Attorney Explains Why Student Debt Cancellation Might Be Good For The Economy, Goes Viral On Twitter

Today, in the US, college graduates earn roughly 80% more than people with just a high school diploma. This means that college is more important than ever in order to secure financial stability in the future. However, college is also more expensive than it was ever before—thanks to that, some 44 million Americans collectively hold more than $1.6 trillion in student debt. The situation is described among experts as a “crisis,” and it’s hard to disagree with them. On top of the debt crisis came coronavirus together with economic struggles and between mid-March and June, according to CNBC, over 42.6 million Americans filed for unemployment.

“Pull yourself up by your bootstraps,” some may suggest, but sadly, it’s not always as easy as it seems. During the recession of 2008, many went back to school to earn new skills, but since then, the cost of a four-year college degree increased by 25%. Therefore, there are experts and researchers who are saying that if student debt gets written off, everyone can benefit from it.

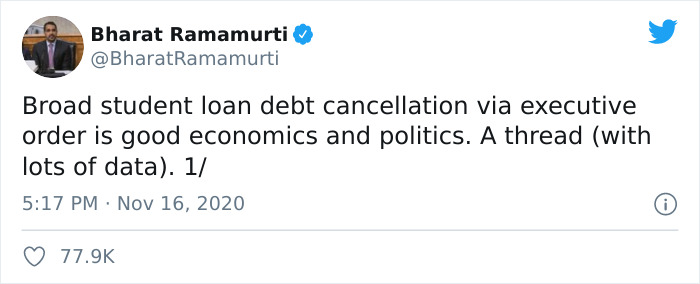

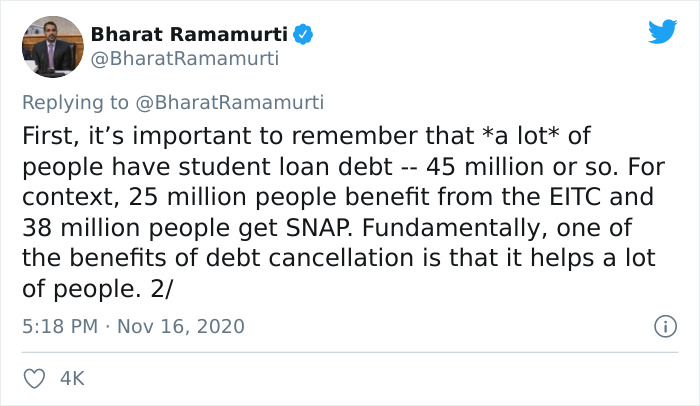

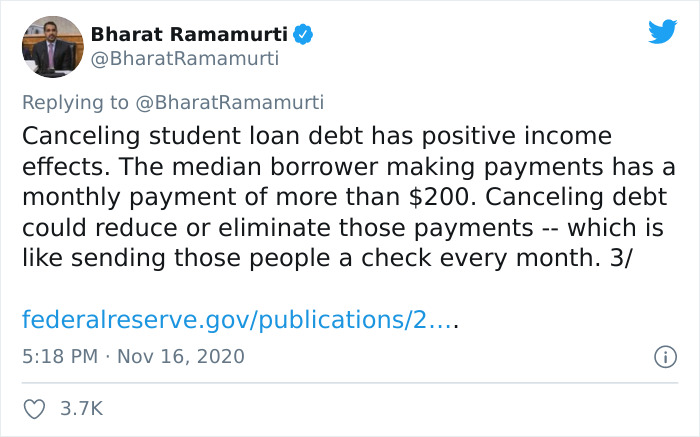

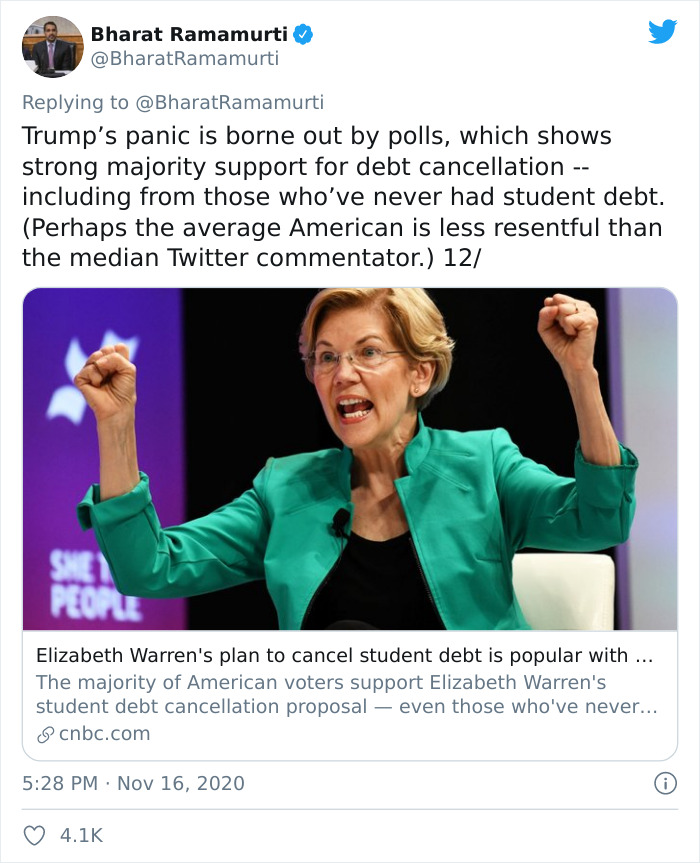

Bharat Ramamurti, a former top economic adviser of Senator Elizabeth Warren during her presidential campaign, recently went viral on Twitter for making a case for broad student loan debt cancellation via executive order. Scroll down below to read the Twitter thread and tell us what you think in the comment section!

More info: Twitter

Around 44 million Americans collectively hold more than $1.6 trillion in student debt

Image credits: Aaron Hall

The average cost of tuition, fees, room, and board during the last school year was $21,950 for in-state students at public universities. Out-of-state students pay $38,330, while the cost at private non-profit universities is a whopping $49,870. According to an estimate by The College Board, today, college graduates leave school with an average debt of $29,000.

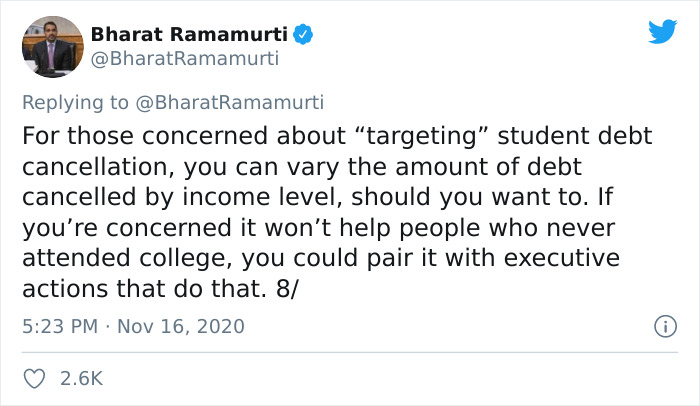

According to the lawyer Bharat Ramamurti, this has got to change

Image credits: BharatRamamurti

Image credits: BharatRamamurti

Image credits: BharatRamamurti

Follow the link here.

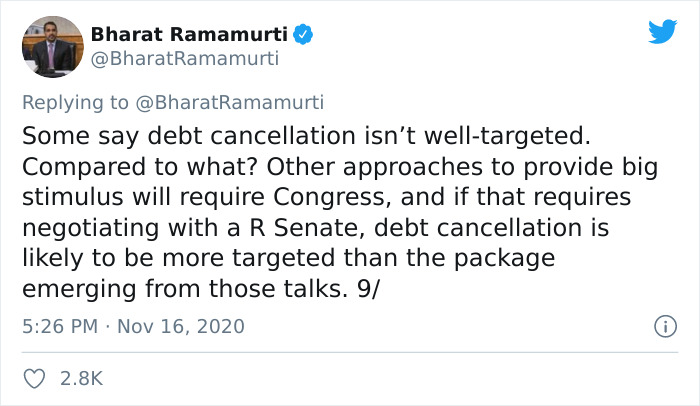

Image credits: BharatRamamurti

Follow the link here.

Image credits: BharatRamamurti

Follow the link here.

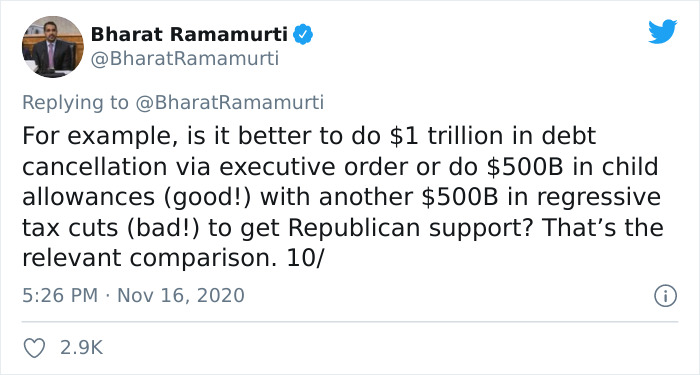

Image credits: BharatRamamurti

Follow the link here.

Image credits: BharatRamamurti

Image credits: BharatRamamurti

Image credits: BharatRamamurti

Image credits: BharatRamamurti

Image credits: BharatRamamurti

Follow the link here.

Image credits: BharatRamamurti

Follow the link here.

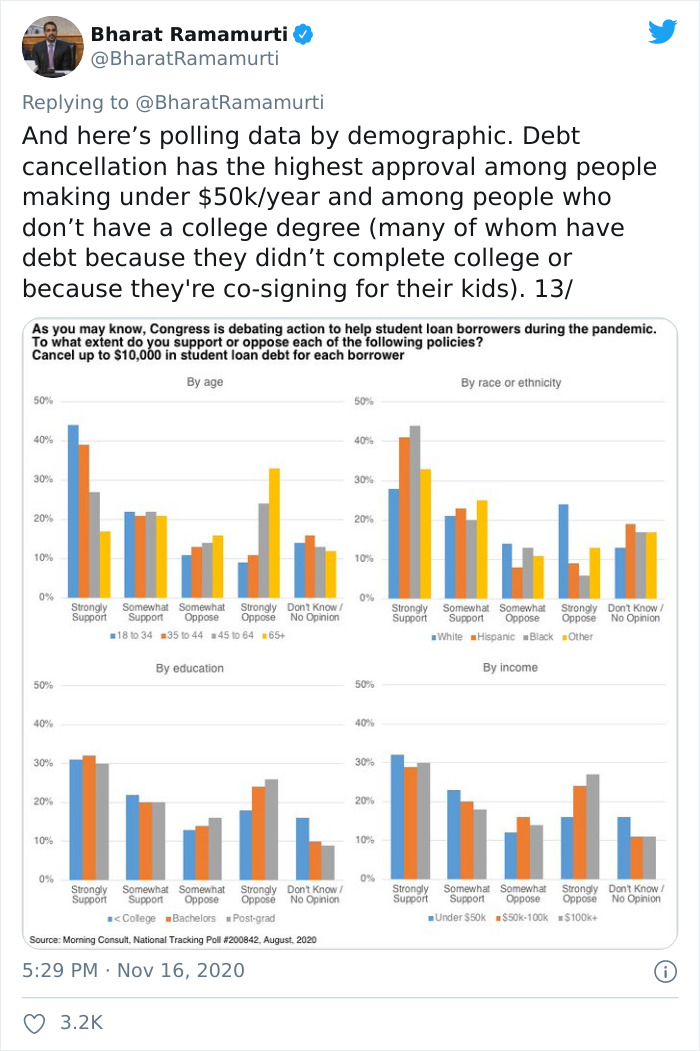

Image credits: BharatRamamurti

Image credits: BharatRamamurti

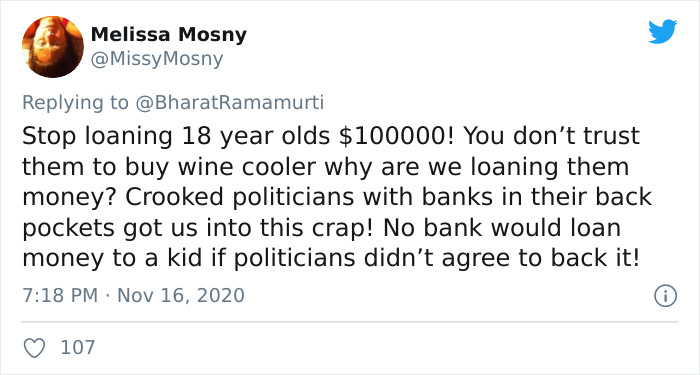

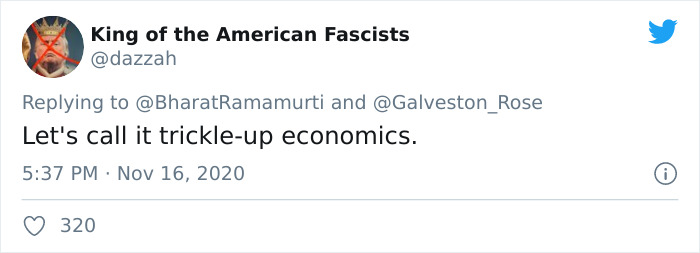

Here’s how people reacted to the thread

Image credits: JamesSt68560053

Image credits: Calind8121

Image credits: BikeGary

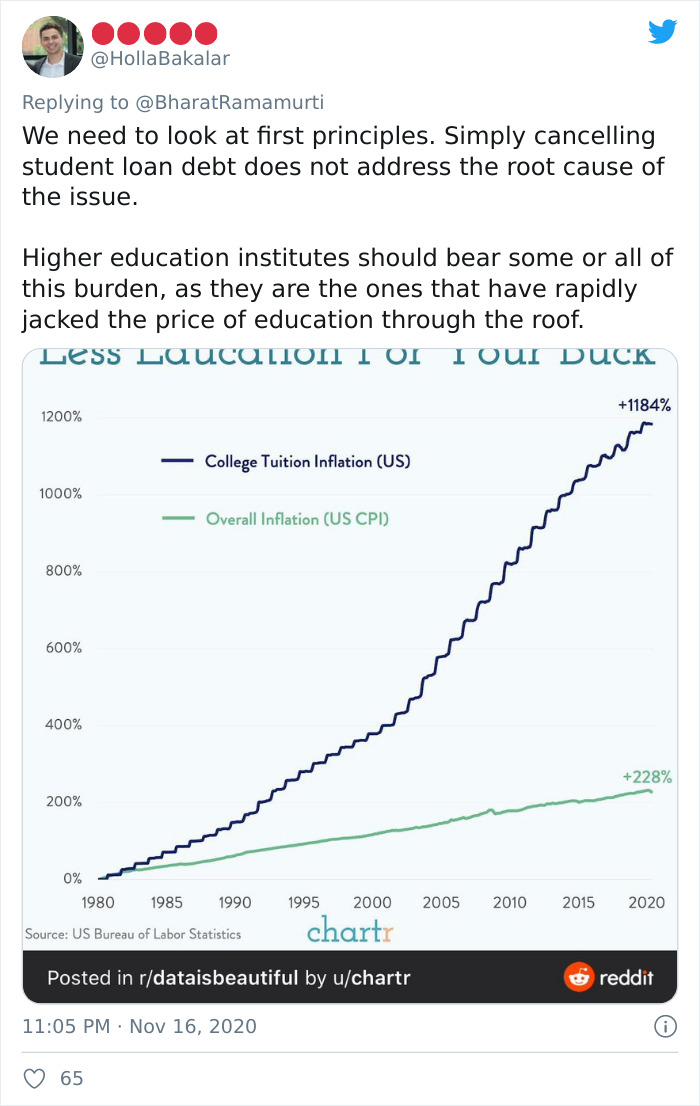

Image credits: HollaBakalar

Image credits: silverlamp1

Image credits: MissyMosny

Image credits: dazzah

Image credits: BCFoltz

6Kviews

Share on FacebookWhilst the Australian system isn’t perfect, it is still a decent program that we have to help with tertiary education costs. In Australia you don’t start paying the fees until you get a job and start earning over a certain pay threshold and gets taken out through your tax. You can choose to make voluntary payments if you wanted to. The other bonus is that it is interest free, the cost does go up slightly every year to keep up with inflation but that is usually less than a 2% increase. If you never reach the income threshold to pay the HECS debt or you die, then the debt gets wiped clean.

That's a great system, it doesn't grind the poor underneath society's heel. It's a compassionate system because the interest doesn't skyrocket and you only start paying when you are actually able.

Load More Replies...I have been paying student loans since 2006. I'm still paying. I just finished one off. I still have the largest one of $30,000 owed. It was 30,000 back in 2006, and it is still that amount because of recession, unemployments, temp jobs, etc. Deferments were necessary. So here I am, 14 years later still paying and it never goes down.

