Guy Can’t Afford His Car Payments And Wants To Cancel His Contract, His Friend Finds Bank Fraud In His Papers And Blackmails The Car Dealership

Car dealerships have a bit of a “reputation”. At least in the US.

Folks generally see car dealers as sleazy, shady, or straight-up sneaky individuals who will 100% of the time give you a junk heap of a car in exchange for every cent you have, and sometimes even more.

In reality, however, you can’t fault car dealers for doing business the way business is supposed to be done—maximizing profits and minimizing expenses. Besides, they can’t do anything illegal. So, of course they will stretch it as far as the boundaries allow them.

There are exceptions, though. A rule breaker is bound to happen in this industry—just like any other industry—and it’s a matter of how you’ll approach the situation.

OP decided to do it in the form of helping out a friend in the most pro revenge way possible.

More Info: Reddit

If you want adventure, go to a car dealership—you’re bound to find at least one good plot hook, and a whole lot of problems

Image credits: Yonkers Honda (not the actual image)

Back in the beginning of 2020, OP had a friend approach him about an issue he had. You see, he made the mistake of buying a new car without really understanding his financial situation at that time. In short, the end result was that the guy made $1,200 a month, and his new car would cost him $795, plus $400 in insurance. He was in dire need of help.

Well, he was in luck as OP’s a former car dealer and knew the industry well enough to work something out. At first, when he picked up the paperwork, he immediately understood just how much price gouging and upselling the salespeople did. All fully legal as car businesses go.

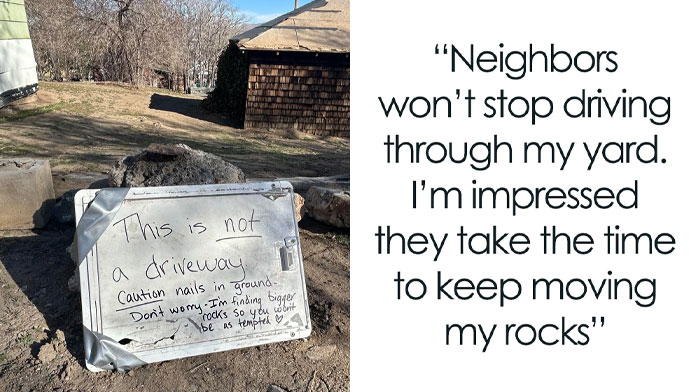

Sometimes, the problem is the buyer, but more often than not it’s gonna be the dealership leaving a “typo” in the bank loan application

Image credits: u/redditadmindumb87

The author of the post used to be a car dealer, the perfect person to help out a friend who had dealership problems in need of an undoing

Image credits: 401(K) 2012 (not the actual image)

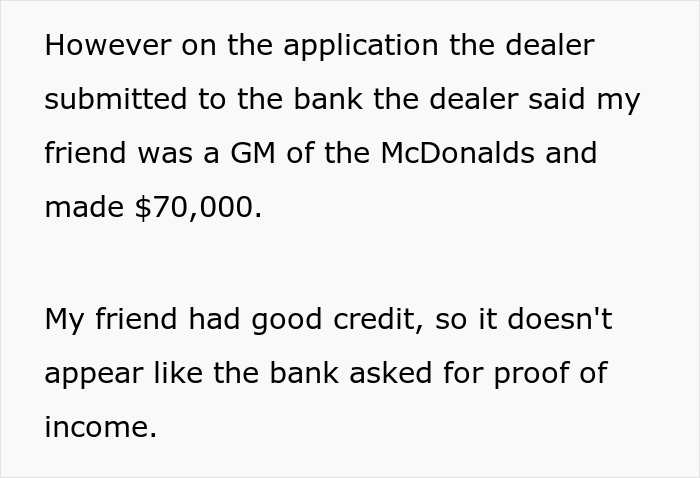

But, what was extremely sus was the fact that his friend, earning roughly $14,000 a year, had managed to buy a car for over half his salary in monthly payments, and the bank was fine with it. What bank in its right mind would ever approve that?

They wouldn’t.

