Man Goes Viral After Stating That Things Cost Too Much And His Budgeting Habits Are Not The Problem

We cannot deny that it’s hard to live in today’s economy. Everything, even necessities, usually cost a fortune. And just as it is hard to live in such an economy, it is hard not to complain about it.

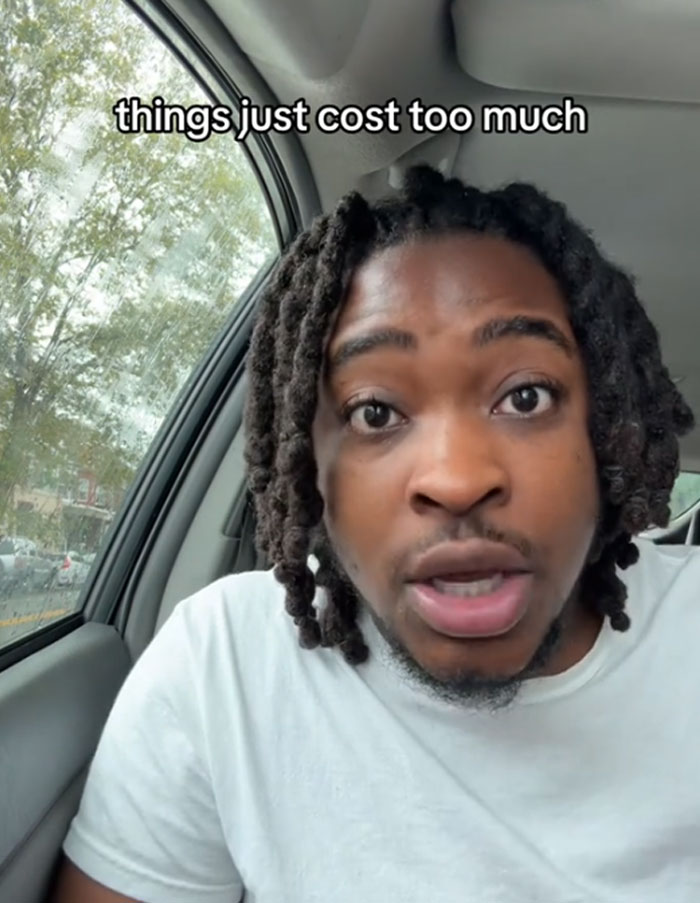

Last month TikTok user @uzoiswho did not resist this urge. They posted a short video on their account, which accumulated over 1M views. In this video, they ranted about how everything costs too much now.

More info: TikTok

Last month, a TikTok user expressed something we all have been thinking about – everything costs way too much – and went viral

Image credits: whoisuzo

“I do not need to budget. Prices either need to go down or my pay needs to go up.”

I think I’m someone who’s fairly reasonable with my spending. I pay my bills, I take care of my needs first and foremost, I take care of my wants within a reasonable parameter. I don’t spend exorbitant amounts of money to the point where I need to track down how much I’m spending because money’s just flying out of my ears.

Image credits: uzoiswho

“Things just cost too much! So again, either prices need to go down, or my pay needs to go up.”

Image credits: uzoiswho

Watch the viral video below

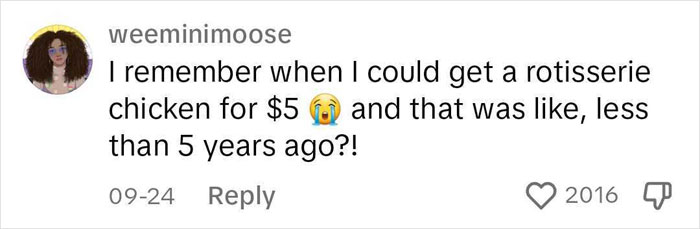

@uzoiswhoWHY DOES A ROTISSERIE CHICKEN COST $10?!?♬ original sound – uZo

You probably already know what a budget, which was mentioned in the video, is. If not, don’t worry, Bored Panda has you covered!

A budget is an estimation of income and expenses over a specified period of time. To put it in simpler terms, it is an estimate of how much money a person will make and spend over a certain period of time. Usually, budgets are used to manage monthly expenses, prepare for unpredictable events or even to afford costly items without going into debt.

Now, let’s give the voice to an expert in finance, Lucy, instead of trying to explain the complexity of budgeting ourselves. Make sure to check out her website!

