“Easy Peasy”: Economists Recommend You Should Start Making An Extra $5200 Due To Rising Costs, Here Are The Best Reactions From The Internet

It’s not just you who recently realized you can barely afford a regular frappe with almond milk. Or a lemon Perrier six pack that instantly makes you feel more French. But hey, we can totally live without that, right? But the prices of basic goods are rising at the pace of a hadron collider (gas, anyone?!) and at this point, it’s just a question of weeks if not days to a generously downsized grocery bag.

$5200. That’s how much money we all need to “add to our budget” a year to make up for the inflation, according to Bloomberg economists. About $2,200 of that inflation tax will come from pricier food and energy, they added. And that, ladies and gents, boils down to an extra $433 per month on the same goods and services as last year.

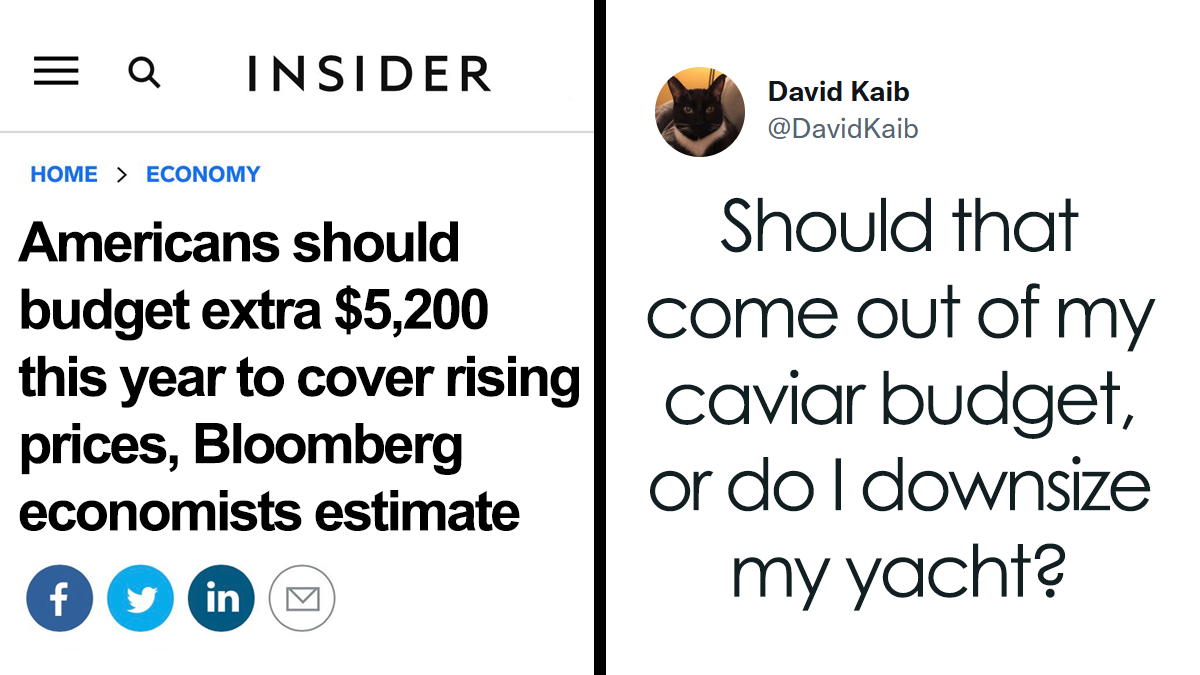

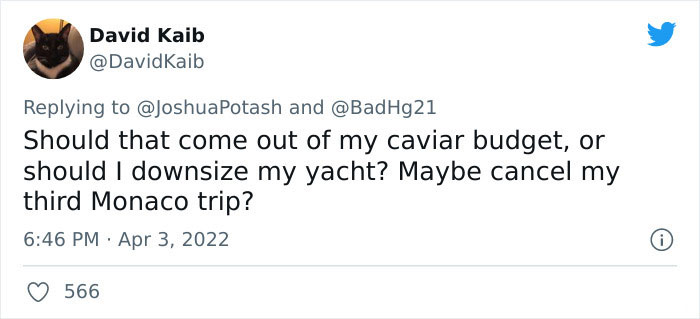

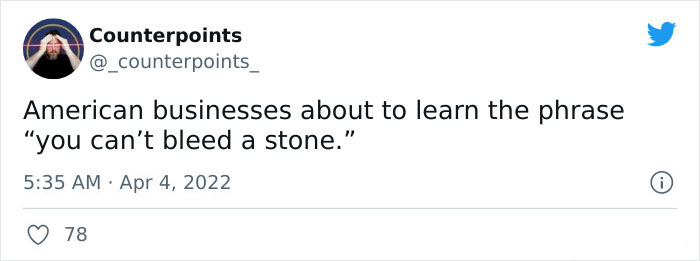

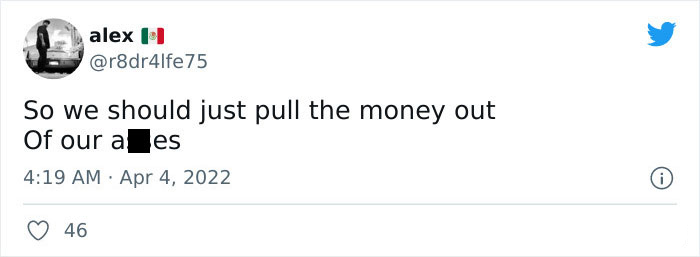

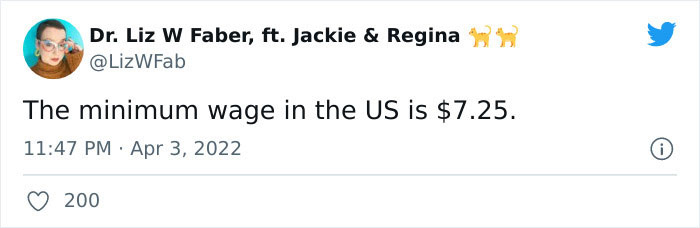

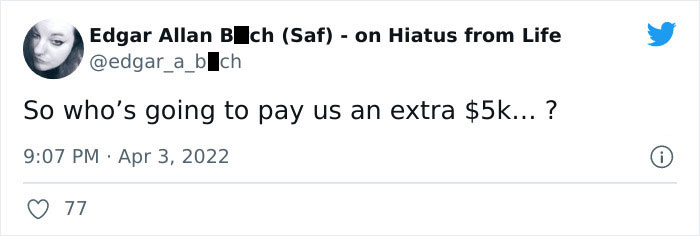

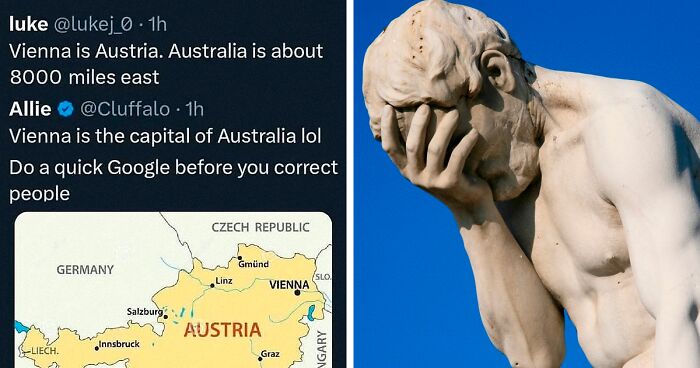

As you can suspect, the headline went viral on social media and in no time, sarcastic reactions flooded Twitter. “Should that come out of my caviar budget, or should I downsize my yacht?” tweeted David Kaib. Another person suggested “making the third home a rental property.”

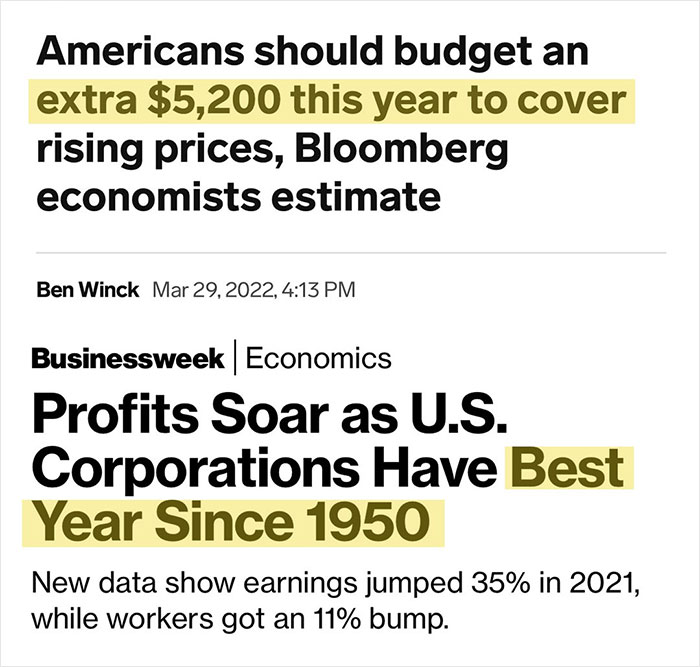

Meanwhile, another set of news broke that corporations reported record profits, making 2021 their best year since 1950. So I just leave the stage to people on Twitter from this point.

Bloomberg economists reported that Americans should budget an extra $5,200 this year to cover rising prices, making basically everyone raise their eyebrows

Image credits: Alexander Mils

INSIDER quoted Bloomberg economists Andrew Husby and Anna Wong who said that in a Tuesday article that went viral on Twitter

Bloomberg economists Andrew Husby and Anna Wong calculated that the red-hot inflation expected to last throughout the year will leave the average US household spending $5,200 more compared to the year prior. They commented: “Accelerated depletion of savings will increase the urgency for those staying on the sidelines to join the labor force, and the resulting increase in labor supply will likely dampen wage growth,” they said.

Image credits: JoshuaPotash

According toBusiness Insider, “as people spend their built-up savings, they’ll need to go back to work, and employers won’t have to pay as much to lure them back.”

But while many American households are already worrying about how they’re going to afford basic things, like fuel, heating and groceries throughout the inflation, major U.S. corporations can’t relate whatsoever. More so, they seem to be riding out the fiercest inflation in 40 years like a walk in the park.

Simultaneously, another news headline broke saying that US corporations saw record profits and that 2021 was the best year for them since 1950

CBSNewspointed out recently that while CEOs spent much of 2021 pointing to the impact of rising wages, pricier raw materials and other ballooning expenses on their companies’ performance, new data from the Commerce Department show that corporate profit margins are the largest they’ve been in 70 years.

Isabella Weber, a professor of economics at the University of Massachusetts Amherst, told in an interview for NPR that companies always want to maximize profits. “In the current context, they suddenly cannot deliver as much anymore as they used to. And this creates an opening where they can say, well, we are facing increasing costs. We are facing all these issues. So we can explain to our customers that we are raising our prices,” she said. However, no one knows exactly how much these prices should be increased.

This didn’t sit well with people on Twitter who wasted no time sharing some very sarcastic reactions

Image credits: Public_Citizen

Image credits: Nicola Barts

Moreover, Weber argues that as a matter of fact, “what we have seen is that profits are skyrocketing, which means that companies have increased prices by more than cost. In the earnings reports, companies have bragged about how they have managed to be ahead of the inflation curve, how they have managed to jack up prices more than their costs and as a result have delivered these record profits.”

