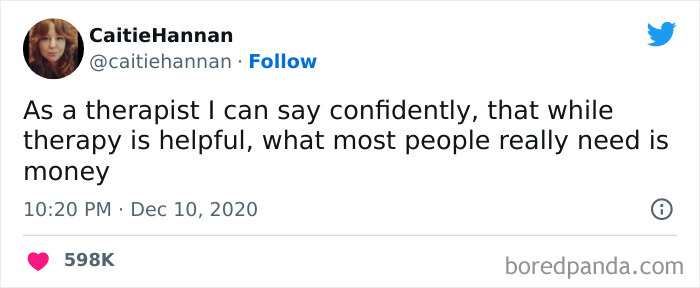

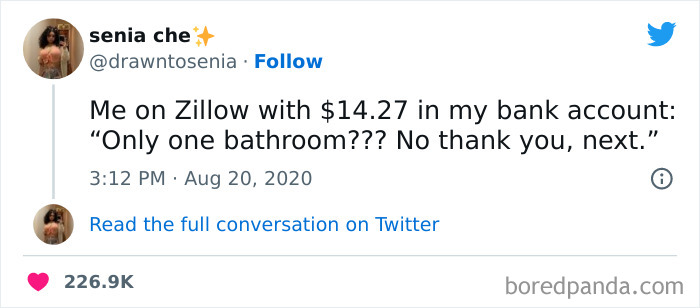

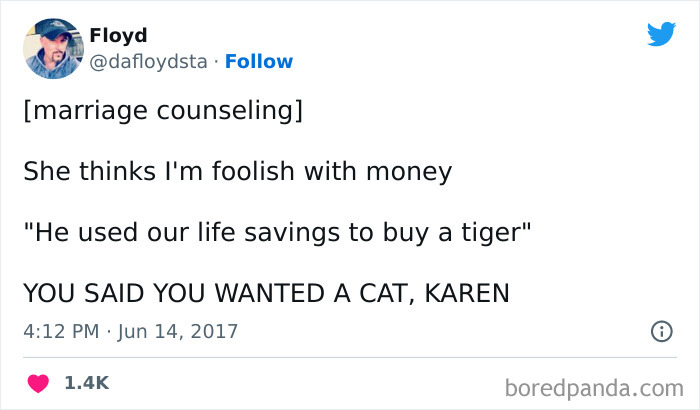

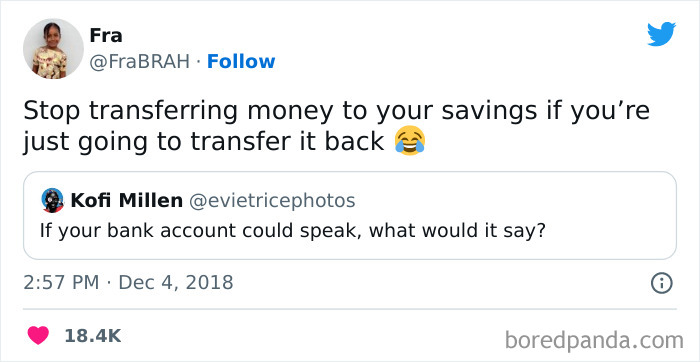

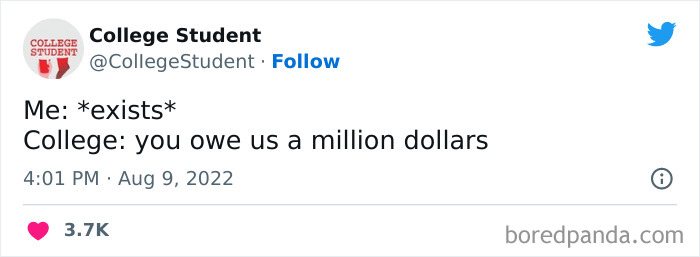

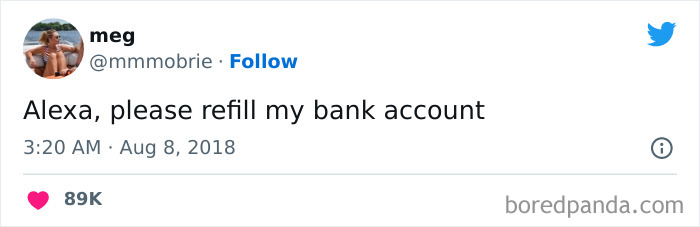

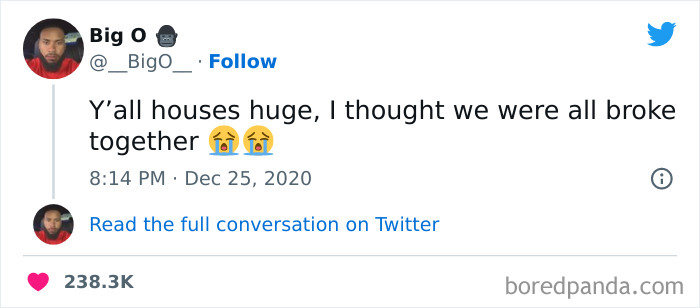

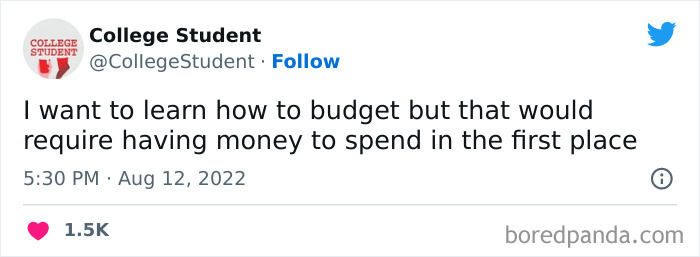

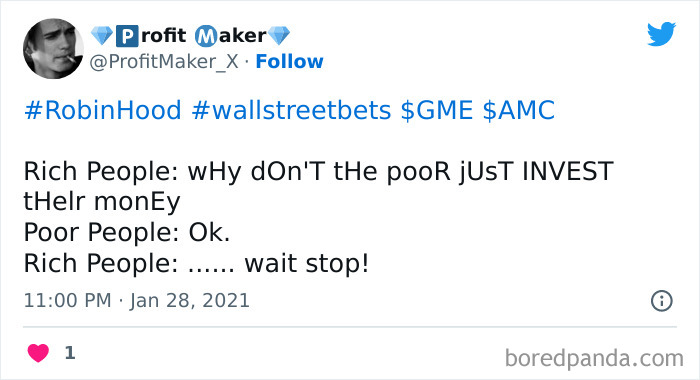

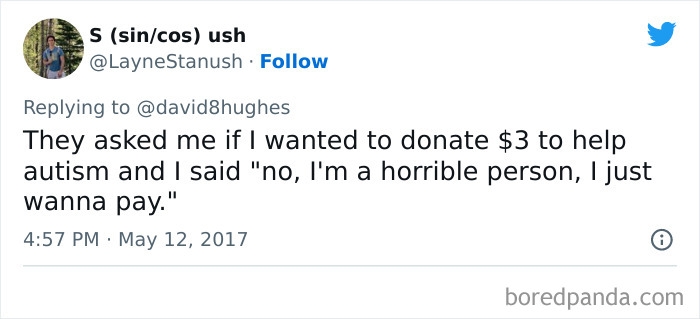

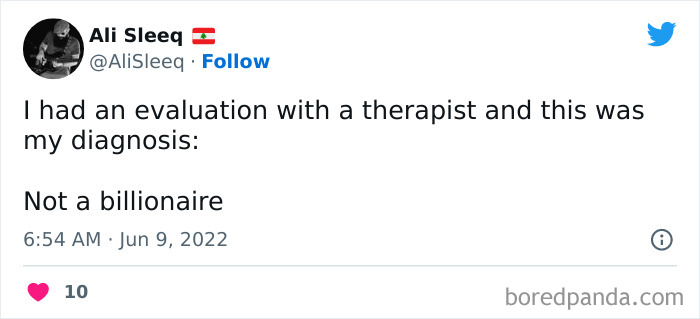

