Someone Tries Proving How A Family With A $350k Yearly Income Is Still Struggling By Posting This Expenses Chart, Gets Roasted

Interview With ExpertDifferent people have different concepts of what struggling with money really means. Some people are thankful that they earn enough to cover their rent, utilities, and food expenses for the month. Others are glad that they have enough to buy one solid meal a day. While still others earn millions, can buy anything and everything their hearts desire, but feel as though they never have enough.

Twitter had a field day making fun of a supposedly financially struggling family that had an annual gross income (that’s before taxes) of 350,000 dollars. Twitter users were ruthless with their jokes, stating how the only thing that family might be struggling with is probably math, while others criticized the family’s flamboyant lifestyle. Scroll down for Bored Panda’s in-depth and enlightening interview with Financial Samurai’s founder Sam Dogen who explained that MarketWatch was the one that mentioned that a family with such an income would be ‘struggling.’

This claim about how earning $350k a year is supposedly ‘struggling’…

Image credits: MarketWatch

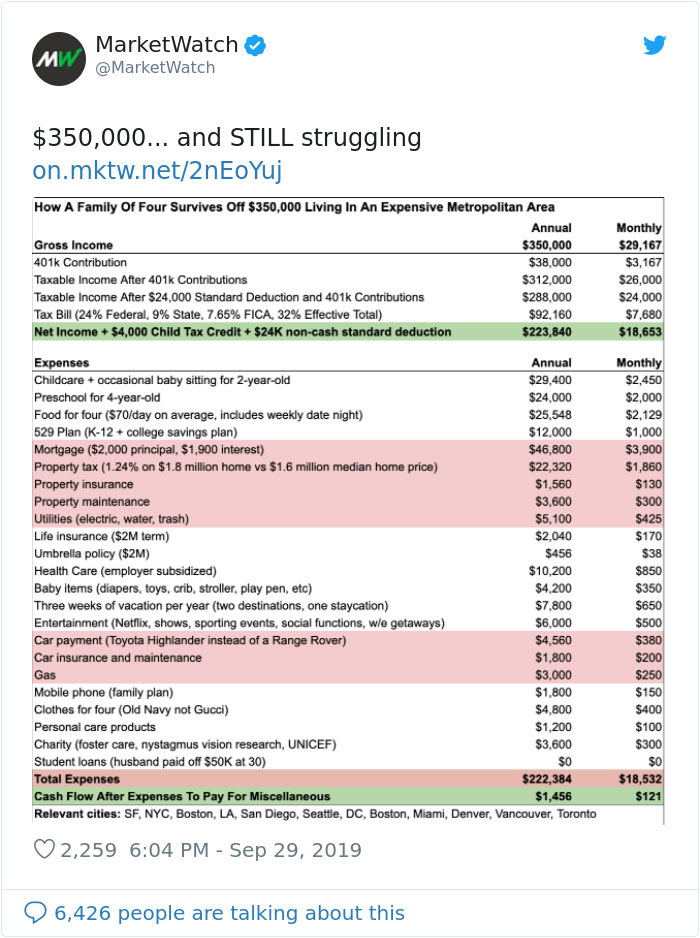

It all started with an article and a tweet published by MarketWatch, which used data collected by Sam Dogen on the Financial Samurai blog, about how a budget shows that an annual 350,000 dollar salary “barely qualifies as middle class.”

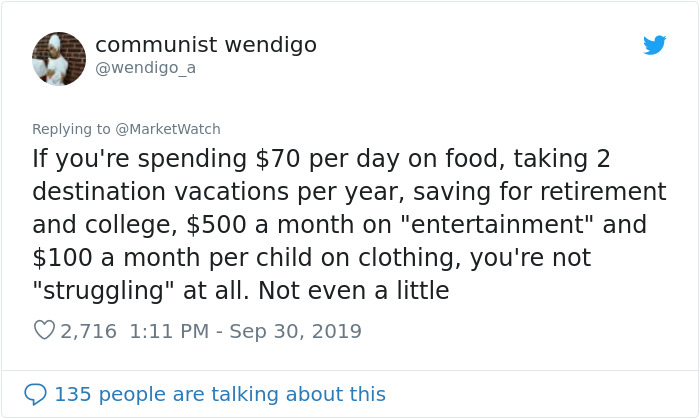

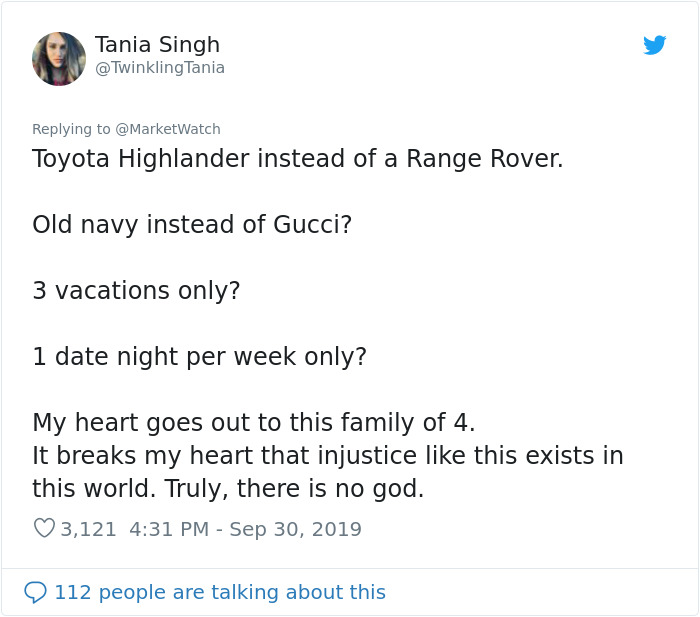

The budget that Dogen created has some strange things in it, like three weeks of vacation, spending 400 dollars a month on clothes from Old Navy, and dropping 2000 dollars a month on preschool. This, to most people, doesn’t look like the budget of a ‘struggling’ family that’s barely getting by.

“Unfortunately, despite making $350,000 a year, this couple will be unable to retire before 60 because they aren’t building an after-tax investment portfolio to generate passive income,” Dogen writes on his blog. “In order for this couple to achieve financial independence, they need to accumulate a net worth equal to at least 25 times their annual expenses — or 20 times their annual gross income.”

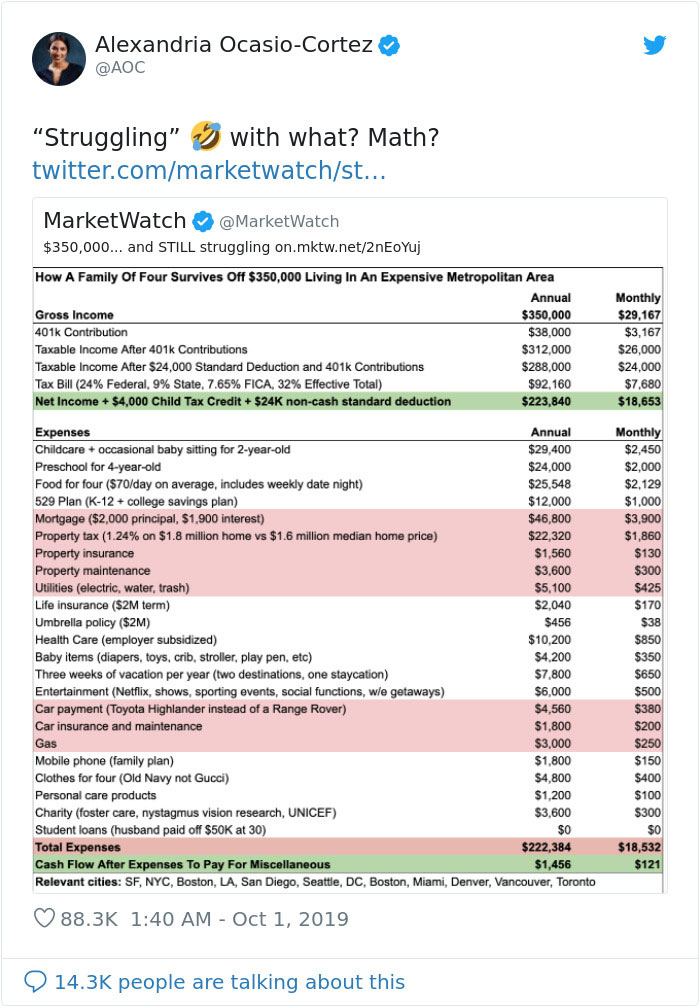

…caught Twitter users’ attention, including that of Alexandria Ocasio-Cortez

Image credits: AOC

Whatever your financial situation at home, there’s always something you can do to save money for a rainy day, pay off debt, and save for college. Discover suggests that families focus on food costs by planning in advance, buying what’s on sale, and having a very clear cash limit.

Another way to save money is to make important events like birthdays a simple affair, like a day at the beach or having a sleepover with pizza and cake. Then there’s the question of clothes. Most parents want their kids to wear the very best brands, but it makes little sense to buy expensive clothes that your kids will grow out of in a matter of months. It’s worth considering going for second-hand clothing. Do you have any advice on saving money, dear Readers? Share the tips that have worked for you in the comments.

Image credits: wendigo_a

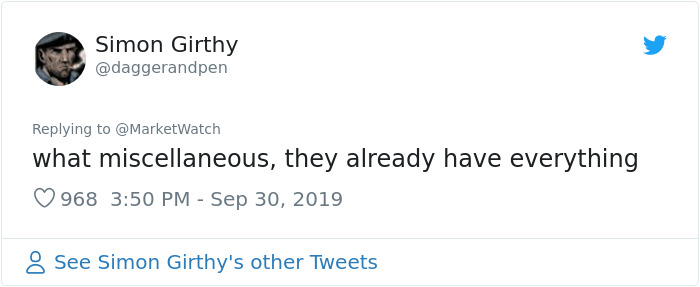

Image credits: daggerandpen

Image credits: TwinklingTania

Bored Panda interviewed Dogen about his insights into savings, finances, and education

Bored Panda reached out to Dogen, the founder of the Financial Samurai blog, to talk about finances, savings, and the reaction of Twitter users.

“I was inspired to come up with the 350,000 dollar budget number because, according to the latest California Association of Realtors report, a household now needs to earn $343,000 to buy the median-priced ~1.6 million dollar home in San Francisco as of Q2 of 2019. Then the household needs to come up with a 320,000 dollar, 20 percent down payment!”

“Based on my original article on CNBC, which MarketWatch riffed off, I really tried to be thorough and analyze all the costs and see where this household could save and could not save. I didn’t say this hypothetical couple was “struggling,” MarketWatch did,” Dogen highlighted.

“I wanted to highlight that living in an expensive metropolitan city can be very difficult for families who want to maintain a traditional middle-class lifestyle. Due to the cost of childcare, surging real estate prices, and the desire to send kids to private school, budgets get eaten up quite quickly, even if you are making multiple six figures. Then if you add on rising healthcare costs, people are forced to work longer than they may really want.”

“My wife and I both decided to stay out of the workforce in order to be full-time parents from the time our boy was born in April 2017 until Sept 2019. The lost income hurt as we missed out on over $1 million in lost income. But it was our choice,” he continued.

Financial Samurai thought that the reactions on Twitter were fair

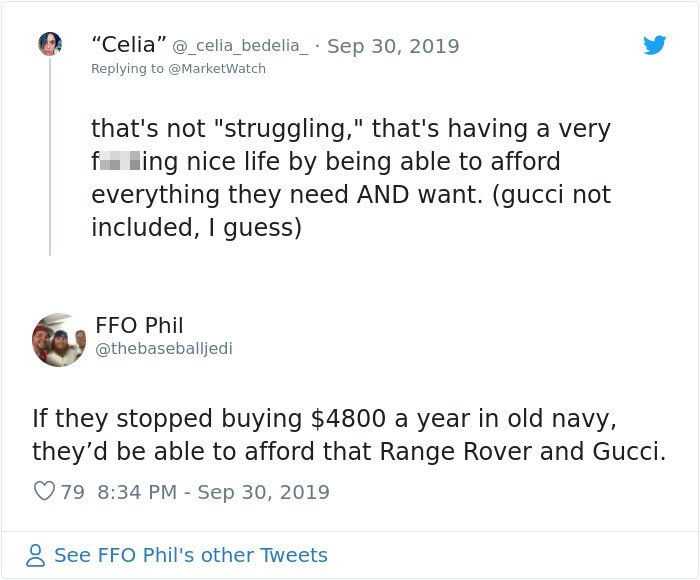

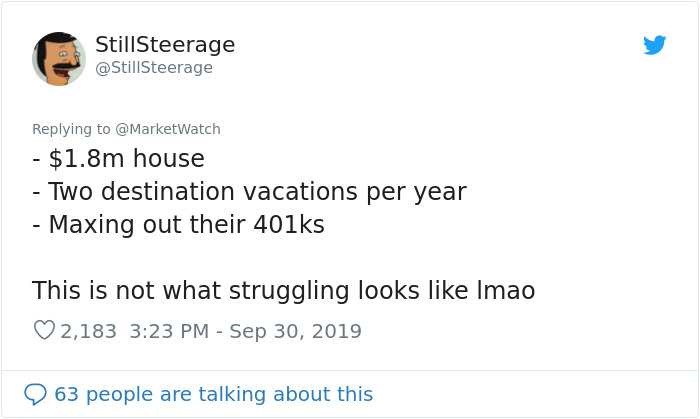

“I think the reactions by readers on Twitter are very eye-opening and fair. I tried to make the budget a little humorous and poke fun at U.S. consumerism with lines such as “Toyota Highlander instead of a Range Rover” and “Old Navy instead of Gucci.”

“I understand 350,000 dollars is a top 2% household income level. Therefore, most people will thumbs down the budget. But I think we are all very lucky to live in the United States, no matter our income. I grew up overseas for 13 years in Zambia, the Philippines, Malaysia, Taiwan, and other emerging countries, and living in America is truly great in comparison.”

“I also realize there is a great divide in America in politics and finances because people fail to see the other side’s perspective. Around half the population live on the expensive coasts and in big cities such as Chicago, Honolulu, and Houston. I thought it would be interesting to highlight how one particular family archetype lives.”

“Finally, my ultimate goal is to encourage people to stay on top of their finances and achieve financial freedom sooner, rather than later. I also want folks to question their never-ending desire for money and status. The best way to get people to review their budgets, save more aggressively, invest more prudently, and plan for retirement is to start a discussion,” Dogen told Bored Panda.

Dogen explained that financial education is incredibly important

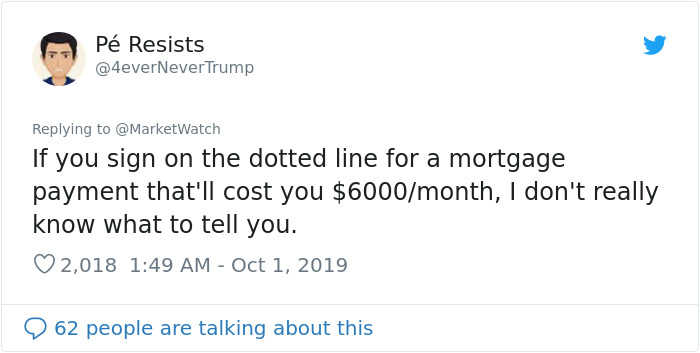

According to Dogen, the biggest barrier for people to becoming rich is the lack of education: “We learn things like chemistry, geology, and English in high school and college, but there are no mandatory courses on personal finance. For example, if more people thoroughly understood their mortgage contracts before signing, the housing crisis between 2008 – 2010 may not have been as deep. In another example, if more people knew they could negotiate a severance instead of quit with nothing, more people would have a more comfortable financial runway to take their time and find a new job or start a new business that is truly meaningful to them. The more people are empowered with financial knowledge, the better financial decisions they can make to ultimately live the lives they desire.”

“One of the key mantras I tell my readers is this: If the amount of money you’re saving each month doesn’t hurt, you’re not saving enough! Too many people go through life, paying no attention to their finances. Then they wake up 10, 15, 20 years from now and wonder where all their money went. Always pay yourself first. By paying yourself first after each paycheck, and making it hurt a little to change your spendy ways, only then will you know whether you are saving enough.”

“Despite more mouths to feed, large families also have synergies that can save them money. Use hand-me-down clothing and shoes for all children with occasional aesthetic adjustments between boys and girls if desired. Buy food in bulk. Send kids to a preschool co-op where they require parental involvement usually once a week. Send your kids to public school and forget about the ridiculous cost of private school tuition. Enjoy the free parks and libraries. Have kids share rooms to save on buying a larger house. But the two most important things are having one parent who works to help subsidize healthcare costs and avoiding private schools.”

According to Financial Samurai, raising kids is a huge financial responsibility

Dogen once again noted that he never personally said that a family earning 350,000 dollars a year was ‘struggling.’

“Marketwatch used that word in their tweet. I simply wanted to highlight how quickly a multiple-six-figure income can go if a couple is trying to raise a family in an expensive metropolitan area. Due to inflation, it’s requiring a higher and higher income to live a middle-class lifestyle today.”

“Having children is a huge responsibility that comes at great cost. My hope is that more people think deeply about their finances and their current situations before having children. We owe it to them to have our stuff together beforehand. If more of us do, I think we’d have much happier kids and better-adjusted adults.”

“I started Financial Samurai in 2009 during the middle of the financial crisis when I lost about 35% of my net worth in six months despite thinking I had done everything right. It was a wakeup moment for me to try harder and analyze my blind spots.”

“After 10 years of a bull market, I feel that many people, especially those aged 35 and under have gotten a little too complacent — like they just can’t lose. I’m hoping that the more we can have a discussion about our personal finances, the better prepared we will be for the next inevitable downturn.”

Financial Samurai also had this to add: “Alexandria Ocasio-Cortez went to Boston University, where Boston University says it will cost a family 72,000 dollars a year to attend. A 350,000 dollar a year earning household with the budget I created has no chance of sending their kid to such a private university because they need to make 100,000 dollars in gross income to afford one year of attendance, and they have two kids. I hope people see the irony in AOC’s tweet. They would have to take on a large amount of student debt, which is one of the big problems in America today.“

Other people expressed their opinion without any reservations

Image credits: thebaseballjedi

Image credits: StillSteerage

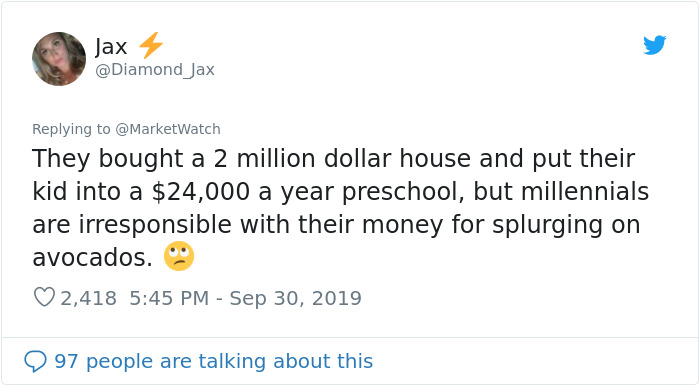

Image credits: Diamond_Jax

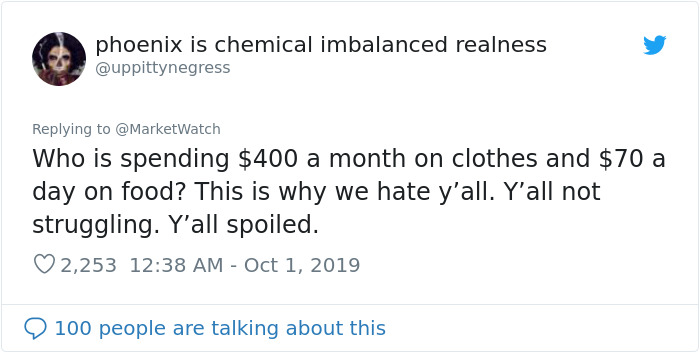

Image credits: uppittynegress

Image credits: 4everNeverTrump

Image credits: kamilumin

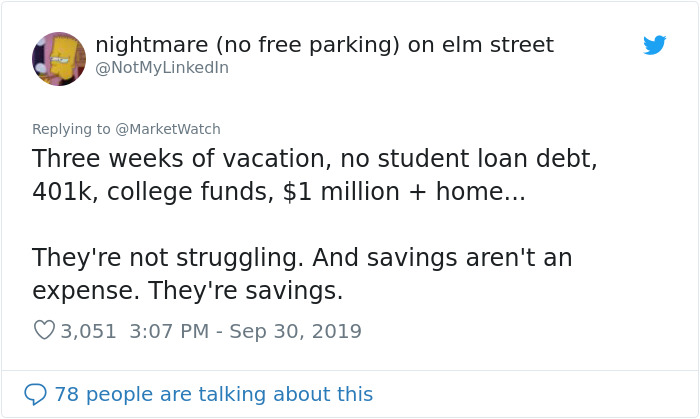

Image credits: NotMyLinkedIn

Image credits: heymanmyband

Bored Panda also reached out to Generic White Guy to hear his thoughts on the topic. In his opinion, “it obviously depends on your family situation, but I’d say about 50,000 dollars a year is the beginning of the middle class. I’m not sure of the upper limit but probably 150,000 dollars a year.

Generic White Guy also shared his tips on how to save money. “The best way to save is to consistently put aside money every month. Be that 50 dollars, 100 dollars, or more. Having a large family probably makes it really difficult to do that. Although I think it’s better to still consistently put that money into a savings account even if you pull out some or all of it to help pay bills later.”

“Cutting costs is also huge, and it’s easier to get good deals in bulk. One of the biggest things that would help, though, is the implementation of a Medicare-for-All system which takes away a large portion of the financial burden that healthcare and health insurance puts on citizens. It’s also the morally right thing to do. Our current healthcare system is criminal,” Generic White Guy criticized the current healthcare system in the US.

According to him, the largest barrier that prevents people from becoming wealthy is that “extremely wealthy people are able to hoard their wealth and continue to amass it through exploitation of workers.”

“A wealth tax would be awesome as well, and also makes a lot of sense. Money works when it flows, it’s destructive when it’s hoarded,” Generic White Guy shared his opinion.

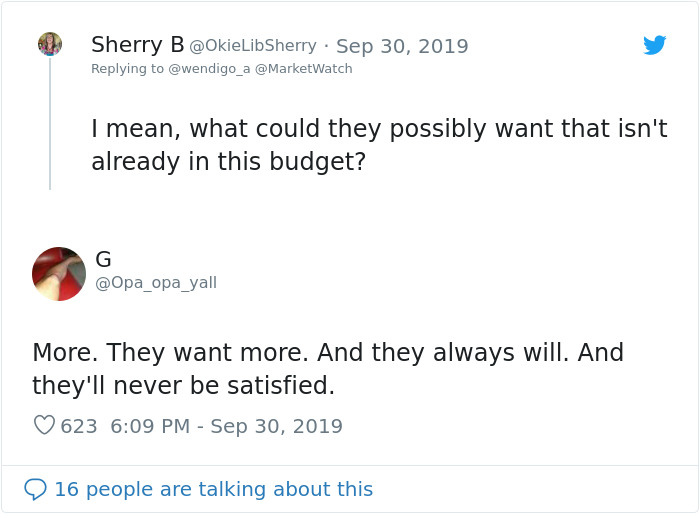

Image credits: Opa_opa_yall

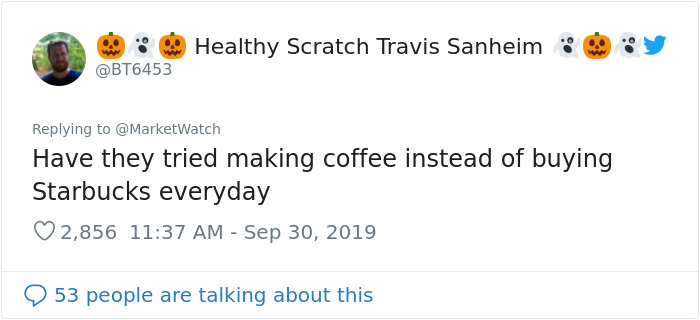

Image credits: BT6453

Image credits: big_buttlefish

Explore more of these tags

hello! id be eating healthy everyday and not hitting sonic for .99 cent corndogs

Load More Replies...Just googled this; The 2017 nominal median income per capita was $31,786. The mean income per capita was $48,150. Real median household income was $61,372. Some news orgs see 350k as normal, while the same news orgs go to "the heart-land" to interview the "real americans", that don't even make 30k to ask them what they think. I'm not sure there is any other "civilized" country in the world who so obviously screws their gen pop over all time, like the US does...

Exactly! They are stuggling so much....that they manage to simply give away money ($300) every month to charity...most people who are struggling are NOT giving away money, even if they wanted to!

Load More Replies...hello! id be eating healthy everyday and not hitting sonic for .99 cent corndogs

Load More Replies...Just googled this; The 2017 nominal median income per capita was $31,786. The mean income per capita was $48,150. Real median household income was $61,372. Some news orgs see 350k as normal, while the same news orgs go to "the heart-land" to interview the "real americans", that don't even make 30k to ask them what they think. I'm not sure there is any other "civilized" country in the world who so obviously screws their gen pop over all time, like the US does...

Exactly! They are stuggling so much....that they manage to simply give away money ($300) every month to charity...most people who are struggling are NOT giving away money, even if they wanted to!

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

199

134