Image credits: DavidKaib

Image credits: DckSlanders

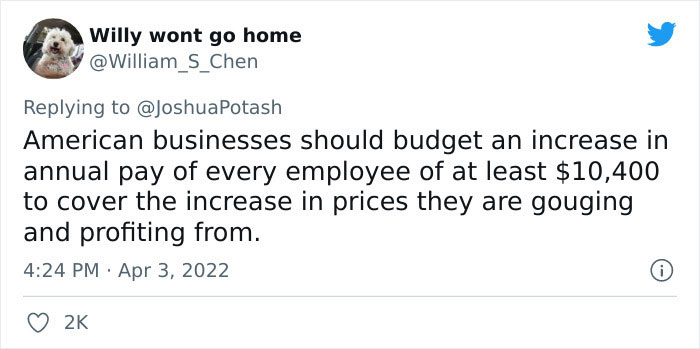

Image credits: William_S_Chen

Image credits: RogueOpsMobile

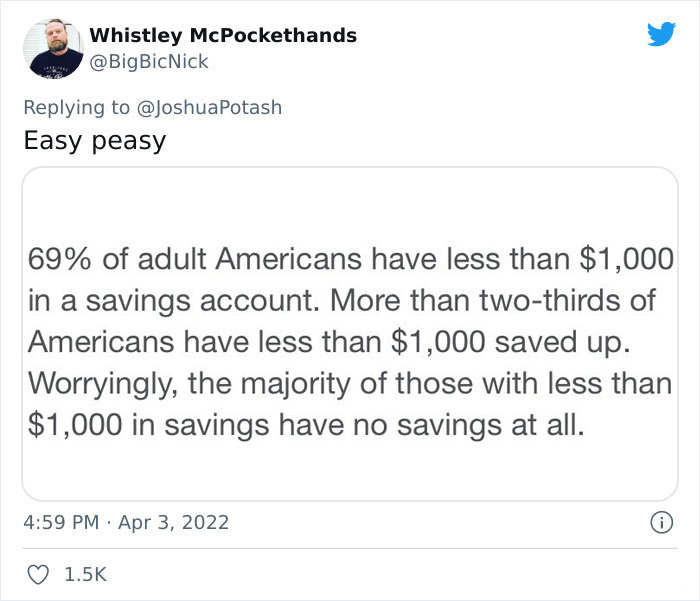

Image credits: BigBicNick

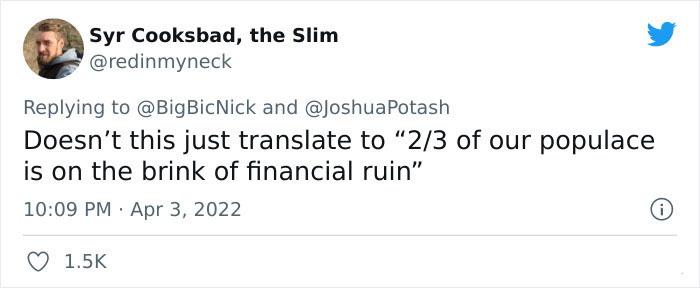

Image credits: redinmyneck

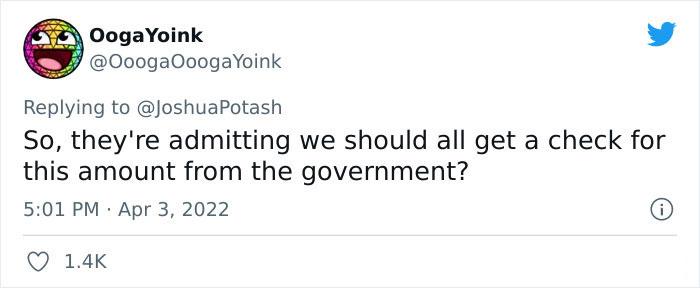

Image credits: OoogaOoogaYoink

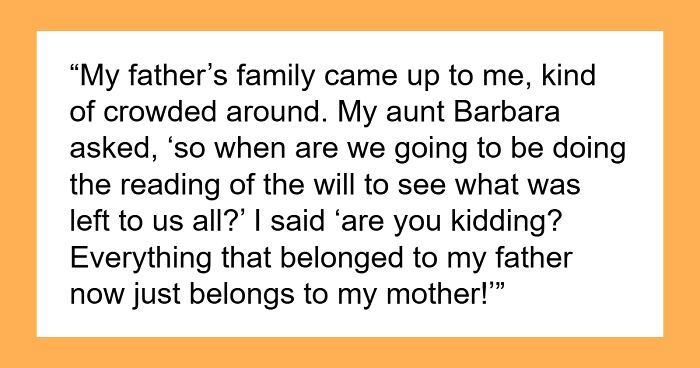

Image credits: jbaaaaaby1

Image credits: stillcham

Image credits: KYT_ThatsME

Image credits: workingdog_

Image credits: _counterpoints_

Image credits: remrkblyrandom