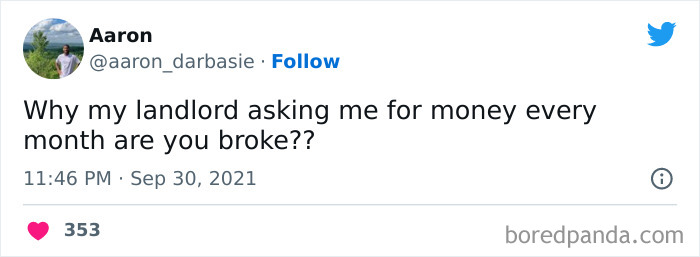

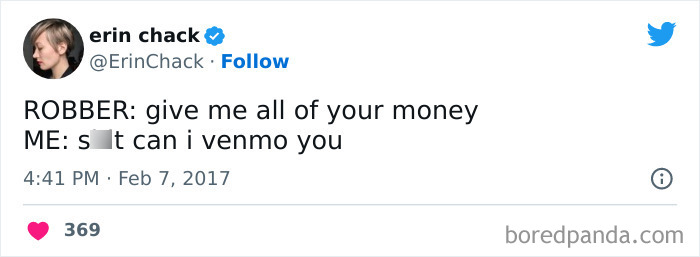

50 Times Broke People Just Laughed Through Their Pain And Created These Funny Tweets (New Pics)

An excellent sense of humor is a valuable trait. Not only is it good fun for the people around you, it can also alleviate the load when it comes to certain hardships in life. Having a hearty laugh can help balance out the hormonal changes in your body induced by stress-related chemicals.

