Woman Is Suspicious Of Her Dad After He Repeatedly Requests Her Baby’s Social Security Number

Interview With ExpertA social security number should be a person’s most-guarded piece of personal information. We constantly hear stories of how people get scammed when they give away their SSNs and have their identity stolen. The Social Security Administration cautions people to never disclose their SSNs to strangers, especially on the phone or online.

But what if it’s a family member asking for your child’s social security number? This woman heard such a request from her father, who claimed he wanted to start a bank account for the baby. She shared her story with people, telling them how she worried her father might start opening lines of credit in her child’s name.

Bored Panda reached out to Michael Bruemmer, an expert at a major American credit report bureau, Experian. He is the vice president of Global Data Breach Resolution and Consumer Protection, and he shed some light on the serious topic of child identity theft.

Generational differences can result in different opinions between parents and adult children

Image credits: Pressmaster / Envato (not the actual photo)

One woman’s father demanded she give him her baby’s social security number, which she found suspicious

Image credits: voronaman111 / Envato (not the actual photo)

Image credits: Mehaniq41 / Envato (not the actual photo)

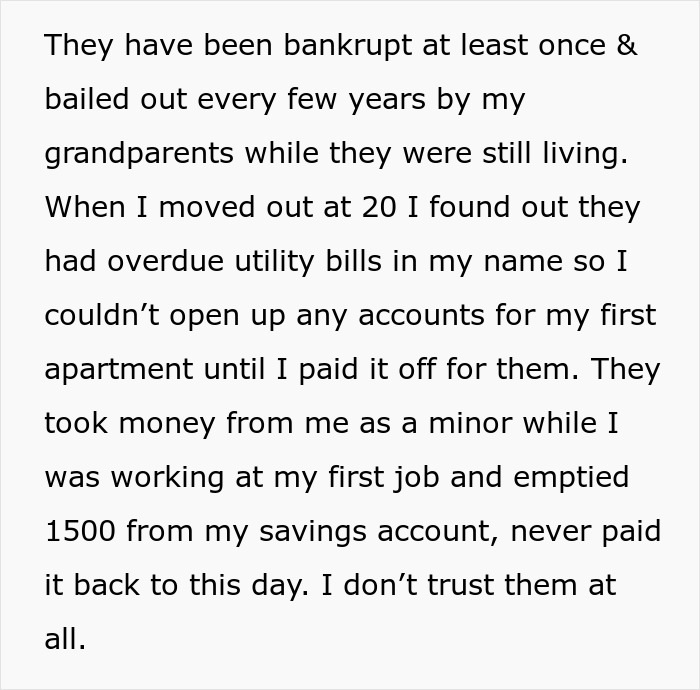

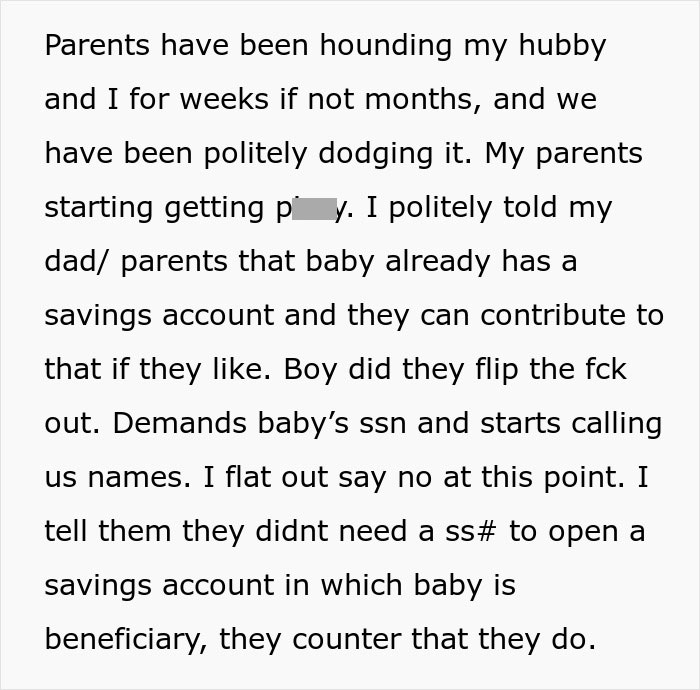

Image credits: Brief-Bend-8605

Using a child’s Social Security Number to take out loans or credit cards is identity theft

Image credits: AnnaStills / Envato (not the actual photo)

Micheal Bruemmer says that keeping their child’s social security number safe should be a top priority. “As a rule of thumb, I’d advise parents to never share their child’s social security number unless they have a very good, legitimate reason to do so.

“Family members may not have any malicious intent when asking for that personal information. In fact, it’s not unheard of for grandparents or other family members to ask for a child’s social security number so they can open a savings account for the child.”

“However, I’d still suggest avoiding this and recommend that parents open an account themselves that family members can contribute to, such as a 529 account.”

Bruemmer says that every time parents share their child’s social security number, there may be potential risks. “That number can be misplaced, misused, and stolen by criminals,” he says. “Child identity theft can create a very big problem for parents and children and can result in fraudsters opening credit card accounts, applying for and obtaining loans, or even gaining employment using the child’s personal information.”

What parents can do to keep their children safe from identity theft

Image credits: nd3000 / Envato (not the actual photo)

The mother in this story mentions how she has had financial trouble with her irresponsible parents in the past, which is why she was suspicious. But many people trust their parents (or spouses) and might not be able to immediately recognize the signs that a family member might be stealing their child’s identity.

Michael Bruemmer has some advice for people who are afraid their children might be victims of identity theft. “First, I would recommend checking to see if their child has a credit report with each credit bureau. This is to ensure that they have not been a victim of fraud.”

“Parents with children 14 years or older can access this option via Experian’s minor credit report request form. For children 13 years or younger, the parents must write to Experian since the Children’s Online Privacy Protection Act restricts the online collection of personal information regarding children.”

“Next,” Bruemmer goes on, “if a credit report exists, parents can freeze their child’s credit with every credit bureau. It’s not necessary to create a child’s credit report solely to freeze it, but parents can do so. When the child’s credit is frozen, lenders cannot issue credit. Parents can also consider enrolling in Experian’s family identity protection plan, which provides identity monitoring for up to 10 minor children.”

One of the most telling signs will be suspicious bills and notices arriving in your post box in your child’s name. “If they start receiving bills, credit card offers, or other age-inappropriate items addressed to their child, that is a sign their personal information may have been compromised,” Bruemmer explains.

“If a child’s identity is stolen, parents should also notify the business or financial institution that issued credit or a loan that the account was opened fraudulently in their child’s name. Parents should follow up with filing a police report and filing a fraud report with the FTC.”

The woman clarified that she and her parents don’t exactly get along well because they caused her financial problems in the past

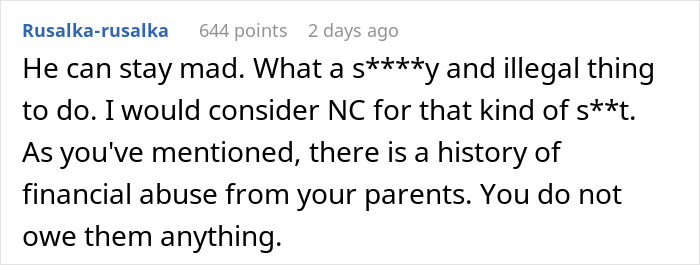

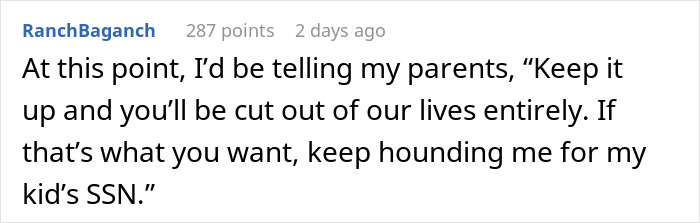

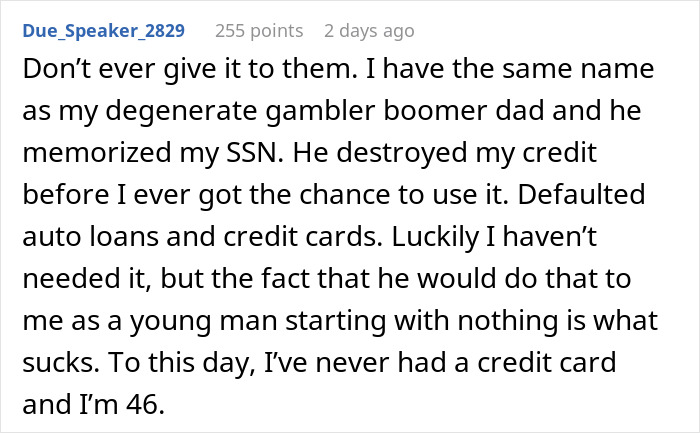

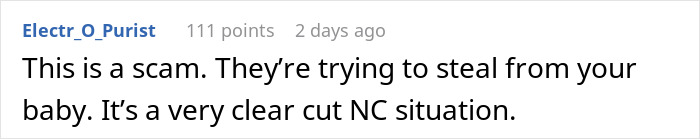

People cautioned the woman to stand her ground

Poll Question

Thanks! Check out the results:

Explore more of these tags

Excuse my naivety, is this just an American thing where you can get a loan or credit against a child's SSN? I'm in the UK and I'm sure it wouldn't be possible to do that here? Kids accounts don't allow an overdraft either?

Yes, it is an American thing. Their whole system is ridiculously vulnerable to identity theft and the way their credit system works, if you get a bad ranking, it is extremely difficult to save it.

Load More Replies...Social Security numbers have way too much power in the US. It really needs to change. The military using SS# is ridiculous, everything military related has my social on.

My mom's health insurance used to use her social security number as the policy number. It was super weird. I try to avoid putting it on as many forms as possible, but it is super vulnerable to identity theft.

Load More Replies...I'm in Ireland and a child gets a pps number. But you can't do anything with it because it has the childs details on it and age. Is that not the same in America?

It's not. Identity theft is very easy in the US, especially when it comes to opening lines of credit

Load More Replies...Excuse my naivety, is this just an American thing where you can get a loan or credit against a child's SSN? I'm in the UK and I'm sure it wouldn't be possible to do that here? Kids accounts don't allow an overdraft either?

Yes, it is an American thing. Their whole system is ridiculously vulnerable to identity theft and the way their credit system works, if you get a bad ranking, it is extremely difficult to save it.

Load More Replies...Social Security numbers have way too much power in the US. It really needs to change. The military using SS# is ridiculous, everything military related has my social on.

My mom's health insurance used to use her social security number as the policy number. It was super weird. I try to avoid putting it on as many forms as possible, but it is super vulnerable to identity theft.

Load More Replies...I'm in Ireland and a child gets a pps number. But you can't do anything with it because it has the childs details on it and age. Is that not the same in America?

It's not. Identity theft is very easy in the US, especially when it comes to opening lines of credit

Load More Replies...

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

57

89