Cancel my home loan while you are at it. I have been paying since 2005.

But where would that leave renters, who are often locked out of the housing market and paying their landlords mortgages for them

Whilst the Australian system isn’t perfect, it is still a decent program that we have to help with tertiary education costs. In Australia you don’t start paying the fees until you get a job and start earning over a certain pay threshold and gets taken out through your tax. You can choose to make voluntary payments if you wanted to. The other bonus is that it is interest free, the cost does go up slightly every year to keep up with inflation but that is usually less than a 2% increase. If you never reach the income threshold to pay the HECS debt or you die, then the debt gets wiped clean.

That's a great system, it doesn't grind the poor underneath society's heel. It's a compassionate system because the interest doesn't skyrocket and you only start paying when you are actually able.

Load More Replies...I have been paying student loans since 2006. I'm still paying. I just finished one off. I still have the largest one of $30,000 owed. It was 30,000 back in 2006, and it is still that amount because of recession, unemployments, temp jobs, etc. Deferments were necessary. So here I am, 14 years later still paying and it never goes down.

Cancel my home loan while you are at it. I have been paying since 2005.

But where would that leave renters, who are often locked out of the housing market and paying their landlords mortgages for them

Dark Mode

Dark Mode

No fees, cancel anytime

No fees, cancel anytime

55

42