People Don’t Usually Save Up For These 27 Things And Face Financial Shock When They Occur

You know, in an economics course, students are told about many economic laws, and it would be worth adding a few more - the so-called “Murphy's Law.” For example, the eighth law, which says: “If everything seems to be going well, you have obviously overlooked something.” It’s incredible how many bad things could have been avoided if people had listened to these laws...

But today we’re not going to talk about that entirely. Even if our financial condition looks great today, in fact, no one can guarantee us that this will continue for a long time. And in human life, there are many expenses, both regular and unexpected, that can punch a big hole in even the most powerful family budget. You can read about everything related in this selection of ours, based on this viral thread in the AskReddit community.

More info: Reddit

This post may include affiliate links.

Almost all the random expenses that come with home ownership. New hvac. New roof. Sewer line repair. List goes on

Almost all the random expenses that come with home ownership. New hvac. New roof. Sewer line repair. List goes on

I just paid 2 guys £1350 for 3 hours work to patch a leak in my roof.

Having a baby with absolutely any health problems.

Having a baby with absolutely any health problems.

Folks are starting to understand just having a kid is expensive (birth, day care, cost of the car seat, etc.), but having a diabetic toddler or a child who needs heart surgery is just off the charts.

My friends from college had a baby with vision and hearing impairments. It's absolutely upended them financially. It changes who can babysit, who can/will go to doctors visits, and pretty much every part of their house has had to change. She's not even school aged yet.

My sister has OI and my family live in the US so my parents had the option to stick her in a wheelchair and just have that be her life or spend tons of money on "non essential" therapies and surgeries so she could at least walk like other kids in her school. The financial stress was almost insurmountable even with decent insurance but the emotional toll can't be put into a monetary amount. My heart goes out to anyone raising a child with any disability. If that is you just know people who lived through it see you and I don't speak for everyone but most of us are here to help if you need it.

The art of managing personal finances in the turbulent contemporary world is not an easy task. It’s not for nothing that today you can find literally hundreds and thousands of master classes on this issue - and hardly a few percent of them will be truly wholesome and effective. In fact, it is unrealistic to calculate what unexpected problems may affect our financial condition, but it is quite possible to minimize their negative effect.

Getting old, your body doesn't work like it used to. Ageism in the work place. Medical cost

Getting old, your body doesn't work like it used to. Ageism in the work place. Medical cost

thankfully medical cost isn't an issue here, at least.. not yet. Though if the tories get their way by the time my generation is old it may well be.

Vet bills. My dog has had 3 surgeries in the past 3 years.

Vet bills. My dog has had 3 surgeries in the past 3 years.

Edit: no pet insurance. All cash unfortunately.

But that’s what money is for and you plan ahead for these things. If my dog wasn’t on his last few years I might do Insurance. I don’t know much about it.

Edit: pet insurance it is. 👏

They’ve done economic surveys; most Americans couldn’t afford an unexpected $1000 expense.

They’ve done economic surveys; most Americans couldn’t afford an unexpected $1000 expense.

So… just about friggin’ anything.

I wish it was a $1000 problem. I have to save ahead of time to go to the doctor because on top of the co-pay we get these surprise bills months later because the insurance "only" paid part of the bill from the doctor and they send you the remainder...this is from a typical office visit at a "primary care" facility.

“Economics is actually a pretty simple science - especially when we talk about personal finance,” says Olga Kopylova, Ph.D., associate professor of economics at Odessa National Maritime University, with whom Bored Panda got in touch for a comment here. "By and large, we are talking here about the ability to balance income and expenses, as well as proper timing for some really big expenses."

“You know, this kind of monetary logistics is to understand at what point you can afford to go into the red and when not. The ability to connect cash flows in space and time. And, of course, a clear understanding of what expenses we can afford, and which ones we can't. True, this will require not only certain knowledge, but also rational thinking, not overestimating one’s strengths and capabilities - but this is not always achievable, unfortunately," Olga summarizes.

Extremely low wages for “entry level” positions that require a degree and ten years of experience.

Extremely low wages for “entry level” positions that require a degree and ten years of experience.

Hey, I remember saying the same thing in the 1970s, the more things change, the more they stay the same.

Job loss.

Job loss.

Near instant doom spiral.

Granted, losing your job sucks, but if you have worked for four years straight, you at least get 2 year's worth of unemployment benefits, which is about 80% of your wages. You are required to find a job in the meantime, of course, but at least you have some sort of income. If you have worked less than 4 year's straight, you are eligible for social benefits, which is lower than unemployment, but it can be supplemented

One I saw too often was when the husband dies, the pension stopped. It sucked helping older women find jobs, especially when they had no experience in any job. We had to provide training in soft skills, too, like showing up at an exact time.

One I saw too often was when the husband dies, the pension stopped. It sucked helping older women find jobs, especially when they had no experience in any job. We had to provide training in soft skills, too, like showing up at an exact time.

