Mistakes are inevitable. No matter how prepared you (think you) are, no matter how lucky you were born, at some point in time, you’re going to get into an accident that might set you back a lot financially. It hurts. It’s embarrassing. It’s devastating. But the silver lining is that you’re far from the only person to be in this predicament—lots of people can empathize with you.

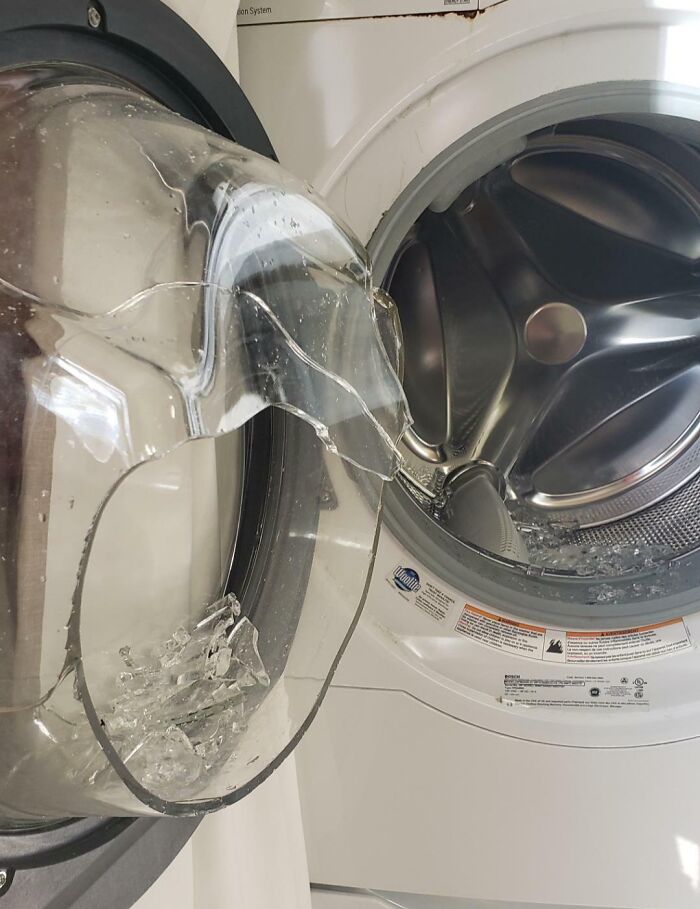

Our team at Bored Panda has collected some of the most expensive fails to ever be shared on the internet, from smashed phones and broken home appliances to damaged cars and wrecked homes. Scroll down to check out the pics below. Remember, no matter how bad you think things can get, they can get a lot worse—and that, ironically, makes you more grateful for what you already have.

We wanted to learn how we can all become more financially and emotionally resilient no matter what may come, as well as how we can resist the temptation to keep upgrading our things to the latest models. Personal finance expert Sam Dogen, the founder of Financial Samurai and the author of Millionaire Milestones: Easy Steps to Seven Figures (out May 2025), was kind enough to share his thoughts on this. You'll find Bored Panda's interview with him below.

This post may include affiliate links.

This Is A Prime Example Of Why You Don't Park In Front Of A Hydrant

"Financial shocks are inevitable—it’s not if they’ll happen, but when. The key to resilience is preparation, adaptability, and having the right mindset," Dogen explained to Bored Panda via email.

"The best financial defense is a cash cushion. Having 6–12 months’ worth of living expenses in a liquid account gives you breathing room when the unexpected happens. It’s not exciting, but cash provides options, and options reduce stress. At the same time, diversifying income streams is just as crucial. Relying on a single paycheck is risky, so whether it’s rental income, dividends, or a side hustle, having multiple sources of income makes you far more resilient when financial storms hit," the personal finance expert advised.

It's also essential to distinguish between the things that are within your control and those that you can't affect while also being active rather than passive. "Beyond financial preparation, controlling what you can control is just as important. You can’t prevent market crashes, layoffs, or recessions, but you can manage your spending, continuously build new skills, and make sure your investment portfolio is structured to withstand downturns. If you stay proactive instead of reactive, you’ll always be in a stronger position," Dogen said.

Looks Like I Won't Be Listening To My New Vinyl Record. Thanks, USPS

That is painful, especially if it was a hard-to-find classic. They should be packaged better. The USPS doesn't pay attention to labels that say "do not bend"

My Mom Accidentally Left Her Mirror In Front Of The Window Over The Day. After Coming Back She Found This

"And when setbacks do happen, reframing them as temporary is key. No financial hardship lasts forever, and history has shown that recoveries always follow downturns. Hence, if we're talking about a big stock market sell-off, dollar-cost average in and stay the course. The people who win are those who keep a long-term perspective and use tough times as opportunities to learn, adapt, and even invest when others panic," he said.

