Man’s Ridiculous Plan To Get Girlfriend To Finance His House’s Down Payment Blows Up In His Face

Interview With ExpertFor some, one of the biggest milestones in life is buying a house. Unfortunately, saving up for one can take a long time, which nudges people to consider cooperatively purchasing a home with someone before getting married. However, this path can be risky, especially without a formal agreement or contingency plan.

Being aware of this, redditor throwawayRA_1931 was careful around her boyfriend, who eagerly wanted to buy a house. So when he asked her to cover his part of the rent and utilities to save even more money for it, she was quite doubtful about it, asking if she would have a share in the property. The answer she received raised even more suspicion, which was the start of the end of their relationship.

Scroll down to find the full story and a conversation with realtor and attorney Bruce Ailion and family law attorney Raymond Hekmat, who kindly agreed to tell us more about buying a property with a partner prior to marriage.

Co-owning a home can be a great solution for some unmarried couples. However, it can be very risky

Image credits:Mikhail Nilov (not the actual photo)

This woman was almost tricked into ‘helping’ her boyfriend buy a house

Image credits:Scott Webb (not the actual photo)

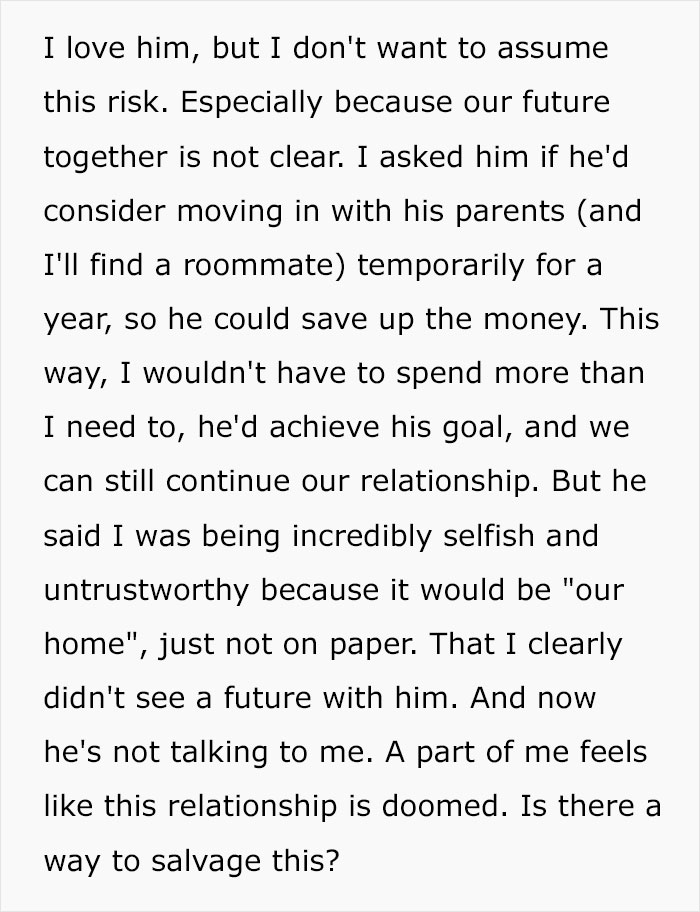

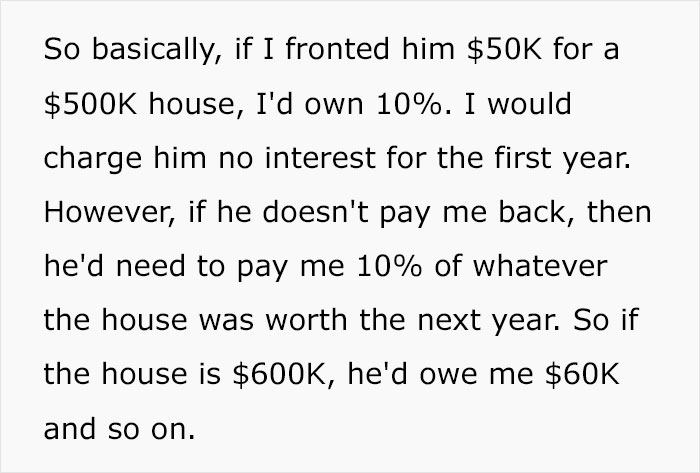

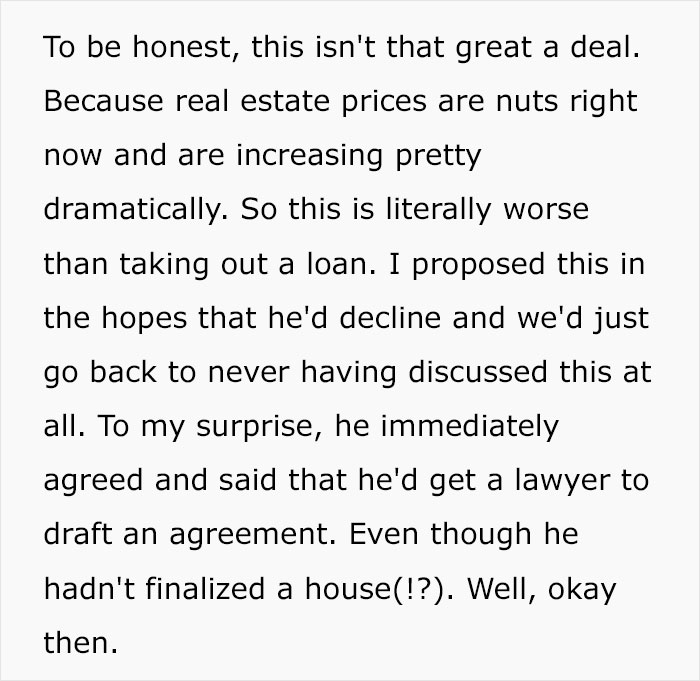

Image credits: throwawayRA_1931

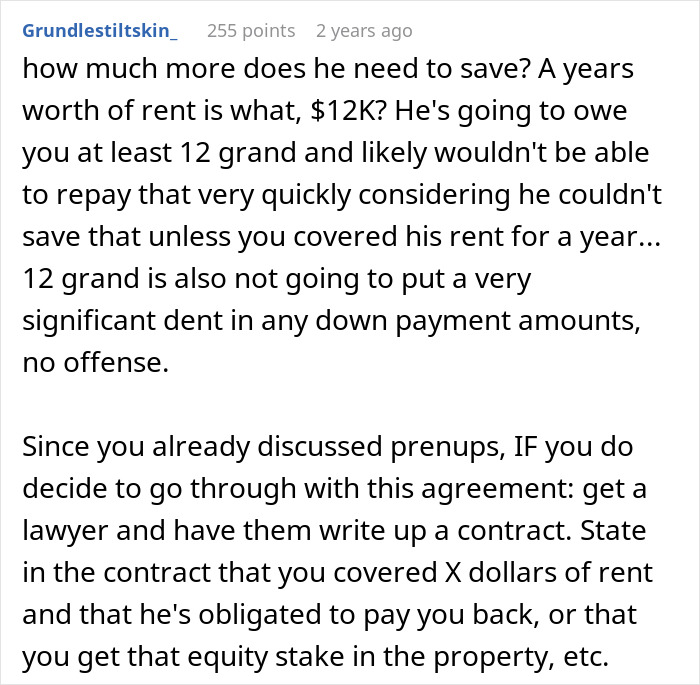