And, of course, we always need to take into account the possibility of so-called “black swans” - events that always come unexpectedly, have significant consequences, and then, in retrospect, rational explanations can be found for each - but only in hindsight. The concept, introduced by the writer and financier Nassim Taleb, of course, relates mainly to the macroeconomic level - of states and large corporations, but it can be extrapolated to the personal level as well.

For example, a sudden illness that will require long-term and expensive treatment also occurs suddenly, has really serious consequences, and then we'll definitely provide quite a logical basis for it - for example, “I should have quit smoking earlier!” Thus, the impact of “black swans” on our personal finances cannot be calculated, but it is possible to create a certain financial “safety cushion” to avoid the main consequences.

Car insurance. Don't get a ticket.

Car insurance. Don't get a ticket.

Where I'm from, insurance has nothing to do with tickets. A ticket you pay yourself: insurance is for when you cause an accident or are a victim of one and the guilty party doesn't have insurance. It's illegal to drive without insurance, by the way. The longer you drive without making use of this insurance, the lower your insurance rate will be.

Family members with poor financial management who have emergencies and no one else to go to.

Family members with poor financial management who have emergencies and no one else to go to.

No response IS a response. You were not their last resort… You were there most convenient…

We sincerely hope that you, our dear readers, will not find yourself in an unpleasant situation when your personal budget is leaking and there are no additional funds to replenish it. And if this collection of thoughts and opinions ever saves you from an unpleasant financial case - well, then our efforts were not in vain!

Hospital bill.

Hospital bill.

I've been to the hospital twice in the last 5 years. The first time was a long weekend in the ICU. The second was checking myself into the ER.

Bill for the former? $40,0000. The latter? $17,000.

Fortunately I had "good" insurance and only paid (checks notes) about 5 grand for both.

Most people don't have "good" insurance or 5 grand they can drop when the guano hits the air conditioner, and I got off light.

Long Term Care costs.

Long Term Care costs.

If you can't take care of yourself, you should budget about $50K-$100K a year. So many planned inheritances go up in smoke because the money they wanted to give their kids goes to their long term care.

Long term care insurance is important folks. Make sure your parents have it.

I don't even make $50K a year. How in the hell am I supposed to budget that or more if I don't even have that to live on before something like that happens?

When you have zero family and friends you see that s**t hits the fan all the time. And it’s costly. You don’t realize just how often until you’re 100% on your own.

When you have zero family and friends you see that s**t hits the fan all the time. And it’s costly. You don’t realize just how often until you’re 100% on your own.

Even worse when you live paycheck to paycheck. It’s nearly impossible to prepare for these kinds of things. And don’t even try to rely on anyone, it just adds bumps in the road.

All you can do is save save save. Every penny counts.

Social Security overpayments. Hello! This is the SSA, and we overpaid you $20,000 over the course of your disability. Please, pay it back in full in 30 days.

Social Security overpayments. Hello! This is the SSA, and we overpaid you $20,000 over the course of your disability. Please, pay it back in full in 30 days.

Needing a heart stent in their 40s even though they are a runner in very good shape.....and their insurance has a 10K max out of pocket.

Needing a heart stent in their 40s even though they are a runner in very good shape.....and their insurance has a 10K max out of pocket.

Completely hypothetical and happening on Monday.

Most developed nations don't have problems like that. Even Cuba does this better than the US.

Not planning for retirement.

Not planning for retirement.

Social security isn't as much money as you think, and if you don't have IRA or 401k you're planning for poverty

Getting sick.

Getting sick.

This. I have been sick too many times to count. High volume retail can kill you.

The difference in registration and insurance when you get rid of the Buick your parents bought you in high school and the new SUV you just bought.

The difference in registration and insurance when you get rid of the Buick your parents bought you in high school and the new SUV you just bought.

Family member committing a serious crime.

Family member committing a serious crime.

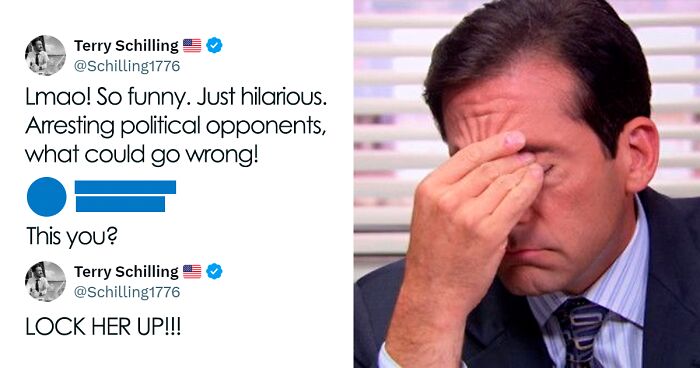

Electing an idiot who wrecks the economy causing record inflation while claiming to be building back better.

You aware that a lot of your readers aren't American and most of this doesn't apply to them?

Electing an idiot who wrecks the economy causing record inflation while claiming to be building back better.

You aware that a lot of your readers aren't American and most of this doesn't apply to them?

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime