Who wouldn't like to achieve financial stability? However, in a world that encourages instant gratification, many of us succumb to the allure of overspending, accumulating debt, and therefore end up living beyond our means.

Interested in what are the biggest pitfalls to avoid, one Reddit user made a post on the platform, asking everyone to share what they believe to be the biggest money mistakes. And to their delight, many responded.

Retirement might seem far away, but the longer we ignore our personal budget, the harder it will be to catch up down the line.

This post may include affiliate links.

Buying designer shoes and expensive jewelry for your baby. eliettgrace replied: I've heard seen stories where parents send their kid to daycare in Gucci and other designer s**t like that and then get mad when the clothes are messed up cause the kid had fun. 1lilhedgehog replied: I once saw a meme that showed tiny preschooler feet in Jordan’s and it said, 'You spend all that money for your preschooler to go to school in Jordan’s...just for them to be jealous of all the kids who have the light-up Paw Patrol shoes. lol too true.

Buying designer shoes and expensive jewelry for your baby. eliettgrace replied: I've heard seen stories where parents send their kid to daycare in Gucci and other designer s**t like that and then get mad when the clothes are messed up cause the kid had fun. 1lilhedgehog replied: I once saw a meme that showed tiny preschooler feet in Jordan’s and it said, 'You spend all that money for your preschooler to go to school in Jordan’s...just for them to be jealous of all the kids who have the light-up Paw Patrol shoes. lol too true.

Why buy designer clothes for children? They don’t understand what it is in order to appreciate it and they grow so fast, they’ll have outgrown them in a few months/weeks. Get them something they’ll actually need!

Going into debt for a wedding.

armyofsnarkness replied:

This is so true. A close friend is still paying off her wedding but the marriage ended last year.

Going into debt for a wedding.

armyofsnarkness replied:

This is so true. A close friend is still paying off her wedding but the marriage ended last year.

Fancy, over the top weddings are nice, but the point of weddings is to display your love to you partner, and it shouldn’t cost thousands to do that!

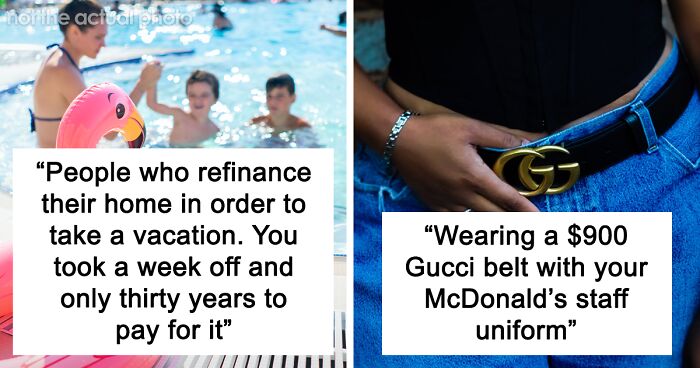

When they have designer clothes and get their hair and nails done every 2 weeks but can't afford to pay the rent.

People who refinance their home in order to take a vacation.

You took a week off and only thirty years to pay for it.

Brilliant idea, bozo.

AssicusCatticus replied:

The neighbors across the street maxed out $25,000 in credit cards to take the family on a 'dream Disney vacation.' She said she'd be paying them off forever, but it was 'worth it for my kids to have this experience.' I was absolutely dumbfounded.

Downtown_Cat_1172 replied:

Kids don’t need that much. Seriously, give them a bunch of super soakers and let them loose at a picnic ground by a lake. They will talk about it for years.

TJ_Rowe replied:

If you go to any hotel with a pool, they'll be talking about that pool for years. I'm not kidding.

People who refinance their home in order to take a vacation.

You took a week off and only thirty years to pay for it.

Brilliant idea, bozo.

AssicusCatticus replied:

The neighbors across the street maxed out $25,000 in credit cards to take the family on a 'dream Disney vacation.' She said she'd be paying them off forever, but it was 'worth it for my kids to have this experience.' I was absolutely dumbfounded.

Downtown_Cat_1172 replied:

Kids don’t need that much. Seriously, give them a bunch of super soakers and let them loose at a picnic ground by a lake. They will talk about it for years.

TJ_Rowe replied:

If you go to any hotel with a pool, they'll be talking about that pool for years. I'm not kidding.

True! I remember all of the random, small things me and my siblings did in summer vacation like going to the park or pool more than any big thing years later

My STBXH. - Quit his job 2 weeks after we bought our house, and then didn't tell me for 2 months. - Has been unemployed for a minimum of 6 months every consecutive year since 2019. - Forgot to transfer his (very small) portion of money to our joint account on payday last month, causing several of our bills to bounce. Got all defensive when I tried to explain why forgetting something like that is extremely risky, and when I tried to explore ideas on how we can prevent recurrence from something like that happening again. - Bailed/ghosted on our tax appointment last year. As in, never showed up in the first place, and refused to answer phone calls and text messages, leaving me to fend for myself during the tax appointment. - Suggested we take out a personal loan to cover our escrow shortage. But remember, he's unemployed. So GUESS WHO would be paying back the loan, even though we're already paycheck to paycheck? That's right, yours truly. I could go on and on, but I'll stop there. I can't wait to be divorced from this deadbeat.

Seeing a a behemoth of a pickup truck with all the bells and whistles parked in front of a mobile home in a trailer park.

Seeing a a behemoth of a pickup truck with all the bells and whistles parked in front of a mobile home in a trailer park.

Having more kids than you can afford to raise

Ok_Department5949 replied:

I only had two for this reason. Putting them through college and grad school has always been in the back of my mind.

Having more kids than you can afford to raise

Ok_Department5949 replied:

I only had two for this reason. Putting them through college and grad school has always been in the back of my mind.

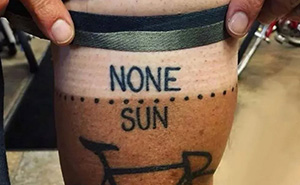

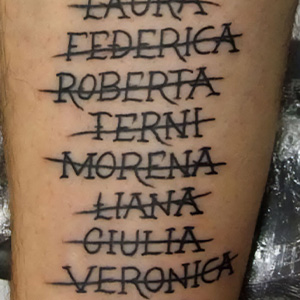

Signing up for a payment plan...for tattoos. I met a woman on a dating app once that had her whole body almost covered of tattoos. She had a low income job so I wondered how she could afford them. Turns out she was on a payment plan with the tattoo studio and I was like 'yeah, no thanks.'

Signing up for a payment plan...for tattoos. I met a woman on a dating app once that had her whole body almost covered of tattoos. She had a low income job so I wondered how she could afford them. Turns out she was on a payment plan with the tattoo studio and I was like 'yeah, no thanks.'

I had a friend who had borrowed money from me, I thought she was in deep s**t at the end of the month, that it was to pay for food for her children. But no, it was for a new tattoo. Fortunately, she refunded me. We're not friends anymore, not because of that, but it didn't weigh in his favor.

My friend's roommate once asked him to borrow money so he could order novelty fart-smell spray from Amazon, instead of waiting for his paycheck.

There are worse financial choices than going into debt for a can of fart spray, but it's certainly the funniest one I've heard.

My friend's roommate once asked him to borrow money so he could order novelty fart-smell spray from Amazon, instead of waiting for his paycheck.

There are worse financial choices than going into debt for a can of fart spray, but it's certainly the funniest one I've heard.

My wife’s siblings each just received a 117k disbursement from their mothers trust. So far one brother who doesn’t own a home nor a pension plan and is 55 went out and bought a brand new Harley Davidson Full bagger bike. The other brother, who was homeless three months ago is shopping for a Dodge Charger. He is 65 and can’t afford to retire. Her three sisters haven’t made any big purchases yet.It is tough to watch knowing how hard my in-laws worked to leave a little money for the siblings.

My wife’s siblings each just received a 117k disbursement from their mothers trust. So far one brother who doesn’t own a home nor a pension plan and is 55 went out and bought a brand new Harley Davidson Full bagger bike. The other brother, who was homeless three months ago is shopping for a Dodge Charger. He is 65 and can’t afford to retire. Her three sisters haven’t made any big purchases yet.It is tough to watch knowing how hard my in-laws worked to leave a little money for the siblings.

Hmm, at least the bike one the bike is around $30k. That still leaves around $87k. Doesn't say what sort of Dodge Charger so can't really tell how much the other brother is aiming to spend. But if he's got himself back into a place and set some money aside, maybe that's not a terrible thing either. Get a car he loves, keep working til he dies. If he's enjoying himself and happy...

always having the latest iPhone

always having the latest iPhone

I don't get how people have a desire to get used to a new phone every year. I just upgraded my Samsung phone. The new one is more fragile, and took me a while to get used to. Just like my old one. It's a pain the a**e. I'm keeping this new one for as long as I can.

I had a coworker who once complained that he was spending more money every week on cigarettes for his wife than what he spends on rent.

I had a coworker who once complained that he was spending more money every week on cigarettes for his wife than what he spends on rent.

Your car payment is more then your rent

Your car payment is more then your rent

Buying a timeshare.

Participating in a MLM scheme.

tripsz replied:

Don't you talk about my sister that way. She's a small business owner! She earned the privilege to get recognized at a company event this month and gets to purchase her own plane ticket! I'm sure her CPA husband is jealous of her success.

Buying a timeshare.

Participating in a MLM scheme.

tripsz replied:

Don't you talk about my sister that way. She's a small business owner! She earned the privilege to get recognized at a company event this month and gets to purchase her own plane ticket! I'm sure her CPA husband is jealous of her success.

Smart fridge.

There is absolutely no reason for a refrigerator to need an internet connection!

Bottled water. It costs more per gallon than gasoline and most people have been told that city water is sucky even though a ton of bottled water companies get it from municipal sources anyways. And if you care, filter it at home.

Driving a very expensive car with tons of body damage because all their money is going to their $800 a month car payment and they can’t afford to fix the damage they caused with their s****y driving.

Windir666 replied:

I had this exact conversation with my friend today. If you cant afford to fix your car, you probably shouldn't be owning a 2022 $60,000 Mercedes.

tristanjones replied:

The financially responsible decision is driving a beat-up reliable car because you own it outright and most people intend to drive it into the ground before buying another one.

Driving a very expensive car with tons of body damage because all their money is going to their $800 a month car payment and they can’t afford to fix the damage they caused with their s****y driving.

Windir666 replied:

I had this exact conversation with my friend today. If you cant afford to fix your car, you probably shouldn't be owning a 2022 $60,000 Mercedes.

tristanjones replied:

The financially responsible decision is driving a beat-up reliable car because you own it outright and most people intend to drive it into the ground before buying another one.

Firstly, this is why you get insurance. Even if you're the best driver ever and will never have an accident it doesn't mean someone won't smash into you. Secondly, you should be factoring insurance and basic maintenance into the costs. And most fancy cars cost way more than people expect. Even things like tyres cost double, triple or more than a "regular" car. My first car was second hand when I got it, and I drove it for roughly 20 years. In the end it was so worn out I sold it to a wrecker (it as 25ish years old by that point). Unless something drastic happens my current car will be the same.

Big rims and tires that cost 4K on a car that's worth 2K.

Using a check cashing store or payday advance type company.

Bizarre_Protuberance replied:

Payday loans are predatory loans and would be forbidden in almost every other country. It's basically a loan shark business. But sometimes low income people need money for emergency purposes like the car broke down and they need to get to work.

nemesismkiii replied:

Oh this 100%. As someone who has worked in financial services, I HATE these places. I will always advocate if you have lower income or cannot seem to work up savings for whatever reason, try switching from a bank to a credit union for your banking needs. They may not be as large as banks or be as good for if you need to travel, but they are local and try to help their local communities since they are owned by them.

Using a check cashing store or payday advance type company.

Bizarre_Protuberance replied:

Payday loans are predatory loans and would be forbidden in almost every other country. It's basically a loan shark business. But sometimes low income people need money for emergency purposes like the car broke down and they need to get to work.

nemesismkiii replied:

Oh this 100%. As someone who has worked in financial services, I HATE these places. I will always advocate if you have lower income or cannot seem to work up savings for whatever reason, try switching from a bank to a credit union for your banking needs. They may not be as large as banks or be as good for if you need to travel, but they are local and try to help their local communities since they are owned by them.

Agree with the commenters. It's not so much poor financial decisions as decisions made out of desperation (usually) and people don't think about what happens next when they are desperate to put food on the table today, or fix the truck they need to get to work.

Expensive leased car, living in a sketch neighborhood.

Expensive leased car, living in a sketch neighborhood.

Bragging about how much you spent on something as if it was a positive. "Uhh, congrats on giving a corporation extra money, I guess?"

I had a friend nearly get evicted because he spent all his money on Funko Pops. Thought he'd get rich off them somehow.

Ordering DoorDash several times a week.

Buying a widescreen television on tax return day and bringing it home in a car held together by duct tape and prayers.

Buying a widescreen television on tax return day and bringing it home in a car held together by duct tape and prayers.

"Hey, can I borrow $15? I'll pay you back next week when I get paid."

With the above happening every other week.

"Hey, can I borrow $15? I'll pay you back next week when I get paid."

With the above happening every other week.

Frequents a Starbucks. Coffee is way to cheap and easy to make well to spend that much per cup. If you do need a specialty coffee that often you are doing yourself a massive disserve not learning to make it. Everytime I see a Dutch Bros or Starbucks cup, I instantly register "*Ah, more money than sense.*"

I don't immediately judge someone with a Starbucks cup. It might be a once every few months treat, or they were desperate for coffee and there were no other options handy. But yeah, if they were getting it frequently? I would.

Lottery tickets

Lottery tickets

Depends. If you're only spending a few dollars here and there then it's as harmless as buying that coffee at Starbucks everyone likes to talk about. It still going to be gone by the end of the day. If your spending hundreds every month, then it's a problem.

I spent over 80$ tryna win a giant pikachu and failed Could have bought that thing for 34$ but it was well worth it

So judgy. How are someone else's financial decisions really affecting you? So what if they have a new phone? That changes your life ZERO PERCENT. Jesus. Let people live. Life sucks enough without total strangers making sh!tty comments on your freaking belt.

“when I see someone with a Starbucks cup, I think more money than sense.” like geez, relax. It’s a cup of coffee.

Load More Replies...HONESTLY - I worked with a man who, in the 1990s, spent all of his extra money on Beanie Babies, bragging that was his retirement plan. (PS: He had a PhD.)

So judgy. How are someone else's financial decisions really affecting you? So what if they have a new phone? That changes your life ZERO PERCENT. Jesus. Let people live. Life sucks enough without total strangers making sh!tty comments on your freaking belt.

“when I see someone with a Starbucks cup, I think more money than sense.” like geez, relax. It’s a cup of coffee.

Load More Replies...HONESTLY - I worked with a man who, in the 1990s, spent all of his extra money on Beanie Babies, bragging that was his retirement plan. (PS: He had a PhD.)

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime