“I Turned Him In”: Person Learns That Dad Secretly Ruined Their Chances Of Buying A House

Normally, family are the people one can always count on in their lives, for help, advice and sometimes even money. So if you started to get strange charges to your bank account, you would probably not immediately jump to the idea that a parent might be engaged in multiple levels of fraud.

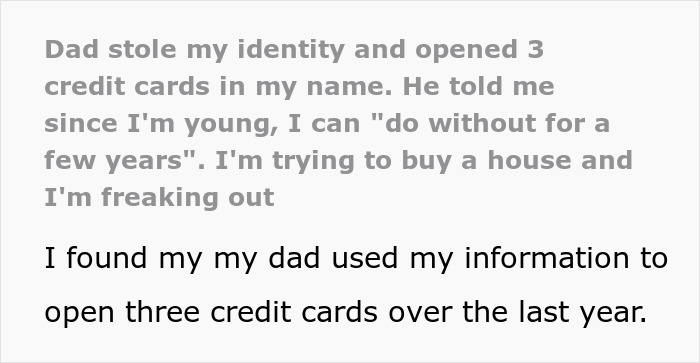

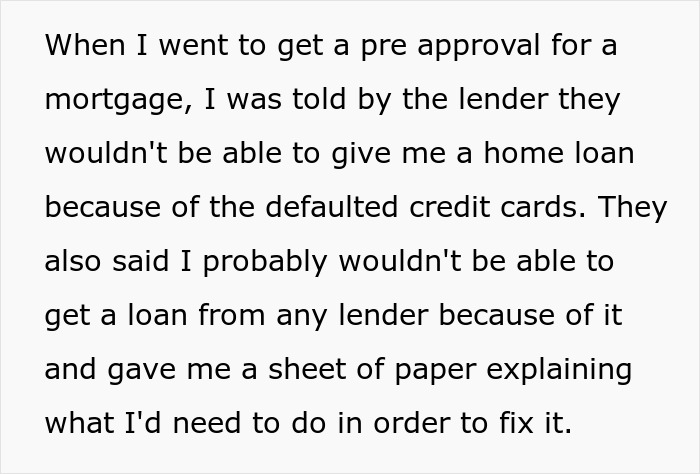

A netizen was denied a home loan, so they decided to do some digging and discovered that their father had taken out three credit cards that they defaulted on. We reached out to the person in the story via private message and will update the article when they get back to us.

Credit card fraud affects a lot more people then one might expect

But one person learned that it was none other than their father who had taken our credit cards in their name

Image credits: Tima Miroshnichenko (not the actual photo)

Image credits: Andrea Piacquadio (not the actual photo)

Image source: Where-aremypants

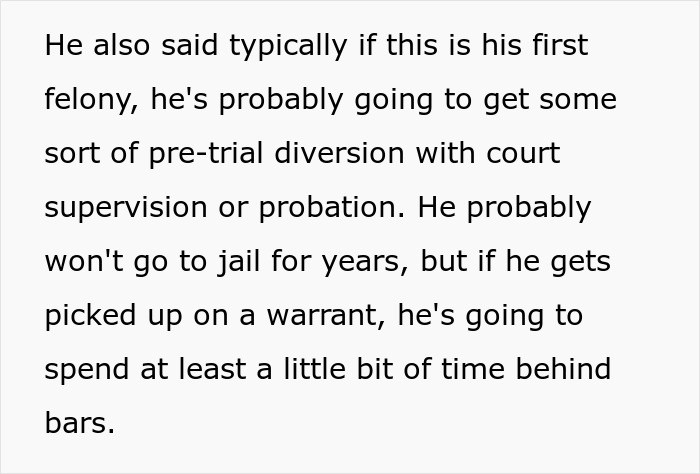

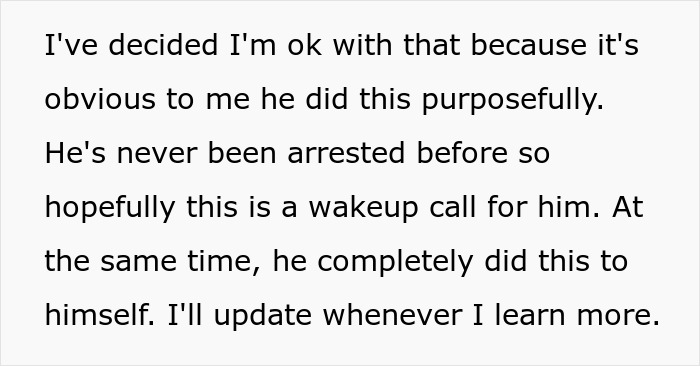

Later, the person shared what they planned to do

Image credits: cottonbro studio (not the actual photo

Image source: Where-aremypants

Credit card fraud is a one way thieves will use your identity to steal

Image credits: Alena Darmel (not the actual photo)

Credit card fraud is one of the most common forms of identity theft. As in this story, people will get the details from someone and open up bank accounts, take out loans and acquire credit cards in their name. While it’s not a comfortable thought, family members do have plausible deniability to ask you personal details and already know things like a birth date and location. Not a pleasant thought, but something to always remember, since most professional thieves have to work a lot harder to get this data.

Generally, this crime is a lot more simple, credit cards are lost and stolen and the thieves simply try to milk them for as long as possible. The father’s crime was more complex, repeated and premeditated, there is no way he could have done any of this “by accident.” Most might believe their in-laws are capable of something like this, but not their literal parents.

For example, one’s credit score is very very important for major life decisions, good loans and all sorts of other things. Having it messed up just so some random person can save on their bills is not worth the cost at all. Even worse, the father trying to gaslight this person into thinking “it’s fine” is disgusting, as this sort of debt and defaults don’t just go away.

In the US alone, identity fraud ends up costing billions of dollars every year, with similar numbers for countries like the UK and Australia. Over 60 million Americans have had their identities stolen, although this doesn’t necessarily mean anything illegal was done with them. Interestingly, most victims identified the reputational damage as the worst issue over loss of money.

A credit rating is quite important, depending on where you live

Image credits: Mikhail Nilov (not the actual photo)

In some cases, the criminals will even invent wholly new credit card applicants. They will use bits of data from various, real people to make a “synthetic” applicant, with just enough information to qualify. They will then use this card for as long as they can until the credit card company shuts it down.

This sort of thing, if left unresolved, will impact mortgages, it might even prevent them from getting one in the first place. It will mean higher interest loans, it might mean that they can’t even work with certain banks. The nature of credit card fraud means that the authorities have to be involved, the father can’t just write a check.

The father has also done this before and avoided criminal charges, so actually being punished for this crime is important. As some commenters noted, he will simply do this again. Indeed, he has all the tools he needs already, if he feels cornered by bills and other expenses, there is no reason why he would simply commit fraud that has worked so well for him in the past.

Fortunately, as shared in the update, the victim has seen reason and will be escalating things. Besides getting their own credit record straight, it’s also important to get justice for the people this man has scammed in the past. Normally, parents being entitled is annoying, but rarely results in actual crimes.

Netizens shared what advice they had

Explore more of these tags

When it comes to "messing up" dad's life, OP owes their father only the same courtesy he gave to them.

1. Dad committed financial fraud on the mom, now he did it on the son. This wasn't his first rodeo and there will probably be more situations with Dad once son starts digging. Maybe check other people in the extended family. 2. If Dad is not stopped now, he will do it again to son. Anytime Dad wants some money, he will try to victimize his son again. It will NEVER "fall off" the record, because Dad will keep trying scams. People who are financial abusers and/or scam artists are deeply habitual with their urge to commit misdeeds.

My ex did exactly this to my daughter. It was a smaller amount and she had to pay it off herself without my ex's help. I'm proud of my daughter but my ex should've been reported to the police..

Make sure she gets the three reporting agencies (Equifax, Experian, and Transunion) to freeze the accounts. The ssn is out there, the chances of it being used again may be slim, but while the ex _may_ not use it, he will get junk mail offers that could be stolen. Freezing is easy, you can do it for free, and you just unfreeze it with a call or a visit to the website. I froze mine after the Equifax breach in 2017. I get less junk mail, I just called to unfreeze when I got a car or planned to add a card to my stable of cash back cards, and then it will refreeze a day or so later, when ever you wish. It's much safer since she's been defrauded.

Load More Replies...When it comes to "messing up" dad's life, OP owes their father only the same courtesy he gave to them.

1. Dad committed financial fraud on the mom, now he did it on the son. This wasn't his first rodeo and there will probably be more situations with Dad once son starts digging. Maybe check other people in the extended family. 2. If Dad is not stopped now, he will do it again to son. Anytime Dad wants some money, he will try to victimize his son again. It will NEVER "fall off" the record, because Dad will keep trying scams. People who are financial abusers and/or scam artists are deeply habitual with their urge to commit misdeeds.

My ex did exactly this to my daughter. It was a smaller amount and she had to pay it off herself without my ex's help. I'm proud of my daughter but my ex should've been reported to the police..

Make sure she gets the three reporting agencies (Equifax, Experian, and Transunion) to freeze the accounts. The ssn is out there, the chances of it being used again may be slim, but while the ex _may_ not use it, he will get junk mail offers that could be stolen. Freezing is easy, you can do it for free, and you just unfreeze it with a call or a visit to the website. I froze mine after the Equifax breach in 2017. I get less junk mail, I just called to unfreeze when I got a car or planned to add a card to my stable of cash back cards, and then it will refreeze a day or so later, when ever you wish. It's much safer since she's been defrauded.

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

61

24