Image credits: r8dr4lfe75

Image credits: LizWFab

Image credits: LumpyLouish

Image credits: edgar_a_btch

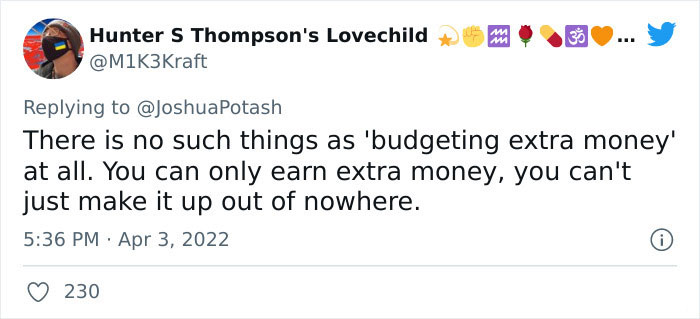

Image credits: m1k3kraft

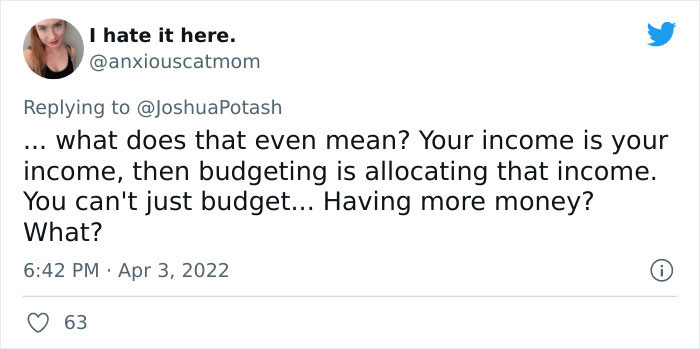

Image credits: anxiouscatmom

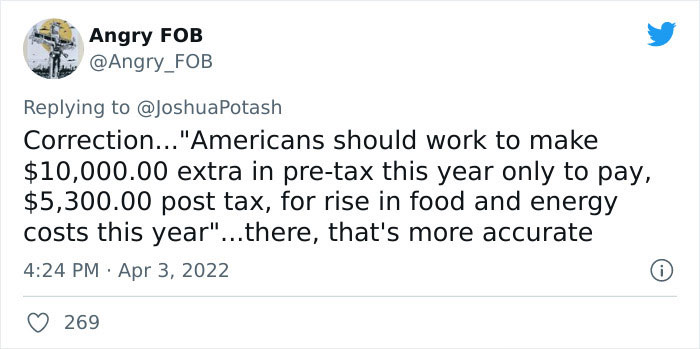

Image credits: angry_fob

Image credits: volksnurse

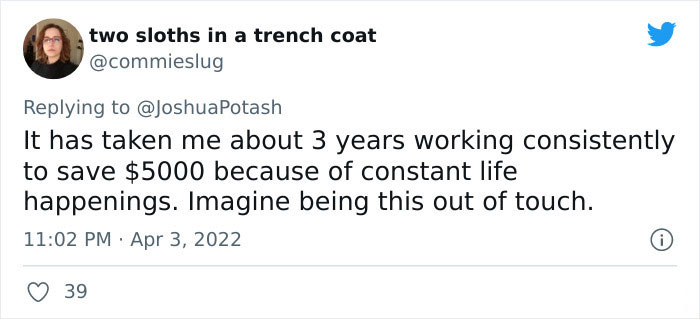

Image credits: commieslug

Image credits: shanadarabie

Image credits: veganrachel

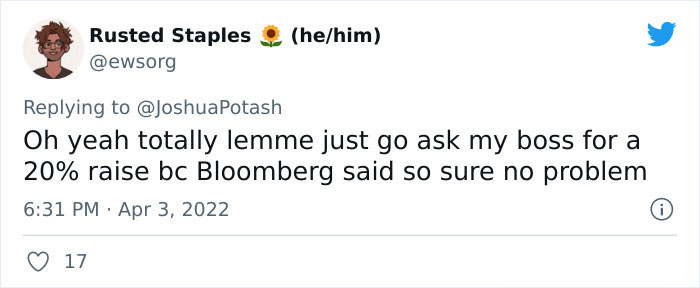

Image credits: ewsorg

Image credits: dafakemikejames