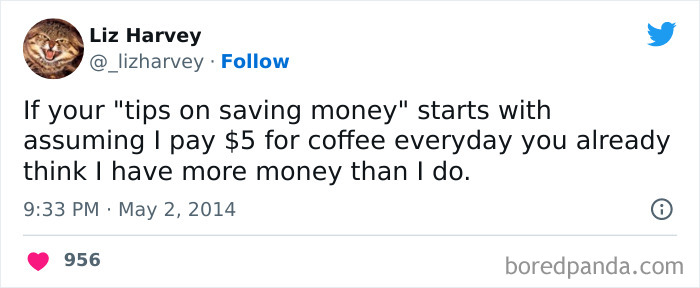

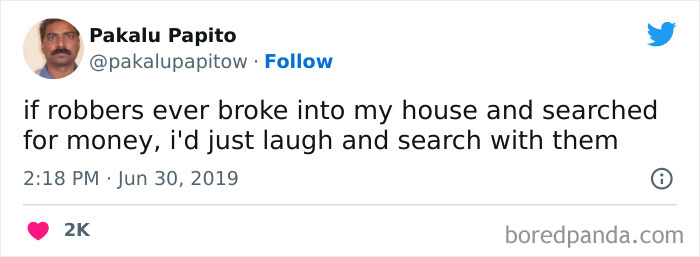

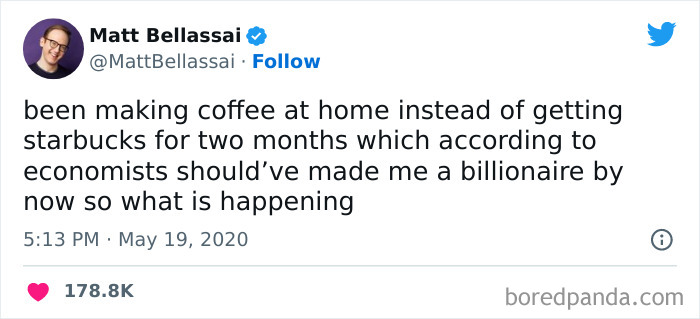

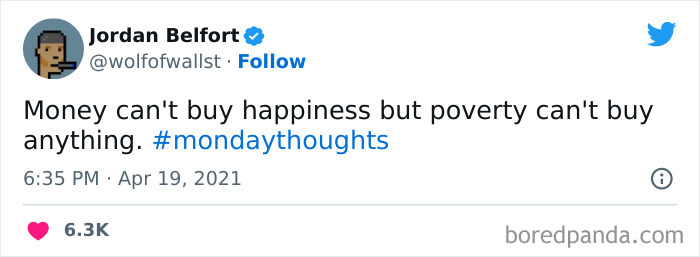

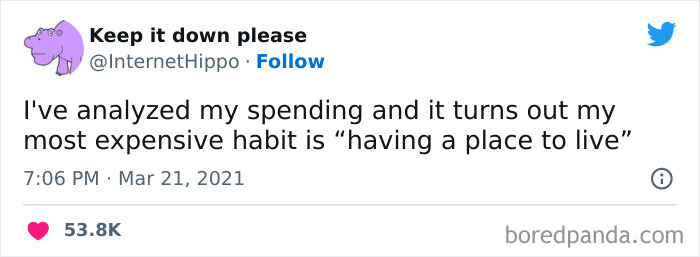

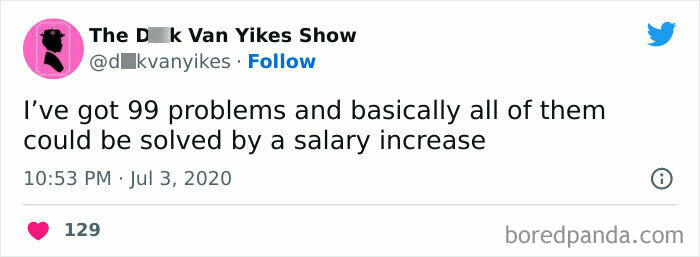

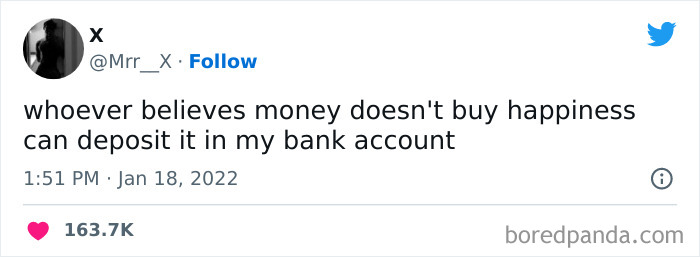

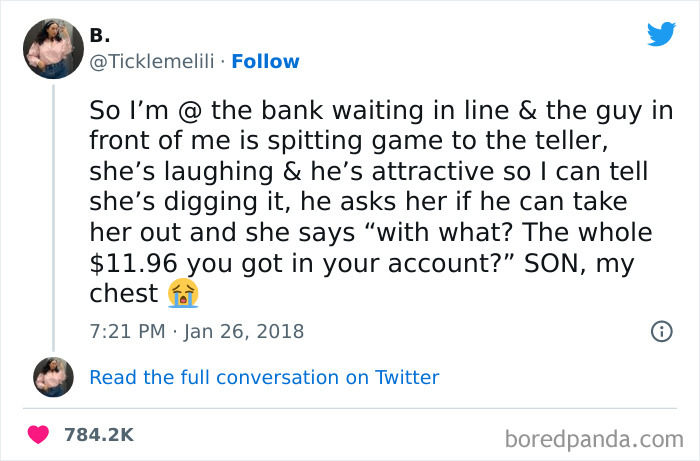

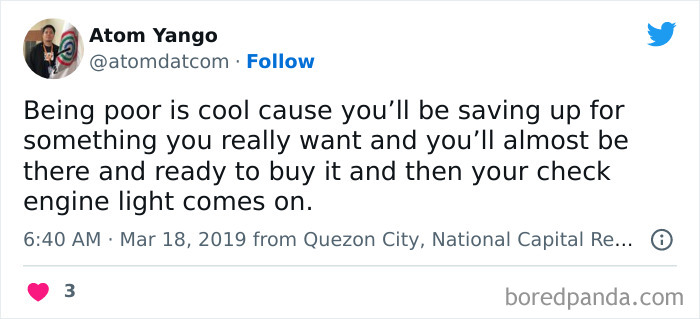

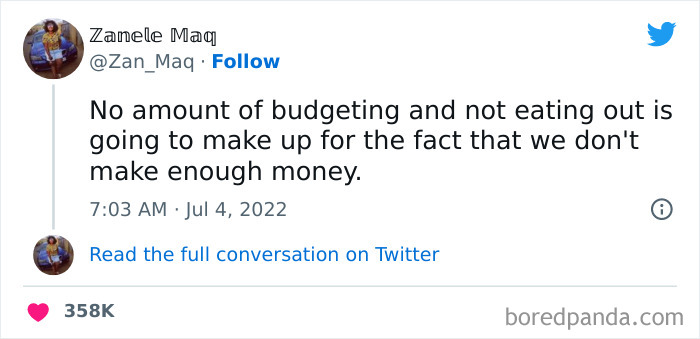

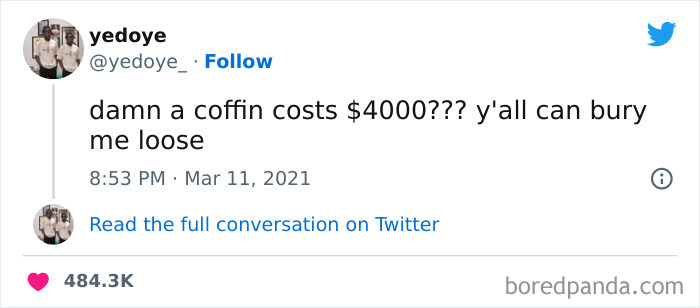

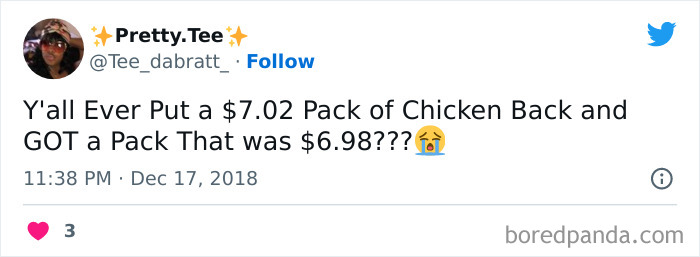

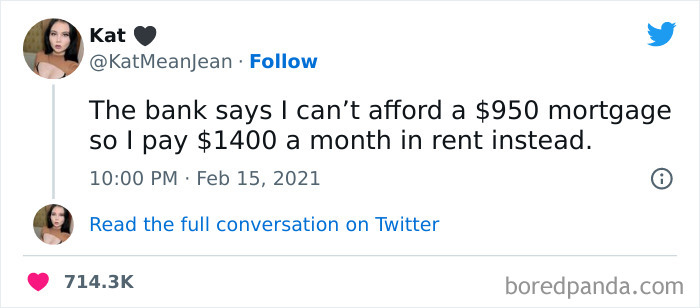

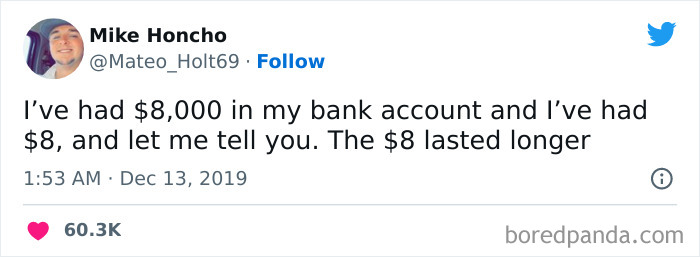