"At the end of the day, resilience isn’t about avoiding financial hardship altogether—it’s about being prepared enough to navigate it with confidence and come out stronger on the other side."

Owning the newest models, makes, and gadgets might sound cool, but it can be a (bigger) drain on your finances. And if you feel compelled to keep upgrading everything all the time, you can feel like you're no longer in control. Bored Panda asked personal finance expert Dogen about resisting this temptation to keep buying the newest things.

"Some people are driven to own the newest, most expensive gadgets, cars, and status symbols because of a mix of psychological and social factors—fear of missing out (FOMO), the thrill of novelty, and the belief that these upgrades signal success. Marketers are brilliant at making us feel like what we have is suddenly outdated, nudging us to spend money unnecessarily," the founder of Financial Samurai explained.

Facade Wall Contractors Used A Drill Too Long For The Job

Was showering for 10 mins, when I realized, two rooms were in this state...

Long Story Short, I Saw A Cockroach

Put Them In Oven On Purpose To Hide Them From Kids. Forgot About Them

You don't have to worry about hiding the controllers from the kids now. NOW, you have to worry about hiding *yourself* from the kids!

"But if you step back and ask, Is my current phone, car, or gadget still doing its job? The answer is probably 'yes.' The trick to resisting the urge to constantly upgrade is shifting your mindset from chasing to appreciating. If you focus on functionality over hype, you’ll realize that holding onto something longer—especially when it still works just fine—is an underrated wealth-building move," he said.

"One of the most important personal finance ratios I’ve developed is The House-To-Car Ratio. If you want to build more wealth, aim for a ratio of 30 or higher. The reasoning is simple: a house is generally an appreciating asset, while a car is almost always a depreciating one," Dogen told us.

"To improve your ratio, either buy a less expensive car or hold onto your car longer. As your car’s value declines over time, your House-To-Car Ratio naturally increases—letting depreciation work in your favor instead of against you. The longer you resist the temptation to upgrade, the more your wealth compounds where it truly matters."

When You Live In Svalbard, Norway And Forgot To Close The Window To The Home Office

30 Inch Water Main Break Caused By Contractor Work

How To Lose Almost Half A Million In 24 Hours. [oc] Porsche 911 Gt3 Rs Put In A River The Day After It Was Purchased

According to Dogen, another great exercise is to calculate what you would save by delaying unnecessary upgrades and investing that money instead. "Put $1,000 into the market instead of a new phone, and in 20 years, that could be worth $5,000 or more. Small decisions like this compound over time and can mean the difference between financial independence and being stuck on the hedonic treadmill," he said.

"I used to think I’d upgrade my car after 10 years, but after driving my dad’s 28-year-old beater in Honolulu, my decade-old car suddenly feels brand new. Perspective is everything. The key is learning to enjoy what you have rather than constantly craving something new. That’s how real wealth—and contentment—is built."

Friend Of Mine Posted This Photo Of The Job Site Today

Break out the shovels and buckets and work fast before it sets. I've been there.

Flooding Inside Duke Hospital In Durham, North Carolina Due To A Burst Pipe

Phone Slipped Out Of My Pocket While Go Karting And Became Wedged Under The Kart. This Is What I Found At The End Of The Lap

You cannot allow yourself to live in constant fear and paranoia that something bad will happen, because all that chronic worry will destroy your health. Naturally, many things will inevitably go wrong in your life. Over and over again. Mistakes, accidents, and rejection are a part of life. How you react to situations that you can’t control, despite your best preparation, is what matters.

On the one hand, you can blame yourself and/or the world for your bad luck, and stew in your misery. On the other hand, you can see failure as an opportunity for growth, flexibility, and improvement. (You get bonus points if you can laugh and stay optimistic in the face of adversity.)

Some mistakes are going to cost you more money, time, and energy than others. Spilling your morning coffee on your shirt during rush hour can be embarrassing and yucky, but it’s likely not going to break the bank. Having your car, home, or expensive new gadget wrecked due to a run of bad luck, meanwhile, is going to set you back immensely.

Before You Ask, It's A Jackfruit

Driving Into Your Garage With Your Bike Still Attached To You Cars Roof

Taking A Shower For The First Time In The House I Just Bought 🤡

My first ever house! The tiles hit me on their way down. I got out of the shower and simply walked away to make/have a coffee because I can not mentally handle this yet.

Your ability to weather the storm is going to depend on your character (i.e., how you respond to immense stress) and your finances (whether or not you have enough resources to replace the loss).

Broadly speaking, the better off you are financially, the more of a safety net you have when it comes to unforeseen events. If your income is bigger than your expenses, if you’ve got enough savings and investments, then you can quite easily pay to repair the damage done without compromising your lifestyle. Not everyone is as lucky, though.

