Poor Person Explains What Invisible Poverty Looks Like To His Rich Friend

The ‘American Dream’ rides largely on the idea that you can pull yourself up by your bootstraps and find success, but the reality that many Americans find themselves in proving that it’s not that easy. In a long heartfelt Tumblr post user rrojasandribbons described a conversation they had had with one of their more privileged friends on why it was so difficult to escape poverty.

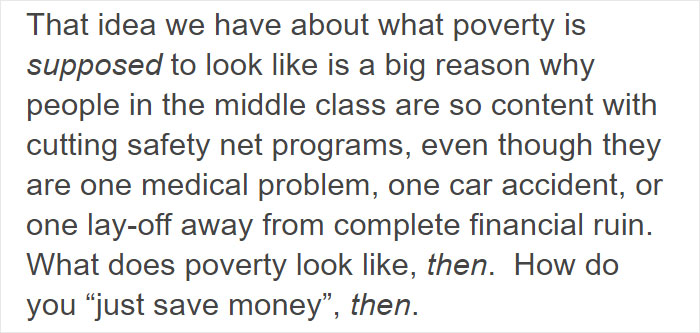

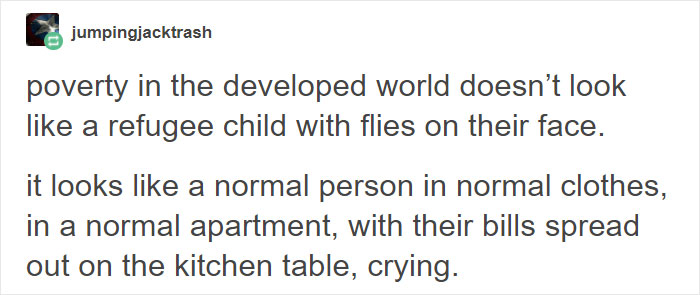

The friend could not believe that the poster had experienced such hardship like living on food stamps before, as they didn’t fit the image of what poverty line people look like or understood why they couldn’t have just “save money” to get out of it. Scroll down below to read this thorough and thoughtful explanation of the reality of escaping the poverty cycle.

Poverty is defined as when people “lack the means to satisfy their basic needs.” These needs can be explained from a more narrow perspective of what is necessary for survival or in a broader sense, the ability to maintain the standard of living for one’s community. A cycle of poverty is when poor families remain so for three or more generations.

When people imagine low-income people much of the time, they have a caricature of a dirty face with ripped clothing, living in the city, but if you look at the data, this image falls completely out of line with the full picture. In 1960 Lyndon Johnson declared war on poverty that focused resources on inner-city and rural areas, but in 2000 there was a geographical shift of poverty – to the suburbs.

According to a May report from the Pew Research Center, in the U.S suburban counties have experienced sharper increases in poverty than urban or rural counties since 2000. This change makes suburbanization of poverty one of the most important demographic trends within the last 50 years. Unfortunately, suburbs lack the same resources to respond to the growing poverty that the cities do.

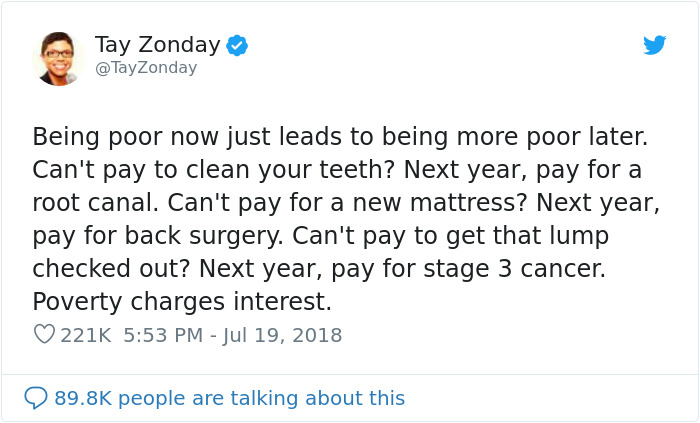

Necessary life expenses can be debilitating when you are living in the poverty cycle – especially health issue ones. To put it in perspective the cost for insulin, the shot for people with diabetes, doubled from 2012 to 2016 from $2,864 annually to $5,705. Meanwhile, the Canadian Diabetes Association (CDA) found that, on average, Canadians spend more than $1,500 Cdn per year on diabetes medications, devices, and supplies.

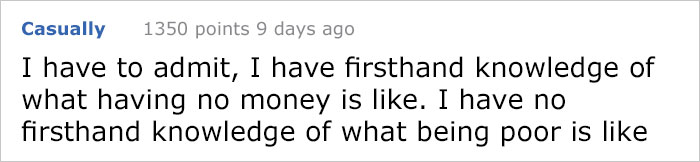

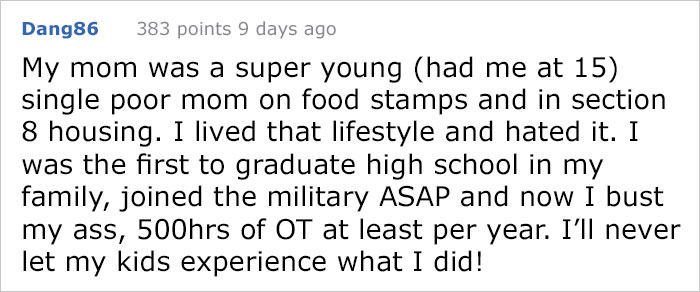

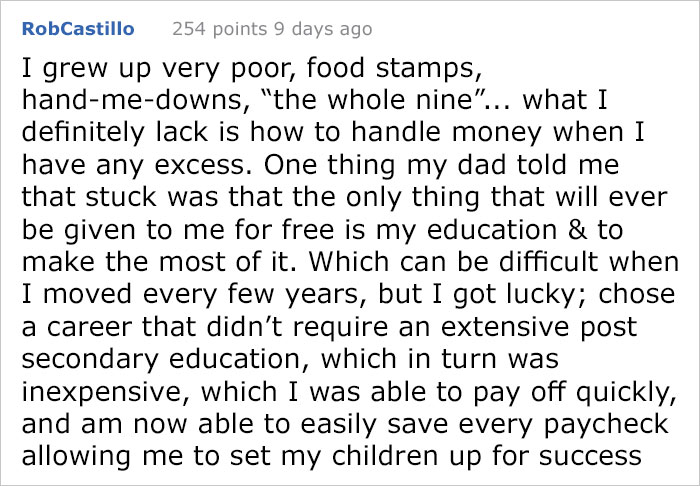

Other people online have echoed this message before

Image credits: TayZonday

And shared their experiences

217Kviews

Share on Facebook"The Sam Vimes "Boots" Theory of Economic Injustice runs thus: At the time of Men at Arms, Samuel Vimes earned thirty-eight dollars a month as a Captain of the Watch, plus allowances. A really good pair of leather boots, the sort that would last years and years, cost fifty dollars. This was beyond his pocket and the most he could hope for was an affordable pair of boots costing ten dollars, which might with luck last a year or so before he would need to resort to makeshift cardboard insoles so as to prolong the moment of shelling out another ten dollars. Therefore over a period of ten years, he might have paid out a hundred dollars on boots, twice as much as the man who could afford fifty dollars up front ten years before. And he would still have wet feet. Without any special rancour, Vimes stretched this theory to explain why Sybil Ramkin lived twice as comfortably as he did by spending about half as much every month." -- Terry Pratchett

This paragraph right here turned Pratchett into one of my favourite authors. I've tried to explain this concept to my dad for years, but now that my parents are a little better off he still keeps buying cheap stuff that he needs to replace often, instead of something that would last.

Load More Replies...It’s not about saving five dollars here and there. A truly, actually poor person is guaranteed to be behind on more than one bill, always, at all months. Any spare five dollars is just part of catching up on whatever is the furthest past due.

True. Having a few hundred dollars in savings is not a reality for most low income people. You are forever behind on bills, and if an emergency occurs, you end up pawning something, or taking out a payday loan. And that's a trap that keeps you further and further behind.

Load More Replies...What the OP said. And anyone who says, "Just go to college" or "just do (fill in blank)" is so blessed that they have *no* idea how blessed/lucky they are... and still probably only one bad day away from the situation they disparage.

And those same people will have no sympathy when you have thousands of dollars in college loans to pay back.

Load More Replies...My favorite statement of ignorance is, "Just get a job." As if there are hundreds of them out there that pay a living wage with benefits and all the trimmings just waiting for any old person to walk in and take without the red tape getting in their way. I currently have a phenomenal job that pays the bills and I love it.

Yes. I also love it when people get mad at poor people being "picky" about which jobs they get. I will do any job to pay the bills, but I can't justify driving 100 miles one way for a low paying job. I'm not being picky; I literally cannot afford to take that job. My car can't handle that. I can't handle that. Someone actually asked why I didn't just move closer. Why, and how, would I do that? I have taken 'out of town' jobs before, and just slept in my car, but no one should have to do that.

Load More Replies...:( Being poor is hard. I lived in relative poverty as a child (single mom, alcoholic/absent dad, social housing). But we had support, there was always financial aid available. Eventually, we were better off than that later (our moment of "we made it" was when we went to shop at IKEA for the first time). I have now a normal job and it feels like I'm living the dream. However, I cannot imagine how it must be to be poor in the US. Being poor in Germany was tough, lonely, but managable. Being poor in the US means that you need to pay for basic human rights (healthcare, sickness, education - none of that affects you financially when you're in Germany). This is some next level sh!t and I'd bet that there'd be a revolution in that system if the people affected by poverty weren't so damn busy just trying to keep themselves and their dependants alive. This is so messed up.

All of my life, my mother has been on disability (she was 41 when I was born, and when I was six months old, she suffered an accident with a horse). She received welfare. My father worked morning to night for his parents, who hardly paid him. Our house should have been condemned, and we couldn’t afford to pay for it. Twice, our power was cut off. The second time, it lasted for three or four years. My mom left my dad, I went with her. I only get clothes because the government helps us, but half of the money we get, my mother uses so she can have clothing as well. We can’t afford to wash them when we need to; we have to rewear stuff. My dad only got his power back on a few years ago. We live paycheck to paycheck. Mom and I have to scrape at the end of the month. I know a level of poverty myself, and always have. And I’m used to it. I’m working age, but still a minor, but I can’t drive. My iPad was given to me by the school. I get a lot of help, and I know I’m not on the lowest (cont...)

- lowest level of poverty. But I understand it. It’s difficult. And you can’t just save to get out of it.

Load More Replies...My husband's illness (Crohn's disease) beggared us along with a whole bunch of medical bills for bowel surgery that he had. He eventually committed suicide after they hooked him on opioids.

Wow. These are the realities of poverty, but because you guys may have went to the movies or had new pants, people dismiss it or say you deserved the poverty. I’m very sorry about your loss.

Load More Replies...My parents make enough money that it puts us in the middle class area, but because of their huge amounts of debt and my dad's constant health problems, I've had to take out loans for every year of college. I work a part time night job from 9:30pm to 2:30am on top of taking 18 hrs a semester, I pay for rent and groceries, have no savings, and am looking into selling plasma so I have a safety net. I've even had to visit the Paw Pantry which is a store of free non-perishable items for students in financial trouble. I’m also going to group therapy every week since it’s covered by tuition and struggle with anxiety and depression. I have to somehow maintain financial stability, mental stability, academic success, and my physical health. I’m doing my best to thrive instead of just survive.

You sound like someone determined and capable. Take any help offered (be mad not to) but it will be YOU that gets you through all of this.

Load More Replies...I'm a single Mom and I fit into the poor to lower middle class range. And I find that I struggle the most when I make bad decisions and try to live above my means. I do not struggle to put food on the table. But I have to be really careful and stick to a budget and not give in to wants. Also I sacrifice stuff that I need so I can provide for my child. I'm lucky because I have a job with insurance. He needs braces though and so I'm not sure where that money is going to come from. We'll make it somehow. :)

I am a single mom too and I do not overindulge. I simply do not have enough money to cover my basic needs. Last month I made $1,600... With the rent over $1,1K and phone & internet bills, gas, food, I do not have to make sacrifices - there's just no room for them. One cannot make "bad decisions" when your total $$ earned are less than what you need to cover basic needs. Yeah, I guess I can go to a bar and get drunk instead of paying rent, but it does not really matter when you don't make enough. You are screwed anyways.

Load More Replies..."The Sam Vimes "Boots" Theory of Economic Injustice runs thus: At the time of Men at Arms, Samuel Vimes earned thirty-eight dollars a month as a Captain of the Watch, plus allowances. A really good pair of leather boots, the sort that would last years and years, cost fifty dollars. This was beyond his pocket and the most he could hope for was an affordable pair of boots costing ten dollars, which might with luck last a year or so before he would need to resort to makeshift cardboard insoles so as to prolong the moment of shelling out another ten dollars. Therefore over a period of ten years, he might have paid out a hundred dollars on boots, twice as much as the man who could afford fifty dollars up front ten years before. And he would still have wet feet. Without any special rancour, Vimes stretched this theory to explain why Sybil Ramkin lived twice as comfortably as he did by spending about half as much every month." -- Terry Pratchett

This paragraph right here turned Pratchett into one of my favourite authors. I've tried to explain this concept to my dad for years, but now that my parents are a little better off he still keeps buying cheap stuff that he needs to replace often, instead of something that would last.

Load More Replies...It’s not about saving five dollars here and there. A truly, actually poor person is guaranteed to be behind on more than one bill, always, at all months. Any spare five dollars is just part of catching up on whatever is the furthest past due.

True. Having a few hundred dollars in savings is not a reality for most low income people. You are forever behind on bills, and if an emergency occurs, you end up pawning something, or taking out a payday loan. And that's a trap that keeps you further and further behind.

Load More Replies...What the OP said. And anyone who says, "Just go to college" or "just do (fill in blank)" is so blessed that they have *no* idea how blessed/lucky they are... and still probably only one bad day away from the situation they disparage.

And those same people will have no sympathy when you have thousands of dollars in college loans to pay back.

Load More Replies...My favorite statement of ignorance is, "Just get a job." As if there are hundreds of them out there that pay a living wage with benefits and all the trimmings just waiting for any old person to walk in and take without the red tape getting in their way. I currently have a phenomenal job that pays the bills and I love it.

Yes. I also love it when people get mad at poor people being "picky" about which jobs they get. I will do any job to pay the bills, but I can't justify driving 100 miles one way for a low paying job. I'm not being picky; I literally cannot afford to take that job. My car can't handle that. I can't handle that. Someone actually asked why I didn't just move closer. Why, and how, would I do that? I have taken 'out of town' jobs before, and just slept in my car, but no one should have to do that.

Load More Replies...:( Being poor is hard. I lived in relative poverty as a child (single mom, alcoholic/absent dad, social housing). But we had support, there was always financial aid available. Eventually, we were better off than that later (our moment of "we made it" was when we went to shop at IKEA for the first time). I have now a normal job and it feels like I'm living the dream. However, I cannot imagine how it must be to be poor in the US. Being poor in Germany was tough, lonely, but managable. Being poor in the US means that you need to pay for basic human rights (healthcare, sickness, education - none of that affects you financially when you're in Germany). This is some next level sh!t and I'd bet that there'd be a revolution in that system if the people affected by poverty weren't so damn busy just trying to keep themselves and their dependants alive. This is so messed up.

All of my life, my mother has been on disability (she was 41 when I was born, and when I was six months old, she suffered an accident with a horse). She received welfare. My father worked morning to night for his parents, who hardly paid him. Our house should have been condemned, and we couldn’t afford to pay for it. Twice, our power was cut off. The second time, it lasted for three or four years. My mom left my dad, I went with her. I only get clothes because the government helps us, but half of the money we get, my mother uses so she can have clothing as well. We can’t afford to wash them when we need to; we have to rewear stuff. My dad only got his power back on a few years ago. We live paycheck to paycheck. Mom and I have to scrape at the end of the month. I know a level of poverty myself, and always have. And I’m used to it. I’m working age, but still a minor, but I can’t drive. My iPad was given to me by the school. I get a lot of help, and I know I’m not on the lowest (cont...)

- lowest level of poverty. But I understand it. It’s difficult. And you can’t just save to get out of it.

Load More Replies...My husband's illness (Crohn's disease) beggared us along with a whole bunch of medical bills for bowel surgery that he had. He eventually committed suicide after they hooked him on opioids.

Wow. These are the realities of poverty, but because you guys may have went to the movies or had new pants, people dismiss it or say you deserved the poverty. I’m very sorry about your loss.

Load More Replies...My parents make enough money that it puts us in the middle class area, but because of their huge amounts of debt and my dad's constant health problems, I've had to take out loans for every year of college. I work a part time night job from 9:30pm to 2:30am on top of taking 18 hrs a semester, I pay for rent and groceries, have no savings, and am looking into selling plasma so I have a safety net. I've even had to visit the Paw Pantry which is a store of free non-perishable items for students in financial trouble. I’m also going to group therapy every week since it’s covered by tuition and struggle with anxiety and depression. I have to somehow maintain financial stability, mental stability, academic success, and my physical health. I’m doing my best to thrive instead of just survive.

You sound like someone determined and capable. Take any help offered (be mad not to) but it will be YOU that gets you through all of this.

Load More Replies...I'm a single Mom and I fit into the poor to lower middle class range. And I find that I struggle the most when I make bad decisions and try to live above my means. I do not struggle to put food on the table. But I have to be really careful and stick to a budget and not give in to wants. Also I sacrifice stuff that I need so I can provide for my child. I'm lucky because I have a job with insurance. He needs braces though and so I'm not sure where that money is going to come from. We'll make it somehow. :)

I am a single mom too and I do not overindulge. I simply do not have enough money to cover my basic needs. Last month I made $1,600... With the rent over $1,1K and phone & internet bills, gas, food, I do not have to make sacrifices - there's just no room for them. One cannot make "bad decisions" when your total $$ earned are less than what you need to cover basic needs. Yeah, I guess I can go to a bar and get drunk instead of paying rent, but it does not really matter when you don't make enough. You are screwed anyways.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

312

229