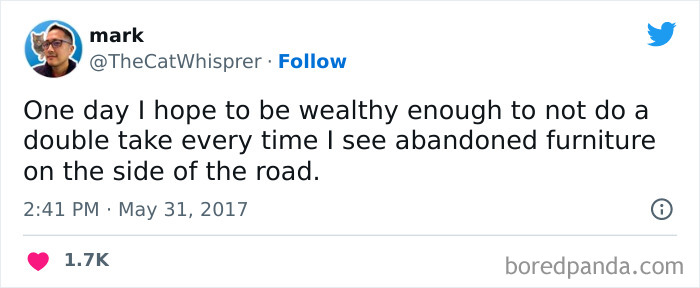

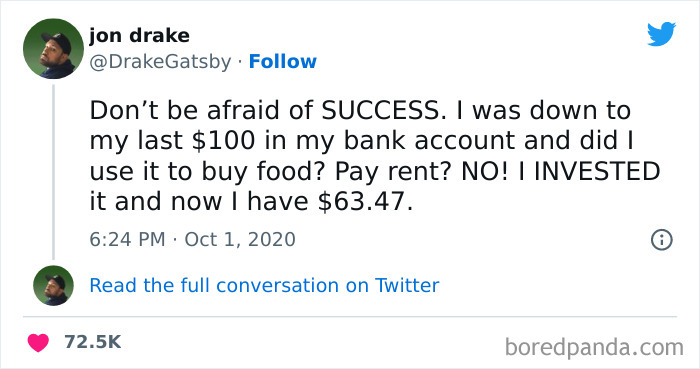

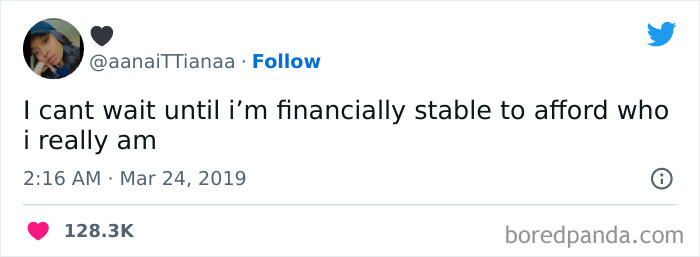

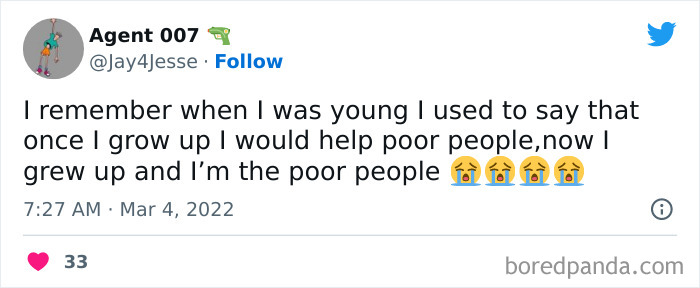

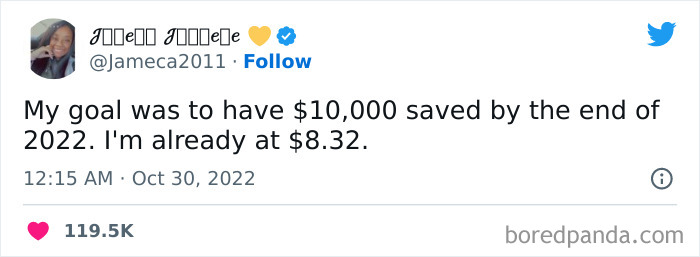

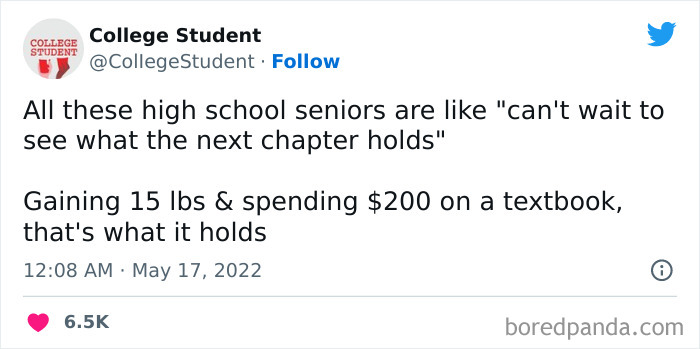

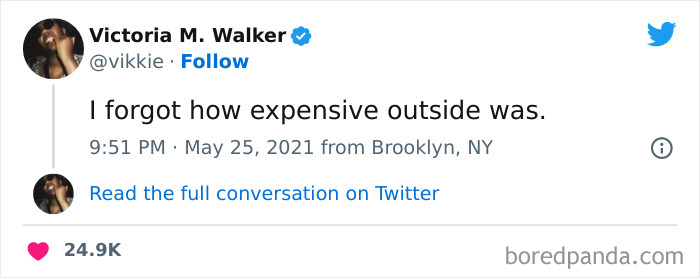

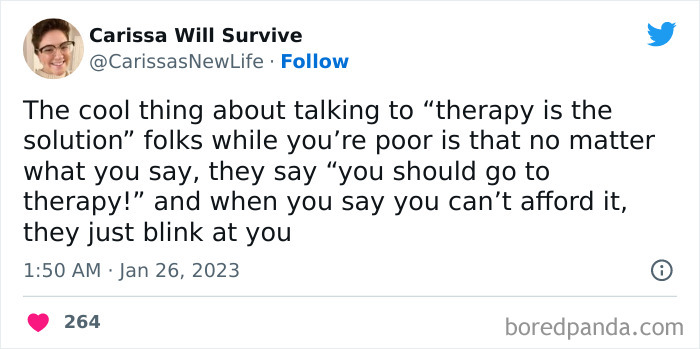

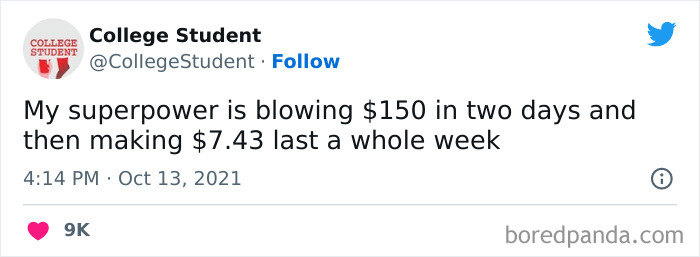

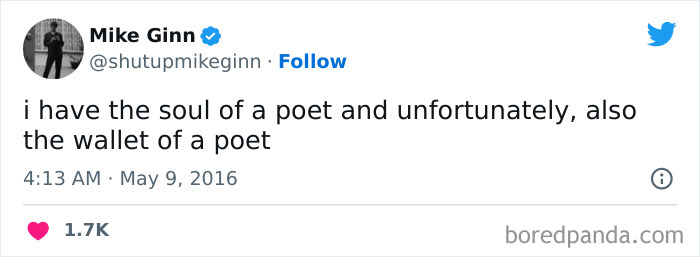

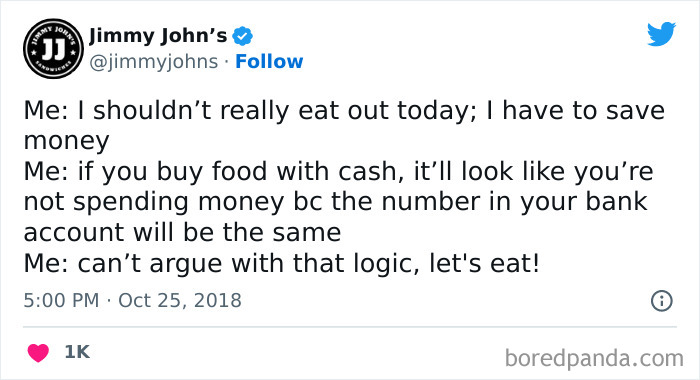

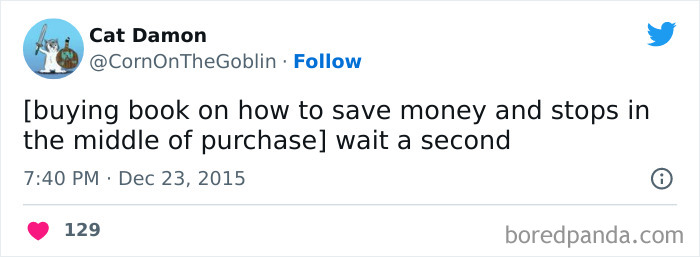

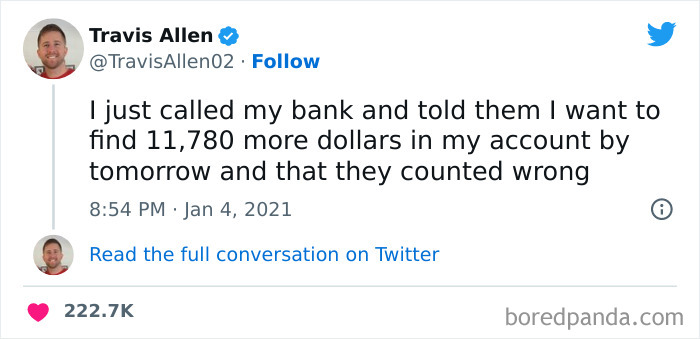

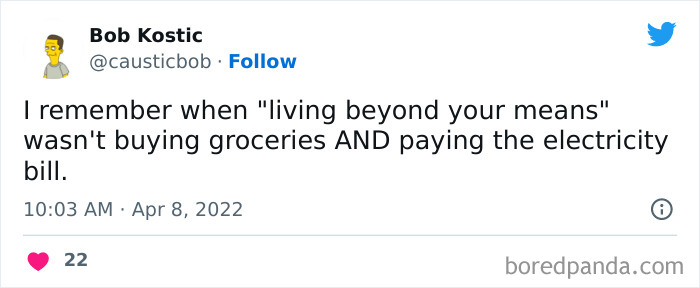

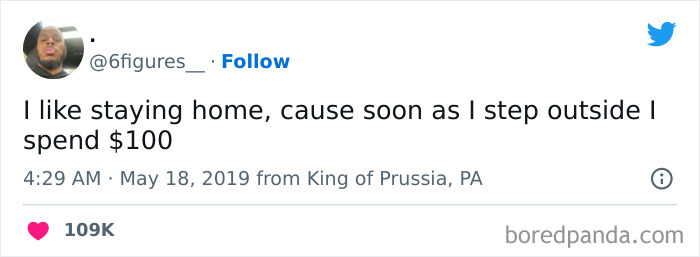

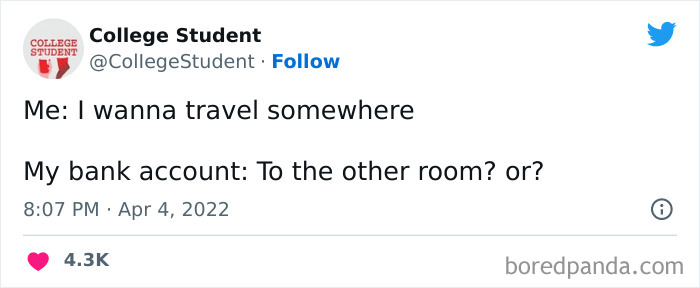

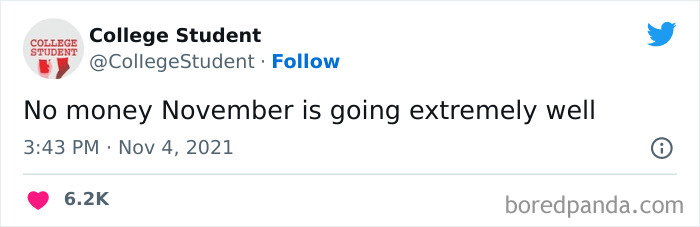

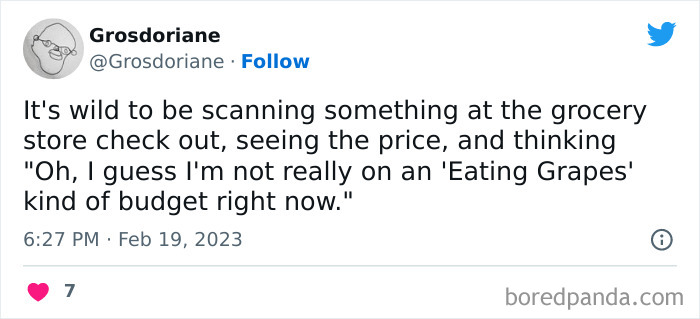

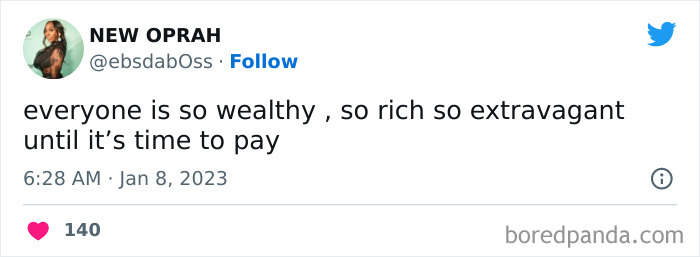

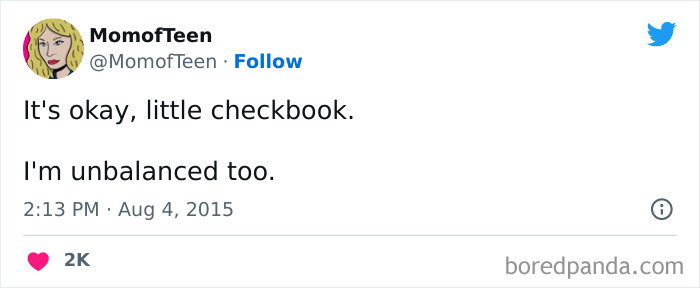

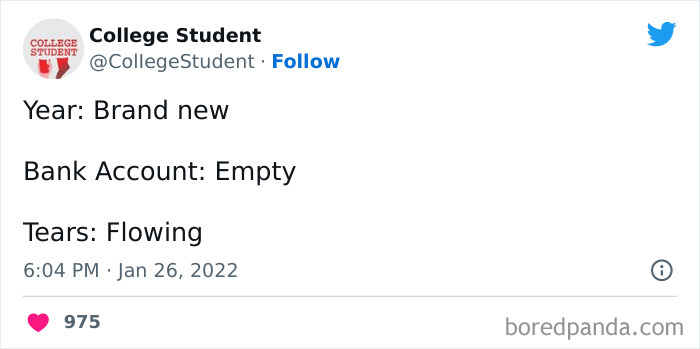

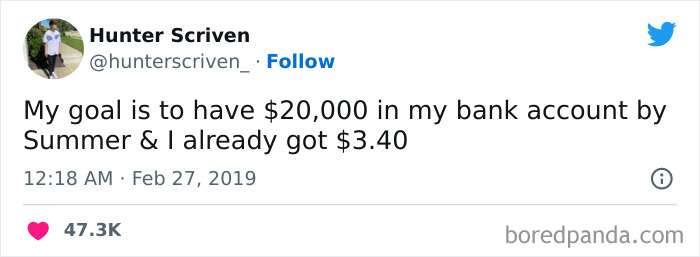

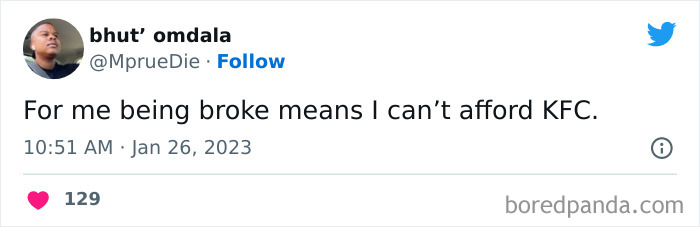

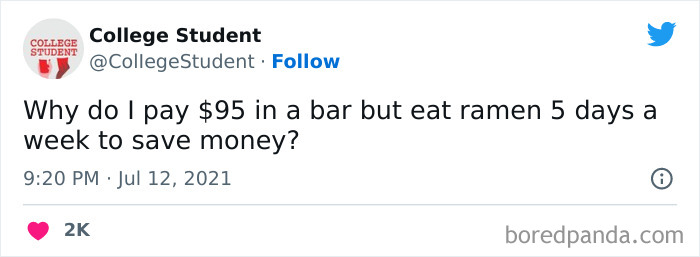

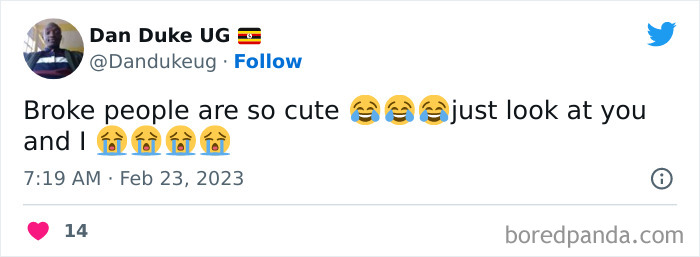

Financial troubles are a common hurdle people have to overcome. It’s not easy by any means, but some manage to look at it in a humorous way. And, luckily for the folk in the same boat (there’s something comforting in knowing that you’re not alone), they often share it with the world. We dove into the depths of the internet to bring you some of the most comical examples describing how broke people are. They might be running out of money, but they surely haven’t run out of jokes. Scroll down to find the descriptions and enjoy.

In order to understand personal finances better, Bored Panda discussed this topic with an expert in the field, the co-founder and CEO of ‘Spring Planning’, and the co-author of “Women & Money”, Julia Chung. You will find her thoughts in the text below.