Lucy stated that in her opinion, the term budgeting has kind of lost its meaning. Being on a budget is not equivalent to being on a diet. According to her, being on a budget is a short-term decision to mitigate overspending or lack of income. “Like overeating at Christmas, you tend to eat less in January, right? Essentially, budgeting is deciding what you want to do with your money and doing it. “You don’t have to track every penny or do anything complicated but you do need to be on top of it – after all, you spent all that effort earning it, why not make it do great things for you?”

Image credits: Mark Stebnicki (not the actual photo)

And while budgeting can be useful, she believes that “making better lifestyle choices in the long term is better for our wellbeing. Same with how we manage our finances.” She added, “When we can’t control the actual economy, the only control we do have is our home economy.”

When asked why people tend to be scared of budgeting, Lucy said that they simply don’t want to get close to their money. “Using food again as an analogy, most of us eat too much. If we managed our food portions & nutrition with more attention to detail, we’d have much better health. Same principle with our money. It feels daunting, it feels like it’s too much of a hassle, that it will take too long to set up & manage, it’s complicated, it’s boring.” She added that not being good at math is not an excuse either. She compared it to cooking – you might not be good at first, but you learn. After all, it’s a life skill.

Lucy stated that no matter how much you earn, you must manage it. “People are scared of looking too deeply at their debts & bank accounts because they know they won’t like what they see. It’s much more fun to spend money until there’s none left.”

Talking about the high costs of various goods and services, Lucy stated that it is influenced by many factors. “The economy grows and shrinks on repeat. Wars broke out, oil prices and so many things hit different elements of our lives from fuel to food production. When it hits hard like it has now, we can’t have our wages going up exponentially because that is unsustainable – the economy will stabilize like it always does but it takes a lot of effort & some short-term pain.”

Image credits: Wendy Wei (not the actual photo)

Lastly, we talked with Lucy about strategies to mitigate the impact of high costs. She stated that the best strategy is living to your means. “When your income has shrunk in real terms against how much things cost, we can’t buy as many things. It’s a fact of life that our families over many generations knew only too well, you have to sometimes go without. Once this recovers & everyone can afford nice things again, I hope that we all remember this will happen in another several years so don’t go nuts with the credit cards! Create some savings!”

Lucy ended the interview by saying “We all have a right to be exhausted, angry, upset & frustrated and the prices do need to come down on things we need. They will.”