On the other hand, if you’re living paycheck to paycheck, every additional expense can be a major headache that forces you to sacrifice important aspects of your life, whether that’s paying for food, fuel, bills, clothes education, etc.

Repairing a damaged phone, appliance, or car isn’t just an inconvenience, it’s now a question of survival. That’s why it’s so important to have some sort of emergency budget that you can fall back on when times get tough.

I Accidentally Dropped My Perfume Bottle

Ever Make A $100,000 Mistake?

Recently moved to shipping for a ink making company. While unloading a dark trailer, I punctured a 2000# tote of water based ink. The entire thing emptied in a matter of seconds. The entire trailer, dock door, and outside was turned blue. Even thou its water based it still had water pollutants in it so EPA had to be called in due to it getting into the sewer. The specialty company that was called in to clean up has spent the last 3 weeks digging up the sewer and surrounding ground that had been contaminated. A few days of heavy rain hasnt helped the clean up at all. Needless to say I had a nervous break down and missed 2 days of work. Got a call asking if I quiting, which would possibly lead to criminal charges. Being close to 3 weeks out I can finally think back and sorta laugh at this situation.

My semi slowly leaked diesel while I was parked overnight at a shipper. Gravel lot. California. By the time a contractor dug all the contaminated stuff out and redid half the lot per EPA, it was over $100,000. Fortunately it was the fault of the shop who replaced the fuel tank…. And yes, I always do a complete pre & post trip inspection

Cable Guy Drills A Hole In The Side Of House, Into A Closet, Through A Guitar Case, And Right Through A Martin Hd-28v

Any emergency fund is better than having nothing, but obviously, the bigger it is, the more flexibility you have when you have to replace an expensive item, transition between jobs, deal with sudden illnesses, etc.

That being said, you also want to enjoy yourself, eat well, invest in your health and fitness, take care of your family, travel, and spend time on your hobbies.

So you have to find a balance between saving enough money each month to forge a sizeable emergency fund (and, ideally, also setting aside another part of your savings for investing) and actually spending your money to make the most of life.

HSBC notes that your emergency fund is the money you save and put aside to cover a financial shock without going into debt. This fund, hopefully, gives you some peace of mind that you can weather the storm.

According to the bank, you should aim to have between 3 and 6 months’ essential expenses covered. The fund should be enough for you to pay your rent or mortgage, groceries, and utilities.

Someone Broke My Friends Bass In Half

Gonna Be A Long Day

I get the general idea, but does anyone have a more exact idea of the scenario and sequence of events, please? I see two pallets of paint, not set exactly together, but both seem to have had tins knocked off with great force, almost akin to a split strike in bowling.

Guy Dropped A $40,000 Pallet Of Glass On His First Day

A large part of figuring out how big your emergency fund should be comes down to being honest with yourself while you look through all of your expenses. It can be uncomfortable, but you have to figure out what you can back on in case of a financial shock.

For instance, getting a cup of coffee in town and going for dinner at a nice restaurant are, obviously, things many people enjoy, but they aren’t essential.

Other areas where you can cut back when things get tough include paying for streaming and other services, expensive food deliveries, vacations, shopping for random things online, etc.

Furthermore, you can always consider replacing your damaged gadgets and appliances with (hopefully) more physically resilient and budget-friendly variants. The freshest upgrade might not always make the most sense economically.