This post may include affiliate links.

You might have heard people saying that laughter is the best medicine. And as hackneyed as it is, this statement has been proven to be correct. The benefits of humor to our well-being are based on scientific research, which reveals what happens in our brains when we laugh.

Expressing glee in such a way decreases the levels of cortisol and epinephrine, among other things, thus minimizing the impact of these stress-making hormones. It also positively affects dopamine and serotonin activity, which are two of the main happiness hormones.

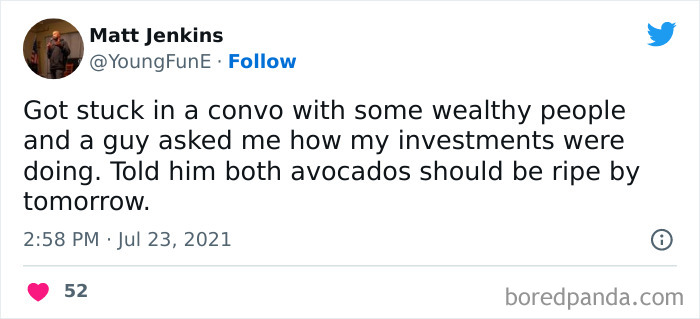

now that's clever, you are reducing your pre-made avo toast habit. Good on you /s

Because of the chemical reactions in our brain, humor can help get us through some rather difficult times. But only when we choose it ourselves. Bryan E. Robinson, a psychotherapist, an author and a professor emeritus at the University of North Carolina at Charlotte, revealed that the way we feel partially depends on what we focus our attention on.

“Science shows that dwelling on worry, disappointment, and loss only increases unpleasant feelings. What you focus on expands,” he wrote in Psychology Today. “If you’re like most people, you focus on the hardships instead of turning the channel and focusing on something that tickles your funny bone. You become the recipient of your own frustration and rage or joy and elation.”

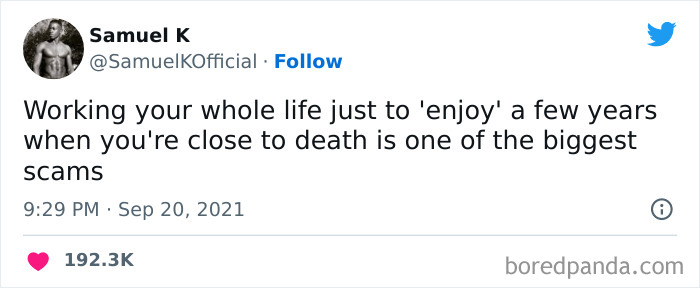

It shows that, by choosing what aspects to emphasize, people can have some control over the way their situation affects them. Authors of these quotes about being broke chose not to dwell on the negative side of their situation, and look at it from a more positive point of view instead.

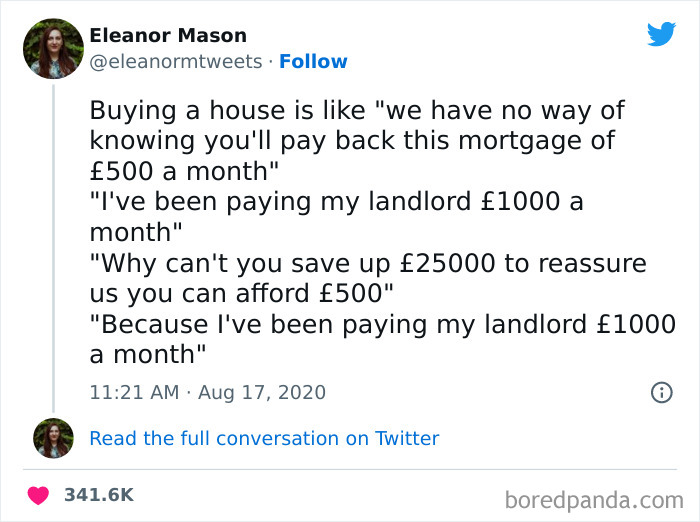

I used to say this to my dad in the 1980s, nothing has changed. It's still b******t.

100% LTV mortgages do exist, even now, but they're difficult to get and very expensive to maintain. The deposit's not about guaranteeing the monthly payments, but indemnifying the bank against losses if you default and they have to repossess and sell the house priced for quick disposal.

Even though we can choose to view a situation in a certain way, we can’t always choose laughter. Sometimes it’s simply inevitable. Have you ever been in a situation where you see someone laughing so hard, you can’t help but giggle yourself?

It might be related to the fact that when we hear laughter, our brain responds by automatically getting our face muscles ready to join in. In a group, this can create a domino effect of people bursting into laughter.

As a matter of fact, a proper fit of laughter could be considered a part of your exercise regime. Research shows that such a way of expressing amusement results in increasing energy expenditure; in other words, burning calories.

Considering that we tend to laugh at everyday occurrences, we might hit certain fitness goals without even realizing. According to SWNS, we laugh most at things kids say and TV sitcoms. The two are followed by memes/animal videos and reality TV respectively.

Humor could be considered a type of social glue. It connects people who share a similar sense when it comes to it, and accounts for numerous moments of laughing your heads off together.

Having a similar funny bone can help in platonic as well as romantic relationships. Research reveals that in the latter case, shared laughter is a very important component of bonding and establishing security.

I still live at home, do I don't have that expense but even so, it's hard to believe how much my car costs me and it's a company one

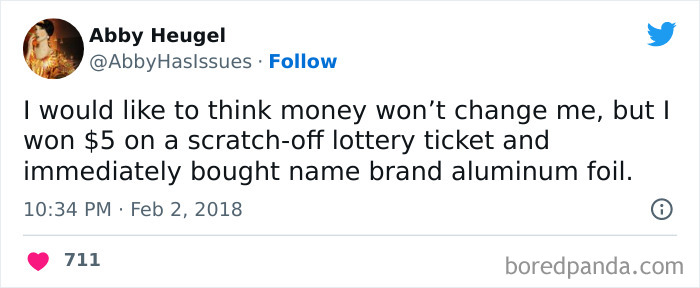

When it comes to the topic of these entertaining images, the data seems to be far less amusing. According to CNBC, nearly 80% of Americans admit to feeling anxious about their financial state. In addition to that, more than half of them (52%) find it difficult to control their concerns when it comes to money.