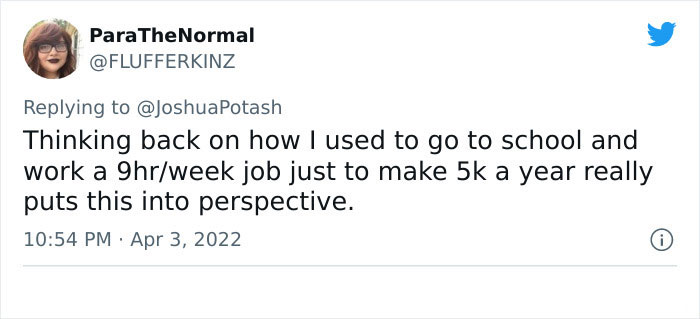

Image credits: flufferkinz

Image credits: soulfox1

Image credits: snachocheese

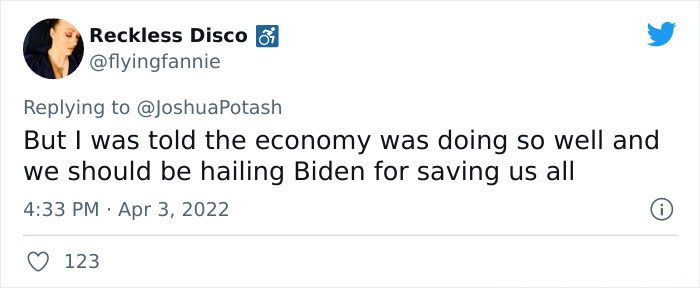

Image credits: flyingfannie

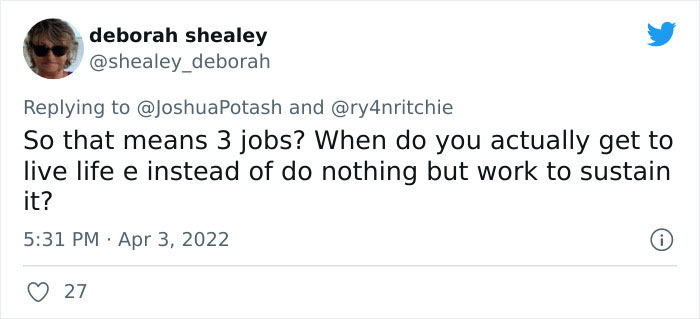

Image credits: shealey_deborah

91Kviews

Share on FacebookExplore more of these tags

Corporations are choosing to raise prices. Corporations are choosing not to pay their workers more. The US President doesn't control gas prices in the US, let alone in other nations. Blame corporations and then maybe learn some things about the dark side of capitalism.