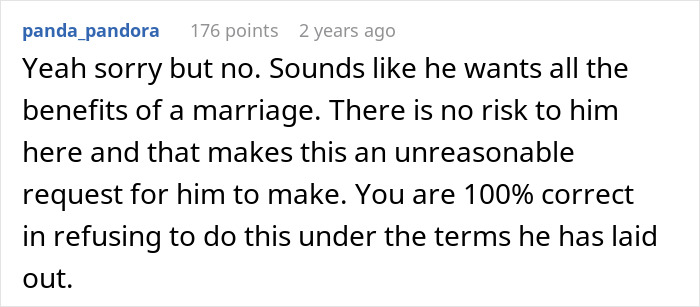

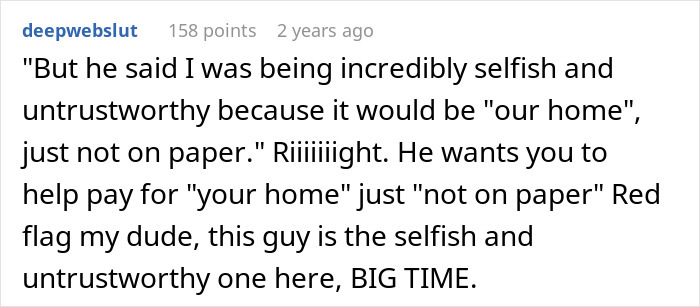

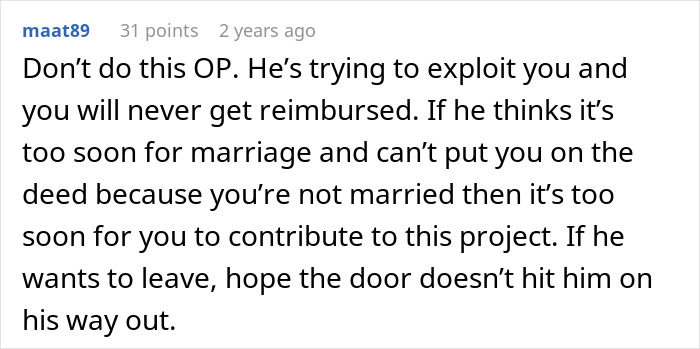

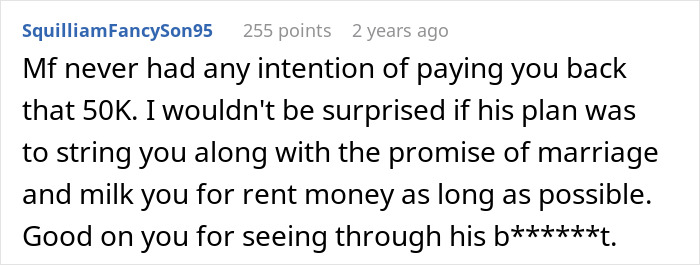

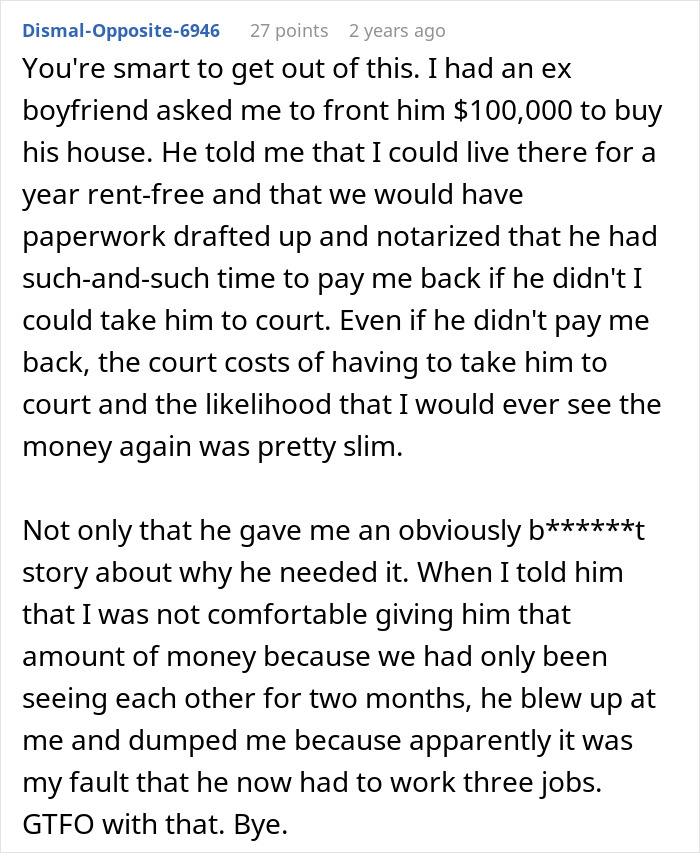

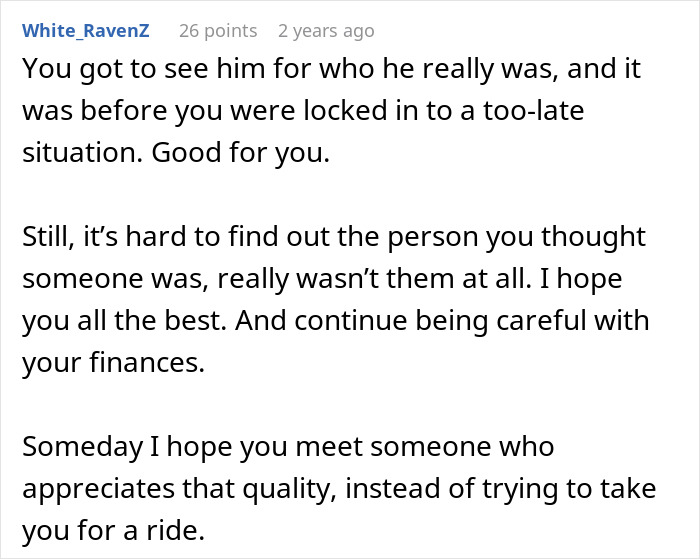

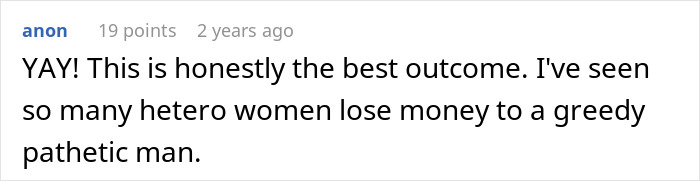

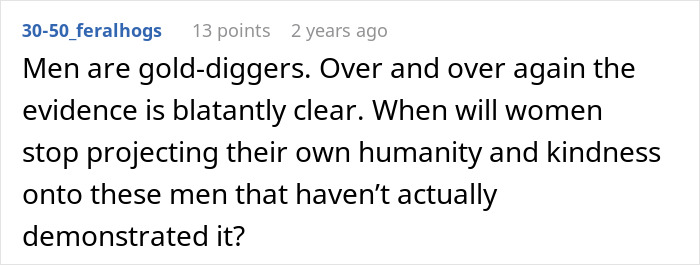

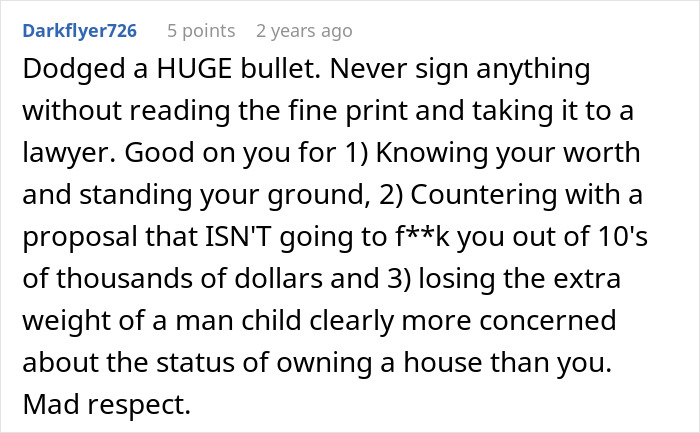

People were flabbergasted by the boyfriend’s audacity

Image credits:Pavel Danilyuk (not the actual photo)