OP did some digging and managed to get to the bottom of things. Turns out, the person managing the deal with filling out the paperwork left a teeny-tiny mistake where it asked to indicate OP’s friend’s income. Somehow their hand slipped and instead of $14,000 it said $70,000. An honest mistake, we’re all sure.

After hitting the documents, he uncovered that someone left a tiny typo in the documentation, stating that the buyer was earning $70K, and not $14K. Whoops

Image credits: u/redditadmindumb87

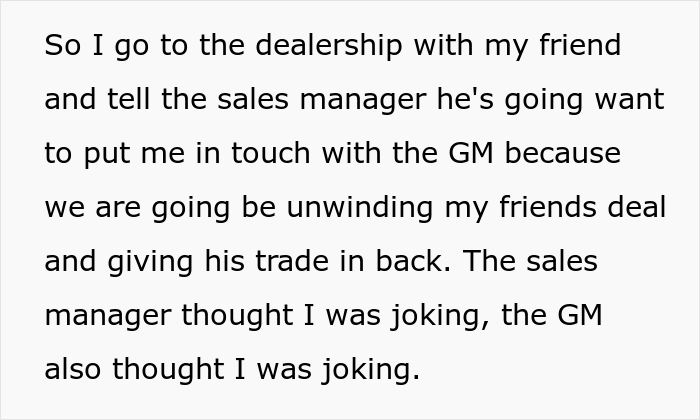

This was their ticket out of this deal. So, OP and his friend went back to the dealership and stated their intentions of having the whole thing unwound. “Unwinding the deal is basically the [general manager] agreeing to cancel the deal, and basically erasing the deal and pretending it never happened,” explained OP. The dealership thought they were joking.

But then OP hit them with the facts: someone had managed to commit bank fraud, bam!, here’s where it happened [points at agreement], and the dealership reps came to a sudden realization they’d done goofed.

Just so you understand the brevity of the situation, what had happened is punishable as a felony level charge. This is besides losing a business franchise, and just straight up having to deal with all the fallout with the bank, reputation, etc. etc. The dealership was not willing to risk it, but it did not stop them from pushing the line.

When confronted about unwinding the whole deal, the dealership was reluctant, but otherwise their hands were tied and they had no other choice than to accept

Image credits: u/redditadmindumb87

And here’s the beauty of it all: they got back their trade-in—a car they had to offer as a substitute, a better one, because the original was already gone, so consider this an upgrade

Image credits: Mark Turnauckes (not the actual image)

Image credits: u/redditadmindumb87

After a back-and-forth (that no reporting could ever do any justice, so read the original screenshot in this article), the dealership was heavily pressured into doing what OP said. And what OP said was to unwind the deal. They did that. The only problem was the trade-in car.

You see, they’d sold it already, so OP’s friend could not get it back. No worries, he could get back another car that is of the same or higher price. Another back and forth ensued, and the only true equivalent they offered was a ‘07 Ford Focus with around 10,000 miles more on the odometer (that thing that shows you how much a car has been driven so far), but that was not good enough.

Well, negotiations were complete after the dealer caved and offered a ‘08 Honda Civic. 5,000 miles more, but it was surely an upgrade in OP’s eyes. They took the deal. The contract was dissolved. No extra charges. Friend went home in a different car. A newer one. You could add “like nothing ever really happened”, except for the friend coming out of the deal with a different car. An absolute win for him, and an even bigger win for friendship.