Anxiety can negatively affect nearly every aspect of our lives, thus it’s unsurprising that it influences our finances as well. Marketing professor Utpal Dholakia pointed out that psychological factors might play a bigger role in saving money, for example, than the size of people’s income. According to him, anxious people are “less likely to do such things such as make plans on how to use money, monitor their spending on various expenditure categories, or set savings goals.”

One of my sort of meditations is designing my perfect home. I always start with the catio

Inflation is one of the reasons people might feel unsteady about their financial well-being. Based on 2022 data, it affected roughly two thirds of working Americans who were worse off financially compared to a year ago. The annual inflation rate in the US for the last 12 months (ended in January, 2023) reached 6.4%. Itn previous years, it went from 1.4% in 2020, to 7% in 2021, and 6.5% in 2022.

not professionnal at all, not king, not true, the best date of my life cost less than 10 euros

or you trip and f**k up your ankle and have to go to ER and get a new tendon $ 100 000 later.

Learning to manage your money is always a good idea; now more than ever. Planning your personal finances can help you establish financial security and reach certain goals easier. The co-founder and CEO of ‘Spring Planning’, Julia Chung, shared with Bored Panda her three main tips for people who want to get better at managing their personal finances.

“Understand what it costs to live your life,” she started. “I don't mean combing through your bank statement, nor doing a bunch of math all the time. A little bit at the beginning is good though. Get an idea of your fixed expenses (bills, utilities, housing) and set up a separate account that you put money in every time you get paid to deal with just those.”

“Then look at the rest of your money; how much do you need to eat, get around, have some fun, and save for your future? Set up separate accounts for these. Look at them once a month. Was that enough? Was it not enough? What should I change for next month? Things change, so remember that your finances will change, too. You can stay on top of the dynamics of your finances with a simple system of accounts (or envelopes if you prefer to work in cash, which almost no one does) that you get to know monthly,” Julia suggested.

“Remember that there are some things that come up once a year (maybe car or property insurance, certain types of bills, special events where you just spend more money) and that those are the ones that mess up your system the most. Planning ahead for these with a little bit of your regular pay to a savings account or two focused on those kinds of expenses helps so much.”

Secondly, the personal finance expert emphasized the importance of creating a safety net. “When you can, start an emergency fund. If you're living pretty tightly, an emergency fund can feel like an incredibly lofty goal. It is one of those things that vastly improves your financial confidence and feelings of security, however.

"If you know that you have 3-6 months of expenses socked away in savings, you'll be okay when you're surprised with a bill you didn't expect, when you really want to walk out on that job where they treated you so badly, when you have a sudden breakup and need a place to stay, and so much more.”

“When you've got the above two sorted out and feeling good, it's time to think about your future,” Julia said. “You're not behind other people if you haven't got a house, a car, or a retirement fund. Whatever they're doing is whatever they're doing and they might be lying about it. It's not your problem.

“Shame is one of the things that gets us in the most trouble when it comes to money. If you can light that shame on fire and instead focus on spending the way that makes sense for you, creating short-term security in an emergency fund, and then thinking about the kind of future you want, and how you're going to get there, you're way ahead of most people.

“Whether that future means a retirement fund, or a house fund, or an education fund, or a travel fund, or learning how to invest for the first time, or buying some more security with personal insurance, or getting a will in place, or something else entirely, all of these are a great start. You'll be able to think more clearly about #3 when you've got #1 and #2 in hand,” the personal finance specialist pointed out.

Could be worse, could be Hong Kong. https://www.theguardian.com/cities/gallery/2017/jun/07/boxed-life-inside-hong-kong-coffin-cubicles-cage-homes-in-pictures

And after that, add another zero to the end of that dollar amount for rent.

me. God I hate it. Please just let me buy takeout every day? I hate cooking it is a mission and I am NOT convinced it's cheaper. Let's take an example. In my country, a mickyd is R 40-ish for the sandwich. About $2. OK? Now let's say I want to make one for dinner and have no ingredients. I must go to the grocery store and buy Mayo (R 25, say, $1 roughly). Then a lettuce, R 10 say, that's $ 0.5. Ketchup? R 40 for a small bottle, so $2. $0. Breadroll? R 5, say. $ 0,30. Patty? R 15-ish or about $0,75. Cooking time? Say 10 minutes, or 0,6 x 2000 kWh. Price at the moment is about $0,15/kWh here. So 0,6 x 2 x 0,15, so $0,18 for the electricity. Total price to make a burger here from scratch: $ 4,75. Or, about 2,3x more expensive to make it at home. This is called economies of scale. Unless I'm making 10 burgers, say, there's no point making at home. And no, I don't want to eat 3 burgers per day for 3,3 days. That will definitely make me fat. So for a single person, get takeout.

150$ in two days? amateur I can do that in one. /jk well not really.

same for self-help books. 1. Depressed because broke. 2. Write self-help bestseller. 3. Profit. 4. No more depression.

Any end-stage -ism is bleak, from what history shows, but when you're the ones living it? It always seems worse. If you are from the US, like I am? Please, vote against the GOP. I don't care what you think of anything else, but they're the party of "let's bring back slavery" and that's NOT OKAY.

Nein we Must Stand United against both the Fascist Menace and the Capitalist Scum!

Load More Replies...Because if we didn't laugh about it, We'd all cry ourselves into insanity.

"Being broke is not a disgrace - it is merely a catastrophe." - Nero Wolfe

My dog eats better than me and has more food choices even though his food looks like peuk in a can.

Any end-stage -ism is bleak, from what history shows, but when you're the ones living it? It always seems worse. If you are from the US, like I am? Please, vote against the GOP. I don't care what you think of anything else, but they're the party of "let's bring back slavery" and that's NOT OKAY.

Nein we Must Stand United against both the Fascist Menace and the Capitalist Scum!

Load More Replies...Because if we didn't laugh about it, We'd all cry ourselves into insanity.

"Being broke is not a disgrace - it is merely a catastrophe." - Nero Wolfe

My dog eats better than me and has more food choices even though his food looks like peuk in a can.

Dark Mode

Dark Mode  No fees, cancel anytime

No fees, cancel anytime