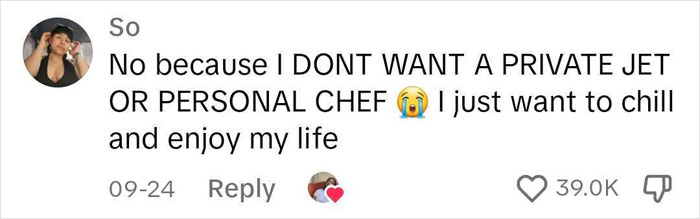

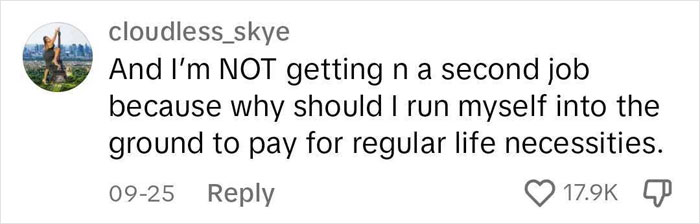

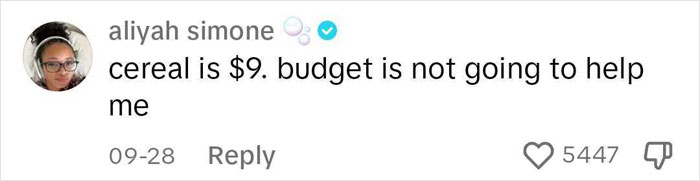

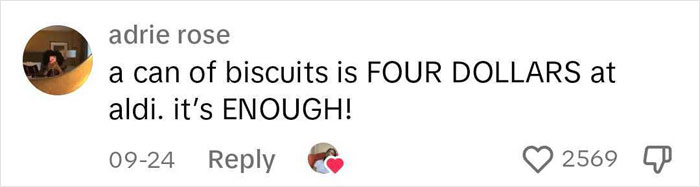

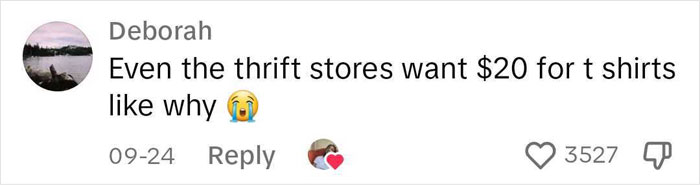

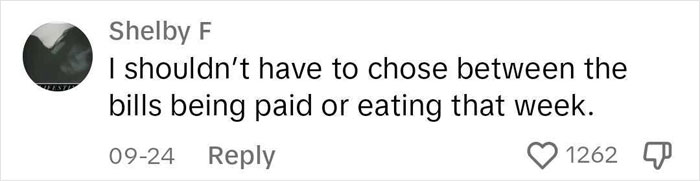

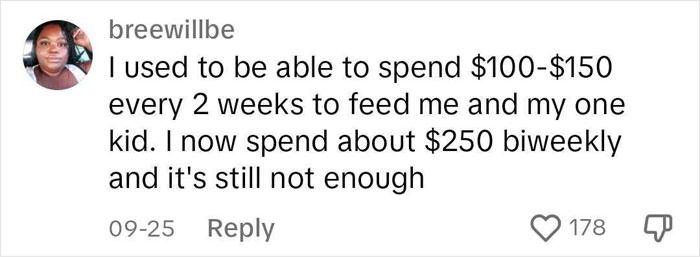

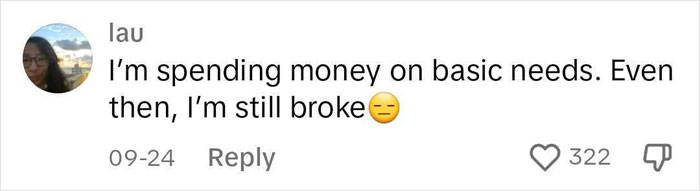

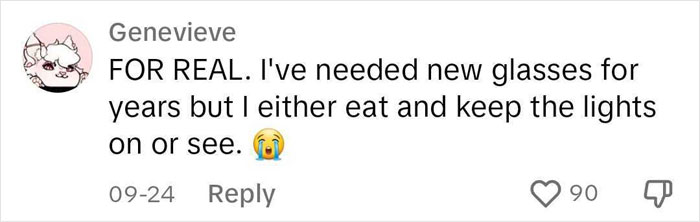

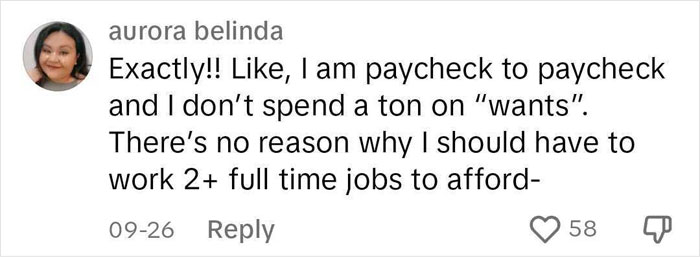

Coming back to the TikTok video, people online wholeheartedly agreed with the video creator. A lot of them shared examples of things costing way too much. And most of these things were basic goods such as cereal or T-shirts. And everyone expressed the idea that they don’t want to run themselves down just to afford necessities.

Netizens agreed with the video creator and shared that they don’t want an overly fancy life, they just want to have fun

Image credits: Pixabay (not the actual photo)

There comes a point in budgeting and cutting out expenses when there’s absolutely NOTHING left in the way of expenses to cut, without cutting necessaries like food or electricity or housing. You can only tighten the belt so far before you cut yourself in half. Why should people kill themselves working full time, and also having to moonlight with another part or full time job as well, and STILL not be able to support themselves, much less any dependents relying on them. This situation has finally ground itself down to the point where it is untenable and cannot continue. There will be a backlash amongst working people that I hope spurs the entire country on to make things right again.

No matter how hard/how many times you go over your spending, there are some expenses that absolutely cannot be cut out. Not everyone is made of money, not everyone can get two or more jobs (especially when one takes transportation and other factors into consideration) and while $12.00 an hour was a good wage back in the 90s - 2010s, even if you never buy name-brand anything and don't splurge even once in a while, there are times when the ends just do not meet. Especially if an emergency comes up, or prices have gone up one more time while you were in-between paydays. No one has the right to critique how other people spend (or do not spend) their money, especially now, when we are very clearly living in a dystopia.

I've tried nothing! And nothing worked! Please stop with these low-quality tiktok posts. They are ruining this site.

Why do folks read stuff you’re not interested in? I don’t get it. The constant complaining is ruining my enjoyment. Why not avoid the things you don’t like?

Load More Replies...Once upon a time, a person could pay rent on even a minimum wage job. Now they can't pay rent with two jobs paying more than minimum wage.