What's more interesting is they have really gotten the middle and lower middle class to buy into this. The whole "embarrassed millionaire" syndrome is rampant. Look at Alabama: they voted against union at Amazon. They basically have so fine tuned the art of foot shooting it's amazing.

Load More Replies...I knew Americans had it bad, but I did not realize how bad. For comparison, I have a pretty standard job with a pretty standard salary. My savings are not that great, because since I lost my fixed job in 2017 I only had short term contracts with month long gaps in-between. Still...according to that graphic I would be in the top 10%. What the hell? Of course I've heard about student debt, insane medical bills, minimal wage jobs etc. But for some reason it never clicked in my brain that all this together means that you will not have any savings, like ever. It's quite shocking, to be honest.

To add a little to the healthcare side of that, many Americans pay insane premiums for their health insurance, often hundreds per month per member of the household, and that still leaves them with having to pay thousands in deductible before it kicks in and at least 20% of the cost after that. So they can be paying over $1K+ to insure a small family and STILL end up in ruinous debt if they have a major medical issue. When an American states their salary, one thing that is hazy is how much their health insurance costs them. Since we have this weird system that ties our insurance to our employer, it's usually completely opaque what the employer pays for it, but in general higher paid workers also get better plans with higher subsidy. So an engineer making $250K might get a plan where they pay $100/month per person with no deductible and a warehouse worker making $40K might be paying $500/month per person for a plan where they have a $3K+ deductible.

Load More Replies...What I don't get, is that there is still not a revolution going on in the US. Eat the rich!

Because we have been brainwashed into buying the propaganda that the stooges of the 1% spew. Because they know the media they control can easily distract us with celebrity gossip, sports, or the old immigrants-are-after-your-jobs B.S.

Load More Replies...Corporations are choosing to raise prices. Corporations are choosing not to pay their workers more. The US President doesn't control gas prices in the US, let alone in other nations. Blame corporations and then maybe learn some things about the dark side of capitalism.

What's more interesting is they have really gotten the middle and lower middle class to buy into this. The whole "embarrassed millionaire" syndrome is rampant. Look at Alabama: they voted against union at Amazon. They basically have so fine tuned the art of foot shooting it's amazing.

Load More Replies...I knew Americans had it bad, but I did not realize how bad. For comparison, I have a pretty standard job with a pretty standard salary. My savings are not that great, because since I lost my fixed job in 2017 I only had short term contracts with month long gaps in-between. Still...according to that graphic I would be in the top 10%. What the hell? Of course I've heard about student debt, insane medical bills, minimal wage jobs etc. But for some reason it never clicked in my brain that all this together means that you will not have any savings, like ever. It's quite shocking, to be honest.

To add a little to the healthcare side of that, many Americans pay insane premiums for their health insurance, often hundreds per month per member of the household, and that still leaves them with having to pay thousands in deductible before it kicks in and at least 20% of the cost after that. So they can be paying over $1K+ to insure a small family and STILL end up in ruinous debt if they have a major medical issue. When an American states their salary, one thing that is hazy is how much their health insurance costs them. Since we have this weird system that ties our insurance to our employer, it's usually completely opaque what the employer pays for it, but in general higher paid workers also get better plans with higher subsidy. So an engineer making $250K might get a plan where they pay $100/month per person with no deductible and a warehouse worker making $40K might be paying $500/month per person for a plan where they have a $3K+ deductible.

Load More Replies...What I don't get, is that there is still not a revolution going on in the US. Eat the rich!

Because we have been brainwashed into buying the propaganda that the stooges of the 1% spew. Because they know the media they control can easily distract us with celebrity gossip, sports, or the old immigrants-are-after-your-jobs B.S.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

135

49