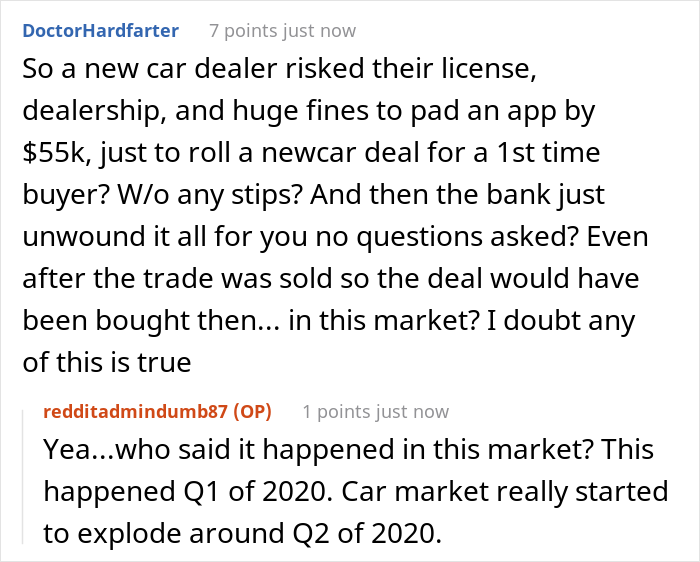

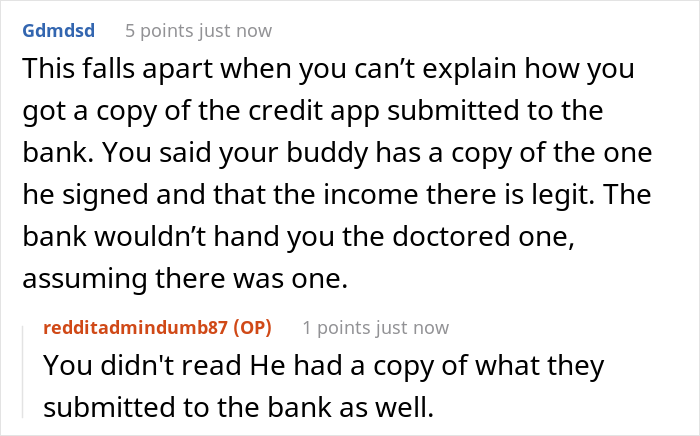

Folks online were applauding the original poster

And the comment section was full of applause. Well, the upvote area was also full of applause in the form of 8,500 upvotes, but I digress. Some suggested financial literacy courses ASAP, which OP agreed with wholeheartedly. What if the friend gets into another pickle where OP won’t be able to save him?

OP was actually quite active in the comment section, giving tidbits of context on how car dealerships function when it comes to contract execution, common sales practices and the like. Yes, he also confirmed that there is shadiness afoot.

If you want to check out the post in context with all of the comments intact, here is the link to it. And you can also check out this and this story, both dealing with car dealerships. Both pieces of malicious compliance, in fact.

But before you jump into your ‘08 Civic (or any other car of your choosing) and ride off into the sunset, leave your comments, stories or any other form of feedback below, and slap that upvote button while you’re at it.

I hate buying a vehicle. So much so that I tend to keep a vehicle for years, even though delerships seem to start hounding me to buy a new one because mine "is three years old". If it runs well and gets my butt from A to B why would I want to drag myself to a dealership and go through all that nonsense?

Well, in my family 5+ years of keeping a car is normal (we also don't buy new). Mine is a 2012 pegeout. It runs well, but has a few issues needing to be adressed within the next few years. Nevertheless, way cheaper than buying an equivalent.

Load More Replies...I've worked for a lot of financial institutions. They're all frauding it up real nice out there. I've seen so much paperwork like this. This sh!t is standard in the U.S.

This could all be true. But if there's a car payment that a person can't possibly afford, it's likely to get repossessed. Doesn't serve anybody well. Dealer gets car back, but they have to sell it as used. Even worse if it shows wear and tear and damage.

Load More Replies...I hate buying a vehicle. So much so that I tend to keep a vehicle for years, even though delerships seem to start hounding me to buy a new one because mine "is three years old". If it runs well and gets my butt from A to B why would I want to drag myself to a dealership and go through all that nonsense?

Well, in my family 5+ years of keeping a car is normal (we also don't buy new). Mine is a 2012 pegeout. It runs well, but has a few issues needing to be adressed within the next few years. Nevertheless, way cheaper than buying an equivalent.

Load More Replies...I've worked for a lot of financial institutions. They're all frauding it up real nice out there. I've seen so much paperwork like this. This sh!t is standard in the U.S.

This could all be true. But if there's a car payment that a person can't possibly afford, it's likely to get repossessed. Doesn't serve anybody well. Dealer gets car back, but they have to sell it as used. Even worse if it shows wear and tear and damage.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

123

70