I'm in my 60s, so I was a grade school kid in the 1960s. One parent working back then was more than enough to support a middle class family and own a home. Since 1970 Top 1 percent wages grew 138 percent, while wages of the bottom 90 percent grew just 15 percent. In 1965, most corporate CEOs made 20 times what typical workers made. As of 2013, they made just under 300 times typical workers’ pay, now it's over 500 times that. Add to that, In the past, corporate profit growth accounted for maybe a third of inflation. But a report from the Kansas City Fed found that nearly 60% of inflation in 2021 was because of corporate profits! We are screwed. Income inequality and corporate greed are ruining our lives, squashing our hopes and dreams.

Load More Replies...I have two young adult kids at home, and my youngest is 16. One of my older kids had a friend staying over so I decided to order pizza. I shopped around and everywhere was so expensive. We ended up ordering a large, a medium, and a calzone. Total? $63. For pizza! And that was one of the cheaper options. If I paid with credit card it would have been $68 because they tack on a fee if you don't use cash. Nearly $70 for two pizzas and a calzone? What in the world?! All my kids work, so everyone offered to chip in but it had been my idea and I wanted to treat everyone. I remeber in college, ordering pizza every week. And we were broke! But you could find a cheap pizza joint, and scrounge up a few bucks. Those days are long gone.

Pizza delivery has become astoundingly expensive! I was shocked when I ordered 2 medium pizzas from Pizza Hut the other day. It was $40. With a coupon. For medium 1 topping. Ouch!

Load More Replies...I want to see BP post intelligent solutions to these problems. Telling someone to give up Starbucks is hardly going to trip the economy in anyone's favor.

If you don't have enough money, budgeting is *precisely* what you need to do, down to the last penny. Write down your known essential expenses - and that does not include shop bought coffee, Netflix etc - then your known income, and try to get the former lower than the latter. Budgeting may not solve your problems, but it may help work out a way forward. If you spend a lot on credit and don't pay it off, you're wasting money on interest, so pay off the card with the highest rate first (or transfer balances to the lowest rate card when offers are on). Don't spend what you can't afford.

On the one hand, there are many things that do cost more than they really should. There's obviously one major factor that businesses think about when pricing their goods/services and that's how much profit they can make; businesses don't spring up just to be altruistic (unless that is their actual purpose - which are usually called charities). But on the other hand, being financially irresponsible and just expecting to get more money or to be allowed to spend less to get what you want isn't reasonable; rather, it's an attitude of entitlement that needs to be kept in check. The whole thing is a balancing act of living within your means, and if you want a better quality of life, being smart about how you make it happen - not expecting society to just fork over whatever you think you need/want to make it happen for you.

No one wants to be financially irresponsible. People want to be able to actually live on the salary they're given. They don't want to kick back and relax and have everything they want presented to them on a silver platter - they want to work full time and be able to pay their bills, buy their food and have some extra to grab a coffee every now and then. If you're working 40+ hours a week, you absolutely should be able to do that.

Load More Replies...I mean, yes, prices are high and salaries remain low, but you ALSO need to budget to a degree. Everyone does I suppose.

I'm continually surprised at how little things cost. If I had to make or do them myself they would cost a lot more. Good quality paper at one cent per page, for example. How?

I'm convinced that companies and businesses are trying to make up for all of the money lost during the pandemic. And boy, are they swinging for the fences!

My family ebbs and flows with what we have available. It's exhausting to not be able to eat out ever, so when we're able to, we give ourselves space in the budget to spend more with that sort of stuff. We budget for everything. It's all in a spreadsheet and has everything mapped out for the entire year. Right now we have our expenses budgeted at $55/day, which is low but it needs to be low right now. When things improve, we'll raise it.

LOL! Bad image selection! OP complains "Things cost too much!" BP shows $5 coffees. "No, I can't afford a house just by skipping pricey coffee" is even a trope!

There comes a point in budgeting and cutting out expenses when there’s absolutely NOTHING left in the way of expenses to cut, without cutting necessaries like food or electricity or housing. You can only tighten the belt so far before you cut yourself in half. Why should people kill themselves working full time, and also having to moonlight with another part or full time job as well, and STILL not be able to support themselves, much less any dependents relying on them. This situation has finally ground itself down to the point where it is untenable and cannot continue. There will be a backlash amongst working people that I hope spurs the entire country on to make things right again.

No matter how hard/how many times you go over your spending, there are some expenses that absolutely cannot be cut out. Not everyone is made of money, not everyone can get two or more jobs (especially when one takes transportation and other factors into consideration) and while $12.00 an hour was a good wage back in the 90s - 2010s, even if you never buy name-brand anything and don't splurge even once in a while, there are times when the ends just do not meet. Especially if an emergency comes up, or prices have gone up one more time while you were in-between paydays. No one has the right to critique how other people spend (or do not spend) their money, especially now, when we are very clearly living in a dystopia.

I've tried nothing! And nothing worked! Please stop with these low-quality tiktok posts. They are ruining this site.

Why do folks read stuff you’re not interested in? I don’t get it. The constant complaining is ruining my enjoyment. Why not avoid the things you don’t like?

Load More Replies...Once upon a time, a person could pay rent on even a minimum wage job. Now they can't pay rent with two jobs paying more than minimum wage.

I'm in my 60s, so I was a grade school kid in the 1960s. One parent working back then was more than enough to support a middle class family and own a home. Since 1970 Top 1 percent wages grew 138 percent, while wages of the bottom 90 percent grew just 15 percent. In 1965, most corporate CEOs made 20 times what typical workers made. As of 2013, they made just under 300 times typical workers’ pay, now it's over 500 times that. Add to that, In the past, corporate profit growth accounted for maybe a third of inflation. But a report from the Kansas City Fed found that nearly 60% of inflation in 2021 was because of corporate profits! We are screwed. Income inequality and corporate greed are ruining our lives, squashing our hopes and dreams.

Load More Replies...I have two young adult kids at home, and my youngest is 16. One of my older kids had a friend staying over so I decided to order pizza. I shopped around and everywhere was so expensive. We ended up ordering a large, a medium, and a calzone. Total? $63. For pizza! And that was one of the cheaper options. If I paid with credit card it would have been $68 because they tack on a fee if you don't use cash. Nearly $70 for two pizzas and a calzone? What in the world?! All my kids work, so everyone offered to chip in but it had been my idea and I wanted to treat everyone. I remeber in college, ordering pizza every week. And we were broke! But you could find a cheap pizza joint, and scrounge up a few bucks. Those days are long gone.

Pizza delivery has become astoundingly expensive! I was shocked when I ordered 2 medium pizzas from Pizza Hut the other day. It was $40. With a coupon. For medium 1 topping. Ouch!

Load More Replies...I want to see BP post intelligent solutions to these problems. Telling someone to give up Starbucks is hardly going to trip the economy in anyone's favor.

If you don't have enough money, budgeting is *precisely* what you need to do, down to the last penny. Write down your known essential expenses - and that does not include shop bought coffee, Netflix etc - then your known income, and try to get the former lower than the latter. Budgeting may not solve your problems, but it may help work out a way forward. If you spend a lot on credit and don't pay it off, you're wasting money on interest, so pay off the card with the highest rate first (or transfer balances to the lowest rate card when offers are on). Don't spend what you can't afford.

On the one hand, there are many things that do cost more than they really should. There's obviously one major factor that businesses think about when pricing their goods/services and that's how much profit they can make; businesses don't spring up just to be altruistic (unless that is their actual purpose - which are usually called charities). But on the other hand, being financially irresponsible and just expecting to get more money or to be allowed to spend less to get what you want isn't reasonable; rather, it's an attitude of entitlement that needs to be kept in check. The whole thing is a balancing act of living within your means, and if you want a better quality of life, being smart about how you make it happen - not expecting society to just fork over whatever you think you need/want to make it happen for you.

No one wants to be financially irresponsible. People want to be able to actually live on the salary they're given. They don't want to kick back and relax and have everything they want presented to them on a silver platter - they want to work full time and be able to pay their bills, buy their food and have some extra to grab a coffee every now and then. If you're working 40+ hours a week, you absolutely should be able to do that.

Load More Replies...I mean, yes, prices are high and salaries remain low, but you ALSO need to budget to a degree. Everyone does I suppose.

I'm continually surprised at how little things cost. If I had to make or do them myself they would cost a lot more. Good quality paper at one cent per page, for example. How?

I'm convinced that companies and businesses are trying to make up for all of the money lost during the pandemic. And boy, are they swinging for the fences!

My family ebbs and flows with what we have available. It's exhausting to not be able to eat out ever, so when we're able to, we give ourselves space in the budget to spend more with that sort of stuff. We budget for everything. It's all in a spreadsheet and has everything mapped out for the entire year. Right now we have our expenses budgeted at $55/day, which is low but it needs to be low right now. When things improve, we'll raise it.

LOL! Bad image selection! OP complains "Things cost too much!" BP shows $5 coffees. "No, I can't afford a house just by skipping pricey coffee" is even a trope!

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

87

50