Forgot I Was Heating Oil For French Fries

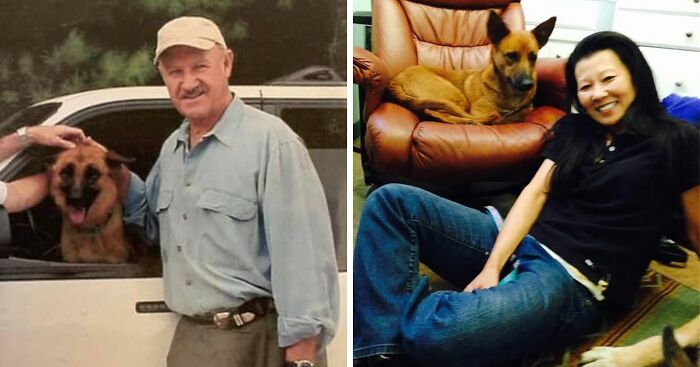

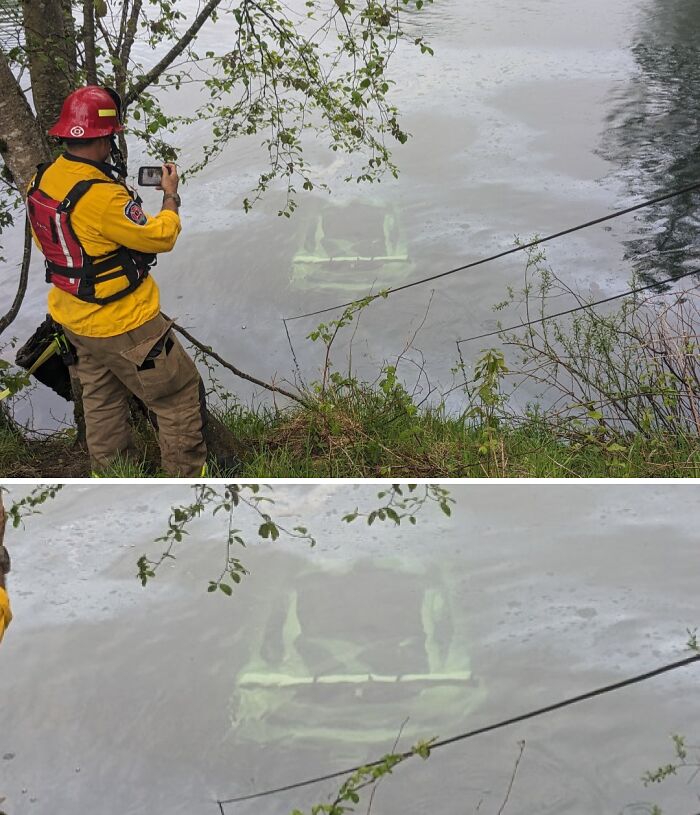

Couple Accidentally Roll Into River While “Getting Busy” Inside Their Car

A Truck Carrying A Tank Of White Paint Dropped It On The Road

However, not everyone agrees with the idea behind the fund worth 3 to 6 months of expenses. For many families, this is a lofty goal that is very difficult to reach.

Economist Emily Gallagher from the University of Colorado Boulder told CNBC Select that low-income American households should aim to save $2,467. This amounts to roughly a month’s worth of income if you’re earning around $30,000 per year in a family of four. This is a more realistic target, according to Gallagher.

Driving My Wife's New Car (Still On The First Tank Of Gas) When This Happened

I has something similar happen years ago. Riding by a construction site and a freaking nail went in teh bottom and out the sidewall. The tire was completely ruined and it was less than a week old.

Played At Topgolf For The First Time Yesterday. This Is What I Found When I Got To My Car

A $5,000,000 Oops

LMAO I love this one. The M in MRI is for MAGNETIC. You don't want to have so much as a steel nail in the same room with one of those when they're on.

CNN reports that American shoppers may be “starting to tap out” as their spending slows. Retail sales rose just 0.2% in February compared to January 2025, as per the Commerce Department. This was lower than the 0.7% increase that was projected and expected. In other words, Americans are becoming more cautious of their spending as they’re becoming more stretched.

Spending in February declined the most at department stores, restaurants, bars, and gasoline stations. On the flip side, spending rose online and at health stores.

My Wife Said She Had Something Crazy To Show Me After We Ate Lunch

My Kid Poured Candle Wax Down The Drain

Yesterday I Forgot To Bring My Arm Down While Driving A Crane Inside

What is the most expensive thing you’ve ever had to repair or replace in your entire life, dear Pandas? What exactly happened? Did you have an emergency budget to help you back then or did you have to scrimp and save for months to afford the replacement?

How do you typically react when things go very, very wrong? Do you tend to panic or are you always as cool as a cucumber? We’d love to hear from you! Share your thoughts in the comments below.

Someone Reversed Their Boat Trailer Into My Rental

Lawn Service Used The Wrong Herbicide On My Neighbor’s 1 Acre Yard

My Friend Arrived At His House And Left His School Backpack In His Car, Moments Later Heard A Breaking Sound And Returns To This With All His School Notes And Books Gone

That is why you never leave something important in your car but the city where we are (Quebec City) this is super rare.

This Is At Least $700k Worth Of LED Video Wall, According To People In The Know

Just Bought This Underwater Protective Case In Thailand And Went Swimming With It

My Cat Decided To Share Her Lunch With Me Via My Headphones

Plane Crashed Into Newly Built House

I Was Tightening The Last Bolt At The Roof Edge Of The Construction When The Spanner Slipped From My Hand And Fell On The Solar Panel On The Adjacent Building

WCGW By Grilling Next To Your Siding?

I Think I’m Going To Need A Bigger Bucket

Note: this post originally had 99 images. It’s been shortened to the top 40 images based on user votes.

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

![Dad Of Two Asks, “Am I The [Jerk] For Leaving My Date At The Bar After She Insulted My Kids?”](https://www.boredpanda.com/blog/wp-content/uploads/2025/03/bar-kids-date_wide-Cover-67d277766e3ca.jpg)