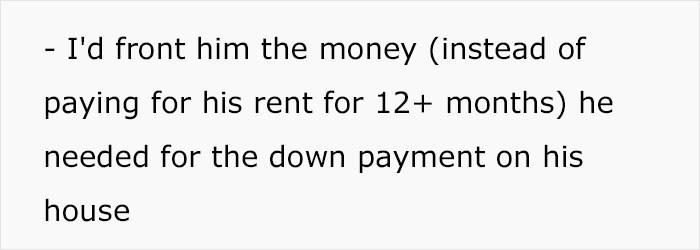

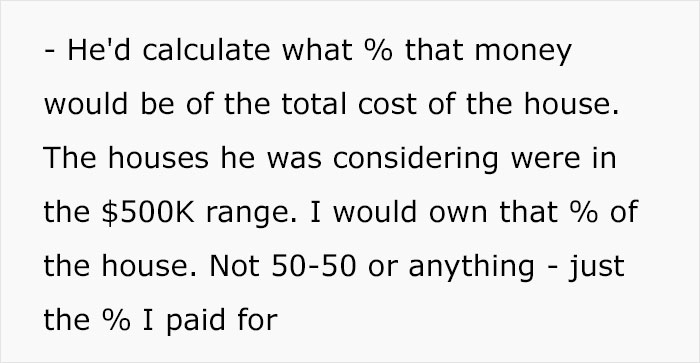

Later, the woman posted an update

Image credits:Vitaly Gariev (not the actual photo)

Image credits: throwawayRA_1931

58% of unmarried couples would consider purchasing a house before saying, “I do”

The Orchard Marriage or Mortgage Report in 2022 found that 58% of unmarried couples would consider purchasing a house before saying, “I do.” Surprisingly, 25% of Americans would start looking at real estate properties with someone as early as 6 months into dating.

Realtor and attorney Bruce Ailion tells Bored Panda, “Buying a home before marriage is similar to having a child before marriage. The action creates a bond that is difficult to break.

In those situations where the relationship is good and becomes long-term, the answer is, why not? If a relationship is on shaky ground and buying a home is to solidify the relationship, the answer is definitely no.”

If living in an apartment has worked out for the couple, it might seem logical to take the next step and proceed with home ownership when the lease is up. This also allows them to save on rent, which can be more expensive than a mortgage payment.

In cases where the couple hasn’t experienced living together, family law attorney Raymond Hekmat encourages them to consider whether partnering in the ownership of real property is a good idea or not. “When you start living together, there could be changes in your relationship that may cause you both to reconsider the relationship as a whole and now you’re stuck owning a house together.”

Without the safety net of a legally binding union, the potential for risks can be much higher than the unmarried couple realizes. Therefore, Ailion recommends partners not rush into buying a home. “All buyers, whether unmarried or otherwise, should not purchase without a certainty that they will be able to pay for the property. Real estate is a long-term investment, and selling in a short period or in periods of economic downturn may result in a loss.”

Image credits:PhotoMIX Company (not the actual photo)

There are ways to lessen the risks while buying property with a partner prior to marriage

Those people who are determined to buy a home without marrying their partner can find ways to lessen the risks that come with it. For this, Ailion recommends meeting with an attorney to draft a document that outlines the responsibilities of each party. “It is also essential to consider what happens when one party can not or will not fulfill their obligation and how that event is resolved between the parties. If there is a loan, both parties are usually “jointly and severally liable,” meaning one party can be liable for all the loan,” he adds.

During the buying process, it might happen that one partner contributes more initial and ongoing funds to the purchase. “You should decide if, how, and when those inequities are restored,” Ailion says.

“If there is a total breakdown in the relationship and it is no longer desired that property be jointly owned, decide in advance how that is resolved,” he additionally mentions. “You should have an agreement outlining a buyout by one party and how that price is determined. When a buyout cannot be reached, who manages the sale of the property, and how are disagreements resolved when selling?”

“These decisions should be in writing,” Ailion warns. “It is much easier to reach these agreements when you are in love and speaking with each other than when you hate each other and never want to talk to your partner again. You can let the document speak when you cannot.”

Hekmat concludes by saying that unmarried couples should definitely avoid buying property without fully understanding the consequences. “There may be certain unspoken expectations that either party may have, and without discussing them first, it could cause a relationship to crumble, and then you have a house that may be fought over.”

Image credits: Pixabay (not the actual photo)

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

80

27